Global Metal Magnesium Market By Production Process (Pidgeon Process, Dow Process, and YSZ Process), By Application(Die Casting, Aluminum Alloys, Titanium Reduction, Iron & Steel Making), by End-User Industry(Aeronautical, Automotive, Electronics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 100479

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

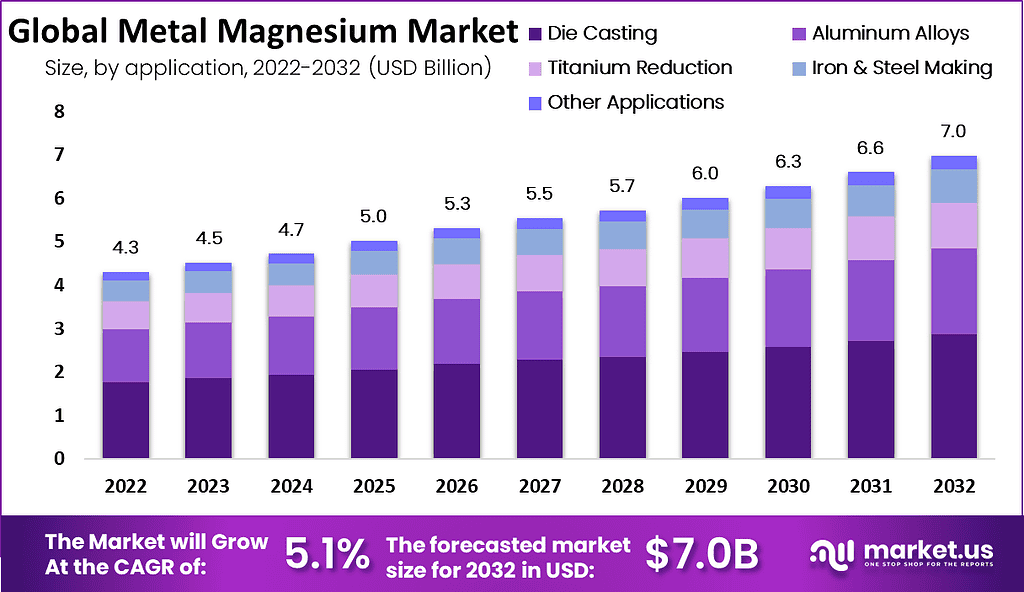

The Global Metal Magnesium Market size is expected to be worth around USD 7.0 Billion by 2032 from USD 4.3 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2022 to 2032.

The metal magnesium (Mg) is a chemical element that is alkaline earth metal. It is a gray metal having a low density, low melting point, and high chemical reactivity. Magnesium is the most abundant element in the earth’s crust by mass. It is found in large deposits of dolomite, magnesite, and other minerals and mineral waters, where magnesium ion is soluble.

It has great demand in construction and medicines; also, it is one of the most essential to all cellular life. Magnesium is a valuable metal that is used in alloy batteries and in chemical synthesis. This metal is mostly obtained from seawater which contains about 1.2g of Mg for every kilogram of seawater.

Magnesium is ideal for die casting and aluminum alloys due to its good electromagnetic screening properties and heat conductivity. This is the lightest metal as compared to other metal components, which enhances its physical properties. The demand for magnesium metal is increasing in the aluminum alloying process in the automotive industry and is expected to drive the market during the forecast period.

Key Takeaways

- Market Growth Projection: The Metal Magnesium Market is projected to reach a value of USD 7.0 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 5.1% from 2023 to 2032.

- Introduction to Metal Magnesium: Metal magnesium (Mg) is an alkaline earth metal known for its low density, low melting point, and high chemical reactivity. It is abundant in the Earth’s crust and is often extracted from sources like seawater.

- Versatile Applications: Metal magnesium finds applications in various sectors, including construction, medicine, and alloy batteries, making it crucial for cellular life. It is primarily sourced from seawater, which contains approximately 1.2g of magnesium per kilogram.

