Global Machine Learning Operations (MLOps) Market By Component (Platform, Service), Deployment Mode (On-premise, Cloud), Organization Size (Large Enterprises, Small and Medium-sized Enterprises), Industry Vertical (BFSI, Manufacturing, IT and Telecom, Retail and E-commerce, Energy and Utility, Healthcare, Media and Entertainment, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 110329

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

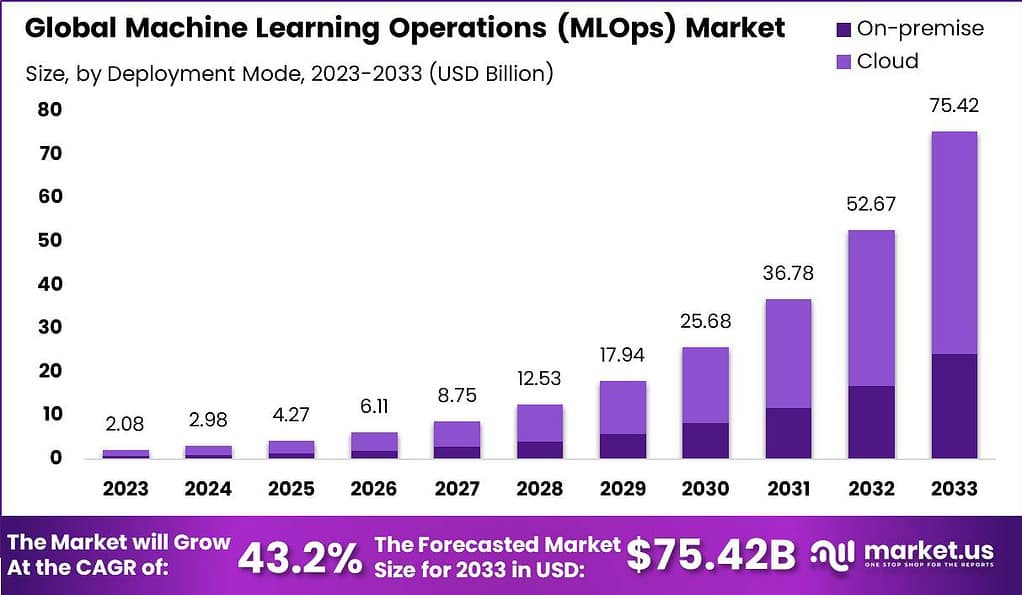

The Global Machine Learning Operations (MLOps) Market size is expected to be worth around USD 75.42 Billion by 2033, from USD 2.08 Billion in 2023, growing at a CAGR of 43.2% during the forecast period from 2024 to 2033.

Machine Learning Operations (MLOps) refers to the practices and techniques used to manage and operationalize machine learning models in a production environment. It involves the integration of various processes, tools, and methodologies to ensure the smooth deployment, monitoring, and maintenance of machine learning models.

The MLOps market plays a crucial role in supporting organizations that leverage machine learning for their operations. It focuses on providing solutions and services that enable efficient and effective management of machine learning workflows. The market is driven by the increasing adoption of machine learning technologies across industries and the growing need to streamline the deployment and management of machine learning models.

Note: Actual Numbers Might Vary In Final Report

The MLOps market refers to the industry segment that offers tools, services, and platforms that are related to MLOps practices. The market includes a range of players, such as software vendors as well as cloud service providers and consulting firms that offer solutions to the problems that organizations face when who are implementing machine learning in their business operations.

The MLOps market is growing quickly as more more companies realize the importance of efficiently managing their models of machine learning. With the increased use in machine learning throughout all industries organisations are searching for methods to speed up the implementation and maintenance of ML models on a large scale.

In April 2023, ClearML launched new capabilities for continuous ML in open-source MLOps, meeting the growing demand across global markets. The introduction of the Sneak Peek application allows ClearML enterprise users to seamlessly deploy applications directly from their development ecosystem.

Key Takeaways

- The global Machine Learning Operations (MLOps) market is anticipated to reach a valuation of USD 75.42 Billion by 2033, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 43.2% from 2024 to 2033.

