Global Managed Travel Distribution Market Size, Share, Growth Analysis By Type (Service-Oriented, Software-Based), By Booking Channel (Online, Offline), By Tourist (Corporate, Leisure), By Tour Type (Individual, Group) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155663

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

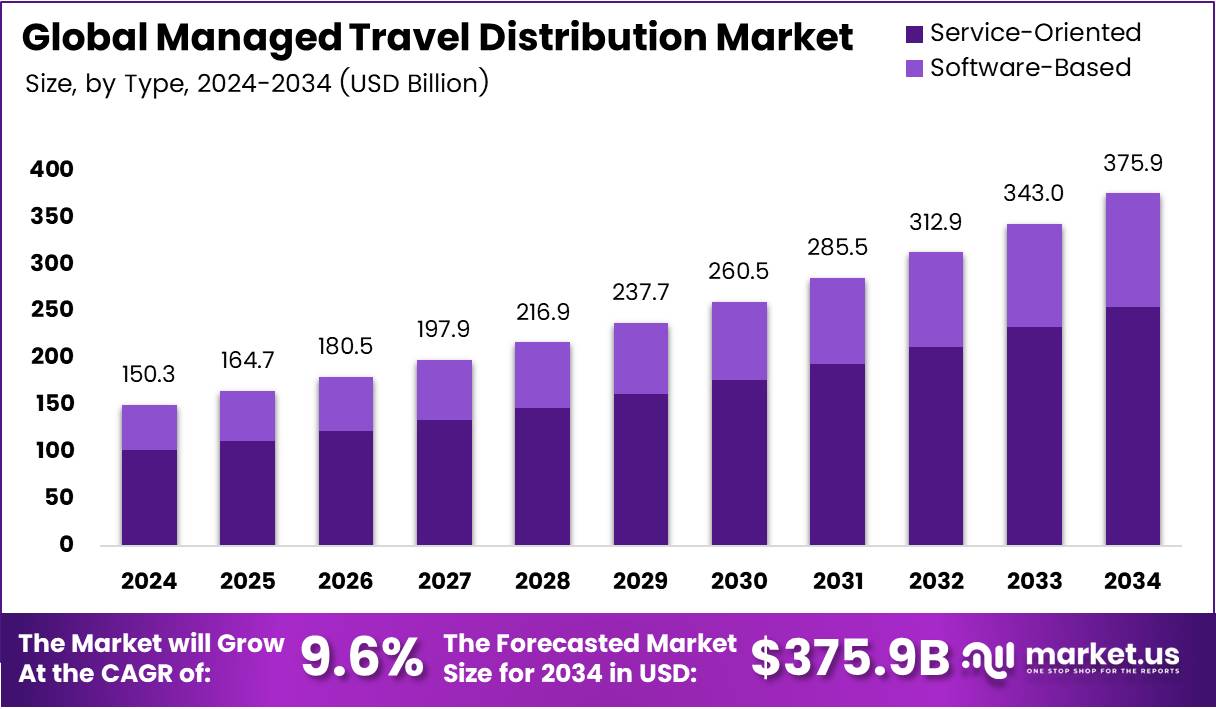

The Global Managed Travel Distribution Market size is expected to be worth around USD 375.9 Billion by 2034, from USD 150.3 Billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034.

The Managed Travel Distribution market is a dynamic segment of the broader travel industry, where organizations streamline and optimize their travel processes. Through managed services, businesses can improve booking efficiency, reduce costs, and enhance traveler satisfaction. This market plays a crucial role in shaping how organizations handle corporate travel in the modern business environment.

The increasing need for efficient travel management solutions is driving growth in the Managed Travel Distribution market. With a focus on cost control and operational efficiency, companies are turning to managed services to handle bookings, itinerary management, and travel policy enforcement. The growing demand for simplified travel experiences is creating substantial market opportunities.

