Global Metalized Flexible Packaging Market Size, Share, Growth Analysis By Material Type (Aluminum-Foil-Based Flexible Packaging, Metalized Film Flexible Packaging, ALOX/SIOX PP, ALOX/SIOX PET, Others), By Structure (Laminated Structures, Mono-Extruded Structures, Others), By Packaging Type (Pouches, Bags, Wraps, Rollstocks, Others), By End-Use (Food & Beverage, Personal Care, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155388

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

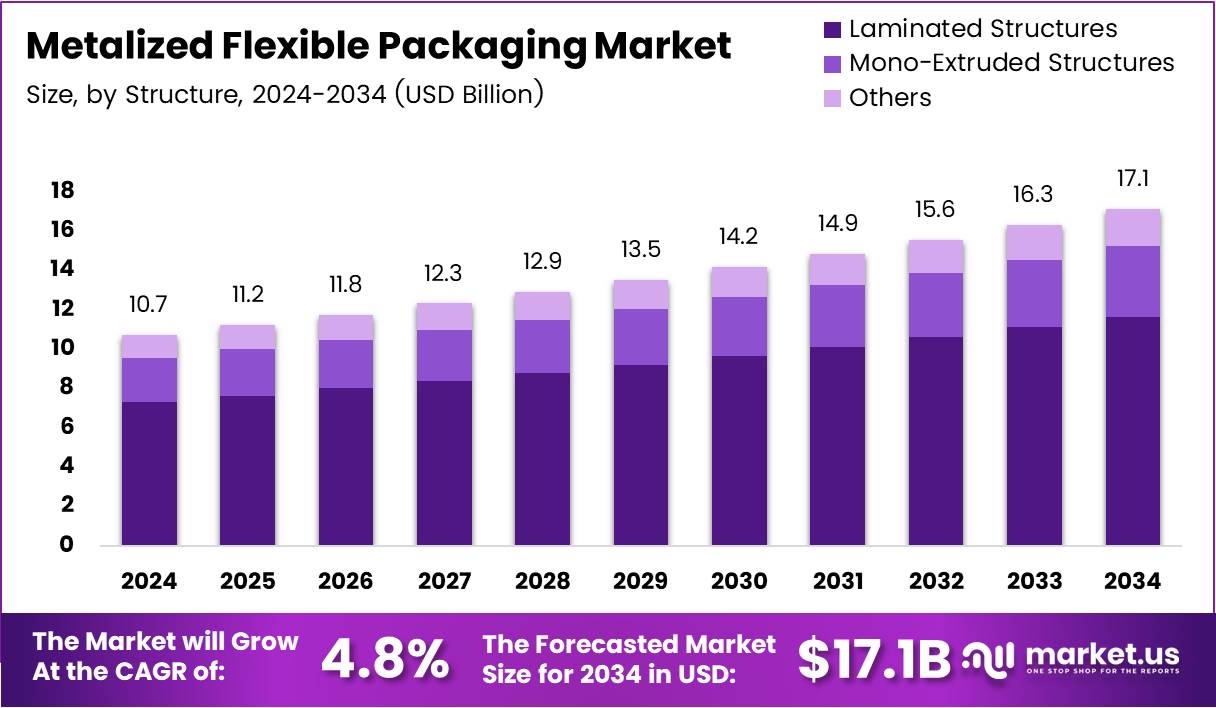

The Global Metalized Flexible Packaging Market size is expected to be worth around USD 17.1 Billion by 2034, from USD 10.7 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The Metalized Flexible Packaging Market refers to packaging materials that combine a flexible substrate, such as plastic or foil, with a thin layer of metal, typically aluminum. This metal layer enhances the barrier properties of the packaging, offering superior protection from moisture, light, and oxygen. The market is witnessing rapid growth due to its increasing applications in food, beverage, pharmaceutical, and consumer goods industries.

The growth of the Metalized Flexible Packaging Market is primarily driven by consumer demand for lightweight, durable, and sustainable packaging solutions. As packaging plays a vital role in brand recognition and product protection, metalized flexible materials provide an edge over traditional options. This growing preference for high-performance materials is boosting market expansion.

