Global Meditation Management Apps Market By Platform (iOS and Android), By Revenue Model (Free (Freemium) and Paid), By Deployment Type (Cloud-Based and On-Premise), By Application (Anxiety and Stress Management, Improved Mental Health, Relaxation and Focus Improvement and Sleep Management), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178640

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

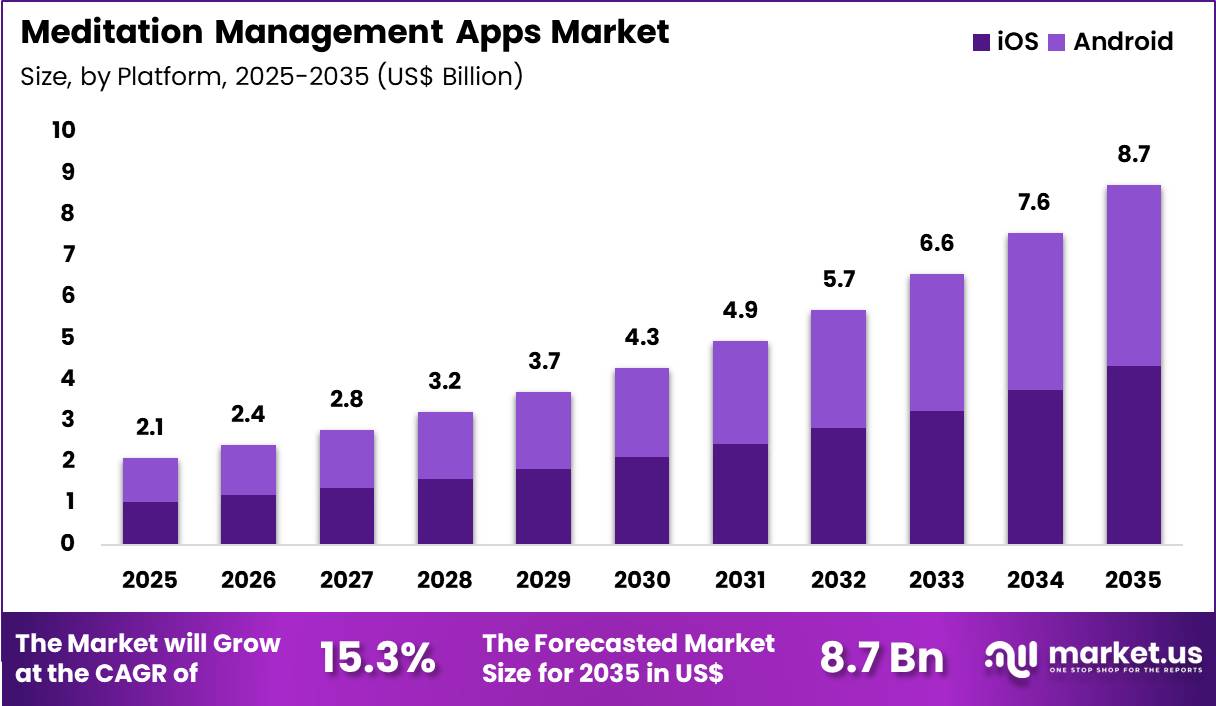

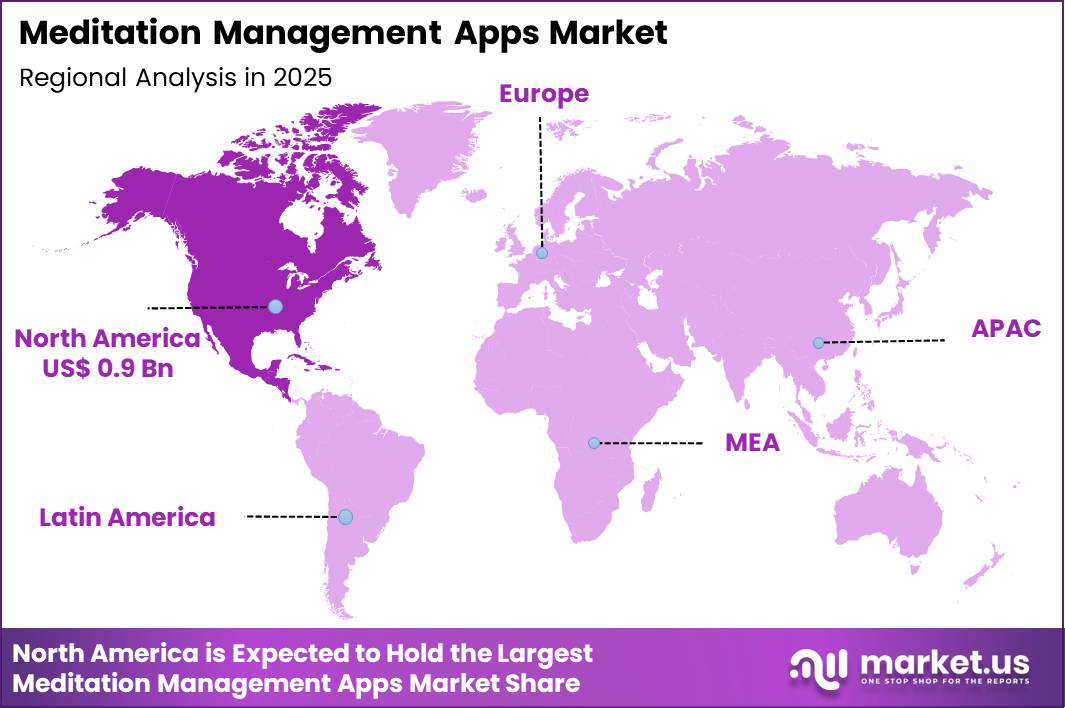

The Global Meditation Management Apps Market size is expected to be worth around US$ 8.7 Billion by 2035 from US$ 2.1 Billion in 2025, growing at a CAGR of 15.3% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 41.4% share with a revenue of US$ 0.9 Billion.

Growing awareness of mental health and stress management accelerates the meditation management apps market as individuals and organizations seek accessible digital tools to cultivate mindfulness and emotional resilience. Users increasingly rely on guided meditation sessions within these apps to reduce anxiety and improve focus during daily routines, with programs tailored for beginners through advanced practitioners.

These applications support sleep enhancement by offering bedtime stories, body scans, and soundscapes that promote relaxation and deeper rest for those experiencing insomnia or irregular sleep patterns. Corporate wellness programs incorporate meditation apps to deliver short, workplace-friendly sessions that help employees manage burnout and enhance productivity in high-pressure environments.

Parents utilize child-specific modules featuring breathing exercises and visualization techniques to support emotional regulation and concentration in school-aged children. Therapists integrate app-based practices into cognitive behavioral therapy protocols, assigning daily mindfulness exercises to reinforce coping strategies for depression and generalized anxiety disorder.

Developers pursue opportunities to incorporate artificial intelligence that personalizes meditation content based on user mood logs, biometric feedback, and progress tracking, expanding applications in preventive mental health for at-risk populations.

Companies advance integration with wearable devices to monitor heart rate variability and provide real-time biofeedback during sessions, broadening utility in stress-reduction coaching and performance optimization for athletes. These innovations facilitate community features that foster virtual group practices, enhancing motivation in long-term adherence programs.

Opportunities emerge in enterprise solutions that offer customized content libraries for healthcare workers and first responders facing chronic stress. Recent trends emphasize evidence-based protocols validated through clinical studies, gamification elements to boost engagement, and hybrid models combining live instructor-led sessions with on-demand access, positioning meditation management apps as scalable tools in comprehensive mental wellness ecosystems.

Key Takeaways

- In 2025, the market generated a revenue of US$ 2.1 Billion, with a CAGR of 15.3%, and is expected to reach US$ 8.7 Billion by the year 2035.

