Global Medical Protective Equipment Market Analysis By Product Type (Hand Protection, Protective Clothing, Respiratory Protection, Face and Eye Protection, Foot and Shoe Covers, Head Protection, Others), By Usability (Disposable, Reusable), By End-User (Hospitals and Clinics, Home Healthcare, Outpatient/Primary Care Facilities, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160602

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

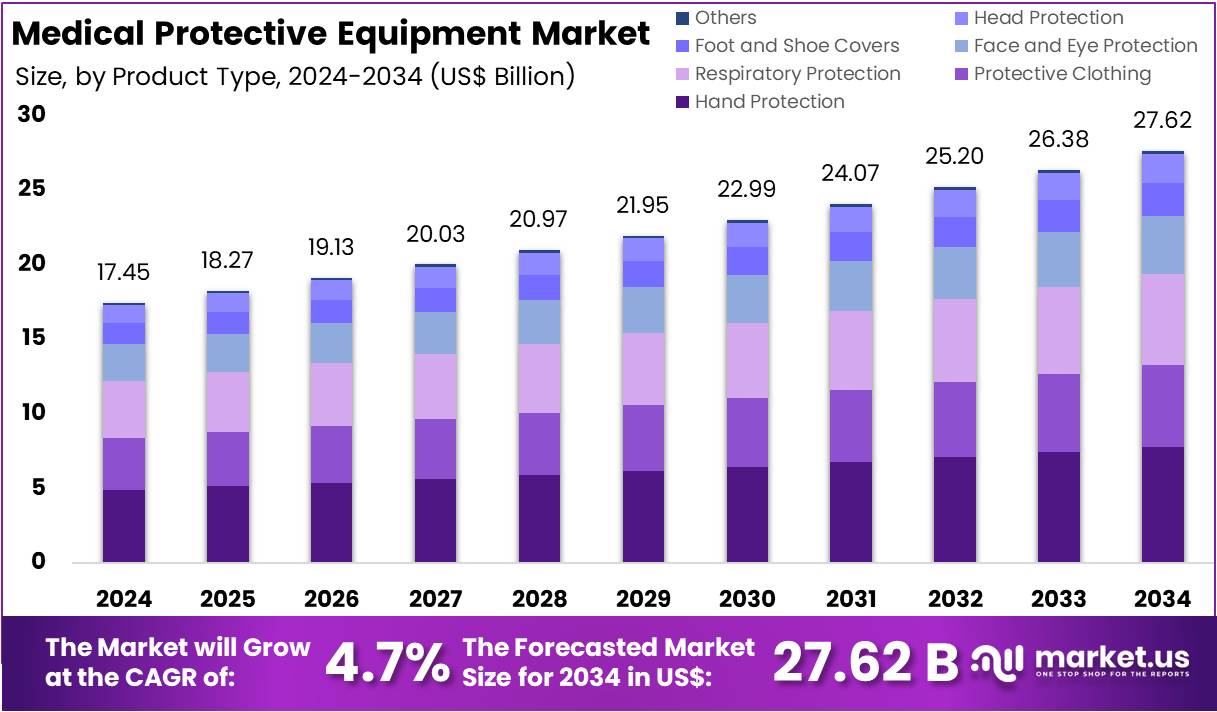

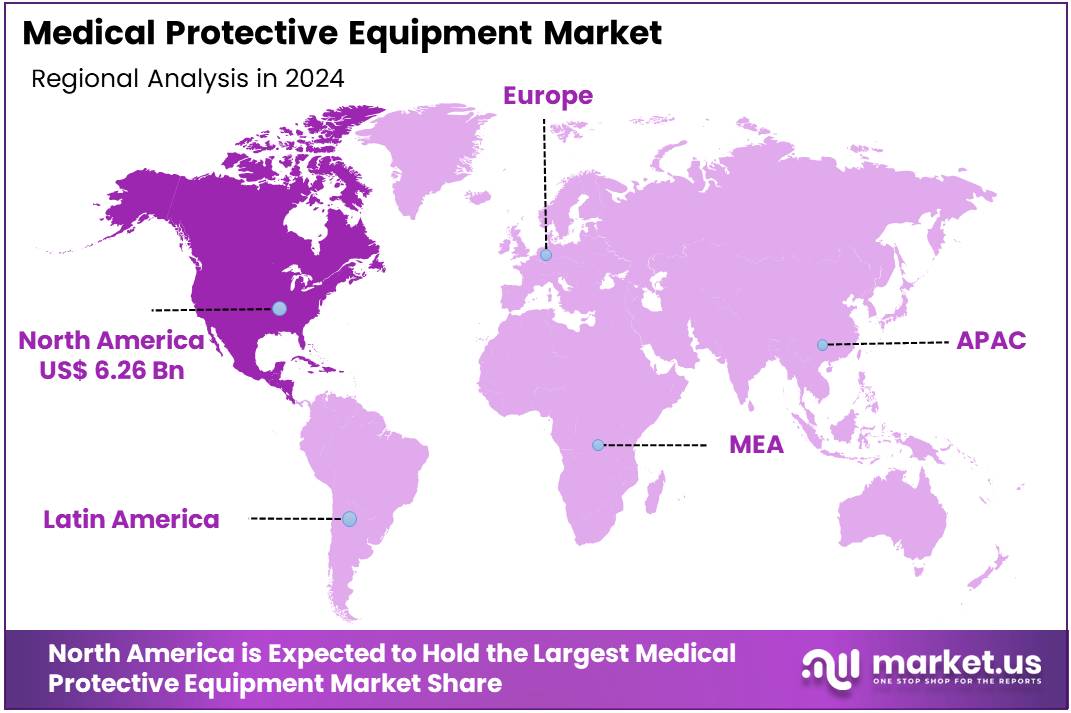

The Global Medical Protective Equipment Market size is expected to be worth around US$ 27.62 Billion by 2034, from US$ 17.45 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.9% share and holds US$ 6.26 Billion market value for the year.

Medical protective equipment refers to specialized products designed to protect healthcare workers, patients, and the public from infection, chemical exposure, and physical harm. These include face masks, gloves, gowns, respirators, eye shields, and footwear. According to the World Health Organization (WHO), infection prevention and control inside hospitals remains critical, as about 7 in 100 patients in high-income countries and about 15 in 100 in low- and middle-income countries acquire healthcare-associated infections.

The COVID-19 pandemic highlighted the structural importance of protective equipment. For instance, WHO estimated monthly needs of 89 million masks, 76 million gloves, and 1.6 million goggles during the outbreak. A WHO model suggested that global production needed to increase by nearly 40% to meet demand. At the same time, shortages caused by export restrictions intensified supply disruptions faster than the disease spread. Prices surged as surgical masks increased sixfold, N95 respirators tripled, and gowns doubled during the crisis.

