Global Metaverse Dating Market Size, Share, Industry Analysis Report By Platform Type (Social Metaverse Platforms, Dedicated Dating Metaverses, Game-Based Dating Environments), By Avatar Type (Humanoid Avatars, Fantasy & Customized Avatars, Others), By Interaction Type (Voice-Based Dating, Text-Based Dating, Activity-Based Dating (Games, Events), Others), By Revenue Model (Subscription Services, In-App Purchases, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168737

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Platform Type Analysis

- Avatar Type Analysis

- Interaction Type Analysis

- Revenue Model Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

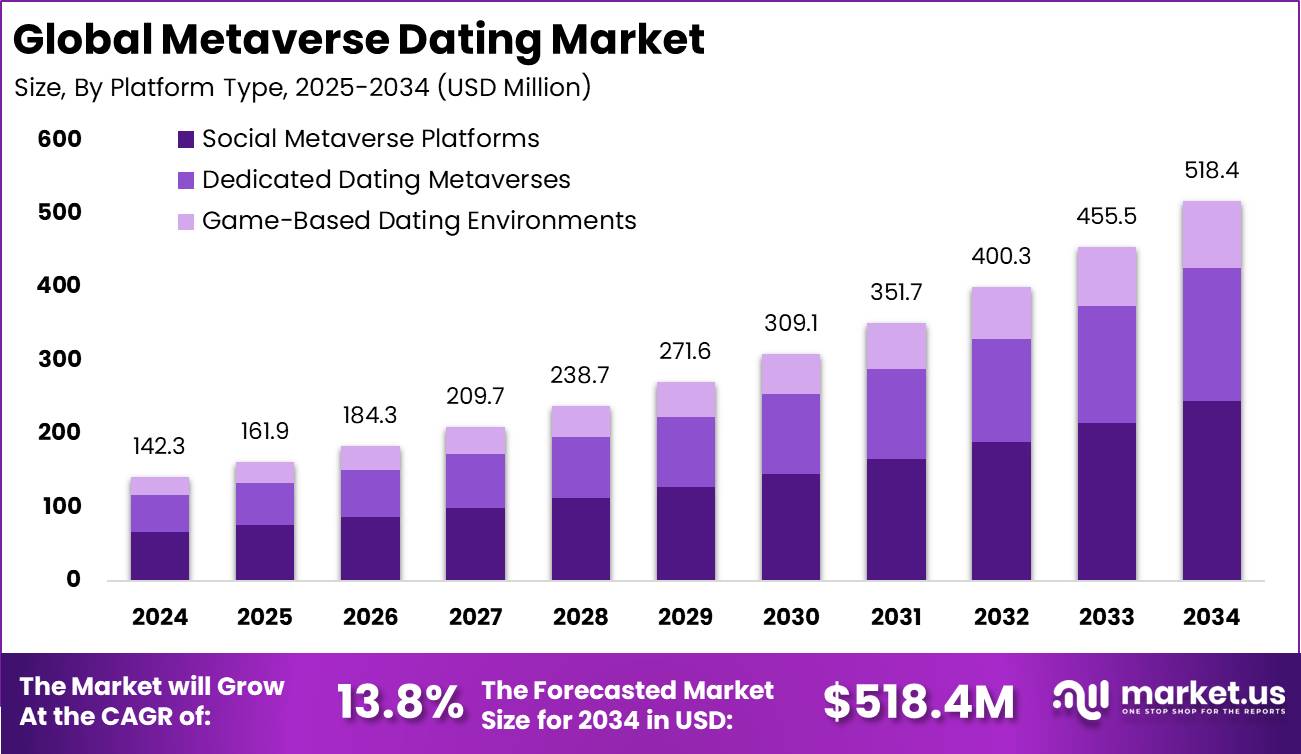

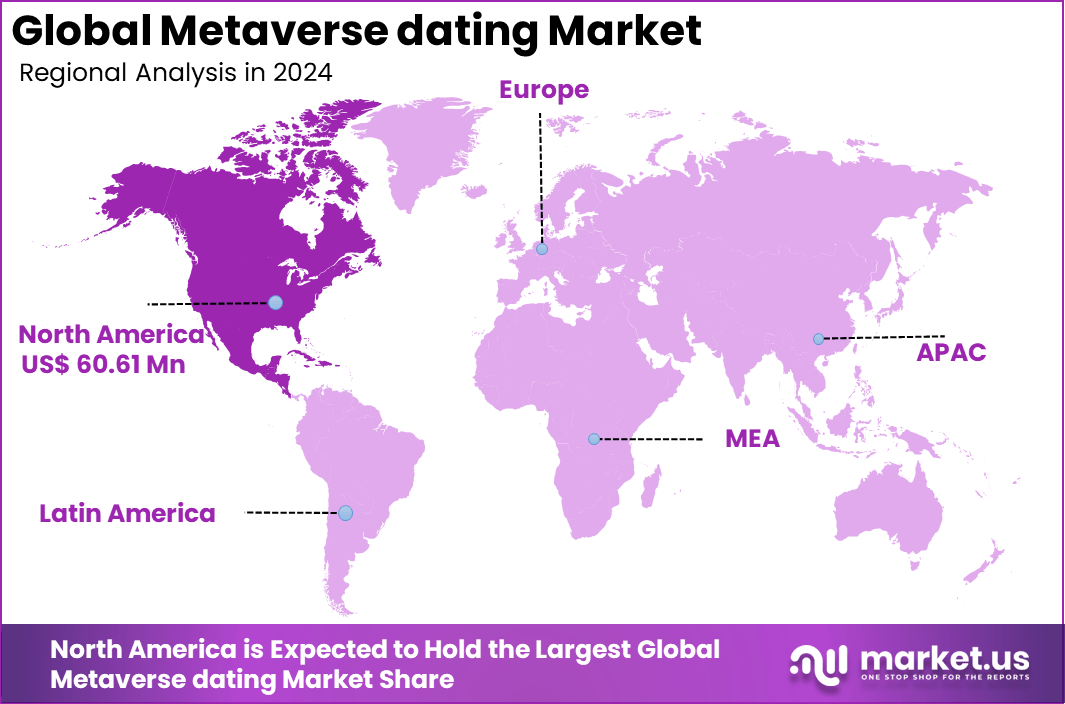

The Global Metaverse dating Market size is expected to be worth around USD 518.4 million by 2034, from USD 142.3 million in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.6% share, holding USD 60.61 million in revenue.

Metaverse dating refers to connecting and building romantic relationships in immersive 3D virtual environments. Unlike traditional online dating, metaverse dating allows users to interact via customizable avatars in shared virtual spaces such as beaches, cities, or concerts. These digital experiences go beyond text-based communication, enabling real-time voice chats, body language expression, and interactive dates in lifelike settings.

Top driving factors behind the growth of metaverse dating include a desire for more meaningful interaction and overcoming the limitations of traditional dating apps. About 44% of users seek partners sharing similar values, and 61% value common interests, showing strong motivation to use immersive platforms for connection. Technologies such as virtual reality, avatars, and 5G networks enhance presence and embodiment, which are essential for users to feel genuine engagement.

The market for metaverse dating is driven by the rising demand for immersive and interactive social experiences that go beyond traditional dating apps. Users seek deeper connections through avatar-based interactions in virtual worlds, where shared experiences feel more engaging and authentic. Advances in VR, AR, and AI technologies make these virtual dating environments more realistic and accessible, attracting tech-savvy individuals eager for new ways to meet and bond.

Demand analysis reveals a rising interest fueled by dissatisfaction with standard dating apps, which cause burnout for 78% of users, partly due to repetitive and superficial interactions. The metaverse offers structured, low-pressure dates that focus on shared experiences, such as virtual concerts or mini-golf, enhancing the quality of connection. Users appreciate being able to express personality through avatars, making attraction more than just about photos or bios.