One key opportunity for the Metalized Flexible Packaging Market lies in the increasing demand for eco-friendly packaging solutions. With rising concerns over plastic waste, manufacturers are seeking innovative ways to reduce the environmental impact of their packaging. As a result, metalized flexible packaging is gaining traction for its recyclability and ability to replace traditional packaging formats, such as glass and rigid plastic containers.

Government investments in sustainable packaging initiatives are further fueling market growth. Many countries have introduced regulations that encourage the use of recyclable and energy-efficient packaging materials. For example, the European Union’s Circular Economy Action Plan emphasizes the need for sustainable packaging solutions, thus creating a favorable regulatory environment for metalized flexible packaging.

In terms of regulatory framework, stricter norms are being enforced to ensure product safety, quality, and environmental responsibility. Regulations around the use of hazardous substances in packaging materials are also pushing companies to adopt safer, more eco-friendly alternatives. This presents both challenges and opportunities for market players to innovate and stay compliant with evolving standards.

The future of the Metalized Flexible Packaging Market looks promising, with continuous advancements in technology and material science. As businesses focus more on sustainability and consumer preferences evolve, there is a strong potential for growth in regions like North America and Europe. Continued investment in research and development will likely drive innovation in product offerings.

Key Takeaways

Material Type Analysis

In 2024, Aluminum-Foil-Based Flexible Packaging held a dominant market position in By Material Type Analysis segment of Metalized Flexible Packaging Market, with a 38.4% share.

In 2024, Aluminum-Foil-Based Flexible Packaging emerged as the leading material in the Metalized Flexible Packaging Market. Its dominance can be attributed to its exceptional barrier properties, which provide high protection against moisture, light, and oxygen. This makes it ideal for packaging products that require extended shelf life and optimal protection, such as food, beverages, and pharmaceuticals.

Metalized Film Flexible Packaging followed, holding a significant share in the market. With its enhanced printability and relatively low production cost, it continues to be widely adopted in various packaging applications, offering a good balance between cost and performance.

ALOX/SIOX PP and ALOX/SIOX PET are also crucial players in the market. These materials offer improved barrier properties and are often chosen for their durability and lightweight characteristics. However, their market share remains comparatively smaller than that of Aluminum-Foil-Based Flexible Packaging.

The Others category consists of various emerging materials that are being explored for specialized applications. This category is expected to grow as new innovations in flexible packaging materials continue to emerge.

Structure Analysis

In 2024, Laminated Structures held a dominant market position in By Structure Analysis segment of Metalized Flexible Packaging Market, with a 68.1% share.

Laminated Structures have maintained a dominant share in the Metalized Flexible Packaging Market due to their ability to combine multiple layers of materials, offering superior barrier properties and durability. This makes them highly suitable for a wide range of products, particularly in the food and beverage sector, where packaging integrity is critical.

Mono-Extruded Structures have a smaller market share in comparison. However, they are favored for their simplicity and cost-effectiveness in producing thinner packaging with reasonable protection.

The Others segment is steadily growing, as new structure types and material combinations are being introduced to cater to evolving packaging requirements, particularly for sustainability-driven applications.

Packaging Type Analysis

In 2024, Pouches held a dominant market position in By Packaging Type Analysis segment of Metalized Flexible Packaging Market, with a 43.2% share.

Pouches continue to dominate the Metalized Flexible Packaging Market, with their versatile use across various industries. The lightweight nature of pouches, combined with their ability to offer high protection and customization options, makes them an attractive choice for both food & beverage and personal care products.

Bags and Wraps also hold a considerable market share. While bags are favored for bulk packaging, wraps are commonly used for single-serve products, particularly in food packaging.

Rollstocks and other packaging types are still relevant in the market but account for a smaller share. Rollstocks are often preferred for large-scale packaging operations due to their ease of use and lower production costs.

