Global Lung Cancer PCR Panel Market By Service Provider (Hospitals, Cancer Research Institutes, and Specialty Clinics), By Application (Adenocarcinoma, Squamous Cell Carcinoma (SCC), and Large Cell Carcinoma), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168965

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

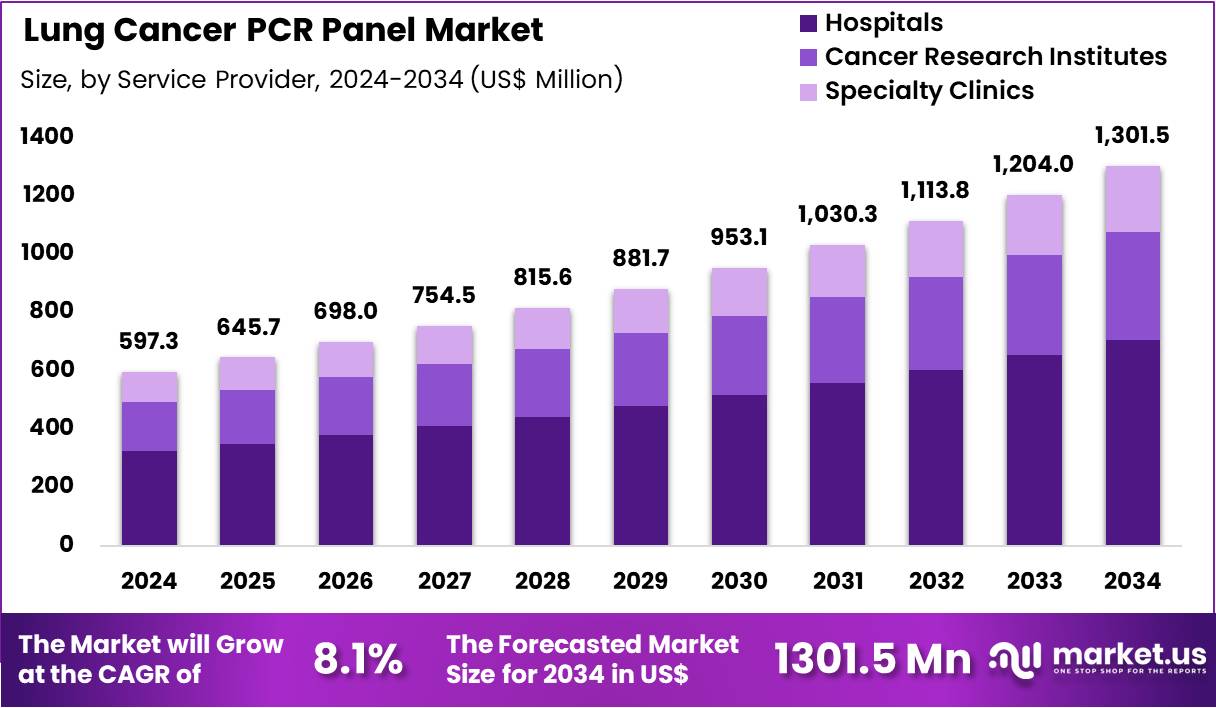

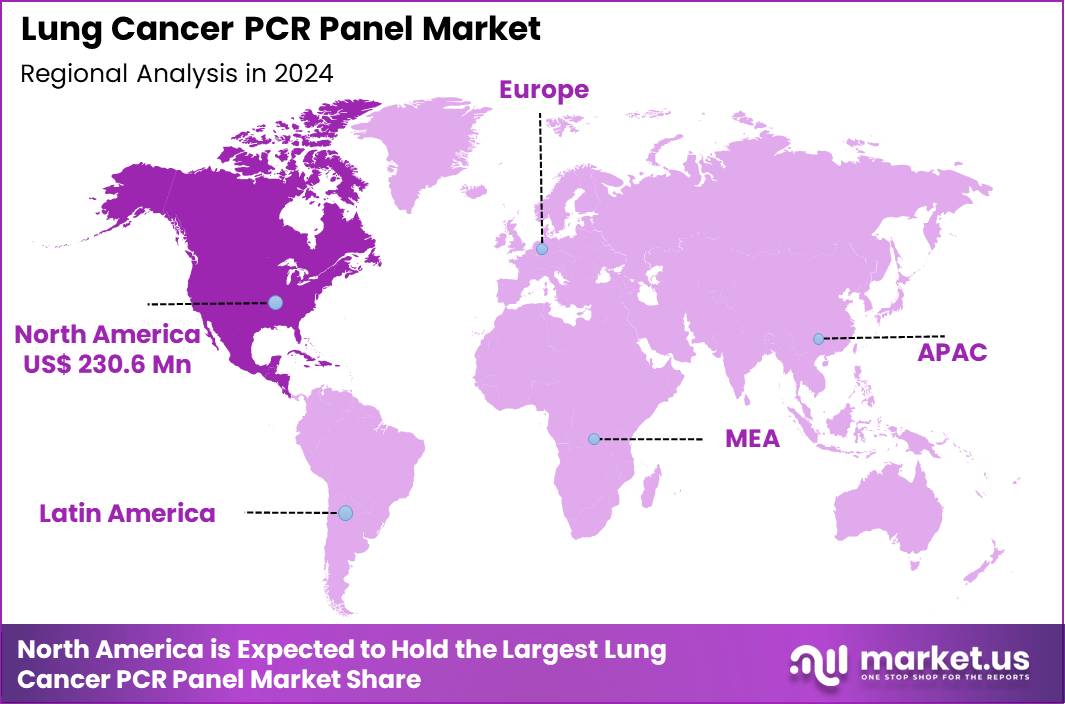

Global Lung Cancer PCR Panel Market size is expected to be worth around US$ 1301.5 Million by 2034 from US$ 597.3 Million in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.6% share with a revenue of US$ 230.6 Million.

Increasing incidence of non-small cell lung cancer propels the Lung Cancer PCR Panel market, as oncologists demand rapid molecular profiling to match patients with targeted therapies amid rising diagnostic volumes. Laboratories deploy multiplex PCR assays that amplify key actionable mutations like EGFR, ALK, and KRAS from formalin-fixed paraffin-embedded tissues in under four hours.

These panels enable initial reflex testing post-biopsy to inform first-line tyrosine kinase inhibitor selection, companion diagnostic confirmation for ROS1 fusions in advanced adenocarcinomas, resistance mechanism detection in progressing tumors, and minimal residual disease monitoring during adjuvant osimertinib regimens.

Evidence from the LUNG-CARE initiative in 2025 reveals that standard NCCN and Chinese high-risk criteria would miss 44–81% of cases, advocating broader screening that amplifies the need for efficient PCR-based panels as immediate follow-up tools. This data-driven shift enlarges the tested population and positions PCR panels as indispensable for confirming tumor biology right after imaging alerts. Healthcare systems seize opportunities to integrate these assays into streamlined pathways that accelerate treatment initiation.

