Global Medical Marijuana Market By Product Type (Flower, Oil, and Tinctures), By Application (Chronic Pain, Migraine, Cancer, Arthritis, Diabetes, AIDS, Parkinson's, Epilepsy, Muscle spasms, Depression and Anxiety), By End User (Pharmaceutical Industries, Hospitals, Research, and Development Centres, Homecare Settings and Rehab Centres), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov 2023

- Report ID: 25269

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

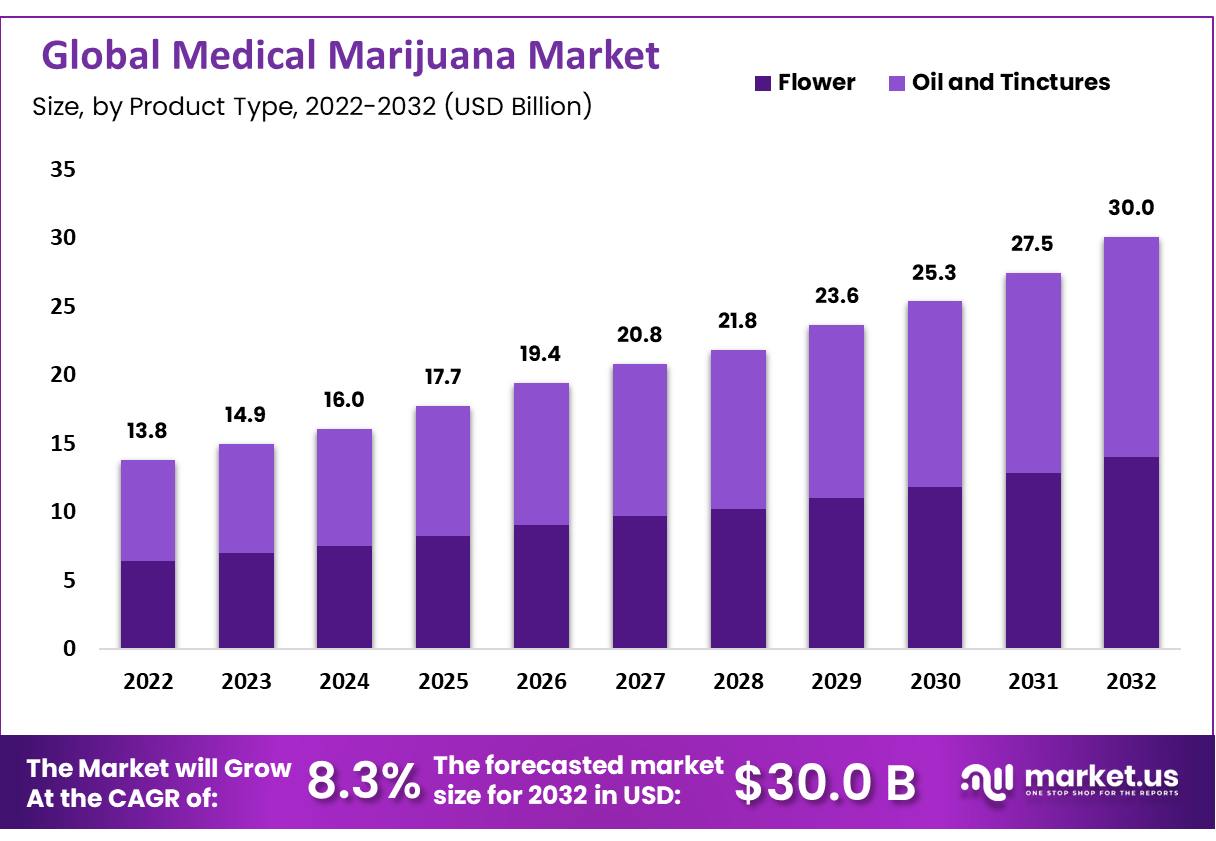

The Global Medical Marijuana Market size is expected to be worth around USD 30 Billion by 2032 from USD 13.8 Billion in 2022, growing at a CAGR of 8.3% during the forecast period from 2022 to 2032.

Medical marijuana is a well-known drug used by people to get high, and it is derived from the plant Cannabis Sativa. The cannabis flower obtained from the female cannabis plant is a smokable part. The Cannabis flower is rich in medicines and natural ingredients. Therefore, it is also prescribed by medical practitioners to deal with the symptoms resulting from certain medical conditions.

