Global Luxury Packaging Market By Material (Plastic, Paper and Paperboard, Metal, Glass, Fabric, Wood), By Product Type (Bags, Pouches, Boxes and Cartons, Bottles, Composite Cans), By End Use (Fashion Accessories and Apparels, Food and Beverages, Consumer Goods, Consumer Electronics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133289

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

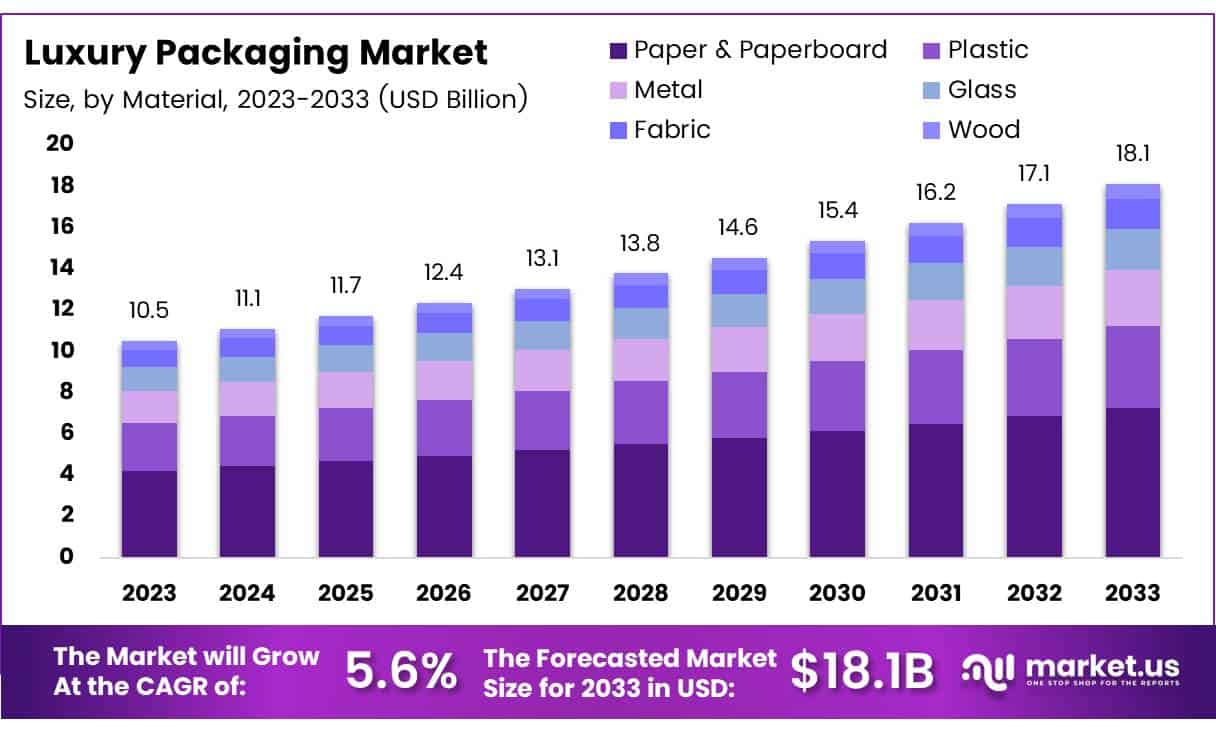

The Global Luxury Packaging Market size is expected to be worth around USD 18.1 Billion by 2033, from USD 10.5 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Luxury packaging, a subset of product packaging, is distinguished by its superior aesthetics, quality materials, and precise design aimed at invoking exclusivity and premium branding. This type of packaging is often employed to enhance the perceived value of high-end products, fostering a strong emotional connection with the consumer through tactile and visual experiences.

The Luxury Packaging Market encompasses a broad array of industries including cosmetics, fashion, gourmet food, and consumer electronics, where packaging plays a pivotal role in brand differentiation and consumer engagement.