Preparedness planning has since reshaped procurement strategies. In the United States, the Strategic National Stockpile maintains PPE reserves and allocates them during emergencies. New funding has been directed to replenish supplies and expand domestic manufacturing. Similarly, regulatory standards have played a stabilizing role. OSHA mandates appropriate respiratory and eye protection for U.S. workers, while Regulation (EU) 2016/425 in Europe sets strict design and performance requirements. These frameworks ensure consistent demand through mandatory replacement and upgrade cycles.

Rising antimicrobial resistance (AMR) has emerged as another long-term driver. A study by WHO and CDC found drug-resistant infections caused 1.27 million deaths in 2019 and were associated with nearly 5 million deaths globally. In the U.S. alone, more than 2.8 million antimicrobial-resistant infections occur annually, costing over USD 4.6 billion to treat. As a result, PPE has been prioritized in national AMR strategies to reduce hospital-based transmission and safeguard long-term care environments.

Investment, Technology, and Sustainability Trends

Global healthcare expenditure patterns continue to reinforce protective equipment demand. According to WHO’s Global Health Expenditure Database and World Bank data, steady increases in health spending enable stable procurement budgets. For example, as countries expand coverage and upgrade hospitals, recurring PPE purchases remain embedded within their annual health budgets. This creates a predictable revenue base for manufacturers and suppliers in the sector.

Technology development has also influenced product adoption. NIOSH outlines protective technologies such as respirators, gowns, gloves, and fit-testing systems, which guide hospitals toward higher-specification items. Procurement is shifting toward certified PPE with advanced features like stronger filtration, fluid resistance, and improved comfort. These upgrades encourage innovation and sustain replacement cycles, ensuring steady growth for certified suppliers.