The industry is experiencing growth due to the increasing awareness of various therapeutic applications for products such as Pain management, appetite enhancement, and intraocular pressure reduction. Medical marijuana is divided into two types: Cannabis Sativa and Cannabis Indica, originating from countries in the Western Hemisphere and Central and South Asian regions, respectively.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The Global Medical Marijuana Market is expected to reach USD 30 billion by 2032.

- This market is growing at a CAGR of 8.3% between 2023 and 2032.

- In 2022, the medical marijuana market was worth USD 13.8 billion.

- The cannabis flower contains natural chemicals and medicinal compounds.

- The oil and tincture segment accounted for 53.4% of the market share in 2022.

- Chronic pain was the dominant application segment with a 26% market share in 2022.

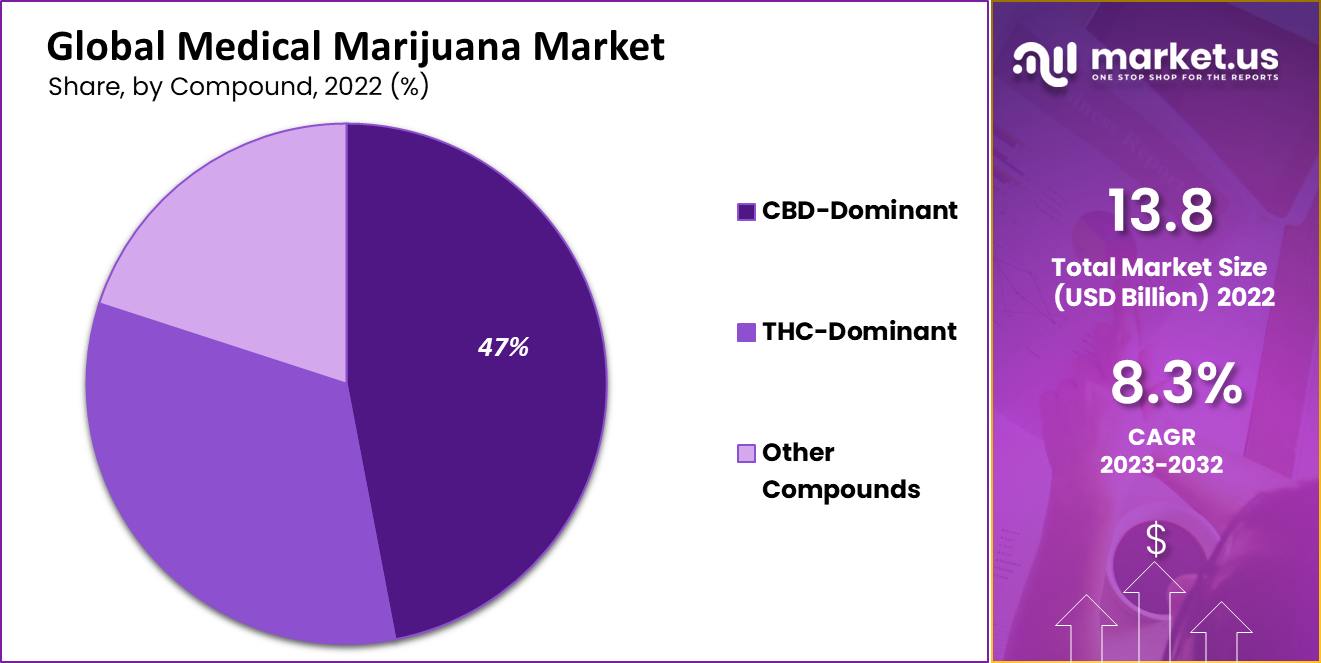

- CBD-dominant compounds are expected to be the most profitable.

- The pharmaceutical sector dominated the end-user market.

