Global Luggage Market By Type (Travel Bags, Business Bags, Casual Bags), By Material (Soft-sided, Hard-sided), By Distribution Channel (Online, Offline, Supermarkets and hypermarkets, Specialty Stores, Online, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Nov 2024

- Report ID: 16332

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

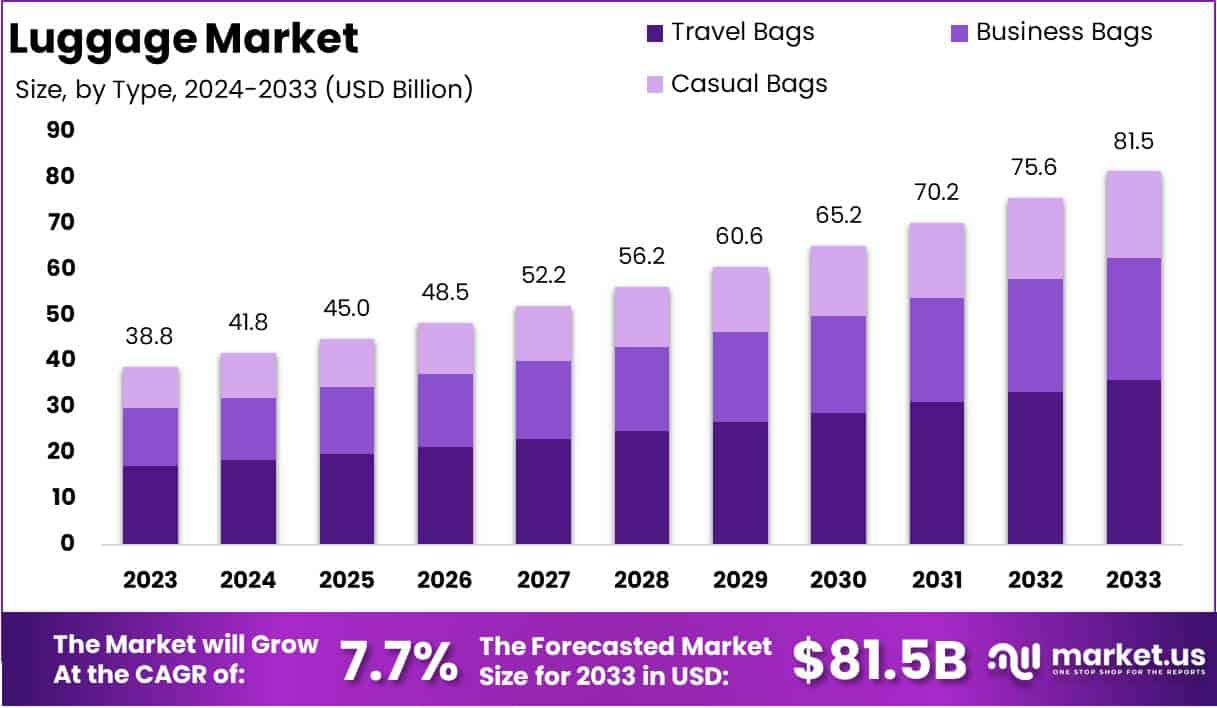

The Global Luggage Market size is expected to be worth around USD 81.5 Billion by 2033, from USD 38.8 Billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

Luggage refers to portable containers such as suitcases, backpacks, duffel bags, and carry-ons used to store and transport personal belongings during travel. These items come in various sizes, designs, and materials to cater to different travel needs, ranging from business trips to leisure vacations.

The luggage market encompasses the production, distribution, and sale of travel bags, luggage sets, and accessories globally. This market includes various segments such as premium, mid-range, and budget-friendly products, catering to diverse consumer preferences. Key players range from luxury brands to mass-market manufacturers.

The luggage market’s growth is driven by increasing travel and tourism activities, rising disposable incomes, and the growing trend of lifestyle upgrades. Business travel resurgence post-pandemic, coupled with the demand for durable and lightweight luggage, also contributes significantly. E-commerce has further accelerated growth by offering a wider reach and diverse product options.

