Global Maritime IoT Via Satellite Market Size, Share, Growth Analysis By Component (Hardware, Software, Services), By Application (Fleet Management & Operations, Vessel Tracking & Monitoring, Environmental & Emissions Monitoring, Crew Welfare & Connectivity, Cargo & Cold Chain Monitoring, Others), By Vessel Type (Commercial Shipping (Tankers, Containers, Bulk), Offshore Support Vessels, Fishing Vessels, Passenger Ships & Ferries, Others), By Service Type (Very Small Aperture Terminal (VSAT), Mobile Satellite Services (MSS), Hybrid Networks), By End-User (Shipping Companies & Operators, Offshore Energy Companies, Government & Defense, Fishing Enterprises, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170062

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of IoT

- Industry Adoption

- Emerging Trends

- US Market Size

- By Component Analysis

- By Application Analysis

- By Vessel Type Analysis

- By Service Type Analysis

- By End-User Analysis

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint factors

- Growth opportunities

- Trending factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

The Maritime IoT via Satellite Market is experiencing rapid expansion as global shipping, offshore energy, and naval operations increasingly rely on real-time data connectivity across remote ocean regions. Growing digitalization in the maritime sector has accelerated the adoption of IoT-enabled sensors, smart fleet management tools, and automated monitoring systems that require uninterrupted satellite communication.

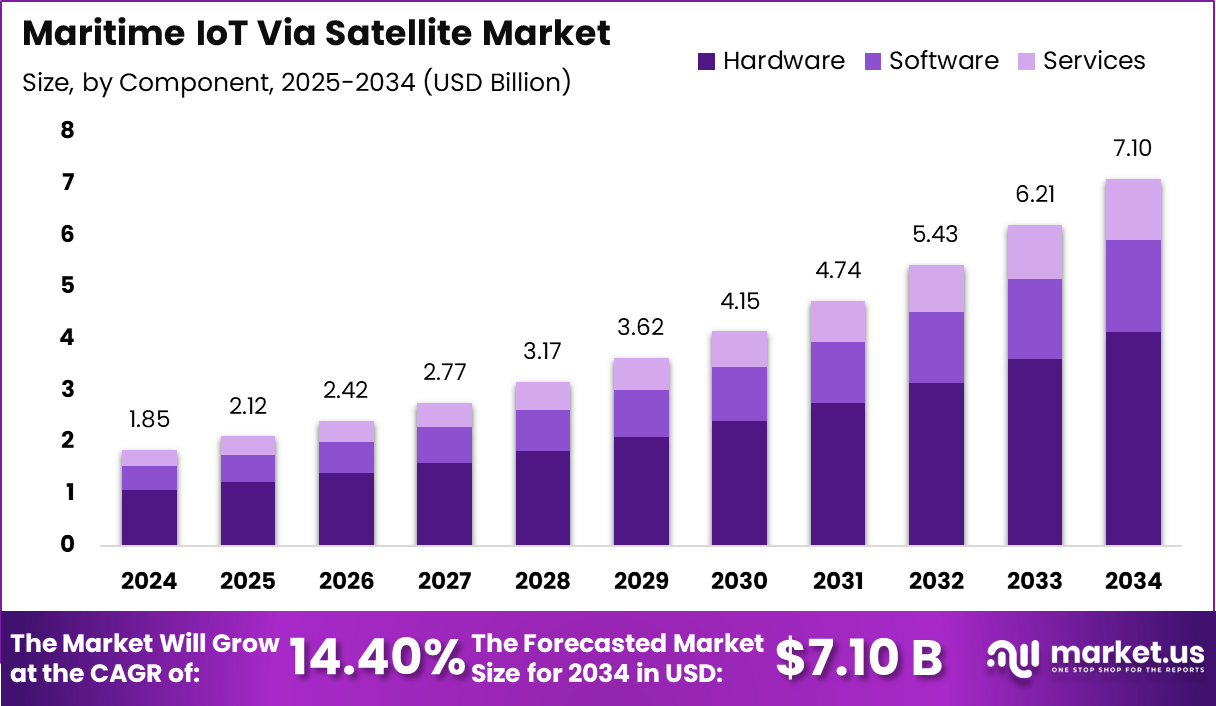

In 2024, the market reached USD 1.85 billion, supported by rising demand for vessel performance analytics, predictive maintenance, cargo tracking, and crew safety solutions. As maritime companies invest in digital transformation, satellite-linked IoT platforms enable ships to transmit operational data, environmental conditions, and compliance reports from any point in the ocean, enhancing decision-making and operational efficiency.