For instance, in October 2025, Nevermet, a U.S.-based VR dating startup, expanded its presence on virtual reality platforms such as VRChat and Rec Room, enabling users to explore relationships through avatar-based socialization in interactive virtual spaces. This expansion marks a significant user growth and advances immersive dating experiences in the metaverse.

Key Takeaway

- In 2024, the Social Metaverse Platforms segment led the market with a 47.3% share, supported by rising user engagement in virtual social spaces designed for relationship building.

- The Humanoid Avatars segment dominated with 52.6%, reflecting strong user preference for realistic and expressive avatar interactions during virtual dating experiences.

- The Activity-Based Dating segment accounted for 38.9%, driven by demand for shared virtual experiences such as games, events, and immersive environments that enhance user connection.

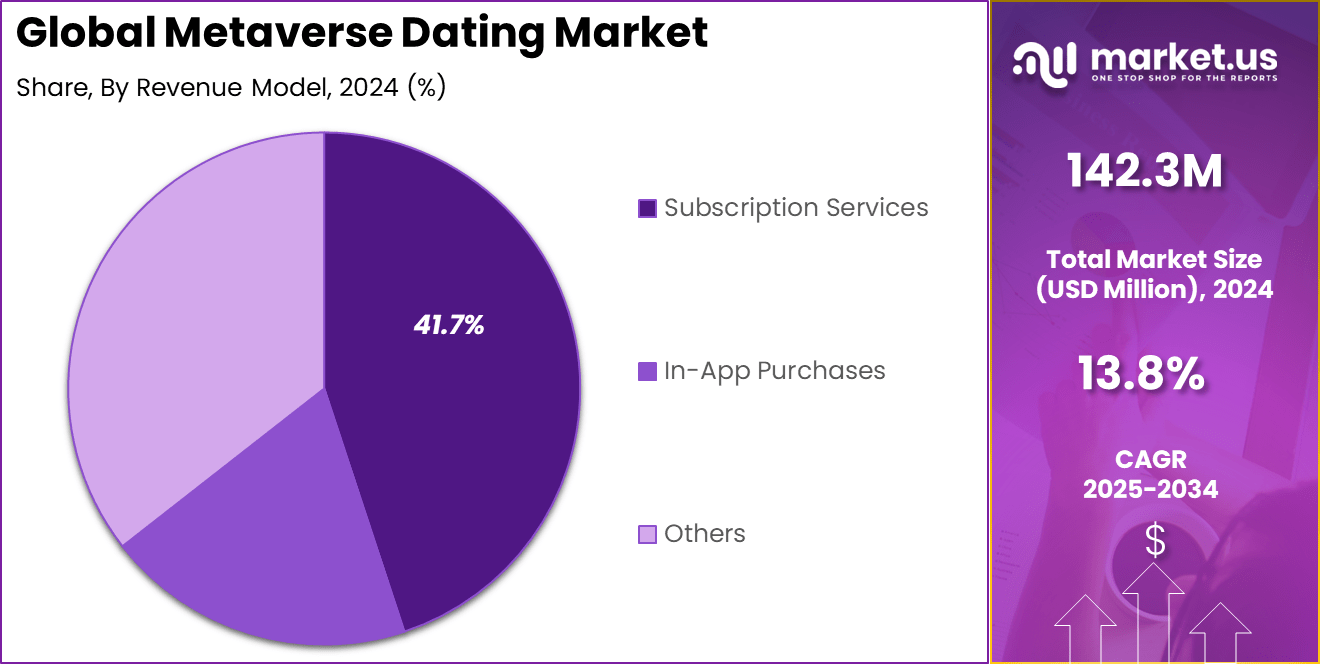

- The Subscription Services segment held a 41.7% share, showing the industry’s reliance on recurring revenue models that offer premium features and enhanced in-world experiences.

