Global Medical Van Market Size, Share, Growth Analysis By Van (Ambulance Vans, Mobile Clinics / Healthcare Vans, Blood Donation Vans, Medical Transport Vans), By Vehicle Size (Full-Size Vans, Mid-Size Vans, Compact Vans), By Vehicle Conversion (Type I, Type II, Type III), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159255

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

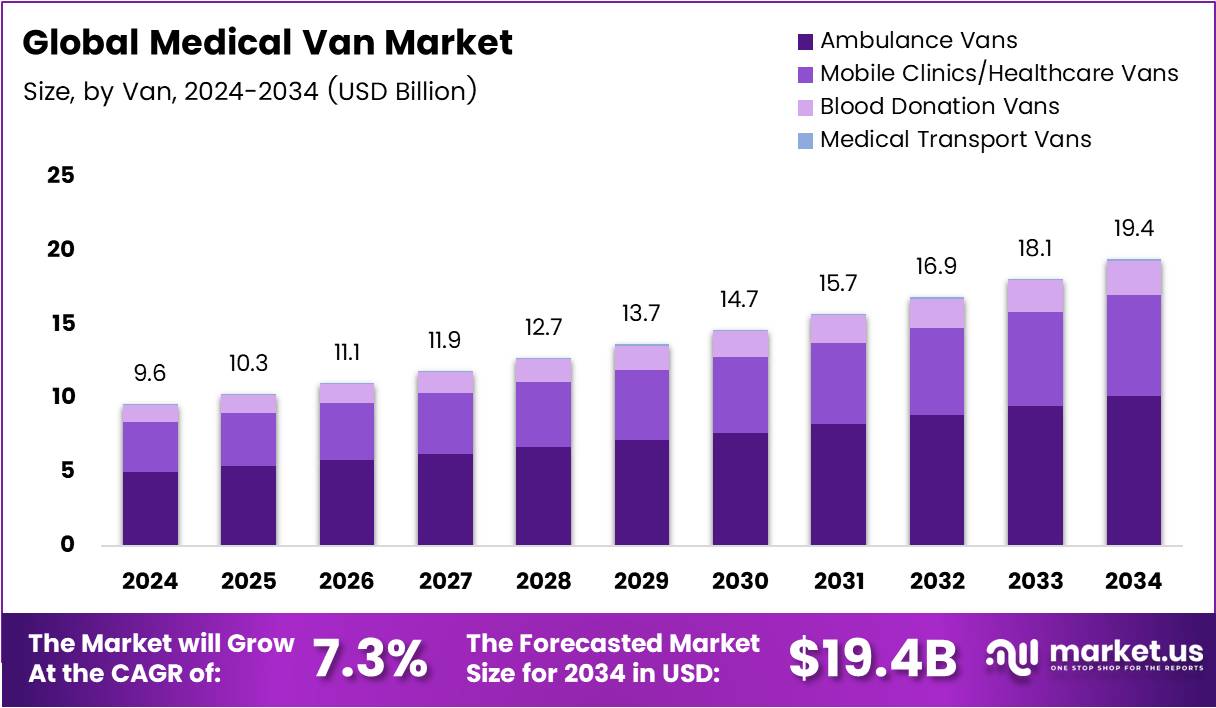

The Global Medical Van Market size is expected to be worth around USD 19.4 Billion by 2034, from USD 9.6 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The medical van market is an emerging segment within the healthcare industry that focuses on providing healthcare services through mobile clinics. These vehicles are equipped with the necessary medical equipment to offer diagnostic, treatment, and emergency care services. They are increasingly being used in both urban and rural areas, providing flexible healthcare access.

Growth in the medical van market is largely driven by increasing demand for accessible healthcare solutions. In particular, mobile clinics are ideal for underserved areas where access to traditional healthcare facilities may be limited. The growing need for healthcare delivery in rural regions and disaster-prone areas is a key factor in market expansion.

Furthermore, opportunities for the market are significant as governments and private sectors continue to invest in healthcare infrastructure. Medical vans are particularly beneficial for preventive care, vaccinations, and emergency services. As healthcare policies evolve to include mobile health solutions, these vans are likely to be integrated more widely into national health strategies.

Regulatory frameworks also play a crucial role in the development of the medical van market. Compliance with health and safety regulations, such as sanitation standards and equipment certifications, is essential for ensuring the quality of services provided. Additionally, regional healthcare regulations impact the design and operation of mobile clinics, influencing their market dynamics.