- The platform segment is divided into iOS and android, with ios taking the lead with a market share of 49.6%.

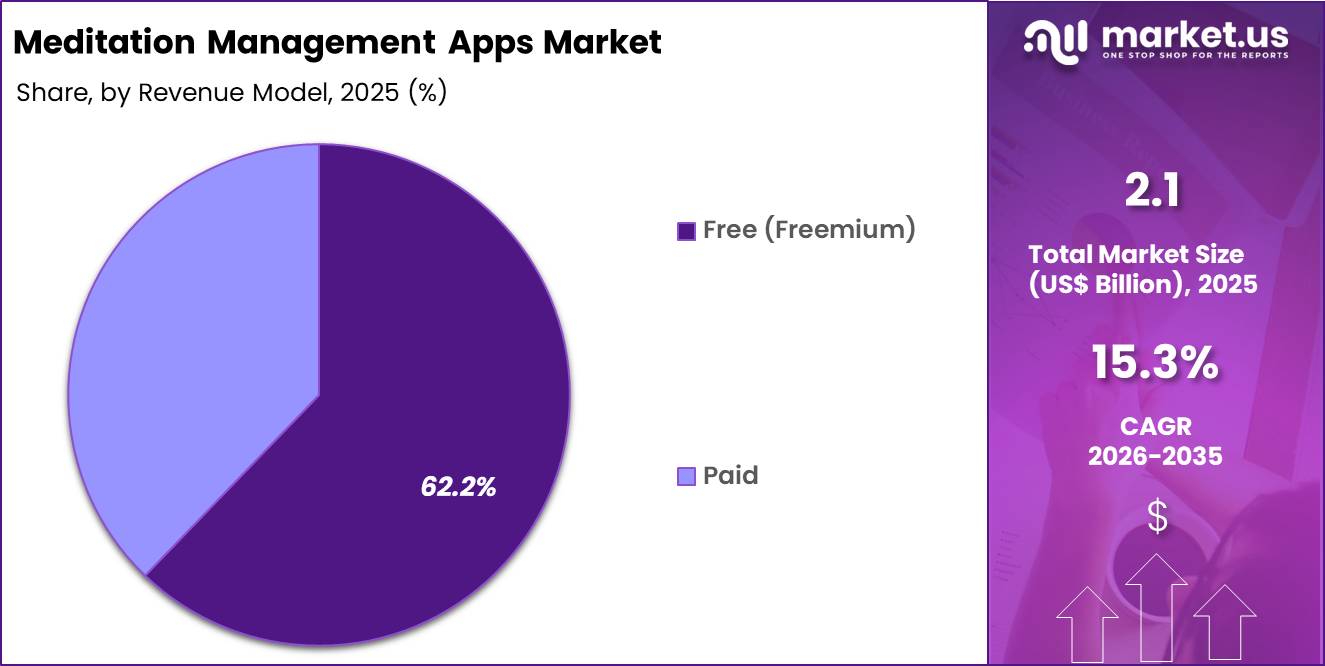

- Considering revenue model, the market is divided into free (freemium) and paid. Among these, free (freemium) held a significant share of 62.2%.

- Furthermore, concerning the deployment type segment, the market is segregated into cloud-based and on-premise. The cloud-based sector stands out as the dominant player, holding the largest revenue share of 56.5% in the market.

- The application segment is segregated into anxiety and stress management, improved mental health, relaxation and focus improvement and sleep management, with the anxiety and stress management segment leading the market, holding a revenue share of 56.0%.

- North America led the market by securing a market share of 41.4%.

Platform Analysis

iOS accounted for 49.6% of growth within platform and led the meditation management apps market due to higher in-app spending behavior and strong penetration in premium smartphone segments.

Developers prioritize iOS optimization because users on this platform demonstrate higher subscription conversion rates. Integration with wearable ecosystems and health tracking frameworks strengthens engagement. App Store visibility and curated health categories further support discovery and user trust.

