Global Media and Entertainment Market Size, Share and Analysis Report By Type (Print Media, Digital Media, Streaming Media, Video Games and eSports, Virtual / Augmented Reality Content), By Revenue Model (Advertising, Subscription, Pay-Per-View / Transactional, Licensing and Merchandising), By Device Platform (Smartphones and Tablets, Smart TVs and Set-top Boxes, PCs and Laptops, Gaming Consoles, VR/AR Headsets), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175585

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Type: Print Media

- By Revenue Model: Subscription

- By Device Platform: Smartphones and Tablets

- Regional View: North America and the US

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

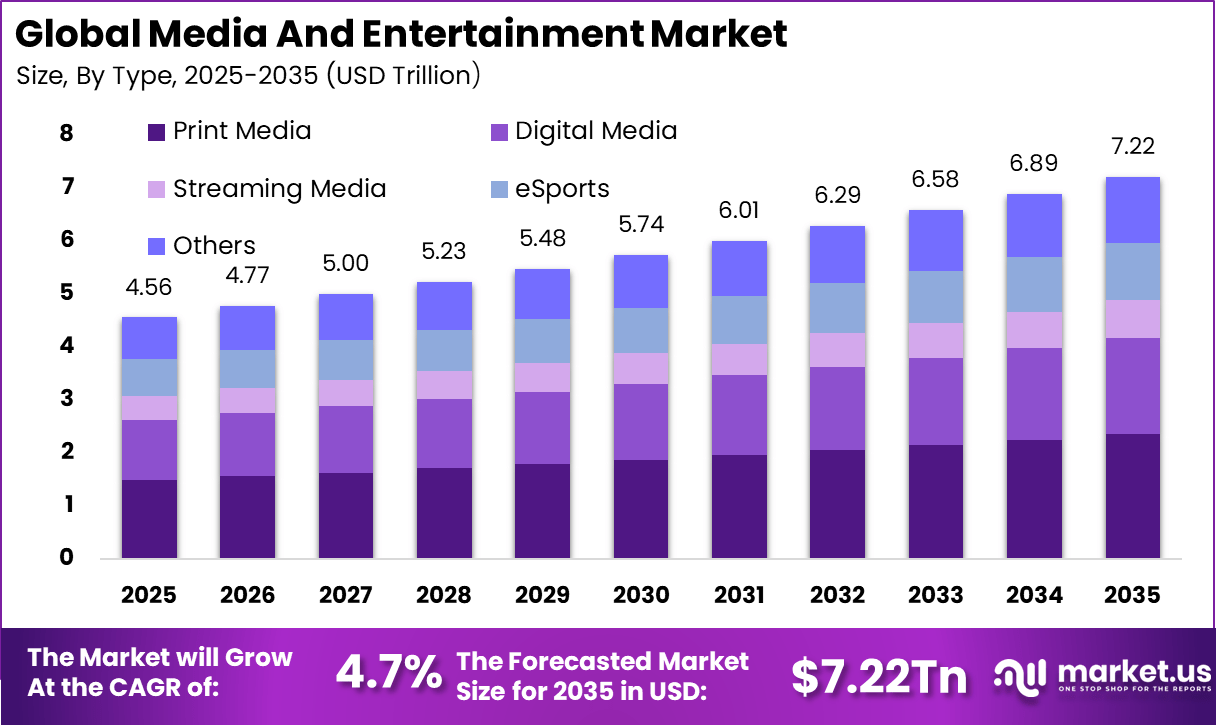

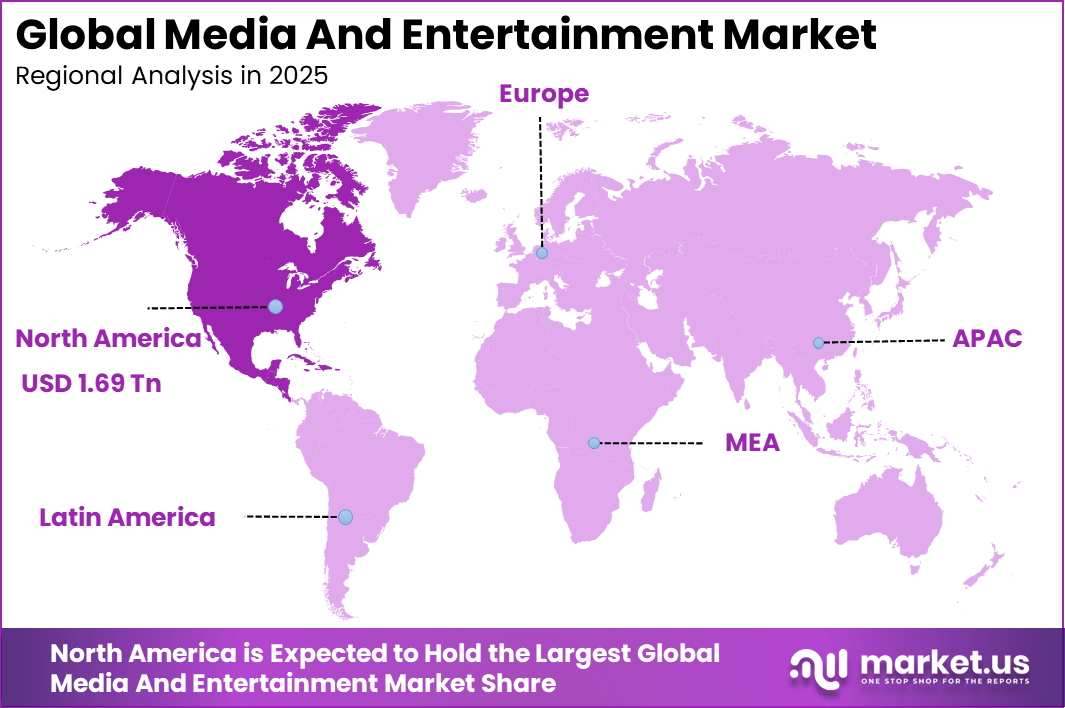

The Global Media and Entertainment Market presents a large-scale investment opportunity, growing from USD 4.56 trillion in 2025 to nearly USD 7.22 trillion by 2035, at a CAGR of 4.7%. North America’s dominant position, capturing more than 37.1% share and USD 1.69 trillion in revenue, underscores the region’s leadership in content production, streaming, and digital media monetization.

The media and entertainment market covers the creation, distribution, and consumption of content across digital and traditional platforms. This market includes film, television, music, gaming, streaming services, publishing, and live events. Digital technologies have transformed how content is produced and delivered to audiences. Consumers now access media through multiple devices and on-demand platforms. Adoption of digital channels continues to reshape content engagement and monetization.

One major driving factor of the media and entertainment market is the widespread adoption of digital streaming platforms. Consumers prefer on-demand access to content across devices. Streaming services offer flexibility and content variety. This shift reduces dependence on scheduled programming. Digital convenience strongly drives market growth.

According to sq magazine, Digital media continues to expand rapidly as a core revenue driver across the global media and entertainment industry. In 2025, digital media revenue is projected to exceed USD 1.08 trillion, accounting for nearly 40% of total industry income. Streaming video services are expected to generate more than USD 196 billion, reflecting a 13.2% year over year increase.

Global media advertising spend is forecast to reach USD 974 billion in 2025, with over 62% coming from digital platforms. Average daily media consumption per person has risen to 7.8 hours, up 6.1% from the previous year. At the same time, AI generated content now represents 14% of all digital media published online, signaling a growing role of automation in content creation.

For instance, in November 2025, Comcast aggressively pursued media dominance by entering talks to acquire ITV’s studio and streaming business for $2.1 billion and exploring a bid for Warner Bros. Discovery. This strategy coincides with spinning off cable networks into Versant, positioning Comcast to compete strongly in streaming against Netflix and others.