The Luxury Packaging Market is witnessing significant growth, driven by the increasing demand for premium and luxury goods globally. As middle and upper-middle-class populations expand in emerging economies, there is a notable surge in demand for luxury goods, which in turn fuels the need for high-quality packaging.

Moreover, the market is also benefiting from innovations in packaging technologies that allow for more intricate designs and sustainable solutions. These innovations are not only enhancing aesthetic appeal but are also improving functionality, such as extended product freshness and damage prevention during transit.

Government initiatives and regulations play a crucial role in shaping the dynamics of the Luxury Packaging Market. Many governments, particularly in Europe and Asia, are investing in recycling facilities and promoting green manufacturing practices to mitigate the environmental impact of packaging waste.

Regulations are increasingly stringent on the use of materials and disposal methods, pushing companies in the luxury packaging sector to adopt more sustainable practices. This regulatory environment is creating opportunities for innovation in biodegradable packaging solutions, which are becoming a significant trend in the market.

According to BR printers, an impressive 61% of consumers are more likely to repurchase a luxury product if it is presented in premium packaging. This statistic underscores the critical role of luxury packaging in customer retention and the enhancement of consumer perception towards a brand.

Additionally, the European Environment Agency highlights that nearly 40% of plastic demand stems from packaging production, pointing to a significant opportunity for luxury packaging solutions that can combine sustainability with premium design.

Prometglass reports that while glass produced in the EU contains about 52% recycled material, the U.S. lags with only 31% of glass packaging recycled. This discrepancy presents a potential for growth in the U.S. market through increased recycling initiatives and the adoption of sustainable practices in luxury glass packaging.

Furthermore, a consumer survey reveals that 68% prefer products in paper or cardboard over plastic, citing that such materials enhance the product’s perceived quality. This preference is a clear indicator for brands to consider paper-based luxury packaging solutions to align with consumer expectations and environmental trends.

Key Takeaways

- The Global Luxury Packaging Market is projected to grow from USD 10.5 billion in 2023 to USD 18.1 billion by 2033, at a CAGR of 5.6%.

- Paper & Paperboard is the leading material in the Luxury Packaging Market in 2023, holding a 50.2% share.

- Boxes & Cartons are the predominant product type in the Luxury Packaging Market, favored for their versatility and premium appeal.