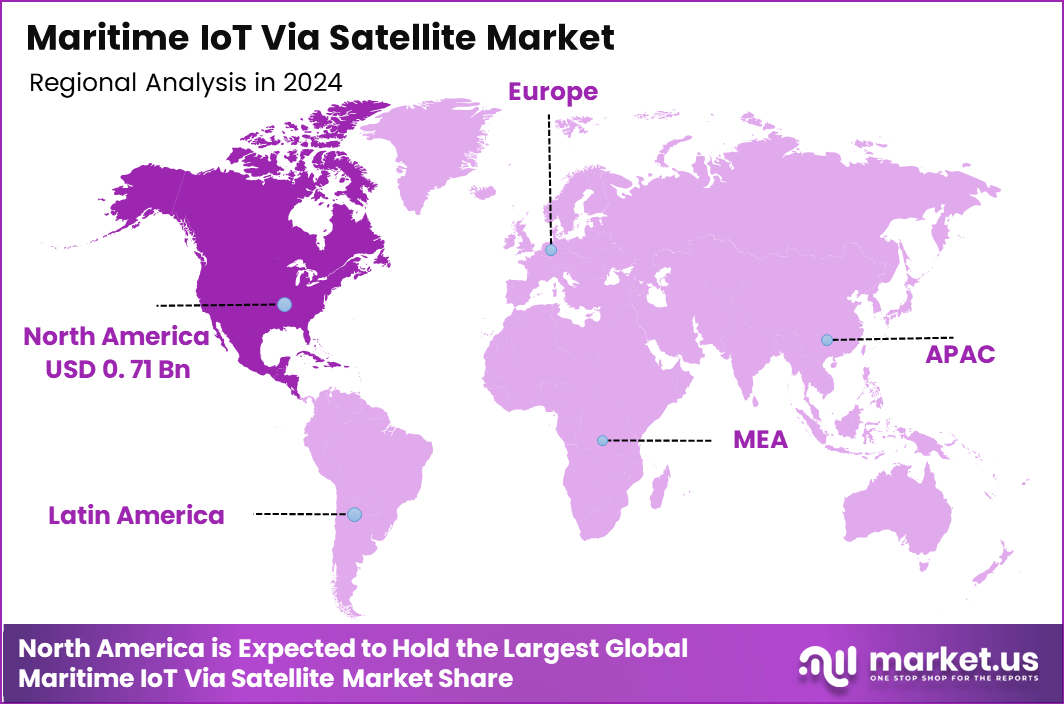

The market is projected to grow at a robust CAGR of 14.40%, reaching USD 7.10 billion by 2034 as advanced LEO, MEO, and GEO satellite networks improve bandwidth, latency, and global coverage. North America accounted for 38.5% of the market in 2024, valued at USD 0.71 billion, driven by strong adoption in commercial shipping, offshore drilling, and naval modernization programs.