In addition to efficiency, technology integration is transforming the Managed Travel Distribution landscape. Artificial intelligence (AI) is playing a pivotal role in automating booking processes, rebooking, and expense management. This shift towards AI-driven solutions is driving innovation, helping companies enhance their service offerings and cater to the evolving needs of business travelers. As a result, the market is experiencing a significant transformation.

Government investment and regulations are shaping the Managed Travel Distribution market’s growth. Governments worldwide are prioritizing regulations to ensure transparency and security within the corporate travel sector. Additionally, government initiatives aimed at enhancing travel infrastructure and supporting the adoption of advanced technologies like AI are providing a boost to market growth, offering an environment conducive to further innovation.

According to a survey, global business travel spend is projected to reach $1.57 trillion by 2025. This growth underscores the increasing importance of efficient travel management solutions. The rising travel expenditure reflects both the recovery of the sector and the expanding adoption of managed travel services by businesses looking to optimize costs while improving employee satisfaction.

Further illustrating market trends, 71% of travel buyers reported an increase in bookings compared to the prior year, as highlighted in a recent survey. This indicates an uptick in business travel demand, further validating the growing importance of managed travel distribution services. Companies are keen to enhance their travel operations to accommodate this rise in bookings.

Moreover, the acceptance of AI in business travel is growing. According to a survey, 88% of business travelers are comfortable using AI automation for booking, rebooking, and managing expenses. This widespread comfort with AI technology is paving the way for greater automation within the Managed Travel Distribution market, resulting in increased efficiency and cost savings for businesses.

Key Takeaways

- The Global Managed Travel Distribution Market is projected to reach USD 375.9 Billion by 2034, from USD 150.3 Billion in 2024, growing at a CAGR of 9.6% from 2025 to 2034.

- Service-Oriented held a dominant market position in By Type Analysis segment in 2024, with a 67.9% share.

- Online dominated the By Booking Channel Analysis segment in 2024, holding a 78.1% share.

- Corporate led the By Tourist Analysis segment in 2024, capturing 72.8% of the market share.

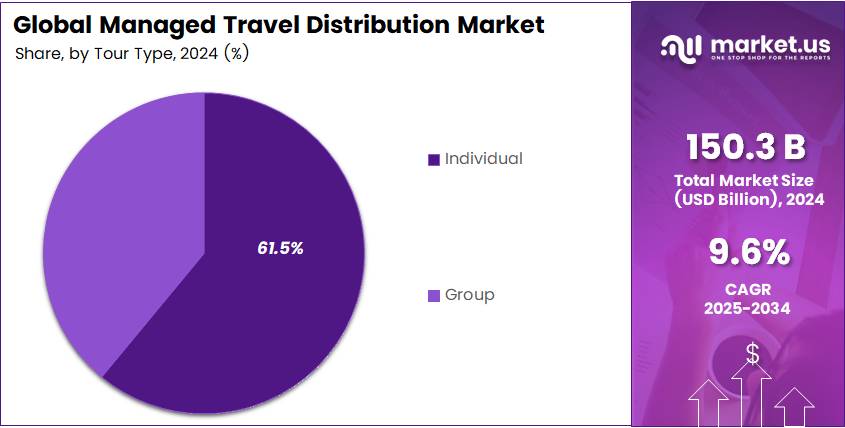

- Individual held a dominant position in the By Tour Type Analysis segment in 2024, with a 61.5% share.