- In 2023, the Platform segment emerged as the frontrunner, commanding a market share exceeding 70%. This dominance is attributed to the versatility and user-friendly interfaces of automated machine learning (AutoML) platforms.

- As of 2023, the Cloud segment emerged as the leader, capturing over 68% of the market share. Its scalability and flexibility make it the preferred choice for organizations seeking agile MLOps solutions.

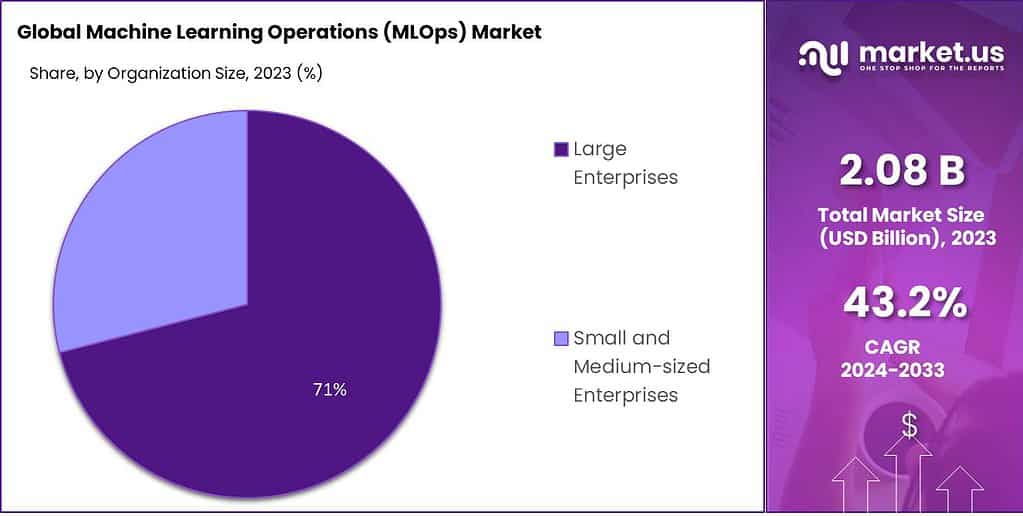

- Large Enterprises held a dominant market position in 2023, capturing more than 71% of the market share. Their substantial resources and technical capabilities enable efficient implementation and scaling of MLOps initiatives.

- The Banking, Financial Services, and Insurance (BFSI) sector led the adoption of MLOps, capturing over 20% of the market share in 2023. MLOps is pivotal in enhancing data analytics, risk management, and personalized customer services in this sector.

Component Outlook

In 2023, the Machine Learning Operations (MLOps) market showcased a dynamic landscape, with the Platform segment emerging as the frontrunner, firmly establishing its dominance with a commanding market share exceeding 70%.

The Platform segment, which includes an array of robust tools and frameworks, played a pivotal role in facilitating end-to-end machine learning workflows for organizations across various industries. The surge in demand for comprehensive MLOps solutions that seamlessly integrate with existing infrastructures catapulted the Platform segment to its preeminent position.

The Platform component of MLOps encompasses a suite of technologies designed to streamline the deployment, monitoring, and management of machine learning models. This segment’s ascendancy can be attributed to the increasing adoption of automated machine learning (AutoML) platforms, which empower organizations to leverage machine learning capabilities without necessitating extensive expertise.

The versatility of these platforms in catering to diverse business needs, coupled with their user-friendly interfaces, fueled their widespread acceptance. Moreover, the Platform segment’s dominance was further reinforced by its ability to address key challenges in model deployment, scalability, and version control.

Conversely, the Service segment, while constituting a substantial portion of the MLOps market, faced a competitive landscape shaped by the overarching influence of the Platform counterpart. The Service segment encompasses a spectrum of offerings, including consulting, training, and support services.

Although indispensable for organizations aiming to navigate the complexities of MLOps implementation, the Service segment encountered stiff competition from the maturing capabilities of end-to-end platforms. Despite this, the Service segment retained its significance, especially for enterprises seeking tailored solutions, personalized guidance, and expertise in optimizing their machine learning workflows.

