Global Medical Adhesive Tapes Market By Type (Acrylic, Silicone, Rubber), By Material (Paper Tapes, Fabric Tapes, Plastic Tapes, Other Tapes), By Adhesion (Single Coated, Double Coated), By Application (Surgery, Wound Dressing, IV Lines, Other Application), By End-User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 14960

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

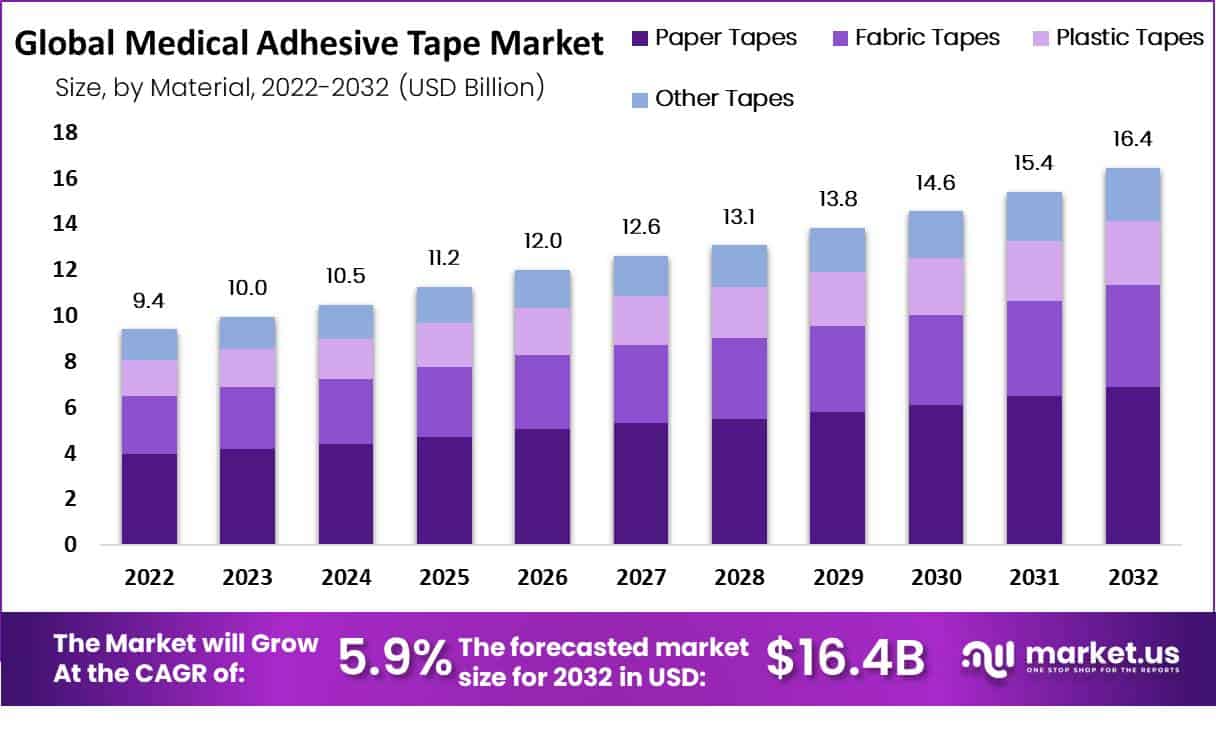

Global Medical Adhesive Tapes Market size is expected to be worth around USD 16.4 Bn by 2032 from USD 9.4 Bn in 2022, growing at a CAGR of 5.9% during the forecast period from 2022 to 2032.

The medical adhesive tapes market is driven by an increase in awareness about noninheritable infections (HAIs), product extensions from manufacturers, increasing innovation in patient safety practices, and the development of single-patient use tapes. Medical adhesive tapes are widely used for securing wound dressings and infusion lines as well as treating injuries, their demand is expected to expand along with growth in surgical volumes worldwide.

The global medical adhesive tapes market is expected to experience growth due to increasing awareness among physicians and patients about their benefits, as well as an increase in wounds, burns, and injuries. Materials like rubber, acrylic, silicone, paper, and adhesives are used as raw materials to produce medical adhesive tapes.

Key Takeaways

- Market Growth: CAGR of 5.9%, reaching USD 16.4 billion by 2032 from USD 9.4 billion in 2022.

- Type Dominance: Acrylic tapes lead with a 41% market share, while silicone tapes grow at 5.9% CAGR.

- Material Preference: Paper tapes hold 42% market share, and plastic tapes and fabric materials show potential.

- Adhesion Trends: Double-coated tapes dominate with a 57% share; single-coated tapes grow at 5.2% CAGR.