Key Takeaway

- In 2025, the print media segment held a leading position in the global media and entertainment market, accounting for 32.7% of the total share.

- In 2025, the subscription-based segment emerged as the dominant revenue model, capturing 43.6% of the global media and entertainment market.

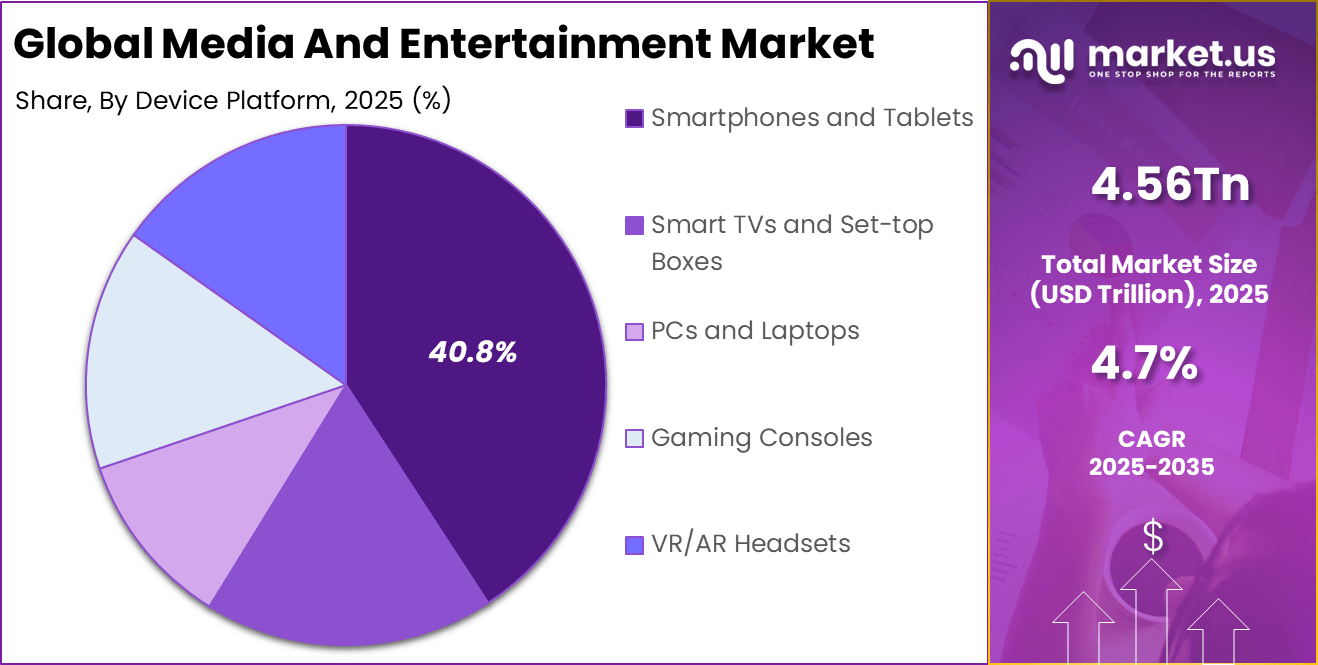

- In 2025, smartphones and tablets were the most widely used devices for media consumption, representing 40.8% of the global market share.

