Global Loyalty Management Market Size, Industry Analysis Report By Component (Solution (Channel Loyalty, Customer Loyalty, Customer Retention, Others), Service), By Deployment Model (Cloud, On-premises), By Enterprise Size (SME, Large Enterprises), By Operator (B2B, B2C), By End Use (Transportation, IT & Telecommunication, BFSI, Media & Entertainment, Retail & Consumer Goods, Hospitality, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 12217

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business benefits

- Regional Focus: North America

- Emerging Trends

- Growth Factors

- By Component Analysis

- By Deployment Model Analysis

- By Enterprise Size Analysis

- By Operator Analysis

- By End Use Analysis

- Top Use Cases

- Customer Insights

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

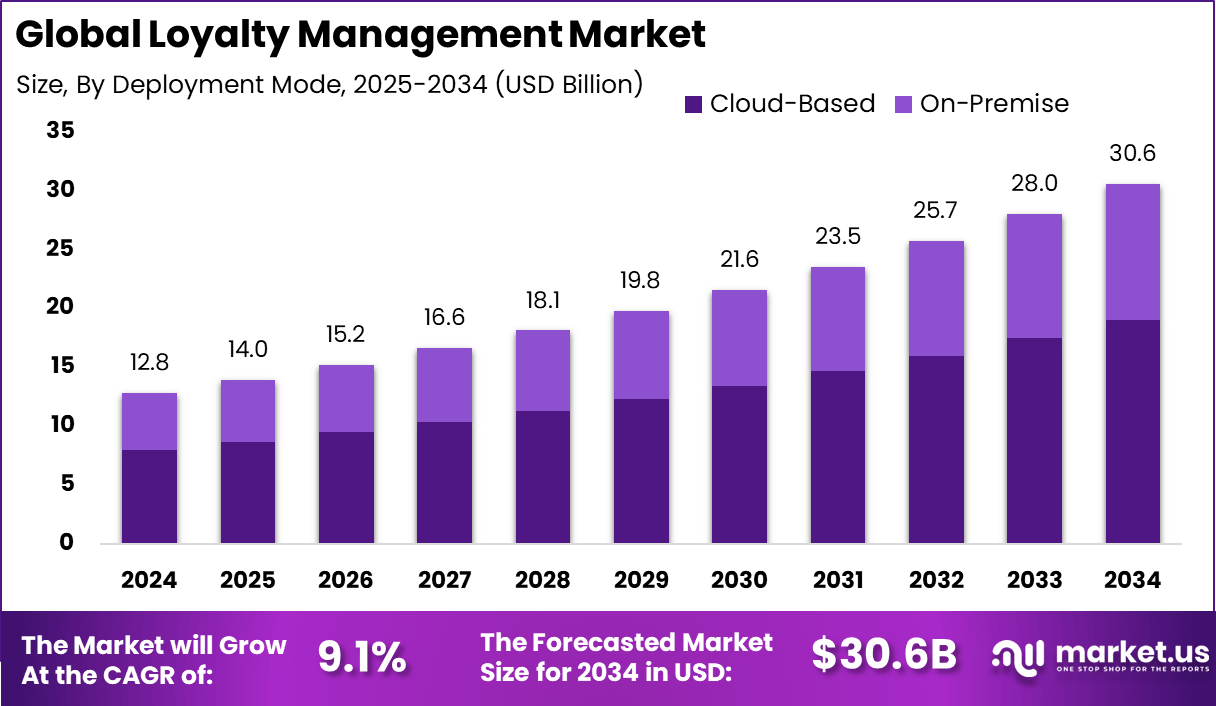

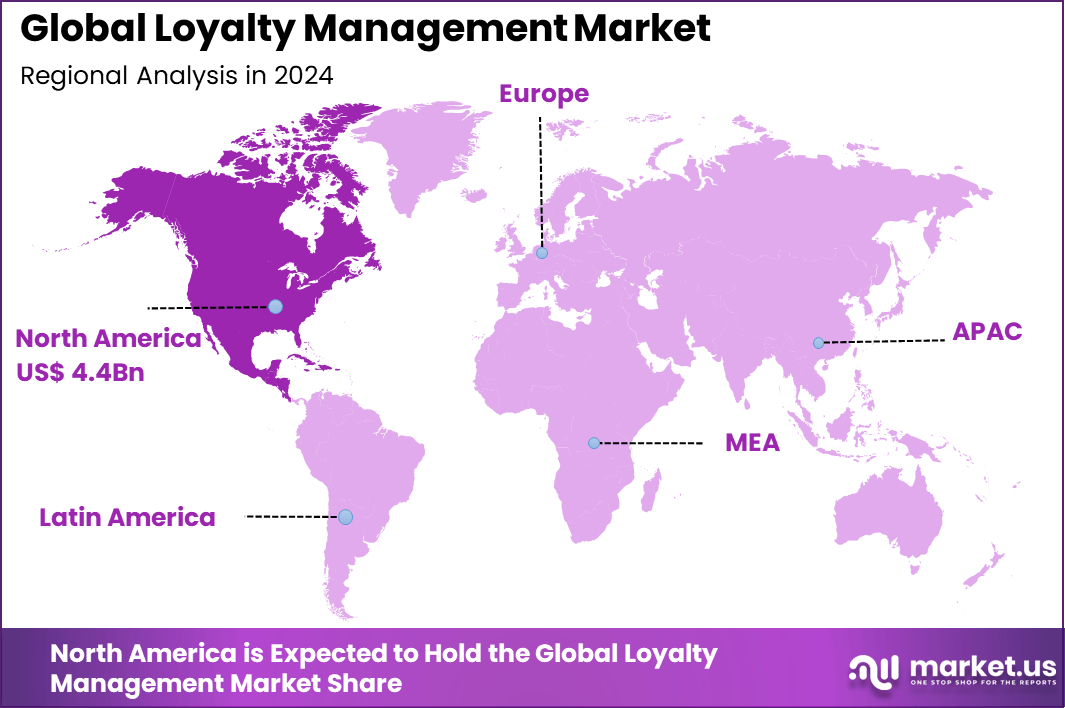

The Global Loyalty Management Market size is expected to be worth around USD 30.6 Billion By 2034, from USD 12.8 billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 34.5% share, holding USD 4.4 Billion revenue.

The Loyalty Management Market refers to systems and strategies designed to attract, retain, and engage customers through rewards, personalized offers, and structured incentive programs. These solutions enable businesses to track customer behavior, manage points-based or tiered rewards systems, and analyze engagement data.

The market includes platforms used across industries such as retail, travel, banking, and telecommunications. Loyalty management systems are implemented both online and in physical environments, helping brands build long-term relationships with customers by encouraging repeat business and brand advocacy.

The growth of this market is driven by increased competition, rising customer acquisition costs, and the growing importance of customer retention. Businesses are focusing on retaining existing customers through loyalty programs that enhance brand engagement. The expansion of e-commerce, mobile payment systems, and digital wallets has made it easier for companies to implement and scale loyalty initiatives.

Demand for loyalty management solutions is rising among organizations seeking to increase customer lifetime value and improve customer satisfaction. Retailers are deploying digital loyalty cards and mobile applications to offer convenience and real-time promotions. Financial service providers use loyalty points and cashback systems to encourage card usage.

According to llcbuddy, 17% of B2B buyers said competence during the purchasing process is the most important factor in their decision-making. At the same time, 20% of consumers remain loyal to online merchants that tailor communication based on personal data, while 26% become less favorable toward companies after a poor online experience.

Marketers themselves acknowledge this digital gap, with 83% stating that their ability to meet client expectations depends directly on their digital skills. Consumer loyalty is further shaped by rewards and influence-driven strategies.

Data from conversant shows that 21% of shoppers seek loyalty points during seasonal shopping. Similarly, Episerver notes that 21% of consumers are more likely to make repeat purchases when brands personalize experiences. According to Accenture, 23% of U.S. customers remain loyal to businesses that engage with social influencers.

