Global Medical Pendant Market By Product Type (Fixed, Single Arm Movable, Fixed Retractable, Double and Multi-Arm Movable and Accessories), By Capacity (Low, Heavy and Medium), By Application (Surgery, Anesthesia, Endoscopy, Intensive Care Unit (ICU) and Others), By End-User (Hospitals, Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174549

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

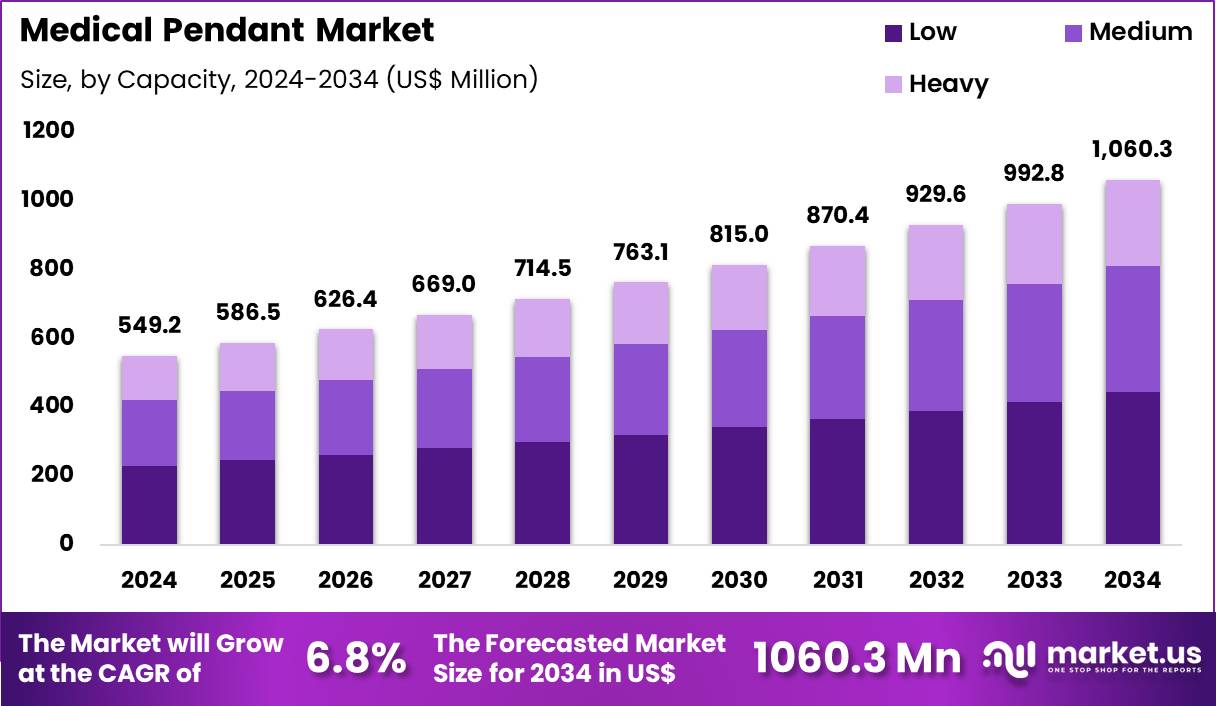

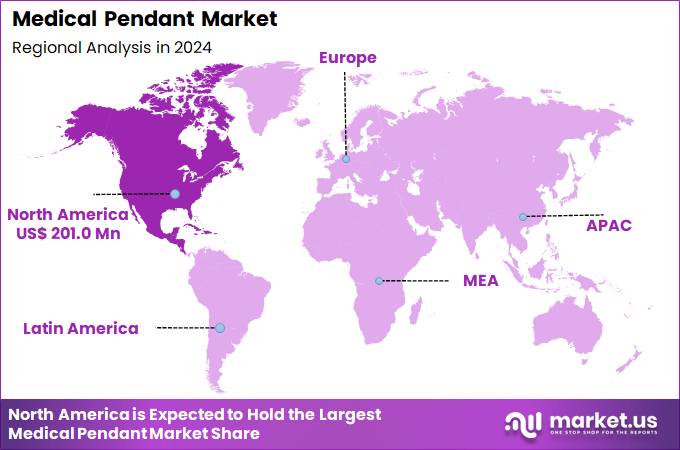

The Global Medical Pendant Market size is expected to be worth around US$ 1060.3 Million by 2034 from US$ 549.2 Million in 2024, growing at a CAGR of 6.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.6% share with a revenue of US$ 201.0 Million.

