Global Luxury Shoes Market By Product (Sneakers, Loafers, Fashion Footwear, Formal Footwear, Others), By End-User (Men, Women, Children), By Distribution Channel (Online, Offline), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 38654

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

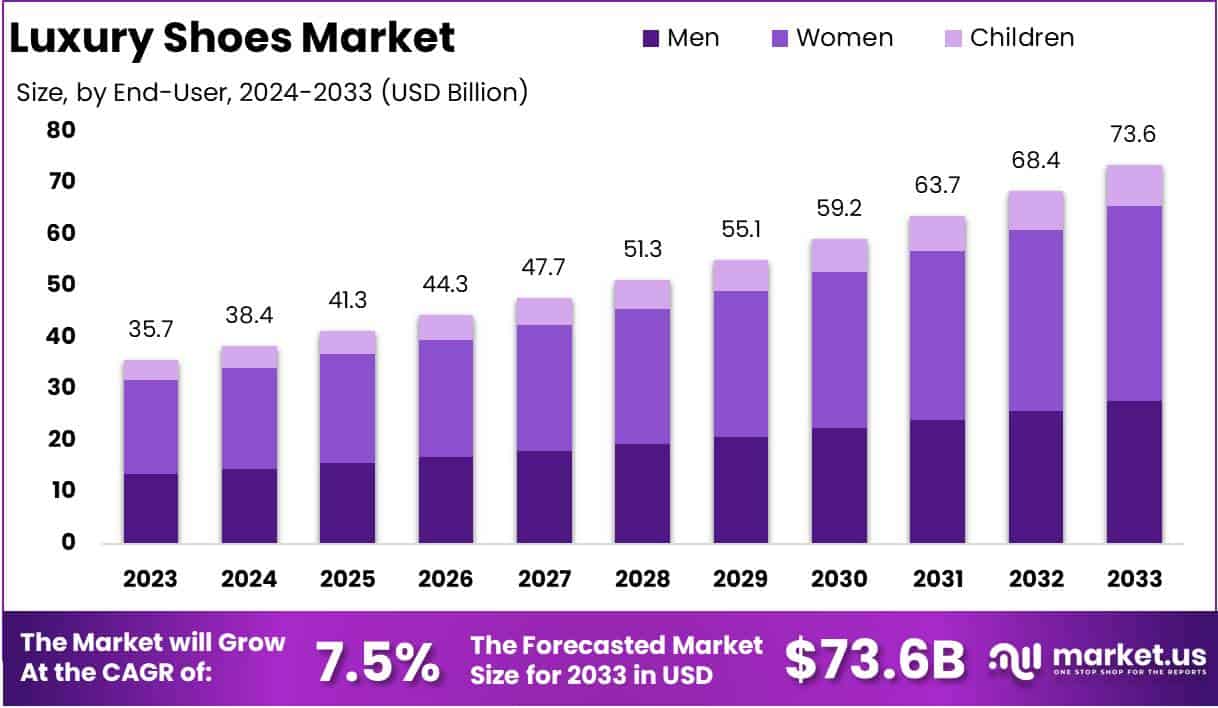

The Global Luxury Shoes Market size is expected to be worth around USD 73.6 Billion by 2033, from USD 35.7 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Luxury shoes are premium footwear designed and crafted with high-quality materials, exceptional craftsmanship, and meticulous attention to detail. These products often feature unique designs, limited production runs, and are associated with prestigious brands, positioning them as status symbols.

The target audience typically includes high-income consumers who value exclusivity, comfort, and style. Luxury shoes encompass a range of categories, including formal wear, casual footwear, and sports-inspired designs, often blending functionality with high fashion.

The luxury shoes market refers to the global industry segment that produces and distributes high-end footwear. This market operates at the intersection of the broader footwear and luxury goods industries, catering to affluent consumers and trend-conscious buyers. It is characterized by premium pricing, strong brand equity, and high customer loyalty.

The market includes both established heritage brands and emerging designers who push the boundaries of design and innovation. Distribution channels range from exclusive flagship stores and high-end department stores to e-commerce platforms tailored for luxury shopping experiences.

