Global Low Jitter Crystal Oscillator Market Size, Share, Industry Analysis Report By Type (SPXO, TCXO, VCXO, OCXO, Others), By Application (Telecommunications, Consumer Electronics, Automotive, Industrial, Medical, Others), By Frequency Range (Up to 50 MHz, 50-100 MHz, Above 100 MHz), By End-User (Aerospace and Defense, IT and Telecommunications, Consumer Electronics, Automotive, Industrial, Medical, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158820

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

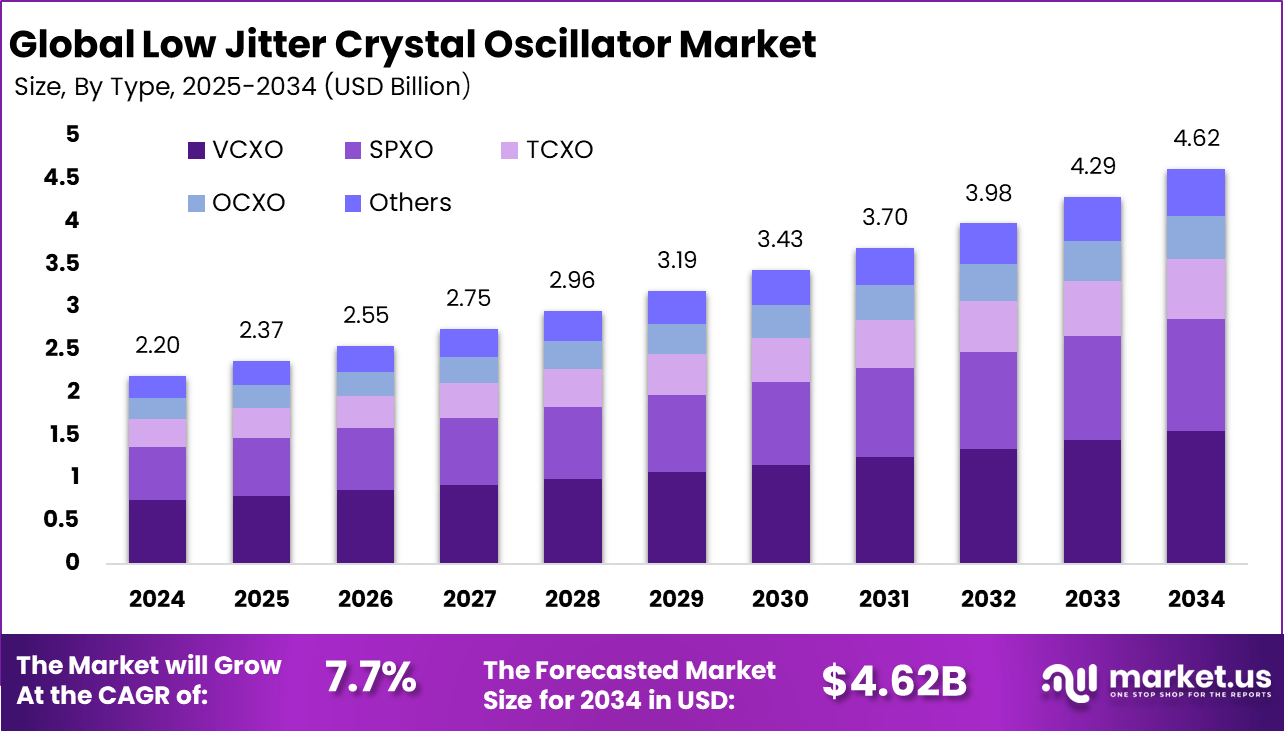

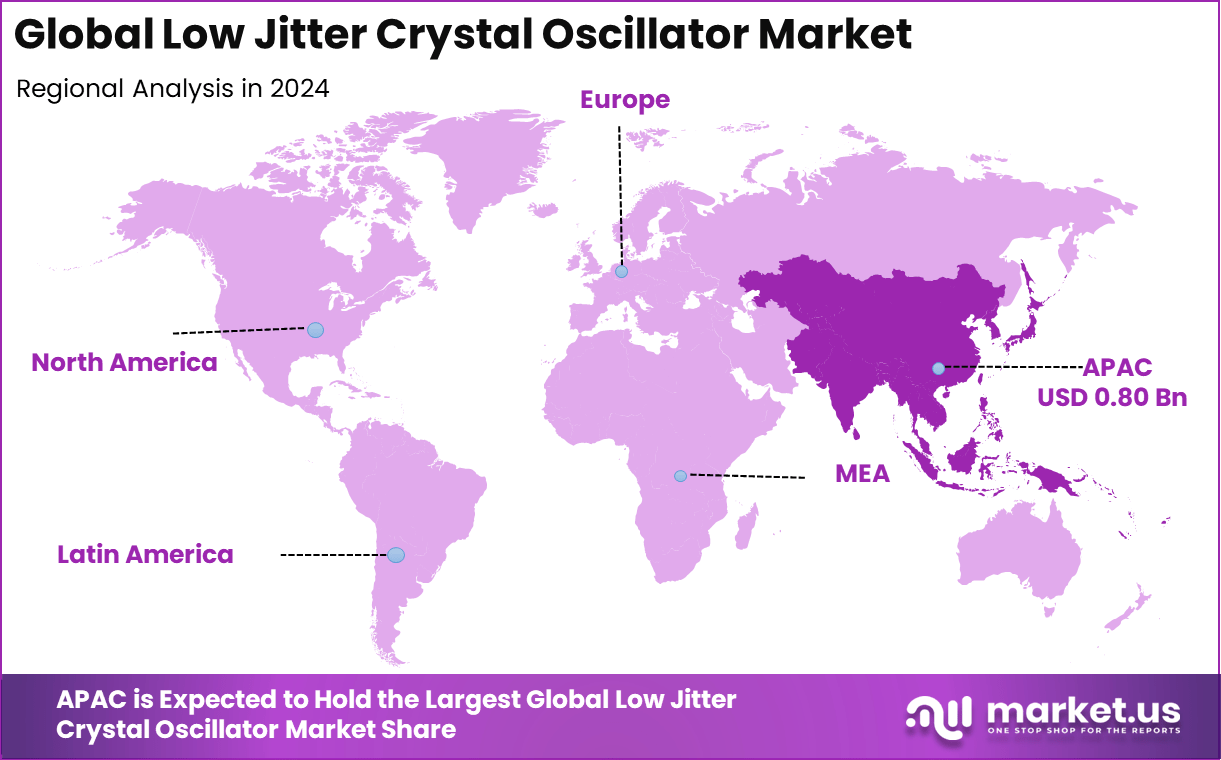

The Global Low Jitter Crystal Oscillator Market size is expected to be worth around USD 4.62 billion by 2034, from USD 2.2 billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 36.4% share, holding USD 0.80 billion in revenue.

The Low Jitter Crystal Oscillator Market refers to the industry producing oscillators designed to deliver precise frequency control with minimal phase noise and timing uncertainty. These oscillators are essential in applications requiring highly stable clock signals, such as telecommunications, data centers, broadcasting, aerospace, defense, and advanced medical equipment.

According to Market.us, The Global Crystal Oscillators Market is projected to reach USD 4.27 billion by 2034, up from USD 2.83 billion in 2024, at a CAGR of 4.2% (2025–2034). In 2024, Asia Pacific led the market with over 42% share, generating USD 1.1 billion in revenue.

