Meal Kit Delivery Services Market By Offering (Cook & Eat, and Heat & Eat), By Service (Multiple and Single), By Platform (Offline and Online) By Meal Type (Vegetarian, Non-Vegetarian, and Vegan), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2024

- Report ID: 16743

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Meal Kit Delivery Services Market Overview:

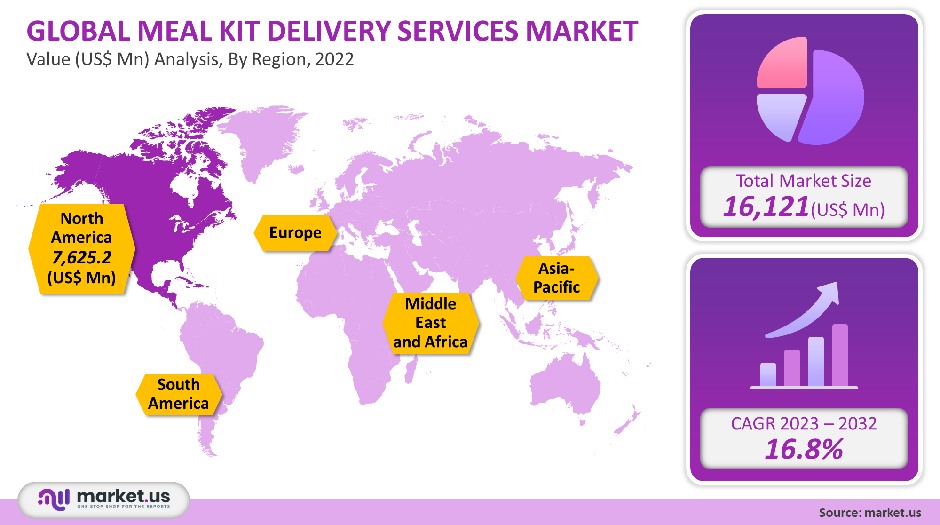

The global meal kit delivery services market was valued at USD 16,121 million in 2022. It is estimated to experience a compound annual growth rate of 16.8% between 2023 and 2032.

The market’s growth is due to millennials’ increasing preference for chef-cooked and home-cooked meals. Generation Y and Z are increasingly using delivery services. The rising preference for this product can be attributed to the many benefits of homemade meals, which are cheaper than takeout and home delivery services.

Global Meal Kit Delivery Services Market Scope:

Offering Analysis

In 2021, the cook and eat segment held the largest revenue share at 61.4%. This segment is expected to continue its dominance during the forecast period. This is due to the growing popularity of home-cooking, especially gourmet-style cooking among young people. You can also try new recipes and gourmet meals at home without having to spend extra on dining out. Although these recipes take longer than the heat and eat section, they are much more efficient than traditional cooking. It saves you time going to the supermarket and grocery store because all ingredients are pre-portioned for one person or more.

The market for meal delivery services is expected to grow at a faster rate of 16.1 % in the heat and eat category between 2023 and 2032. Deliveries of heat and eat meals are prepared by chefs. Consumers can choose the ingredients they want to use or browse the recipes already on the site. Because of their ease of use and accessibility, these kits are gaining popularity all over the world. Freshly Inc., for example, offers custom meals and its signature collection, which includes Dijon Pork Chop and Traditional Beef Stew. These prepared meals have a shelf life of 3-5 days. They can be heated and served in about 5-15 minutes.

Service Analysis

One delivery service segment was the most dominant in the market for meal kit delivery services. It accounted for 58.6% of the total revenue share in 2021. These bachelors don’t have the necessary skills to cook healthy meals. Service providers can help you find a healthy diet that is good for your body and mind. From 2023 to 2032, the multiple delivery service segment will register the highest CAGR at 16.4%.

As more families have two working parents, it is becoming harder and more stressful for them to manage their household. These delivery services are a great way to ease the burden of cooking, which can be time-consuming and exhausting. Lack of time is often the primary reason people don’t participate in traditional cooking. The millennial generation is also known for their love of food and wants to find a way to save time and still have traditional cooking. These multiple meal service providers are the ideal solution for these problems.

Platform Analysis

Online delivery was the dominant market segment for meal kit delivery services in 2021, accounting for 64.1% of the total revenue. Online platforms allow companies to offer clients better service by being more flexible and available around the clock. Most companies sell their products via their websites.

