Global Media Production Technology Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By Deployment (On-premises, Cloud-based), By Technology Type (Video Production and Editing, Audio Production, Graphics and Animation, Live Production and Broadcasting, Others), By End-User (Film and Television Studios, Broadcasters, Independent Producers, Corporate and Online Media, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174658

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Component Analysis

- Deployment Analysis

- Technology Type Analysis

- End-User Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Emerging Trends

- Growth Factors

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- By End-User

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

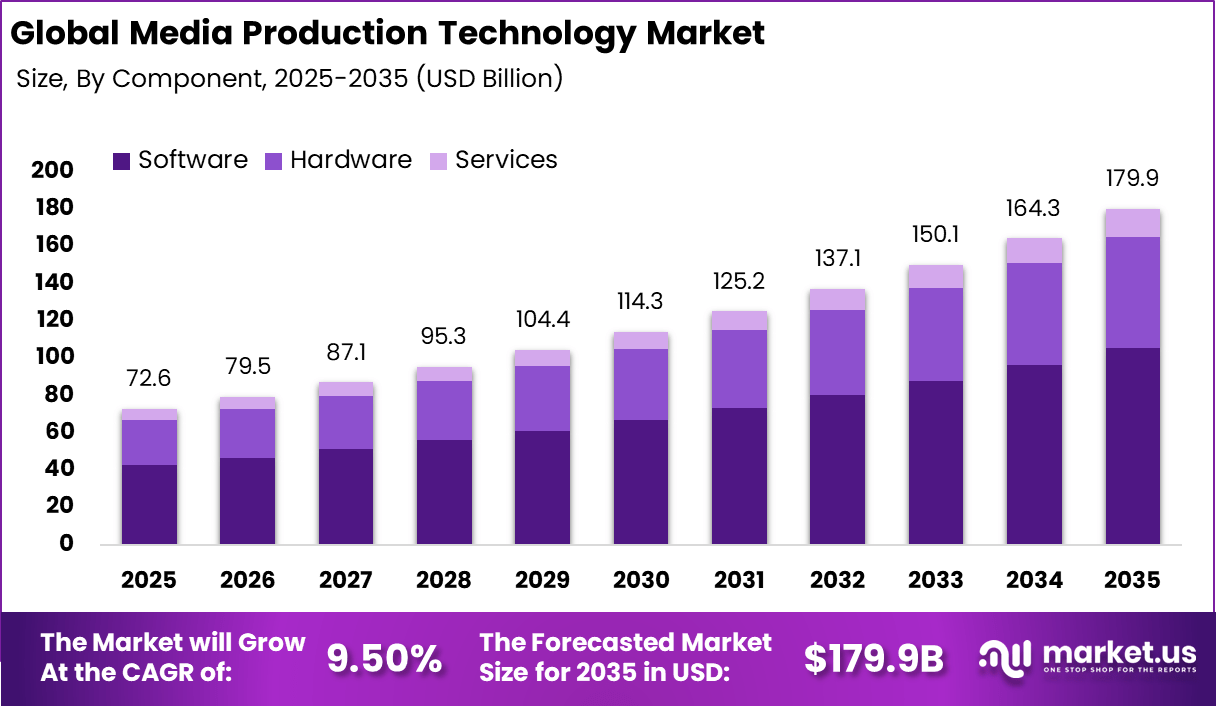

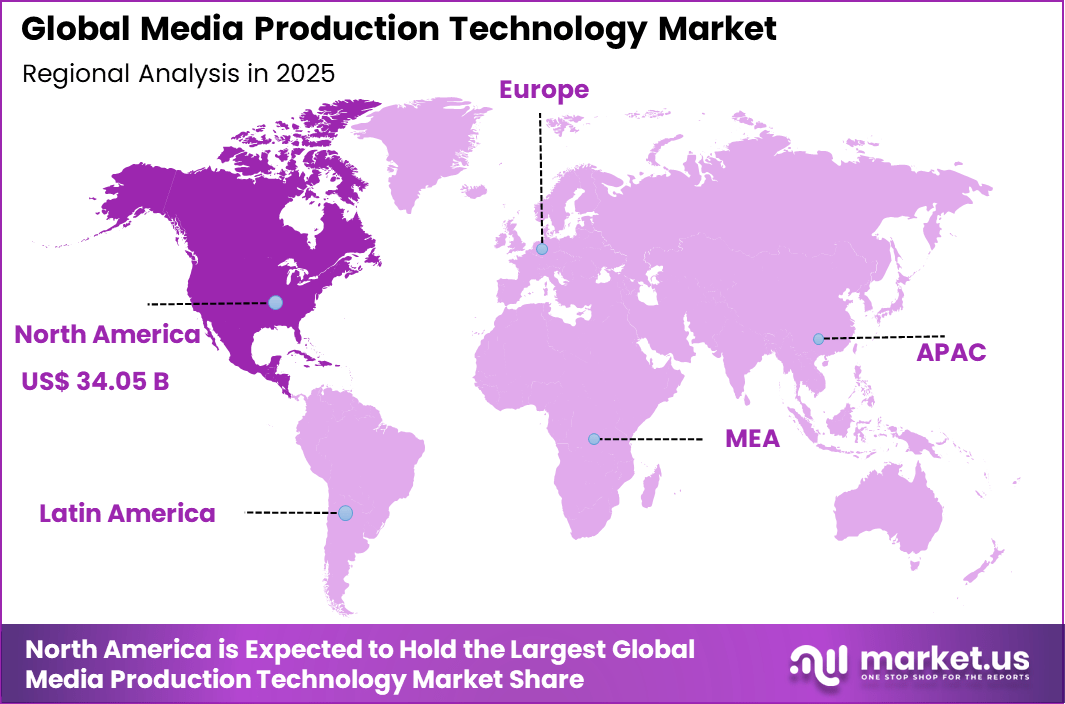

The Global Media Production Technology Market generated USD 72.6 billion in 2025 and is predicted to register growth from USD 79.5 billion in 2026 to about USD 179.9 billion by 2035, recording a CAGR of 9.50% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 46.9% share, holding USD 34.5 Billion revenue.

The media production technology market refers to digital tools and systems used to create, edit, manage, and distribute audio, video, and multimedia content. These technologies support activities such as filming, editing, visual effects, sound design, animation, and post-production. Media production tools are used by broadcasters, film studios, streaming platforms, content creators, and advertising agencies. They enable high-quality content creation across traditional and digital channels.

Adoption supports efficiency, creativity, and scalability in media workflows. Market development has been influenced by the rapid growth of digital content consumption. Streaming services, social media platforms, and online advertising require continuous content production. Traditional production methods are often time-consuming and resource intensive. Modern media production technologies introduce automation and digital collaboration. As content demand increases, advanced production tools become essential.

One major driving factor of the media production technology market is the expansion of digital and streaming platforms. Viewers consume content across multiple devices and formats. This increases the need for efficient production and post-production processes. Technology helps meet tight production schedules. Content volume growth strongly drives adoption. Another key driver is the rise of independent creators and small production teams.

Affordable and user-friendly tools lower entry barriers. Creators can produce professional-quality content without large studios. Technology democratizes media production. Creator economy growth supports market expansion. Demand for media production technology is influenced by increased investment in original content. Streaming platforms and brands focus on unique and engaging media. High production standards are expected by audiences.

Top Market Takeaways

- By component, software led the media production technology market with 58.7% share, powering editing suites, rendering engines, and collaboration tools for efficient workflows.

