Global Marine Software Management Market Size, Share Analaysis Report By Component (Software (Tracking & Monitoring, Navigation & Routing, Supply Chain & Logistics, Finance & Accounting, System Testing, Others), Services (Implementation & Integration, Consulting & Training Services, Support & Maintenance Services)), By Deployment (Cloud, On-premises), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Location (Onboard, Onshore), By Application (Crew Management, Port Management, Harbor Management, Reserve Management, Cruise & Yacht Management, Others), By End-use (Commercial, Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154298

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- U.S. Market Revenue Scope

- Emerging Trends

- Growth Factors

- By Component Analysis

- By Deployment Analysis

- By Organization Size Analysis

- By Location Analysis

- By Application Analysis

- By End-Use Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

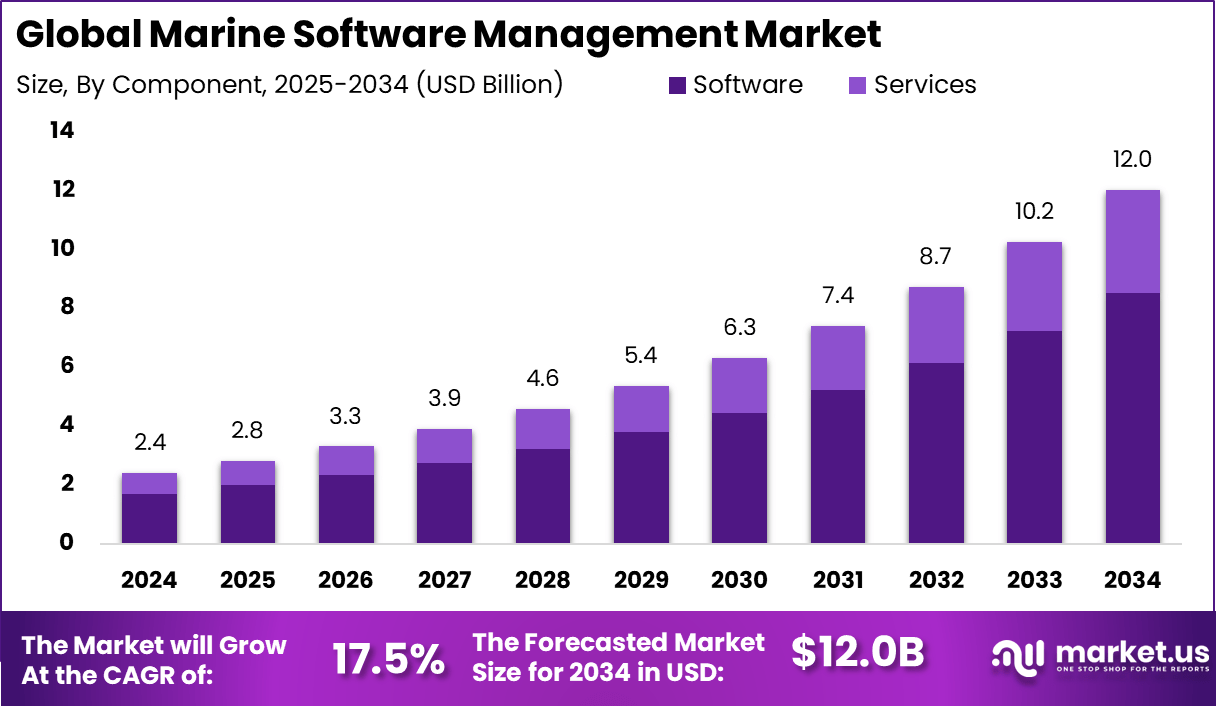

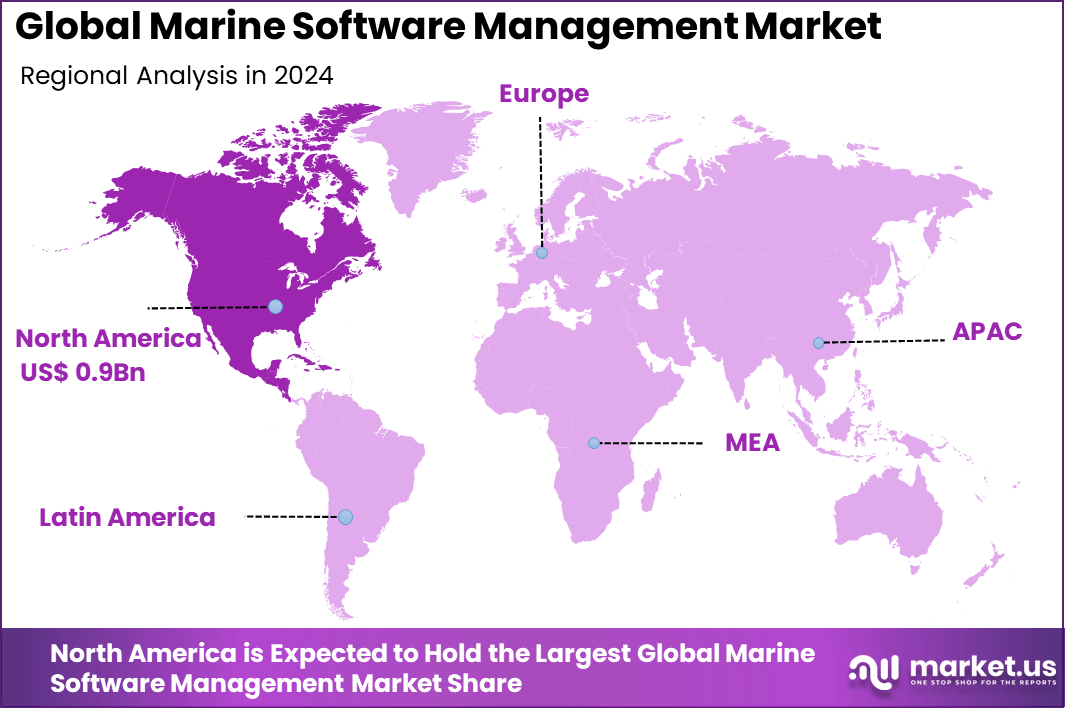

The Global Marine Software Management Market size is expected to be worth around USD 12 Billion By 2034, from USD 2.4 billion in 2024, growing at a CAGR of 17.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.5% share, holding USD 0.9 Billion revenue.

The Marine Software Management Market refers to the suite of digital platforms and integrated solutions deployed in maritime operations to manage fleet logistics, environmental compliance, crew administration, navigation and routing, maintenance, and financial tracking. These systems enable real‑time data aggregation from vessel sensors, supply chain networks, port terminals, and regulatory frameworks to support decision‐making and operational coordination across onboard and onshore systems.

The Top Driving Factors are the increasing complexity of global maritime operations and the demand for optimized supply chain efficiency. Growth in global trade volume and fleet sizes motivates operators to adopt centralized digital systems that reduce inefficiencies and administrative burdens. Simultaneously, tightening environmental and safety regulations at the international and regional level require more robust monitoring and compliance capabilities.