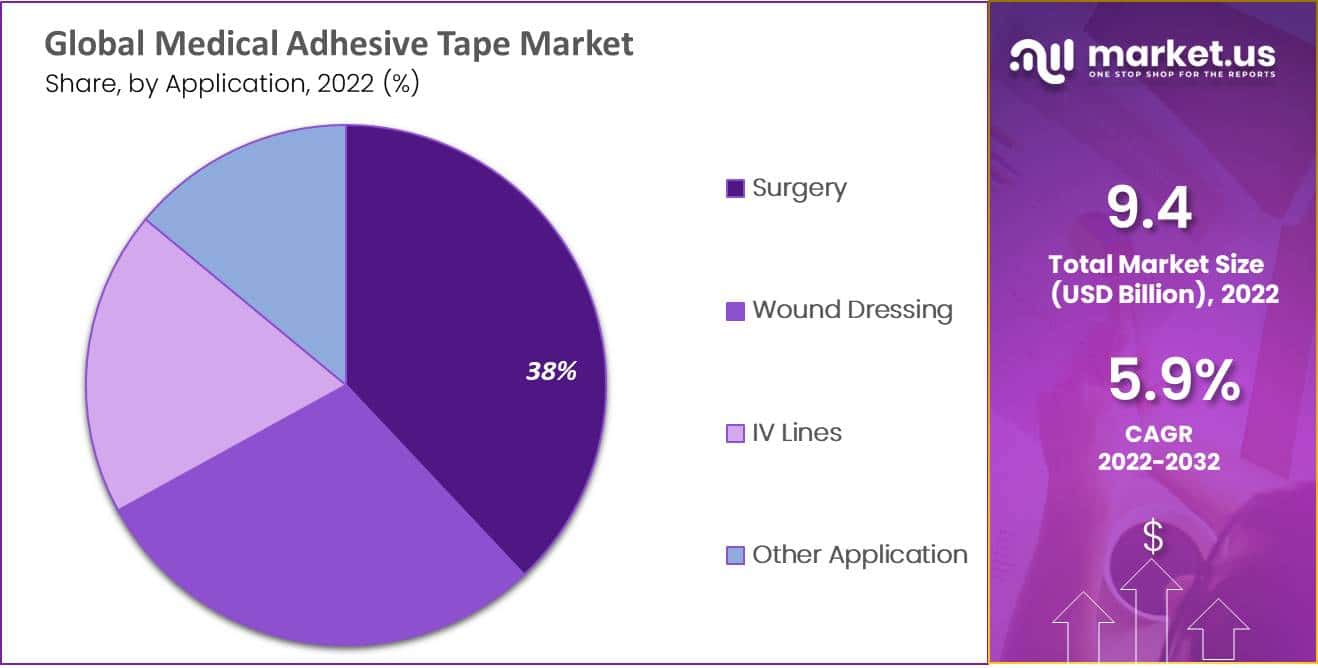

- Application Focus: Surgery commands a 38% market share, with a 5.4% CAGR in wound dressing.

- End-User Insights: Hospitals lead with a 44% market share, while ambulatory surgical centers grow at 5.3% CAGR.

