Global Luxury Furniture Insurance Market Size, Share, Industry Analysis Report By Type (Owner Coverage, Renter Coverage), By End Use (Business, Personal), By Distribution Channel (Direct Sales, Brokers, Online Platforms, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165033

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- Key Features

- U.S. Market Size

- Type Analysis

- End Use Analysis

- Distribution Channel Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

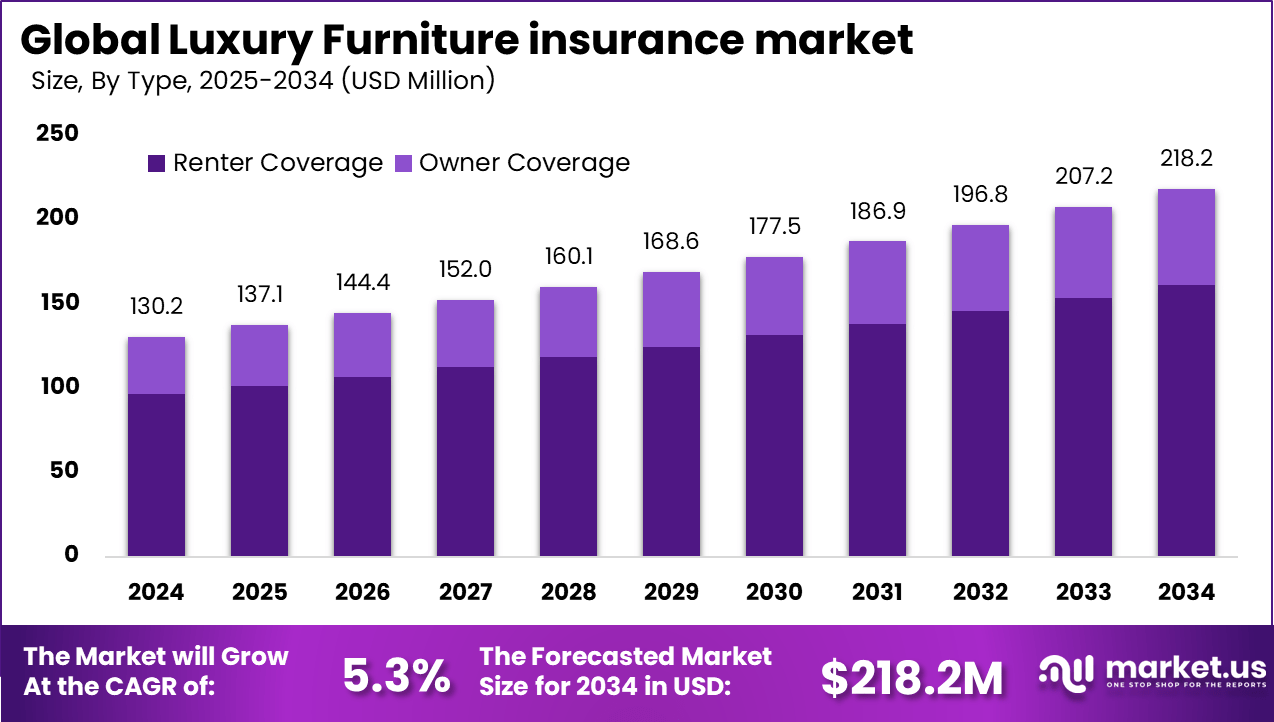

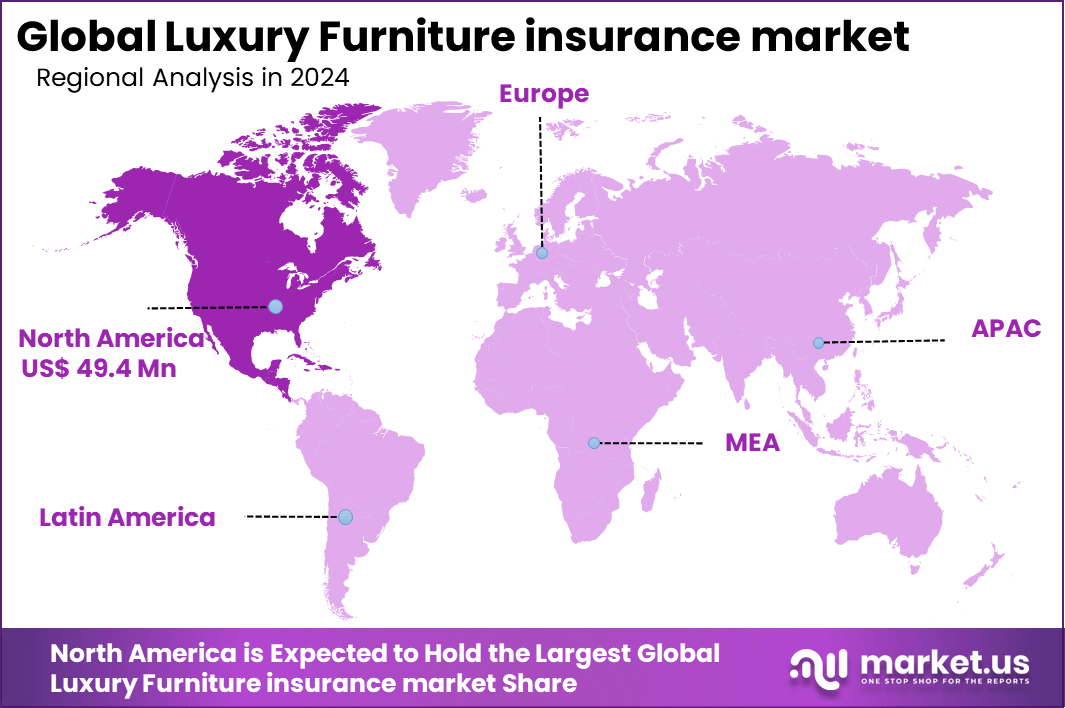

The Global Luxury Furniture insurance market size is expected to be worth around USD 218.2 million by 2034, from USD 130.2 million in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 49.4 million in revenue.

The luxury furniture insurance market forms part of the broader high-value asset protection segment. It caters to individuals who invest in luxury interiors and seek enhanced coverage beyond traditional contents insurance. Policies are often modular and customizable, offering “all-risk” protection for valuable household contents. The growing number of affluent households, coupled with the rise in bespoke interior design projects, has supported this niche insurance category.

A principal factor driving the luxury furniture insurance market is the rising disposable income of high-net-worth individuals globally, which has increased the ownership of luxury furniture items. Rapid urbanization and the expansion of luxury real estate projects also contribute by creating more demand for upscale furnishing protection. Growing consumer preferences for premium quality and bespoke designs further push demand, as customers seek to protect valuable, unique possessions.

The market for luxury furniture insurance is driven by the growing number of wealthy individuals who invest in high-end, custom-made furniture that requires protection. As disposable incomes rise, more consumers seek to safeguard their expensive furniture from risks like theft, damage, or natural disasters. This demand is supported by the increasing trend of home renovations and luxury real estate development, which encourages investment in premium furniture.

For instance, in February 2025, PURE introduced a new insurance program designed specifically for high-value homes under construction or renovation, tailored for projects valued up to $30 million. The offering features highly customizable coverage, including protection for luxury furniture in custom renovations and new builds, especially important in high-risk weather regions.

Key Takeaway

- The Renter Coverage segment dominated in 2024, accounting for 73.9% of the market, as rising luxury apartment rentals and premium furniture ownership among tenants increased the need for specialized coverage.