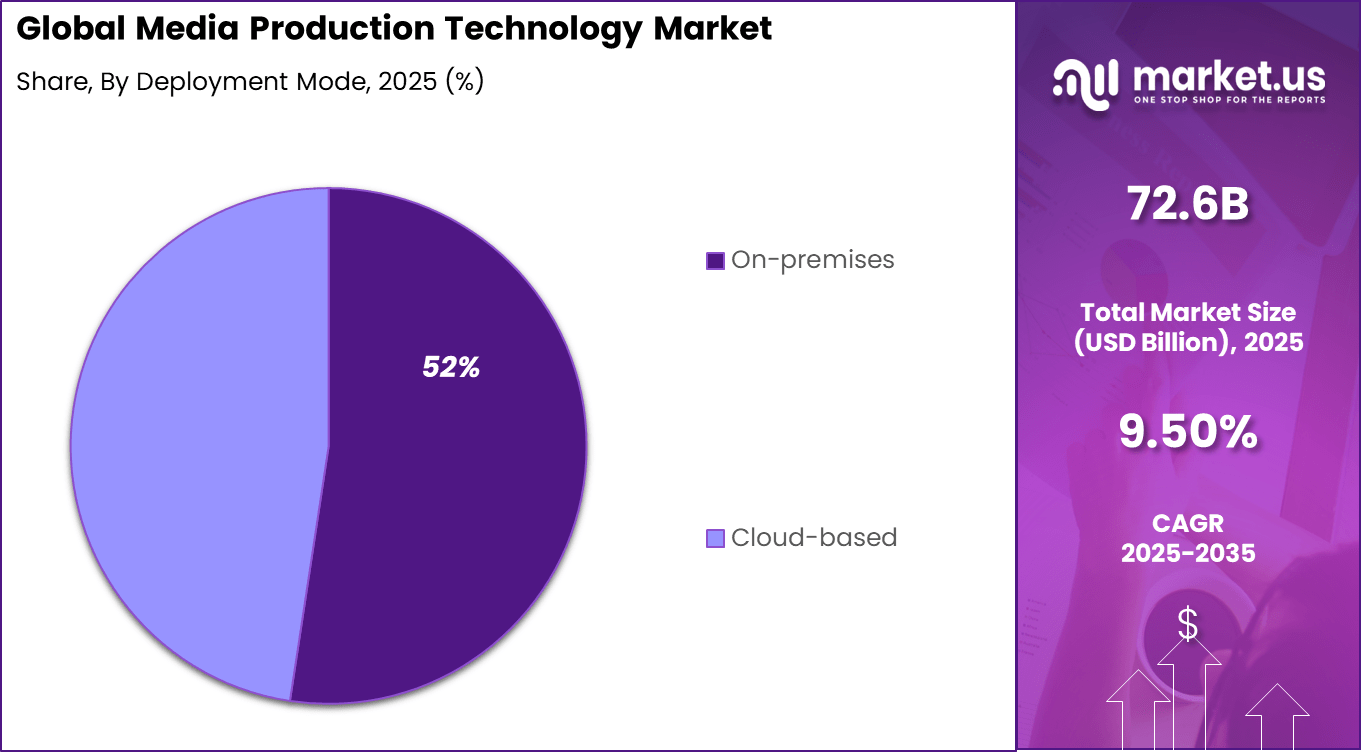

- By deployment, on-premises systems captured 52.4%, preferred for high-security content handling and performance-intensive rendering tasks.

- By technology type, video production and editing dominated at 42.3%, driven by demand for 4K/8K tools and AI-enhanced post-production.

- By end-user, independent producers held 48.6%, accessing affordable cloud-hybrid solutions to compete with studios.