Demand is fueled by both functional and aesthetic considerations. Consumers seek luggage that combines practicality with style, reflecting their personal tastes. The shift towards more sustainable and eco-friendly products is also influencing purchasing decisions, with manufacturers integrating recycled materials and innovative designs.

Opportunities lie in the expansion of smart luggage, equipped with features like GPS tracking, USB charging ports, and digital locking systems. Emerging markets, particularly in Asia Pacific and Latin America, offer immense potential due to urbanization and a burgeoning middle class.

According to TravelFreak, the luggage market reflects a clear bifurcation in product preferences based on weight, capacity, and price. The average carry-on suitcase weighs 7.6 lbs with a volume of 40.3 liters, while checked luggage averages 10.4 lbs and offers 91.2 liters of capacity.

Notably, the July Carry-On Light stands out as the lightest model at just 3.9 lbs, underscoring a growing demand for ultra-lightweight options. On the premium end, the RIMOWA Original Cabin leads with a price point of $1,430, reflecting strong consumer appetite for luxury and durability. These metrics highlight the market’s focus on balancing performance and aesthetics.

According to Eminent Luggage, the U.S. moving industry generates over $18 billion annually, with Americans relocating approximately 11 times in their lifetime. In the luggage market, black remains the predominant color, accounting for about 40% of purchases, followed by blue at 30%, gray at 20%, and red at 10%. The International Air Transport Association (IATA) reports that 52% of global passengers prefer carry-on baggage, while 48% opt to check in luggage.

The U.S. Department of Transportation (DOT) indicates that U.S. airlines collected nearly $6.8 billion in baggage fees in 2022 and $5.5 billion in the first nine months of 2023. Additionally, the average weight of checked luggage for domestic flights in the United States is approximately 45 pounds (20.4 kilograms) per bag.

Key Takeaways

- The global luggage market is projected to grow from USD 38.8 billion in 2023 to USD 81.5 billion by 2033, at a CAGR of 7.7%.

- Travel Bags led the market in 2023, capturing 44.2% of the market share, driven by rising tourism and personal travel.

