Global Marine Coatings Market By Coating Type(Antifouling Coatings, Anti-Corrosive Coatings, Topside Coatings, Specialty Coatings, Others), By Application(Container Ships, Ship Hulls, Offshore Platforms, Yachts, Commercial Vessels, Others), By Technology(Solvent-Based Coatings, Water-Based Coatings, Powder Coatings, Others), By End-Use(Shipping Industry, Offshore Oil and Gas Industry, Naval and Defense, Leisure Boating, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122691

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

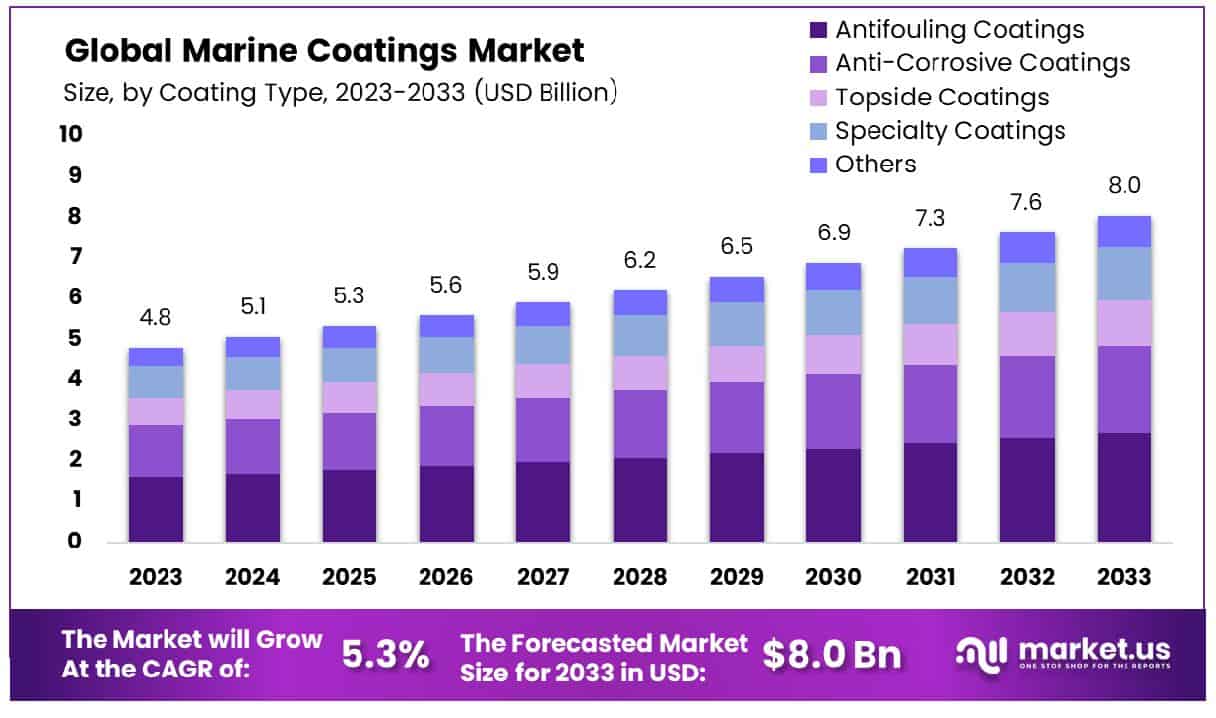

The Global Marine Coatings Market size is expected to be worth around USD 8.0 Billion by 2033, From USD 4.8 Billion by 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

The Marine Coatings Market comprises specialized products used to protect ships and offshore structures from harsh marine environments. These coatings serve critical functions, including corrosion resistance, fouling prevention, and enhanced durability, ensuring structural integrity and operational efficiency. They are crucial for extending the lifespan of maritime assets, reducing maintenance costs, and adhering to environmental regulations.

This market caters to a broad range of vessels, from commercial ships to private yachts, highlighting its integral role in global shipping efficiency and maritime safety. Key stakeholders, including shipbuilders, maintenance providers, and marine operators, rely on these innovations to optimize the longevity and performance of their fleets.