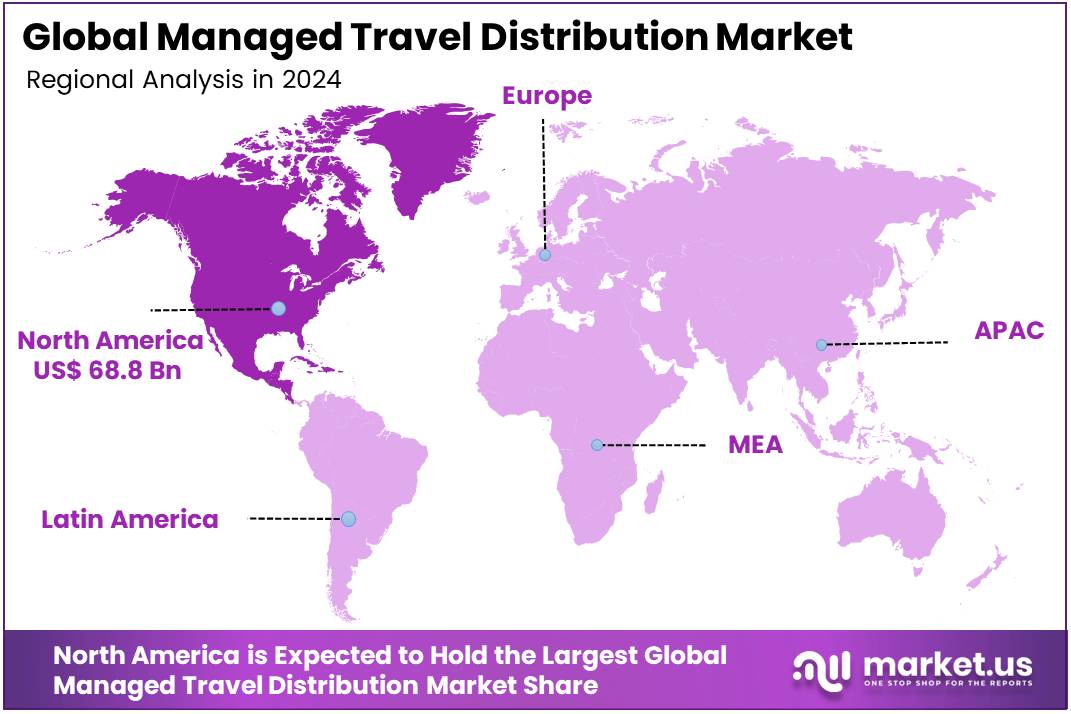

- North America holds a leading market share of 45.8%, valued at USD 68.8 Billion in 2024.

Type Analysis

Service-Oriented dominates with 67.9% due to its comprehensive service delivery and personalized customer experience.

In 2024, Service-Oriented held a dominant market position in By Type Analysis segment of Managed Travel Distribution Market, with a 67.9% share. This substantial market leadership reflects the industry’s preference for comprehensive service delivery models that provide end-to-end travel management solutions.

Service-Oriented platforms excel in delivering personalized customer experiences through dedicated account management, 24/7 support services, and customized travel solutions. These platforms integrate seamlessly with corporate travel policies while offering flexible booking options and real-time travel assistance.

Software-Based solutions captured the remaining market share, appealing to organizations seeking automated, self-service travel management platforms. While these solutions offer cost efficiency and streamlined processes, they lack the personalized touch that many enterprises require for complex travel arrangements.

The dominance of Service-Oriented solutions indicates that businesses prioritize human expertise and personalized service over purely automated systems, especially for managing complex corporate travel requirements and ensuring traveler satisfaction.

Booking Channel Analysis

Online dominates with 78.1% due to its convenience, accessibility, and real-time booking capabilities.

In 2024, Online held a dominant market position in By Booking Channel Analysis segment of Managed Travel Distribution Market, with a 78.1% share. This overwhelming preference for digital booking channels reflects the industry’s digital transformation and travelers’ demand for instant, accessible booking solutions.

Online booking channels provide unparalleled convenience, allowing travelers to access comprehensive travel options, compare prices, and make reservations anytime, anywhere. These platforms offer real-time availability, instant confirmations, and integrated payment processing that streamlines the entire booking experience.

The digital-first approach enables seamless integration with mobile applications, corporate travel management systems, and expense reporting tools. Online channels also provide superior data analytics capabilities, helping organizations track travel patterns and optimize their travel policies.

Offline booking channels maintained a smaller market presence, primarily serving clients who require specialized assistance for complex itineraries or prefer traditional agent-assisted booking processes for high-value travel arrangements.