Growth strengthens as iOS users increasingly adopt digital wellness tools for structured mindfulness routines. Seamless payment gateways simplify subscription upgrades within freemium models. Data privacy features reinforce user confidence in mental health tracking.

Collaboration with healthcare providers and wellness brands enhances credibility. The segment is expected to maintain strong momentum as digital wellness adoption continues to expand among premium device users.

Revenue Model Analysis

Free (freemium) models generated 62.2% of growth within revenue model and dominated the meditation management apps market due to low entry barriers and wide accessibility. Users often begin with free guided sessions before upgrading to premium content.

Freemium strategies attract large user bases, which increase engagement and referral potential. Limited-feature access encourages gradual conversion to paid tiers without upfront commitment.

Growth accelerates as subscription-based unlocks provide personalized meditation plans, analytics, and offline access. Push notifications and gamified progress tracking improve retention rates. Corporate wellness partnerships further expand freemium adoption.

Data-driven personalization increases perceived value, which supports upgrade rates. The segment is anticipated to sustain leadership as accessibility and scalable subscription funnels remain central to digital app monetization strategies.

Deployment Type Analysis

Cloud-based deployment contributed 56.5% of growth within deployment type and led the meditation management apps market due to scalability and cross-device synchronization. Cloud infrastructure supports seamless updates, real-time data storage, and content streaming across global user bases.

Developers leverage cloud architecture to deploy new features quickly and maintain consistent performance. Integration with analytics platforms enhances user behavior insights.

Growth strengthens as remote access and multi-device usage become standard consumer expectations. Cloud-based systems reduce maintenance complexity and support rapid global expansion.

Security enhancements improve data protection for sensitive mental health information. Continuous content updates keep user engagement high. The segment is projected to remain dominant as digital wellness platforms prioritize flexibility and real-time service delivery.

Application Analysis

Anxiety and stress management accounted for 56.0% of growth within application and dominated the meditation management apps market due to rising psychological stress levels across working populations.

Users seek guided breathing exercises and mindfulness routines to manage daily stressors. Workplace burnout and lifestyle pressures increase demand for accessible coping tools. Public health awareness campaigns further encourage digital stress reduction solutions.

Growth continues as employers integrate mindfulness apps into corporate wellness programs. Rising telehealth adoption supports digital mental health supplementation. Structured stress-reduction modules improve measurable user outcomes, which strengthens app credibility.

Social media discussions normalize mental health support seeking. The segment is expected to remain dominant as anxiety and stress remain primary drivers of digital mindfulness engagement.

Key Market Segments

By Platform

- iOS

- Android

By Revenue Model

- Free (Freemium)

- Paid

By Deployment Type

- Cloud-Based

- On-Premise

By Application

- Anxiety and Stress Management

- Improved Mental Health

- Relaxation and Focus Improvement

- Sleep Management

Drivers

Increasing prevalence of anxiety disorders is driving the market.

The escalating incidence of anxiety disorders among adults has substantially heightened the demand for meditation management apps as accessible tools for symptom relief and stress reduction. Greater clinical recognition and self-reporting have contributed to more individuals seeking digital solutions for daily mental wellness practices.

Healthcare providers are increasingly recommending these apps as adjuncts to traditional therapy for managing generalized anxiety. The correlation between chronic stress and anxiety underscores the role of guided meditation in preventive mental health strategies. Government health surveys document this rise, prompting broader adoption of apps in public health initiatives.

Meditation management apps offer on-demand sessions tailored to anxiety triggers, supporting user engagement in self-care routines. National mental health programs emphasize digital interventions to address gaps in professional care access.

Key developers are enhancing app features to align with this growing clinical need. This driver fosters innovation in content personalization for anxiety-focused modules. According to the Centers for Disease Control and Prevention, 12% of U.S. adults regularly experienced feelings of anxiety in 2024.

Restraints

Subscription fatigue among users is restraining the market.

