Global Magazine Advertising Market Size, Share, Industry Analysis Report By Magazine Format (Print Magazines, Digital Magazines, Mobile Apps & Online Portals), By Advertising Format (Display Advertising, Native Advertising & Sponsored Content, Classified Advertising, Others), By Industry Vertical (Automotive, Financial Services, FMCG, Media & Entertainment, Retail, Real Estate, Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168628

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Reader Engagement Statistics

- Role of Generative AI

- U.S. Market Size

- Investment and Business Benefits

- Magazine Format Analysis

- Advertising Format Analysis

- Industry Vertical Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

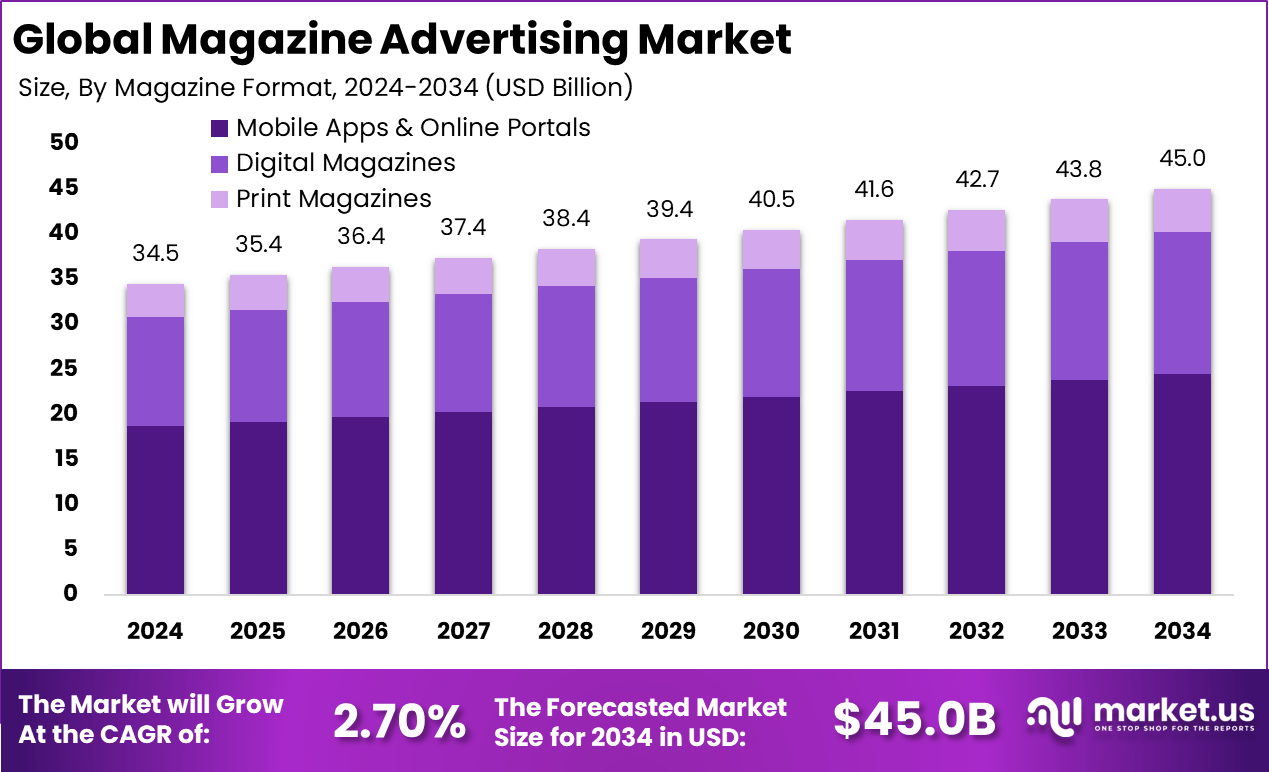

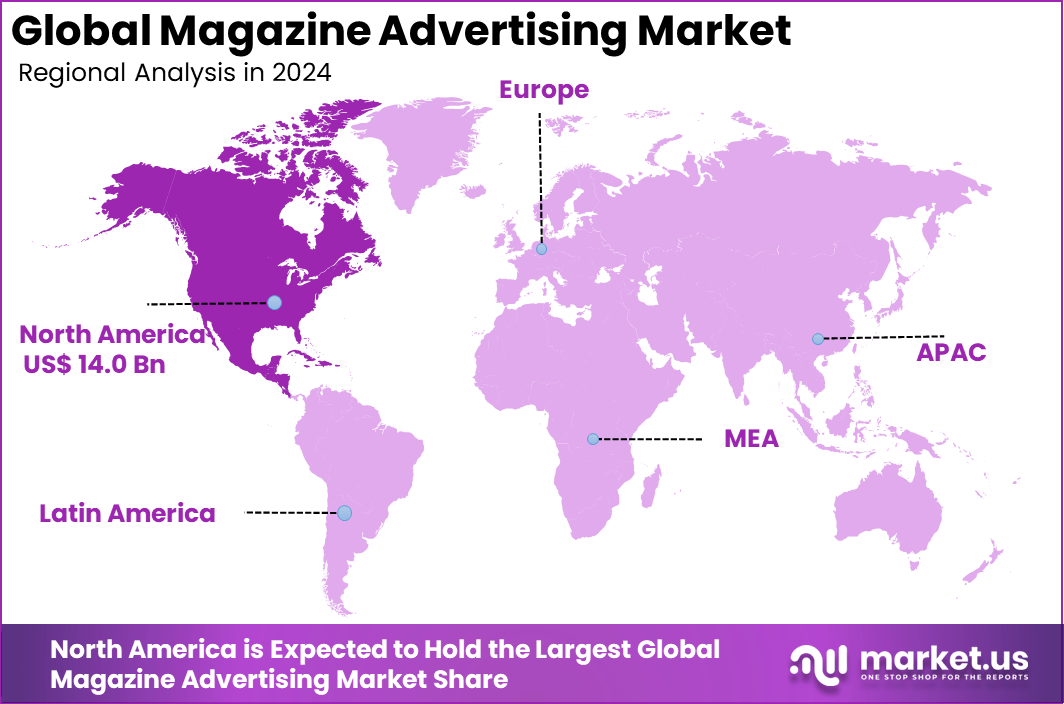

The Global Magazine Advertising Market size is expected to be worth around USD 45.0 billion by 2034, from USD 34.5 billion in 2024, growing at a CAGR of 2.70% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.6% share, holding USD 14.0 billion in revenue.

The magazine advertising market has evolved as publishers balance traditional print placements with digital extensions and cross platform campaigns. Growth in select segments reflects demand for high quality editorial environments, targeted readership and trusted brand association. While print advertising faces competition from digital channels, magazines maintain strong relevance in lifestyle, fashion, luxury, travel and niche interest categories where visual storytelling is essential.

Top driving factors include the selectivity of magazines in reaching niche and premium audiences, creative design opportunities, and the credibility associated with well-established publications. Despite competition from digital platforms, magazine advertising continues to attract brands seeking brand-building and targeted communications. Increasing investments in interactive and augmented reality ads and programmatic buying also contribute to sustaining interest among advertisers.

The magazine advertising market is driven by growing investments from key industries like automobiles and consumer goods, which use print ads to build strong brand trust and customer loyalty. Magazines attract advertisers due to their focused, niche readerships, allowing precise targeting. Additionally, combining print with digital innovations enhances advertiser appeal, creating more engaging campaigns.

For instance, in March 2025, Future plc enhanced its advertising solutions by launching Future Creative, an in-house branded content studio. This initiative helps advertisers develop authentic, resonant campaigns aligned with Future’s niche media verticals spanning tech, gaming, fashion, and homes.

Key Takeaway

- In 2024, the Mobile Apps and Online Portals segment led the market with a 54.3% share, showing the strong shift toward digital readership and mobile-first advertising.

- The Native Advertising and Sponsored Content segment accounted for 45.7%, supported by demand for integrated, non-intrusive ad formats that blend with magazine content.

