Global Luxury Wines and Spirits Market Size, Share, Growth Analysis By Product Type (Luxury Wines, Luxury Spirits), By Luxury Wines (Red Wine, White Wine, Dessert Wine, Sparkling Wine), By Luxury Spirits (Whiskey, Tequila, Vodka, Rum, Gin, Cognac), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152206

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

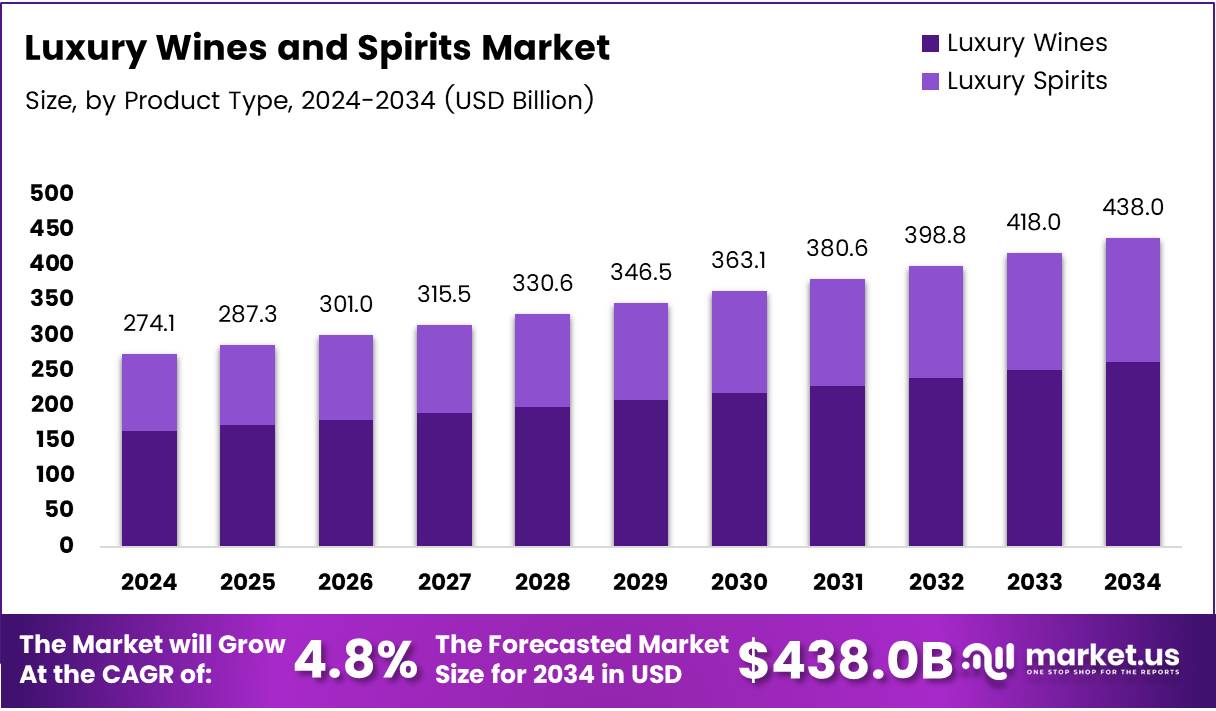

The Global Luxury Wines and Spirits Market size is expected to be worth around USD 438.0 Billion by 2034, from USD 274.1 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The luxury wines and spirits market has seen a remarkable evolution over the past few years, driven by the growing interest in premium alcoholic beverages among affluent consumers. As per Lunzerwine, 71.2% of adults in the UK consume alcohol at least once a week, a key factor in the market’s steady demand. This trend indicates an increasing preference for high-end drinks, including luxury wines and spirits, often associated with celebrations and special occasions.

As the demand for quality alcoholic beverages rises, the global market for luxury wines and spirits is expected to expand significantly. In 2023, the average American consumed 4.7 liters of wine, according to 8wines. This statistic highlights the growing wine consumption in mature markets, further emphasizing the potential for luxury wine sales. Wine consumption is projected to reach 214.2 million hectolitres by 2024, according to Winemag. Such data points are crucial for understanding the broad market scope and the rising demand for premium offerings.

The U.S. has long been a significant market for luxury wines, with wine consumption exceeding the national average. According to Wine-Intelligence, the Consumption Index in the U.S. stands at approximately 113. This indicates a notable increase in wine consumption, underscoring the high demand for luxury wines and spirits among American consumers. These statistics also suggest a shift in consumer behavior toward premium, exclusive wines that offer exceptional quality and taste.