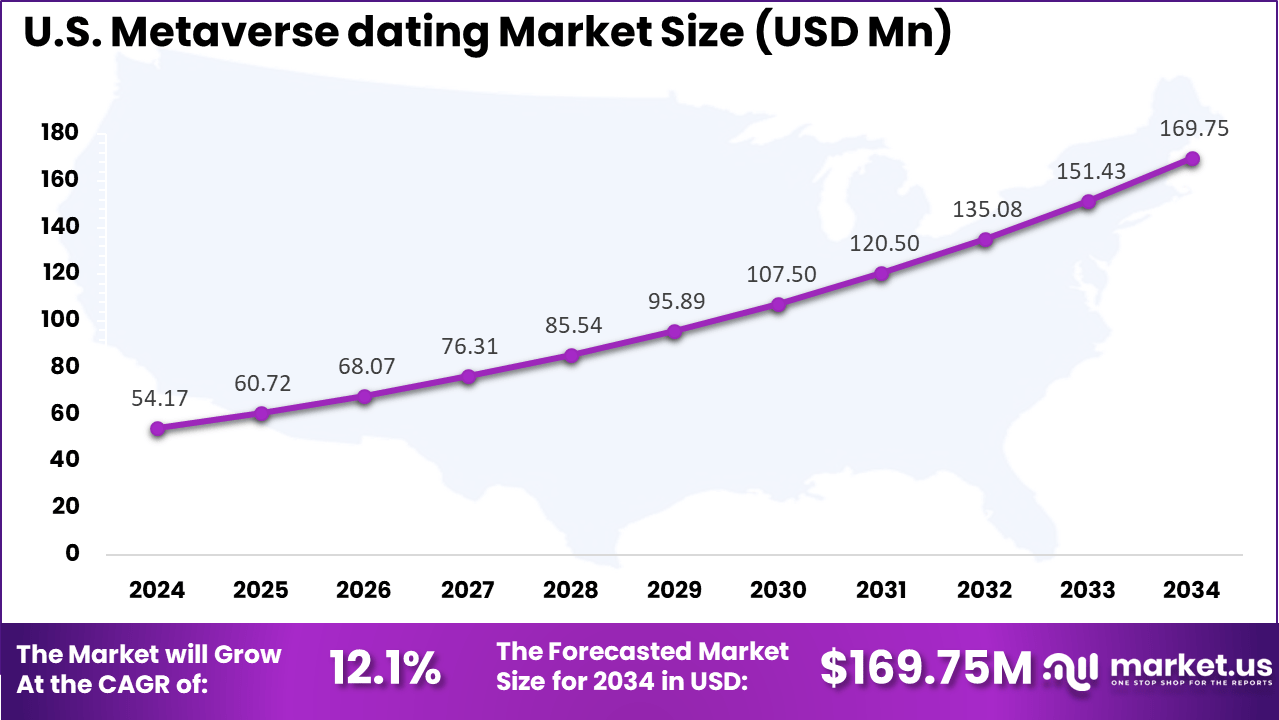

- The US market reached USD 54.17 million in 2024 and is growing at a solid CAGR of 12.1%, supported by high adoption of virtual social platforms and immersive technologies.

- North America captured over 42.6%, driven by strong VR adoption, advanced digital infrastructure, and growing interest in virtual relationship platforms.

Key Statistics

- Overall interest: Surveys indicate that 44% of people would consider dating in the metaverse. More than 80% of couples already using dating apps say they are open to exploring virtual dating experiences.

- Gender trends: Research shows that 48% of women and 68% of men express interest in metaverse dating, suggesting stronger enthusiasm among male users but meaningful engagement across both groups.

- Age demographics: Gen Z and Millennials are the most active participants. Data from Flirtual, a VR dating app, shows that more than half of its users are between 18 and 30 years old, highlighting strong adoption among younger digital-native groups.