The growing reluctance of consumers to maintain multiple paid app subscriptions poses a notable barrier to sustained revenue growth in the meditation management apps sector. High churn rates result from users canceling after initial trials due to perceived overlap in content across platforms. Healthcare consumers prioritize free alternatives or bundled wellness services to manage monthly expenses.

The saturation of similar apps in app stores intensifies competition for limited user budgets. Providers must offer compelling value to retain subscribers beyond introductory periods. This restraint particularly affects premium content models in competitive digital ecosystems.

Industry efforts to introduce flexible pricing provide partial mitigation but face user skepticism. Regulatory scrutiny on auto-renewal practices adds compliance challenges for subscription management. Despite diverse offerings, economic pressures from inflation exacerbate cancellation trends. Addressing retention through loyalty programs remains critical for overcoming this market limitation.

Opportunities

Strong revenue growth from leading apps is creating growth opportunities.

The impressive sales performance of top meditation apps signals substantial potential for market expansion through enhanced content and partnerships. Increased user engagement supports investments in premium features like live sessions and community forums. Strategic alliances with corporate wellness programs enable broader access to employee benefits markets.

The substantial revenue base amplifies funding for global localization and multilingual content. Policy advancements in mental health reimbursement for digital tools strengthen infrastructure for app integration in care plans. Primary developers are pursuing acquisitions to consolidate market share and diversify offerings. This opportunity aligns with efforts to improve accessibility in underserved demographics.

Focused expansions can generate notable progress in enterprise and B2B segments. Calm generated approximately USD 596.4 million in revenue in 2024. Headspace followed with around USD 4 million in in-app revenues in January 2024.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the meditation management apps market through consumer discretionary spending, corporate wellness budgets, and digital subscription trends. Inflation and higher interest rates reduce household spending on non essential digital services, which slows premium subscription growth.

Geopolitical tensions affect global payment systems, data hosting rules, and cross border digital operations, increasing compliance and operating complexity. Current US tariffs on imported smartphones, wearable devices, and certain electronic components indirectly raise device costs, which can limit new user adoption in price sensitive segments.

These pressures challenge smaller app developers that rely heavily on paid marketing and hardware integration. On the positive side, economic stress and workplace burnout increase interest in mental wellness solutions and low cost digital support.

Employers and insurers continue to integrate mindfulness tools into broader health programs to manage stress related conditions. With scalable technology, diversified revenue models, and rising mental health awareness, the market remains positioned for steady and confident growth.

Latest Trends

Integration of artificial intelligence for personalized experiences is a recent trend in the market.

In 2024, leading apps incorporated AI algorithms to tailor meditation recommendations based on user mood and progress tracking. These systems analyze behavioral data to suggest customized sessions and breathing exercises. Manufacturers focused on machine learning models for real-time adaptation during use.

Clinical feedback drove refinements in AI-driven content curation for better retention. Headspace launched AI-enhanced features in 2024 for personalized wellness paths. This development addresses needs for individualized mental health support in daily routines. The trend emphasizes seamless integration with wearable devices for biofeedback.

Regulatory guidelines adapted to ensure ethical AI use in health apps. Industry collaborations refined algorithms for diverse cultural contexts. These innovations aim to elevate user satisfaction while maintaining accessibility in meditation practices.

Regional Analysis

North America is leading the Meditation Management Apps Market

North America accounted for a 41.4% share of the Meditation Management Apps market in 2024, driven by rising focus on mental wellness and digital self-care tools. Employers expanded corporate wellness subscriptions to reduce stress-related absenteeism and improve workforce productivity.

Healthcare providers increasingly recommended guided meditation platforms as complementary support for anxiety, insomnia, and burnout. High smartphone penetration and strong in-app payment adoption supported subscription-based growth models.