Several factors are driving the growth of the luxury shoes market. Rising disposable incomes and the growing middle class in emerging economies have expanded the consumer base for luxury goods. Additionally, the increasing influence of social media and digital marketing has heightened brand visibility and accessibility, particularly among younger, tech-savvy demographics.

The demand for luxury shoes is underpinned by a combination of aspirational purchasing behavior and functional needs. Consumers view luxury shoes not only as a fashion statement but also as an investment in quality and craftsmanship. Seasonal collections, limited editions, and collaborations with artists or influencers further stimulate demand by creating a sense of urgency and exclusivity.

The luxury shoes market presents significant opportunities for growth, particularly in untapped and emerging markets. Regions such as Asia-Pacific, the Middle East, and Africa are witnessing a surge in luxury consumption, driven by rising affluence and changing lifestyle preferences.

Digital transformation offers another avenue, with innovative virtual try-on technologies and direct-to-consumer models enhancing customer engagement.

Sustainability also represents a major growth frontier, as environmentally conscious consumers increasingly favor brands that demonstrate a commitment to ethical sourcing and production practices. Brands that can effectively integrate these trends are well-positioned to capture market share and foster long-term customer loyalty.

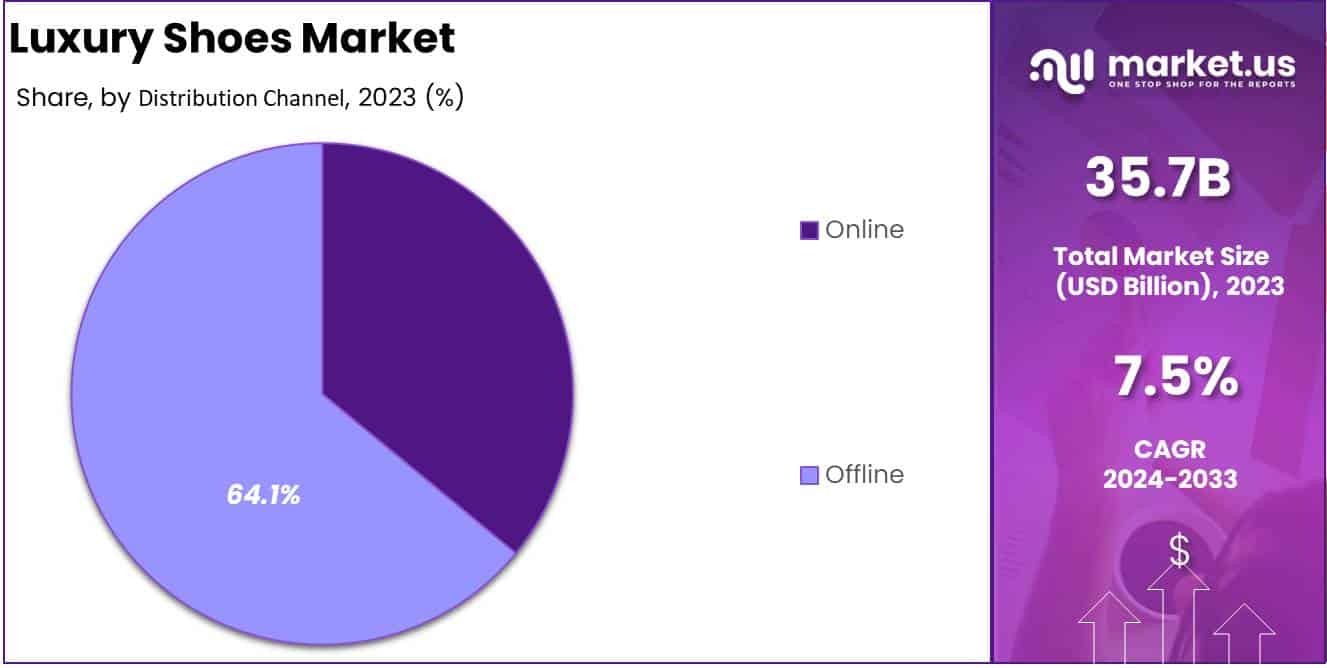

According to RunRepeat, the luxury footwear market in 2023 is valued at US$29.15 billion, with physical retail accounting for US$22.82 billion (78.3%) and e-commerce contributing US$6.33 billion (21.7%). Notably, e-commerce has experienced a significant growth of 131.67% between 2018 and 2023, compared to a 16.16% increase in physical sales during the same period.

