Global Managed Print Services (MPS) Market by Deployment (On-Premise, Cloud-based), by Channel Type (Printer/Copier Manufacturers, System Integrators/Resellers, Independent Software Vendors (ISVs)), by Enterprise Size (Large Enterprise, Small & Medium Enterprises) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 128732

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways:

- Deployment Segment Analysis

- Channel Type Segment Analysis

- Enterprise Size Segment Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

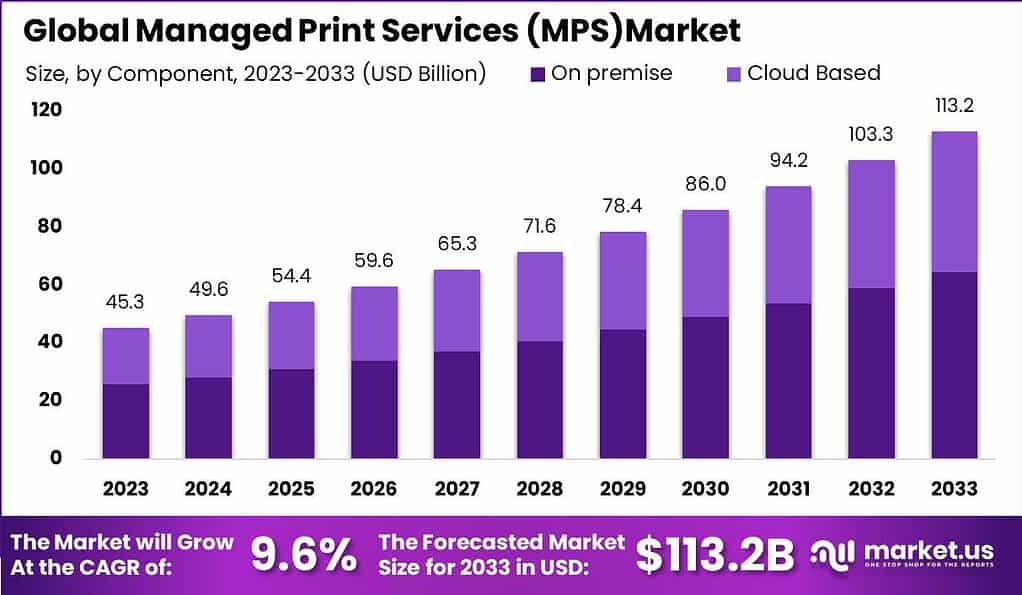

The Global Managed Print Services (MPS) Market size is expected to be worth around USD 113.1 Billion by 2033, from USD 45.26 Billion in 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

Managed Print Services (MPS) refer to a suite of services offered by external providers to optimize or manage a company’s document output. The main components provided are needs assessment, selective or general replacement of hardware, and the service, parts, and supplies needed to operate the new and/or existing hardware (including existing third-party equipment if this is required by the customer).

The market for Managed Print Services (MPS) is expanding as businesses of all sizes seek to reduce operational costs and streamline their workflows. This growth can be attributed to the increasing emphasis on sustainable practices, alongside the growing need for efficient document management systems that integrate digital and physical document processes.

Advances in cloud computing and the integration of artificial intelligence (AI) in MPS are also factors driving the market forward. As companies continue to adopt remote work models, the demand for more sophisticated MPS that can support decentralized work environments is likely to increase, indicating a positive trajectory for the MPS market in the coming years.

The demand for Managed Print Services (MPS) is primarily driven by businesses aiming to reduce operational costs associated with printing. As companies become more aware of the need to optimize their print environments for cost savings and improved workflow efficiencies, the adoption of MPS increases.

Furthermore, the shift towards digital transformation across various industries encourages businesses to integrate their digital and physical document management systems, further boosting the demand for MPS solutions.

The growth of the Managed Print Services market is significant and is projected to continue expanding in the future. This growth is fueled by the continuous evolution of workplace dynamics, including the increasing adoption of remote and hybrid work models that require flexible and efficient printing solutions.

Technological advancements such as cloud-based MPS solutions and AI integration are also vital factors that contribute to the growth of the MPS market. These technologies help in better managing print resources, leading to smarter, cost-effective operations.

There are considerable opportunities in the Managed Print Services market, especially with the ongoing technological innovations and shifting work patterns. Companies looking to offer more sustainable and environmentally friendly solutions find MPS an attractive option due to its ability to significantly reduce paper waste and energy usage.