Tourist Analysis

Corporate dominates with 72.8% due to its structured booking requirements and consistent travel volume.

In 2024, Corporate held a dominant market position in By Tourist Analysis segment of Managed Travel Distribution Market, with a 72.8% share. This significant market dominance reflects the substantial volume and structured nature of business travel in the managed travel distribution ecosystem.

Corporate travel generates consistent, high-volume bookings throughout the year, providing stable revenue streams for travel management companies. Business travelers require sophisticated travel management solutions including policy compliance, expense management integration, and duty of care services.

Corporate segments benefit from negotiated rates, preferred supplier agreements, and comprehensive reporting capabilities that help organizations control travel costs and ensure policy adherence. The predictable nature of business travel patterns enables better inventory management and service optimization.

Leisure travel captured the remaining market share, representing individual and family travelers seeking managed travel services for vacation and personal trips. While leisure travel volumes can be seasonal and less predictable, this segment values personalized service and unique travel experiences that managed travel providers can deliver.

Tour Type Analysis

Individual dominates with 61.5% due to its flexibility, personalization, and customized travel experiences.

In 2024, Individual held a dominant market position in By Tour Type Analysis segment of Managed Travel Distribution Market, with a 61.5% share. This market leadership demonstrates travelers’ growing preference for personalized, flexible travel arrangements that cater to specific needs and preferences.

Individual tour types offer maximum flexibility in itinerary planning, accommodation selection, and activity choices. Travelers can customize their experiences based on personal interests, budget constraints, and scheduling requirements, making these arrangements particularly attractive for both business and leisure travelers.

The managed travel distribution market has adapted to serve individual travelers by providing sophisticated booking platforms that combine the convenience of self-service with the expertise of professional travel management. These solutions offer curated recommendations while maintaining the flexibility that individual travelers demand.

Group tour types captured the remaining market share, appealing to organizations planning corporate events, incentive trips, or leisure groups seeking coordinated travel experiences. While group bookings offer economies of scale, the individual segment’s dominance reflects the market’s shift toward personalized travel solutions.

Key Market Segments

By Type

- Service-Oriented

- Software-Based

By Booking Channel

- Online

- Offline

By Tourist

- Corporate

- Leisure

By Tour Type

- Individual

- Group

Drivers

Rising Demand for Centralized Travel Management Solutions Fuels Managed Travel Distribution Market Growth

The growing corporate demand for centralized travel management solutions is a key driver in the managed travel distribution market. As organizations expand, they require more efficient and streamlined travel booking systems that can centralize all travel data. This centralized approach ensures better control over travel expenses and policy compliance, contributing to improved overall productivity.

Additionally, the expansion of global business travel networks and partnerships is fueling growth in this market. Companies are increasingly looking for partners to manage travel needs across borders, promoting the development of international travel distribution solutions. This enables businesses to manage travel logistics on a global scale, enhancing convenience for employees and ensuring consistency in travel arrangements.

The increasing need for cost transparency and expense optimization also plays a significant role. Companies are focused on reducing travel expenditures while ensuring that employees are not restricted in their travel options. Travel distribution platforms are being designed with advanced features that provide real-time pricing and cost insights, enabling companies to make data-driven decisions on travel spending.

Finally, the integration of AI and automation in travel booking processes is revolutionizing the managed travel distribution market. By automating routine tasks and leveraging AI for personalized travel recommendations, businesses can improve the efficiency and accuracy of travel management, leading to significant time savings and cost reductions.

Restraints

High Implementation Costs and Limited Adoption Hinder Managed Travel Distribution Market Growth

A significant restraint for the managed travel distribution market is the high implementation and subscription costs, especially for small and medium-sized enterprises (SMEs). These businesses often face budget constraints, making it challenging to invest in expensive travel management systems. The upfront and ongoing costs can deter SMEs from adopting advanced travel solutions, limiting their access to the benefits of centralized travel management.