Increasing demand for streamlined clinical workflows in intensive care and surgical environments drives the medical pendant market as hospitals seek ceiling-mounted systems that organize essential utilities and reduce floor clutter. Anesthesiologists rely on anesthesia pendants to deliver precise gas supplies, electrical outlets, and monitoring cables directly to the operating table, enabling efficient airway management and intraoperative adjustments.

Surgeons utilize surgical pendants during complex procedures to position high-definition cameras, light sources, and instrument arms at optimal heights, maintaining sterile fields and unobstructed access. Critical care teams deploy ICU pendants to centralize ventilator connections, infusion pumps, and patient monitoring interfaces around the bedside, facilitating rapid response to hemodynamic instability.

These systems support endoscopy suites by suspending flexible endoscopes and video processors, enhancing maneuverability during diagnostic and therapeutic interventions. In high-acuity settings, pendants integrate nurse call systems and data ports, streamlining communication and documentation for multidisciplinary teams managing ventilated patients or post-operative recovery.

Manufacturers pursue opportunities to develop modular pendant designs with customizable service heads that adapt to evolving procedural requirements, such as robotic-assisted surgery or hybrid operating rooms. Developers advance lightweight, single-arm configurations that improve space utilization in compact procedural areas while maintaining full 360-degree rotation and vertical travel.

These innovations facilitate integration of advanced imaging modalities, allowing seamless repositioning of C-arms or ultrasound units during interventional procedures. Opportunities emerge in incorporating antimicrobial coatings and touchless controls to enhance infection prevention in intensive care and operating environments.

Companies invest in smart pendant platforms that monitor utility usage and provide predictive maintenance alerts, reducing downtime in high-volume facilities. Firms explore energy-efficient LED integration and ergonomic load-balancing mechanisms, elevating safety and usability across diverse clinical applications while supporting hospital efforts to optimize staff ergonomics and patient throughput.

Key Takeaways

- In 2024, the market generated a revenue of US$ 549.2 Million, with a CAGR of 6.8%, and is expected to reach US$ 1060.3 Million by the year 2034.

- The product type segment is divided into fixed, single arm movable, fixed retractable, double and multi-arm movable and accessories, with fixed taking the lead with a market share of 44.8%.

- Considering capacity, the market is divided into low, heavy and medium. Among these, low held a significant share of 41.9%.

- Furthermore, concerning the application segment, the market is segregated into surgery, anesthesia, endoscopy, intensive care unit (ICU) and others. The surgery sector stands out as the dominant player, holding the largest revenue share of 46.3% in the market.