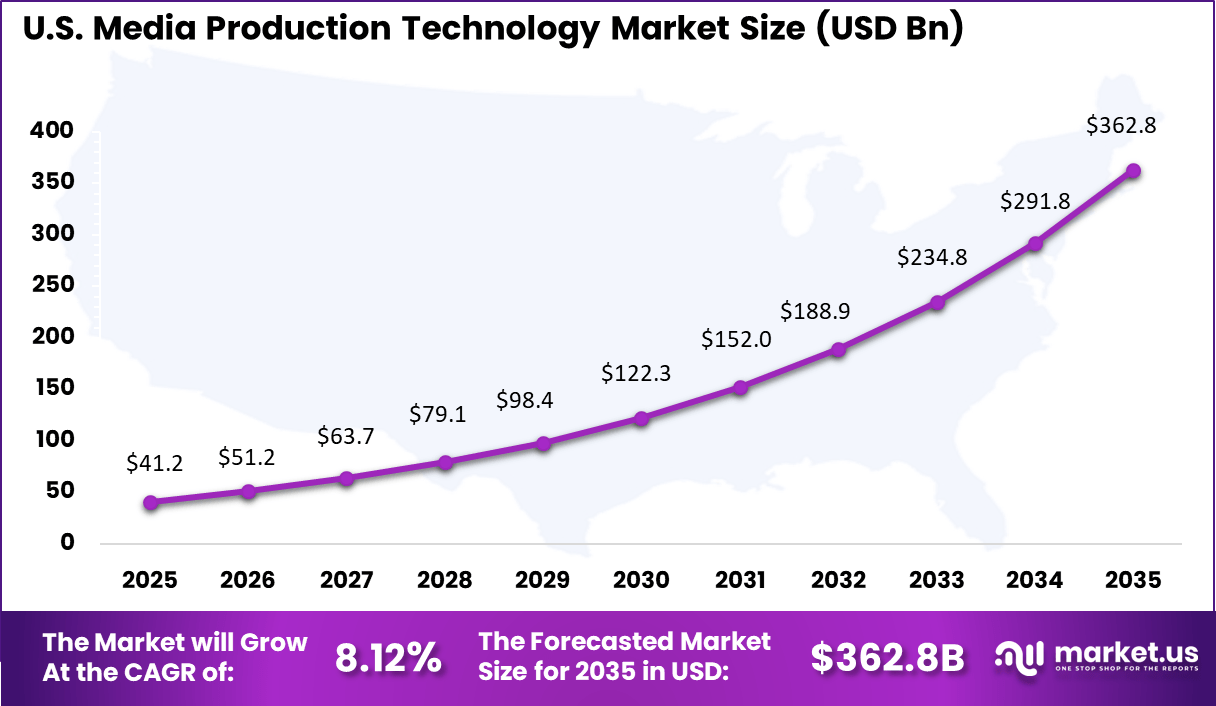

- North America accounted for 46.9% of the global market, with the U.S. valued at USD 30.65 billion and growing at a CAGR of 8.12%.

Key Insights Summary

Technology Adoption and Efficiency

- Generative AI leads media AI adoption with a 49.1% share in 2024.

- AI integration in editing software reduces post-production time by up to 30%.

- High-end film productions generate several terabytes of data per day from multi-camera and 3D scans.

- Virtual production using LED volumes cuts VFX-related post-production costs, which can reach 20% of large film budgets.

Content Consumption Statistics

- Short-form video dominates consumption, with 600-650 million users in India expected by 2025.

- Globally, 66% of users prefer short mobile videos.

- Video, social media, and gaming account for over 75% of global internet traffic.

- Average daily online video consumption stands at around 100 minutes per person.

Career and Employment Trends

- Film and video editors earn a median annual salary of about USD 70,570.

- Employment for editors and camera operators is projected to grow by 3% through 2034.

- Traditional TV and film projects declined by 35% after 2024, but AI-assisted and remote workflows sustained production continuity.

Component Analysis

Software accounts for 58.7% of the media production technology market, highlighting its central role in content creation workflows. Editing, color grading, visual effects, and audio processing tools are essential for modern production environments.

Software solutions enable creators to manage complex projects with higher efficiency and creative control. The dominance of software is driven by continuous feature upgrades and compatibility with high-resolution formats. Producers rely on software to streamline post-production timelines and maintain consistent output quality.

Integration with automation and AI tools further improves productivity. As content volumes increase across platforms, demand for advanced production software remains strong. Software flexibility supports diverse production needs. This sustains its leading position within the market.

Deployment Analysis

On-premises deployment holds a 52.4% share, reflecting the need for performance reliability and data control. Media production workflows require high processing power and low latency, which are well supported by local systems. On-premises setups allow teams to manage large files securely and efficiently.