According to industry reports, approximately 10 million visits are made annually to mobile clinics in the U.S. This shows the substantial reliance on mobile healthcare units for routine and emergency care. Additionally, the U.S. has around 3,000 mobile clinics, emphasizing the market’s size and the growing recognition of mobile healthcare solutions as a valuable service. This aligns with government initiatives to expand healthcare access, especially in remote and underserved communities.

Key Takeaways

- Global Medical Van Market size is expected to be worth around USD 19.4 Billion by 2034, growing at a CAGR of 7.3% from 2025 to 2034.

- In 2024, Ambulance Vans held a dominant position in the By Van segment, with a 52.4% share.

- In 2024, Full-Size Vans held a dominant position in the By Vehicle Size segment, with a 67.3% share.

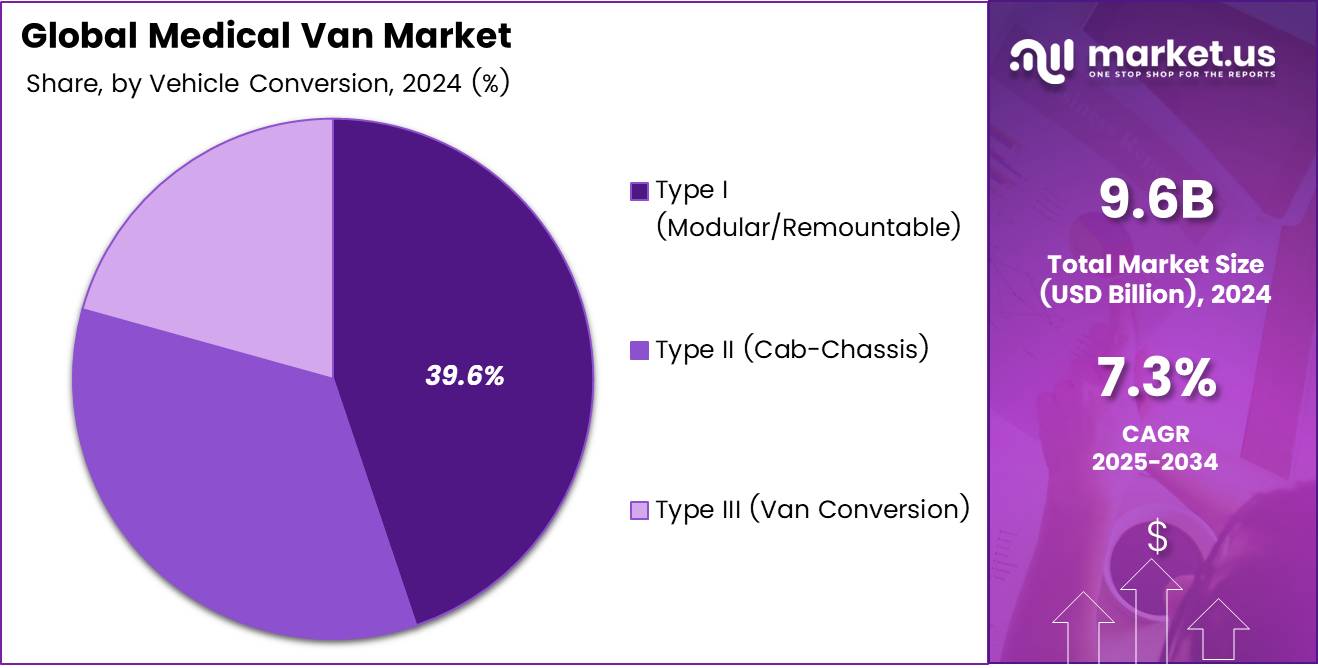

- In 2024, Type I (Modular/Remountable) vans held a dominant position in the By Vehicle Conversion segment, with a 39.6% share.