- Current engagement: About 10% of the population has already tested augmented reality or metaverse-based dating platforms. A majority of those who tried it reported that the virtual experience felt more enjoyable than real-life dating.

- Platform activity: Nevermet, one of the early metaverse dating platforms, reported over 200,000 new virtual relationships within its first six months. Reddit communities focused on VR saw a 249% increase in mentions of the term “dating”, showing a rapid rise in social interest.

Role of Generative AI

Generative AI significantly enhances metaverse dating by creating personalized and interactive avatars that mirror users’ expressions and behaviors. This technology facilitates more natural and intuitive conversations through AI-powered chatbots, improving communication and social interaction in virtual dating environments.

About 47% of people have shown interest in using advanced AI-based dating apps to find long-term partners, highlighting the growing importance of AI in matchmaking processes. The ability of generative AI to adapt storytelling and create dynamic content makes virtual dating experiences more immersive and engaging, helping users connect more deeply before meeting in person.

By analyzing user data, AI customizes dating profiles and matches based on individual preferences and behaviors. This leads to more accurate matches and enhances trust and satisfaction among users. Studies reveal that high interaction quality and avatar customization significantly influence users’ dating intentions within the metaverse, underlining the crucial role of generative AI in this evolving space.

Investment and Business Benefits

Investment opportunities in metaverse dating arise in virtual assets, avatar customization items, and unique virtual event experiences. Investors can explore virtual real estate where users host events or dates, digital collectibles related to dating experiences, and platform monetization through virtual goods sales. Early investments focus on creating immersive, secure, and appealing dating environments.

Businesses see benefits such as increased user engagement, new revenue streams, and access to broader markets through virtual events and advertising integrated into the dating platform. Business benefits of metaverse dating platforms include enhanced brand awareness and market reach by offering innovative user experiences.

They provide interactive and flexible environments for users to form genuine connections beyond traditional media. This leads to improved engagement and retention, particularly among younger consumers seeking immersive social experiences. Additionally, remote interaction capabilities allow businesses to transcend geographic and physical limitations, fostering a global user base and sustained platform growth.

U.S. Market Size

The market for Metaverse dating within the U.S. is growing tremendously and is currently valued at USD 54.17 million, the market has a projected CAGR of 12.1%. The market is growing rapidly due to several key factors driving consumer adoption. Advances in virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) are creating highly immersive and interactive dating experiences that attract tech-savvy users.

Increasing internet penetration and the rollout of 5G networks are enabling faster and smoother virtual interactions, making the metaverse more accessible and enjoyable. Moreover, shifting consumer behavior favors digital socialization and immersive entertainment over traditional platforms. Younger generations seek novel ways to connect and explore relationships, fueling demand for metaverse dating.

For instance, in November 2024, Match Group outlined plans for a metaverse dating ecosystem, including avatar-based virtual experiences on apps like Tinder, featuring virtual goods economies and live interactive environments. Their innovations focus on enabling more natural, real-world-like social interactions within metaverse dating spaces.

In 2024, North America held a dominant market position in the Global Metaverse dating Market, capturing more than a 42.6% share, holding USD 60.61 million in revenue. The region benefits from advanced digital infrastructure and widespread adoption of AR and VR technologies that enable immersive, interactive dating experiences. Strong investments by major tech companies and industry innovators fuel continuous innovation and platform development.

Additionally, North America’s population shows early adoption of new technology and openness to virtual social interactions. The presence of tech-savvy consumers and supportive economic conditions further contributes to sustained market growth. This combination of technology leadership, consumer readiness, and investment strength secures North America’s leading position in the metaverse dating market.

For instance, in September 2025, Meta Platforms, Inc. introduced new Facebook Dating features designed to reduce “swipe fatigue”, enhancing user engagement through smarter matchmaking and interaction tools. These AI-powered updates aim to streamline dating experiences and maintain Meta’s leadership in social and metaverse dating markets.