The Marine Coatings Market, as valued in 2022, stood at approximately $8.7 billion, indicating a robust sector with significant growth drivers. Dominating this market, anti-fouling or fouling release coatings represent about 64% of the overall market share, underscoring their critical role in marine applications.

These coatings are pivotal in reducing the substantial costs associated with vessel maintenance and improving operational efficiencies by mitigating the accumulation of organisms on the hull—a common issue that can lead to increased fuel consumption and operational inefficiencies.

Furthermore, the market also includes significant contributions from anti-corrosion and self-cleaning or self-polishing coatings. These product types further fortify the market’s capacity to meet diverse consumer demands, ranging from the longevity and durability of vessel surfaces to enhanced aesthetic and functional properties. The industry’s trajectory is shaped by these segments, which not only fulfill the immediate protective needs of marine vessels but also adhere to escalating regulatory demands for environmental compliance.

As ship operators increasingly favor coatings that offer longevity and are eco-friendly, the marine coatings market is expected to expand, driven by these aligned interests in economic and environmental sustainability.

Key Takeaways

- Market Growth: The Global Marine Coatings Market size is expected to be worth around USD 8.0 Billion by 2033, From USD 4.8 Billion by 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

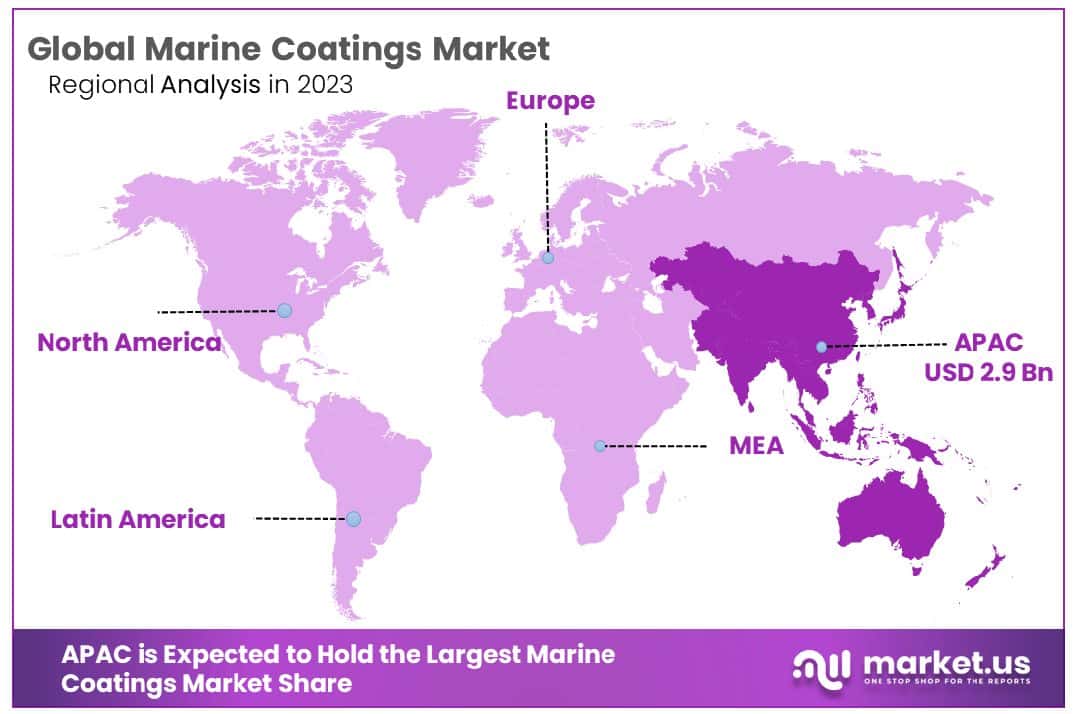

- Regional Dominance: Asia-Pacific dominates the Marine Coatings Market with a 61.5% share, valued at USD 2.9 billion.

- Segmentation Insights:

- By Coating Type: Antifouling Coatings dominate 33.5% of the market by coating type.