Many studios prefer on-site infrastructure to maintain control over intellectual property and project assets. Local deployments also reduce dependence on network availability during critical production stages. This is especially important for high-resolution video editing and rendering tasks.

Despite growing cloud interest, on-premises deployment remains widely adopted. Performance consistency and security considerations continue to support this model. It remains a preferred choice for professional production environments.

Technology Type Analysis

Video production and editing account for 42.3% of the technology segment, making it the most prominent application area. Demand is driven by the growing volume of digital video content across entertainment, advertising, and online platforms. High-quality video production has become a standard requirement.

Advanced editing tools support multi-format output, visual enhancements, and efficient collaboration. Producers rely on these technologies to meet tight deadlines and creative expectations. Improvements in processing speed and interface design further enhance adoption.

As video remains the dominant media format, investment in production and editing tools continues. The need for professional-grade output supports sustained demand. This technology segment remains a key driver of market activity.

End-User Analysis

Independent producers represent 48.6% of end-user demand, reflecting the growth of decentralized content creation. Independent creators produce content for film, television, digital platforms, and social media. Technology access enables them to compete with larger studios.

Affordable and scalable tools allow independent producers to manage entire production cycles. Software-based solutions reduce reliance on large teams and physical studios. This supports creative flexibility and cost control.

The rise of direct-to-audience distribution further strengthens this segment. Independent producers continue to invest in professional tools to improve content quality. This positions them as a major contributor to market demand.

Increasing Adoption Technologies

Cloud-based production technologies play a key role in adoption. Cloud tools enable remote editing, storage, and collaboration. Teams work across locations in real time. Cloud workflows reduce infrastructure dependency. Accessibility improves adoption rates.

Artificial intelligence technologies also support market growth. AI assists in editing, color correction, audio enhancement, and content tagging. Automation reduces manual workload. Faster production cycles improve efficiency. AI-driven tools increase platform value.

One key reason organizations adopt media production technology is improved production efficiency. Automated tools reduce editing and processing time. Faster workflows support higher content output. Reduced manual effort lowers costs. Efficiency gains justify investment.

Another reason is enhanced creative flexibility. Digital tools allow experimentation with effects and formats. Creators adapt content for different platforms easily. Flexibility supports innovation. Creative freedom drives adoption.

Investment and Business Benefits

Investment opportunities in the media production technology market exist in cloud-native and subscription-based platforms. Scalable solutions attract both enterprises and creators. Recurring revenue models improve stability. Cloud adoption supports long-term growth. Investors focus on platform scalability.

Another opportunity lies in AI-enabled production tools. Intelligent automation improves productivity and quality. Tools that simplify complex tasks attract users. Innovation-driven platforms gain attention. AI integration supports differentiation.

Media production technology improves operational efficiency by streamlining workflows. Reduced production time increases output capacity. Teams manage projects more effectively. Productivity improvements support profitability. Operational performance improves overall.

These solutions also enhance content quality and consistency. Advanced editing and processing improve visual and audio standards. High-quality content strengthens audience engagement. Brand credibility improves. Business outcomes benefit from better media output.

Emerging Trends

Key Trend Description AI automation tools Generative AI handles editing, effects, and personalization. Virtual production techniques LED walls and real-time rendering create immersive sets. Cloud collaboration platforms Remote workflows enable global team production. Immersive AR/VR formats Interactive 360-degree content for new experiences. Sustainable production methods Energy-efficient tech reduces carbon footprint. Growth Factors

Key Factors Description Streaming service explosion Demand for high-volume quality content surges. Social media video boom Short-form clips drive mobile-first production. Remote work persistence Distributed teams require cloud-based tools. Consumer personalization Data-driven content boosts engagement metrics. Technological cost declines Affordable AI and VR lower entry barriers. Regional Analysis

North America accounted for 46.9% share, supported by a strong media and entertainment ecosystem and high adoption of advanced production technologies. Broadcasters, film studios, and digital content creators in the region have widely adopted media production technology to improve content quality, production efficiency, and distribution speed.