Low jitter performance ensures reliable high-speed data transmission and synchronization across complex systems, making these devices critical to modern communication and computing infrastructure. The market is driven by the growing demand for high-speed communication networks, including 5G and optical fiber systems, which require accurate timing for data transfer.

The expansion of data centers and cloud computing is another key driver, as low jitter oscillators improve synchronization and reduce latency in servers and storage systems. Growth in defense, aerospace, and satellite communication applications is supporting adoption. The rising importance of medical imaging and diagnostic equipment that depend on precise frequency stability is also fueling demand.

For instance, in October 2024, Epson introduced the OG7050CAN oven-controlled crystal oscillator (OCXO), engineered to greatly reduce power and size while maintaining high stability. It includes an integrated PLL function to set output anywhere from 1 MHz to 170 MHz and a jitter-reduction feature to control PLL-induced noise.

Key Takeaway

- By type, VCXO (Voltage-Controlled Crystal Oscillators) led the market with a 33.7% share.

- By application, Telecommunications dominated, accounting for 28.7% share.

- By frequency range, the Up to 50 MHz category captured the largest share at 37.5%.

- By end-user, the IT and Telecommunications sector held a commanding 30.5% share.

- Regionally, Asia Pacific accounted for 36.4%, supported by strong electronics manufacturing.