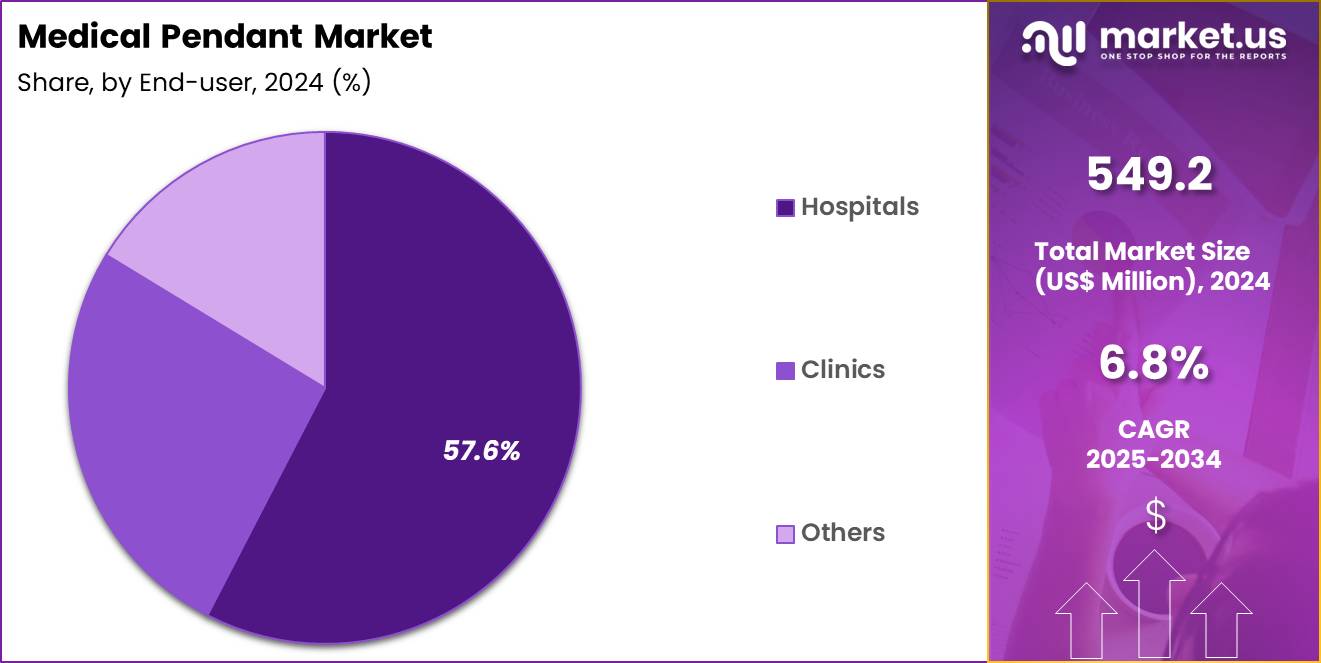

- The end-user segment is segregated into hospitals, clinics and others, with the hospitals segment leading the market, holding a revenue share of 57.6%.

- North America led the market by securing a market share of 36.6%.

Product Type Analysis

Fixed accounted for 44.8% of growth within the product type category and represents the most widely adopted configuration in the Medical Pendant market. Hospitals prefer fixed systems due to structural stability and predictable positioning. Operating rooms rely on fixed pendants to support essential medical gases and power outlets. Lower mechanical complexity reduces maintenance requirements.

Installation simplicity supports faster deployment during facility expansion. Fixed designs suit standardized surgical layouts. Cost efficiency strengthens procurement decisions in budget-conscious settings. Fixed pendants support consistent workflow across operating suites. Surgeons and nurses benefit from reliable equipment access. Reduced movement minimizes accidental cable strain.

Infection control teams favor fixed layouts for easier cleaning. Long service life improves total cost of ownership. Hospitals prioritize dependable infrastructure for high-volume procedures. Fixed systems integrate well with ceiling-mounted surgical lights. Retrofit projects often select fixed pendants to minimize structural changes.

Training requirements remain minimal for clinical staff. Procurement cycles favor proven configurations. Fixed solutions support compliance with safety standards. Demand is projected to remain strong due to reliability and affordability. Growth reflects operational stability and standardized care models.

Capacity Analysis

Low capacity represented 41.9% of growth within the capacity category and leads demand in the Medical Pendant market. Many procedures require limited load-bearing capability for monitors and accessories. Low-capacity pendants meet routine surgical and anesthesia needs efficiently. Reduced structural requirements lower installation costs.

Smaller operating rooms favor low-capacity systems for space optimization. Clinics and secondary hospitals select low-capacity options for versatility. Equipment miniaturization reduces the need for heavy-duty support. Low-capacity designs improve ceiling load distribution. Faster installation timelines support rapid facility commissioning. Maintenance teams prefer simpler load profiles.

Lower energy and material usage improve sustainability metrics. Budget planning aligns with lower upfront costs. Training and operation remain straightforward. Modular add-ons extend functional utility. Procurement standardization increases purchasing volumes.

Compatibility with common accessories supports adoption. Reduced mechanical stress improves durability. Clinical workflows benefit from uncluttered setups. Demand is anticipated to persist due to practicality and cost balance. Growth reflects widespread routine-use scenarios.

Application Analysis

Surgery captured 46.3% of growth within the application category and stands as the primary driver for medical pendant installations. Rising surgical volumes increase infrastructure demand. Modern operating rooms require organized delivery of gases and power. Pendants improve ergonomics and reduce floor clutter during procedures. Surgical safety protocols emphasize organized equipment management. Minimally invasive procedures increase monitor and device usage.