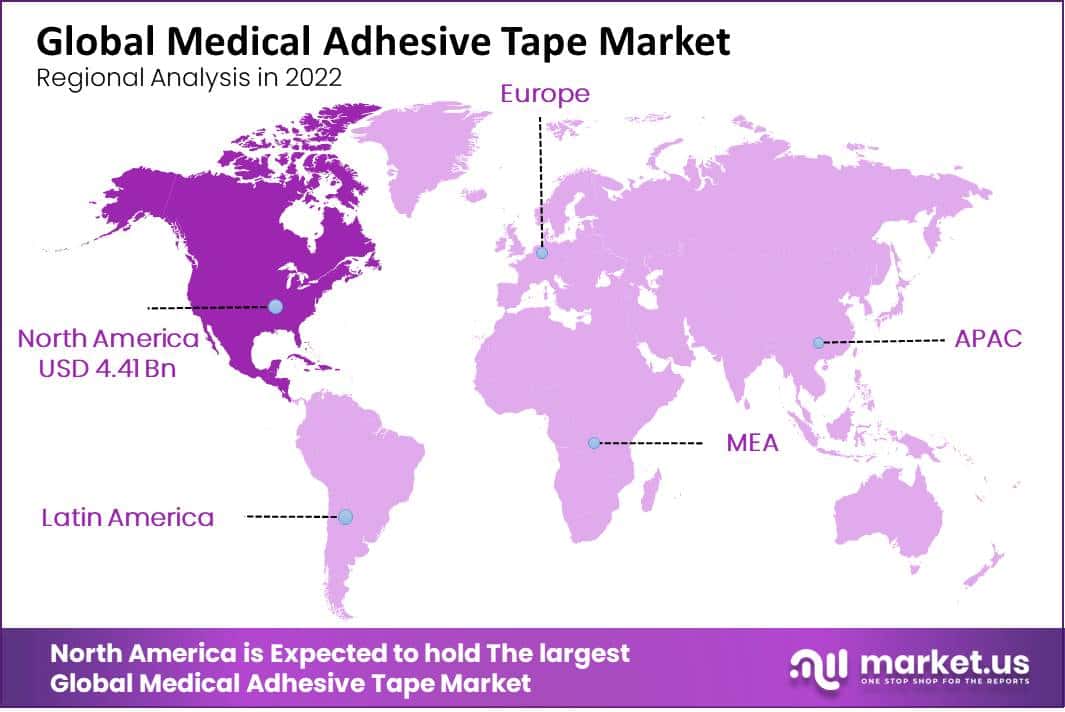

- Regional Leaders: North America dominates with 47% market share; Asia Pacific sees 5.9% CAGR.

- Key Growth Drivers: Rising chronic diseases, aging population, technological advances, and increased surgical procedures.

Type Analysis

Based on type the market for medical adhesive tapes is segmented into Acrylic, Silicone, and Rubber. The acrylic segment dominated the market with a 41% market share. Acrylic medical adhesive tape’s popularity can be attributed to its numerous advantages. For instance, it offers a strong initial tack with low skin sensitivity and won’t leave behind residue when removed. These tapes are resistant to humidity and heat, latex-free, and can be laminated onto surfaces such as foams and film dressings without breaking down during wound dressing.

The silicone medical adhesive tapes segment is projected to experience the fastest growth rate of 5.9% from 2023-2032 due to their increasing demand. Reasons for this growth include their repositioning ability which allows for observation and examination of wounds without needing replacement of dressings, thus extending wear time.

Silicone tapes are non-traumatic and easy to take off, helping avoid secondary infections. Furthermore, they reduce scarring, making them internationally recommended for scar management. Thus, due to these factors alone, the demand for silicone medical adhesive tapes may grow over the forecast period.

Material Analysis

Based on material type the market is segmented into paper tapes, fabric tapes, plastic tapes, and others materials. The paper segment dominates the market with a 42% market share and is expected to remain the leader throughout the forecast period. Paper tapes have become the go-to material globally due to their cost effectiveness compared to other tapes and improved patient compliance, both of which contribute to their dominance in this segment.

According to a research study published in NCBI, wounds closed with adhesive paper tapes had less inflammation and lower rates of wound infection – as well as greater tensile strength and superior cosmetic outcomes than sutured or stapled wounds. Medical paper tapes are cost-effective and ideal for sealing abdominal wounds or other wound care applications. Plastic, on the other hand, ranks second in this material segment due to its waterproof nature and superior long-term adhesive strength.

Fabric materials like cotton, silk, polyester, and nylon are expected to see significant growth over the forecast period due to rising applications in wearable devices like portable diagnostic devices that need to be worn for extended periods. Furthermore, thermoplastics and foam are highly specialized types of tapes used for specific conditions like stress electrocardiography (ECG) among other procedures.

Adhesion Analysis

By Adhesion analysis, double-coated medical adhesive tapes dominate the market with 57% market share.

Adhesion-wise, the market is divided into single-coated medical adhesive tapes and double-coated adhesive tapes. Double-coated tapes were the clear leader with a revenue share of 57% in 2022 due to their improved strength & greater dimensional ability that make them suitable for conversion processes. Furthermore, these tapes offer breathable, hypoallergenic, repositionable, thick, adhesive-strength, backing material tailored to individual needs – thus dominating this market share.

The single-coated medical adhesive tapes market is expected to expand at an estimated CAGR of 5.2% during the forecast years. These tapes consist of foam, nonwoven, film, or metal substrate that has one side coated with a medical-grade adhesive that is pressure sensitive. They come protected by a silicone release liner and are widely used in healthcare devices that require direct skin contact.

Application Analysis

By application, the market is segmented into surgery, wound dressing, iv lines, and other applications. the surgery segment dominates the market with a 38% market share. This could be due to an increase in surgical procedures. According to Trauma of Major Surgery, approximately 310 million major operations take place annually. Medical adhesive tapes have also become more frequently utilized in cosmetic surgery; according to Aesthetic Society, data, 140,314 fat-reduction procedures were performed in 2020 alone – contributing to growth within this segment.