Platform Type Analysis

In 2024, The Social Metaverse Platforms segment held a dominant market position, capturing a 47.3% share of the Global Metaverse dating Market. These platforms facilitate social interactions by creating immersive virtual environments where users can meet, chat, and engage in shared activities. The social nature of these platforms attracts users who want to form meaningful connections beyond traditional online dating apps, favoring interactive and engaging experiences.

The emphasis on social metaverse platforms reflects the increasing demand for digital spaces that replicate real-life social dynamics while offering the freedom to explore identities virtually. These platforms are designed to encourage sustained interaction, community building, and frequent user engagement, making them central to the growth of the metaverse dating ecosystem.

For Instance, In September 2025, Meta Platforms introduced new Facebook Dating features designed to reduce swipe fatigue by promoting more social and immersive interactions. The update aligned with the rising role of social metaverse platforms, where users connect through shared virtual spaces rather than brief matches. Meta’s continued investment in AR and VR technologies reflected its commitment to placing immersive social experiences at the center of digital dating.

Avatar Type Analysis

In 2024, the Humanoid Avatars segment held a dominant market position, capturing a 52.6% share of the Global Metaverse dating Market. These avatars provide a relatable and familiar form for users to express themselves and interact, mimicking human gestures, expressions, and movements. The preference for humanoid avatars stems from their ability to offer a more natural and immersive social experience within virtual dating environments.

Using humanoid avatars helps users bridge personal identity and virtual presence, creating emotional connections by conveying non-verbal cues digitally. As avatar technology advances, these humanoid forms are becoming more customizable and expressive, enhancing the authenticity of virtual dating interactions.

For instance, in June 2025, VRChat emphasized its focus on avatar creativity and diversity with the Avatar Marketplace release and community-driven worlds, offering users rich humanoid avatar options to express themselves authentically. Such advancements demonstrate the market’s appetite for lifelike, relatable avatars to facilitate emotional connection in digital dating environments.

Interaction Type Analysis

In 2024, The Activity-Based Dating segment held a dominant market position, capturing a 38.9% share of the Global Metaverse dating Market. This mode involves users engaging in shared activities or experiences such as games, virtual events, or challenges, which fosters organic connections through collaboration or competition. Activity-based interactions focus on creating dynamic and fun experiences, moving beyond simple messaging or profile matching.

This style of interaction encourages users to bond over common interests and shared experiences, making dating more engaging and less superficial. The immersive and interactive nature of activity-based dating leverages the strengths of the metaverse to create new pathways for relationship building.

For Instance, in March 2025, Planet Theta, Inc. focuses on secure VR dating with identity verification and immersive short virtual dates in various environments, fostering chemistry through interactive, activity-based dating sessions before traditional profile views.

Revenue Model Analysis

In 2024, The Subscription Services segment held a dominant market position, capturing a 41.7% share of the Global Metaverse dating Market. Subscriptions offer users access to premium features, enhanced customization options, and uninterrupted social experiences within the metaverse dating platforms. This recurring revenue model provides a predictable income stream for platform developers while delivering continuous value to engaged users.

Subscription models appeal to users seeking a deeper level of commitment and enhanced digital experiences. They often include perks such as exclusive events, advanced matchmaking algorithms, and priority access, which improve engagement and satisfaction on these dating platforms.

For Instance, in November 2024, Bumble highlighted strong user engagement and positive outlooks driven by premium subscription features that enhance dating experiences through added transparency and personalized content. Bumble’s focus on subscriptions reflects the market tendency towards monetizing meaningful engagement via ongoing membership.

Emerging Trends

One key emerging trend is the rise of VR-enabled dating experiences that allow users to virtually meet in realistic settings using avatars. This trend is driven by the desire to overcome limitations of traditional dating apps by offering immersive environments where people can socialize, play games, and explore relationships virtually.