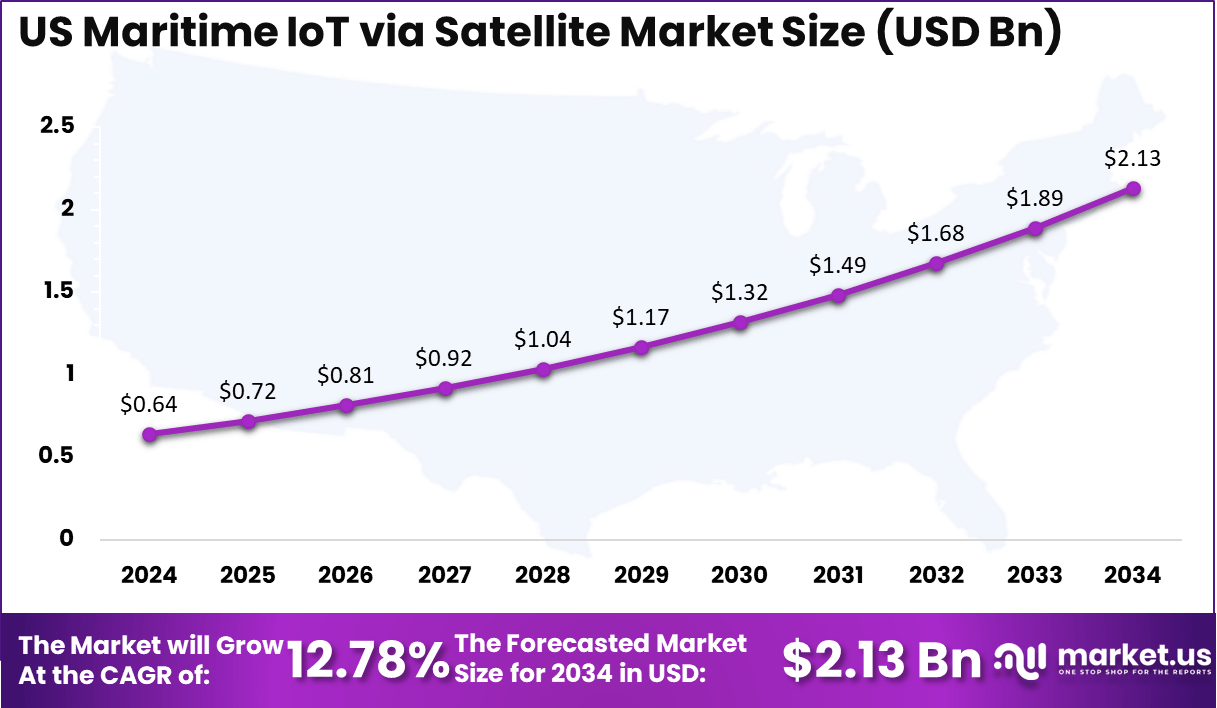

The US contributed USD 0.64 billion and is anticipated to reach USD 2.13 billion by 2034, maintaining steady growth at a 12.78% CAGR as maritime operators prioritize automation, safety, and connected vessel ecosystems.

Maritime IoT via satellite represents a transformative shift in how vessels, offshore platforms, and maritime fleets operate, offering real-time connectivity across even the most remote ocean regions. This technology enables ships to transmit operational data, engine performance metrics, cargo conditions, and environmental parameters continuously, improving decision-making and efficiency.

With over New product launches include advanced IoT devices and analytics platforms, with innovative subscription and pay-as-you-go models making connectivity accessible for smaller operators. Hybrid solutions leveraging LEO satellites improve ship-to-shore data flows and cybersecurity measures. 90% of global trade is transported by sea, and the need for uninterrupted data flow is becoming critical for fleet optimization, safety, and regulatory compliance.

Satellite-enabled IoT systems support applications such as predictive maintenance, where operators can reduce equipment failure risk by up to 40%, and fuel optimization, improving consumption efficiency by 10–15% through data-driven routing and engine monitoring.

Advanced satellite constellations, including LEO and MEO networks, now deliver lower latency and higher bandwidth, enabling high-speed communication for smart shipping operations. The expansion of autonomous and semi-autonomous vessels also increases reliance on satellite IoT infrastructure, as these systems require continuous data exchange for navigation and remote oversight.

Offshore energy platforms utilize IoT sensors with satellite links to monitor structural integrity, detect leaks, and improve worker safety across installations located hundreds of kilometers from shore. As global maritime operations expand into deeper and harsher waters, satellite-powered IoT is becoming essential for operational continuity, sustainability, and digital transformation across the entire maritime ecosystem.

Recent developments in maritime IoT via satellite highlight strategic mergers like a June 2023 deal that combined smart shipping technologies to streamline global trade operations. Companies such as Inmarsat and ORBCOMM have driven growth through acquisitions and partnerships, enhancing R&D, product ranges, and contracts with shipping firms and governments.

Satellite IoT connections reached 7.5 million in 2024, projected to grow from 13.6 million in 2025 to 34.5 million by 2030, signaling broader maritime adoption. Valour noted 28,000 new satellite subscribers added in a recent year, mainly in offshore energy and passenger sectors. Funding focuses on lower launch costs and collaborations among operators, IoT providers, and manufacturers for resilient remote operations.

Key Takeaways

- The Maritime IoT via Satellite Market reached USD 1.85 billion in 2024 and is projected to grow at a 14.40% CAGR to USD 7.10 billion by 2034.

- North America dominated the market with a 38.5% share in 2024, valued at USD 0.71 billion.

- The US contributed USD 0.64 billion in 2024 and is expected to reach USD 2.13 billion by 2034 at a 12.78% CAGR.

- By Component, Hardware: 58.2%, driven by rising adoption of satellite terminals, sensors, and communication modules.

- By Application, Fleet Management & Operations: 36.8%, supported by increasing demand for vessel tracking and performance monitoring.

- By Vessel Type, Commercial Shipping: 47.5%, reflecting strong digitalization across global cargo and container fleets.