Market Size and Growth

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 12 Bn CAGR(2025-2034) 17.5% Leading Segment Software: 70.7% Largest Market North America [38.5% Market Share] Largest Country U.S. [USD 0.72 Billion], CAGR: 15.2% Demand for marine software management is strongest in regions with advanced maritime infrastructure, particularly North America and Europe, followed by rapid growth in Asia Pacific. Commercial shipping, port logistics, naval operations, cruise ships and inland waterway services are major adopters due to their need for centralized data, route planning, emissions monitoring and crew management.

Investment opportunities in this sector abound, particularly for businesses developing software that caters to eco-friendly maritime solutions, cybersecurity, and scalable, cloud-based platforms. R&D efforts channeled into AI-powered analytics, autonomous vessels, and robust compliance modules are especially promising. Both start-ups and tech providers can benefit from rising opportunities in emerging markets modernizing ports and fleets.

Key Insight Summary

- The global marine software management market is expected to grow from USD 2.4 billion in 2024 to around USD 12 billion by 2034, expanding at a strong CAGR of 17.5% during the forecast period.

- Software solutions dominate the component segment with a 70.7% share, driven by increased digitalization across marine operations and the need for integrated management platforms.

- The on-premises deployment model leads with 58.5%, reflecting a preference among shipping companies for locally managed, secure, and customized software environments.

- Large enterprises contribute 65.9% of the market share, as these organizations typically manage complex fleets requiring robust software for efficiency, compliance, and real-time operations.

- Based on location, onboard software holds 55.4% share, signifying rising demand for ship-based systems that enable real-time monitoring, route optimization, and crew coordination.

- Crew management is the top application area, accounting for 34.7%, as companies focus on automating scheduling, compliance, safety, and training processes to improve productivity.