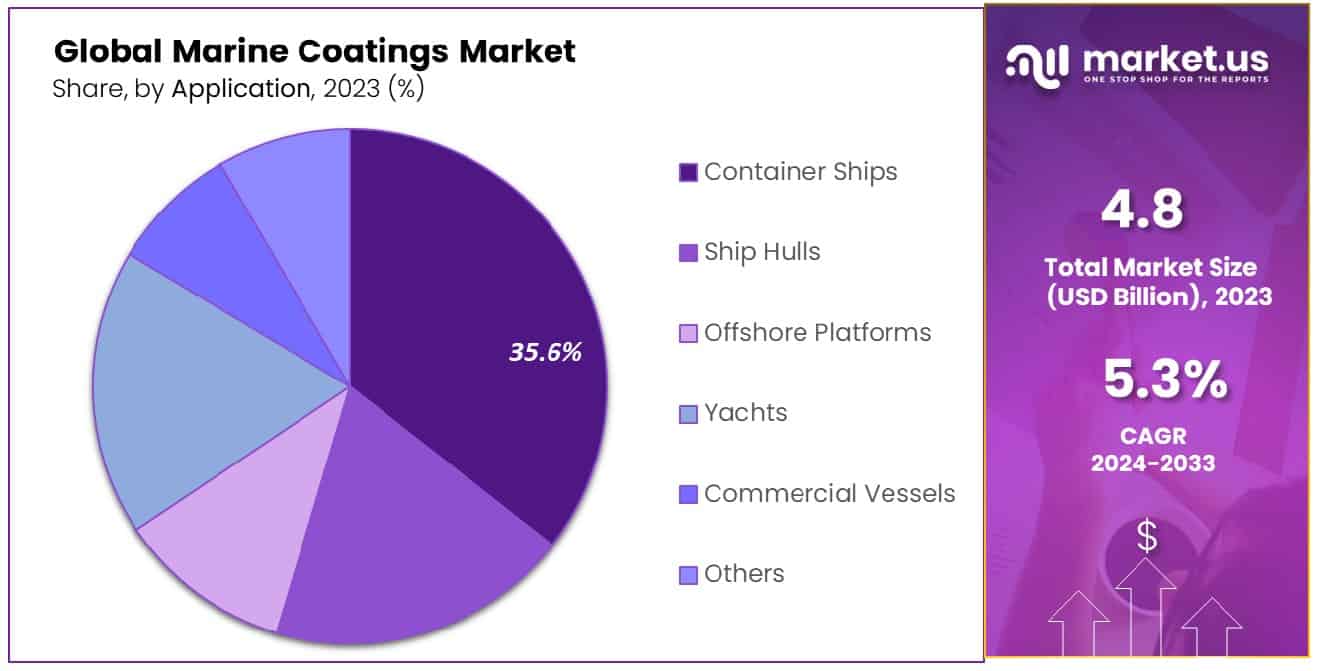

- By Application: Container Ships hold a 35.6% share by application in the sector.

- By Technology: Water-Based Coatings lead with 42.4% market share by technology.

- By End-Use: The Shipping Industry constitutes 45.6% of the market by end-use.

- Growth Opportunities: In 2023, the global marine coatings market sees opportunities to develop fuel-efficient coatings and expand into emerging markets to enhance sustainability and tap new customer bases.

Driving Factors

Increased Shipping Activities Due to Global Trade Growth

The Marine Coatings Market is significantly bolstered by the increase in global shipping activities, which is closely linked to the expansion of international trade. As global economies grow and trade routes expand, there is a heightened demand for marine vessels to transport goods.

This increase in maritime traffic directly translates to a greater need for marine coatings, which are essential for protecting ships against harsh marine environments and corrosion. This continuous growth in shipping activities ensures a robust demand for marine coatings, driving the market’s expansion and innovation in product offerings tailored to the shipping industry’s evolving needs.

Advances in Eco-Friendly Coatings Technology

Environmental sustainability has become a pivotal factor in the Marine Coatings Market. Advances in eco-friendly coatings technology are addressing increasing environmental regulations and the maritime industry’s growing commitment to reducing ecological footprints. The development of low-VOC, non-toxic, and biodegradable coatings has gained momentum, aligning with global mandates to mitigate marine pollution and enhance ship efficiency.