Demand has been driven by growth in streaming platforms, high resolution video formats, and real time content delivery. The region’s mature digital infrastructure and skilled creative workforce have further supported steady market expansion.

The U.S. market reached USD 30.65 Bn and is projected to grow at an 8.12% CAGR, reflecting sustained investment by studios, broadcasters, and digital media companies. Adoption has been driven by the need to produce more content across multiple platforms while maintaining quality and cost efficiency. Media production technologies have helped U.S. producers streamline editing, visual effects, and post production workflows.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The media production technology market is being driven by the rising demand for high-quality, immersive content across digital channels, streaming platforms, and interactive experiences. Advances in camera systems, real-time graphics, virtual production, and cloud-based collaboration tools enable creators to produce professional-grade content with greater speed, flexibility, and creative control.

Content producers and media companies are prioritising workflows that support live streaming, multi-platform publishing, and audience-centric engagement, which reinforce investment in adaptable production technologies. The proliferation of user-generated content and the expansion of short-form video formats also stimulate adoption of efficient, scalable production tools that can deliver consistent outputs across diverse media environments.

Restraint Analysis

A key restraint in the media production technology market relates to the complexity and cost of implementing advanced production systems. Professional-grade technology solutions often require specialised hardware, software licences, and skilled personnel to operate effectively, which can create financial barriers for independent creators, small studios, and emerging media ventures.

Integration of disparate production systems, content management tools, and post-production workflows also demands careful technical coordination, which can slow deployment and increase total cost of ownership. Organisations without defined technology strategies may face operational friction that reduces the perceived value of production technology investments.

Opportunity Analysis

Emerging opportunities in the media production technology market are linked to the growth of remote and distributed production models that support geographically dispersed teams. Cloud-native production platforms enable real-time collaboration, asset sharing, and workflow synchronisation across creative, editorial, and technical teams, enhancing efficiency and creative flexibility.

There is also expanding demand for immersive media experiences such as augmented reality, virtual sets, and interactive storytelling that extend beyond traditional linear formats. Technology solutions that bridge pre-production, production, and post-production phases through unified environments can deliver strategic value by reducing cycle time and improving content consistency across channels.

Challenge Analysis

A central challenge confronting this market relates to balancing innovation intensity with workflow standardisation and interoperability. Rapid evolution in media production technologies creates a dynamic environment where tools and formats change frequently, requiring ongoing training and adaptation by creative professionals.

Ensuring that new technologies integrate seamlessly with existing pipelines, legacy assets, and cross-platform deliverables is complex and can introduce workflow inefficiencies if not managed strategically. Organisations must also address performance, security, and rights management as content moves through distributed production and distribution ecosystems, which adds operational depth to technology adoption.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment

- On-premises

- Cloud-based

By Technology Type

- Video Production & Editing

- Audio Production

- Graphics & Animation

- Live Production & Broadcasting

- Others

By End-User

- Film & Television Studios

- Broadcasters

- Independent Producers

- Corporate & Online Media

- Others

Competitive Analysis

Leading software and platform providers such as Adobe, Apple, and Avid dominate post-production and content creation workflows. Their tools support video editing, audio production, visual effects, and collaborative media management. Cloud integration and AI-assisted features improve editing speed and creative efficiency. These players benefit from strong user ecosystems across film, television, and digital media production environments.

Hardware focused companies such as Sony, Canon, Panasonic, and Blackmagic Design lead in cameras, switchers, and production hardware. ARRI, RED Digital Cinema, and Nikon support high-end and professional filmmaking. Their focus remains on image quality, workflow integration, and reliability for large scale productions.

Visualization and broadcast technology providers such as Autodesk, Foundry, Maxon, and Vizrt address advanced graphics and live production needs. These tools support animation, compositing, and real-time broadcasting. Other regional vendors expand competition and specialization. This competitive landscape supports continuous innovation across content creation, post-production, and broadcast media workflows.