The luxury wines and spirits market is not only benefiting from consumption trends but also from shifts in social behavior. Consumers increasingly seek unique, high-quality experiences, pushing them toward boutique wineries and artisanal spirit producers. Luxury brands are focusing on producing limited-edition offerings that cater to this growing demand for exclusivity and premium craftsmanship.

This segment of the alcoholic beverage industry is likely to continue expanding as luxury consumption increases across the globe. The steady rise in wine consumption in key markets like the U.S. and the UK creates a favorable environment for luxury brands to capitalize on emerging trends. Consequently, businesses in this space are expected to intensify their efforts to differentiate their products, offer more bespoke experiences, and cater to the tastes of the affluent consumer.

Key Takeaways

- The global luxury wines and spirits market is projected to reach USD 438.0 Billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034.

- Luxury Wines dominated the market with a share of 56.1% in the By Product Type Analysis segment in 2024.

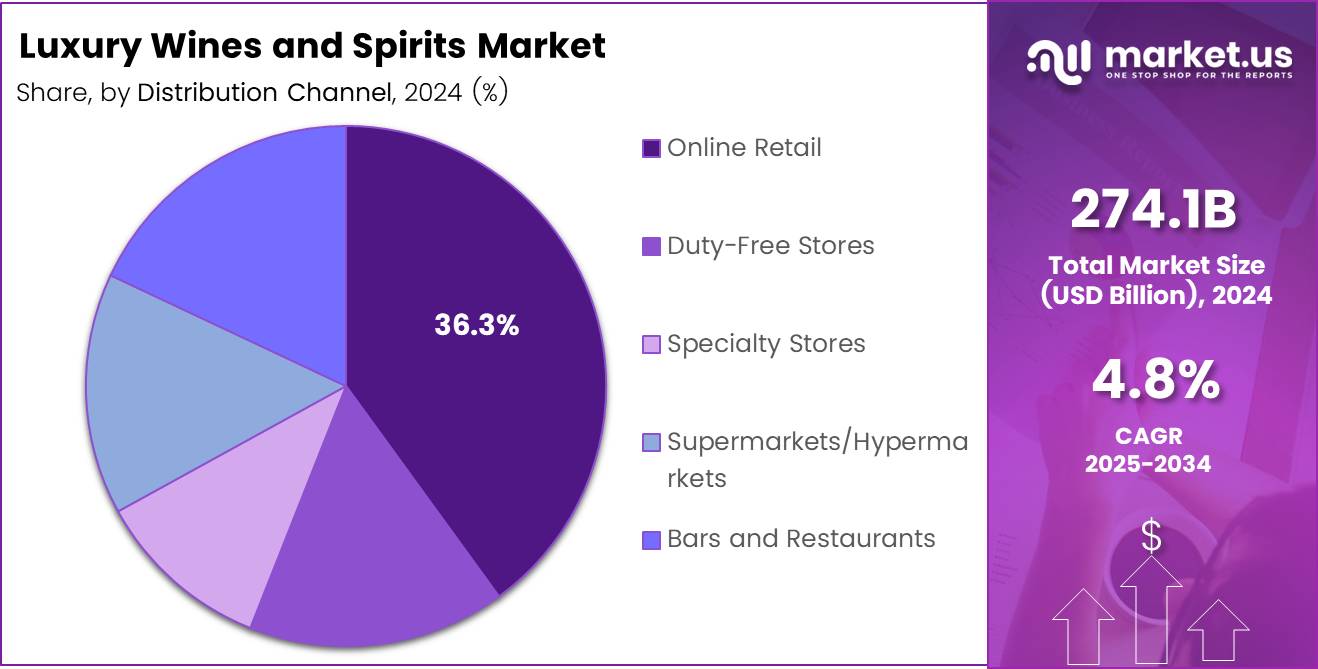

- Online Retail led the By Distribution Channel Analysis segment, holding a share of 36.3% in 2024.