Projections indicate that by 2025, e-commerce revenue will reach US$8.20 billion, capturing 26% of the market share. This trend underscores a pivotal shift towards online channels in the luxury footwear sector, necessitating strategic adaptations by brands to meet evolving consumer preferences.

According to Worldmetrics, the luxury shoes market demonstrates robust potential, driven by rising consumer affinity for high-end footwear. On average, American women own 20 pairs of shoes, while men own 12 pairs, underscoring substantial demand. Notably, the Nike Waffle Racing Flat ‘Moon Shoe’ fetched $437,500 at auction, highlighting a thriving luxury segment.

Key Takeaways

- The global luxury shoes market is projected to grow from USD 35.7 billion in 2023 to USD 73.6 billion by 2033, registering a CAGR of 7.5% over the forecast period 2024-2033.

- Sneakers dominate the luxury shoes market with a 26.5% share in 2023, driven by the athleisure trend and sustainable material integration.

- The Women’s segment leads the market with a 51.3% share, fueled by high demand for fashion-forward and seasonal luxury footwear.

- Offline channels captured 64.1% of the market in 2023, reflecting the importance of in-store experiences and luxury retail hubs.

- North America leads the luxury footwear market with a 31.7% share, supported by high disposable incomes and strong brand loyalty.

By Product Analysis

Sneakers Dominating the Luxury Shoes Market with a 26.5% Share

In 2023, Sneakers held a dominant market position in the luxury shoes segment, capturing more than 26.5% of the total market share. This growth was driven by the increasing consumer preference for comfort combined with high-end aesthetics. Luxury sneaker brands have capitalized on collaborations with fashion designers and celebrities, bolstering their appeal among younger, affluent demographics.

The segment’s success is further fueled by the rise of athleisure and the integration of sustainable materials, aligning with the growing trend towards eco-conscious consumption.

Loafers accounted for approximately 21.3% of the luxury shoes market in 2023. Renowned for their versatility, loafers bridge the gap between formal and casual wear, making them a preferred choice for both professional and social settings.

The segment benefits from consistent demand in regions with strong business cultures, as well as the adoption of premium materials and artisanal craftsmanship that elevate the product’s luxury appeal.

Fashion Footwear, comprising designer heels, boots, and statement pieces, secured an 18.7% share of the luxury shoes market in 2023. This segment thrives on high-fashion trends and seasonal collections, which are often showcased during global fashion weeks. Luxury brands have successfully engaged consumers through limited editions and exclusive designs, enhancing brand loyalty and driving demand.

The Formal Footwear segment held a 16.2% market share in 2023, reflecting steady demand for high-quality leather shoes and oxfords. This category remains a staple in corporate and ceremonial contexts.

Brands in this segment are focusing on innovation through bespoke offerings and premium customization services, catering to consumers seeking unique and personalized products.

The Others category, including sandals, luxury slippers, and specialty footwear, represented 17.3% of the market in 2023. This segment caters to niche markets, often focusing on regional styles, cultural preferences, or specific functionalities. Growth in this category is underpinned by affluent consumers seeking diverse and distinctive footwear options beyond conventional categories.

By End-User Analysis

Women Dominating the Luxury Shoes Market with a 51.3% Share

In 2023, Women held a dominant position in the luxury shoes market by end-user, capturing over 51.3% of the total market share. This segment’s leadership is driven by high demand for fashion-forward footwear, including heels, boots, and designer sneakers.

Women’s preference for variety and seasonal trends, coupled with increased spending on luxury goods, continues to propel growth in this category. Premium brands are leveraging targeted marketing and exclusive collections to enhance their appeal among female consumers.

Men accounted for approximately 37.8% of the luxury shoes market in 2023, reflecting steady demand for formal, casual, and designer footwear. The men’s segment benefits from the growing popularity of premium sneakers, loafers, and formal shoes, particularly in professional and high-income urban settings. Increased brand consciousness and a rising trend towards luxury accessories have further fueled this segment’s growth.