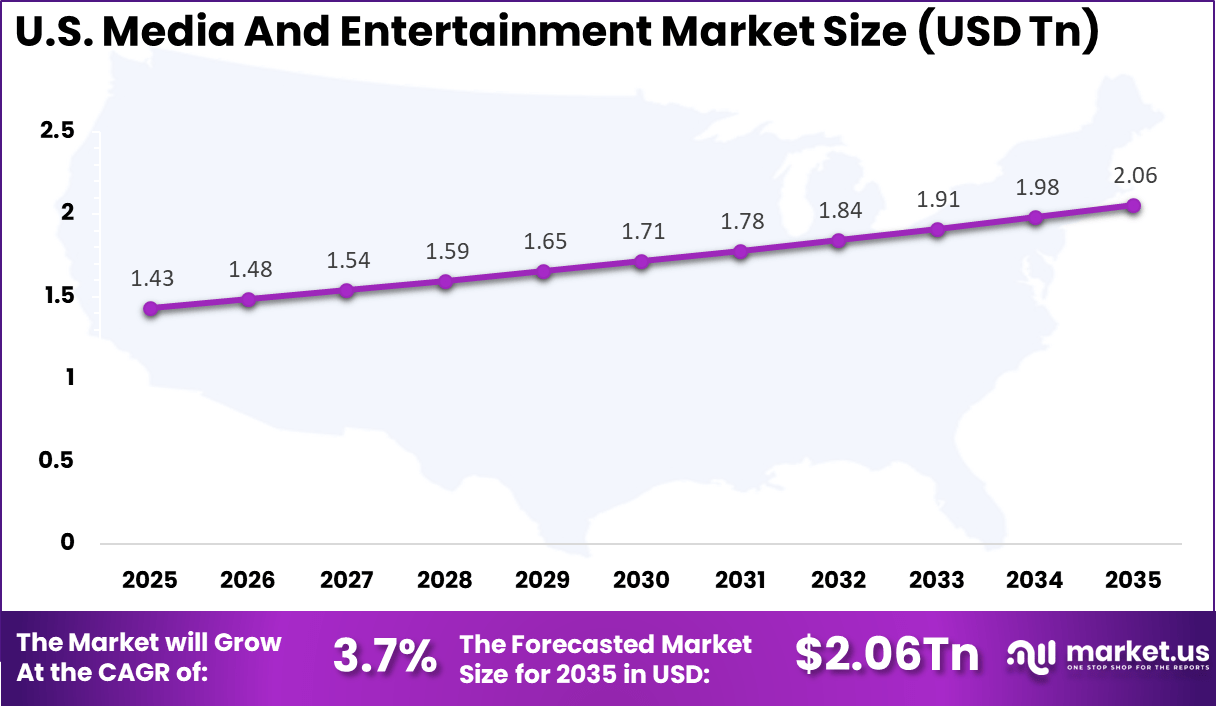

- The U.S. media and entertainment market reached a value of USD 1.43 trillion in 2025, supported by a steady compound annual growth rate of 3.7%.

- In 2025, North America maintained a dominant regional position in the global media and entertainment market, holding over 37.1% of the total share.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of streaming platforms Subscription and ad supported streaming expansion ~1.6% Global Short Term Mobile content consumption Smartphone led media engagement ~1.3% Asia Pacific, North America Short Term Digital advertising growth Programmatic and data driven advertising ~1.0% North America, Europe Mid Term Expansion of gaming and esports Interactive digital entertainment demand ~0.9% Global Mid Term Immersive media formats AR, VR, and interactive storytelling ~0.7% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Content production cost inflation Rising budgets for premium content ~1.2% North America, Europe Short Term Regulatory and censorship challenges Regional content compliance requirements ~1.0% Global Mid Term Audience fragmentation Platform saturation reducing engagement ~0.9% Global Mid Term Piracy and content leakage Revenue loss from unauthorized distribution ~0.8% Emerging Markets Long Term Monetization pressure Subscription fatigue among consumers ~0.6% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration High content acquisition costs Licensing and production expenses ~1.4% North America, Europe Short to Mid Term Platform competition Margin pressure from new entrants ~1.1% Global Mid Term Data privacy regulations Restrictions on targeted advertising ~0.9% Europe, North America Mid Term Infrastructure limitations Streaming quality constraints ~0.7% Emerging Markets Long Term Consumer price sensitivity Resistance to subscription price increases ~0.6% Global Long Term By Type: Print Media

Print media accounts for about 32.7% of the media and entertainment market by type. This segment includes newspapers, magazines, books, and other printed formats that people still use for news, learning, and leisure reading. Many readers view print as a stable and trustworthy source, especially for in depth stories, analysis, and local coverage. Its physical nature also appeals to audiences who prefer a break from screens and constant notifications.