These technological innovations not only comply with stringent environmental standards but also offer superior resistance to fouling and corrosion, contributing to enhanced vessel longevity and fuel efficiency. Consequently, the demand for these advanced eco-friendly coatings is expected to surge, significantly driving market growth as industry stakeholders prioritize sustainability.

Expansion of Oil and Gas Exploration Activities

The expansion of oil and gas exploration activities has a consequential impact on the Marine Coatings Market. With the increasing exploration and production efforts in offshore oil fields, there is a pressing need for specialized marine coatings that can withstand the corrosive environment of saltwater and the harsh chemicals involved in these processes.

These activities necessitate the use of drilling rigs and support vessels that require durable protective coatings to maintain structural integrity and operational efficiency. The robust growth in this sector, propelled by the rising energy demands worldwide, ensures a steady demand for marine coatings, which are critical in safeguarding equipment and minimizing maintenance costs in the oil and gas industry.

Restraining Factors

Strict Environmental Regulations on VOC Emissions

The stringent regulations on volatile organic compounds (VOC) emissions present a significant restraining factor for the Marine Coatings Market. These regulations, aimed at reducing environmental pollution and promoting sustainability, require manufacturers to reformulate their products to comply with lower VOC limits. This shift demands substantial R&D investments to develop and test new, compliant formulations that maintain the performance standards required by the marine sealant industry.

While these regulations are intended to reduce the environmental impact of marine coatings, they also increase production costs and complexity for manufacturers. This can lead to higher prices for end-users and potentially slow down the adoption of new technologies in the short term. Despite these challenges, such regulations also drive innovation within the industry, pushing companies to develop more advanced, environmentally friendly coatings solutions that could eventually enhance market growth through differentiated products.

Fluctuations in Raw Material Prices

Fluctuations in raw material prices are another critical restraining factor for the Marine Coatings Market. The cost and availability of key components like resins, additives, and solvents directly influence the production costs of marine coatings. Volatile raw material prices can result from geopolitical tensions, trade policies, and economic instability, which pose significant challenges to maintaining consistent pricing and supply chain stability.

This volatility can deter investment in new product development and expansion initiatives, as manufacturers may face squeezed margins and uncertain returns on investment. However, this factor also encourages companies to explore alternative materials and innovative production techniques that could mitigate the impact of price fluctuations and enhance supply chain resilience, potentially leading to market growth in the long term through improved efficiency and cost-effectiveness.

By Coating Type Analysis

Antifouling coatings dominate the market, holding a significant 33.5% share by coating type.

In 2023, Antifouling Coatings held a dominant market position in the By Coating Type segment of the Marine Coatings Market, capturing more than a 33.5% share. This significant market penetration can be attributed to the critical need for vessels to maintain optimal performance and durability, which these coatings provide by preventing the accumulation of marine organisms that can lead to hull degradation and increased fuel consumption.

Following Antifouling Coatings, Anti-Corrosive Coatings also represented a substantial portion of the market. These coatings are essential for protecting metal components against harsh marine environments, thereby extending the service life of ships and offshore structures. Topside Coatings, which are used above the waterline to protect and beautify the ship, accounted for the next largest share. Their importance is underscored by their dual function of aesthetics and protection against environmental elements.

Specialty Coatings, which include coatings designed for specific functionalities such as heat resistance and reduced friction, also held a notable share of the market. These products are increasingly sought after for their ability to address unique challenges in marine environments, such as ice accumulation and UV exposure.

The remaining market share was captured by other types of marine coatings, which include a variety of niche products tailored to specific applications and environmental regulations. The diversity within this category highlights the ongoing innovation and specialization within the marine coatings industry as manufacturers strive to meet the evolving demands of maritime operators and regulatory bodies.

By Application Analysis

Container ships lead in applications, comprising 35.6% of the total market segment.

In 2023, Container Ships held a dominant market position in the By Application segment of the Marine Coatings Market, capturing more than a 35.6% share. This leadership stems largely from the global expansion in trade and the corresponding need for durable and efficient shipping solutions. Container ships, which are critical in the transcontinental transport of goods, require robust coatings to minimize maintenance costs and maximize operational uptime.