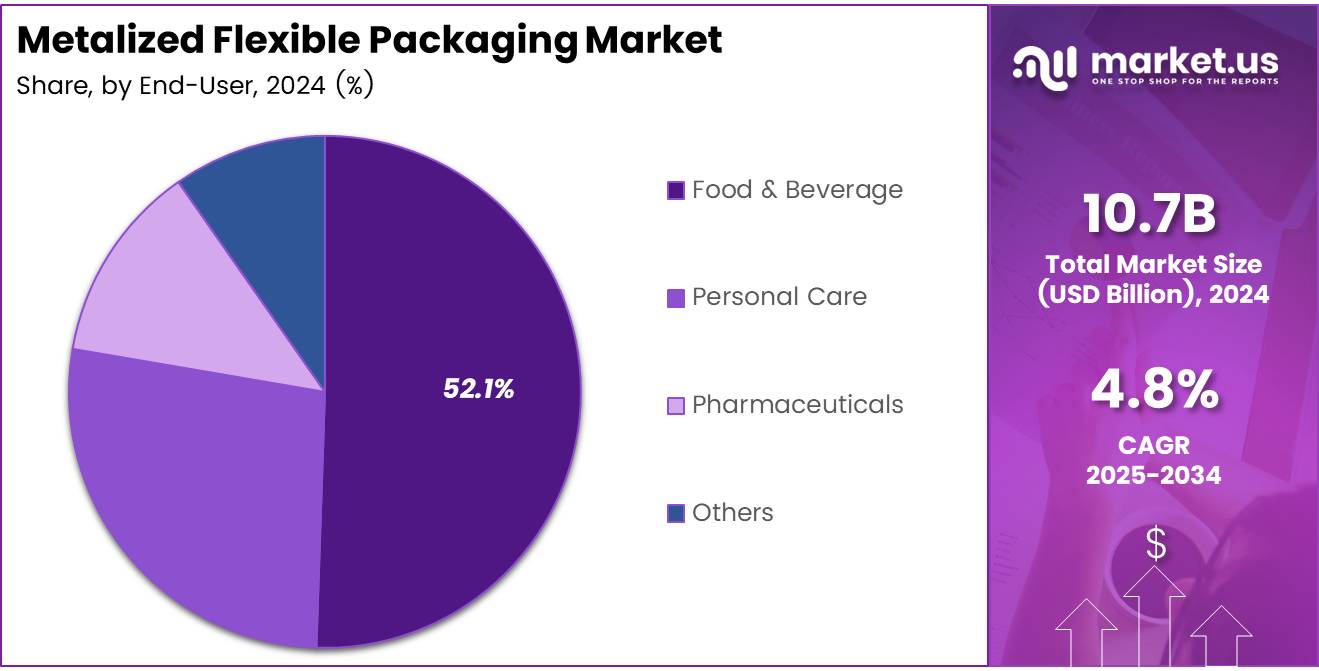

End-Use Analysis

In 2024, Food & Beverage held a dominant market position in By End-Use Analysis segment of Metalized Flexible Packaging Market, with a 52.1% share.

The Food & Beverage sector leads the Metalized Flexible Packaging Market, with the highest share due to the growing demand for products requiring extended shelf life and protection from environmental factors. Metalized flexible packaging is increasingly being used in ready-to-eat meals, snack foods, and beverages.

Personal Care products also represent a significant portion of the market. With growing consumer interest in eco-friendly and sustainable packaging, the demand for flexible packaging solutions is rising within this sector.

Pharmaceuticals also make up a notable segment, driven by the need for protective and sterile packaging for medical products.

The Others category includes various niche industries, including pet food and industrial products, which together contribute to the ongoing diversification of the Metalized Flexible Packaging Market.

Key Market Segments

By Material Type

- Aluminum-Foil-Based Flexible Packaging

- Metalized Film Flexible Packaging

- ALOX/SIOX PP

- ALOX/SIOX PET

- Others

By Structure

- Laminated Structures

- Mono-Extruded Structures

- Others

By Packaging Type

- Pouches

- Bags

- Wraps

- Rollstocks

- Others

By End-Use

- Food & Beverage

- Personal Care

- Pharmaceuticals

- Others

Drivers

Increasing Demand for Longer Shelf Life and Product Protection Drives Market Growth

The metalized flexible packaging market continues expanding as manufacturers prioritize product preservation. Companies increasingly adopt these solutions to extend shelf life and maintain product quality during storage and transportation.