Amidst this market dynamic, the numerical data accentuates the robust performance of the Platform segment. With a market share exceeding 70%, the Platform component outpaced its counterparts, reflecting the growing preference among businesses for comprehensive and integrated MLOps solutions. This numerical insight underscores the strategic importance of MLOps platforms as the linchpin for organizations striving to extract maximum value from their machine learning initiatives.

Deployment Mode Analysis

As of 2023, the Machine Learning Operations (MLOps) market demonstrated a notable dichotomy in the deployment landscape, with the Cloud segment emerging as the undisputed leader, commanding a significant market share exceeding 68%.

The Cloud deployment mode, characterized by its scalability, flexibility, and cost-effectiveness, solidified its dominant position in response to the escalating demand for agile and accessible MLOps solutions. The allure of cloud-based MLOps platforms lies in their ability to empower organizations with the flexibility to scale resources dynamically, facilitating seamless integration and deployment of machine learning models.

The Cloud deployment mode’s ascendancy is further propelled by its alignment with contemporary business paradigms, where agility and adaptability are paramount. The ease of provisioning resources, coupled with the ability to leverage advanced cloud-based machine learning services, positions the Cloud segment as the go-to choice for organizations seeking to streamline their MLOps workflows.

In contrast, the On-premise segment, while still holding a significant share of the MLOps market, faces challenges in terms of scalability and resource management. On-premise deployments are often associated with higher upfront costs and may lack the agility and accessibility offered by cloud-based counterparts. However, certain industries with stringent data privacy and regulatory requirements continue to opt for on-premise solutions, contributing to the segment’s sustained relevance.

Looking ahead, the Cloud segment is poised for continued growth, driven by ongoing advancements in cloud technology and the increasing realization among organizations of the operational benefits associated with cloud-based MLOps solutions. Vendors within the Cloud segment are expected to focus on enhancing security measures, optimizing resource allocation, and offering a diverse range of machine learning services to cater to the evolving needs of businesses across various sectors.

Organization Size Analysis

In 2023, the Large Enterprises segment in the Machine Learning Operations (MLOps) Market held a dominant market position, capturing more than a 71% share. This commanding lead is primarily due to the extensive resources and capabilities large enterprises possess to implement and benefit from MLOps.

These organizations typically have complex and voluminous data workflows, making the integration of MLOps crucial for optimizing machine learning processes. Large enterprises often have the financial and technical resources to invest in advanced MLOps platforms and services, enabling them to efficiently scale their machine learning initiatives.

Additionally, their substantial investment in research and development often leads to more innovative applications of MLOps, further driving this segment’s market dominance. The strategic advantage gained through effective management of machine learning operations makes MLOps a priority for these large-scale businesses.

Conversely, the Small and Medium-sized Enterprises (SMEs) segment, while smaller in market share, is rapidly growing due to the increasing accessibility of MLOps solutions. In 2023, SMEs accounted for a notable percentage of the MLOps market, reflecting the rising importance of machine learning in smaller-scale operations. SMEs are adopting MLOps to enhance their competitiveness, improve decision-making processes, and drive innovation.

The cloud-based deployment of MLOps, in particular, is a significant enabler for SMEs, offering a cost-effective and scalable approach to leveraging advanced machine learning capabilities. This segment’s growth is also spurred by the increasing availability of user-friendly MLOps platforms and services tailored to the needs of smaller businesses. As MLOps technologies become more accessible and affordable, SMEs are expected to increasingly adopt these solutions, driving growth in this market segment.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment in the Machine Learning Operations (MLOps) Market held a dominant market position, capturing more than a 20% share. The significant adoption of MLOps in this sector is driven by the need for enhanced data analytics, risk management, and personalized customer services. BFSI institutions are leveraging MLOps to optimize their machine learning models, ensuring efficient and secure handling of large volumes of financial data.