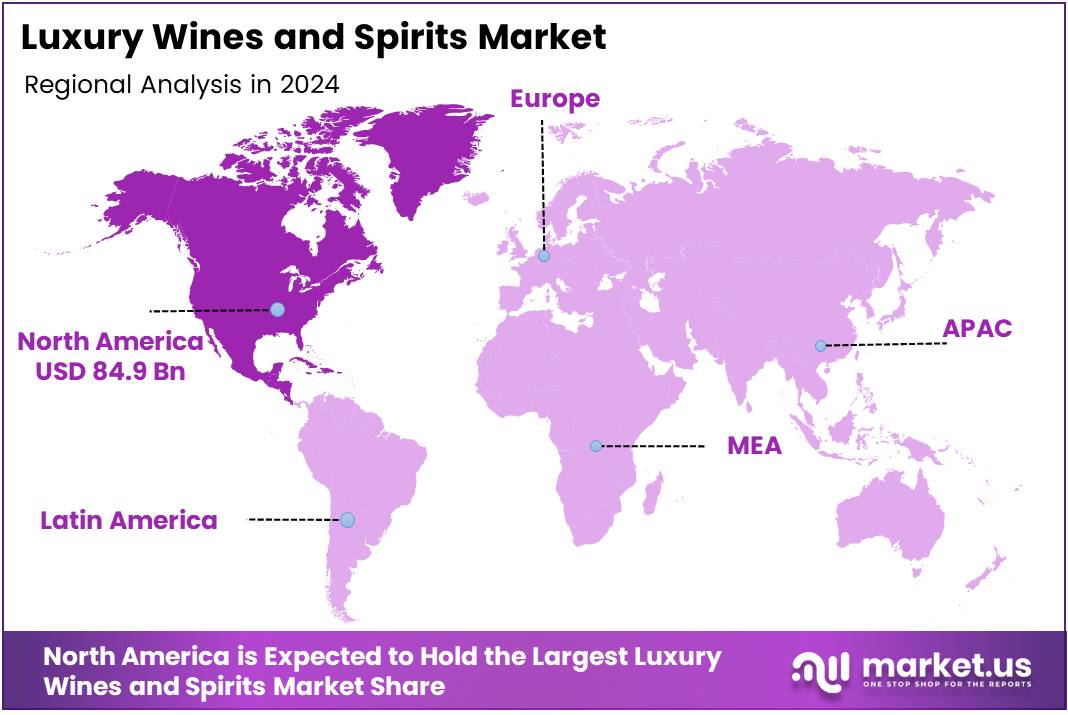

- North America captured 31.4% of the global market share, valued at USD 84.9 Billion in 2024.

Product Type Analysis

Luxury Wines held a dominant market position in the Luxury Wines and Spirits Market with a 56.1% share in 2024.

In 2024, Luxury Wines led the market in the By Product Type Analysis segment of the Luxury Wines and Spirits Market. The segment continues to outperform other categories, showcasing a preference for premium wines among consumers. With a substantial share of 56.1%, Luxury Wines have become the preferred choice for discerning buyers. This preference reflects the growing global trend towards premium and high-end wine experiences, with consumers increasingly seeking top-tier products for special occasions.

On the other hand, Luxury Spirits, while significant, do not yet match the dominance of Luxury Wines in the market. The demand for high-end spirits remains steady, but Luxury Wines continue to outpace them in overall market share. The ongoing focus on fine wine production and the refinement of luxury wine brands will likely sustain their lead in the coming years.

Distribution Channel Analysis

Online Retail held a dominant market position in the Luxury Wines and Spirits Market with a 36.3% share in 2024.

In 2024, Online Retail emerged as the dominant player in the By Distribution Channel Analysis segment of the Luxury Wines and Spirits Market. With a notable share of 36.3%, online retail platforms have become the go-to option for luxury wine and spirit purchases. The convenience and accessibility of online shopping, coupled with the growing trend of e-commerce, have contributed to the rapid expansion of online retail in this market.

While other distribution channels, such as Duty-Free Stores and Specialty Stores, play crucial roles, they have not yet reached the level of influence held by online platforms. This shift highlights the consumer preference for online convenience, especially as luxury buyers increasingly seek streamlined purchasing experiences from the comfort of their homes.

Despite the growth of online retail, traditional retail outlets like Supermarkets/Hypermarkets and Bars and Restaurants still contribute significantly to sales. However, the dominance of online platforms is undeniable, and it is expected to continue growing in the future.

Key Market Segments

By Product Type

- Luxury Wines

- Luxury Spirits

By Luxury Wines

- Red Wine

- White Wine

- Dessert Wine

- Sparkling Wine

By Luxury Spirits

- Whiskey

- Tequila

- Vodka

- Rum

- Gin

- Cognac

By Distribution Channel

- Online Retail

- Duty-Free Stores

- Specialty Stores

- Supermarkets/Hypermarkets

- Bars and Restaurants

Drivers

Increasing Demand for Luxury Wines and Spirits Drives Market Growth

The increasing disposable income and growing affluent consumer base have greatly contributed to the expansion of the luxury wines and spirits market. As individuals’ purchasing power increases, more people are willing to indulge in high-end products, including premium wines and spirits. This rise in affluence has opened the door to more opportunities for brands catering to luxury tastes.

