Global Luxury Perfume Market By End Use (Women, Unisex, Men), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133084

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

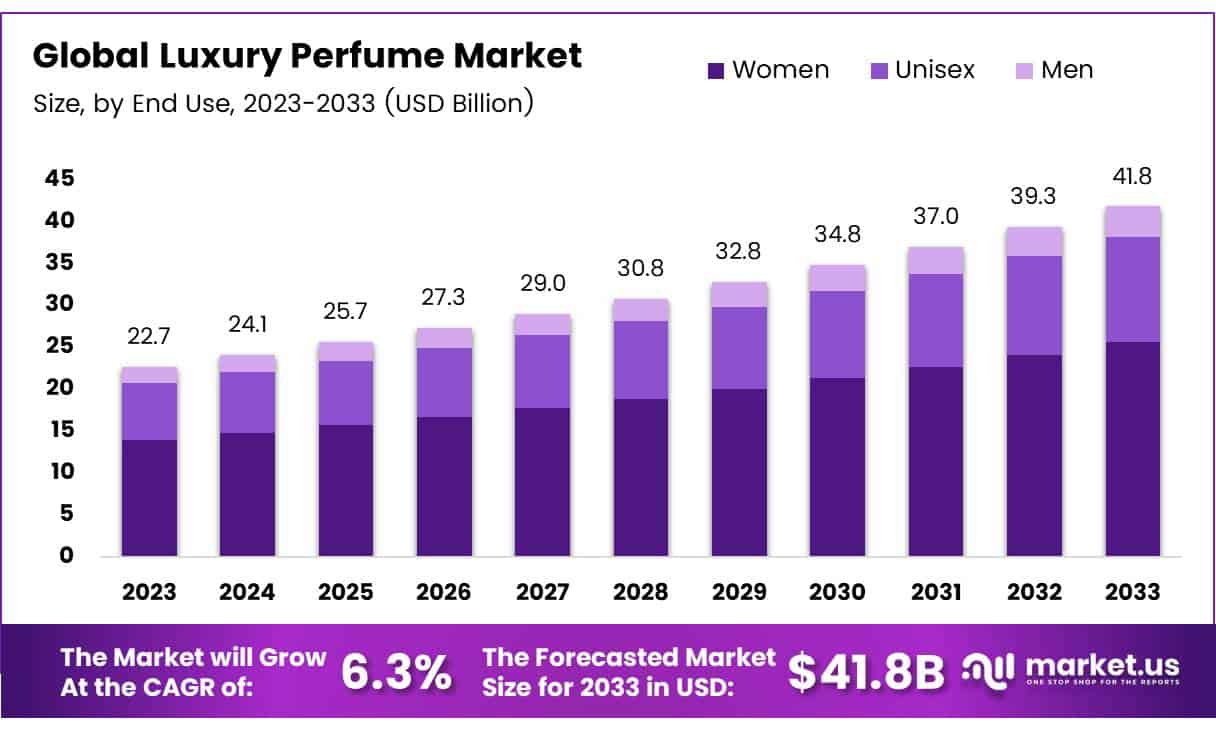

The Global Luxury Perfume Market size is expected to be worth around USD 41.8 Billion by 2033, from USD 22.7 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

Luxury perfume refers to high-end fragrances crafted using premium ingredients, offering sophisticated scents that reflect exclusivity and status. These perfumes are typically produced by renowned luxury brands, with a focus on exceptional quality, unique formulations, and luxurious packaging.

The luxury perfume market caters to affluent consumers who value craftsmanship, elegance, and sensory experiences. With a combination of high-quality raw materials and skilled craftsmanship, luxury perfumes are often considered more than just fragrances they represent a lifestyle choice and a symbol of refined taste.

The luxury perfume market encompasses both established global brands and emerging niche perfume houses. It involves the production, distribution, and sale of fragrances through various channels, including high-end department stores, specialty boutiques, and online platforms.

The market is primarily driven by consumer demand for premium products, increasing disposable incomes, and a growing emphasis on personal luxury. As a segment within the larger fragrance industry, luxury perfumes account for a significant portion of global sales and are expected to continue growing due to increasing brand consciousness and consumer interest in self-expression.

The luxury perfume market has witnessed impressive growth over the past decade, driven by rising demand from affluent consumers and a global increase in the gifting culture.

According to fragrance explorers, 81% of women and 56% of men wear perfume daily, with a growing segment of younger consumers embracing luxury fragrances as part of their lifestyle. This growth is supported by a surge in e-commerce and online sales, although traditional retail outlets remain dominant.