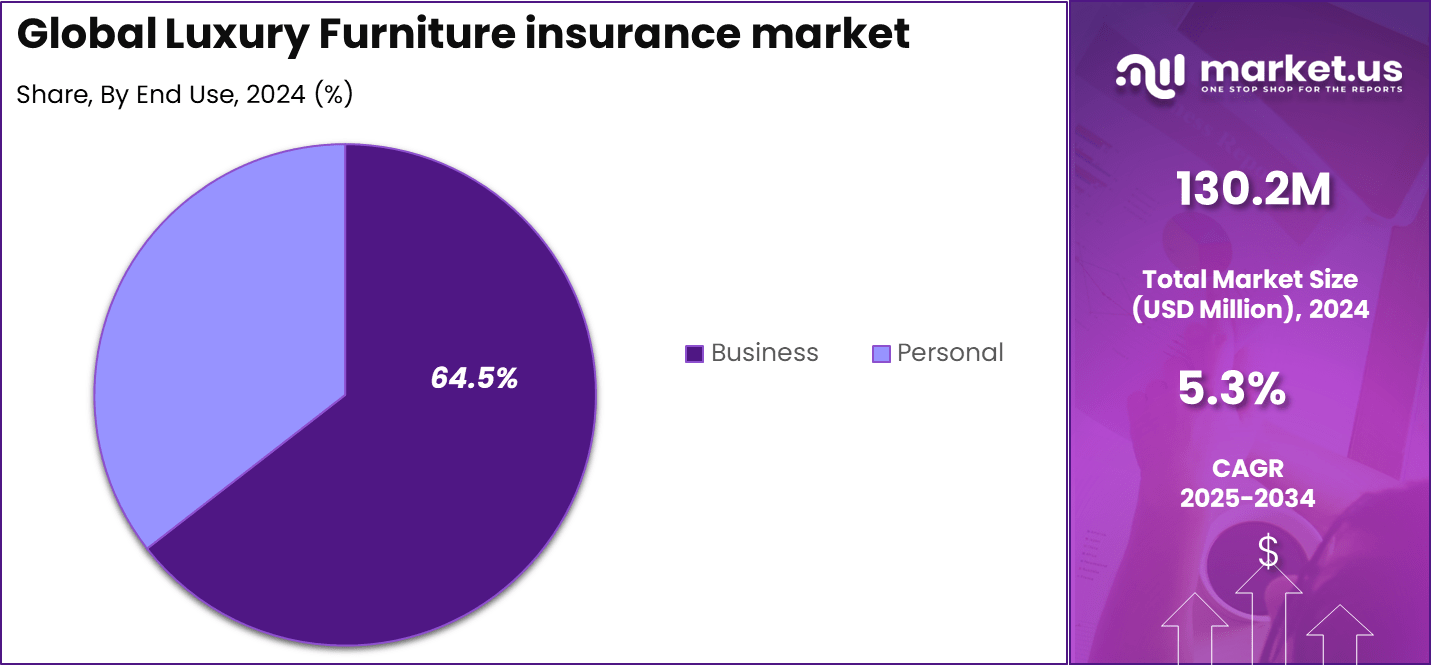

- The Business segment held a strong position with 64.5%, driven by the hospitality and corporate sectors’ focus on safeguarding high-value interior assets from damage or loss.

- Large Enterprises captured 57.3%, reflecting their preference for comprehensive, multi-property insurance packages tailored to protect luxury furnishings in offices, hotels, and retail spaces.