In recent years, there has been a rising popularity of premium and craft spirits. Consumers are shifting away from mass-market offerings and seeking unique, artisanal products with distinctive flavors and qualities. This shift is pushing wineries and distilleries to offer more exclusive, higher-quality options to meet the demand for niche tastes.

The growth of online sales and e-commerce platforms is also a significant driver. Consumers are now able to explore a wide range of luxury wines and spirits from the comfort of their homes, breaking down barriers like geographic location. Online shopping has made it easier to access high-end alcoholic beverages, leading to a surge in demand.

Finally, the expansion of global tourism and luxury experiences has contributed to the luxury wines and spirits market’s growth. As more individuals travel and experience luxury lifestyles, they seek out premium beverages, further fueling the market. The growing trend of wine and spirit tastings at luxury resorts and destinations has created new opportunities for brands to showcase their products.

Restraints

Challenges Facing the Luxury Wines and Spirits Market

One significant challenge for the luxury wines and spirits market is the strict regulations and taxation policies in key markets. Governments in various regions impose high taxes on alcoholic beverages, which affects the pricing of luxury wines and spirits. These policies can limit growth and make it harder for brands to expand in certain markets.

Another restraint is the shift toward health-conscious consumer behavior. As more people become health-conscious, they are opting for low-alcohol or alcohol-free alternatives. This trend is particularly strong among younger generations who are concerned about the effects of alcohol on their health and well-being, which could negatively impact the demand for luxury wines and spirits.

Growth Factors

Growth Opportunities in the Luxury Wines and Spirits Market

One of the key growth opportunities for the luxury wines and spirits market lies in the emergence of new markets in developing economies. As the middle class in regions like Asia, Africa, and Latin America grows, there is an increasing demand for high-quality luxury products, including wines and spirits. This presents an opportunity for brands to expand into these regions and tap into new consumer bases.

Innovation in packaging and luxury product offerings is another avenue for growth. Companies are increasingly focusing on creating unique packaging designs and limited-edition products to attract high-end consumers. These innovations not only enhance the product’s appeal but also make it a desirable collectible for consumers.

The rising demand for organic and eco-friendly wines also offers a significant opportunity. With growing concerns over environmental sustainability, consumers are increasingly choosing organic wines and spirits that are made using sustainable farming practices. This shift is leading to the emergence of eco-conscious luxury brands that cater to this growing demand.

Emerging Trends

Trending Factors in the Luxury Wines and Spirits Market

Increased interest in wine and spirit pairing experiences is one of the key trends in the luxury market. Consumers are seeking out more sophisticated and unique drinking experiences, often looking for the perfect pairing of wines and spirits with food. This trend has led to an increase in exclusive tasting events and culinary experiences hosted by luxury wine and spirit brands.

The popularity of limited-edition and exclusive collections is also gaining traction. Luxury consumers are drawn to rare, one-of-a-kind products that are often available in small quantities. These limited-edition releases generate a sense of exclusivity and attract high-net-worth individuals who want to own something truly unique.

Finally, the influence of social media and celebrity endorsements plays a significant role in shaping trends within the luxury wines and spirits market. Celebrities and influencers often endorse premium wine and spirit brands, which helps raise awareness and creates a buzz around these products. Social media platforms have become a powerful tool for brand promotion and consumer engagement, making it easier for companies to reach their target audience.

Regional Analysis

North America Dominates the Luxury Wines and Spirits Market with a Market Share of 31.4%, Valued at USD 84.9 Billion

North America holds a commanding position in the global luxury wines and spirits market, capturing 31.4% of the market share, valued at USD 84.9 Billion. This dominance is driven by the high demand for premium products among affluent consumers and a growing preference for premium wines and spirits in the region.

The robust presence of established distribution channels and an increasing inclination toward luxury products contribute significantly to this market share. Moreover, increasing disposable income and a strong culture of wine consumption further fuel growth in this region.

Europe Luxury Wines and Spirits Market Trends

Europe represents a significant portion of the global luxury wines and spirits market. The region’s rich heritage in wine production, particularly in countries like France, Italy, and Spain, is key to its dominance in the high-end market. Europe’s wine culture is deeply embedded in daily life, making luxury wine consumption a traditional yet evolving trend. The market benefits from both a strong local consumer base and tourists seeking premium wine and spirits experiences.

Asia Pacific Luxury Wines and Spirits Market Trends

Asia Pacific has witnessed a surge in the luxury wines and spirits market, with an increasing number of affluent consumers, particularly in China and India, who are developing a taste for premium alcohol. The region’s market is driven by growing urbanization and rising disposable incomes. Furthermore, as more people in these countries embrace luxury alcohol as a symbol of status and prestige, the market is expected to see continued growth. Increased awareness and exposure to international wines and spirits also contribute to the market’s expansion.