Moreover, the limited adoption of managed travel distribution solutions in emerging markets with fragmented infrastructure poses another challenge. In many emerging economies, the lack of robust digital infrastructure makes it difficult to implement centralized travel management systems. This can slow down the market’s growth in these regions, as businesses struggle with inconsistent internet connectivity, limited payment gateways, and inadequate local support.

Growth Factors

Emergence of Personalized Travel Distribution Platforms Drives Opportunities in the Managed Travel Distribution Market

The managed travel distribution market is witnessing significant growth opportunities, particularly with the emergence of personalized travel distribution platforms. As travelers seek more tailored experiences, platforms offering personalized travel options are becoming highly attractive to businesses. These platforms allow companies to customize travel options based on specific preferences, improving employee satisfaction and enhancing the travel experience.

Additionally, there is growing interest in niche travel segments such as Bleisure (business + leisure) and eco-tourism. These segments offer new growth avenues for travel management companies, as businesses seek to incorporate leisure elements into corporate travel. The expansion into these niches allows travel providers to capture a more diverse customer base.

Collaboration with payment gateways for seamless transactions is another key growth opportunity. By integrating payment solutions into travel platforms, businesses can simplify the booking process, reduce transaction times, and offer a more streamlined payment experience. This collaboration also promotes transparency in travel costs and can facilitate quicker settlements for international transactions.

Emerging Trends

Growing Popularity of Mobile-First Travel Booking Solutions Shapes Managed Travel Distribution Market Trends

The growing popularity of mobile-first travel booking solutions is one of the major trends in the managed travel distribution market. With the increasing use of smartphones, travelers expect the convenience of booking and managing their trips via mobile apps. This shift is pushing travel management companies to develop mobile-friendly platforms to cater to the needs of modern business travelers.

Another trend gaining traction is the adoption of virtual and augmented reality (VR/AR) for travel previews. These technologies allow travelers to virtually experience destinations or hotels before booking, enhancing the decision-making process. VR/AR can transform the way corporate travelers engage with travel options, creating an immersive and informative experience.

Lastly, there is a noticeable shift toward sustainable and carbon-neutral travel offerings. As sustainability becomes a key concern for businesses and travelers, there is an increasing demand for travel solutions that minimize environmental impact. Managed travel distribution platforms are responding by offering options that align with corporate sustainability goals, such as carbon offsetting and eco-friendly accommodations. This trend reflects the growing importance of responsible travel in corporate travel policies.

Regional Analysis

North America Dominates the Managed Travel Distribution Market with a Market Share of 45.8%, Valued at USD 68.8 Billion

In 2024, North America holds a leading position in the Managed Travel Distribution Market, accounting for 45.8% of the market share, valued at USD 68.8 Billion. The region benefits from advanced infrastructure, high corporate travel expenditure, and a well-established network of travel management solutions. Furthermore, the widespread adoption of technological innovations, such as AI-driven booking platforms, strengthens its market dominance.

Europe Managed Travel Distribution Market Trends

Europe follows closely in market share, driven by an increasing demand for efficient travel management solutions. The region’s corporate sector continues to grow, contributing significantly to the demand for centralized travel services. Additionally, the regulatory framework in Europe has encouraged the adoption of sustainable and cost-effective travel solutions, fueling the market’s expansion.

Asia Pacific Managed Travel Distribution Market Trends

Asia Pacific is experiencing rapid growth in the Managed Travel Distribution Market, driven by the rising demand for business travel and the region’s expanding corporate landscape. Countries such as China, India, and Japan are witnessing increased adoption of digital travel management platforms, further propelling market growth. The region is also expected to benefit from growing technological advancements in the travel sector.

Middle East and Africa Managed Travel Distribution Market Trends

In the Middle East and Africa, the Managed Travel Distribution Market is poised for growth, with an increasing number of businesses adopting managed travel services. The market is driven by the region’s developing corporate travel ecosystem, alongside improvements in infrastructure. The Middle East, particularly, is seeing rising demand for business travel services, driven by international trade and events.