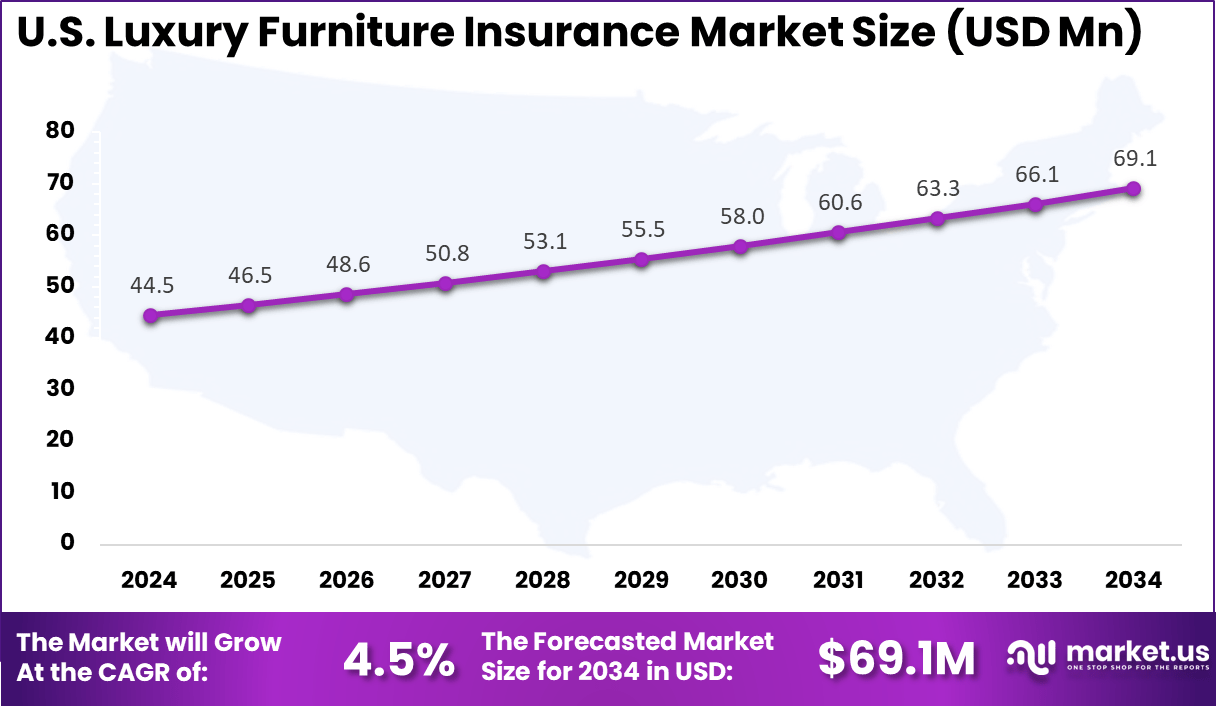

- The U.S. market was valued at USD 44.5 Million in 2024, expanding at a steady 4.5% CAGR, supported by higher consumer spending on luxury interiors and rising adoption of niche insurance products.

- North America remained the leading region, commanding over 38% of the global share, attributed to advanced underwriting services, strong insurer presence, and growing awareness of asset protection among high-net-worth individuals and enterprises.

Role of Generative AI

Generative AI is reshaping insurance, including luxury furniture insurance, by improving efficiency and customer service. With a market growing at nearly 40% annually, AI helps automate risk assessments and underwriting with precision, reducing the time needed to evaluate unique luxury items.

Around 89% of insurers plan to invest in generative AI in 2025, using it to generate accurate risk profiles and detect fraudulent claims, which can be especially complex in luxury asset insurance. AI’s ability to analyze large data sets and generate synthetic scenarios is helping insurers respond faster and with more confidence to claims decisions.

In customer interactions, generative AI enables personalized communication and tailored coverage offers. It also automates routine tasks like claims review and fraud detection, improving overall service quality. With over 68% of insurance professionals using generative AI weekly, it is clear that the technology is becoming integral to the insurance process, enhancing both risk management and customer satisfaction significantly.

Investment and Business Benefits

Investment opportunities in luxury furniture insurance lie in developing tailored policies that meet the unique needs of high-value furniture owners. Opportunities exist to expand coverage offerings in emerging markets where luxury goods ownership is growing.

Digital transformation initiatives present space for new products leveraging AI and blockchain to improve underwriting and claims. Increasing demand for sustainable and custom-designed furniture creates niches for specialized insurance. Partnering with luxury furniture retailers to offer integrated protection plans is another growth avenue.

For insurers and furniture retailers, offering luxury furniture insurance brings recurring revenue streams and strengthens customer loyalty. Insurance plans reduce return rates by assuring customers of protection, enhancing the overall purchase experience.

Efficient claims management powered by technology cuts costs and improves profitability. Providing clear, transparent coverage options gives companies a competitive edge in the luxury segment. Businesses gain peace of mind by mitigating risks connected with high-value inventory or assets on premises.

Key Features

- Specialized coverage: Luxury furniture insurance provides tailored protection for high-end items that standard home insurance policies often overlook. These policies account for the individual value of each item, ensuring that unique or designer pieces receive accurate coverage.

- Inclusions: Coverage generally includes protection against fire, natural disasters, and theft, with additional options available for transit damage, accidental breakage, or storage-related risks. This makes it suitable for collectors, interior designers, and high-net-worth homeowners.

- High-value policies: Premiums for luxury furniture insurance are typically higher than standard home insurance. This is due to elevated coverage limits and specialized terms for rare, antique, or custom-made furniture.

- Asset-based approach: The insurance market is expanding as luxury furniture is increasingly seen as a financial asset, similar to fine art or jewelry. Owners view coverage as part of wealth preservation and estate protection strategies.

- Market growth drivers: The market’s expansion is supported by several key trends, including the rising number of millionaires, rapid urbanization, and consumer demand for exclusive, bespoke designs. These factors are driving growth in both the luxury furniture sector and the associated insurance market.