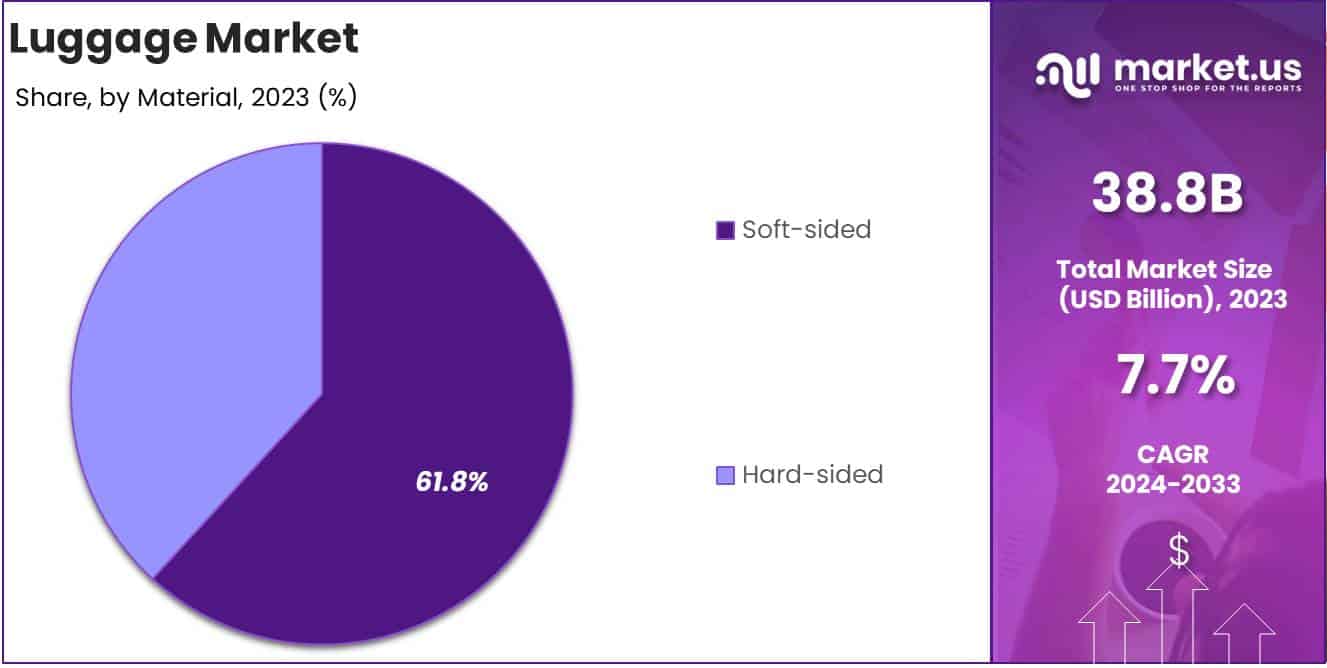

- Soft-sided luggage dominated with a 61.8% share in 2023, attributed to its lightweight and versatile design.

- Offline channels held a 66.2% share in 2023, fueled by consumers’ preference for in-store shopping experiences.

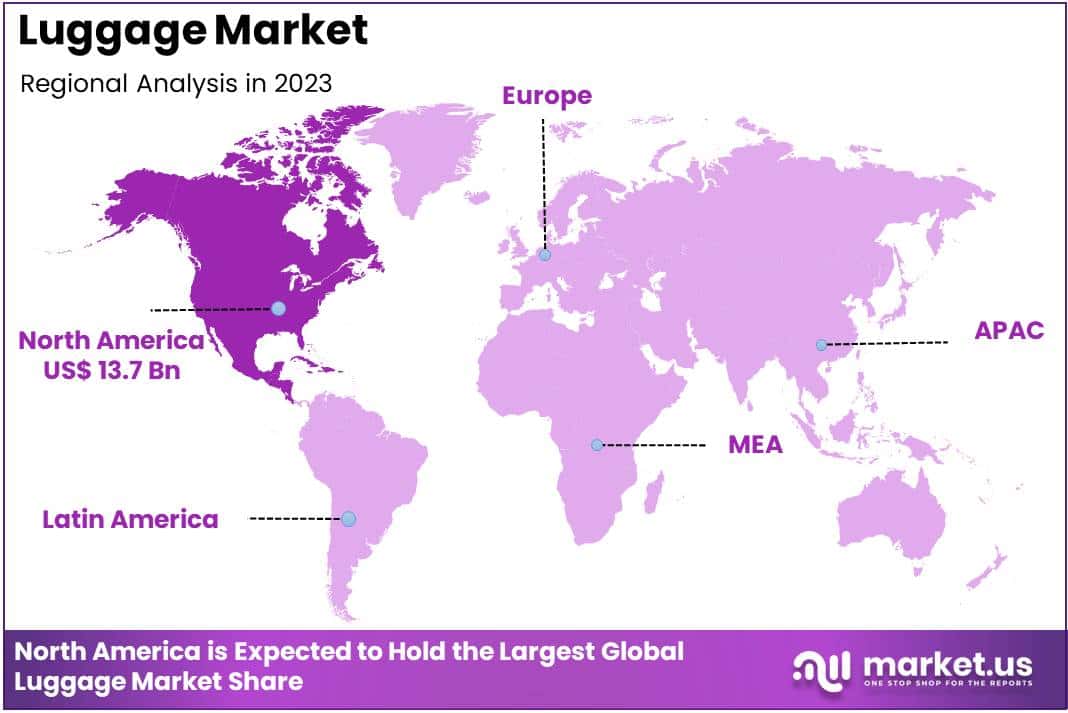

- North America led the luggage market in 2023 with a 35.5% share, supported by a strong tourism sector and high consumer spending.