Following Container Ships, Ship Hulls accounted for the next significant market share. The coating of ship hulls is pivotal in ensuring longevity and efficiency in maritime operations. These coatings are designed to prevent fouling and corrosion, which can severely impair a vessel’s performance and safety.

Offshore Platforms also represented a substantial portion of the market. The unique challenges posed by the marine and atmospheric conditions at sea make specialized coatings essential for protecting these structures, which are crucial for the global oil and gas industry.

Yachts and Commercial Vessels together contribute notably to the market. Yachts require high-quality finishes to maintain aesthetic value and surface integrity, whereas commercial vessels need durable coatings for protection against harsh marine conditions and heavy usage.

The remaining market share was captured by other applications, including specialized marine equipment and smaller vessels. This segment benefits from the development of advanced coatings that offer enhanced protection against extreme environments and more stringent environmental regulations.

By Technology Analysis

Water-based coatings are preferred, representing 42.4% of the market by technology.

In 2023, Water-Based Coatings held a dominant market position in the By Technology segment of the Marine Coatings Market, capturing more than a 42.4% share. This dominance is largely attributed to increasing environmental regulations and the rising demand for sustainable and safer coating solutions. Water-based coatings, recognized for their low volatile organic compound (VOC) emissions, have become the preferred choice in marine applications, aligning with global sustainability goals.

Solvent-Based Coatings, although traditionally favored for their durability and resistance to harsh marine environments, followed with a significant share. However, their market dominance is gradually declining due to stringent environmental regulations and growing health concerns associated with VOC emissions.

Powder Coatings accounted for the next largest market share. These coatings are valued for their robustness, cost-effectiveness, and absence of VOCs, making them an appealing choice for parts and areas that demand high durability and resistance to extreme conditions.

The remaining market share was captured by other technologies, which include a variety of niche applications that require specialized solutions, such as UV-curable coatings and eco-friendly anti-fouling products. This segment highlights the innovation within the marine coatings industry as it adapts to technological advancements and tighter environmental constraints.

By End-Use Analysis

The shipping industry is the primary end-user, accounting for 45.6% of the market.

In 2023, the Shipping Industry held a dominant market position in the By End-Use segment of the Marine Coatings Market, capturing more than a 45.6% share. This preeminence is driven by the global increase in trade and shipping activities, which require extensive maintenance of vessels to ensure efficiency and durability in harsh maritime conditions. Marine coatings for the shipping industry are crucial for protecting ships against corrosion, fouling, and wear, which in turn facilitates reduced maintenance costs and extended service intervals.

The Offshore Oil and Gas Industry also commanded a substantial market share. Coatings in this sector are essential for safeguarding offshore platforms, rigs, and vessels against the corrosive marine environment, enhancing their operational life and safety.

Naval and Defense applications accounted for another significant portion of the market. In this sector, marine coatings are critical for the maintenance and longevity of naval fleets and defense vessels, which operate in some of the most challenging environments and require high-performance protection solutions.

Leisure Boating, reflecting a growing consumer interest in marine leisure activities, contributed notably to the market. The demand in this segment is fueled by the need for aesthetics along with protection, driving advancements in coating technologies that offer both durability and visual appeal.

The remainder of the market was captured by other applications, including specialized vessels and marine structures that require specific protective solutions tailored to unique operational requirements and environmental conditions.

Key Market Segments

By Coating Type

- Antifouling Coatings

- Anti-Corrosive Coatings

- Topside Coatings

- Specialty Coatings

- Others

By Application

- Container Ships

- Ship Hulls

- Offshore Platforms

- Yachts

- Commercial Vessels

- Others

By Technology

- Solvent-Based Coatings

- Water-Based Coatings

- Powder Coatings

- Others

By End-Use

- Shipping Industry

- Offshore Oil and Gas Industry

- Naval and Defense

- Leisure Boating

- Others

Growth Opportunities

Development of New Marine Coatings for Improved Fuel Efficiency

The marine coatings market is witnessing significant innovation, particularly with the development of coatings that enhance fuel efficiency. As environmental regulations become stricter and the demand for sustainable operations grows, marine operators are increasingly seeking solutions that can reduce fuel consumption and emissions.