Print media continues to play a supporting role alongside digital channels rather than disappearing entirely. Niche publications, community papers, and special interest magazines help maintain engagement in targeted groups. Educational and professional content often remains in print due to ease of note taking and long term reference. As a result, print media keeps a meaningful share even as digital formats expand.

By Revenue Model: Subscription

Subscription models contribute around 43.6% of media and entertainment revenues. In this approach, users pay regularly, often monthly or yearly, to access content such as news, series, music, or games. This steady income helps providers plan content budgets and maintain platforms more predictably than one time sales alone. For users, subscriptions offer ongoing access at a known cost, which can feel better value than frequent single purchases.

Many services now combine subscriptions with features like ad free viewing, exclusive content, or early releases. These benefits encourage people to stay subscribed over longer periods. Some providers also offer tiered plans, where basic access is cheaper and premium options include more features. This flexibility supports different income levels while keeping subscription as a central revenue source.

By Device Platform: Smartphones and Tablets

Smartphones and tablets represent about 40.8% of the media and entertainment market by device platform. They are widely used for watching videos, listening to music, reading news, and playing games. Always connected and portable, these devices let people consume content during travel, breaks, or at home without needing a TV or computer. Their touch screens and app ecosystems also make it easy to discover and personalize content.

Short form and interactive formats have grown quickly on mobile devices. Viewers often watch quick clips, follow live streams, or scroll through mixed media feeds on smartphones. Tablets provide a slightly larger screen that suits reading, gaming, and longer videos, especially for families and children. Together, smartphones and tablets anchor daily digital media habits for many users.

Regional View: North America and the US

North America holds about 37.1% of the global media and entertainment market. The region benefits from high internet usage, strong digital payment adoption, and wide access to connected devices. Consumers are quick to try new media formats, from streaming platforms to online gaming and interactive content. This environment supports a broad mix of traditional and digital channels coexisting in the same market.

For instance, in January 2026, Warner Bros. Discovery amended its agreement with Netflix for an all-cash acquisition, accelerating the stockholder vote and highlighting consolidation trends. The deal aims to combine WBD’s century-old IP with Netflix’s platform, strengthening North American entertainment capabilities amid streaming wars.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Trillion) Adoption Maturity North America Streaming leadership and digital monetization 37.1% USD 1.69 Tn Advanced Europe Strong public broadcasting and digital transition 27.4% USD 1.25 Tn Advanced Asia Pacific Mobile first content consumption 25.6% USD 1.17 Tn Developing Latin America Growth of OTT platforms 5.4% USD 0.25 Tn Developing Middle East and Africa Rising digital media penetration 4.5% USD 0.21 Tn Early

Within North America, the United States is a key center with an estimated market value of USD 1.43 Tn and growth around 3.7%. Strong consumer spending and a large base of content creators help sustain this position. The country also exports a significant volume of media, which influences global viewing and listening trends. As technology and user expectations evolve, the US remains a major testing ground for new business models and content formats.

For instance, in January 2026, Alphabet’s YouTube doubled down on creators, paying over $100B in four years, with Shorts reaching 200B daily views. Plans include AI tools, multiview features, and 10+ specialized plans for sports/entertainment, solidifying U.S. digital media leadership.

Driver Analysis

The media and entertainment market is being driven by the rapid expansion of digital consumption across platforms such as streaming, social media, mobile gaming, and on-demand services. Audiences increasingly prefer personalised, high-quality content that can be accessed anytime and on multiple devices.