Growing integration of liquid biopsy specimens accelerates the Lung Cancer PCR Panel market, as clinicians favor non-invasive sampling to enable serial monitoring without repeated invasive procedures. Biotechnology firms optimize droplet digital PCR kits that detect circulating tumor DNA mutations with high analytical sensitivity from plasma samples.

Applications encompass pretreatment genomic characterization for MET exon 14 skipping alterations, dynamic assessment of acquired T790M resistance during EGFR inhibitor therapy, immunotherapy eligibility via PD-L1 expression surrogates, and early response evaluation in clinical trials for novel antibody-drug conjugates.

AmoyDx secured NMPA approval in September 2024 for its Pan Lung Cancer PCR Panel, establishing it as a companion diagnostic for therapies targeting EGFR, ALK, ROS1, and METex14 mutations in non-small cell lung cancer patients. This regulatory endorsement validates PCR panels’ role in guiding precision treatments and unlocks commercial potential for liquid-based adaptations. Diagnostic providers capitalize on opportunities to develop hybrid tissue-plasma workflows that enhance accessibility for frail or inoperable patients.

Rising adoption of digital PCR enhancements invigorates the Lung Cancer PCR Panel market, as researchers leverage absolute quantification to overcome limitations of traditional qPCR in low-input scenarios. Instrument manufacturers embed partitioning technologies that provide partition-level resolution for rare variant calling in heterogeneous samples.

These advanced panels support comprehensive biomarker discovery in early-phase immunotherapy studies, clonal evolution tracking in small cell lung cancer transformations, pharmacodynamic analysis of PI3K/AKT inhibitors, and prognostic stratification using multi-gene expression signatures.