U.S. Market Size

The market for Luxury Furniture insurance within the U.S. is growing tremendously and is currently valued at USD 44.5 million, the market has a projected CAGR of 4.5%. This growth is driven by rising disposable incomes and growing awareness among consumers and businesses about protecting valuable furniture investments.

Increasing urbanization and luxury real estate development boost demand, while the expanding hospitality and commercial sectors require insurance coverage to protect high-end furnishings against damage and theft. Digital advancements also make insurance products more accessible, supporting steady market expansion. These combined factors fuel the steady increase in luxury furniture insurance adoption across the U.S. market.

For instance, in September 2025, Hiscox, with corporate headquarters in Atlanta, Georgia, expanded its small business insurance offerings, including coverage relevant to luxury furnishings in commercial settings. Hiscox maintains strong U.S. licensing and claims service ratings supporting growth in specialized segments.

In 2024, North America held a dominant market position in the Global Luxury Furniture insurance market, capturing more than a 38% share, holding USD 49.4 million in revenue. This dominance is largely due to high disposable incomes and a strong affinity for premium living and commercial spaces.

The region’s expanding luxury real estate and hospitality sectors further drive demand for insurance to protect valuable furniture assets. Additionally, growing e-commerce and digital platforms make luxury furniture more accessible, boosting the need for comprehensive insurance solutions across residential and commercial users. These factors combine to solidify North America’s leadership in the market.

For instance, in May 2025, Cincinnati Insurance Company, based in Fairfield, Ohio, promoted its specialized coverage for valuables, including antiques and fine art, supporting local independent agents in tailoring insurance solutions to North American clients with luxury furniture assets.

Type Analysis

In 2024, The Renter Coverage segment held a dominant market position, capturing a 73.9% share of the Global Luxury Furniture insurance market. This high share shows how important it is for renters to protect their valuable furniture in leased homes or apartments.

Many renters assume that landlords’ insurance covers the furniture, but it only covers the building itself, not personal belongings. Renters insurance fills that gap by covering damage, theft, and other losses to renters’ belongings, which often include expensive furniture pieces. This makes it easier for renters to feel secure while enjoying furnished living spaces.

Renters insurance offers several benefits beyond just protecting furniture. It often includes coverage for liability, which means it can help pay for medical expenses or legal costs if someone is injured in the rented space. It can also cover additional living expenses if the rental becomes uninhabitable due to damage. These protections provide renters with financial peace and security, making renter coverage a crucial consideration for anyone living in rented accommodations with high-value furniture.

For Instance, in December 2024, Chubb enhanced its renters’ insurance policies to provide comprehensive protection for high-value home contents, including luxury furniture. The policies include tailored coverage options such as extended replacement cost and lock replacement, addressing renters’ needs for safeguarding premium belongings against unexpected damage or loss. Chubb’s approach emphasizes personalized protection and quick claims handling, making it a strong player in the renter coverage segment.

End Use Analysis

In 2024, the Business segment held a dominant market position, capturing a 64.5% share of the Global Luxury Furniture insurance market. This reflects the strong demand from commercial spaces such as offices, hotels, and upscale venues that need insurance to protect their expensive furnishings.

Businesses face higher risks because their furniture often experiences heavy use and public access, increasing the chance of damage or theft. Insurance helps businesses safeguard these valuable assets and avoid costly replacements, which is critical for maintaining a professional and luxurious appearance.

For businesses, having the right insurance coverage is not just about asset protection but also risk management. By insuring their furniture, companies reduce the financial impact of unexpected events and can focus more on their core operations. This segment highlights how crucial insurance is for commercial users in preserving their investments and brand reputation in the luxury furniture market.

For instance, in January 2025, Hiscox reported steady growth in its retail insurance sector, including policies for luxury furniture used in commercial settings such as offices and hospitality venues. The company’s focus on tailored business insurance and managing specialized risks supports its strong position in the business end-use segment.

Distribution Channel Analysis

In 2024, The Direct Sales segment held a dominant market position, capturing a 57.3% share of the Global Luxury Furniture insurance market. This shows that a majority of customers prefer to buy insurance directly from providers rather than through agents or brokers.