Key Insight Summary

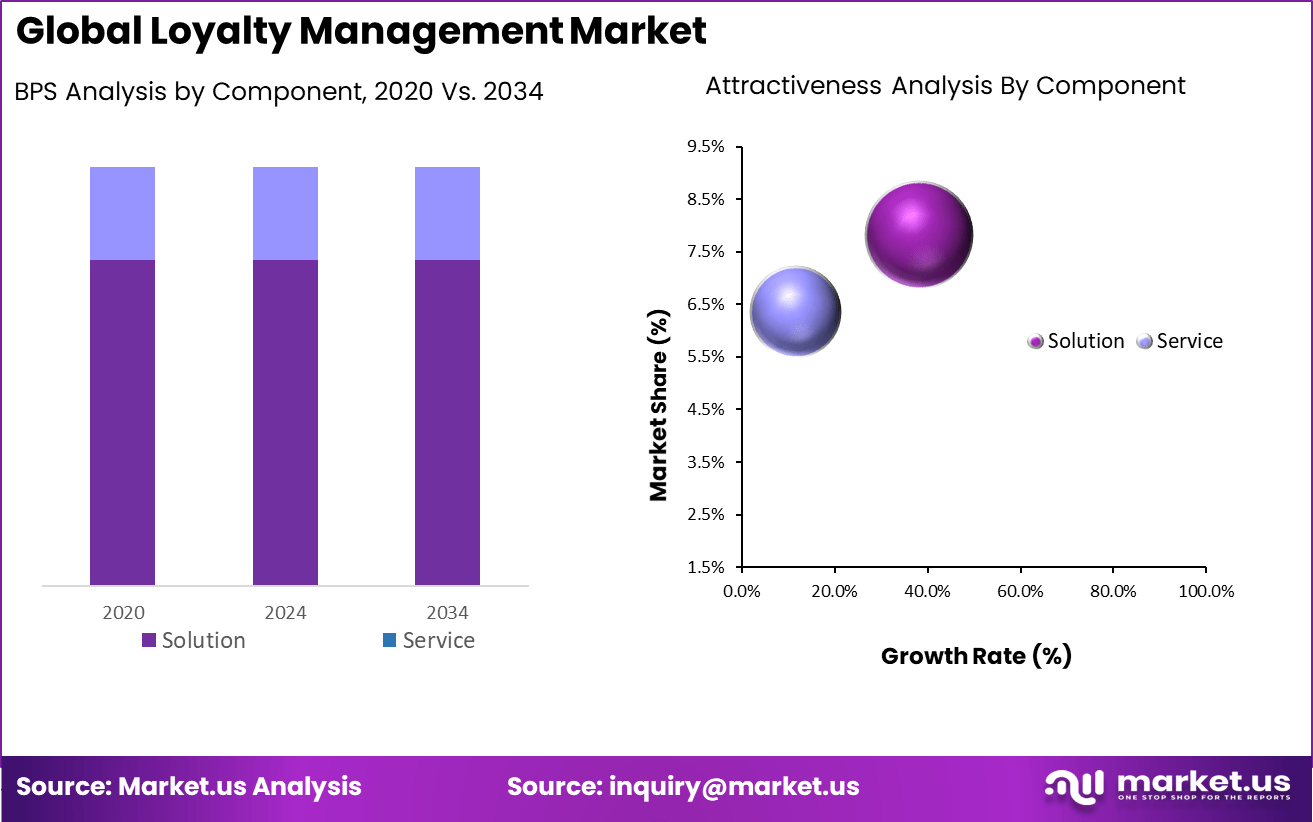

- By component, Solutions dominated the market, accounting for 58.6% share.

- Cloud deployment was the leading model, holding 62.3% share.