The introduction of advanced coatings that minimize resistance in water, thus reducing fuel usage, represents a pivotal growth opportunity in 2023. These technological advancements not only align with global sustainability goals but also offer cost savings for marine operators, which can be a major selling point in competitive markets. Companies investing in research and development to create more efficient and eco-friendly coatings are likely to gain a competitive edge.

Expansion into Emerging Markets

Emerging markets present another substantial growth avenue for the global marine coatings market in 2023. Regions such as Southeast Asia, Africa, and Latin America are experiencing rapid growth in maritime activities due to increasing trade volumes and expanding port infrastructure. This expansion is driving the demand for marine coatings to protect and maintain ships and other maritime structures.

By entering these emerging markets, coating manufacturers can tap into new customer bases and benefit from the first-mover advantage. Strategic partnerships and local joint ventures might be particularly effective in overcoming entry barriers and establishing a strong foothold, which is crucial for long-term success in these regions.

Latest Trends

Adoption of Silicone-Based Fouling Release Coatings

The global marine coatings market is witnessing significant growth in the adoption of silicone-based fouling release coatings. This trend is driven by the coatings’ exceptional ability to reduce marine fouling, which is crucial for improving vessel performance and fuel efficiency. These silicone-based solutions offer a non-toxic alternative to traditional antifouling coatings by providing a slick surface that minimizes the adhesion of organisms without releasing harmful biocides into the marine environment.

As environmental regulations become stricter and the maritime industry’s focus on sustainability intensifies, the demand for silicone-based fouling release coatings is expected to surge. This shift is anticipated to enhance operational efficiencies and contribute to the broader adoption of eco-friendly practices within the sector.

Increased Use of Nanotechnology in Marine Coatings

Nanotechnology is revolutionizing the marine coatings market, offering unprecedented improvements in coating performance and durability. By integrating nano-sized particles into marine coatings, manufacturers are able to enhance properties such as corrosion resistance, UV protection, and antifouling capabilities. This technological advancement not only extends the lifespan of the coatings but also significantly reduces maintenance costs and downtime associated with recoating.

Furthermore, the use of nanotechnology in marine coatings aligns with the increasing demand for more robust and long-lasting protective solutions, particularly in harsh marine environments. As research and development in this area continue to advance, nanotechnology is poised to play a pivotal role in the future developments of marine coatings, driving the market towards more innovative and efficient solutions.

Regional Analysis

The Asia-Pacific Marine Coatings Market dominates with a 61.5% share, valued at USD 2.9 billion.

The Marine Coatings Market exhibits notable regional diversification, with significant developments across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

In North America, the market is driven by robust maritime activities and stringent environmental regulations that foster the adoption of eco-friendly coatings. Europe follows a similar trajectory with an emphasis on sustainability and innovation in ship repair and maintenance services.

Asia Pacific stands as the dominating region, holding 61.5% of the market share, valued at USD 2.9 billion. This supremacy is due to extensive shipbuilding activities in countries like China, South Korea, and Japan. The region benefits from low-cost labor, technological advancements, and substantial governmental support, positioning it as a central hub for the marine coatings industry.

In contrast, the Middle East & Africa region is experiencing gradual growth, spurred by increasing oil and gas exploration activities which necessitate enhanced marine coating solutions for corrosion protection.

Latin America, though smaller in scale, is seeing growth driven by the expansion of its shipping industry and port infrastructure development.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In the global Marine Coatings Market of 2023, AkzoNobel has solidified its position as a key player through its comprehensive range of high-performance coatings that cater to various marine applications, from cargo ships to luxury yachts. The company’s focus on sustainability has particularly resonated in the market, as it continues to innovate with eco-friendly solutions that meet stringent environmental standards without compromising on quality or performance.

AkzoNobel’s strategy includes the integration of advanced technologies into their coating systems, which enhances durability and fuel efficiency through improved hydrodynamics. This approach not only responds to the increasing regulatory pressures concerning VOC emissions and biocidal products but also aligns with the broader industry trends toward greater environmental responsibility.

Furthermore, AkzoNobel maintains a strong global distribution network, which ensures the availability of its products across major shipbuilding regions, including Asia-Pacific, Europe, and North America. This geographical spread is crucial in a sector where the location of manufacturing and maintenance facilities plays a significant role in vendor selection.