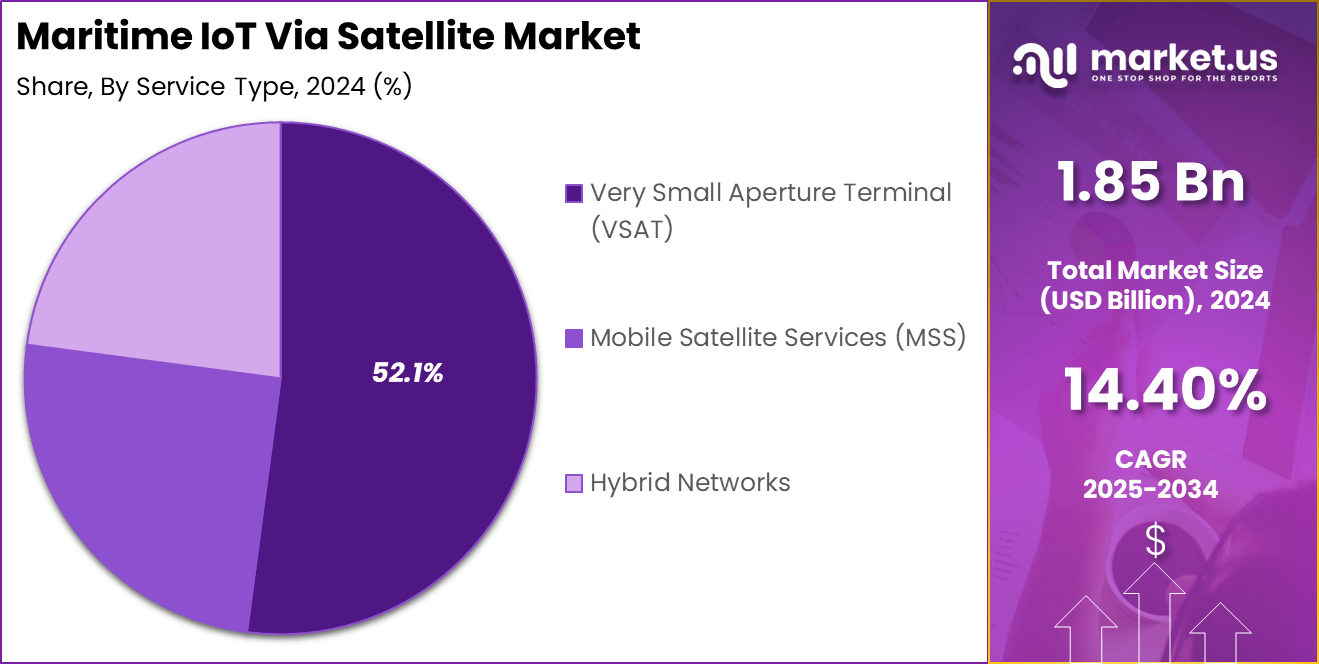

- By Service Type, VSAT: 52.1%, due to the growing need for high-bandwidth, always-on connectivity at sea.

- By End-User, Shipping Companies & Operators: 62.7%, as they prioritize fuel efficiency, safety, and regulatory compliance through IoT-driven insights.

Role of IoT

The role of IoT in the maritime sector has become increasingly critical as global fleets transition toward digital, data-driven operations. IoT enables vessels, cargo systems, engines, and onboard equipment to communicate in real time, generating continuous streams of operational data that enhance safety, efficiency, and compliance.

With over 90% of world trade transported by sea, IoT-driven insights significantly improve decision-making for shipping companies, offshore operators, and port authorities. Engine performance analytics supported by IoT can reduce fuel consumption, while predictive maintenance systems lower unexpected equipment failures by up to 40%, reducing operational downtime and repair costs.

IoT sensors integrated with satellite connectivity allow remote monitoring of cargo temperature, hull integrity, emissions levels, and crew safety conditions, even thousands of kilometers from shore. Fleet managers use IoT platforms to optimize routing, resulting in transit-time reductions of 5–12% and improved schedule reliability.

Environmental monitoring is another key role, with IoT systems enabling compliance with IMO regulations by continuously tracking sulfur emissions and energy efficiency metrics. As autonomous and semi-autonomous vessels evolve, IoT becomes the foundational layer enabling navigation, obstacle detection, and remote command functions. Overall, IoT transforms maritime operations into smarter, safer, and more sustainable systems through continuous, data-rich connectivity.

Industry Adoption

Industry adoption of Maritime IoT via satellite has accelerated rapidly as operators across shipping, offshore energy, and defense increasingly rely on real-time data for operational efficiency and safety. More than 65% of global commercial shipping fleets now use IoT-enabled monitoring systems to track vessel performance, cargo conditions, and route optimization.

These systems help reduce fuel consumption, improve schedule reliability, and support compliance with IMO environmental standards. Offshore oil and gas platforms are also major adopters, with over 50% integrating IoT sensors to monitor structural integrity, equipment health, and worker safety across remote installations located hundreds of kilometers from shore.