- Automotive and Aerospace Demand: The automotive industry increasingly uses magnesium to reduce production costs and vehicle weight. Its combination of specific strength, lightweight, and castability makes it valuable in both automotive and aerospace applications.

- Aerospace Utilization: Magnesium alloys are employed in aerospace for manufacturing aircraft wheels, gearboxes, and helicopter transmissions, improving fuel efficiency and performance.

- Titanium Production: The demand for magnesium in titanium reduction is on the rise, as magnesium serves as a primary raw material in titanium production.

- Availability of Alternative Materials: The high machinery and environmental concerns associated with mining magnesia, as well as the low-temperature strength of metal magnesia, pose challenges to market growth.

- Dominant Production Process: The Pidgeon process dominates the production of metal magnesium, accounting for 80% of the market revenue in 2022. This process offers advantages like steady flow, small investments, and good magnesium quality.

- Key Application: Die Casting: Die casting is the dominant application, contributing 41% of the market revenue in 2022. Magnesium’s attributes, such as good heat conductivity and electromagnetic screening properties, make it ideal for die casting.

- Growing Use in Aluminum Alloys: The aluminum alloy segment is expected to grow at a fast CAGR, as magnesium enhances tensile strength and low-cycle fatigue resistance in aluminum alloys.

- Automotive Industry Dominance: Within end-user industries, the automotive segment holds the largest market revenue share (38% in 2022) due to the demand for lightweight vehicle parts and cost savings achieved by using magnesium.

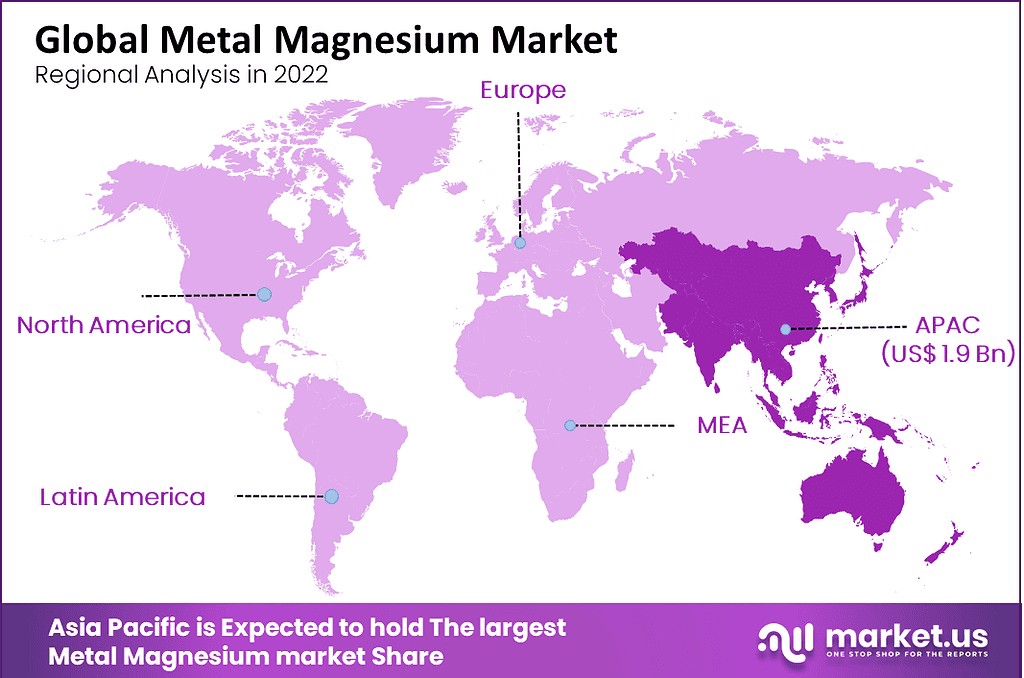

- Global Regional Analysis: The Asia Pacific region is dominant in the market, with the largest revenue share (46% in 2022), driven by the demand for magnesium and its alloys in the automotive and electronics industries. China is a significant producer and consumer of metal magnesium.

