Global Maritime Big Data Market Size, Share, Industry Analysis Report By Data Type (Environmental Data, Operational Data, Vessel Performance Data, Geographical Data), By Application (Fleet Management, Navigation Optimization, Predictive Maintenance, Regulatory Compliance, Environmental Monitoring), By Deployment Model (Cloud-based, On-premises), By End-user (Commercial Shipping, Fishing Industry, Naval Forces), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 156798

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Generative AI

- Emerging Trends

- Investment & Business Benefits

- China Market Size

- By Data Type

- By Application

- By Deployment Model

- By End-user

- Key Market Segments

- Top 5 Use Cases

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

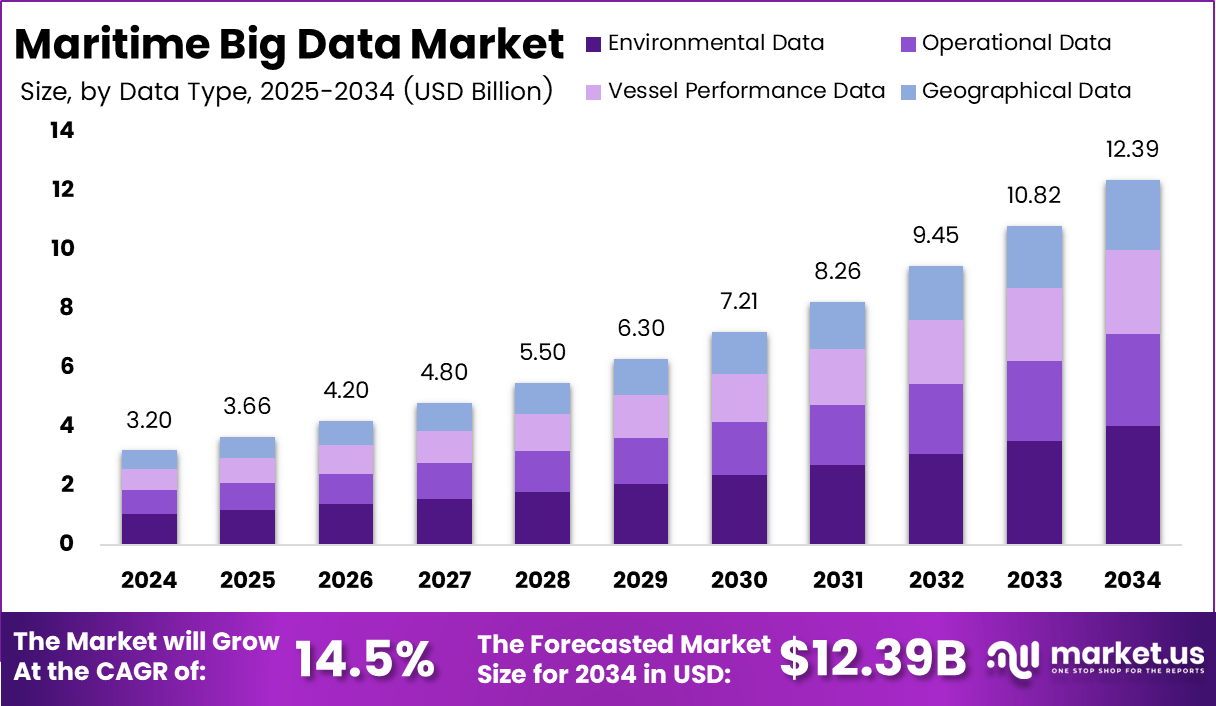

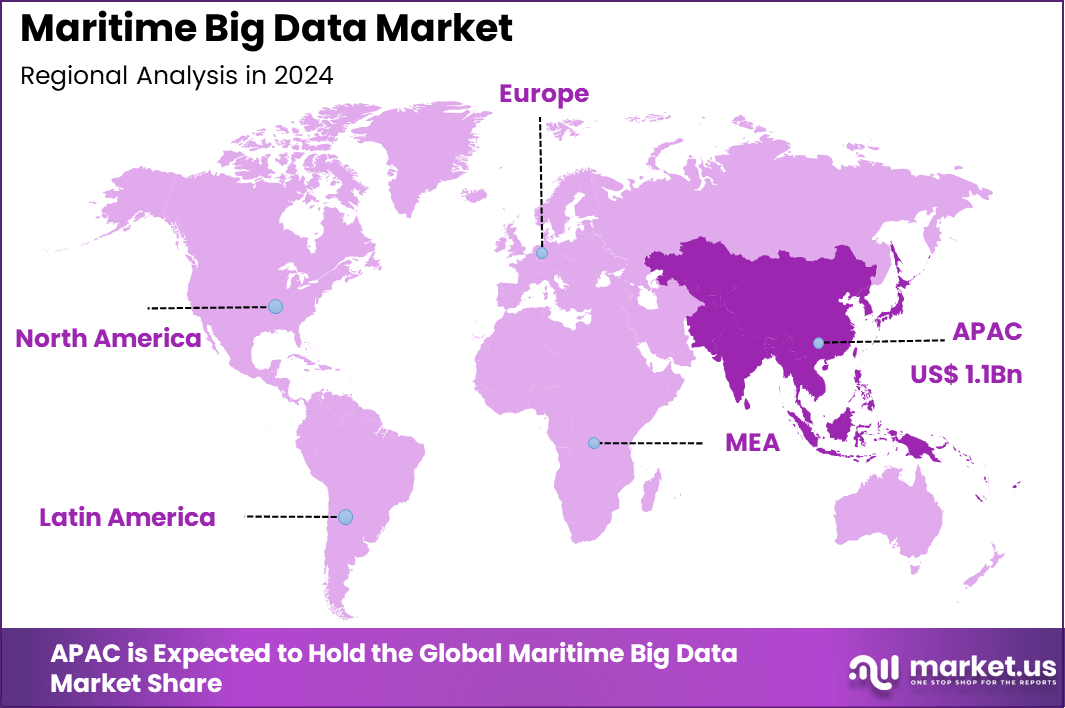

The Global Maritime Big Data Market size is expected to be worth around USD 12.39 Billion By 2034, from USD 3.2 billion in 2024, growing at a CAGR of 14.5% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 36.5% share, holding USD 1.15% Billion revenue.

The Maritime Big Data market is growing steadily, fueled by the increasing need to enhance operational efficiency and safety within the shipping and logistics sectors. Companies are leveraging advanced data analytics to process vast volumes of information from vessel tracking, weather data, and port operations. This allows for improved decision-making in areas like route optimization and predictive maintenance, which helps reduce fuel consumption and operational costs.

One of the top driving factors for this market is the rising demand for real-time data analytics in fleet management. Shipping companies seek to optimize vessel performance and reduce fuel consumption by using real-time data to monitor engine health and optimize routes. In addition, efforts to enhance maritime security by detecting and responding to potential threats using big data contribute to market growth. The maritime big data product segment is projected to account for approximately 18-22% of the overall market share, reflecting the increasing reliance on data-driven insights.

Investment opportunities in this market are substantial, with stakeholders focusing on developing innovative analytics platforms, smart shipping solutions, and integrating advanced technologies into existing maritime systems. Investment in R&D is accelerating to unlock new applications such as autonomous shipping and smart ports, which promise higher efficiency and sustainability.

Key Takeaways

- Environmental Data was the leading data type, contributing 32.6% share of the market.

- Fleet Management dominated by application, securing 28.8% share.