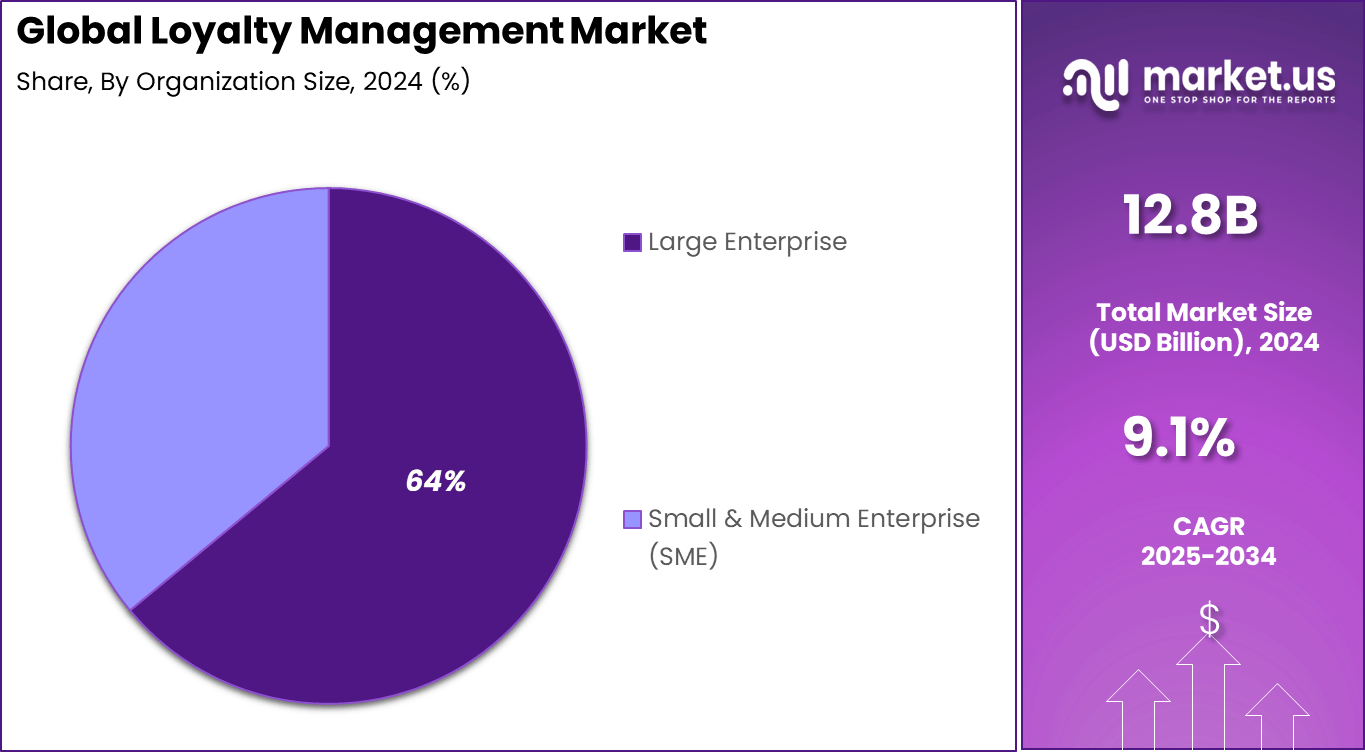

- Large Enterprises were the main adopters, representing 64% share.

- By operator, the B2C segment led with 54.5% share.

- By end use, Retail & Consumer Goods captured 22.9% share.

- Regionally, North America held a strong position with 34.5% share of the global market.

Analysts’ Viewpoint

Technologies increasing in use within the loyalty management market include artificial intelligence, machine learning, predictive analytics, and blockchain for secure and transparent reward systems. AI allows businesses to analyze behavior data to predict what motivates customers, enabling real-time engagement and smarter reward campaigns. Digital wallets and mobile platforms also help customers participate more easily in loyalty programs while providing valuable data to businesses.

Companies adopt loyalty management systems mainly to improve customer retention, increase lifetime customer value, and gain deeper customer insights. Personalized rewards help build emotional connections with customers, turning them into repeat buyers and brand advocates. Loyalty programs also allow businesses to gather data for better decision-making and craft targeted marketing strategies.