Direct sales simplify the process, offering easier access to information, faster policy issuance, and often more competitive pricing by cutting out intermediaries. Customers increasingly value this direct contact for clarity and convenience when purchasing insurance.

The direct sales channel benefits both insurers and buyers by encouraging transparency and reducing costs. Advanced digital tools and platforms enable customers to compare policies, get quotes, and manage their insurance conveniently online. This trend reflects a shift in consumer behavior toward more self-service options, making direct sales a dominant distribution method in this market segment.

For Instance, in August 2025, Berkley One redesigned its insurance product lineup and pricing, improving access through direct sales channels. This approach enabled faster policy issuance and lowered costs for clients seeking insurance for collector items and luxury furniture, reflecting the preference for direct sales in the market.

Emerging trends

One emerging trend in luxury furniture insurance is the rise of hyper-personalized insurance policies, which tailor coverage based on exact furniture types, materials, and use cases. Insurers are leveraging smart home data and detailed asset tracking to provide policies that adjust dynamically to risk levels. This trend is supported by data showing that customer demand for such personalized insurance products scores 9.5 out of 10 on satisfaction and will continue rising in the years ahead.

Another trend is the integration of digital tools such as augmented reality for virtual inspection and claims adjustment. Virtual showrooms and AR help insurers assess claims remotely, speeding up the resolution process while maintaining accuracy. These technology-driven solutions reduce costs and enhance transparency, making them increasingly attractive to both insurers and policyholders.

Growth Factors

A key growth factor is the expanding global luxury furniture market, which is driving demand for specialized insurance coverage. With more customers investing in bespoke and high-value furniture, the need for reliable protection against damage and theft grows. Rising home renovation activities also increase exposure to risks, pushing consumers to seek insurance that covers their modern, luxurious interiors.

Sustainability is another factor boosting insurance growth. As more buyers choose furniture made from eco-friendly and rare materials, insurance products evolve to incorporate coverage for environmental risks and supply chain transparency. This shift encourages insurers to develop policies that account for both the physical and ethical value of furniture, attracting conscientious buyers looking to protect their investments comprehensively.

Key Market Segments

By Type

- Owner Coverage

- Renter Coverage

By End Use

- Business

- Personal

By Distribution Channel

- Direct Sales

- Brokers

- Online Platforms

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Wealth and Disposable Income

Rising wealth and increasing disposable income among affluent individuals are major drivers for the luxury furniture insurance market. As more people invest in high-end furniture made from rare materials and elaborate craftsmanship, the need to protect these expensive assets becomes more important. Buyers want to secure their purchases against risks like theft, damage, or natural disasters, boosting insurance demand along with luxury furniture sales.

This growing financial comfort allows consumers to focus more on safeguarding their lifestyle investments. Particularly in emerging economies, rising personal wealth is encouraging more people to consider insurance for exclusive furniture, recognizing the value of coverage for one-of-a-kind or highly priced items. This trend supports steady growth in insurance offerings tailored specifically for luxury furniture owners.

For instance, in November 2025, Chubb highlighted its growing focus on international property and casualty insurance under new leadership, reflecting strong demand among wealthy clients for comprehensive coverage of high-value assets. Chubb’s global expansion and tailored solutions underline how rising wealth supports demand for luxury furniture insurance by protecting expensive belongings in diverse locations.

Restraint

Price Sensitivity During Economic Slowdowns

Price sensitivity during economic slowdowns limits the growth of luxury furniture insurance. When the economy faces uncertainty or slow growth, even wealthy buyers tend to delay large discretionary expenses, including insurance for their luxury furniture collections. This caution restricts immediate demand and can reduce insurance sales in the short term.

Luxury purchases and related insurance are considered non-essential, so consumers tend to prioritize essentials in tighter economic environments. This restraint highlights the importance for insurers and retailers to offer flexible payment options or phased coverage that appeals to clients during times of market volatility, helping sustain interest despite economic headwinds.

For instance, in January 2024, Nationwide Private Client announced it was exiting the high-net-worth personal lines market, including luxury asset insurance, citing changing economic conditions and the need to focus on more stable market segments. This move underscores how economic uncertainty can lead to reduced demand for luxury insurance products as clients become more cautious with discretionary expenses.