The technology also plays a crucial role in fraud detection, algorithmic trading, and customer service automation. The growing focus on digital transformation within the BFSI sector is further fueling the adoption of MLOps, as these institutions seek to stay competitive and meet evolving regulatory and customer demands.

In the Manufacturing sector, MLOps is increasingly being utilized to streamline operations and enhance production efficiency. The integration of MLOps in manufacturing processes aids in predictive maintenance, quality control, and supply chain optimization. This sector’s investment in MLOps is aimed at harnessing machine learning to reduce downtime, predict equipment failures, and tailor production processes to market demands.

The IT and Telecom industry also shows a strong inclination towards MLOps adoption. In this sector, MLOps is essential for managing the vast amounts of data generated by IT systems and telecommunication networks. It facilitates the development and deployment of AI models that enhance network optimization, customer experience, and cybersecurity measures.

Retail and E-commerce is another key industry vertical embracing MLOps. Here, MLOps is utilized for customer behavior analysis, product recommendation systems, and inventory management. The ability of MLOps to provide insights into consumer preferences and buying patterns is invaluable in this highly competitive market.

Energy and Utility companies are adopting MLOps to manage and analyze data from smart grids and other IoT devices. This enables more efficient energy distribution, predictive maintenance of infrastructure, and better resource management, contributing to sustainable operations.

The Healthcare sector is leveraging MLOps for drug discovery, patient diagnostics, and treatment personalization. MLOps facilitates the handling of complex medical data, aiding in research and the development of predictive models for patient care.

In the Media and Entertainment industry, MLOps is transforming content creation, recommendation systems, and customer engagement strategies. The technology assists in analyzing viewer preferences and creating tailored content, enhancing user experience.

Other Industry Verticals, including government, education, and transportation, are increasingly exploring the benefits of MLOps. These sectors are utilizing machine learning to improve service delivery, operational efficiency, and decision-making processes.

Driver

Standardizing ML Processes for Team Efficiency

The adoption of Machine Learning Operations (MLOps) is driven by the need to standardize ML processes for team efficiency. MLOps focuses on streamlining the deployment, monitoring, and management of machine learning models in production environments. By standardizing these processes, organizations can ensure that ML models are developed, tested, and deployed consistently, reducing errors and improving overall efficiency.

Standardization in MLOps involves implementing best practices, tools, and frameworks that enable collaboration between data scientists, engineers, and other stakeholders involved in the ML lifecycle. This includes version control, automated testing, continuous integration and deployment (CI/CD), and monitoring and alerting systems. By adopting these standardized practices, teams can work more cohesively, iterate quickly, and deliver ML solutions faster to meet business needs.

Restraint

Scarcity of Expertise

One of the significant restraints in the MLOps market is the scarcity of expertise. MLOps requires a combination of skills from data science, software engineering, and operations, making it challenging to find professionals with the necessary expertise in all these areas.

The scarcity of expertise in MLOps stems from the rapid growth of the field and the evolving nature of the technology. Traditional data scientists and engineers often need to upskill themselves to become proficient in MLOps practices. Additionally, the demand for MLOps professionals surpasses the supply, leading to a scarcity of experienced practitioners.

To overcome this restraint, organizations are investing in training and upskilling their existing workforce to bridge the knowledge gap. They are also partnering with external consultants or service providers who specialize in MLOps to leverage their expertise. As the field matures, more educational programs and certifications focused on MLOps are emerging, which can help address the scarcity of expertise.

Opportunity

Growth in the Financial Sector

The financial sector presents a significant opportunity for MLOps growth. Financial institutions are increasingly embracing machine learning to automate processes, enhance risk management, and improve customer experiences. MLOps enables these organizations to deploy and manage ML models effectively, ensuring compliance, reliability, and scalability.

In the financial sector, MLOps can be utilized for fraud detection, credit risk assessment, algorithmic trading, customer segmentation, and personalized recommendations. By integrating MLOps practices, financial institutions can enhance their decision-making capabilities and gain a competitive edge.