Ports and maritime logistics hubs have expanded IoT usage for automated container tracking, crane scheduling, and terminal optimization, improving operational throughput by 20–30%. Defense and naval organizations deploy IoT-connected systems for fleet readiness, mission awareness, and secure communication across dispersed maritime zones. The fishing industry is adopting IoT for catch tracking, vessel monitoring, and sustainability reporting, driven by regulatory mandates and traceability requirements.

As satellite networks offer faster data speeds and lower latency, adoption is expected to grow further, supporting autonomous vessels, advanced weather routing, remote engine diagnostics, and real-time risk assessment. The industry’s shift toward digitalization continues to position IoT as a core enabler of efficiency, safety, and global maritime competitiveness.

Emerging Trends

Emerging trends in Maritime IoT via satellite reflect the rapid evolution of digital technologies and the growing demand for real-time offshore connectivity. One major trend is the rise of low-Earth-orbit (LEO) satellite constellations, which offer significantly lower latency and up to 5–10x higher bandwidth than traditional systems.

Enabling continuous data exchange for fleet management, predictive maintenance, and autonomous vessel operations. Another trend is the integration of AI and machine learning into IoT platforms, allowing ships to analyze engine behavior, weather patterns, and fuel consumption instantly, improving routing efficiency by 10–12% and reducing emissions.

Cybersecurity is emerging as a top priority, with more than 70% of maritime operators increasing investment in secure IoT networks to protect vessel data from cyber threats. Multi-sensor IoT ecosystems are expanding, enabling seamless monitoring of cargo temperature, emissions, hull stress, and crew safety through thousands of interconnected devices onboard a single vessel.

Digital twins are becoming widely adopted, with shipping companies creating real-time virtual models of vessels to simulate performance and detect failures early. Additionally, autonomous and remotely operated ships are gaining momentum, supported by satellite IoT links that ensure continuous situational awareness. These trends collectively drive greater efficiency, safety, and sustainability across global maritime operations.

US Market Size

The US Maritime IoT via Satellite Market is experiencing strong and sustained growth as the nation’s commercial shipping, offshore energy, and naval sectors accelerate digital transformation efforts. In 2024, the US market reached USD 0.64 billion, driven by the rising adoption of satellite-enabled IoT platforms that support vessel tracking, engine diagnostics, emissions monitoring, and real-time cargo visibility.

Shipping operators increasingly rely on IoT connectivity to enhance fleet efficiency, reduce fuel consumption, and comply with evolving environmental regulations. Offshore energy companies also integrate IoT sensors with satellite networks to monitor remote drilling platforms, subsea equipment, and worker safety, ensuring continuous operations even in isolated ocean regions.

By 2034, the US market is expected to reach USD 2.13 billion, expanding at a steady 12.78% CAGR as demand for automation, predictive maintenance, and security-intelligent systems grows. The US Navy and Coast Guard play a key role in market expansion by deploying IoT-connected satellite systems for mission readiness, maritime domain awareness, and secure fleet communication.

Advancements in low-Earth-orbit satellite networks further boost adoption by offering higher bandwidth, lower latency, and improved global coverage. As digitalization reshapes maritime operations, the US remains one of the most technologically progressive markets for satellite-enabled IoT solutions.

By Component Analysis

Hardware accounted for a dominant 58.2% share in the Maritime IoT via Satellite Market, driven by increasing installation of satellite terminals, antennas, onboard sensors, and communication modules across vessels and offshore platforms. These hardware components form the foundation of maritime connectivity, enabling continuous data transmission for navigation, engine health monitoring, cargo tracking, and environmental compliance.

Modern Very Small Aperture Terminals (VSAT), high-gain antennas, and multi-band receivers now support higher bandwidth and lower latency, allowing ships to exchange operational data in real time even in remote ocean regions. As global shipping fleets expand digital integration, demand for robust IoT hardware grows significantly, particularly for systems capable of harsh-weather resilience and long-term endurance.

Software solutions continue to evolve, offering advanced analytics, predictive maintenance algorithms, cybersecurity protection, and fleet management dashboards. These platforms help operators interpret vast amounts of IoT-generated data and optimize decision-making.

Services, including installation, maintenance, network management, and satellite communication subscriptions, also play an essential role as maritime operators require reliable support for continuous global operations.

However, hardware remains the largest segment because it is indispensable for enabling satellite-based IoT connectivity. The shift toward autonomous and semi-autonomous vessels further amplifies the need for advanced onboard communication equipment, ensuring hardware remains central to market growth.

By Application Analysis

Fleet management and operations accounted for a leading 36.8% share in the Maritime IoT via Satellite Market, reflecting the industry’s strong shift toward real-time performance optimization, route planning, and operational transparency.