According to fragrance explorers, 91% of perfume sales occur in brick-and-mortar stores, with only 9% attributed to online channels. However, online sales are expected to increase as consumer preferences shift toward more convenient shopping experiences.

As consumers increasingly seek personalized and exclusive products, luxury perfume companies are exploring new opportunities in niche markets, offering tailored experiences and limited-edition fragrances. This trend has led to the growth of high-end boutique perfume brands, offering distinctive, often artisanal products.

Moreover, the rise of luxury perfumes in emerging markets such as China, India, and the Middle East presents significant growth opportunities for global players in the sector.

Governments in key regions have also supported the growth of the luxury perfume market by implementing regulations that ensure product safety and quality. In the European Union, for example, the European Commission enforces strict regulations on the formulation of cosmetic products, including perfumes, to ensure safety and consumer protection.

These regulations ensure that perfumes meet safety standards while fostering innovation within the industry. Additionally, government investment in luxury retail infrastructure has enabled better distribution networks, making luxury perfumes more accessible to consumers across global markets.

Key Takeaways

- The Global Luxury Perfume Market is projected to grow from USD 22.7 Billion in 2023 to USD 41.8 Billion by 2033, with a CAGR of 6.3%.

- Women dominate the end user segment of the Luxury Perfume Market, holding a 62% share in 2023, driven by their high purchasing power and preference for premium brands.

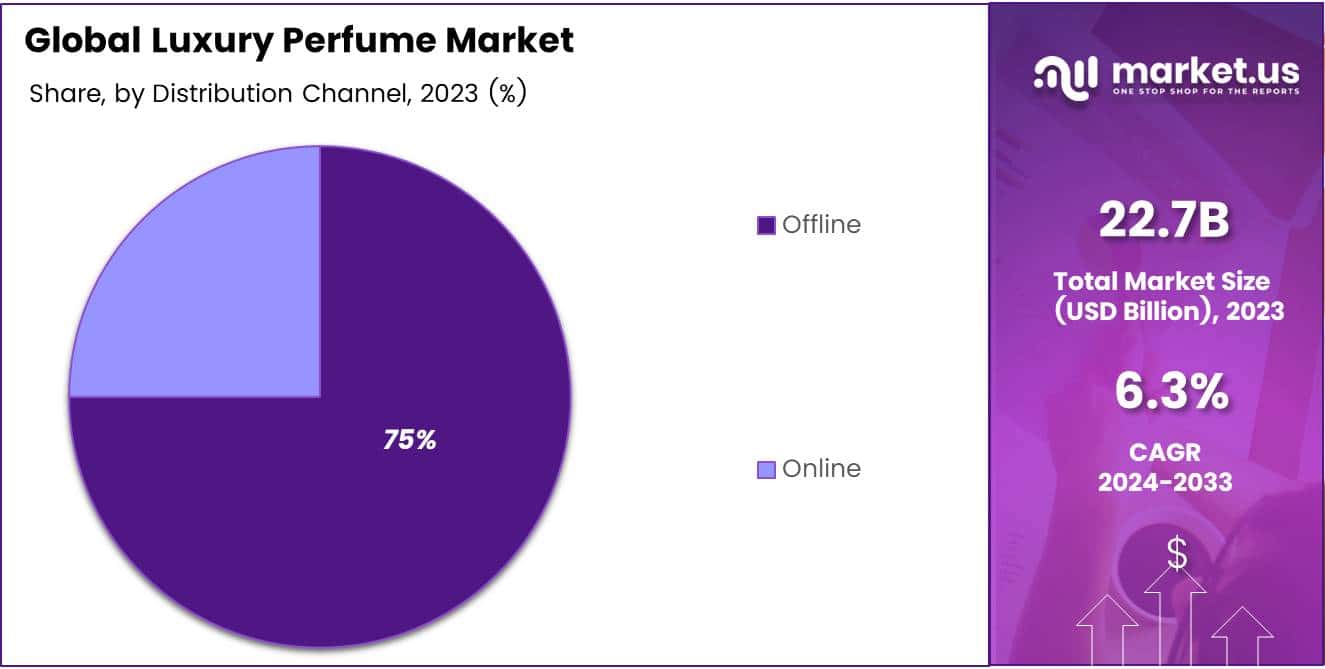

- Offline distribution channels lead with a 75% market share in 2023, favored for the ability to physically test and experience the product.