Latin America Managed Travel Distribution Market Trends

Latin America is gradually emerging as a key player in the Managed Travel Distribution Market, spurred by increasing urbanization and a growing middle class. However, the region faces challenges related to infrastructure development and economic volatility, which may impact market growth. Despite these hurdles, the adoption of travel management solutions is on the rise, particularly among large corporations seeking to optimize travel costs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Managed Travel Distribution Company Insights

In 2024, Amadeus IT Group continues to lead the global Managed Travel Distribution Market with its comprehensive technology solutions that enable travel agencies, corporations, and other entities to optimize their travel operations. Their advanced data analytics and innovative platform drive greater efficiency in managing corporate travel programs.

Sabre Corporation remains a significant player, offering a wide range of software and technology solutions for travel management. Its integration of artificial intelligence and machine learning enhances travel booking processes, making it a preferred choice for companies seeking streamlined travel distribution systems.

CWT (Carlson Wagonlit Travel) stands out due to its ability to provide both technology-driven solutions and personalized services, allowing businesses to manage their travel needs effectively. CWT’s focus on traveler well-being and cost management has earned it strong recognition in the corporate travel space.

BCD Travel offers innovative travel solutions backed by its global reach and strategic partnerships. Its emphasis on sustainability and smart travel management positions BCD Travel as a leading provider of managed travel services, meeting the growing demand for eco-friendly and efficient travel practices.

These players continue to shape the future of the managed travel distribution market through their technological advancements, customer-centric approaches, and industry expertise. Their ability to adapt to changing demands and leverage emerging technologies will define the competitive landscape in 2024.

Top Key Players in the Market

- Amadeus IT Group

- Sabre Corporation

- CWT (Carlson Wagonlit Travel)

- BCD Travel

- American Express Global Business Travel (Amex GBT)

- Concur Technologies (SAP Concur)

- Flight Centre Travel Group

Recent Developments

- In Jan 2025, TravelPerk raised $200 million and acquired Yokoy to create the leading integrated travel and expense management platform. This move strengthens TravelPerk’s position in the corporate travel space, offering a comprehensive solution for business travel and expense tracking.

- In Mar 2025, DerbySoft acquired Arise to boost the travel agent-hotel relationship. This acquisition is expected to enhance DerbySoft’s technology platform, providing travel agents with improved tools to manage hotel bookings more efficiently and strengthen their relationships with hotel partners.

- In Dec 2024, Nuitee raised $48 million to expand its travel and hotel connectivity technology solutions, aiming to enhance the integration between hotels and booking platforms globally. This funding will support the company’s efforts to provide seamless connections and improve booking efficiency within the travel industry.

- In Sep 2024, Distribusion, the world’s leading B2B ground transportation marketplace, announced its heavily oversubscribed $80 million Series C funding round, led by TQ Ventures. The investment will fuel the company’s continued growth and innovation in ground transportation services for the travel industry.

- In Sep 2024, Yatra doubled down on corporate travel with the acquisition of Globe Travels, solidifying its leadership position. This strategic move enhances Yatra’s portfolio, expanding its reach and offerings in the business travel sector, further cementing its market dominance.

Report Scope

Report Features Description Market Value (2024) USD 150.3 Billion Forecast Revenue (2034) USD 375.9 Billion CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Service-Oriented, Software-Based), By Booking Channel (Online, Offline), By Tourist (Corporate, Leisure), By Tour Type (Individual, Group) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amadeus IT Group, Sabre Corporation, CWT (Carlson Wagonlit Travel), BCD Travel, American Express Global Business Travel (Amex GBT), Concur Technologies (SAP Concur), Flight Centre Travel Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Managed Travel Distribution MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Managed Travel Distribution MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amadeus IT Group

- Sabre Corporation

- CWT (Carlson Wagonlit Travel)

- BCD Travel

- American Express Global Business Travel (Amex GBT)

- Concur Technologies (SAP Concur)

- Flight Centre Travel Group