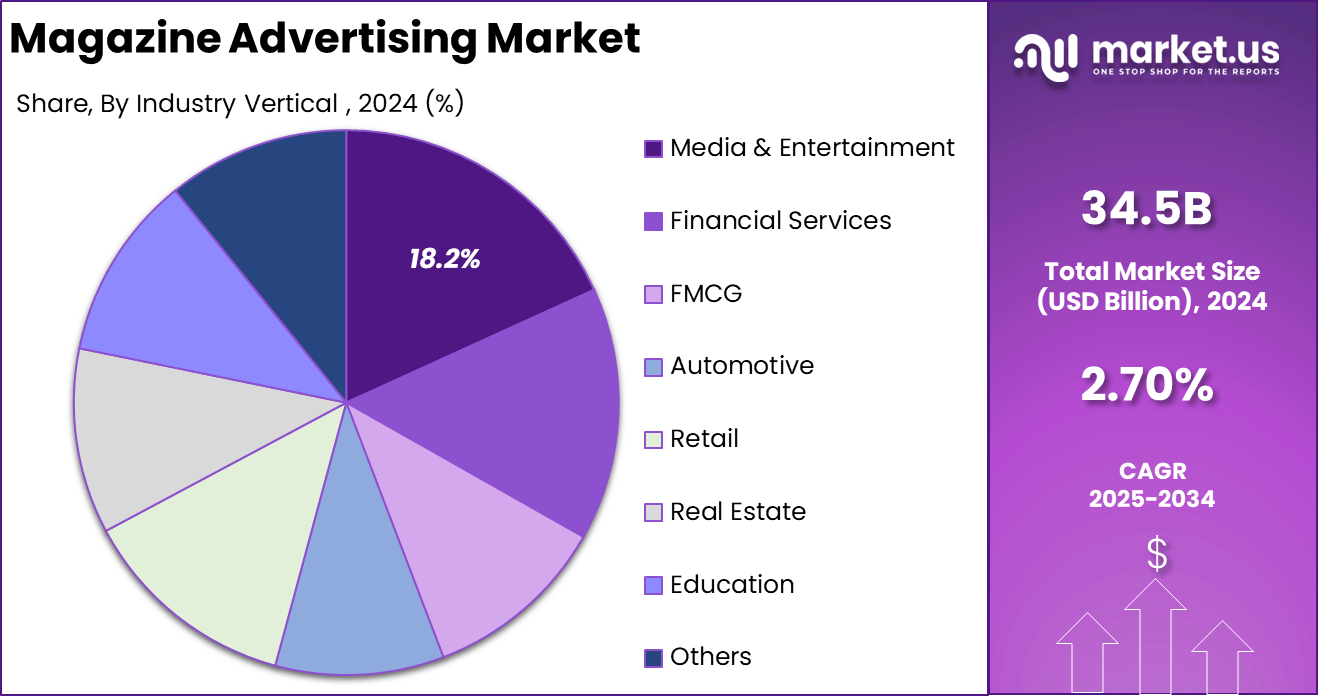

- The Media and Entertainment segment held an 18.2% share, reflecting steady ad spending from publishers, broadcasters, and entertainment brands.