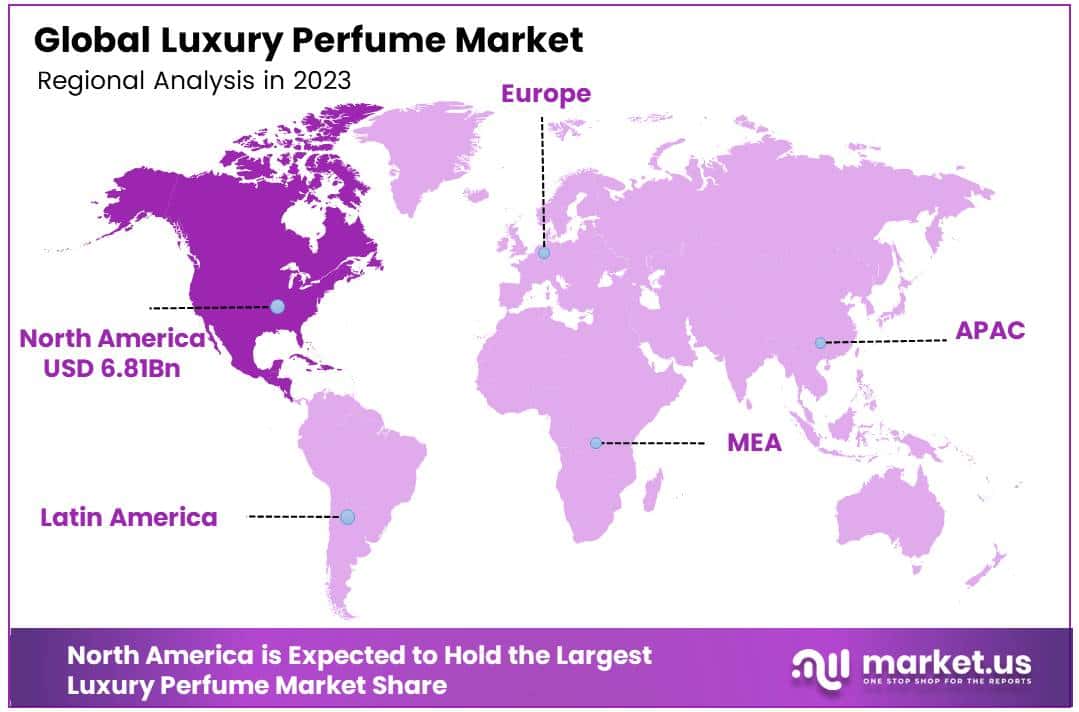

- North America leads the global market, holding a 30% share valued at USD 6.81 billion, due to high consumer spending and a concentration of luxury brands.

End Use Analysis

Women Lead Luxury Perfume Market with 62% Share in 2023

In 2023, Women held a dominant market position in the By End Use Analysis segment of the Luxury Perfume Market, commanding a 62% share. This substantial market share underscores the strong preference and purchasing power of women in this sector, driving the trends and demand in the luxury perfume landscape.

The appeal of luxury perfumes among women is often linked to the high-quality ingredients and prestigious branding that cater to their sophisticated taste and personal expression.

On the other hand, the Unisex segment is gradually expanding, reflecting a shift towards gender-neutral fragrances that emphasize individuality over gender-specific traits. This segment is appealing to a broader audience who seek versatility and inclusivity in their fragrance choices, promoting a modern approach to luxury scents.

Meanwhile, the Men’s segment continues to hold a steady market presence, focusing on bold and traditional scents that align with masculine branding. The demand in this segment is driven by a consistent interest in signature scents that convey a sense of strength and refinement.

Overall, the luxury perfume market is diversifying, with women leading the way in consumption, while unisex products gain traction and men’s fragrances maintain a loyal base.

Distribution Channel Analysis

Offline Dominates Luxury Perfume Market with 75% Share

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Luxury Perfume Market, with a 75% share. This significant market share is attributed to consumers’ preference for physically experiencing the scent before purchasing, a vital factor in the luxury perfume sector.

The tactile experience of interacting with beautifully designed bottles and experiencing personalized service at retail locations continues to draw customers despite the rise of online shopping.

Online channels, while still less prevalent, are rapidly gaining traction due to the convenience they offer and the growing trend of digital consumerism. Enhanced online marketing strategies, such as virtual scent simulation technologies and online consultations, are increasingly bridging the gap between the sensory limitations of buying perfume online and the in-store experience.