Public investment in resilience further supports the sector. For example, climate- and disaster-related health risks have led WHO and UNICEF to recommend PPE inclusion in emergency kits and preparedness plans. Protecting workers during extreme heat and emergencies has broadened the role of PPE beyond pandemics, creating additional demand in disaster management and humanitarian relief contexts.

Sustainability is another emerging theme. During the pandemic, mask waste increased sharply, with studies showing masks rose from less than 0.01% to more than 0.8% of litter. This has accelerated discussions on biodegradable materials and recycling initiatives. Governments and manufacturers are increasingly aligning with policies aimed at reducing medical waste without compromising safety. These shifts highlight innovation opportunities in developing eco-friendly PPE solutions for the future.

Overall, the medical protective equipment market is anchored by recurring infection risks, stringent regulations, and preparedness investments. With more than 1 in 31 patients in U.S. hospitals experiencing at least one healthcare-associated infection daily, consistent use of protective equipment remains essential. Supported by technological progress, policy backing, and sustainable innovation, the sector is expected to maintain steady long-term growth.

Key Takeaways

- The Global Medical Protective Equipment Market is projected to grow from US$ 17.45 Billion in 2024 to US$ 27.62 Billion by 2034.

- The market expansion is anticipated at a compound annual growth rate (CAGR) of 4.7% during the forecast period spanning 2025 to 2034.

- In 2024, the Hand Protection category dominated the Product Type Segment, accounting for more than 28.2% share of the total market.

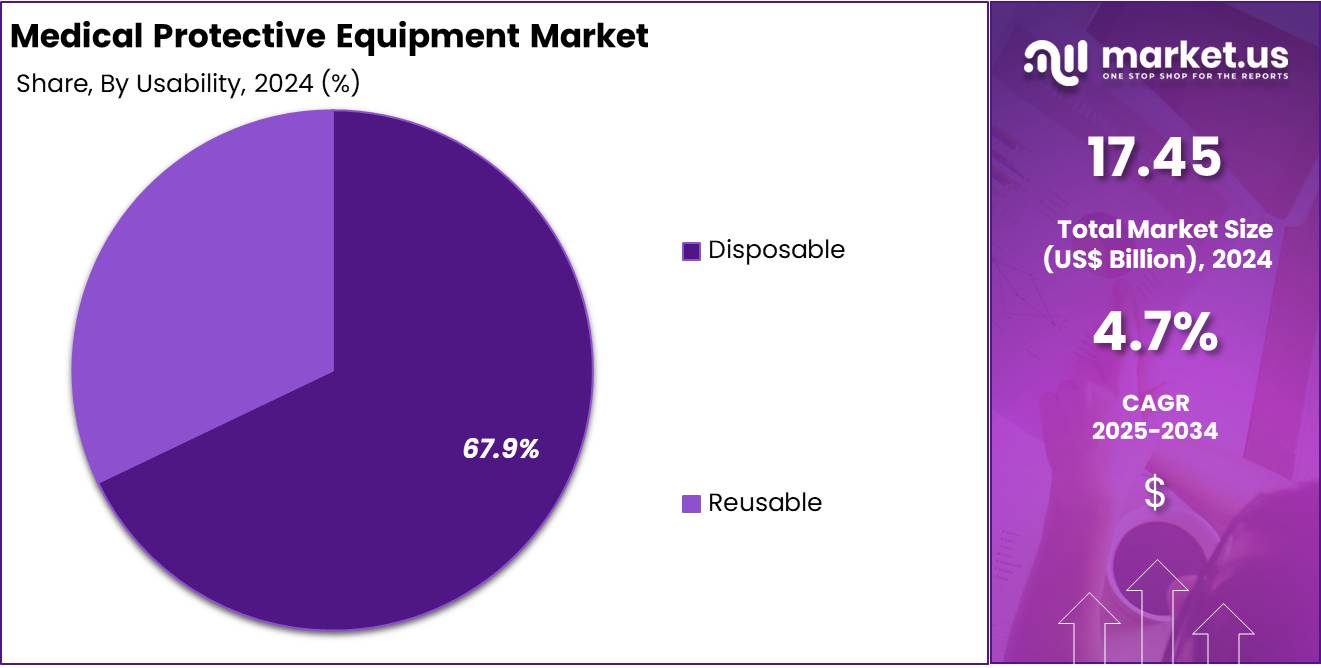

- Within the Usability Segment, Disposable products secured a dominant position in 2024, capturing over 67.9% share of the global market.