Role of Generative AI

Key Points Description Personalized Interactions Generative AI enables hyper-personalized, 1:1 engagement with customers through chatbots and tailored offers, enhancing member experience. Dynamic Loyalty Programs AI transforms static loyalty programs into adaptive ecosystems that evolve with customer behavior and market conditions in real time. Gamified Engagement AI can design gamification elements like challenges and rewards based on customer preferences, keeping loyalty programs engaging and fun. Fraud Detection & Security AI detects unusual spending patterns and potential fraud in loyalty programs, protecting both customers and companies. Predictive Customer Insights Generative AI predicts future customer behavior and trends, allowing timely and relevant campaign targeting. Investment and Business benefits

Investment opportunities exist in developing advanced loyalty platforms that use AI and data analytics to offer hyper-personalized experiences. There is growing interest in systems that integrate loyalty with payments and mobile commerce. Additionally, as many businesses look to digitalize, scalable and user-friendly loyalty solutions offer strong potential for growth.

Business benefits include enhanced customer engagement, higher repeat sales, and improved brand loyalty. Effective loyalty programs increase customer lifetime value and generate positive word-of-mouth, creating a loyal customer base that supports long-term revenue stability. These programs also help businesses differentiate from competitors by offering exclusive perks and personalized treatment.

The regulatory environment is shaped by data privacy laws such as GDPR and the California Consumer Privacy Act. These rules require companies to handle customer data carefully, affecting how loyalty programs collect, store, and use information. Compliance with these regulations is critical to maintaining customer trust and avoiding legal risks.

Regional Focus: North America

In 2024, North America held a dominan Market position, capturing more than a 34.5% share, holding USD 4.4 Billion revenue. The region’s leadership stems from early adoption of digital loyalty solutions, high consumer spending, and a mature retail and services landscape.

The presence of numerous large enterprises, advanced technological infrastructure, and strong data privacy regulations in North America drives the demand for secure, innovative, and customer-centric loyalty management solutions. Continuous innovation in AI, mobile applications, and omnichannel marketing further fuels market growth in the region.

Emerging Trends

Key Trends Description AI-Powered Personalization Advanced AI personalizes every element from offers to communications at scale, improving engagement and retention. Emotional Loyalty Focus Brands shift from transactional rewards to building emotional connections and authentic value alignment with customers. Omnichannel Loyalty Ecosystems Loyalty programs integrate seamlessly across multiple customer touchpoints maintaining consistent experience. Experience-Based Rewards Reward structures increasingly offer experiences rather than just discounts or points, appealing to lifestyle preferences. Data Privacy & Zero-Party Data Loyalty efforts rely more on voluntary, direct customer data sharing complying with privacy norms for better personalization. Growth Factors

Key Factors Description Customer Retention Emphasis Organizations invest in loyalty programs recognizing customer retention as a cost-effective growth strategy. Integration of AI & Analytics AI and real-time analytics enable personalized offers and adaptive rewards boosting satisfaction and loyalty. E-Commerce & Mobile Commerce Expansion Growth of online and mobile shopping drives demand for digital, scalable loyalty solutions. Increasing Digital Transformation Across sectors, digital adoption pushes companies to implement automated and omnichannel loyalty programs. Gamification Adoption Incorporating gamified elements enhances customer engagement and encourages repeat participation in programs. By Component Analysis

In 2024, the solution segment holds the largest share of 58.6% in the Loyalty Management Market. This dominance is driven by organizations increasingly adopting specialized loyalty management solutions to design, implement, and manage loyalty programs effectively.

These solutions offer tools for customer segmentation, reward management, analytics, and campaign automation, enabling businesses to build long-term customer relationships and enhance engagement. Loyalty management solutions help companies move beyond traditional reward points by offering personalized experiences and targeted incentives.

This focus on solution adoption reflects businesses’ priorities to reduce churn, increase repeat purchases, and foster brand advocacy. As loyalty programs become more complex and data-driven, the demand for sophisticated software platforms continues to rise, making solutions the largest and fastest-growing component within this market.