Furthermore, the growing regulatory scrutiny in the financial industry necessitates robust ML model governance and explainability, which can be facilitated by MLOps. Financial institutions that successfully implement MLOps practices can demonstrate transparency, mitigate risks, and build trust with regulators and customers alike.

Challenge

Raw Data Management

Raw data management poses a significant challenge in the MLOps landscape. Machine learning models rely on large volumes of high-quality data for training, and managing this raw data effectively is crucial for accurate model development and deployment.

Raw data management involves tasks such as data ingestion, preprocessing, storage, and data versioning. Ensuring data quality, integrity, and consistency across the ML pipeline is essential but can be complex and time-consuming.

Organizations face challenges related to data access, data governance, data privacy, and data security. They need to establish robust data pipelines, implement data validation techniques, and adhere to regulatory requirements, such as data anonymization and protection.

To address these challenges, organizations are adopting data management platforms, data cataloging tools, and data governance frameworks. They are also leveraging cloud-based solutions and automated data processing techniques to streamline raw data management in the MLOps workflow.

Emerging Trends

- AutoML and Automated MLOps: The integration of AutoML (Automated Machine Learning) with MLOps is becoming prominent. AutoML tools automate various stages of the ML lifecycle, such as data preprocessing, feature engineering, model selection, and hyperparameter tuning, making it easier to deploy ML models efficiently.

- Model Explainability and Interpretability: As ML models are increasingly used in critical domains, the need for model explainability and interpretability is growing. Emerging trends focus on developing techniques and tools that provide insights into model decisions and ensure transparency, enabling organizations to address regulatory requirements and build trust.

- Federated Learning: Federated Learning is gaining traction as a privacy-preserving technique for training ML models on distributed data sources. This approach allows multiple parties to collaborate on model development without sharing raw data, thus addressing privacy concerns and enabling cross-organizational ML collaborations.

- MLOps in Edge Computing: With the proliferation of Internet of Things (IoT) devices and edge computing, MLOps is expanding to support ML model deployment and management at the edge. Edge MLOps involves optimizing models for resource-constrained edge devices, ensuring low latency, and enabling real-time inferencing.

- Ethical and Responsible AI: The ethical implications of AI and ML are receiving increased attention. Emerging trends focus on incorporating ethical considerations into the MLOps workflow, such as bias detection and mitigationstrategies, fairness metrics, and robust validation techniques. Organizations are striving to ensure responsible AI practices by integrating ethics frameworks and guidelines into their MLOps processes