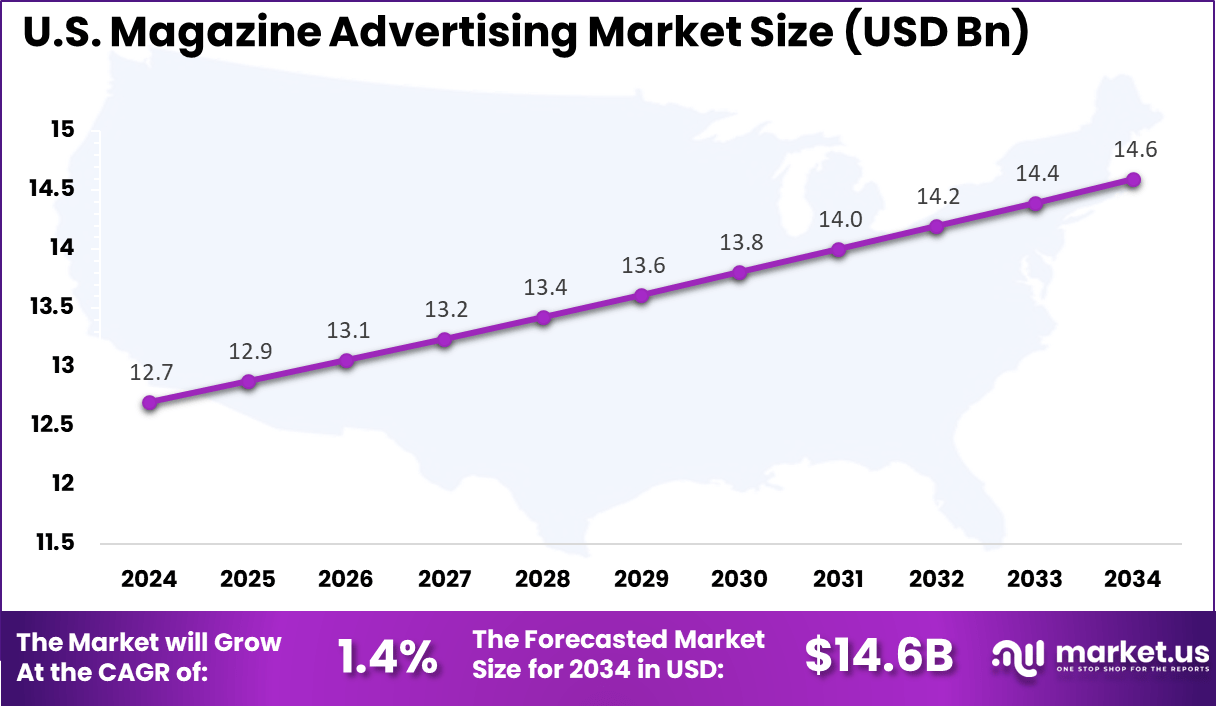

- The US market reached USD 12.7 billion in 2024 and is growing at a modest CAGR of 1.4%, driven by stable digital magazine advertising demand.

- North America maintained leadership with over 40.6% share, supported by high digital adoption, established publishers, and strong consumer engagement with online magazine platforms.