Satellite-enabled IoT systems allow shipping companies to continuously collect and analyze data on vessel speed, fuel consumption, engine performance, and weather conditions, enabling more efficient voyage planning. These capabilities help reduce fuel usage by 10–15%, lower operational costs, and improve schedule reliability. Fleet operators also rely on IoT platforms for predictive maintenance, reducing equipment failure risk by up to 40% and minimizing unplanned downtime.

Vessel tracking and monitoring remain essential for safety and regulatory compliance, ensuring ships transmit accurate location data globally. Environmental and emissions monitoring is expanding as IMO regulations push vessels to track sulfur levels, CO₂ output, and energy efficiency metrics.

Crew welfare and connectivity benefit from satellite IoT by enabling internet access, telemedicine, and communication services, supporting retention and well-being. Cargo and cold chain monitoring use IoT sensors to maintain temperature-sensitive shipments, reducing spoilage rates across global routes.

Although several applications are growing rapidly, fleet management and operations continue to dominate due to their direct impact on cost savings, safety, and fleet-wide operational visibility.

By Vessel Type Analysis

Commercial shipping accounted for a dominant 47.5% share of the Maritime IoT via Satellite Market, driven by the sector’s strong need for continuous connectivity across global trade routes. Tankers, container vessels, and bulk carriers depend heavily on satellite-enabled IoT systems to optimize navigation, monitor engine performance, and track cargo conditions throughout long-distance voyages.

With over 90% of global trade transported by sea, commercial fleets rely on IoT data to reduce fuel consumption, enhance operational safety, and meet stringent environmental regulations. Real-time analytics support more accurate voyage planning, reducing delays and improving schedule reliability across major shipping lanes.

Offshore support vessels use IoT for dynamic positioning, equipment monitoring, and safety management, especially during operations near drilling platforms. Fishing vessels adopt IoT for catch tracking, route optimization, and compliance with sustainability reporting requirements. Passenger ships and ferries are expanding IoT usage to improve onboard connectivity, safety monitoring, and service efficiency for thousands of daily travelers.

While several vessel categories are increasing adoption, commercial shipping remains the largest user segment due to its global operational scale, high-value cargo, and reliance on uninterrupted satellite communication. With the industry’s ongoing digitalization, IoT integration continues to be central to efficiency, compliance, and vessel performance optimization.

By Service Type Analysis

Very Small Aperture Terminal (VSAT) accounted for a dominant 52.1% share of the Maritime IoT via Satellite Market, driven by its ability to deliver high-bandwidth, always-on connectivity essential for modern vessel operations. VSAT systems enable real-time data exchange for fleet management, predictive maintenance, engine diagnostics, and environmental monitoring, supporting the growing digitalization of global shipping fleets.

With rising demand for applications such as video surveillance, crew connectivity, and cloud-based analytics, VSAT networks provide the stable, high-capacity communication backbone required for uninterrupted maritime IoT performance. Their ability to offer broadband speeds across vast oceanic regions makes them the preferred choice for commercial shipping, offshore platforms, and passenger vessels.

Mobile Satellite Services (MSS) remain important for low-bandwidth, mission-critical communication, especially for safety alerts, distress signals, and basic tracking functions. MSS is widely used by smaller vessels, fishing fleets, and operators requiring reliable communication without the need for high data throughput. Hybrid networks are gaining interest by combining VSAT and MSS to deliver resilient connectivity, ensuring seamless switching during adverse weather or coverage gaps.

Despite the growth of MSS and hybrid systems, VSAT continues to lead due to expanding bandwidth requirements, increasing automation, and rising adoption of data-intensive IoT applications across maritime operations.

By End-User Analysis

Shipping companies and operators accounted for a dominant 62.7% share of the Maritime IoT via Satellite Market, driven by the sector’s strong need for real-time connectivity, operational visibility, and regulatory compliance. Large commercial fleets rely on satellite-enabled IoT systems to monitor vessel performance, optimize routing, track cargo conditions, and ensure fuel efficiency across global trade routes.

These solutions help achieve reductions in fuel consumption and 5–12% improvements in voyage scheduling accuracy. IoT platforms also support predictive maintenance by identifying engine or equipment issues early, reducing the risk of failures by up to 40% and minimizing costly downtime.

Offshore energy companies adopt IoT-satellite integration to monitor drilling platforms, subsea equipment, and worker safety in remote ocean regions. Government and defense agencies use these technologies for maritime surveillance, search and rescue coordination, and secure fleet communication. Fishing enterprises benefit from IoT for catch tracking, vessel monitoring, route optimization, and compliance with sustainability reporting standards.