ChromaCode pivoted to oncology in 2024 by launching a digital PCR-based lung cancer test, demonstrating how dPCR elevates panel accuracy for therapeutic monitoring and expands multiplex capacity. This innovation addresses the demand for precise, reproducible results in high-stakes decision-making. Collaborative initiatives open avenues for AI-augmented interpretation that pairs PCR data with imaging to refine risk models and personalize surveillance strategies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 597.3 Million, with a CAGR of 8.1%, and is expected to reach US$ 1301.5 Million by the year 2034.

- The service provider segment is divided into hospitals, cancer research institutes, and specialty clinics, with hospitals taking the lead in 2023 with a market share of 54.2%.

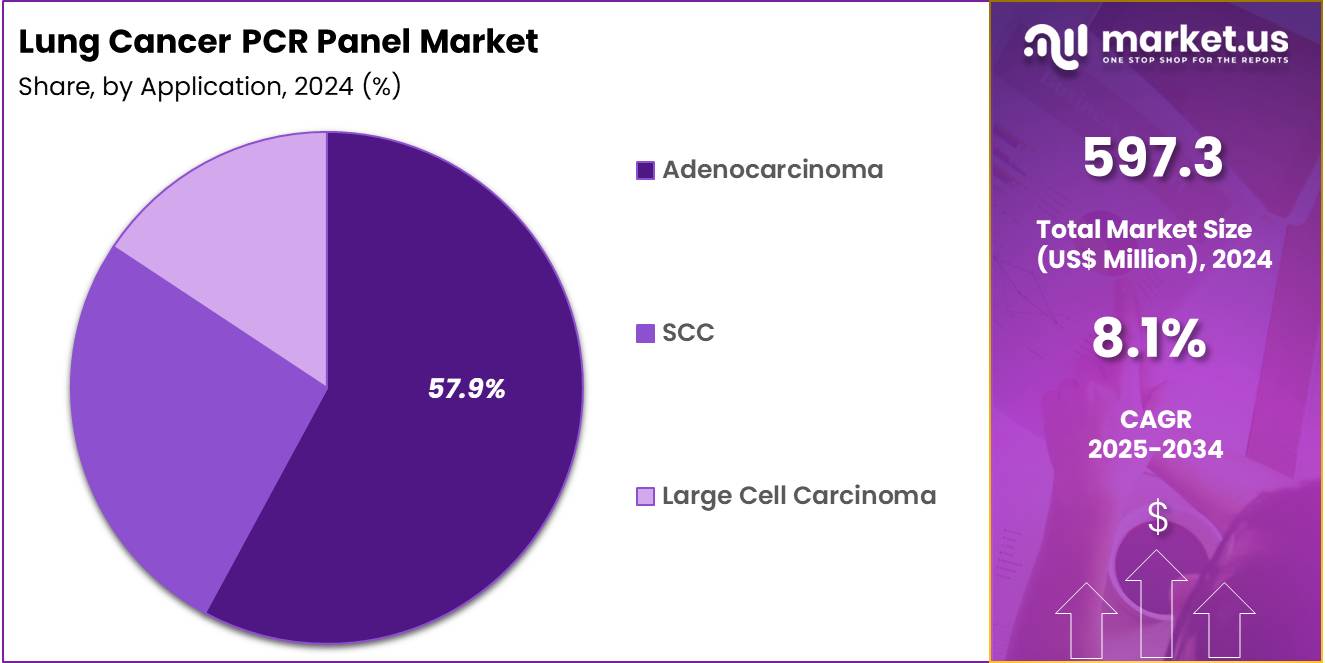

- Considering application, the market is divided into adenocarcinoma, SCC, and large cell carcinoma. Among these, adenocarcinoma held a significant share of 57.9%.

- North America led the market by securing a market share of 38.6% in 2024.

Service Provider Analysis

Hospitals, holding 54.2%, are expected to dominate as they manage the highest number of lung cancer diagnoses and molecular testing requests. Multidisciplinary oncology teams depend on PCR panels to detect EGFR, KRAS, ALK, and other actionable mutations essential for targeted therapy selection. Hospitals invest in advanced molecular laboratories that support rapid and accurate PCR-based profiling.

Rising global lung cancer prevalence increases routine testing demand across inpatient and outpatient oncology units. Precision-medicine programs expand PCR-driven testing as clinicians prioritize biomarker-guided treatments. Hospitals also participate in screening and early-detection programs, increasing test volume.