As e-commerce platforms further refine their user experience and trust in online purchases strengthens, the online segment is expected to see substantial growth. However, the deeply ingrained habit of testing perfumes in person maintains the offline channel’s predominance in the market landscape for now.

Key Market Segments

By End Use

- Women

- Unisex

- Men

By Distribution Channel

- Offline

- Online

Drivers

Drivers of the Luxury Perfume Market Reflecting the Impact of Brand Loyalty

In the luxury perfume market, brand loyalty emerges as a pivotal driver, influencing consumer behavior significantly. Esteemed brands with strong recognition and loyalty command premium pricing and enjoy consistent repeat purchases, underpinning their market position.

Furthermore, celebrity endorsements and collaborations amplify this effect by elevating brand visibility and allure, drawing more consumers into the luxury perfume fold. These endorsements, often from renowned fashion icons and celebrities, not only enhance the brand’s prestige but also directly impact consumer preferences and purchase decisions.

Additionally, the market’s expansion is supported by the broadening of distribution channels. The rise of online sales platforms and specialty stores has made luxury perfumes more accessible to a global audience, allowing brands to reach customers beyond traditional retail boundaries.

This distribution strategy has not only expanded the market’s geographical footprint but has also adapted to evolving consumer shopping behaviors, further fueling market growth.

Restraints

Health Concerns Dampen Luxury Perfume Demand

As an analyst reviewing the luxury perfume market, the primary restraint impacting its growth stems from increasing health and environmental concerns. Consumers are becoming more aware of the potential allergies and health risks associated with synthetic compounds commonly used in perfumes.

This heightened awareness often leads to a reluctance to purchase traditional luxury perfumes that may contain these irritants, impacting market growth negatively.

Additionally, the rising consumer preference for sustainable and eco-friendly products poses a significant challenge. Many luxury perfume brands, traditionally not aligned with these environmental values, find themselves at a disadvantage as more consumers shift their loyalties towards brands that emphasize natural ingredients and eco-friendly practices.

These consumer trends are reshaping the market dynamics, compelling luxury perfume brands to innovate and adapt to maintain their market share and appeal to a more health-conscious and environmentally aware clientele.

Growth Factors

Technology Transforms Perfume Customization

As market analysts, we observe significant growth opportunities within the luxury perfume market, particularly through technological integration.

Advancements in AI and other technologies offer the potential to deeply analyze consumer preferences, enabling brands to craft highly personalized perfume experiences. This tailored approach not only enhances customer satisfaction but also boosts brand loyalty and market share.

Additionally, the male perfume market presents a lucrative expansion avenue, driven by increasing demand among male consumers for premium scents. Another promising strategy involves the development of layered fragrances. These products allow users to customize their scent by combining multiple layers, catering to a desire for uniqueness and personal expression.

These strategies collectively signify a robust pathway for growth in the luxury perfume sector, inviting brands to innovate continually and differentiate themselves in a competitive market.

Emerging Trends

Rising Demand for Artisanal Perfumes

The luxury perfume market is experiencing significant growth, driven by several emerging trends that appeal to contemporary consumers. Firstly, there is a marked increase in the popularity of artisanal and craft perfumes, which are highly valued for their craftsmanship and authenticity.

These small-batch perfumes, often created by independent perfumers, emphasize unique scent profiles and quality ingredients, attracting customers seeking exclusivity and personalization.

Additionally, augmented reality (AR) is revolutionizing the way consumers shop for perfumes online. By enabling virtual try-on experiences, AR technology helps buyers explore various scents from the comfort of their homes, enhancing customer engagement and satisfaction. Lastly, the market is seeing innovative redesigns in packaging.

Modern luxury perfumes are now packaged using materials that not only reflect current aesthetic trends but also uphold the essence of luxury, thereby appealing to a design-conscious audience. These trends collectively signify a dynamic shift towards more personalized, tech-integrated, and aesthetically pleasing luxury perfume offerings.

Regional Analysis

North America Leads Luxury Perfume Market with 30% Share and USD 6.81 Billion in Revenue

The Luxury Perfume Market showcases distinct regional characteristics and market penetration across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Dominating the global arena, North America accounts for 30% of the market, translating to a substantial value of USD 6.81 billion. This dominance is attributed to high consumer spending power and a strong presence of premium brands that capitalize on the region’s sophisticated consumer base seeking unique and personalized scents.