- Key Market Players: Notable companies in the Metal Magnesium Market include Alliance Magnesium, Esan Eczacibasi, Taiyuan Tongxiang Magnesium, Latrobe Magnesium, and more. These players are expanding globally and adopting competitive pricing and acquisition strategies.

Driving Factors

Increasing Demand in Automotive and Aerospace Industries Driving Market Growth

The demand for lightweight parts, mainly in the automotive industry, is increasing. The Major key players in the automotive industry are replacing steel parts with magnesium parts to reduce production costs and minimize vehicle weight.

The combination of high specific strength, lightweight, and good castability makes magnesium alloys a good engineering agent for the automotive and aerospace industries. The demand for versatile magnesium alloys is used in aerospace industries in the manufacturing of aircraft wheels, manufacturing of gearboxes, and helicopter transmissions to increase fuel efficiency.

The demand for magnesium alloys such as RZ5, MSR, EQ21, and ZRE is increasing in the aerospace industry in the manufacturing of aviation engines and gearbox casings. The major manufacturers’ aeronautical industries, such as Wright Aeronautical, use magnesium crankcases in the manufacturing of WWII-era Wright R-3350 Duplex Cyclone aviation engines.

Due to their higher ability to withstand extreme conditions, the metal aluminum is significantly used in the construction of ballistic missiles and spacecraft because they require lightweight materials so that they can resist short-wave electromagnetic radiation. The demand for magnesium metal is increasing in titanium reduction, driving the growth of the market. Magnesium is the main raw material in titanium production.

Restraining Factors

Availability of Alternative Materials

The mining of magnesia requires high machinery; the concerns regarding mining activities and the adverse effect of mining on the environment hamper the market growth. The high corrosion rate and low-temperature strength of metal magnesia have a negative impact on market growth.

The lack of availability of economic infrastructure and increasing governmental concerns about reducing energy availability in certain countries, such as China, are expected to have a negative impact on market growth in the forecast period.

Production Process Analysis

The Pidgeon Process Segment is Dominant in the Market, with the Largest Market Revenue Share

Based on the production process, the metal magnesium market is classified into the Pidgeon process, Dow process, and YSZ process. The Pidgeon process segment was dominant in the market, with the largest market revenue share of 80% in 2022. China is almost relay on the silicothermic Pidgeon process for the extraction of magnesium metals. The world production was approximately 1,100 kt in 2017, with the bulk being produced of about 930 kt in China and 60 kt in Russia.

The process provides the advantages of steady flow, small investments, good magnesium quality, short construction period, and good utilization of natural gas, coal, and heavy oil; thus, the manufacturers in the magnesium industry adopt this process for the quality production of magnesium metals.

The dow process segment is expected to grow at the fastest CAGR during the forecast period due to the increasing use of this process in production industries in North America. The YSZ is the new process of solid oxide membrane technology that involves electrolytic reduction of MgO. This process provides a 40% reduction in cost per pound over the electrolytic reduction method.

Application Analysis

The Die Casting Segment is Dominant in the Market, with Largest Market Revenue Share

By application, the metal catalyst market is classified into die casting, aluminum alloys, titanium reduction, iron & steel making, and other applications. The die-casting segment was dominant in the market, with the largest market revenue share of 41% in 2022. Magnesium is the ideal metal in die-casting applications due to its good heat conductivity and better electromagnetic screening properties. Magnesium is the lightest metal, and it has excellent stiffness and strength-to-weight ratios.

In addition, it has good EMI and RFI shielding properties; thus, the demand for magnesium is increasing in in casting process. Magnesium has significant applications in die casting. It increases tool life, has good finishing characteristics, ideal material thermal and electrical conductivity, and provides excellent noise and vibration-dampening properties. Magnesium is 75% less in weight than steel. Therefore, the demand for magnesium metal is increasing in the automotive parts manufacturing industries.

The aluminum alloy segment is expected to grow at the fastest CAGR during the forecast period. Aluminum alloys are significantly used in engineering components and structures that require corrosion-resistant and lightweight materials properties. Magnesium in aluminum alloys not only enhances tensile strength but also significantly increases low-cycle fatigue resistance.