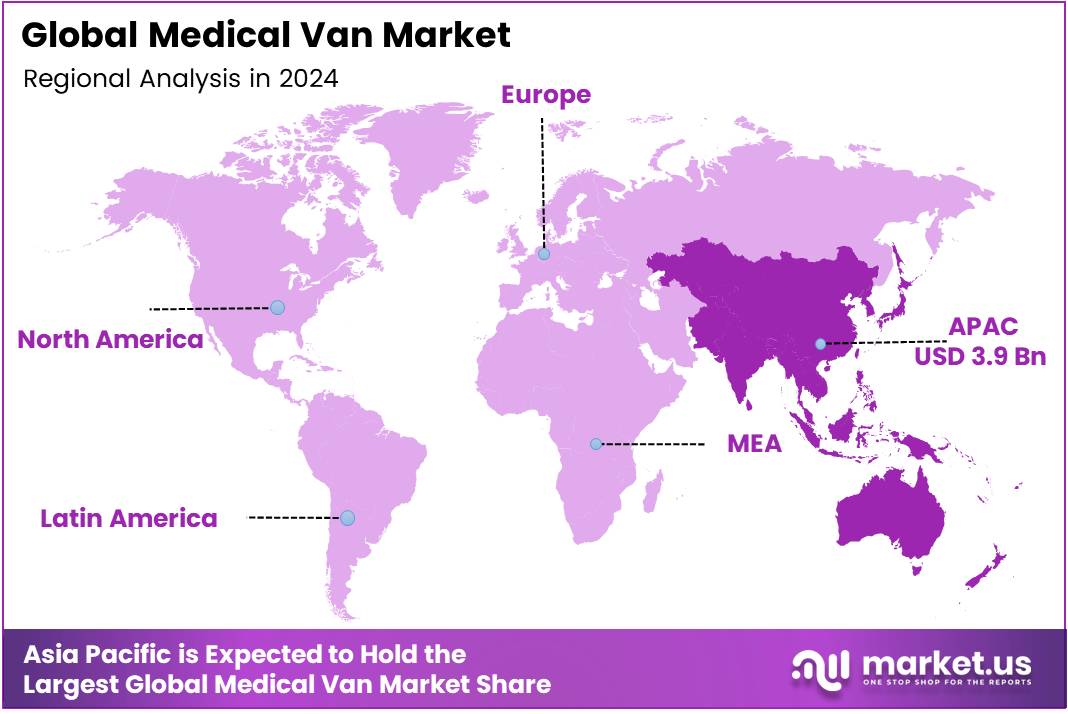

- Asia Pacific is the dominant region, holding 41.3% of the market share, valued at USD 3.9 billion.

By Van Analysis

Ambulance Vans dominates with 52.4% due to their widespread use in emergency medical services and government procurement.

In 2024, Ambulance Vans held a dominant market position in the By Van Analysis segment of the Medical Van Market, with a 52.4% share. These vans are essential for providing immediate medical assistance during emergencies. Their dominance is attributed to the growing need for rapid response vehicles in urban and rural settings. The high share reflects consistent demand driven by healthcare infrastructure expansion and government investments in emergency medical services.

Mobile Clinics/Healthcare Vans follow with their significant role in providing healthcare services in remote areas. These vans facilitate easy access to essential health services, especially in underserved regions, and are increasingly supported by government health programs. Their rising adoption is fueled by increased awareness about healthcare accessibility.

Blood Donation Vans have gained traction, contributing to the overall medical van market growth. Their focus is on mobile blood collection, which is crucial in emergency and disaster management. However, they hold a smaller share compared to ambulance vans, driven by their niche use case.

Medical Transport Vans, while necessary, are less prevalent than the other types of vans. These vehicles are used for the non-emergency transportation of patients, offering mobility for patients who need regular care. Despite their importance, their market share remains lower compared to ambulance vans.

By Vehicle Size Analysis

Full-Size Vans dominates with 67.3% due to their larger capacity and ability to accommodate medical equipment.

In 2024, Full-Size Vans held a dominant market position in the By Vehicle Size Analysis segment of the Medical Van Market, with a 67.3% share. The larger capacity of these vans allows for advanced medical equipment, essential for performing complex procedures in transit. Their ability to house more equipment and personnel makes them the preferred choice in emergency medical services and mobile healthcare clinics.

Mid-Size Vans are also an important sub-segment, catering to situations where space is required but full-size vans are impractical. Their versatility offers a balance between mobility and capacity, though they hold a smaller share compared to full-size vans.

Compact Vans are the smallest in size but are still used in certain healthcare applications. These vans are primarily used for smaller, non-emergency medical transport, where the space is adequate for basic medical needs. Despite their smaller footprint, they play a role in specific healthcare settings.

By Vehicle Conversion Analysis

Type I (Modular/Remountable) dominates with 39.6% due to its flexibility and modular design.

In 2024, Type I (Modular/Remountable) held a dominant market position in the By Vehicle Conversion Analysis segment of the Medical Van Market, with a 39.6% share. The modular nature of these vehicles allows them to be customized for different medical needs, such as mobile ICU or general patient transport. This flexibility makes them ideal for diverse healthcare applications.

Type II (Cab-Chassis) conversion vehicles are used primarily for specialized medical transport but are not as customizable as Type I vehicles. These vehicles serve a more specific purpose and have a lower market share compared to Type I.

Type III (Van Conversion) is a popular choice for medical transport due to its ability to house standard medical equipment. While it holds a smaller share than the other types, it still caters to mobile healthcare solutions in specific use cases where the size and structure are adequate for basic services.