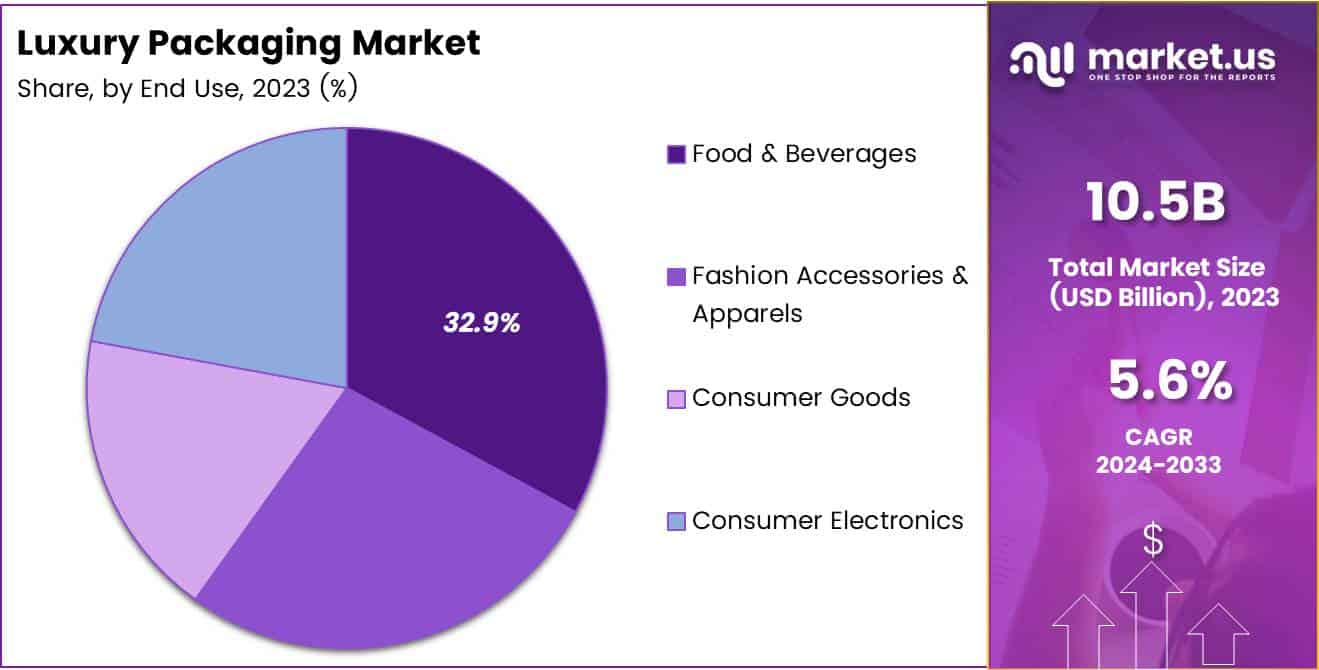

- The Food & Beverages sector is the largest end-user in the Luxury Packaging Market, with a 32.9% share in 2023.

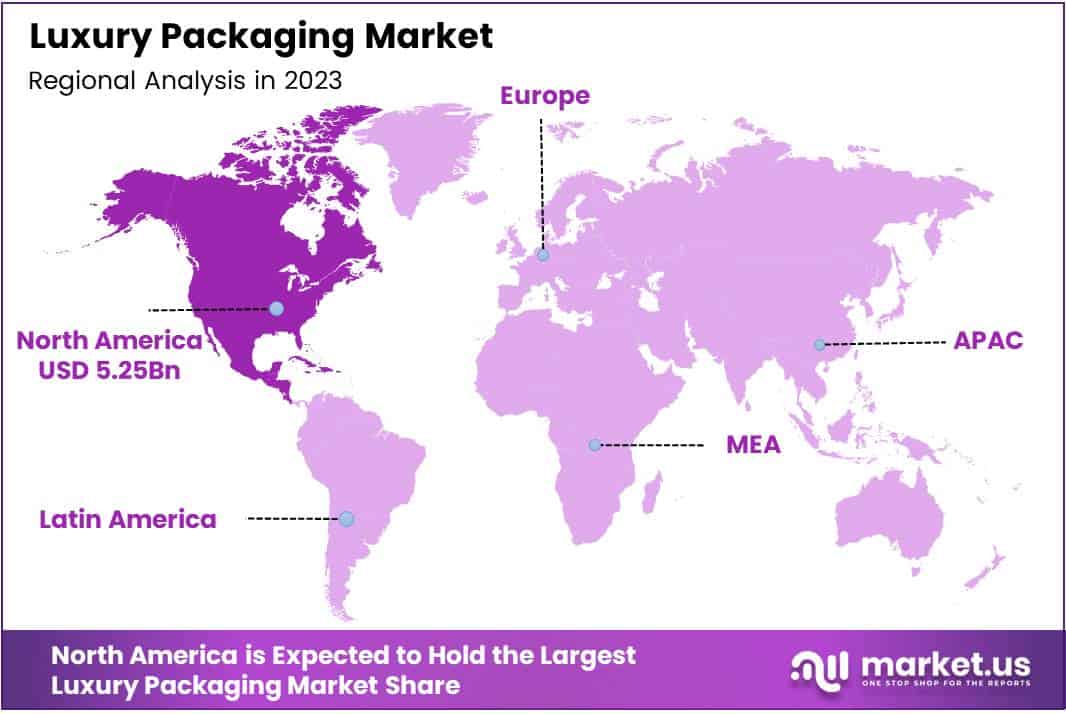

- North America dominates the Luxury Packaging Market with a 50% share, driven by high consumer spending and a preference for sustainable packaging.