By Type Analysis

Travel Bags Leading the Luggage Market with a 44.2% Share in 2023

In 2023, Travel Bags emerged as the dominant segment in the luggage market by type, securing more than 44.2% of the total market share. This leadership can be attributed to the growing demand for versatile and durable luggage options that cater to both short and long-term travel. The rise in tourism and frequent personal travel significantly contributed to this segment’s strong performance.

Business Bags segment benefited from the increasing number of business travelers and the growing need for functional bags that combine style with practicality. Features such as dedicated laptop compartments and RFID protection drive its appeal among professionals.

Rounding out the market, Casual Bags segment caters to consumers seeking lightweight and fashionable options for everyday use. Its growth is supported by rising lifestyle changes and the popularity of multipurpose bags that blend casual aesthetics with practicality.

By Material Analysis

Soft-sided Leading the Luggage Market with a 61.8% Share in 2023

In 2023, Soft-sided luggage held a dominant market position by material type, capturing more than 61.8% of the market share. This significant lead is attributed to its versatility, lightweight nature, and cost-effectiveness, which have made it a preferred choice among travelers.

Soft-sided luggage, often crafted from durable fabrics such as nylon or polyester, offers flexibility in terms of packing capacity and is particularly valued for short trips and domestic travel. Additionally, the presence of multiple compartments enhances its utility, catering to consumers who prioritize organization and convenience.

The growing preference for soft-sided luggage has also been influenced by its adaptability to varying travel requirements and its ease of storage in overhead compartments or tighter spaces. As consumer demand for travel products that balance affordability and functionality continues to rise, the soft-sided segment is well-positioned to maintain its market dominance in the near term.

Hard-sided luggage, in contrast, accounted for a smaller yet significant share of the market. Known for its durability and superior protection, this segment has seen increased adoption among travelers prioritizing the safety of fragile or valuable items.

Hard-sided luggage, typically made from materials such as polycarbonate, ABS, or aluminum, appeals to consumers who seek modern aesthetics and robust performance. Furthermore, the rise in international travel and premium travel experiences has driven demand for hard-sided options, particularly in the luxury segment.

While soft-sided luggage currently holds the larger market share, hard-sided products are poised for steady growth due to their evolving designs, enhanced functionality, and growing appeal to a premium consumer base. Together, these segments reflect the diverse preferences of a dynamic and expanding global travel market.

By Distribution Channel Analysis

Offline Channels Leading the Luggage Market with a 66.2% Share in 2023

In 2023, Offline channels led the luggage market by distribution channel, capturing more than 66.2% of the total market share. This segment’s stronghold is driven by the consumer preference for in-store experiences, allowing them to evaluate product quality, size, and design firsthand. The wide availability of luggage in specialty stores and supermarkets & hypermarkets further supports the dominance of offline distribution.

Online channels fueled by the growing popularity of e-commerce platforms. Convenience, competitive pricing, and a wide range of options have made online shopping an increasingly favored choice for consumers, particularly among tech-savvy and younger demographics.

Supermarkets & hypermarkets benefiting from their broad product offerings and frequent promotional discounts. These stores provide customers with the convenience of purchasing luggage while shopping for other essentials, making them a preferred retail destination.

Specialty stores offering a curated selection of high-quality and branded luggage. Their focus on personalized service and premium products appeals to consumers looking for tailored advice and exclusive designs.

The Others category, which includes departmental stores and local retailers. Despite a smaller share, this segment remains significant in regions where traditional shopping habits persist.

Key Market Segments

By Type

- Travel Bags

- Business Bags

- Casual Bags

By Material

- Soft-sided

- Hard-sided

By Distribution Channel

- Online

- Offline

- Supermarkets & hypermarkets

- Specialty Stores

- Online

- Others

Driver

Surge in Global Travel and Tourism

The global luggage market is experiencing significant growth, primarily driven by the resurgence of international travel and tourism. As economies recover and borders reopen post-pandemic, there has been a notable increase in both leisure and business travel.