Additionally, the expanding trend towards personalized and customer-centric service offerings presents a unique opportunity for MPS providers to differentiate their services and cater to the specific needs of diverse business environments.

One of the major drivers for the MPS market is the digital transformation across various industries. By 2025, over 70% of enterprises are expected to implement MPS solutions to streamline their printing operations and reduce manual interventions. With MPS, businesses can monitor and control their printing environment, significantly cutting down operational costs by reducing unnecessary printing and optimizing printer usage.

The integration of cloud-based services with MPS is another key factor boosting market growth. By 2026, cloud-based MPS solutions are expected to account for 40% of the total market, as organizations increasingly adopt cloud platforms for secure and remote management of their printing needs. These solutions provide enhanced flexibility, allowing businesses to access printing services across multiple locations while maintaining centralized control over document security and print workflows.

Security has also emerged as a top concern for organizations, with 60% of businesses citing document security as a critical factor in adopting MPS. As data breaches and cyberattacks become more frequent, companies are turning to managed print services to secure their sensitive documents and control access to printing devices. MPS providers are integrating advanced security features, such as user authentication and encrypted document storage, to address these growing concerns.

Despite these opportunities, the MPS market faces challenges related to the transition towards a paperless office. While MPS solutions can help optimize printing operations, the rising focus on digital documentation and the gradual decline in printing volumes could slow down market growth in the long term. However, by 2028, the MPS market is still expected to reach $63.5 billion, underscoring its importance in managing both physical and digital document workflows.

Key Takeaways:

- The global managed print services (MPS) market size is expected to be worth around USD 113.1 billion by 2033, from USD 45.26 billion in 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

- In 2023, the on-premise segment held a dominant market position, capturing more than a 57% share of the managed print services market.

- In 2023, the printer and copier manufacturers segment held a dominant market position, capturing more than a 42% share of the managed print services market.

- In 2023, the large enterprise segment held a dominant market position, capturing more than a 63% share of the managed print services market.

- In 2023, North America held a dominant market position in the managed print services market, capturing more than a 35.6% share.

Deployment Segment Analysis

In 2023, the on-segment held a dominant market position, capturing more than a 57% share of the managed print services market. The dominance of the on-premise segment in the managed print services market is largely due to concerns over data security. Many organizations, particularly in highly regulated industries like finance, healthcare, and government, prefer on-premise solutions because they allow for tighter control over sensitive information and compliance with strict regulatory standards.

On-premise MPS enables companies to maintain ownership of their infrastructure and data, reducing the risks associated with third-party access inherent in cloud-based solutions. additionally, on-premise setups offer greater customizations to meet specific organizational needs, allowing businesses to tailor their printing environments to unique workflows and security requirements.

This segment also appeals to large enterprises with complex printing demands and substantial in-house IT resources, where the cost and complexity of cloud mitigation can be prohibitive. Despite the growing trend towards cloud services, the on-premise segment remains strong due to these critical concerns around security and control.

Channel Type Segment Analysis

In 2023, the printer and copier manufacturers segment held a dominant market position, capturing more than a 42% share of the managed print services market. The dominance of printer and copier manufacturers in the managed print servers market evolving from their inherent expertise, established customer base, and ability to offer end-to-end solutions.

These manufacturers such as Xerox, HP, and Canon, have a deep understanding of printing technologies and can leverage their existing infrastructure to provide comprehensive MPS solutions.

Their extensive product portfolios enable them to integrate hardware, software, and services seamlessly, offering a one-stop shop experience for customers. Moreover, these manufacturers have long-lasting relationships with businesses, which enhances customer loyalty and trust. Their ability to provide tailored solutions, including equipment leasing, maintenance, and software integration, gives them a competitive edge.

Additionally, they can offer more competitive pricing and bundled services, making them attractive to businesses looking for cost-effective and reliable print management solutions. this combination of expertise, customer loyalty, and comprehensive service offerings solidifies the dominance of printer and copier manufacturers in the MPS market.

Enterprise Size Segment Analysis

In 2023, the large enterprise segment held a dominant market position, capturing more than a 63% share of the managed print services market. the dominance of the large enterprise segment in the managed print services market is driven by their complex and extensive printing needs, which makes MPS highly beneficial for optimizing efficiency and reducing costs.

Large enterprises typically have vast numbers of printers and copiers spread across multiple locations, leading to significant management challenges, including high operational costs, security risks, and ineffective workflows.

MPS providers offer these organizations tailored solutions that streamline print management, enhance security, and improve document workflows, ultimately driving substantial cost savings.