Furthermore, consumer preference for sustainable packaging drives market adoption. Eco-friendly and recyclable metalized materials attract environmentally conscious buyers, encouraging brands to switch from traditional packaging methods to more sustainable alternatives.

Additionally, e-commerce growth accelerates demand for secure packaging solutions. Online retailers require attractive, protective packaging that withstands shipping challenges while maintaining visual appeal for customer satisfaction and brand representation.

Moreover, metalized packaging offers superior barrier properties against moisture, oxygen, and light. This protection ensures product integrity across various industries, from food items to sensitive pharmaceuticals requiring extended preservation periods.

Restraints

Environmental Concerns Related to Plastic-Based Packaging Materials Limit Market Growth

Environmental sustainability concerns significantly impact the metalized flexible packaging market. Consumers and regulatory bodies increasingly scrutinize plastic-based materials, creating pressure for manufacturers to develop more eco-friendly alternatives and sustainable production methods.

Additionally, stringent regulatory standards restrict certain packaging materials usage. Government agencies worldwide implement strict guidelines governing packaging composition, recyclability requirements, and environmental impact assessments, limiting manufacturers’ material choices.

Furthermore, waste management challenges associated with metalized packaging create market barriers. Complex recycling processes for multi-layer materials increase disposal costs and environmental concerns, deterring some companies from adopting these solutions.

Nevertheless, rising awareness about plastic pollution influences purchasing decisions. Consumers actively seek alternatives to traditional packaging, forcing manufacturers to balance performance requirements with environmental responsibility and regulatory compliance expectations.

Growth Factors

Rise in Demand for Metalized Packaging in Food and Beverage Sector Creates Growth Opportunities

The food and beverage industry presents substantial growth opportunities for metalized flexible packaging. Increasing consumer demand for convenient, shelf-stable products drives manufacturers to adopt advanced packaging solutions that maintain freshness and nutritional value.

Subsequently, pharmaceutical applications expand market potential significantly. Drug manufacturers increasingly utilize metalized packaging to protect sensitive medications from environmental factors, ensuring product efficacy and extending expiration dates for critical healthcare products.

Meanwhile, innovative packaging designs enhance consumer appeal and protection capabilities. Companies invest in creative solutions that combine aesthetic appeal with functional benefits, attracting customers while maintaining superior product preservation standards.

Consequently, emerging markets offer untapped potential for expansion. Growing middle-class populations in developing regions create new opportunities for packaged goods, driving demand for advanced packaging technologies and solutions.

Emerging Trends

Shift Towards Lightweight and Flexible Packaging Solutions Shapes Market Trends

The packaging industry increasingly embraces lightweight and flexible solutions to reduce transportation costs and environmental impact. Metalized flexible packaging offers superior strength-to-weight ratios, making it ideal for various applications requiring efficient material usage.

Simultaneously, nanotechnology integration improves barrier properties significantly. Advanced nanomaterials enhance protection against moisture, gases, and UV radiation while maintaining package flexibility and reducing material thickness requirements for optimal performance.

Moreover, smart packaging features revolutionize consumer interaction and product tracking. Integration of QR codes, RFID tags, and sensors enables real-time monitoring, authentication, and enhanced customer engagement throughout the supply chain process.

Therefore, sustainable innovation drives technological advancement in the sector. Manufacturers continuously develop biodegradable metalized materials and recyclable alternatives to meet growing environmental demands while maintaining superior protection and aesthetic qualities.