This uptick has led to a heightened demand for various types of luggage, including travel bags, business cases, and casual bags, as consumers seek reliable and durable options for their journeys. The expansion of the travel and tourism sector is a key factor propelling the luggage market forward.

Additionally, the rise of budget airlines and more accessible travel options have made it easier for a broader demographic to embark on trips, further boosting luggage sales.

The growing trend of experiential travel, where individuals prioritize unique experiences over material possessions, has also contributed to this demand. As travelers seek to explore new destinations, the need for functional and stylish luggage becomes paramount, thereby driving market growth.

Restraint

Proliferation of Counterfeit Products

The global luggage market faces a significant challenge due to the widespread availability of counterfeit products. These imitation goods, often sold at a fraction of the price of authentic brands, attract cost-conscious consumers but compromise on quality and durability. The presence of counterfeit luggage not only undermines the sales of genuine manufacturers but also erodes brand reputation and consumer trust.

This issue is particularly prevalent in regions with less stringent intellectual property enforcement, making it a formidable barrier to market growth. Moreover, counterfeit products often fail to meet safety and quality standards, leading to potential consumer dissatisfaction and safety concerns.

The financial losses incurred by legitimate companies due to counterfeiting are substantial, affecting their ability to invest in innovation and expansion. Addressing this challenge requires concerted efforts from manufacturers, governments, and consumers to promote awareness and enforce stricter regulations against counterfeit goods.

Opportunity

Integration of Smart Technology in Luggage

The advent of smart technology presents a lucrative opportunity for the luggage market. Consumers are increasingly seeking luggage equipped with advanced features such as GPS tracking, built-in charging ports, and biometric locks. These innovations enhance the travel experience by offering convenience, security, and connectivity.

The integration of technology into luggage design caters to the tech-savvy traveler, creating a new segment within the market and driving growth. Furthermore, the rise of the Internet of Things (IoT) has facilitated the development of interconnected luggage systems, allowing users to monitor and control their bags remotely via smartphones.

This trend aligns with the broader consumer shift towards smart devices and connected ecosystems. Companies that invest in research and development to incorporate these technologies into their products are well-positioned to capitalize on this emerging demand, thereby gaining a competitive edge in the market.

Trends

Shift Towards Sustainable and Eco-Friendly Materials

A notable trend in the luggage market is the growing consumer preference for sustainable and eco-friendly products. Environmental concerns have led to increased demand for luggage made from recycled or biodegradable materials. Manufacturers are responding by adopting sustainable practices and materials, such as recycled plastics and organic fabrics, to appeal to environmentally conscious consumers.

This shift not only meets consumer expectations but also aligns with global sustainability goals, influencing purchasing decisions and driving market evolution. Additionally, companies are implementing eco-friendly manufacturing processes to reduce carbon footprints, further appealing to green-minded consumers.

The emphasis on sustainability extends beyond materials to include packaging and corporate social responsibility initiatives. Brands that prioritize environmental stewardship are likely to build stronger customer loyalty and differentiate themselves in a competitive market, thereby fostering long-term growth.

Regional Analysis

North America Leads Luggage Market with Largest Market Share of 35.5%

In 2023, North America emerged as the leading region in the global luggage market, capturing 35.5% of the total market share and generating approximately USD 13.7 billion in revenue. This dominance is attributed to a robust travel and tourism sector, high consumer spending on premium and smart luggage solutions, and a strong distribution network.

Europe follows closely, benefiting from a well-established tourism industry and increasing demand for eco-friendly and lightweight luggage products. The region’s emphasis on sustainability and innovation has spurred the adoption of luggage made from recycled materials and advanced composites.

The Asia Pacific region is witnessing the fastest growth, driven by rising disposable incomes, urbanization, and a burgeoning middle class, particularly in countries such as China, India, and Japan.