Opportunities

Integration with Furniture Retail

A strong opportunity exists by integrating insurance offerings directly with luxury furniture retail. By bundling insurance with the sales experience, retailers can provide customers with seamless protection solutions right at the point of purchase. This simplifies the buying process and addresses consumers’ desire for convenience and risk reduction.

Offering insurance as an add-on or standard option also creates stronger customer loyalty and increases the perceived value of the furniture purchase. Retailers who embrace this integrated model can differentiate themselves in a competitive market, capturing more sales and providing peace of mind to buyers investing in premium, fragile, or custom-made furniture pieces.

For instance, in February 2024, PURE Programs launched a customizable insurance solution for high-value homes under renovation or construction, with on-site advisors helping clients and builders prevent damage. This integration of insurance services with the furniture and home improvement process shows the opportunity to embed insurance in the purchase experience, making protection easier and more attractive.

Challenges

Complexity of Insuring Custom Luxury Pieces

The complexity of ensuring custom or highly unique luxury furniture is a key challenge in the market. These pieces often require special valuation, and risks related to repairs or replacements involve rare materials or expert craftsmanship. This makes underwriting and claims handling complicated and costly.

Additionally, the specialized knowledge required to assess these items means fewer insurers are willing or able to provide comprehensive coverage. Geographic differences in laws and client privacy needs add to the complexity, creating operational challenges for insurance providers as they seek to serve this niche market efficiently while controlling costs.

For instance, in October 2023, Cincinnati Insurance Company faced a legal dispute with a luxury furniture manufacturer over storm damage claims, highlighting difficulties in valuing and settling claims for high-end custom pieces. This incident reflects challenges insurers face in underwriting and claims handling when dealing with unique, handcrafted furniture.

Key Players Analysis

The Luxury Furniture Insurance Market is supported by major global and private client insurers offering tailored protection for high-value furnishings, décor, and custom interiors. Chubb, AIG Private Client Group, and AXA XL lead the market by providing comprehensive coverage for affluent homeowners. Their policies address unique risks such as accidental damage, theft, and transit losses involving rare or bespoke furniture.

Mid-tier insurers such as Hiscox, Berkley One, and Cincinnati Insurance Company provide flexible and detailed coverage designed for collectors and design-conscious consumers. Their services include professional valuation, restoration cost coverage, and consultation for loss prevention. The emphasis is on ensuring that every luxury asset, including antique or limited-edition furniture, is insured at its true replacement value.

Advisory firms like AON Private Risk Management, Marsh Private Client Services, and Nationwide Private Client act as intermediaries connecting clients with the right insurers and risk management solutions. They specialize in customizing policies that integrate property, fine art, and luxury furniture coverage. PURE Insurance also plays a vital role by focusing on affluent households that demand seamless claims processes and specialized expertise.

Top Key Players in the Market

- Chubb

- AIG Private Client Group

- PURE Insurance

- Nationwide Private Client

- Hiscox

- AXA XL

- Berkley One

- Cincinnati Insurance Company

- AON Private Risk Management

- Marsh Private Client Services

- Others

Recent Developments

- In February 2025, PURE Insurance launched a new customizable insurance program for high-value homes undergoing construction or renovation, covering projects up to $30 million. This program is designed to address challenges like extreme weather risks and major restructuring during construction, complementing luxury furniture coverages for clients with high-end assets.

- In August 2025, Berkley One announced a redesigned insurance product with lowered base rates for comprehensive and collision coverage, including optional endorsements tailored for collector items. This development aims to deliver cost savings and improved protection for luxury asset owners, which could extend to luxury furniture collectors as part of high-net-worth personal lines.

Report Scope

Report Features Description Market Value (2024) USD 130.2 Mn Forecast Revenue (2034) USD 218.2 Mn CAGR(2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Owner Coverage, Renter Coverage), By End Use (Business, Personal), By Distribution Channel (Direct Sales, Brokers, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Chubb, AIG Private Client Group, PURE Insurance, Nationwide Private Client, Hiscox, AXA XL, Berkley One, Cincinnati Insurance Company, AON Private Risk Management, Marsh Private Client Services, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Luxury Furniture Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Luxury Furniture Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Chubb

- AIG Private Client Group

- PURE Insurance

- Nationwide Private Client

- Hiscox

- AXA XL

- Berkley One

- Cincinnati Insurance Company

- AON Private Risk Management

- Marsh Private Client Services

- Others