Competitive Landscape Comparison

Company Core Product Focus Key Technology Strength Primary End-User Segment Deployment Model Competitive Positioning Adobe Editing, VFX, audio, media management AI assisted creative software, cloud collaboration Film, TV, digital creators Cloud, hybrid Market leader in creative software ecosystems Apple Editing software, hardware ecosystem Integrated hardware software workflow Independent creators, studios On premises, hybrid Strong ecosystem driven differentiation Avid Professional editing and audio systems Enterprise media workflow management Broadcast, film studios On premises, hybrid High penetration in professional studios Blackmagic Design Cameras, switchers, editing tools Cost efficient professional hardware Independent filmmakers, broadcasters On premises Value driven professional hardware provider Sony Cameras, broadcast systems Advanced imaging sensors, workflow tools Broadcast, cinema production On premises Strong brand in professional imaging Canon Cameras, lenses, imaging systems Optical and sensor innovation Film, broadcast, content creators On premises Trusted imaging and optics provider Panasonic Broadcast and production equipment Reliable broadcast grade hardware Broadcast, live production On premises Strong presence in live production Grass Valley Live production systems Real time broadcast technology TV networks, live events On premises Specialist in live broadcast solutions ARRI Cinema cameras, lighting High end cinematic imaging Film studios, cinematographers On premises Premium positioning in cinema production RED Digital Cinema Digital cinema cameras High resolution digital imaging Film production houses On premises Innovation focused cinema camera brand Nikon Imaging and camera systems Precision optics and sensors Content creators, studios On premises Strong imaging heritage Autodesk Animation, VFX software 3D modeling and simulation Animation studios, VFX houses Cloud, hybrid Strong in animation and design workflows Foundry VFX and compositing tools Node based compositing VFX studios On premises, hybrid Specialist VFX software provider Maxon 3D animation and rendering Real time 3D graphics Motion graphics studios On premises, hybrid Strong in motion graphics Vizrt Broadcast graphics and visualization Real time graphics engines Broadcasters, sports media On premises, cloud Leader in real time broadcast graphics Others Niche tools and regional solutions Specialized production technologies Regional and niche users Mixed Fragmented but innovation driven Future Outlook

Growth in the Media Production Technology market is expected to remain strong as content creation expands across digital platforms. Film, television, streaming, and online creators are using advanced tools to improve video quality, speed up editing, and manage large media files.

Rising demand for high resolution content and remote production workflows is supporting adoption. Over time, better cloud based production, automation, and integration of AI tools are likely to improve efficiency and creative flexibility.

Recent Developments

- April, 2025: Blackmagic Design unveiled the PYXIS 12K cinema camera at NAB, packing a 12K RGBW sensor with 16 stops dynamic range, plus major DaVinci Resolve 20 upgrades featuring AI tools for voice isolation and immersive Apple Vision Pro video editing.

- July, 2025: Sony launched the PXW-Z300 handheld 4K camcorder with AI subject recognition and remote workflow boosts, ideal for fast-paced news and events.

- January, 2025: ARRI rolled out a fresh entry-level ALEXA 35 model with flexible licensing and cheaper media options, making high-end cinema gear more accessible for production teams.

Report Scope

Report Features Description Market Value (2025) USD 72.6 Bn Forecast Revenue (2035) USD 179.9 Bn CAGR(2025-2035) 9.50% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware,Software,Services), By Deployment (On-premises,Cloud-based), By Technology Type (Video Production and Editing,Audio Production,Graphics and Animation,Live Production and Broadcasting,Others), By End-User (Film and Television Studios,Broadcasters,Independent Producers,Corporate and Online Media,Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe, Apple, Avid, Blackmagic Design, Sony, Canon, Panasonic, Grass Valley, ARRI, RED Digital Cinema, Nikon, Autodesk, Foundry, Maxon, Vizrt, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Media Production Technology MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Media Production Technology MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe

- Apple

- Avid

- Blackmagic Design

- Sony

- Canon

- Panasonic

- Grass Valley

- ARRI

- RED Digital Cinema

- Nikon

- Autodesk

- Foundry

- Maxon

- Vizrt

- Others