The Middle East & Africa and Latin America are experiencing steady growth, fueled by improving travel infrastructure and increased international tourism. However, their market shares remain comparatively smaller due to economic and political uncertainties in some areas.

North America’s lead highlights the region’s maturity in the luggage market, supported by innovative product launches and a strong distribution network. The emphasis on quality, brand reputation, and technological integration, such as smart luggage features, continues to drive consumer preferences in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global luggage market in 2024 is shaped by a competitive landscape where established brands continue to innovate to capture evolving consumer preferences. Rimowa and Tumi, both premium players, focus on high-end, durable, and technologically advanced luggage.

Rimowa’s iconic aluminum designs and Tumi’s focus on functionality and style position them as leaders in the luxury segment, targeting affluent, frequent travelers. Samsonite, a global giant, and its subsidiary American Tourister dominate the mid-tier and budget-conscious segments, leveraging their extensive distribution network and brand recognition.

Samsonite’s versatility in catering to multiple price points ensures its leadership remains unchallenged. American Tourister, with its colorful, youthful appeal, effectively targets younger demographics and family travelers.

Delsey and Travelpro are known for innovation in lightweight and ergonomic designs, appealing to business travelers and those seeking functional, stylish solutions. Briggs & Riley, recognized for its lifetime warranty, emphasizes durability and customer loyalty, catering primarily to the professional market.

Victorinox, leveraging its heritage in Swiss precision, combines rugged utility with sleek design, appealing to both business and adventure travelers.

Thule and Heys cater to niche markets. Thule, known for its outdoor gear, attracts adventure travelers with robust, multi-functional luggage. Heys, on the other hand, capitalizes on design aesthetics and affordability, targeting fashion-conscious travelers.

Together, these players are reshaping the luggage market, responding to trends like sustainability, smart luggage integration, and the rise of experiential travel, setting the stage for dynamic competition and growth.

Top Key Players in the Market

- Rimowa

- Samsonite

- Tumi

- American Tourister

- Delsey

- Travelpro

- Briggs & Riley

- Victorinox

- Thule

- Heys

Recent Developments

- In 2024, Yatra Online, Inc., India’s largest corporate travel services provider, announced the acquisition of Globe All India Services Limited (Globe Travels) for INR 1280 million (~USD 15.25 million). This strategic move aims to enhance Yatra’s leadership in corporate travel solutions.

- In 2023, VistaJet partnered with Italian luxury brand Valextra to launch an exclusive travel collection. The collaboration blends VistaJet’s aviation expertise with Valextra’s timeless design, offering premium travel accessories tailored for the Global 7500 aircraft.

- In 2024, Samsonite continued its sustainability efforts with the “Luggage Trade-In Campaign.” From April 1 to May 31, customers could trade in old suitcases for a 30%–50% discount on new Samsonite products at participating stores.

- In October 2024, Vela Software Spain S.L. reaffirmed its commitment to data privacy. The company updated its privacy notice, outlining its practices for collecting, using, and protecting personal data across its digital platforms.

- In 2024, SITA expanded its services by acquiring ASISTIM, a leader in airline flight operations. This acquisition positions SITA to offer comprehensive operations-as-a-service solutions, enhancing efficiency and resilience for airlines globally.

Report Scope

Report Features Description Market Value (2023) US$ 38.8 Bn Forecast Revenue (2033) US$ 81.5 Bn CAGR (2023-2032) 7.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Travel Bags, Business Bags, Casual Bags), By Material (Soft-sided, Hard-sided), By Distribution Channel (Online, Offline, Supermarkets and hypermarkets, Specialty Stores, Online, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC, Latin America: Brazil, Mexico, and Rest of Latin America, Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa Competitive Landscape Rimowa , Samsonite , Tumi , American Tourister , Delsey , Travelpro , Briggs & Riley , Victorinox , Thule , Heys Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rimowa

- Samsonite

- Tumi

- American Tourister

- Delsey

- Travelpro

- Briggs & Riley

- Victorinox

- Thule

- Heys