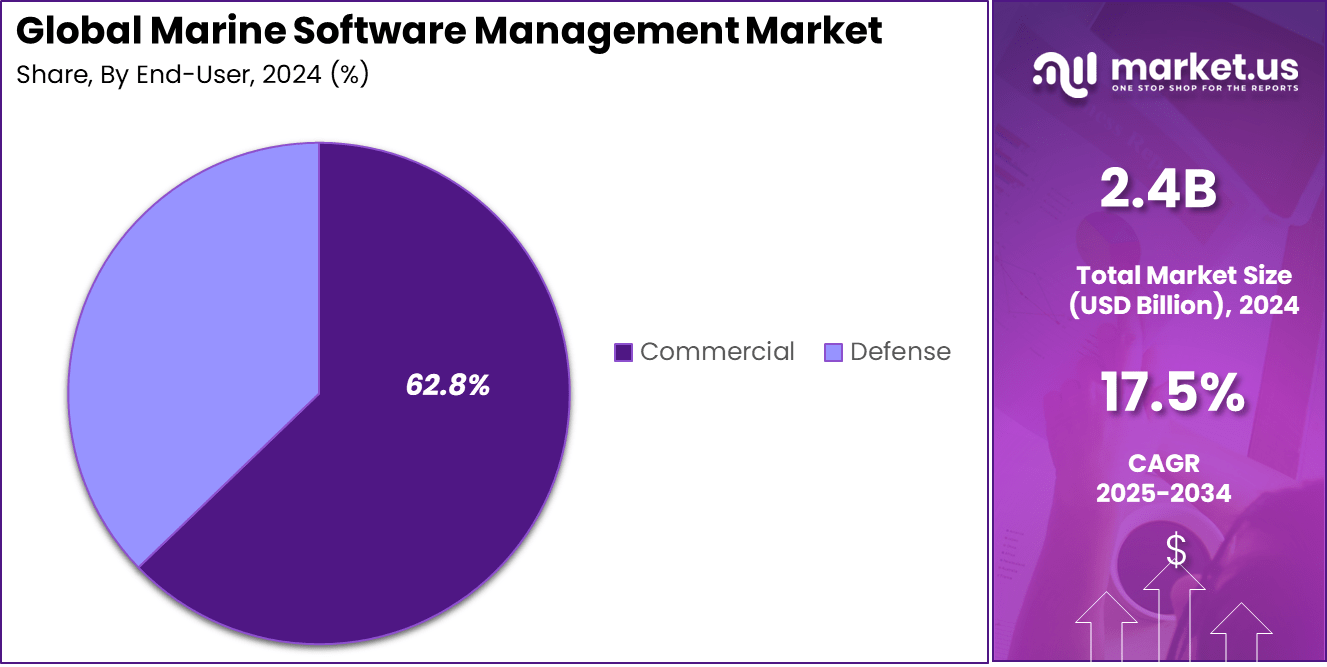

- The commercial end-use segment holds 62.8%, with commercial fleets adopting software to streamline operations, reduce costs, and meet regulatory standards.

- North America captured 38.5% of the global market in 2024, with total revenue reaching USD 0.9 billion, reflecting strong adoption across developed shipping infrastructure.