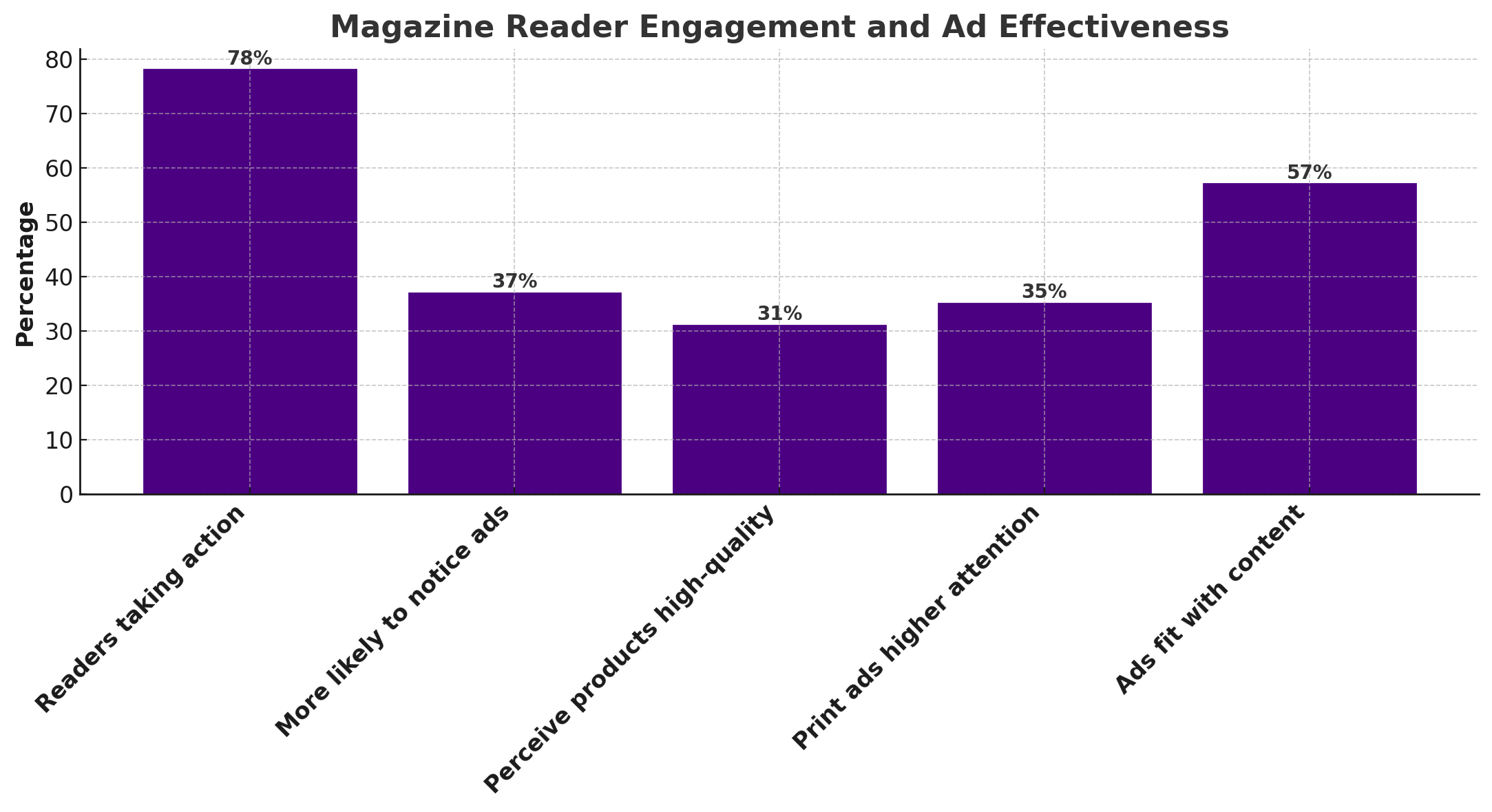

Reader Engagement Statistics

Role of Generative AI

Generative AI has become a major force in magazine advertising by speeding up content creation and improving personalization. Studies show AI-driven campaigns can increase marketing productivity by 5% to 15% of total marketing spend. Unlike traditional ads, generative AI enables producing multiple personalized versions rapidly to target different audience segments with tailored imagery and messages.

The impact of generative AI extends beyond static ads to automated video production and more immersive content formats. Tools now generate high-quality visuals and videos at a fraction of the traditional time, with some agencies achieving up to 10 times efficiency gains in creative output. As AI evolves, it is also expected to handle entire campaign lifecycles with minimal human input, bringing a new level of scale and precision to magazine advertising efforts.

U.S. Market Size

The market for Magazine Advertising within the U.S. is growing tremendously and is currently valued at USD 12.7 billion, the market has a projected CAGR of 1.4%. There is a strong shift toward digital magazine formats, particularly mobile apps and online portals, which offer advertisers more interactive and targeted ways to reach engaged consumers. This digital transformation is helping publishers attract advertising budgets previously reserved for traditional print.

Additionally, advertisers increasingly prefer native advertising and sponsored content that blend seamlessly with editorial material, leading to higher reader engagement and effectiveness. The media and entertainment sector, a key industry vertical, continues to drive demand by investing heavily in magazine ads to promote films, events, and other entertainment offerings.

For instance, in October 2025, Hearst Communications showcased its leadership at the 2025 FIPP World Media Congress by emphasizing trust, storytelling, and innovation in an AI-driven media environment. Hearst is doubling down on credible journalism and first-party data initiatives to strengthen direct multi-channel audience engagement, protecting its premium ad revenues despite industry challenges.

In 2024, North America held a dominant market position in the Global Magazine Advertising Market, capturing more than a 40.6% share, holding USD 14.0 billion in revenue. The region benefits from a well-established media landscape led by major publishers headquartered there, which maintain strong advertiser relationships.

Increased internet penetration and mobile device usage accelerate digital magazine consumption, offering advertisers effective multi-platform engagement. Moreover, North America leads in adopting advanced advertising technologies like data-driven targeting and programmatic advertising, enhancing campaign precision and ROI.

The demand for niche publications catering to specific interests and robust investments in both print and digital ads by sectors such as media, entertainment, and lifestyle also fuel growth. These factors collectively maintain North America’s stronghold in the magazine advertising space.

For instance, in November 2025, Condé Nast held its high-profile Vogue World event at Paramount Studios in Los Angeles, blending entertainment and advertising to enhance brand engagement and revenue. This event showcases Condé Nast’s strategy of integrating commerce with editorial content to adapt to the evolving media landscape and maintain advertising dominance.