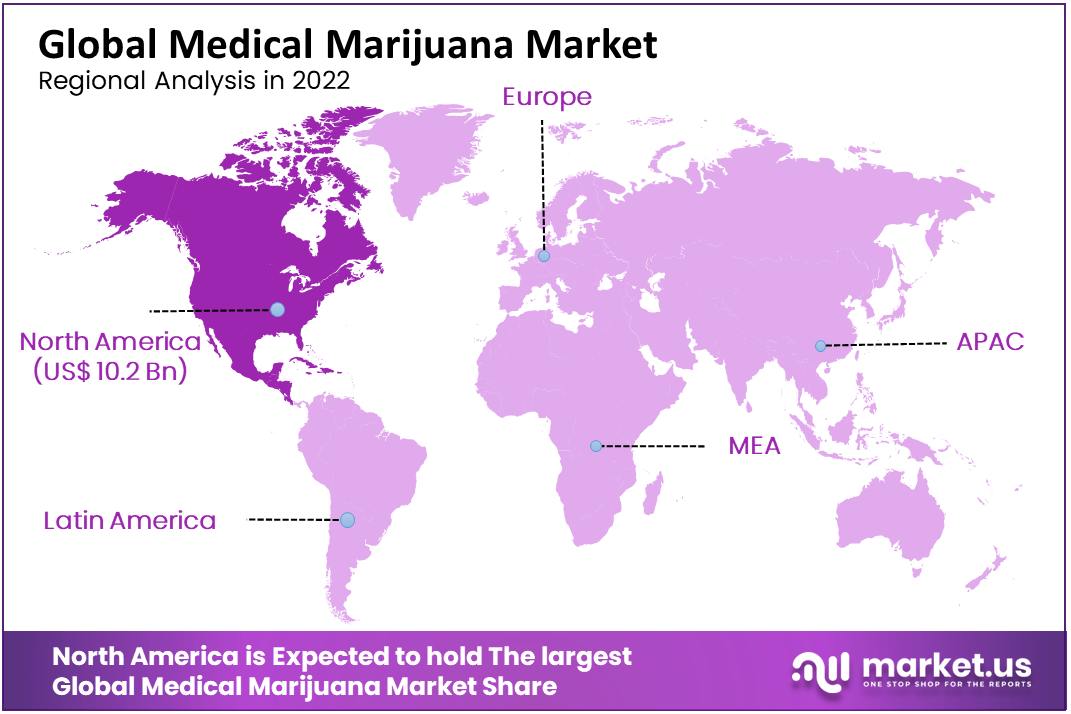

- In 2022, North America held the largest revenue share at 74%.

- Factors driving the growth of the global medical marijuana industry include increased legalization, FDA approvals, social clubs, and increased usage.

- Cannabinoid-based medications are used for conditions like HIV/AIDS-related weight loss, chemotherapy-induced vomiting, and neurological diseases.

- Key players in the medical marijuana market include Tilray, Aurora Cannabis, and Canopy Growth Corporation.

Product Type Analysis

The oil and tincture segment held the largest market share

Based on the product type analysis, the global medical marijuana market is segmented into flower, oil, and tinctures. Among these segments, the Oil and tincture segment held the largest market share of 53.4% in 2022, and hence it is a leading segment in the cannabis industry.

Therefore, it dominated the medical marijuana market. Clinical studies have shown that non-psychoactive compounds in Cannabis, such as CBD, have the ability to reduce inflammation and may offer new treatments for chronic pain.

Its beneficial properties can also be used to treat cancer, sleep disorders, anxiety disorders, and more. Additionally, the increasing legalization of Cannabis around the world is expected to further accelerate the growth of the industry.

In addition, children who consume cannabis derivatives for treatment are prescribed oils and tinctures because they are unable to smoke the flowers due to respiratory problems that may be caused by smoking the flowers.

The flower segment is predicted to have a slower growth rate in the upcoming years. However, the new product launch is expected to boost the market growth of this segment.

By Application Type Analysis

The chronic pain segment dominated the market by holding a market largest share

Based on the application type, the market is segmented into Chronic Pain, Migraine, Cancer, Arthritis, Diabetes, AIDS, Parkinson’s, Epilepsy, Muscle spasms, Depression, and Anxiety. Among these segments, the chronic pain segment dominated the market by holding a market share of 26% in 2022.

Medical Cannabis is safe for treating patients suffering from neuropathic and chronic pain, according to studies from a variety of research findings. An increasing number of clinical trials using marijuana to treat chronic and neuropathic pain is one of the main indicators underscoring the increasing use of Cannabis for pain management over the next few years.

Under New York State’s new medical marijuana law, patients who are certified to use medical marijuana by a health care professional and have a patient ID card registered with the New York State Department of Health and Human Services are entitled to medical marijuana for pain management.