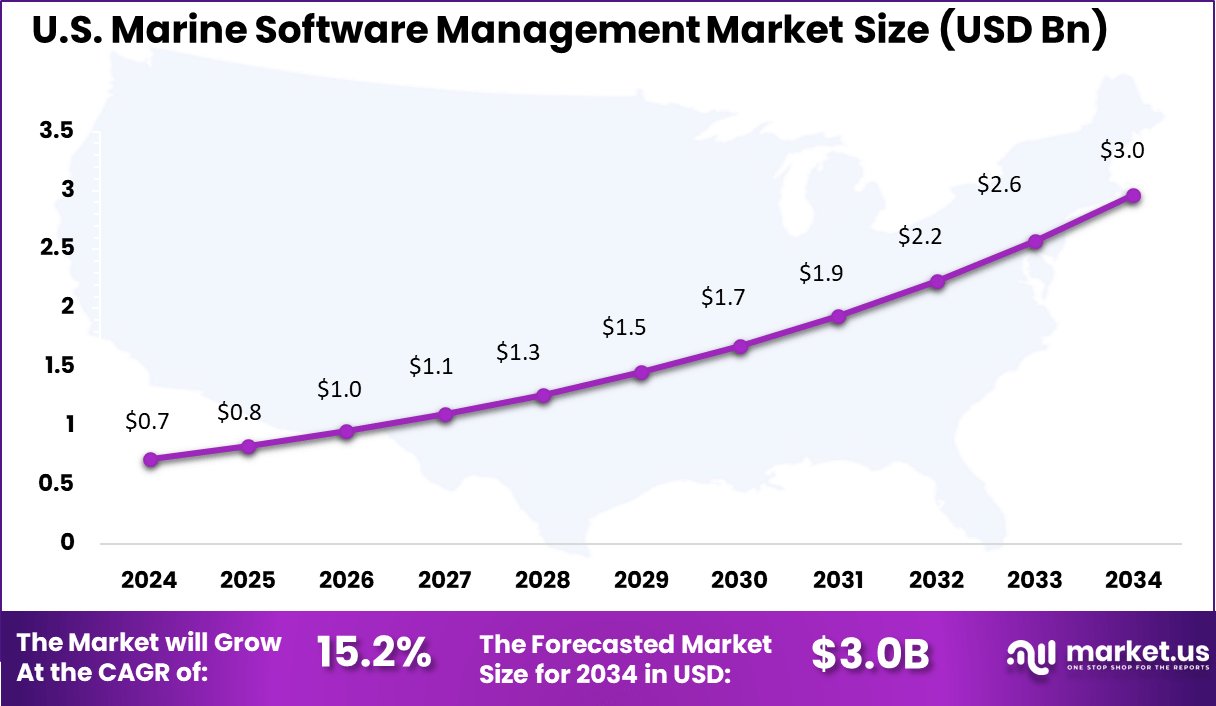

- Within the region, the US market reached USD 0.72 billion, and is projected to grow at a robust CAGR of 15.2%, supported by advancements in marine logistics, cybersecurity, and fleet automation.

U.S. Market Revenue Scope

The U.S. Marine Software Management Market was valued at USD 0.7 Billion in 2024 and is anticipated to reach approximately USD 3.0 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 15.2% during the forecast period from 2025 to 2034.

The country’s leadership in the Marine Software Management Market can be attributed to its advanced naval infrastructure, early adoption of digital maritime solutions, and strong defense and commercial fleet modernization programs.

The U.S. Navy and Coast Guard have aggressively implemented digital platforms for asset management, route optimization, predictive maintenance, and regulatory compliance, creating consistent demand for software solutions across operational and administrative domains.

In 2024, North America held a dominant market position in the Marine Software Management Market, capturing more than a 38.5% share and generating approximately USD 0.9 billion in revenue. This leadership can be attributed to the region’s strong focus on maritime digitalization, driven by stringent compliance requirements from U.S. agencies like the Coast Guard, NOAA, and MARAD.

Commercial shipping operators across the U.S. and Canada have been increasingly investing in voyage optimization, predictive maintenance, and cybersecurity systems to improve efficiency and reduce costs. The presence of major software developers and maritime solution providers in this region has further supported widespread adoption across both coastal and inland fleets.

North America’s dominance is also supported by high investment in smart ports and autonomous ship trials. U.S. ports, including Los Angeles, Houston, and New York, have adopted digital platforms for traffic scheduling, emissions tracking, and cargo visibility. Naval defense modernization projects are also pushing the adoption of intelligent fleet management systems, adding another growth layer.

Emerging Trends

Key Trend Description AI & IoT Integration AI and IoT enhance predictive maintenance, real-time tracking, and data-driven decision-making for fleet and logistics operations. Cloud-Based & Remote Monitoring Migration to cloud platforms and remote management tools offer scalability, flexibility, lower costs, and ease of upgrades. Blockchain & Smart Contracts Use of blockchain and smart contracts for secure, transparent, and automated transactions and logistics tracking. Autonomous & Automated Vessels Software supports autonomous vessel operations and unmanned fleet management, improving safety and reducing labor costs. Smart Port & Digitalization Initiatives Investments in smart port modernization, automation, and digital platforms fuel demand for integrated marine management software. Growth Factors

Key Factor Description Rise in Global Maritime Trade Expansion of international trade and growing fleet sizes drive demand for efficient vessel and supply chain management software. Regulatory Compliance & Environmental Standards Stricter environmental regulations (e.g., IMO 2020, MARPOL) require software for emission monitoring, reporting, and regulatory tracking. Digital Transformation & Technological Advancements Adoption of AI, IoT, big data analytics, and cloud solutions improves operational efficiency, predictive maintenance, and real-time monitoring. Demand for Operational Efficiency & Cost Savings Need for route optimization, fuel savings, cargo tracking, and streamlined logistics increases reliance on centralized software solutions. Focus on Cybersecurity As maritime operations digitize, robust security features in software are necessary to manage cyber threats and ensure regulatory compliance. By Component Analysis

In 2024, the Software segment accounted for 70.7% of the Marine Software Management Market. The rising demand for digital maritime operations and real-time analytics has driven strong adoption of software solutions across the industry. From voyage planning to compliance tracking, software platforms now offer integrated functionalities that support fuel efficiency, safety protocols, maintenance forecasting, and performance optimization.