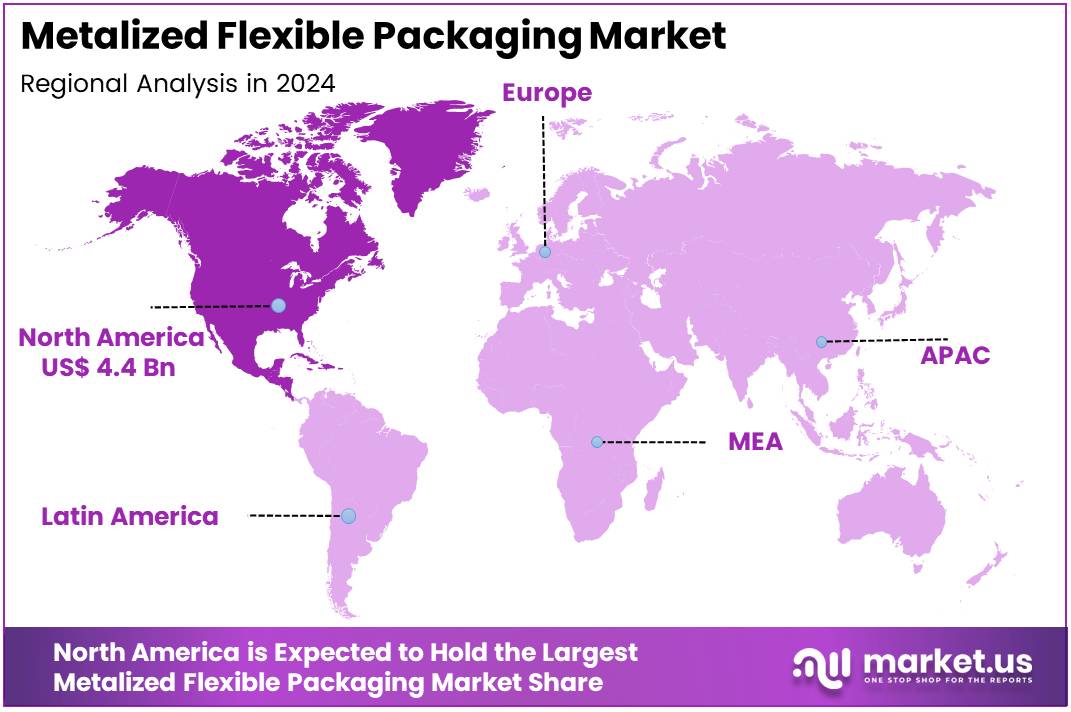

Regional Analysis

North America Dominates the Metalized Flexible Packaging Market with a Market Share of 41.7%, Valued at USD 4.4 Billion

North America stands as the leading regional market with a Market Share of 41.7%, Valued at USD 4.4 Billion, driven by robust demand from the food and beverage industry and advanced packaging technologies. The region benefits from strong consumer preference for convenient, shelf-stable products and stringent food safety regulations that favor barrier packaging solutions.

Major food processing companies and snack manufacturers in the United States and Canada extensively utilize metalized films for products requiring extended shelf life and enhanced product protection. The presence of established packaging manufacturers and continuous innovation in sustainable metalized packaging solutions further strengthens North America’s dominant position in the global market.

Europe Metalized Flexible Packaging Market Trends

Europe represents a significant market for metalized flexible packaging, characterized by increasing demand for premium food products and growing emphasis on sustainable packaging solutions. The region’s strict environmental regulations are driving innovation in recyclable and bio-based metalized films, particularly in countries like Germany, France, and the United Kingdom.

European consumers’ preference for high-quality packaged foods, coupled with the expanding ready-to-eat meal segment, continues to fuel market growth. The pharmaceutical and personal care industries also contribute substantially to the regional demand for metalized flexible packaging solutions.

Asia Pacific Metalized Flexible Packaging Market Trends

Asia Pacific emerges as the fastest-growing regional market for metalized flexible packaging, propelled by rapid urbanization, changing lifestyle patterns, and expanding food processing industries. Countries like China, India, and Japan are witnessing significant growth in packaged food consumption, driving demand for advanced barrier packaging solutions.

The region’s large population base, rising disposable incomes, and increasing penetration of organized retail contribute to market expansion. Manufacturing cost advantages and growing investments in packaging infrastructure position Asia Pacific as a key growth engine for the global metalized flexible packaging market.