- The Hospitals and Clinics category was the leading End-User segment in 2024, representing more than 54.1% of the market share.

- North America emerged as the leading regional market in 2024, holding a 35.9% share valued at approximately US$ 6.26 Billion.

Product Type Analysis

In 2024, the Hand Protection Section held a dominant market position in the Product Type Segment of the Medical Protective Equipment Market, and captured more than a 28.2% share. The growth of this section was supported by the extensive demand for disposable and reusable medical gloves. Infection control protocols and hospital hygiene standards further encouraged the use of latex, nitrile, and vinyl gloves. Hospitals and diagnostic centers remained the largest users, which reinforced the dominance of this category.

The Protective Clothing segment also accounted for a significant portion of the market. The demand increased due to the rising use of surgical gowns, isolation suits, and medical coveralls. Hospitals adopted these products to reduce hospital-acquired infections. Regulatory compliance and strict safety standards supported the expansion of this category. The Respiratory Protection segment recorded notable growth as well. The demand was driven by rising airborne infections and the widespread adoption of surgical masks, N95 respirators, and PAPRs.

The Face and Eye Protection segment maintained steady demand in laboratories, operating rooms, and emergency departments. Safety goggles, face shields, and visors were used to protect against splashes and aerosol exposure. The Foot and Shoe Covers segment gained traction due to their mandatory use in operation theaters and critical care units. Head Protection recorded moderate demand, primarily for surgical caps and cleanroom hoods. The Others segment, which included hearing protection and specialized gear, contributed a small but relevant share to the overall market.

Usability Analysis

In 2024, the Disposable Section held a dominant market position in the Usability Segment of the Medical Protective Equipment Market, and captured more than a 67.9% share. The preference for disposable protective equipment was mainly supported by strict hygiene rules and infection control protocols. Items such as gloves, masks, gowns, and shields were widely used in hospitals and clinics. Their ease of disposal and reduced cross-contamination risk increased adoption. The rising demand for affordable and accessible protective gear also contributed to their stronger market presence.

The Reusable Section accounted for a smaller share of the market. These products included durable protective goggles, gowns, and face shields. Their adoption was often influenced by cost savings over time and sustainability initiatives in healthcare facilities. Concerns about environmental waste pushed some providers to explore reusable solutions. However, cleaning and sterilization requirements remained challenges. The higher upfront investment also limited wider acceptance, especially when compared to disposable options that provided faster and simpler usage benefits.

Despite the smaller share, the Reusable Section is expected to show steady growth in the future. This is supported by innovation in sterilization technologies and the rising emphasis on eco-friendly practices in healthcare. Hospitals aiming to reduce medical waste are likely to increase the adoption of reusable protective equipment. Meanwhile, the Disposable Section is projected to sustain its dominance due to demand in surgeries, diagnostics, and outpatient care. Overall, both segments will continue to play key roles, with disposables maintaining leadership and reusables growing gradually.

End-User Analysis

In 2024, the Hospitals and Clinics Section held a dominant market position in the End-User Segment of Medical Protective Equipment Market, and captured more than a 54.1% share. This dominance was attributed to continuous patient admissions and the critical need for infection control practices. Regulatory standards in hospitals and clinics have also strengthened the use of protective equipment. Constant supply demand, coupled with strict safety rules, ensured the leadership of this segment in the overall market structure.

The Home Healthcare segment has been observed as a steadily expanding category. Growth in this segment was supported by the aging population, which is more inclined towards in-home care services. Increased adoption of disposable medical protective products was noted as a major driver. Convenience of use and reduced exposure risks also promoted demand. Experts highlighted that greater acceptance of home treatment methods will continue to create opportunities for this segment over the forecast period.

The Outpatient and Primary Care Facilities segment accounted for another significant portion of the market. Demand here was driven by rising patient visits in ambulatory and non-emergency care centers. Lower cost structures encouraged facilities to increase their usage of protective products. Regulatory guidelines further supported adoption in this category. The Others segment, covering laboratories and emergency services, showed moderate growth. Infection awareness and occupational safety protocols played an essential role. Collectively, these segments contributed to the diversification of demand within the overall medical protective equipment market.