Growing availability of reimbursement for molecular diagnostics encourages adoption. Integration of automated PCR platforms improves turnaround time and testing throughput. Strong collaboration between pulmonologists, oncologists, and molecular pathologists strengthens testing consistency. These drivers keep hospitals anticipated to remain the leading service provider in this market.

Application Analysis

Adenocarcinoma, holding 57.9%, is anticipated to dominate because it presents the highest burden among lung cancer subtypes and carries multiple clinically actionable genetic alterations. PCR panels are essential for detecting common mutations such as EGFR, KRAS, BRAF, and MET, enabling targeted therapeutic planning. Rising incidence of adenocarcinoma among non-smokers increases molecular testing demand.

Clinicians rely on PCR-based mutation profiling to determine eligibility for tyrosine kinase inhibitors and other targeted therapies. Research groups intensify molecular studies on adenocarcinoma evolution, boosting PCR panel usage. Early-stage cases benefit from molecular testing to guide adjuvant therapy choices.

Increased adoption of minimally invasive biopsy techniques improves sample collection and testing efficiency. Pharmaceutical companies expand clinical trials focused on adenocarcinoma biomarkers, increasing PCR panel utilization. Greater awareness of mutation-driven disease pathways strengthens the need for comprehensive PCR testing. These factors keep adenocarcinoma projected to remain the most influential application segment in the Lung Cancer PCR Panel market.

Key Market Segments

By Service Provider

- Hospitals

- Cancer Research Institutes

- Specialty Clinics

By Application

- Adenocarcinoma

- Squamous Cell Carcinoma (SCC)

- Large Cell Carcinoma

Drivers

Increasing Incidence of Lung Cancer is Driving the Market

The escalating global incidence of lung cancer has emerged as a primary driver for the lung cancer PCR panel market, as these panels enable rapid detection of actionable mutations essential for personalized treatment strategies. This rise, attributed to aging populations and environmental exposures, heightens the demand for comprehensive genetic profiling to identify targets like EGFR and ALK fusions. Healthcare systems are incorporating PCR panels into standard diagnostic workflows to support early intervention and improve survival outcomes.

Diagnostic laboratories are scaling operations to process higher volumes of tissue and liquid biopsy samples efficiently. Regulatory agencies endorse multiplex PCR assays for their speed and cost-effectiveness compared to broader sequencing methods. Collaborative oncology networks facilitate data sharing, refining panel designs based on regional mutation prevalences.

The economic burden of advanced lung cancer justifies investments in accessible PCR technologies to avert metastatic complications. Professional guidelines from cancer societies recommend routine panel testing for non-small cell lung cancer patients at diagnosis. This driver accelerates advancements in real-time PCR formats, enhancing turnaround times in community settings.

Educational programs for oncologists emphasize the panels’ role in therapy selection, promoting widespread adoption. The World Health Organization reported an estimated 2.5 million new lung cancer cases worldwide in 2022, accounting for 12.4% of all new cancer cases.

Restraints

High Cost-Benefit Ratio Challenges are Restraining the Market

The unfavorable cost-benefit ratio of high-throughput PCR panels for lung cancer continues to restrain market expansion, as the expense of comprehensive genetic testing often outweighs immediate clinical returns in resource-limited settings. These panels, while informative, require specialized equipment and reagents, imposing financial strains on public health systems with limited reimbursement structures. This barrier leads to selective use, primarily in advanced cases rather than routine screening, limiting overall market penetration.

Laboratories in low-income regions face additional hurdles from import duties on kits, exacerbating affordability issues. Regulatory demands for extensive validation data further inflate development costs, delaying affordable iterations. The restraint perpetuates inequities, as underserved populations miss opportunities for targeted therapies due to testing inaccessibility. Policy efforts to subsidize panels progress slowly amid competing health priorities.

Manufacturers grapple with balancing panel breadth against pricing, hindering innovation in cost-optimized designs. These dynamics foster reliance on single-gene tests, despite their narrower scope for mutation detection. Addressing this necessitates integrated economic models demonstrating long-term savings from precision oncology.

Opportunities

FDA Approvals for EGFR-Targeted Therapies are Creating Growth Opportunities

The surge in U.S. Food and Drug Administration approvals for therapies targeting EGFR mutations in lung cancer is unlocking substantial growth opportunities for the PCR panel market, as these drugs mandate companion genetic testing for patient eligibility. Panels that detect exon 20 insertions and other variants become integral to treatment pathways, driving demand for validated assays.