It states that you are eligible to use marijuana for recreational purposes. However, ALS (amyotrophic lateral sclerosis) is expected to be the fastest-growing segment. One of the driving factors behind the growth of this segment is the rising prevalence of (ALS) amyotrophic lateral sclerosis.

End-User Analysis

The pharmaceutical segment dominated the market

Based on end-user, the market is segmented into Pharmaceutical Industries, Hospitals, Research and Development Centres, Homecare Settings, and Rehab Centres. Among these segments, the pharmaceutical segment dominated the market in recent years, and it is expected to remain a dominant segment during the forecast period.

The main factor responsible for the growth of this segment is rising investment and increasing use of Cannabis in pharmaceutical companies due to the health benefits associated with Cannabis in certain medical conditions. Second, on the list stands R&D centers which are expected to grow in the upcoming years due to rising investment in research to overcome certain medical conditions and discover the new health benefits associated with Cannabis.

Key Market Segments

Based on Product Type

- Flower

- Oil and Tinctures

Based on the Application Type

- Chronic Pain

- Migraine

- Cancer

- Arthritis

- Diabetes

- AIDS

- Parkinson’s

- Epilepsy

- Muscle spasms

- Depression and Anxiety

Based on End-User

- Pharmaceutical Industries

- Hospitals

- Research and Development Centres

- Homecare Settings

- Rehab Centres

Drivers

The legalization of Marijuana in the majority of regions

Many countries have legalized medical marijuana use. This is the primary method of its cultivation, reducing imports and generating income in the form of taxes.

The increasing number of states legalizing medical marijuana and increasing acceptance of Cannabis for health care and recreational use are some of the key aspects expected to drive demand for medical marijuana in the next few years. Growing research and development activity are some of the major factors responsible for boosting demand.

The increasing proportion of countries permitting medical marijuana use in various parts of the world is one of the key factors driving the prevalence of Cannabis for therapeutic use. As government policies change, so does the demand for medical marijuana.

Rising Usage of Cannabis in the Healthcare Sector for Chronic Diseases

Consumers in Cannabis legal states in the (U.S.) United States are typically over the age of 50. This demographic profile is estimated to increase demand for Cannabis in the region, with a higher likelihood of chronic illness after age 50 and the effectiveness of Cannabis in treating such conditions.

Due to medical research and product standardization, the popularity and demand for Cannabis are expected to increase. Furthermore, the rising authorization of marijuana for medical applications is driving market growth. Anxiety Disorders, Chronic Disorders, Psychiatric Disorders, Acute Pain Diseases, Acute Disease Ailments, and other clinical conditions are crucial factors increasing the adoption of Cannabis.

Restraints

Marketing usage of Cannabis in any condition or disease is not permitted by the Food and Drug Administration

One of the biggest challenges facing the medical marijuana market is that the FDA does not allow Cannabis to be marketed to treat any disease or condition. However, the organization does approve cannabis-derived medicines.

Epidiolex (cannabidiol) and three synthetic cannabis-related drugs: Marinol (dronabinol), Syndros (dronabinol), and Sesamet (nabilone). These approved medicines are available only with a prescription from an approved healthcare provider.

High dosage of Cannabis can lead to problems

As there is the most number of health benefits associated with the use of Cannabis, there are also certain risks and side effects associated with overdose, long-term use, and a toxic dose of Cannabis. Some of the side effects are panic attacks or anxiety, while long-term side effects include mental health issues and arrhythmia; consuming too much Cannabis has negative effects such as cannabis poisoning.

Opportunity

Rising demand for cannabis capsules

Capsule dosages must be accurate prior to consumption to achieve the intended medicinal benefits. Using sophisticated machines, skilled and licensed inspectors, and manufacturers make it more reliable. With the legalization of medicinal Cannabis in the United States, demand for cannabis capsules has skyrocketed due to their medicinal properties.

As a result, investors are looking to build or acquire facilities with the necessary machinery, skilled labor, and licenses to manufacture cannabis capsules. In addition, incumbent manufacturers invest time and resources in developing new methods to produce high-quality capsules in reasonable doses.

Regional Analysis

North America dominated the market in 2022 by holding the largest revenue share of 74% in the 2022

The increasing legalization of Cannabis in the United States is one of the key factors contributing to the increased demand for Cannabis. Additionally, in the United States, 37 states and the District of Columbia have legalized Cannabis for therapeutic purposes.