Research shows that approximately 33% of singles intend to try dating in the metaverse, where building digital intimacy is prioritized. Another trend is the use of augmented reality (AR) to display interactive 3D avatars performing hobbies or activities, which helps people form more authentic connections.

This form of socialization through AR/VR blends real-world interests with virtual presentations, increasing engagement and realism in dating interactions. The integration of social gaming within metaverse dating platforms is also gaining traction, enhancing community building and shared experiences.

Growth Factors

Increasing demand for immersive social experiences is a major growth driver for metaverse dating. Many users seek more meaningful connections beyond text profiles, favoring environments where they can interact naturally through avatars.

Technological advancements in 5G and cloud computing support these experiences by enabling seamless, high-quality virtual interactions. Around 54% of users want AI to assist them in finding matches tailored to their lifestyles and interests, demonstrating the impact of AI-enabled personalization on growth. The rising trend of socialization and entertainment in virtual spaces also fuels growth.

Users increasingly prefer platforms that combine dating with gaming and other interactive features that enhance enjoyment and minimize social anxiety. The ability to customize avatars and engage in dynamic storytelling within the metaverse has made dating platforms more attractive to younger demographics seeking innovative dating experiences.

Key Market Segments

By Platform Type

- Social Metaverse Platforms

- Dedicated Dating Metaverses

- Game-Based Dating Environments

By Avatar Type

- Humanoid Avatars

- Fantasy & Customized Avatars

- Others

By Interaction Type

- Voice-Based Dating

- Text-Based Dating

- Activity-Based Dating (Games, Events)

- Others

By Revenue Model

- Subscription Services

- In-App Purchases

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Immersive Social Experiences

The metaverse dating market is driven by rising demand for immersive and interactive social experiences that allow users to connect beyond physical limits. Avatar based interactions in virtual environments enable more expressive communication and shared activities that traditional dating apps cannot provide, strengthening emotional connection. Growing adoption of VR and AR technologies also supports this shift by making these virtual experiences more accessible and realistic.

In December 2024, Meta Platforms highlighted new AR and AI innovations at its Meta Connect 2025 event, focusing on richer social interactions and advanced virtual dating environments. These developments strengthened interest in immersive social connections and supported wider adoption of metaverse dating platforms.

Restraint

Privacy and Security Concerns

Privacy and security concerns remain a major restraint for the metaverse dating market because immersive platforms require users to share detailed personal, behavioral, and sometimes biometric data. This raises risks related to identity theft, data breaches, and tracking, especially in the absence of consistent cybersecurity standards. These issues create uncertainty and reduce user willingness to fully participate.

In November 2021, Match Group introduced its avatar based app Single Town, but concerns over real time audio, location, and personal data sharing highlighted the need for stronger safety and moderation measures before wider adoption of metaverse dating can be achieved.

Opportunities

Expansion of Virtual Dating Ecosystems

The metaverse dating market holds a major opportunity in the expansion of virtual dating ecosystems that integrate multiple services and experiences. Platforms can capitalize on features like avatar customization, virtual events, and gamified social interaction to create unique dating journeys that traditional apps cannot offer.

Moreover, as more users seek authentic and shared social experiences amid increasing digitalization, these ecosystems can build strong, loyal communities. This growth is supported by advancements in 5G, AI, and digital economies, allowing dating platforms to monetize virtual goods and services within these ecosystems.

For instance, In August 2025, Roblox revealed plans to introduce virtual dating features for users aged 21 and older, allowing them to meet and interact inside immersive metaverse spaces. This move was positioned as a response to the rising demand for social experiences in gaming, where virtual engagement is increasingly linked to real-life connections.

Challenges

High Cost and Technological Accessibility

A key challenge for the metaverse dating market is the high cost and limited accessibility of VR and AR devices that are required for an immersive experience. Many users, particularly in emerging markets, lack access to affordable hardware and fast internet, which creates a clear divide between those who can fully participate and those who cannot. This gap limits adoption and makes the experience far less inclusive compared with traditional dating apps that only require a smartphone.