Key Market Segments

By Product Type

- Hand Protection

- Protective Clothing

- Respiratory Protection

- Face and Eye Protection

- Foot and Shoe Covers

- Head Protection

- Others

By Usability

- Disposable

- Reusable

By End-User

- Hospitals and Clinics

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

Drivers

Increasing Prevalence of Infectious Diseases and Pandemic Preparedness

The growth of the medical protective equipment market is being driven by the increasing prevalence of infectious diseases worldwide. Rising incidences of viral outbreaks, bacterial infections, and hospital-acquired infections have created strong demand for protective solutions. Healthcare facilities are under pressure to maintain safety standards and reduce transmission risks. As a result, the use of protective equipment such as gloves, gowns, masks, and face shields has become essential for both medical staff and patients in clinical and hospital environments.

The demand for protective equipment has also surged due to pandemic preparedness measures. Global health emergencies, most notably COVID-19, highlighted the urgent need for reliable and large-scale protective gear. Governments and healthcare systems have been compelled to build stockpiles and strengthen supply chains for these products. Such preparedness strategies ensure a ready response to potential pandemics, thereby sustaining consistent market demand. Manufacturers are increasingly focusing on scalable production and compliance with international safety standards.

In addition, the awareness of infection control practices among the general population has expanded. Public use of medical protective equipment is no longer restricted to healthcare settings but has extended to households, workplaces, and public spaces. This behavioral shift, reinforced by public health campaigns, has further boosted consumption. Market growth is thus supported by both institutional and consumer demand. The convergence of healthcare needs, government initiatives, and personal safety awareness continues to reinforce the critical role of protective equipment.

Restraints

Supply Chain Vulnerability And Raw Material Dependency

Supply chain vulnerability and dependency on raw materials present a significant restraint for the medical protective equipment market. The production of masks, gloves, gowns, and other equipment is heavily reliant on key inputs such as nonwoven fabrics and nitrile. During global crises, when demand rises suddenly, the availability of these materials becomes unstable. This disrupts the entire supply chain and reduces the ability of manufacturers to meet urgent healthcare needs. As a result, volatility in availability and costs becomes a serious challenge.

The limited access to essential raw materials creates major risks for both manufacturers and end-users. Price fluctuations of nonwoven fabrics and nitrile are frequent, and during shortages, production schedules are delayed or interrupted. Hospitals, clinics, and distributors often face irregular supplies of protective equipment in such circumstances. This dependency also places manufacturers under pressure to source from limited suppliers, creating further vulnerabilities. Such factors weaken supply stability and increase the risk of market slowdowns.

Furthermore, global reliance on specific production hubs intensifies this restraint. Countries with concentrated raw material supply chains hold disproportionate influence, making the market highly sensitive to disruptions such as export restrictions or trade barriers. The medical protective equipment industry is therefore exposed to high procurement risks. Sustained shortages, combined with rising input costs, limit the capacity to scale up production during emergencies. This directly impacts the market’s ability to maintain steady growth and meet the increasing demand for safety equipment worldwide.

Opportunities

Development Of Eco-Friendly And Reusable Protective Equipment

The development of eco-friendly and reusable medical protective equipment presents a significant opportunity for the healthcare industry. Rising concerns about environmental impact and stringent sustainability regulations are creating demand for alternatives to single-use products. Biodegradable and recyclable solutions are being viewed as effective in reducing medical waste. Reusable protective gear, designed with high-quality materials, offers durability while lowering long-term costs. Manufacturers that invest in innovation in this direction can align with global sustainability goals while strengthening their competitive positioning.

Growing awareness of environmental sustainability among healthcare institutions is driving a shift toward greener medical equipment. Hospitals and clinics are increasingly adopting eco-conscious procurement policies. This is expected to accelerate the adoption of biodegradable and reusable protective products. Government initiatives aimed at reducing single-use plastics and medical waste further strengthen the business case. Manufacturers that develop certified, safe, and reusable products can gain early mover advantages. This opportunity can expand both in developed and emerging markets as awareness grows.