Material Analysis

Paper & Paperboard Lead with 50.2% in Luxury Packaging

In 2023, Paper & Paperboard held a dominant market position in the By Material Analysis segment of the Luxury Packaging Market, with a 50.2% share. This substantial market share underscores the continued preference for paper and paperboard materials, favored for their versatility and sustainability, key attributes in the luxury packaging sector.

Plastics, metals, glass, fabrics, and wood also contribute to the market, though to a lesser extent. Plastics follow, with characteristics like flexibility and cost-effectiveness supporting a significant yet smaller segment share. Metals and glass are chosen for their premium appearance and robustness, enhancing the unboxing experience, crucial in luxury markets.

Fabrics and wood, while niche, are selected for their distinct textures and eco-friendly appeal, appealing to luxury brands aiming for uniqueness and environmental responsibility.

Together, these materials create a diverse ecosystem in luxury packaging, catering to various aesthetics and functional requirements demanded by high-end consumers and brands.

Product Type Analysis

Boxes & Cartons Lead Luxury Packaging with Unmatched Elegance

In 2023, Boxes & Cartons held a dominant market position in the By Product Type Analysis segment of the Luxury Packaging Market. This segment’s strength is rooted in its versatility and premium appeal, which are crucial for high-end products that demand superior aesthetic and protective qualities.

The ability of boxes and cartons to be customized with high-quality finishes, sophisticated graphics, and unique shapes makes them particularly appealing to luxury goods manufacturers aiming to enhance brand value and consumer experience.

Meanwhile, other segments like Bags, Pouches, Bottles, and Composite Cans also contribute to the market’s diversity. Luxury bags are prized for their material quality and craftsmanship, making them ideal for fashion and high-end retail. Pouches offer a lightweight and innovative packaging alternative, often used for premium cosmetics and jewelry. Bottles, essential for the fragrance and spirits sectors, emphasize precision in design to convey brand heritage and luxury.

Composite Cans are gradually gaining traction by offering eco-friendly features combined with premium finishes, aligning with the growing consumer preference for sustainability without compromising on luxury. These segments collectively underscore the dynamic nature of luxury packaging solutions, catering to a wide array of products and consumer expectations in the luxury market.

End Use Analysis

Food & Beverages Lead Luxury Packaging with 32.9% Share

In 2023, Food & Beverages held a dominant market position in the By End Use Analysis segment of the Luxury Packaging Market, capturing a 32.9% share. This sector’s prominence is primarily attributed to the increasing consumer demand for premium and aesthetically appealing packaging for gourmet foods and high-end beverages.

As luxury brands aim to enhance consumer experience through innovative and sustainable packaging solutions, this segment has seen significant investment and innovation.

Following closely, the Fashion Accessories & Apparels segment accounted for a substantial market share, driven by the luxury goods sector’s need for distinctive and high-quality packaging that reflects brand value and craftsmanship.

This segment benefits from the rising global expenditure on luxury personal items, which fuels demand for elegant packaging designs that command attention and convey exclusivity.

Consumer Goods and Consumer Electronics also play crucial roles in the luxury packaging market. These segments leverage premium packaging to differentiate products in a saturated market, where packaging often influences purchasing decisions.

Particularly in Consumer Electronics, where the unboxing experience is integral to customer satisfaction, luxury packaging is increasingly employed to deliver a superior first impression, thereby enhancing brand perception and boosting sales.

Key Market Segments

By Material

- Paper & Paperboard

- Plastic

- Metal

- Glass

- Fabric

- Wood

By Product Type

- Boxes & Cartons

- Bags

- Pouches

- Bottles

- Composite Cans

By End Use

- Food & Beverages

- Fashion Accessories & Apparels

- Consumer Goods

- Consumer Electronics

Drivers

Rising Demand for Luxury Goods Fuels Market

The luxury packaging market is experiencing robust growth, primarily driven by the increasing consumer appetite for premium products.