In April 2025, Flirtual highlighted this issue when demonstrating its AI and VR based dating features, which depend on compatible headsets and stable high-speed connections. The need for advanced equipment restricts the market’s reach, especially in regions with weak digital infrastructure. Overcoming these hurdles is considered essential for expanding metaverse dating services to a broader global audience.

Key Players Analysis

Meta Platforms, Match Group, Bumble, and Tencent lead the metaverse dating market with large-scale social ecosystems, immersive interaction tools, and strong user networks. Their platforms focus on virtual presence, avatar-based communication, and AI-driven matchmaking. These companies prioritize safety features, real-time interaction, and cross-platform accessibility.

VRChat, Rec Room, Unity, and Roblox strengthen the competitive landscape by enabling social discovery, shared virtual spaces, and interactive activities for users seeking connections. Their platforms offer customizable avatars, spatial audio, and multiplayer environments that support organic relationship formation. These providers help users build deeper engagement through virtual events, mini-games, and community-driven worlds.

Nevermet, Planet Theta, Flirtual, IRL Social, The Circle, Volar, and other emerging participants add diversity with dating-specific metaverse experiences tailored for immersive romantic interactions. Their solutions focus on privacy-friendly design, curated matchmaking spaces, and guided virtual date experiences. These companies promote comfort, authenticity, and creative self-expression through avatar-based interaction.

Top Key Players in the Market

- Meta Platforms, Inc.

- Match Group, LLC

- Bumble, Inc.

- Tencent Holdings, Ltd.

- VRChat, Inc.

- Rec Room, Inc.

- Unity Software, Inc.

- Roblox Corporation

- Nevermet, Inc.

- Planet Theta, Inc.

- Flirtual, Inc.

- IRL Social, Inc.

- The Circle, Inc.

- Volar, Inc.

- Others

Recent Developments

- In September 2025, Meta Platforms continued its deep investments in metaverse technologies at Meta Connect 2025, unveiling the Meta Horizon Engine that enables richer, more immersive virtual social experiences, including augmented reality (AR) and virtual reality (VR)-powered dating environments. This platform enhances avatar-based interactions and virtual date activities, reinforcing Meta’s leadership in creating next-gen digital social spaces.

- In August 2025, Roblox Corporation: Roblox, famed for its user-generated virtual worlds, plans to launch a virtual dating feature allowing users aged 21+ to meet, date, and form relationships in the metaverse. This effort aims at addressing loneliness among Gen Z by offering a safer and more engaging virtual space for romantic and social interaction.

Report Scope

Report Features Description Market Value (2024) USD 142.3 Mn Forecast Revenue (2034) USD 518.4 Mn CAGR(2025-2034) 13.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform Type (Social Metaverse Platforms, Dedicated Dating Metaverses, Game-Based Dating Environments), By Avatar Type (Humanoid Avatars, Fantasy & Customized Avatars, Others), By Interaction Type (Voice-Based Dating, Text-Based Dating, Activity-Based Dating (Games, Events), Others), By Revenue Model (Subscription Services, In-App Purchases, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Meta Platforms, Inc.; Match Group, LLC; Bumble, Inc.; Tencent Holdings, Ltd.; VRChat, Inc.; Rec Room, Inc.; Unity Software, Inc.; Roblox Corporation; Nevermet, Inc.; Planet Theta, Inc.; Flirtual, Inc.; IRL Social, Inc.; The Circle, Inc.; Volar, Inc.; Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Meta Platforms, Inc.

- Match Group, LLC

- Bumble, Inc.

- Tencent Holdings, Ltd.

- VRChat, Inc.

- Rec Room, Inc.

- Unity Software, Inc.

- Roblox Corporation

- Nevermet, Inc.

- Planet Theta, Inc.

- Flirtual, Inc.

- IRL Social, Inc.

- The Circle, Inc.

- Volar, Inc.

- Others