By Deployment Model Analysis

In 2024, Cloud deployment captures a significant market share of 62.3% due to its scalability, flexibility, and cost-effectiveness for loyalty management applications. Cloud-based solutions allow businesses to deploy loyalty programs quickly and seamlessly across multiple channels, supporting omnichannel customer engagement strategies.

The cloud model also simplifies integration with other enterprise systems such as CRM and marketing automation, enabling real-time customer data analytics and personalized loyalty experiences. Its robust security features and reduced need for on-premises infrastructure further contribute to its rising adoption. Cloud deployment supports businesses of all sizes but is especially valued by large enterprises looking for agility and ease of maintenance in their loyalty management systems.

By Enterprise Size Analysis

In 2024, Large enterprises dominate with 64% market share in the loyalty management market, reflecting their leading role in strategic investments toward customer retention and engagement. These organizations operate extensive loyalty programs that cater to millions of customers, requiring scalable, secure, and feature-rich platforms.

Large enterprises prioritize advanced analytics, AI-driven personalization, and integration capabilities in their loyalty management software to deepen customer relationships and improve lifetime value. Their substantial resources allow them to implement comprehensive loyalty initiatives that differentiate their brands in competitive markets. This focus on loyalty reflects the ongoing shift toward customer-centric business models, where large firms see loyalty programs as essential growth drivers.

By Operator Analysis

In 2024, the B2C segment comprises 54.5% of the loyalty management market, showcasing the widespread use of loyalty programs aimed directly at end consumers. B2C loyalty solutions target industries such as retail, hospitality, and consumer goods, where consumer retention and repeat purchases are critical to business success.

Loyalty programs in the B2C space focus on personalized offers, rewards, gamification, and experiential incentives that enhance customer engagement and brand loyalty. Growing consumer expectations for seamless and rewarding experiences drive continuous innovation in this sector. The emphasis on B2C loyalty reflects firms’ efforts to build emotional connections and foster long-term engagement in highly competitive consumer markets.

By End Use Analysis

In 2024, Retail and consumer goods is the largest end-use vertical, representing 22.9% of the loyalty management market. This sector has been an early and enthusiastic adopter of loyalty programs due to the intense competition and need for customer retention. Loyalty management solutions in retail & consumer goods help brands deliver personalized promotions, track customer purchasing behavior, and create rewards that enhance shopping experiences.

The rise of e-commerce and omnichannel retailing has further amplified the demand for advanced loyalty programs that integrate online and offline customer journeys. Retailers continue to invest heavily in loyalty technologies as they seek to differentiate themselves and increase customer lifetime value.

Top Use Cases

Key Points Description Retail & E-commerce Personalized promotions and rewards to increase purchase frequency and customer lifetime value. Travel & Hospitality Experiential rewards and tiered programs that foster emotional loyalty with frequent travelers. Food & Beverage Loyalty points tied to product purchases and gamified reward systems to boost repeat visits. Financial Services Lifestyle benefits and financial wellness rewards embedded in loyalty programs. Mobile App Engagement Leveraging mobile platforms for seamless, real-time customer interaction and reward redemption. Customer Insights

Key points Description Multi-Program Membership Customers typically belong to multiple loyalty programs, indicating the need for differentiated value propositions. Preference-Based Personalization Insights from purchase and interaction data allow tailored offers that match customer preferences and behaviors. Importance of Convenience & Value Loyalty programs that provide ease of use and clear value drive higher customer retention rates. Sustainability Considerations Especially among younger customers, brand sustainability practices influence loyalty decisions. Key Market Segments

By Component

- Solution

- Channel Loyalty

- Customer Loyalty

- Customer Retention

- Others

- Service

By Deployment Model

- Cloud

- On-premises

By Enterprise Size

- SME

- Large Enterprises

By Operator

- B2B

- B2C

By End Use

- Transportation

- IT & Telecommunication

- BFSI

- Media & Entertainment

- Retail & Consumer Goods

- Hospitality

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Focus on Customer Retention and Engagement

Customer retention is a key driver propelling the loyalty management market. Businesses increasingly realize that maintaining existing customers is more cost-effective than acquiring new ones. Loyalty management solutions enable companies to create personalized experiences, rewards, and communication that deepen customer engagement.