Ten other states have also legalized recreational cannabis use. The U.S. government approved a new research marijuana grower in the past year, and this is subject to the broadening capacity for studying the drug’s medical value. Moreover, new product launches in North America are expected to fuel the cannabis market growth.

Asia-Pacific is expected to record the fastest CAGR in the coming years, owing to aggressive government initiatives and increased support. Additionally, rising disposable incomes, growing social acceptance and awareness of the benefits of the product, and increasing legalization of Cannabis are certainly impacting the cannabis market.

The growing popularity of cannabis oil in countries where medical marijuana has been legalized and an increasing proportion of the population suffering from chronic conditions such as Parkinson’s, Alzheimer’s, cancer, and neurological disorders are fueling industry growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Key players are developing various strategic initiatives to expand their business footprints and gain a competitive advantage. They also focus on strategic initiatives such as mergers and acquisitions, collaborations, partnerships, fundraising and investments, and innovative product development and launches to expand their product portfolio.

This forms the competitive landscape among the prominent market players. Some of the major players in the global medical marijuana market are Tilray; Canopy Growth Corporation; Aurora Cannabis; Maricann Group, Inc.; Aphria, Inc.; Tikun Olam, Ltd.; MedReleaf. Corp.; GW Pharmaceuticals plc.; Cannabis Sativa, Inc.; Medical Marijuana, Inc.

Market Key Players

- Tilray Inc.

- Aurora Cannabis

- Canopy Growth Corporation

- Aphria Inc.

- Maricann Group, Inc.

- Tikun Olam, Ltd.

- GW Pharmaceuticals plc.

- Cannabis Sativa Inc.

- Medical Marijuana, Inc.

- Emerald Health Therapeutics Inc.

- Pfizer Inc.

- Green Relief Inc.

- GBSciences Inc.

- Other Key Players

Recent Developments

- In May 2022, Canopy Growth introduced new flavors for their flavored cannabis-infused carbonated drinks: orange orbit and the grape. Due to this launch, the company’s product portfolio was increased.

- In March 2022, Martha Steard collaborated with Canopy Growth Corporation and Marquee Brands and launched a 15-flavor CBD Wellness Gummies Sampler. These products offer consumers the wellness benefits of CBD.

Report Scope

Report Features Description Market Value (2022) USD 13.8 Billion Forecast Revenue (2032) USD 30.0 Billion CAGR (2023-2032) 8.3% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type – Flower, Oil and Tinctures; By Application – Chronic Pain, Migrane, Cancer, Arthritis, Diabetes, AIDS, Parkinsons, Epilepsy, Muscle spasms, Depression, and Anxiety; and By End User – Pharmaceutical Industries, Hospitals, Research and Development Centres, Homecare Settings and, Rehab Centres Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Tilray Inc., Aurora Cannabis, Canopy Growth Corporation, Aphria Inc., Maricann Group, Inc., Tikun Olam, Ltd., GW Pharmaceuticals plc., Cannabis Sativa Inc., Medical Marijuana, Inc., Emerald Health Therapeutics Inc., Pfizer Inc., Green Relief Inc., GBSciences Inc., and other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the medical marijuana market growth?The global medical marijuana market size is expected to be worth around USD 30.0 Bn billion by 2032 from USD 13.8 billion in 2022, growing at a CAGR of during the forecast period from 2023 to 2032.

What segments are covered in the medical marijuana market report?The global medical marijuana market segmented on the basis of device type, application, end user, and geography.

Who are the key players in medical marijuana market ?Tilray Inc., Aurora Cannabis, Canopy Growth Corporation, Aphria Inc., Maricann Group, Inc., Tikun Olam, Ltd., GW Pharmaceuticals plc., Cannabis Sativa Inc., Medical Marijuana, Inc., Emerald Health Therapeutics Inc., Pfizer Inc., Green Relief Inc., GBSciences Inc., Other Key Players,

-

-

- Tilray Inc.

- Aurora Cannabis

- Canopy Growth Corporation

- Aphria Inc.

- Maricann Group, Inc.

- Tikun Olam, Ltd.

- GW Pharmaceuticals plc.

- Cannabis Sativa Inc.

- Medical Marijuana, Inc.

- Emerald Health Therapeutics Inc.

- Pfizer Inc.

- Green Relief Inc.

- GBSciences Inc.

- Other Key Players