Moreover, large enterprises have the financial capacity to invest in comprehensive MPS solutions that include advanced features like predictive maintenance, analytics, and cloud integration.

The scalability of MPS also appeals to these organizations as it allows for consistent service across all branches and departments. As large enterprises continue to prioritize digital transformation and sustainability, their demand for efficient, secure, and scalable print management solutions ensures their dominance in the MPS market.

Key Market Segments

By Deployment

- On-Premise

- Cloud-based

By Channel Type

- Printer/Copier Manufacturers

- System Integrators/Resellers

- Independent Software Vendors (ISVs)

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprises

Driving Factors

Increasing demand for reduced printing costs

The increasing demand for reduced printing costs is a significant driver for the managed printing costs is a significant driver for the managed print services market as organizations seek ways to optimize their operational expenses. Printing is often an overlooked cost center in businesses, with expenses related to hardware, consumables, maintenance, and energy consumption adding up quickly.

MPS addresses this by offering comprehensive management of the entire print environment, helping organizations streamline operations, minimize waste, and reduce overall printing expenses. Through MPS, companies can achieve better control and visibility over their print usage, identifying inefficiencies such as unnecessary printing or underutilized devices.

Additionally, MPS providers often implement cost-saving strategies like deploying energy-efficient printers, automating supply orders, and optimizing printer placement to reduce excessive usage. These efficiencies lead to substantial cost reduction, making MPS an attractive solution for businesses looking to improve their bottom line while also enhancing productivity and sustainability. As cost pressure increases, demand for the MPS continues to grow.

Restraining Factors

Decline in the use of paper printing

The decline in paper printing poses a significant restraint for the managed print services market. as businesses increasingly adopt digital workflows and move towards paperless operations, the demand for traditional printing services has diminished.

This shift is driven by factors such as environmental sustainability, cost reduction, and enhanced efficiency in digital document management. Additionally, the rise of remote work and cloud-based solutions further reduces the need for on-site printing infrastructure.

Consequently, organizations are scaling back their investments in printers, copiers, and related services, leading to reduced revenues for MPS providers. As the reliance on digital platforms continues to grow, the MPS market faces challenges in adapting to this trend.

Providers must innovate by offering value-added services that integrate digital and print solutions to remain relevant and meet evolving customer needs in a rapidly digitizing business environment.

Growth Opportunities

Technological advancements

Technological advancements present a substantial opportunity for the global managed print services market. The integration of cutting-edge technologies such as artificial intelligence, the Internet of Things, and cloud computing into MPS solutions is transforming the way organizations manage their printing needs.

AI-driven analytics can optimize print workflows, predict maintenance needs, and reduce downtime enhancing operational efficiency. Further, IoT-based devices also allow for real-time monitoring and automated supply replenishment, reducing administrative burdens.

Cloud-based MPS solutions offer greater flexibility and scalability, enabling remote management of print infrastructure across multiple locations. Furthermore, advancements in security technology help protect sensitive information, addressing growing concerns about data breaches.

By leveraging these technologies, MPS providers can deliver more personalized, efficient, and secure services, catering to the evolving demands of modern businesses. this technological shift not only enhances customer satisfaction but also opens new revenue streams for MPS providers, positioning them as key partners in digital transformation.

Challenging Factors

Resistance to change

Resistance to change is a significant challenge for the managed print services market. Many organizations, particularly those with long-established practices, are hesitant to transition from traditional print management to managed services.

This reluctance often stems from concerns about disrupting existing workflows, the perceived complexity of new systems, and uncertainty about the return on investment. Employees accustomed to conventional printing processes may resist adopting new technologies, fearing the learning curve or potential job redundancies.

Additionally, decision-makers might be wary of committing to long-term MPS contracts, especially if they are unsure about the benefits or have a limited understanding of the technologies involved.

This resistance can slow down the implementation of MPS solutions, leading to delays in achieving operational efficiency and cost savings. To overcome this challenge, MPS providers must focus on educating clients about the tangible benefits of managed services, offering tailored solutions that align with the organization’s needs, and ensuring a smooth transition process.

Growth Factors

Increasing digitalization: The growing adoption of digital technologies and cloud-based solutions drives the need for efficient print management and integration with digital workflows.

Cost reduction: organizations seek MPS to lower printing costs, optimize resource utilization, and reduce operational expenses associated with print infrastructure.

Enhanced security: rising concerns about data security and compliance push businesses to adopt MPS solutions that offer robust security features and protect sensitive information.