The demand for eco-friendly protective equipment also creates opportunities for product diversification and premium branding. Reusable alternatives can be marketed not only for their protective function but also for their role in reducing environmental impact. Partnerships with healthcare providers and sustainability-driven organizations can boost adoption. Moreover, the cost-efficiency of reusables over time may appeal to institutions under financial constraints. By leveraging innovation and sustainable materials, manufacturers can secure long-term growth while addressing environmental concerns, creating a balanced advantage for both business and society.

Trends

Integration of Advanced Technologies in Medical Protective Equipment

The medical protective equipment market is witnessing a clear shift towards advanced technologies. The integration of antimicrobial coatings is improving hygiene standards by minimizing the risk of contamination on frequently touched surfaces. These coatings enable products to remain self-sanitizing, which enhances safety for both healthcare professionals and patients. The demand for such technology-driven protective solutions is expanding as hospitals and laboratories prioritize infection prevention and operational efficiency in high-risk environments.

Another key trend is the introduction of smart protective equipment with embedded sensors. These devices monitor vital parameters such as heart rate, oxygen levels, and body temperature in real time. This capability not only supports the well-being of healthcare workers but also assists in early detection of potential health risks. By combining protection with continuous monitoring, these smart solutions are gaining wide acceptance in healthcare, industrial, and emergency service applications. Their adoption highlights a shift towards multi-functional protective gear.

Improved comfort and ergonomic designs are further shaping the development of medical protective equipment. Lightweight materials, enhanced breathability, and user-friendly designs are addressing long-term wear challenges. These advancements allow professionals to maintain productivity and comfort during extended working hours. The combination of safety, monitoring, and usability positions advanced protective equipment as an essential element in modern healthcare systems. Consequently, the trend reflects growing investment in innovation and emphasizes the role of technology in shaping the next generation of protective solutions.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 35.9% share and recording a market value of US$ 6.26 billion. The region’s leadership can be attributed to exceptional healthcare expenditure and strict infection-control measures. According to official data, the United States alone spent US$ 4.9 trillion on healthcare in 2023, equivalent to 17.6% of its GDP. Such high spending ensures predictable and continuous demand for medical protective equipment, including gowns, masks, respirators, gloves, and eye protection.

The regulatory framework has also reinforced steady consumption patterns. For instance, the U.S. Food and Drug Administration requires 510(k) clearance for surgical gowns and performance reviews for medical gloves, while the National Institute for Occupational Safety and Health (NIOSH) certifies respirators with mandatory approval numbers. Similarly, in Canada, Health Canada applies a risk-based classification system and recognized technical standards to ensure quality. These measures promote replacement cycles and favor suppliers capable of meeting high specifications.

Demand has further been institutionalized by infection-prevention guidelines. The U.S. Centers for Disease Control and Prevention mandates PPE use under Standard and Transmission-Based Precautions whenever exposure to infectious material is expected. Likewise, Canada’s Public Health Agency issues guidance for routine practices and outbreaks, such as influenza, measles, Ebola, and mpox. These strict policies ensure that PPE usage remains consistent across hospitals, clinics, and long-term care facilities, both during normal operations and health emergencies.

Government initiatives have also expanded baseline demand. For example, the U.S. Strategic National Stockpile procures PPE in large volumes, while HHS and ASPR fund domestic production and issue standardization priorities to enhance supply resilience. According to a study by Canadian authorities, about one-third of Canadian businesses continued reporting PPE needs in January 2022 due to public health rules. This demonstrates how usage has extended beyond hospitals into wider economic activities, strengthening regional scale and stability for suppliers.

Operational tools and global trends have amplified this advantage. The CDC and NIOSH offer burn-rate calculators and inventory tracking systems that help providers forecast PPE requirements. During COVID-19, the World Health Organization estimated global monthly needs at 89 million medical masks and 76 million gloves, underscoring the critical role of reliable suppliers. North America responded by expanding strategic reserves and domestic production, securing long-term dominance in the medical protective equipment market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Medical Protective Equipment market is shaped by the presence of globally recognized companies. 3M Company maintains a dominant position through its diversified product portfolio, extensive distribution channels, and focus on technological innovation. The company’s consistent investments in product safety and filtration technology have strengthened its leadership. Its wide presence across hospitals and industrial applications provides resilience against demand fluctuations. The trust established through regulatory compliance and product reliability further enhances 3M’s strong market position in medical protective equipment.