The aluminum with magnesium can be formed into truck bodies, pressure vehicles, ships, train bodies, armored vehicles, and lids on aluminum beverage cans. Small quantities of magnesium are added to white cast iron to transform graphite into spherical nodules, which helps in improving the strength and malleability of the iron.

End-User Industry Analysis

The Automotive Segment is Dominant in the Market, with the Largest Market Revenue Share

Based on the end-user industry, the metal magnesium market is classified into aeronautical, automotive, electronics, and other end-user industries. The automotive industry segment was dominant in the market, with the largest market revenue share of 38% in 2022. The use of magnesium metal in vehicles can reduce the overall weight of the vehicles. Thus, the demand for metal magnesium is increasing in automotive industries.

Many automotive industries have started replacing steel and aluminum parts of vehicles with magnesium metal. Key companies in manufacturing industries are currently adopting magnesium metal in steering columns, gearboxes, seat frames, and steering wheels due to its easy availability and low cost. The use of magnesium in vehicles not only reduces vehicle costs but also allows for shifting of the center of gravity toward the rear of the car, which helps in improving vehicle safety.

The key manufacturers in the automotive industries, such as Mercedes Benz, Fait, Kia, Ford, and Jaguar, are focusing on replacing steel parts of cars with metal magnesium. The electronics segment is expected to grow at the fastest CAGR during the forecast period. Magnesium alloys have significant applications in TVs, mobile phones, computers, and LCDs.

Magnesium metal is used as a replacement for plastics when they require adequate thermal conductivity properties. Magnesium alloy is lightweight and strong, and they have excellent heat removal characteristics. Therefore, the demand for magnesium alloys is increasing in portable personal computers.

Key Market Segments

By Production Process

- Pidgeon Process

- Dow Process

- YSZ Process

By Application

- Die Casting

- Aluminum Alloys

- Titanium Reduction

- Iron & Steel Making

- Other Applications

By End-User Industry

- Aeronautical

- Automotive

- Electronics

- Other End-User Industries

Growth Opportunity

Increasing Demand for Lightweight Electric Vehicles

The increasing demand for electric vehicles due to strict governmental regulations on the emission of hazardous gases is expected to drive the demand for metal magnesium in the manufacturing of electric vehicles. The increasing demand for commercial aircraft is due to increasing air passengers and air transport. With the increasing demand for aluminum alloys and titanium in aerospace parts production, the metal magnesium is likely to show significant growth in the forecast period.

Magnesium metal and its alloys are lightweight and have high strength; thus, manufacturers in automotive industries are using metal magnesium as an alternative agent in the manufacturing of vehicle parts such as brake drums, engine components, and brake pads. The increasing use of metal magnesium in the automotive industry, electronics industry, and aeronautical industry is expected to create lucrative market opportunities in the global metal magnesium market.

Latest Trends

Metal Magnesium is Used as a standard Alternative to Steel in the Automotive Industry

The demand for fuel-efficient vehicles is increasing. Thus, the manufacturers in the automotive industry are focusing production of lightweight vehicles. Therefore, they prefer to use magnesium metal in vehicle parts other than steel and aluminum. Magnesium metal is increasingly used as an alternative to fiber metal laminates due to its low costs and high strength. Several major key players in the metal magnesium industry are focusing on business strategies such as collaboration, acquisition, and merging to obtain a competitive edge in the market.

Regional Analysis

Asia Pacific Region is Dominant in the Market with Largest Market Revenue Share

Asia Pacific region was dominant in the market, with the largest market revenue share of 46% in 2022. The increasing demand for magnesium and its alloys from end-use industries such as the automotive and electronics industries is driving the growth of the market in the region.

Rising trends towards electric vehicles (EVs) due to increasing governmental regulations on emissions in emerging economies such as China, India, Australia, and Japan are driving the market. China was the largest producer and consumer of the metal magnesium due to high demand from the automotive industries.