Investment and Business Benefits

Investment opportunities lie in digital transformation of magazines including digital editions, integrated advertising models combining print and online presence, and innovations in audience segmentation using data analytics. Emerging markets with growing middle classes show promise for expanding magazine advertising as brands look for reputable and trusted channels.

Business benefits of magazine advertising include enhanced brand credibility through association with reputable publications, longer ad lifespan compared to fleeting digital ads, and more immersive storytelling via rich visual and editorial content. Magazines also provide advertisers with a loyal and attentive audience, leading to deeper engagement and higher return on advertising spend. They complement digital efforts by reinforcing brand messages and fostering customer trust in a multi-channel strategy.

Magazine Format Analysis

In 2024, the Mobile Apps & Online Portals segment held a dominant market position, capturing a 54.3% share of the Global Magazine Advertising Market. This digital dominance reflects a clear shift in how audiences engage with magazine content, favoring access through smartphones and tablets. Advertisers benefit from this by reaching a wider and more mobile audience, who interact with magazines in a more dynamic and accessible way.

The rise of digital consumption has prompted publishers to innovate their content delivery and advertisement offerings on mobile and online platforms. This shift helps maintain advertiser interest and budget allocation despite declining print readership. The convenience and immediacy of mobile apps and online portals attract both readers and advertisers looking for tailored, data-driven marketing solutions.

For Instance, in November 2025, Condé Nast expanded its digital presence with a multi-year partnership with eBay focused on integrating commerce directly into its platforms like Vogue, targeting digital consumers increasingly accessing content via mobile apps and portals. This strategy reflects their focus on digital formats that engage audiences on mobile devices.

Advertising Format Analysis

In 2024, the Native Advertising & Sponsored Content segment held a dominant market position, capturing a 45.7% share of the Global Magazine Advertising Market. These types of ads integrate smoothly with editorial content, providing a subtle yet effective form of advertising that does not interrupt the reader’s experience.

By blending in with the magazine’s look and feel, native ads encourage higher engagement and build trust among readers, which is crucial for advertisers aiming to establish a deeper connection with audiences. This approach has become popular as brands seek more authentic ways to communicate their messages without disrupting content consumption.

The use of sponsored content continues to grow because it offers a win-win: readers get relevant, valuable information, and advertisers benefit from improved receptivity and brand perception. This format is increasingly driving advertising strategies in magazines.

For instance, in October 2025, Condé Nast also demonstrated a strong emphasis on sponsored content by expanding editorial commerce, transforming editorial content into direct shopping experiences, which aligns with the rise of native ad formats that blend seamlessly with content.

Industry Vertical Analysis

In 2024, The Media & Entertainment segment held a dominant market position, capturing an 18.2% share of the Global Magazine Advertising Market. This sector invests heavily in magazines to promote movies, music, TV shows, and other entertainment offerings where visual appeal and engaging storytelling matter. Magazines provide an ideal platform for creative and immersive advertisements that capture the attention of entertainment consumers and generate excitement for new releases.

The sector’s strong presence in magazine advertising highlights the ongoing importance of this medium in reaching niche audiences interested in entertainment content. Magazines combine high-quality visuals and curated editorial environments, which appeal to advertisers promoting entertainment products and events. This vertical continues to drive considerable ad spending within the magazine advertising space.

For Instance, in October 2025, Condé Nast hosted its annual Vogue World event featuring high-profile entertainment acts, reinforcing its deep connection to the media and entertainment vertical through immersive experiences and advertising partnerships.

Emerging Trends

Emerging trends in magazine advertising point to the use of augmented reality and virtual reality to create immersive ad experiences. These technologies let readers interact with ads in new ways, such as trying products virtually in their own environment. Such interactive ads boost consumer interest and help brands stand out.

Additionally, programmatic advertising continues to grow, enabling more precise targeting and efficient ad purchasing. This trend improves how advertisers reach specific groups, making campaigns more relevant and cost-effective. Sustainability is another trend shaping magazine ads.

More consumers favor brands that promote eco-friendly messages, prompting advertisers to focus on green initiatives in their content. Interactive multimedia ads also increase readership engagement by making the ad experience more dynamic and enjoyable. These developments show a clear shift toward ads that offer value both through technology and meaningful messages.

Growth Factors

Growth in magazine advertising is supported by better use of data and analytics, which help marketers understand their audiences deeply. This insight allows ads to be tailored for higher relevance and stronger impact.