Honeywell International Inc. is a prominent participant with a strong emphasis on respiratory protective equipment. Its competitive edge lies in advanced engineering capabilities, product customization, and robust research and development. Honeywell leverages its global supply chain and manufacturing capacity to meet rising demand, particularly during health crises. Continuous expansion of product offerings, including masks and protective apparel, supports its growth. The company’s reputation for quality and safety standards has enabled it to strengthen its global footprint in both healthcare and industrial protective applications.

MSA Safety Incorporated specializes in protective gear and has established a niche position in safety solutions. The company focuses on delivering innovative respiratory equipment and protective headgear. Its ability to adapt products for medical and healthcare environments provides a strategic advantage. Continuous partnerships with healthcare institutions and government bodies further drive its presence. While smaller compared to major multinational players, MSA Safety’s targeted innovation and specialized approach help it capture a significant share in the medical protective equipment segment.

Ansell Limited and DuPont de Nemours Inc. are also vital players contributing significantly to market development. Ansell focuses on medical gloves and protective clothing, with a strong emphasis on healthcare worker safety. DuPont leverages its material science expertise to provide advanced protective apparel such as gowns and coveralls. Both companies benefit from continuous product innovation and global distribution networks. Along with other regional players, they contribute to market competitiveness. Their strategies in expanding manufacturing capacity and enhancing safety features support steady market growth worldwide.

Market Key Players

- 3M Company

- Honeywell International Inc.

- MSA Safety Incorporated

- Ansell Limited

- DuPont de Nemours Inc.

- Kimberly-Clark Professional

- Cardinal Health Inc.

- Medline Industries Inc.

- Lakeland Industries Inc.

- Alpha Pro Tech Ltd.

- Sioen Industries NV

- Radians Inc.

- Avon Protection plc

- Bullard

- Delta Plus Group

- Other key players

Recent Developments

- April 2024: 3M completed the spin-off of its Health Care division, forming Solventum Corporation (NYSE: SOLV). The new independent company now manages medical products, including infection prevention and surgical solutions. This separation was aimed at sharpening portfolio focus and improving capital allocation.

- February 2024: The company introduced the Cairns® 1836 Fire Helmet. This addition expanded the head-protection portfolio with a lighter-weight design, which was presented alongside advanced connected technologies.

- November 2024: Honeywell announced the sale of its Personal Protective Equipment (PPE) business to Protective Industrial Products (PIP) in a transaction valued at approximately USD 1.325 billion. The divestiture was aligned with Honeywell’s strategy to streamline its portfolio and emphasize growth in automation, aviation, and energy transition. The PPE division included recognized brands such as North®, Howard Leight®, Miller®, KCL®, Fibre-Metal®, and Salisbury®. The transaction was finalized in May 2025.

- November 2024: The company was awarded a USD 33 million, 10-year contract by the U.S. Coast Guard for its G1 self-contained breathing apparatus (SCBA). Initial orders valued at USD 22 million were placed, and production began shortly after.

Report Scope

Report Features Description Market Value (2024) US$ 17.45 Billion Forecast Revenue (2034) US$ 27.62 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hand Protection, Protective Clothing, Respiratory Protection, Face and Eye Protection, Foot and Shoe Covers, Head Protection, Others), By Usability (Disposable, Reusable), By End-User (Hospitals and Clinics, Home Healthcare, Outpatient/Primary Care Facilities, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M Company, Honeywell International Inc., MSA Safety Incorporated, Ansell Limited, DuPont de Nemours Inc., Kimberly-Clark Professional, Cardinal Health Inc., Medline Industries Inc., Lakeland Industries Inc., Alpha Pro Tech Ltd., Sioen Industries NV, Radians Inc., Avon Protection plc, Bullard, Delta Plus Group, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Protective Equipment MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Protective Equipment MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Honeywell International Inc.

- MSA Safety Incorporated

- Ansell Limited

- DuPont de Nemours Inc.

- Kimberly-Clark Professional

- Cardinal Health Inc.

- Medline Industries Inc.

- Lakeland Industries Inc.

- Alpha Pro Tech Ltd.

- Sioen Industries NV

- Radians Inc.

- Avon Protection plc

- Bullard

- Delta Plus Group

- Other key players