The wound dressing segment will experience a CAGR of 5.4% between 2023 and 2032. This growth is attributed to an increase in wound dressings for both acute and chronic wounds alike; medical adhesive tapes will become increasingly commonplace when treating pressure ulcers, diabetic foot ulcers, and venous leg ulcers.

According to the Centers for Disease Control and Prevention (CDC), 34.2 Million Americans were diagnosed with diabetes in 2018, accounting for 10.5% of America’s total population. Furthermore, diabeticfootonline.com reports that up to 34% of diabetics may develop diabetic foot ulcers, fueling the market growth.

End-User Analysis

By end-user, the hospital segment dominates the market with a 44% market share. This could be explained by an increase in surgery, the growth of hospitals, and accidental occurrences across different countries. Philkotse reports that traffic accidents in The Phillippines have gone from 63.072 in 2007 up to 116.906 by 2020; this surge has necessitated more surgeries and the increased use of medical adhesive tapes; hospital segments are expected to be the largest end-use segment due to these factors.

The market for ambulatory surgery centers is expected to expand at an annual growth rate of 5.3% during the forecast period. A rising number of chronic diseases, increased investment into ASCs, government initiatives, and shifting patient preference towards ASCs over hospitals will all drive demand for medical adhesive tapes in this space.

Market Segmentation

Based on Type

- Acrylic

- Silicone

- Rubber

Based on Material

- Paper Tapes

- Fabric Tapes

- Plastic Tapes

- Other Tapes

Based on Adhesion

- Single Coated

- Double Coated

Based on Application

- Surgery

- Wound Dressing

- IV Lines

- Other Application

Based on End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Other End-Users

Drivers

Increased Incidence of Chronic Diseases

With the rising incidence of chronic diseases such as diabetes and cancer, there has been an uptick in demand for medical adhesive tapes for wound care and other medical applications.

Growing Geriatric Population

As people get older, they become increasingly susceptible to chronic illnesses and injuries – thus driving demand for medical adhesive tapes.

Technology Developments

Recent advancements in technologies and materials have enabled the production of more sophisticated medical adhesive tapes that provide superior adhesion, comfort, and ease of use.

Increased Awareness of Wound Care

There is an increasing recognition of the significance of proper wound care, which has resulted in a rise in demand for medical adhesive tapes that provide effective wound closure and management.

The surge in Surgical Procedures

The surge in surgical procedures globally has created a demand for high-performance medical adhesive tapes that can safely secure surgical incisions and devices.

Rising Demand for Home Healthcare

The trend toward home healthcare is driving demand for medical adhesive tapes that are user-friendly and provide secure fixation of medical devices and dressings.

Restraints

Regulatory Challenges

Medical adhesive tapes face stringent regulations, making it difficult for manufacturers to introduce new products and technologies onto the market. Medical adhesive tapes tend to be more costly than other wound care products, which may prevent their widespread adoption – especially in low-income countries.

Allergic Reactions

Some individuals may experience allergic reactions to the adhesive used in medical tapes, which could prohibit their use and necessitate using alternative products.

Alternative Wound Care Products

While there are numerous alternative wound care products such as bandages and dressings, there may be limitations to using medical adhesive tapes.

The Complexity of Use

Some medical adhesive tapes may be difficult to apply, especially in complex wound care scenarios, which could limit their usefulness for healthcare providers and patients alike.

Environmental Concerns

Disposing of medical adhesive tapes can be a difficult task, particularly those that contain non-biodegradable materials that could pose environmental problems.

Opportunity

Developing Markets

There is considerable growth potential in developing nations where healthcare infrastructure is expanding and there is an increasing need for advanced wound care products.

Technological Advances

Manufacturers have the opportunity to develop and introduce new technologies and materials that enhance medical adhesive tape performance, comfort, and ease of use.

Aging Population

The aging population presents an opportunity for growth in the medical adhesive tape market, especially for wound care and device fixation applications.

Home Healthcare

As healthcare moves towards home settings, medical adhesive tape manufacturers have an opportunity to develop user-friendly products and provide effective wound care and device fixation in the comfort of their own homes.

Customization

Medical adhesive tapes can be tailored to meet the individual needs of patients and healthcare providers, providing manufacturers with an opportunity to differentiate their products and improve patient outcomes.

Green Initiatives

With the growing attention paid to environmental sustainability, manufacturers can now develop biodegradable and eco-friendly medical adhesive tapes that are safe for the environment while meeting the demands of healthcare providers and patients.