Middle East and Africa Metalized Flexible Packaging Market Trends

The Middle East and Africa region shows promising growth potential in the metalized flexible packaging market, driven by expanding food and beverage industries and increasing consumer awareness about product quality and safety.

Growing urbanization and changing dietary habits in countries across the Gulf Cooperation Council and South Africa are boosting demand for packaged foods requiring barrier protection. The region’s harsh climatic conditions necessitate packaging solutions with excellent moisture and oxygen barrier properties, making metalized films particularly suitable for local market requirements.

Latin America Metalized Flexible Packaging Market Trends

Latin America presents a developing market for metalized flexible packaging, with growth primarily driven by the expanding snack food industry and increasing adoption of modern retail formats. Countries like Brazil, Mexico, and Argentina are experiencing rising demand for packaged convenience foods, supporting market growth in the region.

The growing middle-class population and increasing consumer spending on branded packaged products create opportunities for metalized flexible packaging applications. However, economic volatility and price sensitivity in certain markets pose challenges for premium packaging solutions adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Metalized Flexible Packaging Company Insights

In 2024, Amcor plc is anticipated to continue its dominance in the global Metalized Flexible Packaging Market, leveraging its extensive experience in producing high-quality packaging solutions. The company’s focus on sustainability and innovation in packaging materials, along with its global footprint, makes it a strong contender in this market.

Sealed Air Corporation remains a key player, with its specialized solutions in protective packaging. The company’s advanced material technologies, especially in metalized films, enhance the protection and shelf-life of products, catering to industries such as food and beverage, which is critical in the growing demand for longer-lasting packaging.

Huhtamaki Oyj is also a significant force in the metalized flexible packaging sector, known for its eco-friendly innovations and efforts to reduce carbon footprints. The company’s strategic investments in sustainable packaging solutions have made it a key supplier in the global market, aligning with the growing demand for recyclable and environmentally responsible packaging options.

Transcontinental Inc. stands out due to its continuous investment in flexible packaging technologies. Known for its extensive portfolio in metalized films, the company focuses on expanding its market share through innovations in packaging design and functionality, making it an important player in the flexible packaging landscape.

Top Key Players in the Market

- Amcor plc

- Sealed Air Corporation

- Huhtamaki Oyj

- Transcontinental Inc.

- Polyplex Corporation Ltd.

- Uflex Limited

- Jindal Poly Films Limited

- Cosmo First Limited

- TOPPAN Holdings Inc.

- Ester Industries Limited

Recent Developments

- In December 2024, Movopack secured $2.5 million in funding to further enhance its sustainable e-commerce packaging solutions, aiming to reduce environmental impact and cater to the growing demand for eco-friendly packaging in the online retail sector.

- In February 2025, Nfinite Nanotechnology raised over $6.5 million in seed funding to accelerate its innovations in nanotechnology, partnering with major global brands like PepsiCo to revolutionize packaging and product development across multiple industries.

Report Scope

Report Features Description Market Value (2024) USD 10.7 Billion Forecast Revenue (2034) USD 17.1 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Aluminum-Foil-Based Flexible Packaging, Metalized Film Flexible Packaging, ALOX/SIOX PP, ALOX/SIOX PET, Others), By Structure (Laminated Structures, Mono-Extruded Structures, Others), By Packaging Type (Pouches, Bags, Wraps, Rollstocks, Others), By End-Use (Food & Beverage, Personal Care, Pharmaceuticals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor plc, Sealed Air Corporation, Huhtamaki Oyj, Transcontinental Inc., Polyplex Corporation Ltd., Uflex Limited, Jindal Poly Films Limited, Cosmo First Limited, TOPPAN Holdings Inc., Ester Industries Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Metalized Flexible Packaging MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Metalized Flexible Packaging MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Sealed Air Corporation

- Huhtamaki Oyj

- Transcontinental Inc.

- Polyplex Corporation Ltd.

- Uflex Limited

- Jindal Poly Films Limited

- Cosmo First Limited

- TOPPAN Holdings Inc.

- Ester Industries Limited