North America region is expected to grow at the fastest CAGR during the forecast period. The increasing number of air passengers and rising air transport activities in the region are expected to drive the demand for metal magnesium in aerospace industries.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

The major players in the metal magnesium market are focusing on expanding their businesses in foreign countries. Several key players are focusing on competitive pricing, merging, and acquisition strategies to stay competitive in the market.

The major key players in metal magnesium market include Alliance Magnesium, Esan Eczacibasi, YinGuang Magnesium Industry (Group) Co., Taiyuan Tongxiang Magnesium Co., Latrobe Magnesium, Nippon Kinzoku Co. Ltd., Regal Metal, Shanghai Sunglow Investment (Group) Co., Ltd., SolikamskDesulphurizer Works, U.S. Magnesium LLC, VSMPO-Avisma Corp., Western Magnesium Corporation, RIMA Group, and Other Key Players.

Top Key Players

- Alliance Magnesium

- Esan Eczacibasi

- YinGuang Magnesium Industry (Group) Co.

- Taiyuan Tongxiang Magnesium Co.

- Latrobe Magnesium

- Nippon Kinzoku Co. Ltd.

- Regal Metal

- Shanghai Sunglow Investment (Group) Co., Ltd.

- SolikamskDesulphurizer Works

- S. Magnesium LLC

- VSMPO-Avisma Corp.

- Western Magnesium Corporation

- RIMA Group

- Other Key Players

Recent Developments

- In August 2021, the Western Magnesium Corporation announced that it had signed a Memorandum of Understanding with ZeGen Energy to explore the potential for using ZeGen’s gasification technology in the production of magnesium metal.

- In May 2021, the Western Magnesium Corporation announced that it had successfully produced magnesium metal using its proprietary process at its pilot plant in Canada.

Report Scope

Report Features Description Market Value (2022) US$ 4.3 Bn Forecast Revenue (2032) US$ 7.0 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Car Type: Executive car, Luxury car, Sports utility vehicle (SUV), Economical car, and Multi utility vehicle (MUV); By Application: Leisure, and Commercial; By Rental Category: Airport transport, Local usage, Outstation, and Others. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Avis Budget Group, Europecar, Enterprise Holdings Inc., The Hertz Corporation, Toyota Rent-a-Car, Sixt SE, Alamo Rent-a-Car LLC, Carzonrent India Pvt Ltd, Localiza, ANI Technologies Pvt. Ltd, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Metal Magnesium Market is expected to grow at?The Metal Magnesium Market is expected to grow at a CAGR of 5.1% (2023-2032).

What is the size of the Metal Magnesium Market in 2023?The Metal Magnesium Market size is USD 4.3 Billion in 2023.

Which region is more appealing for vendors employed in the Metal Magnesium Market?Asia Pacific region was dominant in the market, with the largest market revenue share of 46% in 2022.

Name the key business areas for the Metal Magnesium Market.The US, Canada, China, India, Brazil, South Africa, Singapore, Indonesia, Portugal, etc., are leading key areas of operation for the Metal Magnesium Market.

List the segments encompassed in this report on the Metal Magnesium Market?Market.US has segmented the Metal Magnesium Market by geography (North America, Europe, APAC, South America, And Middle East and South Africa). The market has been segmented By Production Process Pidgeon Process, Dow Process, and YSZ Process. By Application Die Casting, Aluminum Alloys, Titanium Reduction, Iron & Steel Making, and Other Applications. By End-User Industry Aeronautical, Automotive, Electronics, and Other End-User Industries.

-

-

- Alliance Magnesium

- Esan Eczacibasi

- YinGuang Magnesium Industry (Group) Co.

- Taiyuan Tongxiang Magnesium Co.

- Latrobe Magnesium

- Nippon Kinzoku Co. Ltd.

- Regal Metal

- Shanghai Sunglow Investment (Group) Co., Ltd.

- SolikamskDesulphurizer Works

- S. Magnesium LLC

- VSMPO-Avisma Corp.

- Western Magnesium Corporation

- RIMA Group

- Other Key Players