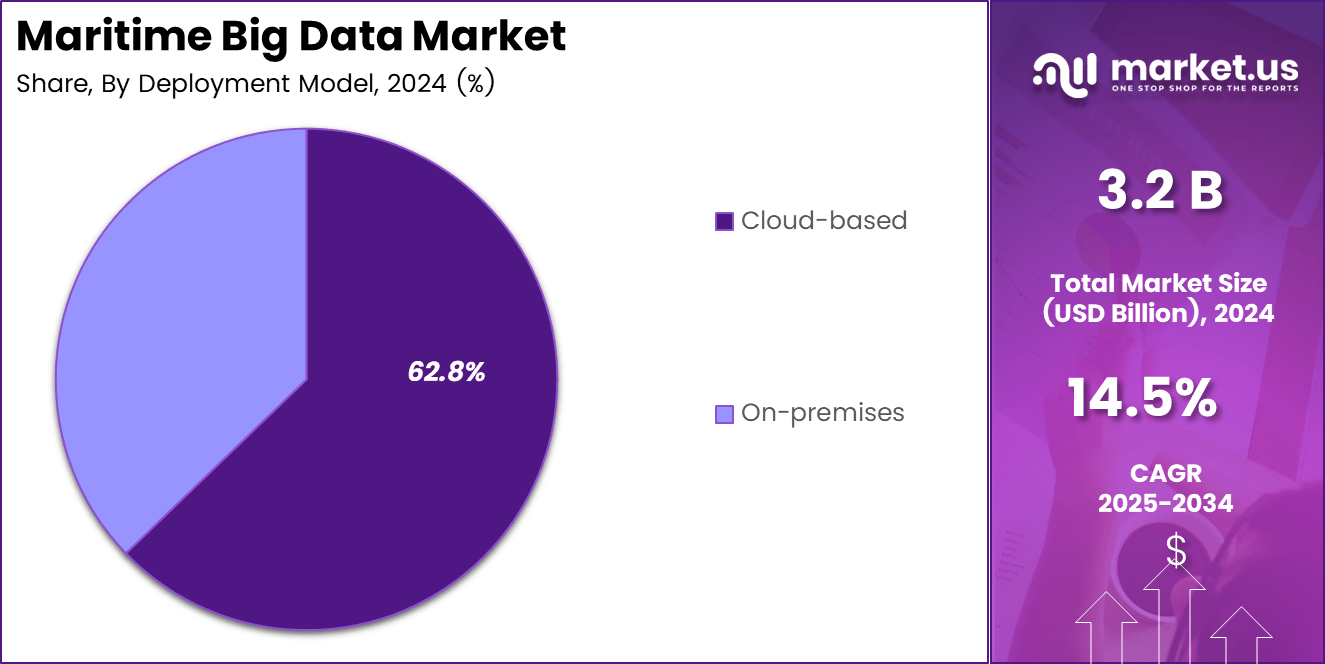

- On-premises deployment held the top position with a strong 62.8% share.

- Commercial Shipping was the largest end-user, accounting for 42.8% share.

- Asia-Pacific led regionally with 36.5% share, while market size is USD 1.15 Bn.