As disposable incomes rise globally, more consumers are indulging in high-end goods, necessitating packaging that matches the quality and exclusivity of the products inside. This trend is not just about protection but about enhancing the overall brand experience, making luxury packaging a critical element for differentiation and adding perceived value to products.

Additionally, the explosion of e-commerce has transformed shopping behaviors, requiring packaging solutions that maintain product integrity and visual appeal during delivery. This shift demands innovative approaches in packaging design to meet the rigorous standards of luxury brands and their discerning customers, further propelling the market forward.

Restraints

Supply Chain Challenges Impact Luxury Packaging

In the luxury packaging market, two main challenges significantly impact growth and operations. First, supply chain disruptions have become a considerable obstacle. These disruptions complicate acquiring essential materials necessary for producing high-quality luxury packaging, leading to increased costs and delays. This problem is exacerbated by global economic fluctuations and logistical issues, which affect everything from raw material availability to the delivery timelines of finished products.

Second, the high costs of integrating advanced technologies in packaging production pose another significant restraint. While these technologies can enhance the appeal and functionality of luxury packaging, their adoption requires substantial investment.

This financial barrier can be prohibitive, especially for smaller manufacturers aiming to innovate and compete in the high-end market segment. These challenges collectively hinder the market’s ability to meet demand efficiently and innovate consistently, impacting both production scales and market growth.

Growth Factors

Eco-Friendly Innovation Drives Growth

In the evolving landscape of the luxury packaging market, significant growth opportunities are emerging from the development and utilization of biodegradable packaging materials. These eco-friendly options not only align with global sustainability trends but also appeal to the environmentally conscious consumer base, enhancing brand loyalty and market share.

Furthermore, the integration of smart packaging technologies such as NFC (Near Field Communication) and RFID (Radio Frequency Identification) presents a frontier for luxury brands to bolster consumer engagement through enhanced interactivity and security features. These technologies facilitate personalization and protect against counterfeiting, adding substantial value to the consumer experience.

Additionally, establishing robust recycling initiatives can further bolster a brand’s image by demonstrating a commitment to environmental responsibility, potentially setting a new standard in the industry for sustainability and innovation. This comprehensive approach to upgrading traditional luxury packaging methods with modern technology and sustainable practices presents a lucrative pathway for growth in this high-value market.

Emerging Trends

Interactive Packaging Draws Consumer Interest

As an analyst observing the Luxury Packaging Market, a significant trend is the rise of interactive packaging. This innovation is captivating as it involves elements that encourage consumer interaction, offering tactile and visual experiences that enrich the product’s appeal.

Whether it’s through textures that invite touch or visuals that change with viewing angles, these interactive features significantly enhance user engagement. Alongside this, there’s a noticeable return to vintage and retro styles, which conjure a sense of nostalgia and convey a timeless, premium quality.

Moreover, minimalist design trends continue to shape the market, prioritizing elegance and simplicity. This approach not only appeals to modern aesthetic sensibilities but also aligns with the growing consumer preference for sustainability, as it often uses fewer materials. Overall, these trends are shaping a dynamic market landscape where the design and functionality of packaging are key to captivating the luxury consumer.

Regional Analysis

North America Dominates Luxury Packaging Market with 50% Share Valued at USD 5.25 Billion

The Luxury Packaging Market exhibits significant differentiation across global regions, reflecting distinct consumer preferences and economic conditions.

North America, the market commands a dominant 50% share, valued at USD 5.25 billion. This region’s leadership stems from a robust luxury goods sector, driven by high consumer spending and a preference for premium, sustainable packaging solutions. The presence of leading luxury brands and a growing emphasis on aesthetically pleasing, eco-friendly packaging options further bolster the market.

Regional Mentions:

Europe follows closely, representing a mature market where luxury packaging is integral to the branding strategies of high-end manufacturers, especially in the fashion, cosmetics, and gourmet food sectors. The emphasis here is on innovative design and material quality, aligning with the region’s stringent sustainability regulations and luxury consumers’ environmental consciousness.