This focus helps reduce churn by building long-term emotional connections and brand advocacy beyond simple transactional relationships. The integration of AI and real-time analytics allows businesses to track customer behavior and tailor loyalty offers precisely, driving repeat purchases and enhancing overall satisfaction. This targeted engagement strengthens loyalty programs and fuels market growth.

The rise of digital platforms plays a crucial role in this trend. Mobile apps, digital loyalty cards, and omnichannel engagement tools help brands connect with customers anytime and anywhere. These digital innovations provide a seamless user experience and make it easier for customers to participate in loyalty programs continually. As a result, businesses can foster a sense of community and exclusivity that keeps customers coming back.

Restraint

Data Privacy Concerns and Regulatory Challenges

A significant restraint facing the loyalty management market is the increasing concern around data privacy and compliance with regulations. Loyalty programs collect extensive personal and behavioral customer data to enable personalized marketing and targeted rewards.

However, this data collection raises privacy issues and puts companies under strict regulatory scrutiny from laws such as GDPR in Europe and CCPA in the U.S. These regulations demand rigorous data protection practices, explicit user consents, and transparency about data usage, adding operational complexity and costs.

Many consumers are also hesitant to join loyalty programs due to fears about how their data is handled, which can limit program participation and market penetration. Companies must invest heavily in cybersecurity and compliance to build and maintain trust while balancing effective personalization. Failure to meet these standards can damage brand reputation and slow loyalty management adoption, making privacy concerns a noteworthy hurdle in market expansion.

Opportunity

AI and Predictive Analytics for Hyper-Personalization

The integration of artificial intelligence (AI) and predictive analytics presents a major opportunity in the loyalty management market. AI-driven platforms can analyze large volumes of customer data to understand purchase patterns, preferences, and engagement history.

This insight allows businesses to anticipate customer needs and deliver timely, relevant offers that enhance customer satisfaction and loyalty. By employing AI, companies can move from generic loyalty rewards to hyper-personalized experiences tailored to individual customers. This not only improves program effectiveness but also increases customer lifetime value.

Furthermore, AI can automate program management, optimize reward allocation, and detect fraudulent activities, increasing operational efficiency. Expanding use of AI and machine learning technologies is expected to drive market growth and innovation in loyalty management solutions.

Challenge

Delivering a Seamless Omnichannel Loyalty Experience

A key challenge in loyalty management is providing a consistent, seamless experience across multiple channels. Customers interact with brands through online websites, mobile apps, physical stores, and social media, expecting cohesive loyalty program access and rewards everywhere.

Integrating these diverse touchpoints into a unified loyalty platform can be technically complex and resource intensive. Brands often struggle with disparate systems and data silos that hinder real-time synchronization of customer activity and reward points.

Additionally, inconsistent experiences across channels can frustrate users, reducing program engagement and loyalty. Overcoming these integration issues requires advanced technology architectures and ongoing optimization to ensure customers receive smooth, reliable interactions at all times. Successfully addressing this challenge is essential to maximizing loyalty program effectiveness.

Competitive Analysis

The loyalty management market is driven by firms that specialize in customer engagement and retention. Aimia Inc., BOND Brand Loyalty Inc., and Brierley+Partners provide data-driven loyalty strategies that strengthen brand relationships. Their expertise is widely applied in retail, travel, and financial services, where customer lifetime value is directly influenced by well-structured reward programs and engagement initiatives.

Technology-focused companies such as IBM Corporation, Comarch SA, and Five Stars Loyalty Inc. enhance loyalty platforms through AI, analytics, and cloud integration. ICF International Inc. and Kobie Marketing add value by combining consultancy and execution, helping organizations design scalable and measurable loyalty solutions across multiple industries and markets.