Efficient cable management improves procedural flow. Hospitals upgrade surgical suites to meet accreditation standards. Pendants support rapid equipment reconfiguration between cases. Infection prevention benefits from elevated equipment placement. Surgeons value unobstructed access to critical devices. Anesthesia integration supports synchronized workflows.

High procedure throughput amplifies equipment utilization. Teaching hospitals expand surgical capacity, driving installations. Technology adoption increases accessory integration needs. Surgical expansion projects prioritize pendant systems. Clinical outcomes improve with optimized environments. Demand is projected to remain dominant due to procedural centrality. Growth reflects ongoing operating room modernization.

End-User Analysis

Hospitals accounted for 57.6% of growth within the end-user category and dominate the Medical Pendant market. Hospitals conduct the majority of surgical and critical care procedures. Infrastructure investments focus on advanced operating rooms. Multidisciplinary care requires centralized utility access. Hospitals manage high patient throughput, increasing equipment demand. Capital budgets support comprehensive pendant systems.

Accreditation requirements encourage standardized installations. Teaching hospitals adopt pendants for training environments. Emergency and trauma care drive continuous usage. Hospitals integrate pendants across surgery, ICU, and anesthesia. Centralized procurement supports volume purchasing. Facility expansions increase installation counts.

Maintenance capabilities support long-term operation. Hospitals prioritize safety and ergonomics for staff. Technology upgrades require adaptable infrastructure. Infection control policies favor ceiling-mounted systems. Patient outcomes benefit from organized care spaces. Referral networks concentrate complex cases in hospitals. Demand is expected to remain strong due to infrastructure scale. Growth reflects centralized care delivery and modernization initiatives.

Key Market Segments

By Product Type

- Fixed

- Single arm movable

- Fixed retractable

- Double and multi-arm movable

- Accessories

By Capacity

- Low

- Heavy

- Medium

By Application

- Surgery

- Anesthesia

- Endoscopy

- Intensive Care Unit (ICU)

- Others

By End-User

- Hospitals

- Clinics

- Others

Drivers

Increasing number of hospital beds and ICU expansions is driving the market

The medical pendant market is strongly driven by the increasing number of hospital beds and ICU expansions worldwide, which require advanced ceiling-mounted systems to support critical care equipment and improve workflow efficiency. Hospitals are upgrading infrastructure to accommodate higher patient volumes, particularly in intensive care units where pendants organize gas outlets, electrical supplies, and monitoring devices.

Regulatory bodies in many countries mandate modernized hospital designs that incorporate integrated pendant systems for patient safety and staff accessibility. Healthcare administrators prioritize pendants that reduce clutter and enhance infection control in expanded facilities. Medical device suppliers are scaling production to meet the needs of new hospital constructions and renovations.

Clinical departments benefit from pendants that allow flexible positioning of ventilators, infusion pumps, and vital sign monitors. Global health investments in critical care infrastructure, especially post-pandemic, continue to fuel demand for reliable pendant solutions. Academic medical centers are leading the adoption of modular pendants in newly built wings.

Patient care improves with organized bedside access to medical gases and power, reducing response times in emergencies. The U.S. Centers for Medicare & Medicaid Services reported that the number of hospital beds in the United States increased by approximately 3% between 2022 and 2023, with significant growth in ICU capacity during the same period.

Restraints

High installation and maintenance costs are restraining the market

The medical pendant market is restrained by the high installation and maintenance costs, which include structural modifications to ceilings, electrical and gas piping integration, and ongoing service contracts. Hospitals often face significant capital expenditure when retrofitting existing buildings to support heavy pendant systems. Manufacturers must provide specialized engineering support during installation, adding to overall project expenses.

Regulatory compliance for ceiling load-bearing capacity and safety standards further increases implementation costs. Smaller healthcare facilities, particularly in rural or developing regions, frequently delay upgrades due to budget limitations. Clinical departments must allocate resources for regular inspections and repairs to ensure uninterrupted operation.

Global supply chain disruptions for components like gas outlets and articulated arms can elevate pricing. Academic analyses indicate that total ownership costs remain a barrier to adoption in cost-sensitive environments. Patient care can be indirectly affected when budget constraints lead to delayed modernization. These financial pressures collectively slow market penetration and limit replacement cycles for older systems.