The Asia Pacific region is witnessing rapid growth in luxury packaging, fueled by increasing disposable incomes and expanding middle-class populations in countries like China and India. The market is characterized by a demand for intricate, culturally resonant packaging designs that emphasize craftsmanship and luxury experience.

Middle East & Africa and Latin America are emerging as potential growth areas. The Middle East, with its affluent consumer base and preference for opulent, high-quality packaging, shows promise, particularly in the UAE and Saudi Arabia. Latin America, though smaller in scale, is gradually recognizing the value of luxury packaging to enhance brand perception among its evolving consumer demographics.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Luxury Packaging Market for 2023, several key players are shaping the landscape with innovative solutions and strategic market positioning.

Amcor Limited continues to lead with its extensive range of sustainable luxury packaging options, capitalizing on the growing consumer demand for eco-friendly products. Their initiatives in recyclable and reusable packaging solutions have set a competitive standard in the industry.

Lucas Luxury Packaging and MW Creative Ltd are noteworthy for their bespoke packaging solutions tailored to high-end consumer goods. These companies excel in delivering customized designs that enhance brand value through aesthetic appeal and uniqueness, catering to premium segments in cosmetics, fine spirits, and luxury goods.

DS Smith Plc stands out for its investment in technology to provide sophisticated packaging solutions that offer both luxury appeal and protection. Their focus on structural design innovation has enabled them to support luxury brands in optimizing the unboxing experience, a critical element in luxury marketing.

Pendragon Presentation Packaging Ltd and Winter and Company AG have both emphasized craftsmanship and material innovation. Their use of premium materials combined with traditional techniques ensures that the tactile and visual aspects of packaging are distinctively luxurious, meeting the expectations of high-end consumers.

CLP Packaging Solutions Inc. and HH Deluxe Packaging focus on incorporating advanced materials and finishes to create packaging that not only protects but also enhances the product’s perceived value.

Ekol Ofset distinguishes itself with high-quality printing techniques that allow for intricate designs and detailed imagery, crucial for brands that rely on visual storytelling.

Top Key Players in the Market

- Amcor Limited

- Lucas Luxury Packaging

- MW Creative Ltd

- DS Smith Plc

- Pendragon Presentation Packaging Ltd

- Winter and Company AG

- CLP Packaging Solutions Inc.

- HH Deluxe Packaging

- Ekol Ofset

Recent Developments

- In October 2024, the Estonian startup RAIKU introduced a groundbreaking 100% natural packaging material noted for its aesthetic appeal and superior shock absorption, which also boasts the lowest carbon footprint figures currently available in the market.

- In September 2024, Menasha Packaging announced a substantial investment of $50 million to enhance its preprint capabilities across North America, aiming to significantly boost its production efficiency and market reach.

- In August 2024, Mainetti expanded its foothold in the luxury packaging sector through the strategic acquisition of Morresi, a move designed to enhance its product offerings and market presence in high-end retail packaging.

Report Scope

Report Features Description Market Value (2023) USD 10.5 Billion Forecast Revenue (2033) USD 18.1 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Paper & Paperboard, Metal, Glass, Fabric, Wood), By Product Type (Bags, Pouches, Boxes & Cartons, Bottles, Composite Cans), By End Use (Fashion Accessories & Apparels, Food & Beverages, Consumer Goods, Consumer Electronics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor Limited, Lucas Luxury Packaging, MW Creative Ltd, DS Smith Plc, Pendragon Presentation Packaging Ltd, Winter and Company AG, CLP Packaging Solutions Inc., HH Deluxe Packaging, Ekol Ofset Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor Limited

- Lucas Luxury Packaging

- MW Creative Ltd

- DS Smith Plc

- Pendragon Presentation Packaging Ltd

- Winter and Company AG

- CLP Packaging Solutions Inc.

- HH Deluxe Packaging

- Ekol Ofset