Key Market Segments

By Van

- Ambulance Vans

- Mobile Clinics/Healthcare Vans

- Blood Donation Vans

- Medical Transport Vans

By Vehicle Size

- Full-Size Vans

- Mid-Size Vans

- Compact Vans

By Vehicle Conversion

- Type I (Modular/Remountable)

- Type II (Cab-Chassis)

- Type III (Van Conversion)

Drivers

Increasing Demand for Mobile Healthcare Solutions Drives Market Growth

The increasing demand for mobile healthcare solutions is one of the key drivers in the medical van market. As healthcare needs expand, particularly in underserved or rural areas, the need for mobile units that bring healthcare services directly to patients is rising. This demand is further fueled by the growing preference for convenience and accessibility, which allows patients to receive timely medical care without the need to travel long distances.

Government initiatives are contributing significantly to this growth, especially in rural healthcare access. Many governments are funding or incentivizing the deployment of medical vans to ensure that remote populations receive critical healthcare services, thus bridging the healthcare gap. Additionally, the rising prevalence of chronic diseases such as diabetes, hypertension, and heart disease is further intensifying the need for continuous, accessible healthcare, which medical vans are well-equipped to provide.

Technological advancements are also playing a crucial role in the mobile healthcare sector. With improvements in telemedicine and mobile health technologies, medical vans are now able to offer a wide range of services, from routine checkups to specialized consultations, enhancing their appeal in providing efficient, high-quality healthcare on the go.

Restraints

Regulatory Hurdles and Compliance Issues Restrain Market Growth

Despite the growing demand, regulatory hurdles and compliance issues remain significant restraints for the medical van market. Medical vans must meet stringent health regulations, which vary by region and country. These regulations often require specific certifications and standards for both the vehicle and the healthcare equipment inside, making it difficult for providers to expand quickly.

Additionally, there is limited infrastructure in remote areas, making it challenging to establish mobile healthcare units. The lack of reliable roads, electricity, and other basic services can impede the deployment of medical vans in these regions, limiting their reach and effectiveness.

In addition, there is a shortage of skilled healthcare professionals in rural and underserved areas, which complicates the ability to provide medical care through mobile units. These factors present barriers to the growth of the market and pose challenges for both public and private sector investments.

Growth Factors

Expansion in Emerging Markets Drives Growth Opportunities

One of the most significant growth opportunities for the medical van market lies in the expansion of services into emerging markets with limited healthcare infrastructure. Many developing countries, especially in Africa and Southeast Asia, have vast rural populations with minimal access to healthcare. Medical vans offer a solution to this challenge by delivering healthcare directly to these areas, helping to improve overall health outcomes.

The development of telemedicine capabilities in medical vans is another opportunity. With the increasing prevalence of digital health technologies, medical vans can offer remote consultations, diagnostics, and follow-up services, reducing the need for physical visits to healthcare facilities. This is particularly beneficial in remote areas where healthcare professionals are scarce.

There is also a growing focus on preventive healthcare services, and medical vans are well-suited for this role. They can be used for routine screenings, vaccination drives, and health education programs, which can help in reducing the incidence of diseases in underserved areas. Furthermore, collaborations with private healthcare providers for mobile clinics present opportunities to enhance service delivery and expand the reach of medical vans.

Emerging Trends

Integration of AI and Telehealth Drives Market Trends

The integration of AI and telehealth technologies is one of the most prominent trends in the medical van market. These technologies allow for enhanced diagnostic capabilities, real-time consultations with specialists, and personalized care through data analytics. The growing adoption of AI-powered health systems in medical vans is expected to drive the market by offering more accurate, efficient, and timely care, particularly in rural and underserved regions.

Another significant trend is the increased adoption of electric and eco-friendly medical vans. With the growing emphasis on sustainability, many medical van providers are opting for electric vehicles that reduce carbon footprints and lower operational costs. This shift toward green technology is gaining traction as governments and healthcare providers focus on reducing environmental impacts.

The surge in on-demand healthcare services is another driver, as patients seek more flexible and accessible options for care. Medical vans are well-positioned to meet this demand, offering convenient healthcare delivery at the point of need.

Finally, rising consumer interest in personalized healthcare solutions is shaping the market, with mobile healthcare providers increasingly offering customized services tailored to individual patient needs.

Regional Analysis

Asia Pacific Dominates the Medical Van Market with a Market Share of 41.3%, Valued at USD 3.9 Billion

Asia Pacific is the dominant region in the medical van market, holding 41.3% of the total market share, valued at USD 3.9 billion. This dominance is driven by the region’s large population and increasing healthcare needs, particularly in rural and remote areas where mobile healthcare units are vital. Government initiatives and investments in mobile health services have further boosted the market growth in this region.