The Children segment held a 10.9% market share in 2023, reflecting its position as a growing niche within the luxury shoes market. This segment is driven by affluent parents seeking high-quality, stylish, and durable footwear for their children.

Luxury brands are increasingly offering dedicated children’s collections, often mirroring adult styles, to cater to this demand. Additionally, the trend of gifting premium products for children has contributed to the segment’s expansion.

By Distribution Channel Analysis

Offline Dominating the Luxury Shoes Market with a 64.1% Share

In 2023, Offline channels held a dominant position in the luxury shoes market by distribution channel, capturing more than 64.1% of the total market share. Physical retail stores, including flagship stores, high-end department stores, and boutique outlets, remain the primary touchpoints for luxury shoe purchases.

Consumers in this segment value the in-store experience, which allows them to interact with products, access personalized services, and benefit from brand-exclusive offerings. The strong presence of luxury retail hubs in key cities worldwide further reinforces the dominance of offline channels.

Online channels accounted for 35.9% of the luxury shoes market in 2023, reflecting a rapid shift towards e-commerce. This growth is fueled by the increasing adoption of digital platforms and mobile shopping apps, offering consumers convenience, a wider product selection, and seamless purchasing experiences.

Luxury brands are investing in direct-to-consumer (DTC) websites and partnering with high-end online retailers to tap into this expanding market. Enhanced digital marketing strategies, including virtual try-ons and personalized recommendations, are also driving the online segment’s growth.

Key Market Segments

By Product

- Sneakers

- Loafers

- Fashion Footwear

- Formal Footwear

- Others

By End-User

- Men

- Women

- Children

By Distribution Channel

- Online

- Offline

Driver

Rising Disposable Incomes

The global luxury footwear market is experiencing significant growth, primarily driven by increasing disposable incomes across various demographics. As individuals attain higher levels of financial stability, their propensity to invest in premium products, including high-end footwear, escalates.

This trend is particularly pronounced in emerging economies where rapid economic development has expanded the middle and upper-middle classes, thereby broadening the consumer base for luxury goods. Consumers in these regions are not only seeking quality and durability but also the prestige associated with luxury brands, leading to a surge in demand for designer shoes.

Moreover, the aspirational nature of luxury consumption plays a pivotal role in this dynamic. As consumers’ purchasing power increases, so does their desire to acquire products that symbolize success and sophistication. Luxury footwear, often perceived as a status symbol, becomes a preferred choice for those looking to express their elevated social standing.

This inclination is further amplified by the influence of social media and celebrity endorsements, which showcase luxury brands as desirable and attainable. Consequently, the combination of rising disposable incomes and the aspirational appeal of luxury footwear is propelling market growth, as more consumers are willing and able to invest in high-end shoes that reflect their personal success and style.

Restraint

Economic Uncertainties

Despite the positive trajectory of the luxury footwear market, economic uncertainties pose a significant restraint on its growth. Global economic fluctuations, including recessions, inflation, and geopolitical tensions, can adversely affect consumer confidence and spending habits.

During periods of economic instability, consumers tend to prioritize essential expenditures over discretionary spending, leading to a decline in the purchase of luxury items such as high-end footwear.

This cautious approach is particularly evident among middle-income consumers who may aspire to own luxury products but are compelled to defer such purchases in uncertain economic climates.

Additionally, currency volatility can impact the affordability and attractiveness of luxury footwear in different markets. For instance, a strong domestic currency can make imported luxury goods more expensive, thereby reducing demand. Conversely, a weaker currency can erode the purchasing power of consumers, making luxury items less accessible.

These economic factors create a challenging environment for luxury footwear brands, as they must navigate fluctuating market conditions and adjust their strategies accordingly. Therefore, economic uncertainties remain a critical restraint, influencing consumer behavior and potentially hindering the sustained growth of the luxury footwear market.

Opportunity

Expansion into Emerging Markets

The luxury footwear market is presented with a substantial opportunity through expansion into emerging markets. Regions such as Asia-Pacific, Latin America, and parts of Africa are witnessing rapid economic growth, leading to the emergence of affluent consumer segments with a growing appetite for luxury goods.