Integration with wearable devices enabled users to track breathing patterns, sleep cycles, and heart rate variability. Social acceptance of therapy and mindfulness practices further strengthened user engagement. A relevant supporting indicator comes from the National Institute of Mental Health, which reported in 2022 that 22.8% of US adults experienced any mental illness, highlighting substantial demand for accessible digital mental health solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Meditation Management Apps market in Asia Pacific is expected to grow steadily during the forecast period as urban lifestyles and work-related stress increase across major economies. Consumers actively seek convenient tools to manage anxiety, improve sleep, and enhance focus.

Governments and employers promote digital well-being initiatives to address rising mental health concerns among younger populations. Expanding internet access and affordable smartphones enable broader reach across emerging markets.

Regional developers localize content in multiple languages to improve cultural relevance and adoption. Partnerships with telehealth platforms strengthen integration into mainstream care pathways. A verifiable signal of need appears in 2023 data from the World Health Organization, which estimates that around 1 in 8 people globally live with a mental disorder, reinforcing strong long-term growth prospects across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the meditation management apps market grow by enhancing user engagement with personalized content, adaptive session plans, and advanced tracking that help individuals build consistent wellness habits. They also strengthen platform value by integrating with wearable devices, sleep and stress analytics, and social features that support community interaction and long-term retention.

Firms pursue strategic partnerships with employers, insurers, and healthcare providers to embed digital mindfulness resources into corporate wellness and preventive care programs. Geographic expansion into North America, Europe, and high-growth Asia Pacific diversifies revenue and taps rising demand for mental health support across age groups.

Calm.com, Inc. exemplifies a leading digital well-being company with a broad suite of guided meditation, sleep, and resilience-building content, strong global brand recognition, and coordinated commercial strategies that address individual and enterprise wellness priorities.

The company advances its competitive agenda through disciplined investment in original content, targeted collaborations, and a customer-centric approach that aligns technological enhancements with evolving stress-management trends.

Top Key Players

- Headspace Inc.

- Calm (Market leader in consumer spend)

- Simple Habit

- MindApps

- Breethe

- Meditation Moments

- Aura Health

- InnerExplorer

- Ten Percent Happier

- Meditopia

- Insight Network Inc. (Insight Timer)

- Smiling Mind

- Meditation Studio App LLC

- Buddhify

- The Mind Company

- BetterMe

- Oak Meditation

Recent Developments

- In December 2025, Seoul National University introduced the “SNU Healthing U” mobile application to support faculty wellness. The app promotes healthy routines such as walking, balanced nutrition, and meditation, using a points-based reward structure to encourage sustained participation and engagement.

- In January 2025, Hilton Hotels collaborated with Calm to incorporate Calm’s digital wellness content into Hilton’s Connected Room Experience. Guests can access guided meditations, sleep stories, ambient soundscapes, and mindfulness programs directly within their rooms, extending meditation-based services into the hospitality environment.

Report Scope

Report Features Description Market Value (2025) US$ 2.1 Billion Forecast Revenue (2035) US$ 8.7 Billion CAGR (2026-2035) 15.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform (iOS and Android), By Revenue Model (Free (Freemium) and Paid), By Deployment Type (Cloud-Based and On-Premise), By Application (Anxiety and Stress Management, Improved Mental Health, Relaxation and Focus Improvement and Sleep Management) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Headspace Inc., Calm, Simple Habit, MindApps, Breethe, Meditation Moments, Aura Health, InnerExplorer, Ten Percent Happier, Meditopia, Insight Network Inc., Smiling Mind, Meditation Studio App LLC, Buddhify, The Mind Company, BetterMe, Oak Meditation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Meditation Management Apps MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Meditation Management Apps MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Headspace Inc.

- Calm (Market leader in consumer spend)

- Simple Habit

- MindApps

- Breethe

- Meditation Moments

- Aura Health

- InnerExplorer

- Ten Percent Happier

- Meditopia

- Insight Network Inc. (Insight Timer)

- Smiling Mind

- Meditation Studio App LLC

- Buddhify

- The Mind Company

- BetterMe

- Oak Meditation