As maritime operations become increasingly data-driven, software systems are central to enabling automation, reducing human error, and supporting decision-making. Their ability to integrate with vessel sensors and other digital tools has further strengthened their role in operational efficiency.

By Deployment Analysis

The On-Premises deployment model led the market with 58.5% share in 2024. Many maritime organizations prefer on-premises solutions due to concerns over data sovereignty, offline reliability, and strict cybersecurity requirements. Vessels operating in remote regions or with limited internet access benefit from locally hosted systems that ensure uninterrupted access and real-time control.

On-premises deployments are also favored for customization and internal infrastructure integration, particularly by larger operators managing sensitive operations. This model allows for greater control over software updates, security configurations, and data governance in regulated environments.

By Organization Size Analysis

In 2024, Large Enterprises dominated the market with a 65.9% share. These companies typically operate vast fleets or manage global shipping routes, requiring robust software systems to handle complex logistics, crew rotations, asset tracking, and regulatory compliance. Their greater financial resources allow for investment in advanced marine software platforms with features like predictive analytics, AI-powered insights, and cloud integration.

Additionally, large enterprises often face higher scrutiny in terms of international maritime regulations and environmental standards. As a result, they adopt sophisticated software tools to ensure operational transparency and regulatory alignment across their global operations.

By Location Analysis

Onboard systems led by holding 55.4% of the market share in 2024. Shipboard operations rely heavily on software that can function in real-time to support navigation, safety, crew communication, and equipment monitoring. Onboard solutions are essential for optimizing voyage execution, minimizing fuel consumption, and ensuring compliance with maritime laws while at sea.

These systems are designed to work offline or in hybrid mode, syncing with onshore databases when connectivity permits. The growing emphasis on autonomous and semi-autonomous ships has further driven the development and adoption of onboard software platforms.

By Application Analysis

In 2024, Crew Management emerged as the leading application, contributing 34.7% to the overall market. Managing a global, rotating workforce across vessels requires precise scheduling, certification tracking, payroll management, and health monitoring. Software solutions designed for crew management streamline these functions, improving compliance with international labor laws and boosting operational continuity.

Crew welfare, especially post-pandemic, has gained attention, leading operators to invest in tools that enhance onboard working conditions. These systems also help ensure the right personnel are assigned based on skill, certification, and operational requirements, reducing downtime and improving safety.

By End-Use Analysis

In 2024, the Commercial segment held a dominant 62.8% share, driven by widespread adoption across cargo shipping, logistics, offshore services, and passenger transportation. These sectors require highly coordinated operations, documentation, and real-time decision-making, all of which are enabled by advanced marine software systems.

With global trade expanding and environmental compliance tightening, commercial fleet operators are prioritizing digital tools to improve fuel efficiency, reduce emissions, and enhance competitiveness. Their reliance on scalable, integrated software systems positions this segment as the largest consumer of marine software management solutions.

Key Market Segments

By Component

Software

- Tracking & Monitoring

- Navigation & Routing

- Supply Chain & Logistics

- Finance & Accounting

- System Testing

- Others

Services

- Implementation & Integration

- Consulting & Training Services

- Support & Maintenance Services

By Deployment

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Location

- Onboard

- Onshore

By Application

- Crew Management

- Port Management

- Harbor Management

- Reserve Management

- Cruise & Yacht Management

- Others

By End-use

- Commercial

- Defense

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Push for Operational Efficiency and Compliance

A major driver for adopting marine software management relates to the growing need for operational efficiency and strict regulatory compliance. As the maritime industry faces tougher international rules and heightened safety requirements, digital management platforms help operators keep up with schedules, reduce fuel consumption, and ensure alignment with environmental laws.

These software solutions streamline everything from tracking cargo and crew to automating compliance paperwork, allowing shipping firms to run smoother operations and avoid costly penalties while also enhancing sustainability.

Restraint

High Implementation and Integration Costs

Despite the benefits, one significant restraint is the high upfront and ongoing costs associated with implementing marine software. Smaller shipping companies, in particular, may struggle with expenses tied to software licensing, necessary hardware upgrades, installation, and integration with often outdated legacy systems.