This economic progression is accompanied by urbanization and increased exposure to global fashion trends, fostering a favorable environment for luxury footwear brands to establish a presence. By tailoring products to align with local tastes and cultural nuances, brands can effectively tap into these burgeoning markets and cultivate brand loyalty among new consumer bases.

Furthermore, the proliferation of digital platforms and e-commerce facilitates access to these markets, allowing brands to reach consumers without the immediate need for physical retail spaces. Online channels enable luxury footwear companies to showcase their offerings to a wider audience, providing convenience and personalized shopping experiences that resonate with tech-savvy consumers in emerging economies.

By leveraging digital strategies alongside traditional retail approaches, brands can optimize their market penetration and capitalize on the increasing demand for luxury footwear in these regions. Thus, the strategic expansion into emerging markets represents a pivotal opportunity for sustained growth and diversification within the global luxury footwear industry.

Trends

Emphasis on Sustainability and Ethical Production

A prominent trend shaping the luxury footwear market is the growing emphasis on sustainability and ethical production practices. Consumers are increasingly conscious of the environmental and social impacts of their purchases, leading to a demand for products that align with their values.

In response, luxury footwear brands are adopting sustainable materials, such as recycled or bio-based components, and implementing eco-friendly manufacturing processes to reduce their carbon footprint. This shift not only appeals to environmentally aware consumers but also enhances brand reputation and loyalty.

Additionally, transparency in supply chains and fair labor practices are becoming critical factors for consumers when choosing luxury footwear. Brands that demonstrate commitment to ethical sourcing and production are more likely to gain favor among discerning customers.

This trend is further reinforced by regulatory pressures and industry standards aimed at promoting sustainability within the fashion sector. By integrating sustainable and ethical practices into their operations, luxury footwear companies can meet evolving consumer expectations, differentiate themselves in a competitive market, and contribute to broader environmental and social objectives.

Regional Analysis

North America Leads Luxury Footwear Market with 31.7% Share

In 2023, North America emerged as the dominant region in the luxury footwear market, capturing a 31.7% share, equivalent to approximately USD 2.67 billion. This leadership is attributed to high disposable incomes, a substantial population of affluent consumers, and a strong inclination towards premium fashion products.

The United States, in particular, stands out as a significant contributor, driven by a robust economy and a culture that values luxury brands. The region’s well-established retail infrastructure and the growing influence of e-commerce platforms have further facilitated consumer access to high-end footwear, reinforcing North America’s leading position in the global luxury footwear market.

Europe holds a significant position in the luxury footwear market, driven by its rich fashion heritage and the presence of renowned luxury brands. Countries such as Italy, France, and the United Kingdom are pivotal, with consumers exhibiting a strong preference for high-quality, designer footwear. The region’s market is bolstered by a combination of affluent consumers and a deep-rooted appreciation for craftsmanship and style.

The Asia Pacific region is experiencing rapid growth in the luxury footwear market, propelled by increasing disposable incomes, urbanization, and a burgeoning middle class. Countries like China, India, and Japan are at the forefront of this expansion.

The rising number of high-net-worth individuals and a growing appetite for luxury brands among younger consumers contribute to this trend. The proliferation of e-commerce platforms and the influence of social media have also made luxury footwear more accessible, fueling market growth in the region.

In the Middle East & Africa, the luxury footwear market is emerging, supported by a growing affluent population and increasing urbanization. The United Arab Emirates and Saudi Arabia are notable markets, where consumers have a strong inclination towards luxury goods. The region’s market growth is further supported by a rise in tourism and the establishment of luxury retail outlets.

Latin America’s luxury footwear market is developing, with countries like Brazil and Mexico leading the way. Economic growth and a rising middle class are contributing to increased demand for luxury products.

However, the market faces challenges such as economic volatility and a prevalence of counterfeit goods, which can hinder growth. Despite these obstacles, the region presents opportunities for luxury brands to tap into a market with evolving consumer preferences and a growing appreciation for high-quality footwear.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global luxury footwear market is characterized by a diverse array of key players, each contributing uniquely to the industry’s landscape.