Opportunities

Growth in hybrid operating rooms is creating growth opportunities

The medical pendant market presents growth opportunities through the expansion of hybrid operating rooms, which combine surgical and imaging capabilities and require sophisticated pendant systems to manage multiple utility lines. Device manufacturers can develop multi-arm pendants capable of supporting heavy imaging equipment alongside anesthesia and surgical tools. Regulatory approvals for hybrid OR designs are encouraging hospitals to invest in integrated pendant infrastructure.

Healthcare systems benefit from pendants that allow seamless movement of monitors and lights during image-guided procedures. Pharmaceutical and equipment companies are collaborating on solutions tailored for hybrid environments. Clinical specialties such as interventional cardiology and neurosurgery are driving demand for advanced pendant configurations.

Global hospital construction projects increasingly include hybrid ORs, creating a pipeline for pendant installations. Academic medical centers are pioneering hybrid designs that require customizable pendant systems. Patient outcomes improve with pendants enabling efficient workflow in complex interventions. The U.S. Food and Drug Administration cleared several hybrid OR-compatible pendant systems in 2023-2024, supporting broader implementation.

Impact of Macroeconomic / Geopolitical Factors

Global economic advancements steer substantial investments toward hospital infrastructure upgrades, energizing the medical pendant market as facilities integrate versatile ceiling systems for efficient patient care. Executives pursue expansion in rapidly urbanizing areas, where healthcare modernization initiatives heighten adoption of multi-arm pendants equipped with gas and electrical outlets.

Regrettably, pervasive inflation across economies inflates component and labor expenditures, prompting manufacturers to confront diminished profitability in oversaturated segments. Escalating geopolitical frictions in manufacturing strongholds sever access to critical alloys and electronics, obliging suppliers to endure extended procurement delays worldwide.

Forward-looking teams alleviate these strains through proactive diversification of vendor networks in politically steady territories, which refines inventory management and unlocks collaborative cost reductions. Current US tariffs on imported medical equipment from prominent sources like Asia impose additional financial loads, complicating market entry for international competitors dependent on economical shipping.

Native enterprises embrace this shift by bolstering U.S.-centered assembly hubs, which invigorates workforce development and aligns with stringent quality mandates. Evolving designs incorporating smart connectivity features invariably bolster the industry’s adaptability, guaranteeing progressive enhancements and widespread operational benefits in healthcare settings.

Latest Trends

Adoption of modular and ceiling-integrated pendant designs is a recent trend

In 2024, the medical pendant market has shown a clear trend toward the adoption of modular and ceiling-integrated pendant designs, which provide greater flexibility and space optimization in modern hospital environments. Manufacturers are prioritizing systems that allow easy reconfiguration of arms and service heads without major structural changes.

Healthcare facility planners are selecting modular pendants to accommodate evolving equipment needs in ICUs and operating rooms. Regulatory standards are increasingly favoring designs that improve ceiling clearance and reduce clutter. Clinical teams benefit from integrated pendants that streamline cable management and gas delivery.

Academic evaluations are demonstrating improved staff ergonomics with modular configurations. Global hospital renovation projects are incorporating ceiling-integrated systems for aesthetic and functional advantages. Patient safety is enhanced through organized utility routing that minimizes trip hazards. Ethical considerations are guiding designs that support infection control and ease of cleaning. The trend reflects a broader shift toward adaptable infrastructure in critical care areas.

Regional Analysis

North America is leading the Medical Pendant Market

In 2024, North America held a 36.6% share of the global medical pendant market, bolstered by ongoing hospital expansions and upgrades to accommodate rising surgical and critical care demands, where ceiling-mounted pendants with integrated utilities streamline operations in operating rooms and ICUs by providing clutter-free access to gases, power, and equipment.

Healthcare facilities increasingly opted for articulated multi-arm systems to support advanced procedures like robotics-assisted surgeries, driven by infection control protocols that favor designs minimizing surface contamination amid workforce constraints. Innovations in modular pendants with embedded monitors and LED illumination enhanced procedural visibility, aligning with safety standards for high-acuity environments.

Demographic aging and chronic disease surges amplified critical care admissions, necessitating pendants capable of handling multiple life-support devices. Manufacturers introduced lightweight composites with improved ergonomics, meeting demands for flexible configurations in outpatient centers.