The rise of niche magazines with loyal readerships also supports advertiser interest since these outlets offer direct access to well-defined audiences. Combining print with digital ads provides additional growth opportunities by blending traditional strengths with modern reach and flexibility, making campaigns more effective overall.

Data-driven marketing and targeted content remain key factors in attracting advertisers who seek to maximize their returns from magazine ads. This focus on measurable results and audience engagement helps sustain the sector despite challenges from digital media shifts. Specialized magazines and multi-channel strategies are thus crucial elements for continued growth in this advertising space.

Key Market Segments

By Magazine Format

- Print Magazines

- Digital Magazines

- Mobile Apps & Online Portals

By Advertising Format

- Display Advertising

- Native Advertising & Sponsored Content

- Classified Advertising

- Others

By Industry Vertical

- Automotive

- Financial Services

- FMCG

- Media & Entertainment

- Retail

- Real Estate

- Education

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Investment in Print Advertising

The magazine advertising market is supported by steady investments from sectors such as automobiles and fast moving consumer goods. Print advertising is used to build trust and strengthen customer relationships because magazine ads help generate brand awareness and work effectively alongside other marketing channels.

Magazines also provide a focused and loyal readership, which makes them valuable for reaching specific demographic groups. Demand remains stable as interest in high quality and niche content continues, particularly in developing regions where print media maintains strong influence.

In October 2025, Condé Nast outlined plans to expand its audience by using AI tools to improve engagement and enhance subscription experiences. These efforts aim to support value driven growth and increase advertising revenue by deepening connections with loyal readers.

Restraint

Declining Magazine Circulation

A significant restraint for the magazine advertising market is the steady decline in magazine circulation worldwide. Fewer readers mean a shrinking audience for print ads, making magazine advertising less attractive to advertisers seeking impactful reach. As more consumers turn to affordable digital alternatives and online publications, the print space becomes harder to sustain profitably.

Print magazines also face competition from faster, more flexible digital campaigns. Digital advertising can be launched and adjusted quickly, contrasting with the long preparation times required for magazine ads. This inflexibility in timing and slower adaptation to market trends limit magazine advertising’s growth and discourage some advertisers from committing substantial budgets to print media.

For instance, in October 2025, Hearst’s CEO publicly acknowledged that 2025 was a difficult year for magazine advertising due to declining ad revenues and increasing competition from digital platforms. The company highlighted challenges such as shrinking print circulation and rising costs, which make it harder to attract traditional advertisers who now prefer the flexibility and measurability of digital media.

Opportunities

Growth in Niche and Targeted Advertising

An important opportunity in the magazine advertising market comes from the growing demand for niche magazines that serve specific interests and demographics. Advertisers benefit from delivering precise and relevant messages to highly engaged readers, which increases campaign effectiveness and strengthens audience connection with the promoted product or service.

The addition of digital features to print publications also supports hybrid advertising formats that improve interactivity and tracking. These innovations help advertisers enhance campaign performance while maintaining the trusted qualities of print content. Rising interest in sustainability and ethical advertising further expands opportunities as brands aim to align with responsible consumer preferences.

In August 2025, Meredith Corporation reported a 5% year on year rise in premium advertising revenue. Growth was supported by focused campaigns in health, technology, and travel, reflecting the value of targeted magazine audiences. The company’s move toward premium and contextual ad strategies demonstrated how niche advertising and better audience intelligence are shaping new expansion pathways in the magazine advertising market.

Challenges

High Costs and ROI Concerns

A key challenge for the magazine advertising market is the rising cost of producing and distributing print ads, which can be difficult for smaller advertisers to manage. These higher expenses, combined with strong competition from digital platforms, make it harder for brands to justify allocating budgets to print campaigns.

Concerns about return on investment also continue to grow because digital media provides more flexible and measurable advertising options. Declining print circulation further limits audience reach, making it difficult to gauge campaign impact. As media consumption shifts toward digital environments, advertisers must reassess the cost effectiveness of traditional magazine advertising.

In July 2025, Bauer Media Group introduced a digital magazine supported by native advertising in collaboration with brands such as Bacardi and H&M. The move reflected adaptation to digital demand while highlighting the high production and distribution costs that challenge the print model. The company’s investments in digital and out of home advertising indicated the level of spending needed to stay competitive as traditional print revenues decline.