Organisations in the sector are investing in digital distribution, content diversification, and immersive experiences to meet evolving consumer expectations. The availability of high-speed broadband, affordable devices, and user-centric interfaces supports broader engagement, making digital media consumption a central part of everyday entertainment.

Restraint Analysis

A key restraint in the media and entertainment market relates to the ongoing challenge of content monetisation amid fragmentation of consumer attention and rising costs of content creation. As audiences spread across numerous platforms and services, individual providers may face pressure to invest heavily in original content, rights acquisition, and user-experience features to attract and retain subscribers.

Smaller companies may find it difficult to compete with global players that have deeper financial resources, established brand equity, and extensive content libraries. Regulatory restrictions on cross-border content distribution and licensing agreements can also limit market reach and operational flexibility.

Opportunity Analysis

Emerging opportunities in the media and entertainment market are linked to technologies that support deeper audience engagement and new revenue streams. Personalisation engines, data analytics, and recommendation systems enable content providers to tailor experiences to individual preferences, driving longer viewing times and higher customer satisfaction.

There is also opportunity in interactive and immersive formats, including virtual reality, augmented reality, live-streamed events, and user-generated content, which expand creative possibilities and audience participation. Strategic partnerships with advertisers, brands, and platform developers can unlock monetisation through targeted advertising, sponsorships, and cross-platform promotions.

Challenge Analysis

A central challenge facing this market involves balancing creative innovation with operational efficiency and regulatory compliance. Content producers and distributors must navigate diverse legal frameworks related to copyright, content moderation, data privacy, and age-appropriate access, which vary by region and platform.

Rapid technological shifts require continual investment in infrastructure, skills, and digital security to protect intellectual property and user data. Ensuring consistent quality and relevance in a highly competitive environment demands agile production processes, cross-functional collaboration, and clear governance standards that align with audience expectations and legal requirements.

Emerging Trends

Emerging trends in the media and entertainment market include the rise of personalised content delivery supported by machine learning and predictive analytics that adapt recommendations based on individual behaviour. Another trend is the growth of immersive and interactive experiences that incorporate elements such as real-time engagement, participatory storytelling, and spatial audio or visual effects, which deepen user involvement.

The convergence of media with social platforms and community-driven content creation is increasing, as creators and audiences interact more directly and communities form around shared interests. Monetisation innovations such as subscription bundles, micro-transactions, and hybrid advertising models are also gaining traction.

Growth Factors

Growth in the media and entertainment market is supported by expanding digital infrastructure, increasing screen time, and the proliferation of content distribution channels that cater to diverse audience preferences. Advances in technology, including cloud delivery, high-definition video, and multi-platform integration, enhance accessibility and scalability for providers of all sizes.

Consumer demand for new content formats, personalised experiences, and interactive engagement continues to elevate investment in creative production and technology development. As global audiences grow and media consumption becomes more deeply embedded in daily life, the media and entertainment market remains a dynamic and evolving space with robust potential for ongoing expansion.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Pattern Media conglomerates Very High ~41.3% Content ownership and scale Long term capital deployment Streaming platforms High ~28.7% Subscriber growth and retention Content led investments Advertising networks High ~15.4% Data driven monetization Platform integration Gaming publishers Moderate ~9.1% Interactive engagement IP focused investments Independent creators Low ~5.5% Niche audience monetization Project based Technology Enablement Analysis

Technology Layer Enablement Role Impact on Growth (%) Adoption Status Streaming infrastructure Scalable content delivery ~1.6% Mature Data analytics platforms Audience insight and targeting ~1.3% Mature AI driven content recommendation Personalization and engagement ~1.1% Growing Cloud production tools Remote content creation ~0.9% Growing Immersive media technologies New storytelling formats ~0.7% Developing Key Market Segments