Middle East and Africa Luxury Wines and Spirits Market Trends

The Middle East and Africa luxury wines and spirits market is still in its nascent stages but shows promise due to an emerging affluent class and increased interest in premium products. Although stricter regulations on alcohol in some countries might limit growth, the increasing acceptance of luxury wines and spirits in more liberalized markets like the UAE supports market progress. The region is also benefitting from rising tourism and an increasing number of luxury experiences available to consumers.

Latin America Luxury Wines and Spirits Market Trends

In Latin America, the luxury wines and spirits market is steadily expanding, driven by increased consumer interest in premium products. Countries such as Brazil and Argentina, known for their rich wine heritage, are at the forefront of this growth. As the middle class continues to grow and disposable income rises, the demand for luxury wines and spirits is expected to climb. The region’s growth is further supported by the increasing export of luxury wines from other regions, expanding consumer choice and availability.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Luxury Wines and Spirits Company Insights

The global Luxury Wines and Spirits Market in 2024 is driven by the consistent growth and strategic expansion of key players within the industry.

Diageo, a leader in the spirits industry, has continued to maintain a strong presence in the luxury segment through its premium brands, such as Johnnie Walker Blue Label and Don Julio. The company’s strategic focus on product innovation and expanding its portfolio of luxury offerings positions it well for sustained growth.

Ruinart, one of the oldest Champagne houses, remains a dominant player in the luxury wine market. Known for its prestigious champagnes, Ruinart emphasizes craftsmanship and exclusivity, which cater to the growing demand for high-end wines among affluent consumers globally.

Pernod Ricard continues to thrive by focusing on premium spirits and wines, with a robust portfolio of luxury brands like Chivas Regal, Glenlivet, and Martell. The company’s aggressive marketing strategies and acquisitions of premium brands further strengthen its position in the competitive luxury wines and spirits space.

Glenfiddich, renowned for its single malt Scotch whisky, has maintained a strong foothold in the luxury spirits market. The brand’s commitment to quality and its heritage in Scotch whisky production ensures continued consumer loyalty and supports its growth in global luxury markets.

These companies exemplify the luxury sector’s resilience, relying on brand strength, strategic expansions, and a growing demand for premium offerings. Their ability to innovate and maintain exclusivity will drive the continued success of the luxury wines and spirits market in 2024.

Top Key Players in the Market

- Diageo

- Ruinart

- Pernod Ricard

- Glenfiddich

- Brown-Forman

- Bacardi

- LVMH (Moët Hennessy Louis Vuitton)

- Thai Beverage

- Constellation Brands

- E&J Gallo Winery

- Château Margaux

- Rémy Cointreau

- Moët Hennessy

- The Edradour Distillery

- The Macallan

- Penfolds

- Taittinger

Recent Developments

- In June 2025, Oeno Group launched its first fine wine and whisky investment fund, aiming to provide high-net-worth individuals with a unique opportunity to diversify their portfolios by investing in rare and valuable wines and whiskies.

- In May 2025, Alcobev startup Feline Spirits raised Rs 5.2 cr in pre-series A funding, with IPV leading the investment round, to further expand its product offerings and scale its operations in the alcoholic beverage sector.

- In May 2024, O’Neill launched its luxury division with the acquisition of Ram’s Gate Winery, marking a significant step in the brand’s expansion into the luxury wine market.

Report Scope

Report Features Description Market Value (2024) USD 274.1 Billion Forecast Revenue (2034) USD 438.0 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Luxury Wines, Luxury Spirits), By Luxury Wines (Red Wine, White Wine, Dessert Wine, Sparkling Wine), By Luxury Spirits (Whiskey, Tequila, Vodka, Rum, Gin, Cognac) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Diageo, Ruinart, Pernod Ricard, Glenfiddich, Brown-Forman, Bacardi, LVMH (Moët Hennessy Louis Vuitton), Thai Beverage, Constellation Brands, E&J Gallo Winery, Château Margaux, Rémy Cointreau, Moët Hennessy, The Edradour Distillery, The Macallan, Penfolds, Taittinger Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Luxury Wines and Spirits MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Luxury Wines and Spirits MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Diageo

- Ruinart

- Pernod Ricard

- Glenfiddich

- Brown-Forman

- Bacardi

- LVMH (Moët Hennessy Louis Vuitton)

- Thai Beverage

- Constellation Brands

- E&J Gallo Winery

- Château Margaux

- Rémy Cointreau

- Moët Hennessy

- The Edradour Distillery

- The Macallan

- Penfolds

- Taittinger