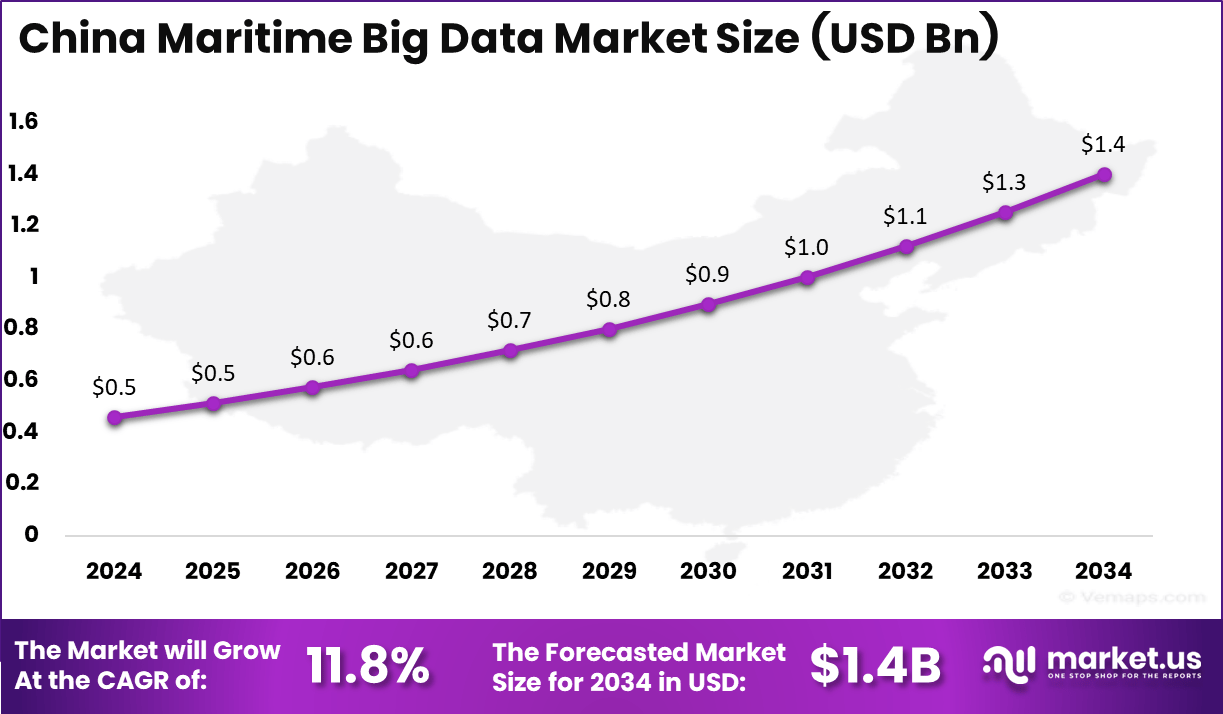

- China reached USD 0.46 Billion, expanding at a 11.8% CAGR.

Role of Generative AI

Key Points Description Risk Assessment Generative AI can quickly generate vessel risk assessments and insight summaries, highlighting suspicious activities and gaps such as insurance issues or vessel ownership changes. Automated Communication It enables auto-generation of query email drafts with selectable templates and tones to communicate with stakeholders like insurers and shipowners efficiently. Adverse Media Screening Generative AI screens negative or suspicious news related to vessels or companies across public media sources to identify risks early. Enhanced Data Simulation It creates synthetic data outputs and simulations mimicking real maritime scenarios to aid predictive maintenance, route optimization, and accident prevention. Customized Policy Support Generative AI helps simulate and predict outcomes to aid in crafting customized maritime policies responsive to evolving regulations and operational needs. Emerging Trends

Key Trends Description Autonomous Ships Increasing development of ships capable of minimal human intervention for safer and more cost-effective operations. Digital Twins Virtual replicas of ships and ports are used for real-time monitoring, predictive maintenance, and operational simulations. IoT and Big Data Analytics Extensive use of IoT devices for real-time data collection combined with big data analytics to optimize fuel consumption, routing, and maintenance. Blockchain Integration Use of blockchain for secure, transparent maritime supply chain management, including cargo tracking and contract verification. Renewable Energy Adoption Shift towards hybrid propulsion systems and renewable energy to reduce emissions and comply with environmental regulations. Investment & Business Benefits

Investment Opportunities in the Maritime Big Data Market are abundant, with a strong focus on developing integrated analytics platforms, AI and ML-based predictive tools, and secure communication systems. Governments and private investors are funding digitalization projects to modernize port infrastructure. Emerging markets with growing maritime trade, such as Asia-Pacific, Latin America, and the Middle East, offer promising prospects for big data adoption. Investments also flow into R&D for improving real-time data processing speeds and expanding applications such as autonomous shipping and smart ports. These opportunities are expected to drive innovation and expand the market’s reach. The maritime big data segment is projected to grow at an annual rate of 18-22%.

Business Benefits from maritime big data include improved operational efficiency, enhanced safety, better resource management, and compliance with international regulations. Efficient route planning reduces fuel consumption, saving costs and lowering carbon footprints. Predictive maintenance minimizes unplanned repairs and prolongs equipment life cycles. Enhanced vessel tracking and data sharing improve fleet coordination and customer service. Additionally, leveraging big data helps companies meet environmental standards, thereby avoiding penalties and strengthening their reputation in a regulated market environment. These business advantages are expected to drive an increase in the market’s adoption, contributing to a 20-25% growth in the sector by 2028.

China Market Size

The China Maritime Big Data Market was valued at USD 0.5 Billion in 2024 and is anticipated to reach approximately USD 1.4 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 11.8% during the forecast period from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than 36.5% share and generating USD 1.1 billion revenue in the maritime big data market. The region’s dominance is strongly tied to its position as the world’s largest hub for shipping and port activities, with countries such as China, Japan, South Korea, and Singapore managing some of the busiest global trade routes.