By Type

- Print Media

- Newspaper

- Magazines

- Billboards

- Banners, Leaflets, and Flyers

- Other Print Media

- Digital Media

- Television

- Music and Radio

- Electronic Signage

- Mobile Advertising

- Podcasts

- Other Digital Media

- Streaming Media

- OTT Streaming

- Live Streaming

- Video Games and eSports

- Virtual / Augmented Reality Content

By Revenue Model

- Advertising

- Subscription

- Pay-Per-View / Transactional

- Licensing and Merchandising

By Device Platform

- Smartphones and Tablets

- Smart TVs and Set-top Boxes

- PCs and Laptops

- Gaming Consoles

- VR/AR Headsets

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in December 2025, Netflix announced plans to acquire Warner Bros. following the planned separation of Warner Bros. Discovery’s Streaming & Studios division. This deal aims to consolidate Netflix’s content library and strengthen its global position against rivals, potentially reshaping Hollywood’s streaming landscape.

Top Key Players in the Market

- News Corporation

- Comcast Corporation

- Walt Disney Company

- Warner Bros. Discovery, Inc.

- Paramount Global

- Netflix, Inc.

- com, Inc. (Prime Video)

- Alphabet Inc. (YouTube)

- Apple Inc.

- Sony Group Corporation

- Tencent Holdings Ltd.

- Bertelsmann SE and Co. KGaA

- ByteDance

- Axel Springer SE

- Reliance Industries

- Roku, Inc.

- WPP plc

- Omnicom Group Inc.

- Publicis Groupe

- Spotify Technology S.A.

- Electronic Arts Inc.

- Nintendo Co. Ltd.

- Activision Blizzard, Inc.

- Others

Recent Developments

- In June 2025, Disney finalized its full control of Hulu by paying Comcast $438.7 million, wrapping up a lengthy valuation process. This move lets Disney seamlessly bundle Hulu with Disney+ and the upcoming ESPN streaming service, boosting subscriber retention and content integration across platforms.

- In January 2026, Netflix redesigned its app for short-form video and podcasts to rival TikTok, while pursuing a Warner Bros. acquisition. With 325M subscribers and $45.2B revenue, California’s streaming pioneer drives daily engagement.

Report Scope

Report Features Description Market Value (2025) USD 4.5 trillion Forecast Revenue (2035) USD 7.2 trillion CAGR(2026-2035) 4.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Print Media, Digital Media, Streaming Media, Video Games and eSports, Virtual / Augmented Reality Content), By Revenue Model (Advertising, Subscription, Pay-Per-View / Transactional, Licensing and Merchandising), By Device Platform (Smartphones and Tablets, Smart TVs and Set-top Boxes, PCs and Laptops, Gaming Consoles, VR/AR Headsets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape News Corporation, Comcast Corporation, Walt Disney Company, Warner Bros. Discovery, Inc., Paramount Global, Netflix, Inc., Amazon.com, Inc. (Prime Video), Alphabet Inc. (YouTube), Apple Inc., Sony Group Corporation, Tencent Holdings Ltd., Bertelsmann SE and Co. KGaA, ByteDance, Axel Springer SE, Reliance Industries, Roku, Inc., WPP plc, Omnicom Group Inc., Publicis Groupe, Spotify Technology S.A., Electronic Arts Inc., Nintendo Co. Ltd., Activision Blizzard Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Media and Entertainment MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Media and Entertainment MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- News Corporation

- Comcast Corporation

- Walt Disney Company

- Warner Bros. Discovery, Inc.

- Paramount Global

- Netflix, Inc.

- com, Inc. (Prime Video)

- Alphabet Inc. (YouTube)

- Apple Inc.

- Sony Group Corporation

- Tencent Holdings Ltd.

- Bertelsmann SE and Co. KGaA

- ByteDance

- Axel Springer SE

- Reliance Industries

- Roku, Inc.

- WPP plc

- Omnicom Group Inc.

- Publicis Groupe

- Spotify Technology S.A.

- Electronic Arts Inc.

- Nintendo Co. Ltd.

- Activision Blizzard, Inc.

- Others