The company also benefits from its established brand reputation and a long track record of industry innovations, which continue to attract both new and loyal customers. Through ongoing investment in R&D, AkzoNobel is well-positioned to address future challenges in the marine sector, particularly in developing next-generation coatings that further reduce the environmental impact and enhance the operational efficiency of marine vessels.

Market Key Players

- AkzoNobel

- PPG Industries

- Hempel A/S

- Jotun

- Sherwin-Williams Company

- Nippon Paint Marine Coatings

- Chugoku Marine Paints

- Kansai Paint Co., Ltd.

- RPM International Inc.

- Boero Group

- KCC Corporation

- PPG Protective & Marine Coatings

- Axalta Coating Systems

- The Sherwin-Williams Company

- Jotun Group

Recent Development

- In June 2024, Nippon Paint Marine’s FASTAR coating won the Environmental Technology Award from JCIA for reducing fuel consumption and benefiting marine life. It features a hydrophilic-hydrophobic nano-domain structure and hydrogel water-trapping technology, cutting emissions and friction.

- In June 2024, PPG’s PPG SIGMAGLIDE® 2390, approved by RightShip, utilizes HYDRORESET™ technology for biocide-free silicone fouling release, achieving up to 150 days of idle performance with low-friction properties, supporting maritime sustainability.

Report Scope

Report Features Description Market Value (2023) USD 4.8 Billion Forecast Revenue (2033) USD 8.0 Billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Coating Type(Antifouling Coatings, Anti-Corrosive Coatings, Topside Coatings, Specialty Coatings, Others), By Application(Container Ships, Ship Hulls, Offshore Platforms, Yachts, Commercial Vessels, Others), By Technology(Solvent-Based Coatings, Water-Based Coatings, Powder Coatings, Others), By End-Use(Shipping Industry, Offshore Oil and Gas Industry, Naval and Defense, Leisure Boating, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AkzoNobel, PPG Industries, Hempel A/S, Jotun, Sherwin-Williams Company, Nippon Paint Marine Coatings, Chugoku Marine Paints, Kansai Paint Co., Ltd., RPM International Inc., Boero Group, KCC Corporation, PPG Protective & Marine Coatings, Axalta Coating Systems, The Sherwin-Williams Company, Jotun Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Marine Coatings Market Size in 2023?The Global Marine Coatings Market Size is USD 4.8 Billion in 2023.

What is the projected CAGR at which the Global Marine Coatings Market is expected to grow at?The Global Marine Coatings Market is expected to grow at a CAGR of 5.3% (2024-2033).

List the segments encompassed in this report on the Global Marine Coatings Market?Market.US has segmented the Global Marine Coatings Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Coating Type(Antifouling Coatings, Anti-Corrosive Coatings, Topside Coatings, Specialty Coatings, Others), By Application(Container Ships, Ship Hulls, Offshore Platforms, Yachts, Commercial Vessels, Others), By Technology(Solvent-Based Coatings, Water-Based Coatings, Powder Coatings, Others), By End-Use(Shipping Industry, Offshore Oil and Gas Industry, Naval and Defense, Leisure Boating, Others)

List the key industry players of the Global Marine Coatings Market?AkzoNobel, PPG Industries, Hempel A/S, Jotun, Sherwin-Williams Company, Nippon Paint Marine Coatings, Chugoku Marine Paints, Kansai Paint Co., Ltd., RPM International Inc., Boero Group, KCC Corporation, PPG Protective & Marine Coatings, Axalta Coating Systems, The Sherwin-Williams Company, Jotun Group

Name the key areas of business for Global Marine Coatings Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Marine Coatings Market.

-

-

- AkzoNobel

- PPG Industries

- Hempel A/S

- Jotun

- Sherwin-Williams Company

- Nippon Paint Marine Coatings

- Chugoku Marine Paints

- Kansai Paint Co., Ltd.

- RPM International Inc.

- Boero Group

- KCC Corporation

- PPG Protective & Marine Coatings

- Axalta Coating Systems

- The Sherwin-Williams Company

- Jotun Group