Opportunities emerge in co-development partnerships between diagnostic firms and pharmaceutical companies, ensuring seamless integration of panels with drug labels. Regulatory fast-tracks for these companion diagnostics expedite market entry, broadening applicability across metastatic non-small cell lung cancer subtypes. This alignment supports expansion into liquid biopsy formats, enabling non-invasive monitoring in follow-up care.

Economic incentives from improved response rates justify payer coverage for panel testing, enhancing reimbursement landscapes. Global oncology consortia accelerate evidence generation, validating panels for diverse ethnic mutation profiles. These developments diversify revenue through service contracts for panel interpretation and reporting.

Emerging markets benefit from technology transfers, tailoring panels to local resistance patterns. Sustained clinical utility data will cement panels’ role in first-line therapy decisions. In 2024, the U.S. Food and Drug Administration approved Rybrevant as a first-line treatment for adults with locally advanced or metastatic non-small cell lung cancer harboring EGFR exon 20 insertion mutations.

Impact of Macroeconomic / Geopolitical Factors

Fiscal tightening and healthcare cost escalations across key markets force oncology labs to delay lung cancer PCR panel implementations, narrowing deployment in cash-constrained public systems. Surging biomarker research grants and climbing tobacco-related diagnoses, however, encourage providers to embrace these panels for personalized treatment mapping, spurring adoption in specialized centers.

Geopolitical flare-ups in the Persian Gulf and Eastern Mediterranean snag polymerase enzyme exports from regional refineries, stretching production schedules and ratcheting up logistics fees for assay fabricators. These snags, nonetheless, prompt agile firms to activate backup Asian-Pacific routes and invest in modular kit designs that expedite assembly and cut freight dependencies.

The U.S. universal 10% tariff on imported medical diagnostics, coupled with the recent November 2025 trade accord reducing Chinese duties to 10%, mildly elevates entry costs for American importers and nudges pricing adjustments in competitive tenders. Developers tackle this head-on by bolstering U.S. compounding sites and capitalizing on exemption clauses for essential oncology tools, maintaining supply fluidity.

At bottom, these pressures cultivate sharper budgeting and alliance-building skills throughout the industry. The lung cancer PCR panel market forges onward with vitality, harnessing such trials to pioneer quicker genomic profiling that ultimately saves more lives through timely, targeted interventions.

Latest Trends

Development of Pan Lung Cancer PCR Panels is a Recent Trend

The introduction of comprehensive pan lung cancer PCR panels has defined a key trend in 2025, offering multiplex detection of over 160 actionable genes in a single assay for streamlined genomic profiling. This advancement addresses limitations of targeted panels by covering rare fusions and co-mutations, facilitating holistic therapy guidance. The trend prioritizes rapid turnaround, with results available within 48 hours to support urgent treatment initiations.

Developers are focusing on compatibility with next-generation sequencing hybrids, enhancing depth for low-frequency variants. Regulatory validations confirm high concordance with reference methods, accelerating clinical adoption in oncology centers. This evolution intersects with AI analytics for variant prioritization, reducing interpretive burdens on pathologists.

Competitive launches include adaptations for formalin-fixed paraffin-embedded samples, preserving utility in archived tissues. Broader implications encompass integration with immunotherapy response predictors, adapting panels for immune checkpoint assessments.

The trend fosters international collaborations for validation cohorts, addressing geographic mutation disparities. Ethical considerations emphasize equitable access to prevent testing gaps in underserved regions. A 2025 study demonstrated the Pan Lung Cancer PCR Panel’s high concordance with other assays, covering 167 genes for rapid local laboratory implementation.

Regional Analysis

North America is leading the Lung Cancer PCR Panel Market

North America accounted for 38.6% of the overall market in 2024, and the region saw strong growth as oncology networks expanded molecular profiling for non-small cell lung cancer to support targeted-therapy decision making. Hospitals increased use of multiplex mutation panels to detect EGFR, KRAS, ALK, and other actionable biomarkers essential for personalized treatment pathways.