This makes it convenient for consumers. Customers prefer to go to websites to find out more about their products and to see the available subscriptions. From 2023 to 2032, the offline platform will register a CAGR in the market for meal kit delivery services of 18.7%. These products can be found at Walmart, Kroger, and Tesco as well as other major retailers. Due to their large customer base, both small and large companies can offer their products through these channels.

Many consumers also like to buy these products along with other grocery items. This is driving demand for offline platforms. Many retailers, including Walmart, Raley’s, and Meijer, Inc., have started launching their own meal kits, which include a variety of veg as well as non-veg options. This is due to a growing consumer base that doesn’t want to commit to a subscription.

Meal Type Analysis

Non-vegetarians dominated the market in meal kit delivery services. They held the largest revenue share at 64.9% for 2021. This segment will continue to dominate the market for meal kit delivery services over the forecast period. This segment’s growth is due to the high level of protein and vitamins and minerals like A, B6, B12, and niacin in meat.

It appeals to people who are looking to increase their intake of lean protein. Many companies offering non-vegetarian meal plans are offering a variety of fresh, high-quality, and nutritious meats. Product demand is also driven by growing awareness about the health benefits of eating non-vegetarian meals like fish and chicken.

From 2023 to 2032, the segment of vegetarian meal kits is expected to see an 18.9% CAGR in meal kit delivery services. Many people prefer to eat a high amount of fresh, healthy, plant-based food. This provides antioxidants and fiber as well as other long-term health benefits. The increase in vegetarianism is likely due to the widespread adoption of cruelty-free and plant-based diets. These numbers indicate that vegan and vegetarian kits will be in demand.

Кеу Маrkеt Ѕеgmеntѕ

By Offering

- Cook & Eat

- Heat & Eat

By Service

- Multiple

- Single

By Platform

- Offline

- Online

By Meal Type

- Vegetarian

- Non-Vegetarian

- Vegan

Market Dynamics:

As almost all restaurants and eateries across the globe were closed down, the COVID-19 pandemic opened up a new market for meal delivery services. To increase immunity and maintain a healthy lifestyle, people are now looking for easy and healthy meals. Key players in the market saw a rise in sales in response to the pandemic. Blue Apron and HelloFresh reported an increase in their global sales.

HelloFresh also saw a rise in its U.S. customer base with a 65.3% increase in its Y-O-Y revenue.

Consumers in the U.S. are increasingly interested in heat and eating. Many delivery companies have begun to tap into this market by offering single or multiple meals. Homemade food is cheaper than dining out at restaurants. Homemade meals are also easier to prepare than takeout or home delivery.You can also control the ingredients you use at home, which is a great advantage for those who have allergies or want to avoid certain ingredients.

HUNTER conducted a survey in 2020 and found that 53.2% of Americans are now cooking more than ever before, while 22.8% order prepared meals more often. It is more popular to eat in than to go out. Boomers and millennials are increasingly choosing to cook at home or order from restaurants, rather than spend money at expensive restaurants. Consumers are choosing to stay home and make fewer restaurant visits. This shift can be attributed to the attitudes and behavior of the largest generation, the boomers and the millennials.

Although millennials are now more common than baby boomers, they still make up a substantial portion of the population. Meal delivery services can be a great solution as meal planning ahead significantly reduces food waste. Because each meal is measured out in portions, meal kits contain all the ingredients needed to make a meal. Many delivery companies offer larger portions but still give nutritional information and calorie counts based on the portion.