North America Medical Van Market Trends

North America holds a significant position in the medical van market due to advanced healthcare infrastructure and high demand for mobile health solutions. The region is expected to see sustained growth, driven by technological advancements in mobile healthcare units and a growing emphasis on healthcare accessibility in rural areas.

Europe Medical Van Market Trends

Europe continues to show a strong market for medical vans, with several governments introducing policies to improve healthcare delivery in underserved regions. The region’s focus on sustainable healthcare solutions and the growing trend of telemedicine have contributed to the expansion of mobile healthcare services.

Latin America Medical Van Market Trends

Latin America has witnessed gradual growth in the medical van market, fueled by increasing healthcare demands in rural and isolated communities. While the market is still developing, there is a rising adoption of mobile clinics driven by government and non-governmental organizations aiming to enhance healthcare access.

Middle East and Africa Medical Van Market Trends

The Middle East and Africa market is growing as governments invest in mobile healthcare units to address infrastructure challenges. The region’s demand for mobile healthcare solutions is anticipated to rise due to an increasing focus on healthcare quality and access in underserved regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Medical Van Company Insights

The global medical van market is experiencing dynamic shifts in 2024, driven by innovation, strategic partnerships, and evolving healthcare needs.

REV Group continues to lead with its extensive portfolio of specialty vehicles, including ambulances and mobile medical units. In 2024, the company showcased its diverse offerings, highlighting its commitment to advancing emergency medical services.

Mobile Healthcare Facilities LLC remains a key player in providing customized mobile healthcare solutions. Their focus on delivering tailored medical vans addresses the growing demand for accessible healthcare in underserved areas.

Mercedes-Benz Vans is enhancing its presence in the medical van sector by leveraging its expertise in vehicle manufacturing. The company’s commitment to quality and innovation positions it as a strong contender in the market.

Demers Braun Crestline has been actively expanding its footprint in the U.S. market. Their introduction of the Crestline CCL 150 model line and the innovative MMC Multiplex electrical system demonstrates their dedication to integrating advanced technology in emergency vehicles.

These companies are at the forefront of a rapidly evolving medical van market, each contributing unique strengths to meet the increasing demand for mobile healthcare solutions.

Top Key Players in the Market

- REV Group

- Mobile Healthcare Facilities LLC

- Mercedes-Benz Vans

- Demers Braun Crestline

- Excellance, Inc.

- First Priority Emergency Vehicles, Inc.

- Malley Industries

- AEV Ambulance

- Leader Emergency Vehicles

- O’Gara Coach

- Frazer Ltd.

Recent Developments

- In February 2025, AmeriPro Health acquired Priority Medical Transport, aiming to expand its presence across the Midwest region and enhance its medical transportation services for a broader customer base.

- In September 2025, NationsBenefits announced the acquisition of CareCar, to expand its integrated non‑emergency medical transportation capabilities to serve millions of health plan members nationwide.

- In February 2025, DocGo acquired PTI Health, thereby enhancing its proactive healthcare offerings through expanded mobile lab collection and mobile phlebotomy services for improved patient care.

- In April 2025, UPS announced the acquisition of Andlauer Healthcare Group for $1.6 billion, strengthening its global logistics capabilities in the complex healthcare logistics sector.

- In September 2024, Beacon Mobility announced the acquisition of Medical Transport Systems, further boosting its presence in the medical transportation sector to provide expanded service offerings.

Report Scope

Report Features Description Market Value (2024) USD 9.6 Billion Forecast Revenue (2034) USD 19.4 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Van (Ambulance Vans, Mobile Clinics / Healthcare Vans, Blood Donation Vans, Medical Transport Vans), By Vehicle Size (Full-Size Vans, Mid-Size Vans, Compact Vans), By Vehicle Conversion (Type I, Type II, Type III) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape REV Group, Mobile Healthcare Facilities LLC, Mercedes-Benz Vans, Demers Braun Crestline, Excellance, Inc., First Priority Emergency Vehicles, Inc., Malley Industries, AEV Ambulance, Leader Emergency Vehicles, O’Gara Coach, Frazer Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- REV Group

- Mobile Healthcare Facilities LLC

- Mercedes-Benz Vans

- Demers Braun Crestline

- Excellance, Inc.

- First Priority Emergency Vehicles, Inc.

- Malley Industries

- AEV Ambulance

- Leader Emergency Vehicles

- O'Gara Coach

- Frazer Ltd.