Key Players Analysis

Condé Nast, Hearst Communications, Meredith Corporation, Time Inc., and Bauer Media Group lead the magazine advertising market with strong global portfolios, influential editorial brands, and deep advertiser relationships. Their magazines offer premium audiences and trusted content across lifestyle, fashion, business, and news categories. These companies focus on integrated print-digital campaigns, audience segmentation, and data-driven placement strategies.

Future plc, Lagardère Group, Hachette Filipacchi Médias, Rodale, IPC Media, Gruner + Jahr, Sanoma Media, and Scripps Networks Interactive strengthen the competitive landscape with niche and special-interest publications. Their platforms appeal to targeted reader segments, enabling advertisers to run more precise campaigns. These publishers emphasize cross-platform storytelling, branded content, and multimedia extensions.

National Geographic Partners, The New York Times Company, The Economist Group, Reed Elsevier, Thomson Reuters, Bertelsmann, Pearson, Wolters Kluwer, Grupo Expansión, Grupo Reforma, The Hindu Group, India Today Group, and others broaden the market with authoritative content and strong regional influence. Their publications attract engaged readers through high-credibility reporting and deep subject expertise. These companies focus on subscription-led growth, digital ad formats, and multi-channel distribution.

Top Key Players in the Market

- Condé Nast

- Hearst Communications

- Meredith Corporation

- Time Inc.

- Bauer Media Group

- Future plc

- Lagardère Group

- Hachette Filipacchi Médias

- Rodale Inc.

- IPC Media

- Gruner + Jahr

- Sanoma Media

- Scripps Networks Interactive

- National Geographic Partners

- The New York Times Company

- The Economist Group

- Reed Elsevier

- Thomson Reuters

- Bertelsmann

- Pearson PLC

- Wolters Kluwer

- Grupo Expansión

- Grupo Reforma

- The Hindu Group

- India Today Group

- Others

Recent Developments

- In February 2025, Hearst Magazines launched a global expansion of AURA, its AI-powered first-party ad targeting tool, now rolling out across Europe. AURA leverages billions of audience signals to deliver more accurate, privacy-forward ad targeting, driving double-digit click-through rate improvements over traditional cookie-based methods.

- In October 2025, Bauer Media Group restructured leadership to sharpen its focus on its core publishing, audio, and outdoor businesses. CEO Yvonne Bauer emphasized faster decision-making for sustainable growth, reflecting ongoing investments in digital transformation and diversified media formats.

Report Scope

Report Features Description Market Value (2024) USD 34.5 Bn Forecast Revenue (2034) USD 45 Bn CAGR(2025-2034) 2.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Magazine Format (Print Magazines, Digital Magazines, Mobile Apps & Online Portals), By Advertising Format (Display Advertising, Native Advertising & Sponsored Content, Classified Advertising, Others), By Industry Vertical (Automotive, Financial Services, FMCG, Media & Entertainment, Retail, Real Estate, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Condé Nast, Hearst Communications, Meredith Corporation, Time Inc., Bauer Media Group, Future plc, Lagardère Group, Hachette Filipacchi Médias, Rodale Inc., IPC Media, Gruner + Jahr, Sanoma Media, Scripps Networks Interactive, National Geographic Partners, The New York Times Company, The Economist Group, Reed Elsevier, Thomson Reuters, Bertelsmann, Pearson PLC, Wolters Kluwer, Grupo Expansión, Grupo Reforma, The Hindu Group, India Today Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Magazine Advertising MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Magazine Advertising MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Condé Nast

- Hearst Communications

- Meredith Corporation

- Time Inc.

- Bauer Media Group

- Future plc

- Lagardère Group

- Hachette Filipacchi Médias

- Rodale Inc.

- IPC Media

- Gruner + Jahr

- Sanoma Media

- Scripps Networks Interactive

- National Geographic Partners

- The New York Times Company

- The Economist Group

- Reed Elsevier

- Thomson Reuters

- Bertelsmann

- Pearson PLC

- Wolters Kluwer

- Grupo Expansión

- Grupo Reforma

- The Hindu Group

- India Today Group

- Others