Key Market Segments

Component

- Platform

- Service

Deployment Mode

- On-premise

- Cloud

Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

Industry Vertical

- BFSI

- Manufacturing

- IT and Telecom

- Retail and E-commerce

- Energy and Utility

- Healthcare

- Media and Entertainment

- Other Industry Verticals

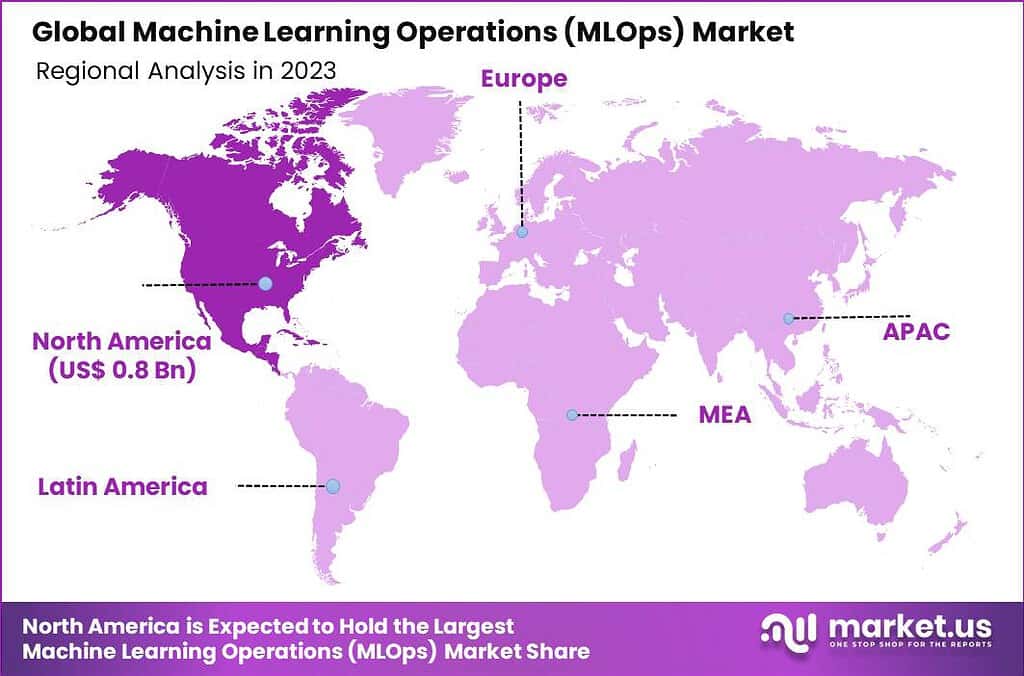

Regional Analysis

In 2023, North America held a dominant market position in the Machine Learning Operations (MLOps) Market, capturing more than a 41% share. This significant market dominance can be attributed to the region’s advanced technological infrastructure and the presence of leading AI and machine learning companies.

The demand for Machine Learning Operations (MLOps) in North America reached USD 0.8 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. The United States, in particular, is at the forefront of innovation in MLOps, driven by substantial investments in AI research and a strong ecosystem supporting startups and tech giants alike.

The high adoption rate of AI technologies in various industry verticals, such as healthcare, finance, and retail, further fuels the growth of the MLOps market in this region. Additionally, North America’s focus on developing regulatory frameworks for data privacy and AI ethics contributes to a structured growth environment for MLOps.

Europe follows North America closely in the MLOps market. The region’s emphasis on data privacy and security, especially with regulations like GDPR, plays a significant role in shaping MLOps strategies. European countries are increasingly investing in AI and machine learning, with a focus on ethical and responsible AI, driving the demand for sophisticated MLOps solutions. The strong presence of automotive, manufacturing, and healthcare industries in Europe also contributes to the growth of MLOps in the region.

The Asia-Pacific (APAC) region is experiencing rapid growth in the MLOps market, driven by the digital transformation initiatives in countries like China, Japan, India, and South Korea. These countries are making significant strides in AI and machine learning, backed by government support and investments. The growing IT sector, coupled with a surge in data-driven businesses, is propelling the demand for MLOps solutions in the region. Furthermore, the increasing adoption of cloud technologies in APAC contributes to the scalability and accessibility of MLOps solutions.

Latin America, while holding a smaller share of the global MLOps market, shows promising growth potential. The region’s growing IT industry and increasing digitalization efforts across various sectors are key drivers for the adoption of MLOps. Countries like Brazil and Mexico are gradually emerging as significant players in the MLOps landscape, with a focus on leveraging AI for economic growth and innovation.

The Middle East and Africa (MEA) region is also starting to make its mark in the MLOps market. The region’s investment in smart city initiatives and a growing focus on diversifying economies through technology are notable factors contributing to the growth of MLOps. The MEA region’s increasing interest in healthcare technology and financial services powered by AI technologies is expected to drive further expansion in the MLOps market.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The key players in the MLOps market have established a strong presence and reputation in the industry. They are often well-known technology companies with a proven track record in delivering innovative solutions and services related to machine learning and AI. Their reputation and brand recognition contribute to their credibility in the market.

These key players provide comprehensive MLOps offerings that cover various aspects of the machine learning lifecycle. Their solutions typically encompass key capabilities such as model development and training, model deployment and management, model monitoring and optimization, and collaboration and automation tools. Their offerings cater to the diverse needs of organizations adopting machine learning.

Top Key Players

- Akira AI

- Cloudera Inc.

- Alteryx Inc.

- IBM Corporation

- Amazon Web Services Inc.

- Databricks Inc.

- DataRobot Inc.