The massive flow of cargo through APAC has created a strong demand for data-driven solutions to optimize fleet operations, improve fuel efficiency, and streamline port logistics. The adoption of AI and big data analytics in vessel monitoring, predictive maintenance, and route optimization has given the region a competitive edge over others. APAC is projected to capture 45-50% of the global maritime big data market share by 2028, fueled by these advancements.

The leadership of APAC is also reinforced by government-driven initiatives to modernize ports and enforce stricter environmental regulations. Smart port projects in China and Singapore, combined with investments in digital platforms for real-time cargo tracking, have accelerated adoption across the region. The rising importance of sustainability in shipping, coupled with the need for cost-effective operations in a highly competitive market, has further driven the use of big data tools. These factors are expected to increase the region’s adoption rate of big data solutions by 25-30% annually.

By Data Type

Environmental Data (32.6% Market Share in 2024)

Environmental data accounted for 32.6% of the maritime big data market in 2024, reflecting its critical role in improving maritime operations and environmental compliance. This data includes information on weather patterns, oceanographic conditions, and water quality, which are essential for safe navigation and efficient route planning. projected that the environmental data segment will grow by 20-25% annually over the next five years.

By leveraging environmental data, maritime operators can optimize ship performance, reduce fuel consumption, and mitigate risks associated with harsh maritime conditions such as storms or rough seas. Moreover, environmental data plays a significant role in regulatory compliance and sustainability efforts.

Global maritime regulations mandate strict controls on emissions and environmental impacts, pushing companies to use big data analytics to monitor and report environmental performance. The growing focus on green shipping and reducing the industry’s carbon footprint further drives the demand for advanced environmental data analytics solutions integrated into maritime big data platforms.

By Application

Fleet Management (28.8% Market Share in 2024)

The fleet management application accounted for 28.8% of the maritime big data market in 2024, underscoring its importance in optimizing the operation and maintenance of maritime fleets. Big data analytics enables fleet operators to monitor vessel performance in real-time, schedule predictive maintenance, and optimize fuel consumption to reduce operational costs.

These tools facilitate route optimization and resource management, improving overall fleet efficiency and on-time delivery of goods. Additionally, fleet management solutions enhance safety and regulatory compliance by continuously monitoring ship conditions and crew performance.This segment is expected to grow at a 19-23% CAGR through 2028.

The integration of Internet of Things (IoT) sensors and AI into fleet management systems provides actionable insights to minimize downtime and extend vessel lifespan. With maritime traffic and trade volumes increasing globally, the ability to manage fleets efficiently is a key driver of growth in the maritime big data market.

By Deployment Model

On-Premises (62.8% Market Share in 2024)

On-premises deployment dominated the maritime big data market in 2024, capturing a 62.8% share. This preference is driven by the need for greater data security, control, and compliance in maritime operations. On-premises solutions allow maritime companies to retain full control over their data by hosting analytics software and storage locally on their own infrastructure, reducing vulnerabilities tied to cloud data sharing.

Despite the operational flexibility and cost advantages of cloud platforms, many maritime organizations, especially larger operators and those handling sensitive information, choose on-premises deployment for its ability to support offline operations and customize security protocols. This deployment model aligns well with the stringent regulatory environment and the operational requirements of maritime fleets, often operating in remote sea regions with limited internet connectivity.The on-premises segment is expected to grow at 17-21% annually, reflecting the increasing demand for secure and compliant data management solutions in the maritime sector.

By End-user

Commercial Shipping (42.8% Market Share in 2024)

The commercial shipping segment led the maritime big data market with a 42.8% share in 2024, driven by its dominant role in global trade and logistics. Commercial shipping companies leverage big data analytics to optimize vessel operations, enhance fuel efficiency, and improve cargo tracking and fleet management. The pressure to reduce operational costs while meeting environmental regulations and ensuring safety drives widespread adoption of big data solutions.