Additionally, migration from traditional or paper-based management methods to advanced digital solutions can result in operational downtime and training demands, making it harder for smaller operators to justify or afford these investments.

Opportunity

Customization and Specialization

A promising opportunity lies in the creation of highly customizable and specialized marine software tailored to specific operational needs. The maritime sector covers a variety of activities – including cargo, passenger transport, port management, and cruise operations – each with its own requirements.

Demand is rising for solutions that are not one-size-fits-all but can be adapted and extended for unique workflows, compliance standards, and integration with other digital systems. This opens up a pathway for innovators and developers to offer bespoke platforms, increasing software adoption and operational value across the industry.

Challenge

Digital Skills Gaps and Change Management

A persistent challenge for effective marine software rollouts is the shortage of digital skills among crews and onshore staff. Many maritime professionals are more familiar with analog systems and manual processes, so transitioning to complex digital management tools can be daunting.

Without proper training and organizational support, companies risk underutilizing advanced features and not realizing the full return on their investment. Helping teams adapt to new technology, building confidence in digital workflows, and fostering a culture of continuous learning are all essential to overcoming resistance and ensuring successful adoption.

Key Player Analysis

In the Marine Software Management Market, several established companies are shaping the competitive landscape through innovation and digital integration. ABB and Oracle are widely recognized for offering end-to-end vessel and fleet management software that supports automation and predictive maintenance. Their platforms are often adopted by large shipping companies seeking operational transparency and cost optimization.

Meanwhile, Chetu Inc., Dockmaster, and Scribble Software Inc. have built strong reputations by serving niche segments such as marina operations, vessel inventory tracking, and accounting. These vendors offer customizable and modular solutions that cater to mid-sized enterprises. Their tools provide robust integrations with third-party applications and enhance user interface design for smoother workflows.

Smaller but rapidly evolving players like MARINA MASTER Ltd., Marine Cloud Ltd., MESPAS AG, TIMEZERO, and Lloyd’s Register Group Services Limited are investing heavily in user-centric design and mobile accessibility. These companies focus on delivering scalable platforms for voyage planning, compliance management, and maintenance scheduling. Their tools often incorporate weather analytics, IoT integration, and digital logbook functionalities.

Major players

- ABB

- Chetu Inc.

- Dockmaster

- Lloyd’s Register Group Services Limited.

- MARINA MASTER Ltd.

- Marine Cloud Ltd

- MESPAS AG

- Oracle

- Scribble Software Inc.

- TIMEZERO

- Others

Recent Developments

- April 2025: DockMaster announced upgrades to deliver a unified product platform, integrating boat sales, service, inventory, parts, and complete marina management into a single software suite. The platform scales from small marinas to large dealerships – this streamlining reduces complexity for businesses and improves operational efficiency across the board.

- July 2024: Chetu Inc. formed a services partnership with UKG, a leader in HR and workplace management solutions. This collaboration leverages Chetu’s custom software expertise with UKG’s AI-powered platforms, enhancing workplace and crew management for marine operators. Customers benefit from integrated, next-generation HR technology backed by over 24 years of Chetu’s industry experience.

- January 2024: ABB made headlines by acquiring DTN Shipping’s business in Europe and the Philippines. This move positioned ABB as a market leader in ship route optimization by expanding their capabilities in vessel routing software, analytics, and modeling. The deal added DTN’s weather routing solutions, bringing their total connected vessel count to over 5,000.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software (Tracking & Monitoring, Navigation & Routing, Supply Chain & Logistics, Finance & Accounting, System Testing, Others), Services (Implementation & Integration, Consulting & Training Services, Support & Maintenance Services)), By Deployment (Cloud, On-premises), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Location (Onboard, Onshore), By Application (Crew Management, Port Management, Harbor Management, Reserve Management, Cruise & Yacht Management, Others), By End-use (Commercial, Defense) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Chetu Inc., Dockmaster, Lloyd’s Register Group Services Limited, MARINA MASTER Ltd., Marine Cloud Ltd., MESPAS AG, Oracle, Scribble Software Inc., TIMEZERO, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Marine Software Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Marine Software Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Chetu Inc.

- Dockmaster

- Lloyd's Register Group Services Limited.

- MARINA MASTER Ltd.

- Marine Cloud Ltd

- MESPAS AG

- Oracle

- Scribble Software Inc.

- TIMEZERO

- Others