Trends

Utilization of Advanced Materials

The advancements in materials like hydrocolloids and silicones are spurring the creation of new medical adhesive tapes with improved performance, comfort, and user-friendliness in mind.

Customization

Tailoring medical adhesive tapes to individual patient needs is becoming more and more popular. Customized tapes can be designed to match skin tone and hair color, reduce irritation, and provide better wound closure.

Adoption of Electronic Medical Records (EMRs)

With the rise in electronic medical records (EMRs), demand is growing for medical adhesive tapes that can be easily scanned and tracked, helping reduce medical errors and enhance patient outcomes.

Sustainable Products

There is a growing movement towards more eco-friendly and sustainable medical adhesive tapes, with manufacturers developing products that are biodegradable, recyclable, or made from renewable materials.

Wearable medical devices

The growing trend towards wearable medical devices such as glucose monitors and activity trackers has spurred the development of medical adhesive tapes that can securely attach these items to the skin for extended periods.

Telemedicine

The growth in telemedicine has created a need for medical adhesive tapes that are user-friendly and offer secure fixation of remote patient monitoring devices.

Regional Analysis

By regional analysis, North America dominates the market with 47% market share. This dominance can be attributed to North America’s superior healthcare infrastructure, rising public awareness, and the presence of key factors. The market for medical adhesive tapes will be driven by an expected rise in North American surgical procedures.

Asia Pacific is projected to experience a CAGR of 5.9% during the forecast period. This growth Is a result of an increasing number of diabetics within the region; according to Down to Earth, India had 74.2 million people between 20 and 79 years old with diabetes as of December 2021 and this number is projected to reach 124.8 million by 2045.

According to data provided by International Diabetes Federation (IDF), 3,993,300 Filipinos had diabetes 63 265,700 total individuals in 2019. Diabetics are particularly at risk for diabetic foot ulcers, so the region could see an uptick in wound dressing use. Furthermore, with more surgical cases expected to arise, the regional market for medical adhesive tapes will see growth due to this rise in wound care needs.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market for medical adhesive tapes is highly fragmented and there is a multitude of competitors. As current market players strive to gain control of the majority share, competition could intensify. To gain an advantage over their rivals, many market players take strategic actions such as product launches, mergers, and acquisitions, along with geographic expansion to gain market share.

3M recently unveiled an extended-wear medical adhesive tape, designed to stay on your skin for up to 21 days. As more product launches are expected in this space, major players in the global medical adhesive tape market include:

Market Key Players

- Smith & Nephew

- 3M

- Medline Industries, LP

- Paul Hartmann AG

- Cardinal Health

- Baxter International

- Johnson & Johnson

- Nitto Denko Corporation

- Nichiban

- Lohmann GmbH & Co. KG

- Other Key companies

Recent Developments

- 3M, a global leader in manufacturing, launched an innovative silicone adhesive tape in December 2020. This tape is ideal for patients who use wearable devices frequently or who require heavier support when their devices become weary.

Report Scope

Report Features Description Market Value (2022) USD 9.4 Bn Forecast Revenue (2032) USD 16 Bn CAGR (2023-2032) 5.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type, By Adhesion, By Material, By Application, and By End-User Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smith & Nephew; 3M; Medline Industries LP; Paul Hartmann AG; Cardinal Health; Baxter International; Johnson & Johnson; Nitto Denko Corporation; Nichiban; Lohmann GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the Global Medical Adhesive Tapes Market worth?Global Medical Adhesive Tapes Market market size is Expected to Reach USD 16 Bn by 2032.

What was the Market Segmentation of the Medical Adhesive Tapes Market ?By Type, By Adhesion, By Material, By Application, and By End-User

What is the CAGR of Medical Adhesive Tapes Market ?The Medical Adhesive Tapes Market is growing at a CAGR of 5.9% during the forecast period 2022 to 2032.

Who are the major players operating in the Medical Adhesive Tapes Market ?Smith & Nephew; 3M; Medline Industries LP; Paul Hartmann AG; Cardinal Health; Baxter International; Johnson & Johnson; Nitto Denko Corporation; Nichiban; Lohmann GmbH & Co. KG

Which region will lead the Global Medical Adhesive Tapes Market ?North America is estimated to be the fastest-growing region during the forthcoming years.

Medical Adhesive Tapes MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Medical Adhesive Tapes MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Smith & Nephew

- 3M

- Medline Industries, LP

- Paul Hartmann AG

- Cardinal Health

- Baxter International

- Johnson & Johnson

- Nitto Denko Corporation

- Nichiban

- Lohmann GmbH & Co. KG

- Other Key companies