Diagnostic laboratories strengthened PCR-based workflows to deliver faster variant identification for newly diagnosed patients. Growth accelerated as clinicians integrated molecular testing earlier in the diagnostic cycle to improve therapeutic selection and survival outcomes. The CDC reported 127,952 lung-cancer deaths in the United States in 2022 (CDC – National Center for Health Statistics, “Deaths: Final Data for 2022”), and this substantial burden drove wider adoption of rapid molecular assays.

Pharmaceutical companies expanded access to biomarker-matched therapies, pushing labs to increase testing throughput. Tele-oncology programs facilitated broader access to precision diagnostics across remote regions. These factors collectively supported significant market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience strong growth during the forecast period as healthcare systems intensify early cancer-detection programs and increase access to genomic profiling across major urban centers. Hospitals upgrade molecular laboratories to support routine testing for actionable driver mutations, allowing clinicians to optimize frontline treatment choices.

Diagnostic chains introduce high-throughput PCR solutions to handle rising test volume linked to growing cancer awareness. Government-led screening initiatives encourage earlier diagnosis, increasing demand for rapid mutation detection. Public hospitals expand reimbursement for biomarker testing, leading to broader adoption of precision-medicine workflows.

The National Cancer Center Japan reported 74,518 lung-cancer deaths in 2022 (NCC Japan – Cancer Statistics 2022), and this high mortality burden highlights the region’s need for faster molecular diagnostics. Research institutes strengthen partnerships with pharmaceutical developers to validate new therapeutic biomarkers. These developments position Asia Pacific for robust forward-looking growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms drive growth in the lung-cancer molecular diagnostics space by expanding test menus to cover a broad array of actionable driver mutations and gene fusions, thereby appealing to oncologists pursuing precision medicine strategies. They focus investment on automation and high-throughput real-time PCR platforms that deliver rapid turnaround and low per-sample cost, making molecular profiling scalable for high-volume oncology labs.

They expand their geographic footprint by entering underserved regions and forging partnerships with local distributors and hospital networks to tap rising lung cancer incidence and limited diagnostic access. They strengthen their value proposition by working closely with pharmaceutical companies to align tests with targeted therapies, enabling companion diagnostics that support treatment decisions.

They integrate their assays into broader oncology workflows including tissue-based and liquid-biopsy applications to create comprehensive diagnostic offerings that adapt to evolving clinical practices. One prominent example, Roche Diagnostics, uses its deep molecular-diagnostics expertise, global laboratory footprint, and broad platform portfolio to provide integrated mutation-testing solutions for lung cancer biomarkers such as EGFR and ALK, positioning itself as a leading partner for clinical labs and healthcare providers in oncology diagnostics.

Top Key Players

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- QIAGEN N.V.

- Guardant Health, Inc.

- Agilent Technologies, Inc.

- NeoGenomics Laboratories, Inc.

- Quest Diagnostics Incorporated

Recent Developments

- In April 2025, the LUNG-CARE Project in Guangzhou reported that non-risk-based LDCT screening identified lung cancer in 1.7% of screened individuals, with 82.5% detected at Stage 0-I, and demonstrated a 63% mortality reduction versus unscreened populations. Earlier identification creates a surge in downstream confirmatory molecular testing, directly amplifying demand for PCR panels capable of rapidly detecting early-stage actionable mutations.

- In September 2024, AmoyDx received NMPA approval for its PCR-based companion diagnostic targeting MET exon 14 skipping mutations in advanced NSCLC patients eligible for Haiyitan® (gumarontinib). By enabling precise patient selection for targeted therapy, this approval expands the clinical requirement for mutation-focused PCR panels across China, accelerating adoption of CDx-linked lung cancer assays in routine oncology workflows.

Report Scope

Report Features Description Market Value (2024) US$ 597.3 Million Forecast Revenue (2034) US$ 1301.5 Million CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Provider (Hospitals, Cancer Research Institutes, and Specialty Clinics), By Application (Adenocarcinoma, Squamous Cell Carcinoma (SCC), and Large Cell Carcinoma) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Roche Diagnostics, Thermo Fisher Scientific, Illumina, QIAGEN N.V., Guardant Health, Agilent Technologies, NeoGenomics Laboratories, Quest Diagnostics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lung Cancer PCR Panel MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Lung Cancer PCR Panel MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- QIAGEN N.V.

- Guardant Health, Inc.

- Agilent Technologies, Inc.

- NeoGenomics Laboratories, Inc.

- Quest Diagnostics Incorporated