While multiple sectors utilize maritime IoT, shipping companies and operators remain the largest end-user group due to the scale of global fleet operations, the value of transported goods, and the increasing emphasis on digitalization. Satellite-enabled IoT continues to be essential for ensuring efficiency, safety, and competitiveness across commercial maritime activities.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Fleet Management & Operations

- Vessel Tracking & Monitoring

- Environmental & Emissions Monitoring

- Crew Welfare & Connectivity

- Cargo & Cold Chain Monitoring

- Others

By Vessel Type

- Commercial Shipping (Tankers, Containers, Bulk)

- Offshore Support Vessels

- Fishing Vessels

- Passenger Ships & Ferries

- Others

By Service Type

- Very Small Aperture Terminal (VSAT)

- Mobile Satellite Services (MSS)

- Hybrid Networks

By End-User

- Shipping Companies & Operators

- Offshore Energy Companies

- Government & Defense

- Fishing Enterprises

- Others

Regional Analysis

North America held a strong 38.5% share of the Maritime IoT via Satellite Market in 2024, reaching a market size of USD 0.71 billion. The region’s leadership is supported by the rapid digital transformation of commercial shipping fleets, advanced offshore energy activities, and extensive naval modernization programs.

Shipping companies across the US and Canada increasingly deploy satellite-enabled IoT platforms to optimize routing, reduce fuel consumption, and monitor vessel performance in real time. These capabilities are essential for operations along major trade routes and in challenging environments such as the North Atlantic and Arctic waters.

Offshore oil and gas operators in the Gulf of Mexico rely on IoT-satellite integration for continuous monitoring of drilling platforms, subsea infrastructure, and worker safety. The region’s strong technological ecosystem, including leading satellite providers and maritime analytics companies, accelerates adoption across commercial and government sectors.

The US Navy and Coast Guard also contribute significantly by implementing IoT-supported communication networks, predictive maintenance systems, and maritime domain awareness tools for enhanced mission readiness. With the expanding deployment of low-Earth-orbit satellite networks and increasing demand for autonomous vessel technologies, North America is poised to maintain its leading position. Growing investment in digital maritime infrastructure continues to drive innovation and adoption across the region.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Key driving factors for the Maritime IoT via Satellite Market include the rising need for real-time vessel monitoring, growing digitalization across global shipping fleets, and increasing regulatory pressure for emissions tracking. Shipping operators rely on IoT data to reduce fuel consumption by 10–15%, optimize routing, and improve schedule reliability.

Offshore energy platforms further drive adoption by requiring continuous remote monitoring of drilling operations across vast ocean regions. The expansion of low-Earth-orbit satellite networks offering 5–10x higher bandwidth accelerates IoT uptake. Increasing focus on crew safety, predictive maintenance, and automated reporting strengthens the shift toward satellite-enabled IoT systems.

Restraint factors

Despite strong growth, several restraints affect widespread adoption. High installation and subscription costs for VSAT and IoT hardware pose challenges for smaller shipping operators and fishing fleets. Bandwidth limitations in remote regions can impact data-intensive applications, limiting performance.

Cybersecurity risks remain a major concern, with more than 70% of maritime operators identifying vulnerabilities in connected systems. Regulatory variations across maritime jurisdictions complicate large-scale IoT deployment. Harsh marine environments also cause equipment degradation, increasing maintenance expenses. Additionally, older vessels require costly retrofitting to support IoT infrastructure, slowing digital transformation for aging global fleets.

Growth opportunities

Significant opportunities arise from the expansion of autonomous and semi-autonomous vessels, which require continuous satellite-IoT connectivity for navigation and remote command. Offshore wind development, increasing by 40% globally, drives demand for sensor-based monitoring of turbine foundations, subsea cables, and marine conditions.

Digital twins offer new opportunities by allowing real-time simulation of vessel performance for predictive maintenance. Environmental agencies are adopting IoT systems to monitor emissions, water quality, and ocean health, expanding non-commercial use cases. Growth in smart ports and automated logistics hubs also presents opportunities for integrating satellite IoT into port-to-vessel communication systems.

Trending factors

Emerging trends include the rapid adoption of LEO satellite constellations that deliver lower latency and higher bandwidth for data-heavy applications. AI-powered analytics are becoming central to IoT platforms, improving routing efficiency by 10–12% and enabling earlier detection of mechanical failures. Cybersecurity-enhanced IoT architectures are trending as operators strengthen protection of vessel communication networks.

Hybrid VSAT-MSS networks are gaining popularity due to their ability to ensure uninterrupted connectivity. Another major trend is the rise of crew welfare technologies, providing high-speed satellite internet for communication and telemedicine. Sustainability-focused IoT applications for emissions tracking and energy optimization continue to influence industry priorities.

Competitive Analysis

The competitive landscape of the Maritime IoT via Satellite Market is shaped by a mix of global satellite operators, maritime technology providers, IoT platform developers, and specialized communication companies.