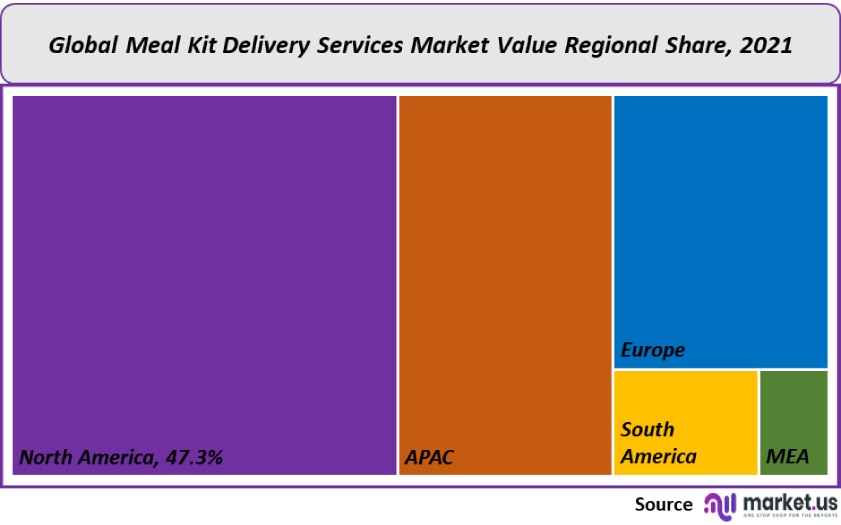

Regional Analysis

North America was the dominant market for meal kit delivery services and held 47.3% of the total revenue in 2021. These kits are popular because they save time and money. This product is a healthier, more affordable alternative to pre-cooked foods that can be purchased in restaurants, online delivery services, or retail stores.

Blue Apron, Sun Basket, and others have seen a sharp rise in product demand due to the COVID-19 pandemic. This is because consumers are more comfortable eating home-cooked meals. Blue Apron saw an increase in demand for its meal kit in 2020. This was partly due to changes in consumer behavior as a result of the COVID-19 pandemic.

Asia Pacific is predicted to see a 19.5% CAGR in the market for meal kit delivery services between 2023 and 2032. Due to its convenience and freshness, the market is expected to grow tremendously in this region. These delivery services are being sought after by a growing number of consumers who are less time-savvy. The region’s key markets are China, South Korea, and Japan.

COVID-19, which has increased interest in home-cooked foods and boosted the demand for this product in the country, is another important market. Market leaders in vegetarian and vegan meal kit sales are India, Japan, China, and Singapore.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

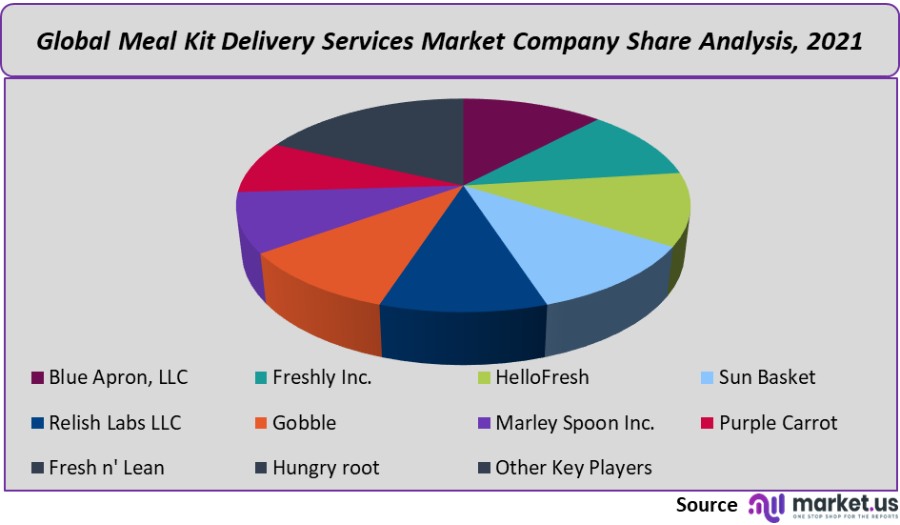

The market for meal kit delivery services is characterized by the presence of several well-established players, as well as small and medium players. Here are some of the most prominent players in the market for meal kit delivery services:

Маrkеt Кеу Рlауеrѕ:

- Blue Apron, LLC

- Freshly Inc.

- HelloFresh

- Sun Basket

- Relish Labs LLC

- Gobble

- Marley Spoon Inc.

- Purple Carrot

- Fresh n’ Lean

- Hungry root

- Other Key Players

For the Meal Kit Delivery Services Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Meal Kit Delivery Services MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Meal Kit Delivery Services MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Blue Apron, LLC

- Freshly Inc.

- HelloFresh

- Sun Basket

- Relish Labs LLC

- Gobble

- Marley Spoon Inc.

- Purple Carrot

- Fresh n' Lean

- Hungry root

- Other Key Players