Regional Mentions:

Europe follows closely, characterized by a deep-rooted heritage in luxury perfumes, with countries like France and Italy leading in artisanal and luxury fragrance production. The region’s market is driven by a blend of tradition and innovation in scent creation, appealing to both local and international consumers.

In Asia Pacific, the market is expanding rapidly, fueled by increasing disposable incomes and growing brand awareness among consumers. This region is witnessing a shift towards luxury consumer goods, with international brands establishing strong footholds and local brands emerging to cater to the regional preferences for distinct fragrances.

The Middle East & Africa region, known for its rich fragrant traditions, sees a continuous demand for opulent and unique perfume blends. The market here benefits from the luxurious lifestyles of its affluent populations and the cultural significance of perfumery.

Latin America, although smaller in comparison, is experiencing growth in the luxury perfume segment due to rising urbanization and the increasing influence of Western lifestyle trends. The market here is driven by a growing middle class and an increasing interest in luxury and niche fragrances that offer a sense of exclusivity and status.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Luxury Perfume Market witnessed innovative contributions from leading companies that shaped consumer preferences and industry standards.

CHANEL continued to epitomize timeless elegance, leveraging its iconic brand to introduce fragrances that blend classic allure with modern sensibilities. Hermès excelled in crafting unique olfactory experiences, emphasizing artisanal quality and luxury ingredients.

Kering, known for its fashion prowess, effectively extended its luxury aesthetic into the perfume sector, enhancing brand loyalty and expanding market reach.

Coty Inc. strategically capitalized on collaborations and celebrity endorsements to diversify its portfolio and attract a younger demographic. Ralph Lauren Corporation infused its American heritage into its fragrances, reinforcing a sense of exclusivity and prestige.

LVMH Moet Hennessy-Louis Vuitton stood out for its extensive portfolio and innovation in fragrance technology, driving growth through cross-brand synergies and global marketing strategies. The Estée Lauder Companies focused on sustainability and personalization, appealing to environmentally conscious consumers seeking bespoke fragrances.

Puig made significant strides in market expansion by integrating digital strategies to enhance customer engagement and retention. L’Oréal Groupe, with its robust R&D capabilities, introduced advanced fragrance formulations that promise longer-lasting scents and a smaller ecological footprint.

Lastly, Prada Holding S.P.A. leveraged its high-fashion credibility to infuse its perfumes with avant-garde elements, capturing the attention of luxury consumers seeking novel and bold aromas.

Top Key Players in the Market

- CHANEL

- Hermès

- Kering

- Coty Inc.

- Ralph Lauren Corporation

- LVMH Moet Hennessy-Louis Vuitton

- The Estée Lauder Companies

- Puig

- L’Oréal Groupe

- Prada Holding S.P.A.

Recent Developments

- In April 2024, L’Oreal announced its strategic investment intentions, eyeing a significant stake in the esteemed perfume brand Amouage, valued at approximately €3 billion. This move is aimed at diversifying L’Oreal’s luxury fragrance portfolio and strengthening its presence in the global high-end perfume market.

- In August 2023, Jadwa Investment secured a 35% ownership stake in Gissah Perfumes Company. This acquisition aligns with Jadwa’s investment strategy to expand its footprint in the luxury consumer goods sector, enhancing its portfolio with a prominent Middle Eastern fragrance brand.

- In June 2023, Kering Beauté made a notable expansion in the luxury fragrance industry by acquiring Creed, a renowned luxury perfume house. This acquisition supports Kering Beauté’s objective to enhance its market share in the upscale fragrance segment, leveraging Creed’s longstanding heritage and loyal customer base.

- In April 2024, the L’Occitane Group finalized the acquisition of the Italian luxury fragrance brand, Dr. Vranjes Firenze. This acquisition is part of L’Occitane’s strategic efforts to broaden its product range in the luxury scent market, further embedding the group’s presence in the European luxury sector.

Report Scope

Report Features Description Market Value (2023) USD 22.7 Billion Forecast Revenue (2033) USD 41.8 Billion CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By End Use (Women, Unisex, Men), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CHANEL, Hermès, Kering, Coty Inc., Ralph Lauren Corporation, LVMH Moet Hennessy-Louis Vuitton, The Estée Lauder Companies, Puig, L’Oréal Groupe, Prada Holding S.P.A., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CHANEL

- Hermès

- Kering

- Coty Inc.

- Ralph Lauren Corporation

- LVMH Moet Hennessy-Louis Vuitton

- The Estée Lauder Companies

- Puig

- L'Oréal Groupe

- Prada Holding S.P.A.