Environmental sustainability: the focus on sustainability and reducing carbon footprints encourages the adoption of MPS to minimize paper waste and optimize energy use.

Technological advancements: Innovations such as AI, IoT, and advanced analytics enhance the capabilities of MPS, making it more attractive to businesses.

Latest Trends

Cloud-based MPS: adoption of cloud-based solutions for managing print infrastructure, providing scalability and remote management capabilities.

Sustainability issues: focus on eco-friendly practices, including reduced paper usage, energy-efficient devices, and recycling programs.

Hybrid work support: solutions designed to support both in-office and remote work environments, ensuring consistent and flexible print capabilities.

Personalized user experience: tailoring MPS solutions to meet specific organizational needs, with customizable options for user preferences and print policies.

Regional Analysis

North America region is leading the market

In 2023, North America held a dominant market position in the managed print services market, capturing more than a 35.6% share with a growth of USD 16.1 Billion. The North American region dominates the Managed print services market due to several key factors. The region’s advanced technological infrastructure and high adoption rates of digital solutions drive the demand for efficient print management.

North American businesses are early adopters of innovations like AI, IoT, and cloud-based MPS, which enhances operational efficiency and security. The strong presence of major MPS providers and a competitive market environment further accelerate service advancements and customer adoption.

Additionally, stringent regulatory requirements and a focus on data security compel organizations to seek managed services that ensure compliance and protect sensitive information.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The market includes various prominent companies known for their innovative solutions and global reach. These companies are at the forefront of the MPS market, driving innovation and offering comprehensive solutions to meet the evolving needs of businesses worldwide.

Xerox Corporation is one of the major players in the MPS market that offers solutions including document management, print optimization, and cost control. The firm emphasizes innovation in print technology and digital transformation, leveraging its extensive experience and global network.

Another leading provider of MPS solutions is HP Inc., which offers a range of managed print services, including cloud-based solutions, security features, and advanced analytics. HP’s strength lies in its extensive portfolio of hardware and software, which integrates with its MPS offerings to provide comprehensive print management.

Top Key Players in the Market

- Xerox Corporation

- Ricoh Company Ltd.

- HP Development Company, L.P.

- Canon, Inc.

- Brother UK Ltd.

- Lexmark International, Inc.

- Konica Minolta, Inc.

- Samsung Electronics Co. Ltd.

- Kyocera Corporation

- Toshiba Corporation

- Sharp Corporation

- Other Key Players

Recent Developments

- In August 2024, HP Inc. announced services and solutions that enable partners to build and grow their services and software businesses. These new solutions include HP WEX, HP’s first AI-enabled digital experience platform, and a new print subscription service.

- In November 2023, Ricoh, a Japanese imaging and electronics company partnered with Materialise, a Belgian 3D printing firm to produce 3D models of a patient’s anatomy. Utilizing Materialise’s software alongside Ricoh’s printing hardware allows clinicians to easily request anatomical models of a patient’s anatomy, mapped digitally through imaging software.

Report Scope

Report Features Description Market Value (2023) USD 45.26 billion Forecast Revenue (2033) USD 113.1 billion CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Deployment (On-Premise, Cloud-based), by Channel Type (Printer/Copier Manufacturers, System Integrators/Resellers, Independent Software Vendors (ISVs)), by Enterprise Size (Large Enterprise, Small & Medium Enterprises) Region Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Xerox Corporation, Ricoh Company Ltd., HP Development Company, L.P., Canon, Inc., Brother UK Ltd., Lexmark International, Inc., Konica Minolta, Inc., Samsung Electronics Co. Ltd., Kyocera Corporation, Toshiba Corporation, Sharp Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Managed Print Services?Managed Print Services (MPS) refers to a solution where third-party providers manage and optimize an organization’s printing infrastructure, reducing costs, improving document security, and streamlining workflows.

What are the key factors driving the growth of the Managed Print Services Market?The growth is driven by increasing demand for cost reduction, enhanced document security, digital transformation, and the shift towards more sustainable printing practices.

What are the current trends and advancements in the Managed Print Services Market? Managed Print Services (MPS) MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample

Managed Print Services (MPS) MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Xerox Corporation

- Ricoh Company Ltd.

- HP Development Company, L.P.

- Canon, Inc.

- Brother UK Ltd.

- Lexmark International, Inc.

- Konica Minolta, Inc.

- Samsung Electronics Co. Ltd.

- Kyocera Corporation

- Toshiba Corporation

- Sharp Corporation

- Other Key Players