- GAVS Technologies

- Microsoft Corporation

- Google LLC

- Neptune Labs

- H2O.ai

- Other Key Players

Recent Developments

- November 2023: DataRobot formed an alliance with Cisco and partnered with Evolutio to introduce an MLOps solution for the Cisco FSO (Full-Stack Observability) platform. This new solution provides business-grade observability for generative AI and predictive AI, optimizing and scaling deployments while delivering enhanced business value to customers.

- April 2023: MLflow released MLflow 2.3, an upgraded version of the open-source ML platform. This update includes new features and LLMOps (Large Language Model Operations) support, enhancing its capability to deploy and manage large language models and seamlessly integrate them into other ML operations.

- March 2023: Striveworks collaborated with Microsoft to offer the Chariot MLOps platform in the public segment. This integration empowers organizations to leverage Striveworks’ Chariot platform for their complete model lifecycle on Azure’s scalable infrastructure.

- January 2023: Domino Data Lab enhanced its partner program, providing advanced offerings to drive data science innovation. The program includes new training, accreditations, and ecosystem integrations, enabling partners to leverage extended machine learning operations capabilities and knowledge.

Report Scope

Report Features Description Market Value (2024) US$ 2.98 Bn Forecast Revenue (2033) US$ 75.42 Bn CAGR (2024-2033) 43.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Platform, Service), Deployment Mode (On-premise, Cloud), Organization Size (Large Enterprises, Small and Medium-sized Enterprises), Industry Vertical (BFSI, Manufacturing, IT and Telecom, Retail and E-commerce, Energy and Utility, Healthcare, Media and Entertainment, Other Industry Verticals) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Akira AI, Cloudera Inc., Alteryx Inc., IBM Corporation, Amazon Web Services Inc., Databricks Inc., DataRobot Inc., GAVS Technologies, Microsoft Corporation, Google LLC, Neptune Labs, H2O.ai, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is MLOps, and how does it differ from traditional machine learning development?MLOps, short for Machine Learning Operations, is a set of practices that aims to streamline and automate the deployment, monitoring, and management of machine learning models in a production environment. Unlike traditional machine learning development, MLOps emphasizes collaboration between data scientists, machine learning engineers, and operations teams to ensure a seamless and efficient ML lifecycle.

What is the market size of ML operations?The global Machine Learning Operations (MLOps) Market size is poised to cross USD 2.98 Billion in 2024 and is likely to attain a valuation of USD 75.42 Billion by 2033. The Machine Learning Operations (MLOps) industry share is projected to develop at a CAGR of 43.2% from 2024 to 2033.

Is MLOps in demand?Yes, MLOps is in high demand as organizations increasingly recognize the importance of efficiently deploying, managing, and scaling machine learning models in a production environment. The demand for MLOps arises from the need to address challenges associated with model deployment, monitoring, collaboration between teams, and ensuring the reliability of machine learning workflows.

Why is MLOps becoming increasingly important in the business landscape?MLOps is gaining importance due to the growing adoption of machine learning in various industries. It addresses challenges related to deploying and maintaining ML models at scale, ensuring reliability, reproducibility, and compliance.

What are the key components of an MLOps infrastructure?An MLOps infrastructure typically consists of two main components: Platforms and Services. Platforms include tools and frameworks for model development, deployment, and monitoring. Services encompass consulting, training, and support to assist organizations in implementing and maintaining MLOps practices effectively.

What role does data security play in MLOps implementation?Data security is a critical aspect of MLOps implementation. MLOps frameworks incorporate measures to ensure the privacy and integrity of sensitive data used in machine learning models. Security protocols, encryption, and access controls are implemented to mitigate risks associated with data breaches and unauthorized access.

Machine Learning Operations (MLOps) MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Machine Learning Operations (MLOps) MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Akira AI

- Cloudera Inc.

- Alteryx Inc.

- IBM Corporation

- Amazon Web Services Inc.

- Databricks Inc.

- DataRobot Inc.

- GAVS Technologies

- Microsoft Corporation

- Google LLC

- Neptune Labs

- H2O.ai

- Other Key Players