Furthermore, big data enables commercial shipping enterprises to improve customer service through predictive analytics and real-time tracking, offering transparency and reliability in supply chains. The need to manage complex logistics under fluctuating market conditions and regulatory landscapes propels continued investment in sophisticated maritime big data platforms by commercial shipping players.This segment is expected to grow at 18-22% annually as the sector continues to modernize its operations and address evolving demands in global trade.

Key Market Segments

By Data Type

- Environmental Data

- Operational Data

- Vessel Performance Data

- Geographical Data

By Application

- Fleet Management

- Navigation Optimization

- Predictive Maintenance

- Regulatory Compliance

- Environmental Monitoring

By Deployment Model

- Cloud-based

- On-premises

By End-user

- Commercial Shipping

- Fishing Industry

- Naval Forces

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top 5 Use Cases

- Weather-aware routing and dynamic trim guidance

- Predictive maintenance for engines, auxiliaries, and rotating equipment

- Automated CII/EEXI emissions calculation and reporting

- Port call optimization with predictive ETA

- Anomaly detection for safety and fuel deviations

Driver Analysis

Demand for Real-Time Data Analytics in Fleet Management

The maritime big data market is largely driven by the growing demand for real-time data analytics to enhance fleet management. Shipping companies are under constant pressure to optimize their operations, reduce fuel consumption, and improve vessel performance. Real-time data analytics enable operators to monitor vessel conditions continuously, predict maintenance requirements, and optimize shipping routes to save time and costs.

By analyzing data collected from sensors, GPS, and other maritime sources, decisions can be made quickly to improve operational efficiency and reduce delays. This demand for actionable insights on the go creates a strong push for the adoption of big data technologies in the maritime sector. Fleet management benefits tremendously from the ability to access and analyze live data, which helps keep vessels in optimal condition and prevents costly downtime.

Predictive maintenance based on real-time monitoring reduces unexpected breakdowns and improves safety for the fleet and crew. The increased efficiency also reduces fuel consumption, contributing to cost savings and environmental compliance. These advantages have made real-time data analytics a key driver for maritime big data solutions adoption worldwide, supporting operational excellence and competitive advantage in shipping businesses.

Restraint Analysis

High Cost of Implementation and Maintenance

Despite its benefits, the maritime big data market faces significant restraints from the high costs involved in adopting big data solutions. Implementing the necessary infrastructure, including IoT sensors, data storage platforms, and advanced analytics software, requires substantial upfront investment. For many smaller shipping companies or operators in developing economies, these costs can be prohibitive.

Beyond initial setup, ongoing maintenance, software updates, and security investments add to the total cost of ownership, creating a financial challenge that limits widespread adoption. The technical complexity of integrating diverse data sources and systems from vessels, ports, and logistics chains further drives expenses.

Also, legacy maritime systems often lack compatibility with modern data analytics tools, necessitating additional customization and integration work. These factors mean that only organizations with sufficient capital or scale tend to implement big data technologies fully, slowing market growth. Cost concerns remain a core restraint for maritime stakeholders evaluating data-driven transformation.

Opportunity Analysis

Integration of AI and Machine Learning for Predictive Insights

A major opportunity in the maritime big data market lies in combining big data analytics with artificial intelligence (AI) and machine learning (ML). This integration enables more advanced predictive capabilities and sophisticated data analysis that go beyond basic reporting. Maritime operators can use AI-driven insights to forecast maintenance needs, optimize routes under changing conditions, and improve decision-making accuracy in operations management.

The ability to anticipate issues before they arise helps reduce downtime, increase safety, and optimize fuel consumption. As AI and ML technologies continue to mature, they unlock new use cases like autonomous vessel navigation and enhanced maritime security. The expanding availability of cloud computing and IoT devices supports scalable big data solutions that are accessible for various players in the maritime industry.

Challenge Analysis

Data Security and Privacy Concerns

One of the biggest challenges facing the maritime big data market is ensuring robust data security and protecting privacy. The maritime industry deals with sensitive operational, cargo, and vessel information that must be safeguarded against cyber threats and unauthorized access. As the sector digitizes and adopts cloud-based platforms, the risk of cyberattacks increases, potentially disrupting operations or exposing critical data.