Adidas AG continues to bridge the gap between high-performance sportswear and luxury fashion. Through collaborations with designers and limited-edition releases, Adidas has solidified its presence in the premium segment, appealing to consumers seeking both functionality and exclusivity.

LVMH, as a conglomerate encompassing brands like Louis Vuitton and Christian Dior, maintains a dominant position in the luxury footwear sector. Its strategy of integrating traditional craftsmanship with contemporary design ensures sustained consumer interest and market leadership.

Chanel Limited upholds its reputation for timeless elegance in footwear. By focusing on classic designs and superior materials, Chanel caters to a clientele that values enduring style over transient trends.

Burberry Group PLC leverages its British heritage to offer luxury footwear that blends tradition with modernity. Recent initiatives to rejuvenate its product lines have been well-received, enhancing its appeal among younger demographics.

Silvano Lattanzi remains a paragon of bespoke Italian shoemaking. Its commitment to handcrafted excellence attracts discerning customers who prioritize personalization and artisanal quality.

Prada S.p.A continues to innovate within the luxury footwear space, introducing avant-garde designs that challenge conventional aesthetics. This approach resonates with fashion-forward consumers seeking distinctive products.

A.Testoni focuses on merging traditional Italian craftsmanship with modern techniques. Its emphasis on quality materials and intricate detailing appeals to consumers valuing sophistication and durability.

Dr. Martens has successfully transitioned from a subcultural icon to a mainstream luxury brand. Collaborations with high-end designers have elevated its status, attracting a broader, style-conscious audience.

Base London offers affordable luxury, targeting consumers who desire premium aesthetics without premium pricing. Its versatile designs cater to both formal and casual settings, broadening its market reach.

John Lobb Bootmaker continues its legacy of bespoke shoemaking, emphasizing customization and superior craftsmanship. Its products appeal to clientele seeking exclusivity and personalized service.

Salvatore Ferragamo focuses on innovation and sustainability in its luxury footwear offerings. By integrating eco-friendly materials and practices, it appeals to environmentally conscious consumers without compromising on style.

Lottusse – Mallorca draws on its Spanish heritage to produce handcrafted footwear that combines tradition with contemporary design. Its commitment to quality craftsmanship attracts consumers valuing authenticity and heritage.

Top Key Players in the Market

- LVMH

- Chanel Limited

- Burberry Group PLC

- Silvano Lattanzi

- Prada S.p.A

- A.Testoni

- Dr. Martens

- Base London

- John Lobb Bootmaker

- Salvatore Ferragamo

- Lottusse – Mallorca

- Adidas AG

Recent Developments

- In 2023, L’Oréal completed its acquisition of luxury beauty brand Aesop, as initially outlined in April. CEO Nicolas Hieronimus highlighted Aesop’s unique market positioning and significant growth opportunities, particularly in China.

- In 2024, Mytheresa and Richemont announced a binding agreement for Mytheresa to acquire 100% of YNAP. This deal aims to create a global digital luxury group, offering a curated selection of top luxury brands to high-end consumers.

- In 2024, LVMH disclosed it would sell Off-White LLC to Bluestar Alliance, a brand management firm. Although the terms remain undisclosed, the move reflects Bluestar’s ongoing expansion strategy.

- In 2023, Kering acquired a 30% stake in Valentino for €1.7 billion from Mayhoola. The agreement includes an option for full ownership by 2028, as Kering seeks to diversify beyond Gucci amid slower growth in comparison to competitors like Louis Vuitton.

Report Scope

Report Features Description Market Value (2023) USD 35.7 Billion Forecast Revenue (2033) USD 73.6 Billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sneakers, Loafers, Fashion Footwear, Formal Footwear, Others), By End-User (Men, Women, Children), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LVMH, Chanel Limited, Burberry Group PLC, Silvano Lattanzi, Prada S.p.A, A.Testoni, Dr. Martens, Base London, John Lobb Bootmaker, Salvatore Ferragamo, Lottusse – Mallorca, Adidas AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LVMH

- Chanel Limited

- Burberry Group PLC

- Silvano Lattanzi

- Prada S.p.A

- A.Testoni

- Dr. Martens

- Base London

- John Lobb Bootmaker

- Salvatore Ferragamo

- Lottusse - Mallorca

- Adidas AG