Enterprise solution providers including Oracle Corporation, Salesforce Inc., and SAP SE dominate through integrated platforms that connect loyalty with broader customer experience management. Alongside them, AnnexCloud, Tibco Software Inc., The Lacek Group, and Martiz Holdings Inc. deliver customizable solutions that address industry-specific needs.

Top Key Players in the Market

- Aimia Inc.

- BOND BRAND LOYALTY INC.

- Brierley+Partners

- IBM Corporation

- Comarch SA

- Five Stars Loyalty Inc.

- ICF International Inc.

- Kobie Marketing

- The Lacek Group

- Martiz Holdings Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- AnnexCloud

- Tibco Software Inc.

Recent Developments

- In January 2025, SAP SE launched a new loyalty management solution for retailers and consumer packaged goods companies. The solution focuses on real-time personalization and immersive experiences, integrating with SAP Commerce Cloud, SAP Service Cloud, SAP Emarsys, and SAP S/4HANA Cloud Public Edition to support industries like fashion and retail.

- In 2024, Visa introduced its Web3 Loyalty Engagement Solution to bring gamified, digital-first rewards, while Starbucks upgraded its program with Starbucks Rewards 2.0, adding contactless ordering, mobile payments, and tailored offers. Both reflect the rising role of technology in shaping customer loyalty.

- In August 2024, Marriott International strengthened its Bonvoy program by acquiring LiveNinja, an AI-powered chatbot provider. This move highlights how artificial intelligence is being used to deliver personalized and efficient customer interactions, reinforcing loyalty and retention.

Report Scope

Report Features Description Market Value (2024) USD 12.8 Bn Forecast Revenue (2034) USD 30.6 Bn CAGR(2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution (Channel Loyalty, Customer Loyalty, Customer Retention, Others), Service), By Deployment Model (Cloud, On-premises), By Enterprise Size (SME, Large Enterprises), By Operator (B2B, B2C), By End Use (Transportation, IT & Telecommunication, BFSI, Media & Entertainment, Retail & Consumer Goods, Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aimia Inc., BOND BRAND LOYALTY INC., Brierley+Partners, IBM Corporation, Comarch SA, Five Stars Loyalty Inc., ICF International Inc., Kobie Marketing, The Lacek Group, Martiz Holdings Inc., Oracle Corporation, Salesforce Inc., SAP SE, AnnexCloud, Tibco Software Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Loyalty Management Market in 2021?The Loyalty Management Market size is US$ 8,220 million in 2021.

What is the projected CAGR at which the Loyalty Management Market is expected to grow at?The Loyalty Management Market is expected to grow at a CAGR of 8% (2023-2032).

List the segments encompassed in this report on the Loyalty Management Market?Market.US has segmented the Loyalty Management Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component, the market has been further divided into Service and Software. By Software, the market has been further divided into Customer Loyalty, Channel Loyalty, and Customer Retention. By Deployment Mode, the market has been further divided into Cloud and On-Premise. By Industry Vertical, the market has been further divided into Retail & Consumer Goods, Transportation, Hospitality, BFSI, and Other Industry Verticals.

List the key industry players of the Loyalty Management Market?SAP SE, Oracle Corporation, Comarch, AIMIA, Lacek Group, Breirley+Partners, ICF Next, Fivestars, and Other Key Players are engaged in the Loyalty Management market

Which region is more appealing for vendors employed in the Loyalty Management Market?North America is expected to account for the highest revenue share of 36%. Therefore, the Loyalty Management industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Loyalty Management?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Loyalty Management Market.

Which segment accounts for the greatest market share in the Loyalty Management industry?With respect to the Loyalty Management industry, vendors can expect to leverage greater prospective business opportunities through the software segment, as this area of interest accounts for the largest market share.

Loyalty Management MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Loyalty Management MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aimia Inc.

- BOND BRAND LOYALTY INC.

- Brierley+Partners

- IBM Corporation

- Comarch SA

- Five Stars Loyalty Inc.

- ICF International Inc.

- Kobie Marketing

- The Lacek Group

- Martiz Holdings Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- AnnexCloud

- Tibco Software Inc.