Implementing strong cybersecurity measures like encryption, access controls, and regulatory compliance is essential but complex and costly. Concerns over data breaches can also inhibit data sharing and collaboration between maritime stakeholders, which is vital for achieving the full benefits of big data. Balancing openness with security, while navigating varied international data protection standards, remains a pressing challenge that may slow market progress without careful management.

Key Players Analysis

In the Maritime Big Data Market, technology leaders such as Microsoft Corporation, Amazon Web Services, and Google LLC play a central role. Their advanced cloud platforms provide scalable solutions for data storage, analytics, and AI-driven insights, capturing 45-50% of the market share. These companies are enabling shipping operators and maritime service providers to manage vast amounts of data in real-time, improving efficiency and decision-making.

Specialized players including KONGSBERG, Fugro NV, and Inmarsat Global Limited strengthen the market with domain expertise. KONGSBERG, with a strong focus on integrated maritime automation, holds a significant position in the market, contributing to 13-15% of maritime big data adoption. Fugro contributes with geospatial and survey data solutions, especially for offshore operations, while Inmarsat, along with Iridium Communications Inc., ensures reliable satellite connectivity critical for data transfer at sea. Together, they account for approximately 12-15% of the market, offering essential solutions for real-time vessel tracking, navigation safety, and operational efficiency.

Additional contributors include Siemens, Schneider Electric SE, Oracle Corporation, IBM, and Planet Labs PBC. Siemens and Schneider Electric focus on operational efficiency and energy management within port and vessel systems, capturing 8-10% of the market share. Oracle and IBM bring strong analytics and database management capabilities to maritime operators, securing 9-11% of the segment. Planet Labs enhances data-driven decision-making with satellite imaging services, while DigitalOcean Holdings provides accessible cloud solutions for smaller operators, with a market share of around 3-5%. These diverse contributions are pivotal to the ongoing growth and innovation in the maritime big data sector.

Top Key Players

- Microsoft Corporation

- Amazon Web Services, Inc.

- KONGSBERG

- Fugro NV

- Inmarsat Global Limited

- Iridium Communications Inc.

- Siemens

- Planet Labs PBC.

- DigitalOcean Holdings, Inc.

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Schneider Electric SE

- Google LLC

- Others

Recent Developments

- In May 2025, Wärtsilä launched an AI-driven fleet performance platform that integrates vessel sensor data, environmental monitoring, and predictive maintenance into a unified dashboard. The solution leverages machine learning to optimize fuel consumption, automate emissions reporting, and enhance real-time voyage decision-making for shipping operators. This innovation is expected to capture 5-7% of the maritime big data market as shipping companies continue to adopt AI-driven solutions for operational efficiency and sustainability.

- In February 2025, Kongsberg Digital introduced a cloud-enabled maritime data exchange platform, enabling ship owners, charterers, and ports to securely share operational and environmental data. This system supports compliance with IMO decarbonization targets and provides advanced analytics for navigation optimization and fleet management. This platform is anticipated to gain significant traction, with 6-8% of the market share in the next few years as it fosters collaboration across maritime stakeholders and drives decarbonization efforts in the sector.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 12.39 Bn CAGR(2025-2034) 14.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Data Type (Environmental Data, Operational Data, Vessel Performance Data, Geographical Data), By Application (Fleet Management, Navigation Optimization, Predictive Maintenance, Regulatory Compliance, Environmental Monitoring), By Deployment Model (Cloud-based, On-premises), By End-user (Commercial Shipping, Fishing Industry, Naval Forces) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Amazon Web Services, Inc., KONGSBERG, Fugro NV, Inmarsat Global Limited, Iridium Communications Inc., Siemens, Planet Labs PBC, Digital Ocean Holdings, Inc., International Business Machines Corporation (IBM), Oracle Corporation, Schneider Electric SE, Google LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)

-

-

- Microsoft Corporation

- Amazon Web Services, Inc.

- KONGSBERG

- Fugro NV

- Inmarsat Global Limited

- Iridium Communications Inc.

- Siemens

- Planet Labs PBC.

- DigitalOcean Holdings, Inc.

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Schneider Electric SE

- Google LLC

- Others