Collaborative procurement initiatives standardized features across networks, facilitating efficient installations in community hospitals. Supply resilience ensured timely delivery of compliant units for rapid deployment. The American Hospital Association reported that the number of community hospitals in the United States stood at 5,112 in 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate vigorous progression in medical pendant technologies across Asia Pacific throughout the forecast period, as rapid hospital construction addresses escalating surgical needs from population booms and chronic conditions. Hospital operators install multi-functional arms in new operating suites, configuring them to support the growing number of laparoscopic and interventional procedures in urban tertiary centers.

Health ministries fund modular units for public hospitals, enabling them to equip expanded ICU capacities amid rising respiratory and cardiovascular admissions. Medical device manufacturers develop compact, corrosion-resistant designs with enhanced load capacity, adapting to high-humidity environments common in tropical regions.

Regional procurement consortia standardize specifications through joint tenders, ensuring cost-effective deployment across secondary and tertiary facilities. Local engineering firms customize pendant arms with integrated data ports, supporting the integration of advanced monitoring and robotic systems in modern operating theaters.

Policy frameworks promote technician training on installation and maintenance, extending reliable functionality to newly built rural hospitals. The OECD reports that capital expenditure on health in Asia-Pacific countries averaged 0.4% of GDP in 2022, reflecting ongoing investment in facility infrastructure that supports medical pendant adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Medical Pendant market drive growth by delivering modular ceiling-mounted systems that optimize space, improve workflow efficiency, and enhance safety in operating rooms and intensive care units. Companies expand adoption through close collaboration with hospitals and architects to customize layouts that integrate medical gases, power, data, and ergonomic positioning.

Commercial strategies focus on turnkey project delivery, lifecycle service contracts, and upgrade paths that protect capital investments over time. Innovation priorities include higher load capacities, improved maneuverability, and seamless integration with digital hospital infrastructure.

Market expansion targets regions upgrading acute-care facilities and increasing critical-care bed capacity. Dräger operates as a leading participant by combining deep expertise in medical technology, a strong portfolio of ceiling supply units, and global project execution capabilities that support reliable, future-ready clinical environments.

Top Key Players

- Stryker Corporation

- Hill-Rom Holdings, Inc.

- Getinge AB

- Drägerwerk AG & Co. KGaA

- Midmark Corporation

- Amico Corporation

- Berchtold GmbH & Co. KG

- Span America

- Skytron LLC

- Ergotron, Inc.

Recent Developments

- In January 2025, PieX AI disclosed plans to introduce a personalized, AI enabled mental health pendant, signaling its entry into the digital wellness and wearable health technology space. The device is designed to assist users in managing mental well being by continuously analyzing biometric and contextual signals through proprietary sensing technology and advanced AI models. By delivering subtle, real time insights and adaptive support, the pendant targets discreet mental health monitoring and intervention outside traditional clinical settings.

- In October 2024, Vocodia broadened its product portfolio by launching an emergency response pendant as it entered the medical alert segment. The pendant integrates the company’s expertise in artificial intelligence and communication systems to deliver round the clock emergency connectivity through a simple activation mechanism. This expansion reflects growing demand for reliable personal safety devices that provide immediate access to assistance during medical or safety related events.

Report Scope

Report Features Description Market Value (2024) US$ 549.2 Million Forecast Revenue (2034) US$ 1060.3 Million CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fixed, Single Arm Movable, Fixed Retractable, Double and Multi-Arm Movable and Accessories), By Capacity (Low, Heavy and Medium), By Application (Surgery, Anesthesia, Endoscopy, Intensive Care Unit (ICU) and Others), By End-User (Hospitals, Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stryker Corporation, Hill-Rom Holdings, Inc., Getinge AB, Drägerwerk AG & Co. KGaA, Midmark Corporation, Amico Corporation, Berchtold GmbH & Co. KG, Span America, Skytron LLC, Ergotron, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stryker Corporation

- Hill-Rom Holdings, Inc.

- Getinge AB

- Drägerwerk AG & Co. KGaA

- Midmark Corporation

- Amico Corporation

- Berchtold GmbH & Co. KG

- Span America

- Skytron LLC

- Ergotron, Inc.