Leading satellite service providers compete by expanding coverage, improving bandwidth, and offering integrated communication solutions tailored for commercial shipping, offshore energy, and naval operations. Maritime IoT platform companies strengthen their position by offering advanced analytics, predictive maintenance tools, cybersecurity solutions, and fleet management systems that integrate seamlessly with satellite networks.

Hardware manufacturers play a crucial competitive role by developing resilient antennas, onboard sensors, and communication terminals optimized for harsh marine environments. These players focus on enhancing durability, ease of installation, and compatibility with next-generation satellite constellations. In parallel, software providers differentiate themselves through cloud-based analytics dashboards, real-time monitoring suites, and AI-driven operational insights that support ship operators in managing complex maritime operations.

Offshore energy service providers, defense technology firms, and large logistics companies increasingly form strategic partnerships with satellite and IoT vendors to co-develop customized connectivity ecosystems.

Startups specializing in maritime digitalization also contribute to competition by introducing innovative sensor technologies, smart routing algorithms, and autonomous vessel communication systems. Overall, competition centers on reliability, global coverage, technological innovation, and the ability to deliver seamless end-to-end maritime connectivity.

Top Key Players in the Market

- Inmarsat Global, Ltd.

- Iridium Communications, Inc.

- ORBCOMM, Inc.

- Globalstar, Inc.

- Thuraya Telecommunications Company

- KVH Industries, Inc.

- Intelsat S.A.

- Cobham SATCOM

- Airbus SE

- Astrocast SA

- Spire Global, Inc.

- Myriota, Ltd.

- Swarm Technologies, Inc.

- Marlink AS

- Sateliot

- Others

Recent Developments

- November 2025: Greece is prepared to launch its first maritime nanosatellite, MICE-1, designed for maritime identification, communications, and IoT-based monitoring from orbit. The satellite aims to enhance ship tracking and data exchange for more than 800 vessels, marking a strategic step toward national maritime IoT capabilities supported by advanced machine learning and encryption technologies.

- November 2025: Karrier One and Iridium Communications entered into a strategic collaboration to extend satellite IoT connectivity into decentralized telecom networks, promising broader global reach for vessel monitoring, tracking, and maritime safety well beyond traditional coastal coverage.

- Late 2025: Industry reports identified key players such as Inmarsat, Iridium, Orbcomm, and KVH Industries as central to ongoing innovation in satellite-IoT platforms and connectivity services tailored for fleet monitoring, asset tracking, and maritime safety applications.

Report Scope

Report Features Description Market Value (2024) USD 1.85 Billion Forecast Revenue (2034) USD 7.10 Billion CAGR(2025-2034) 14.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Application (Fleet Management & Operations, Vessel Tracking & Monitoring, Environmental & Emissions Monitoring, Crew Welfare & Connectivity, Cargo & Cold Chain Monitoring, Others), By Vessel Type (Commercial Shipping (Tankers, Containers, Bulk), Offshore Support Vessels, Fishing Vessels, Passenger Ships & Ferries, Others), By Service Type (Very Small Aperture Terminal (VSAT), Mobile Satellite Services (MSS), Hybrid Networks), By End-User (Shipping Companies & Operators, Offshore Energy Companies, Government & Defense, Fishing Enterprises, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Inmarsat Global, Ltd., Iridium Communications, Inc., ORBCOMM, Inc., Globalstar, Inc., Thuraya Telecommunications Company, KVH Industries, Inc., Intelsat S.A., Cobham SATCOM, Airbus SE, Astrocast SA, Spire Global, Inc., Myriota, Ltd., Swarm Technologies, Inc., Marlink AS, Sateliot, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Maritime IoT Via Satellite MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Maritime IoT Via Satellite MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Inmarsat Global, Ltd.

- Iridium Communications, Inc.

- ORBCOMM, Inc.

- Globalstar, Inc.

- Thuraya Telecommunications Company

- KVH Industries, Inc.

- Intelsat S.A.

- Cobham SATCOM

- Airbus SE

- Astrocast SA

- Spire Global, Inc.

- Myriota, Ltd.

- Swarm Technologies, Inc.

- Marlink AS

- Sateliot

- Others

- Inmarsat Global, Ltd.

- Iridium Communications, Inc.

- ORBCOMM, Inc.

- Globalstar, Inc.

- Thuraya Telecommunications Company

- KVH Industries, Inc.

- Intelsat S.A.

- Cobham SATCOM

- Airbus SE

- Astrocast SA

- Spire Global, Inc.

- Myriota, Ltd.

- Swarm Technologies, Inc.

- Marlink AS

- Sateliot

- Others