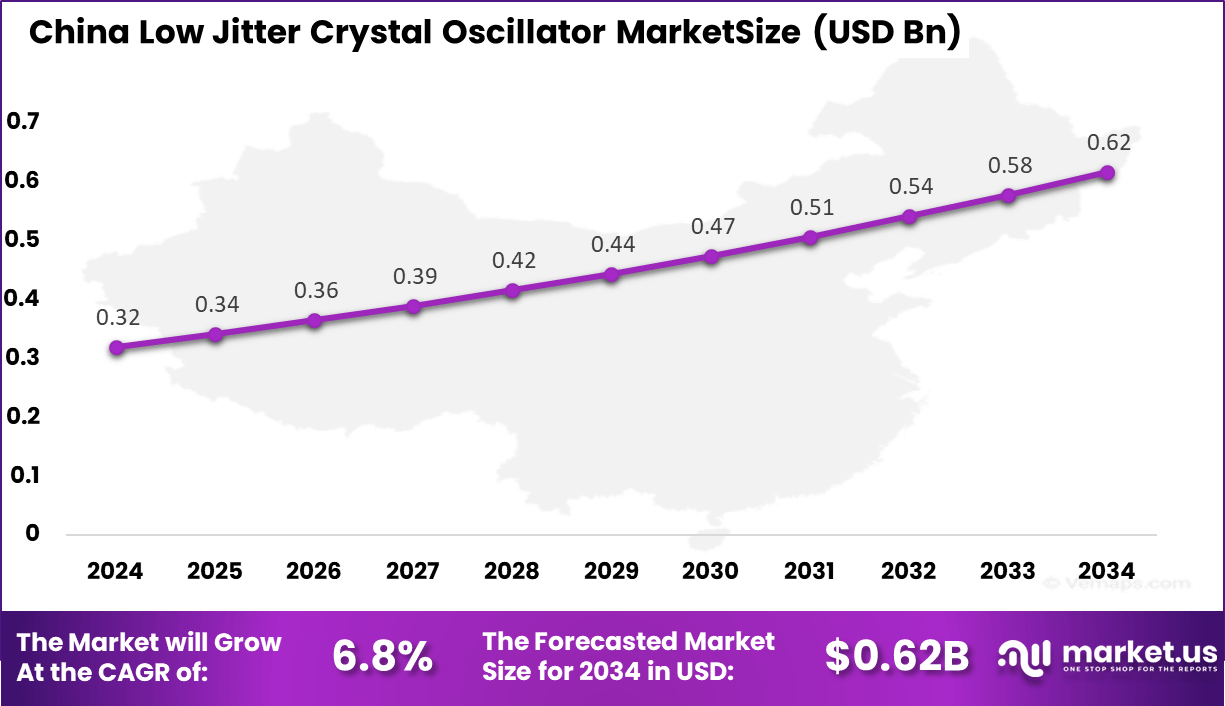

- Within APAC, China reached USD 0.32 Billion in 2024, expanding at a steady 6.8% CAGR.

Analysts’ Viewpoint

Demand for low jitter crystal oscillators is strongest among sectors needing flawless timing and signal stability, such as telecommunications, data centers, aerospace, and automotive. The need for enhanced synchronization in network infrastructure and smart vehicles amplifies adoption, while rapid growth in consumer electronics and wearables continues to fuel usage.

Asia Pacific leads in production and technological development, whereas North America and Europe show strong consumption supported by advanced digital infrastructure and automation. The drive toward ultra-low jitter and high-frequency precision results in the adoption of advanced temperature-compensation techniques, MEMS technology, and surface-mount packaging for oscillators.

There is rising integration of system-in-package (SiP), chip-scale packaging (CSP), and energy-efficient designs for portable electronics and IoT devices. Innovations such as voltage-regulated oscillators and improved EMC/RFI compliance add to the technical sophistication and appeal of these products.

Low jitter crystal oscillators are chosen for their ability to enhance system reliability and data transmission by minimizing timing errors. Industries rely on these components for precise frequency control, reduced signal distortion, and improved overall system accuracy – especially crucial for error-free communications, automotive safety features, and robust industrial processes.

Role of Generative AI

Generative AI is increasingly playing a significant role in improving the design and manufacturing of low jitter crystal oscillators. By using machine learning models and generative design algorithms, manufacturers can quickly optimize oscillator configurations for better frequency stability and lower phase noise.

AI-driven simulations enable rapid iteration without physical prototypes, saving time and costs in development. Additionally, generative AI helps in real-time performance tuning and self-diagnostics of oscillators once deployed, adapting to changing environmental conditions to maintain signal integrity. This AI-driven approach is particularly vital for telecom infrastructure and data centers where signal accuracy is critical.

The impact of AI extends to manufacturing quality control, where AI-powered computer vision detects defects with higher precision than manual inspection, thus enhancing product reliability. Currently, low jitter oscillators designed with AI support show improvements in jitter performance often reaching below tens of femtoseconds compared to traditional designs.

China Market Size

The market for Low Jitter Crystal Oscillators within China is growing tremendously and is currently valued at USD 0.32 billion, the market has a projected CAGR of 6.8%. The market is growing tremendously due to the country’s rapid expansion of 5G infrastructure, expansive 5G network rollout, and advanced semiconductor manufacturing.

China is heavily investing in next-generation communication systems and high-performance computing, both of which require precise timing solutions to ensure stability and speed. The rising adoption of cloud services, AI applications, and industrial automation further boosts demand. With strong government support for technology development, China is becoming a key hub for low-jitter oscillator deployment.

In 2024, Asia Pacific held a dominant market position in the Global Low Jitter Crystal Oscillator Market, capturing more than a 36.4% share, holding USD 0.80 billion in revenue. This dominance is due to its strong presence in electronics manufacturing, rapid 5G deployment, and expanding semiconductor industry.

Countries like China, Japan, South Korea, and Taiwan are leading in telecom infrastructure and consumer electronics production, creating large-scale demand for precise timing devices. The growth of data centers, automotive electronics, and industrial automation across the region further strengthened its leadership, making Asia Pacific a critical hub for oscillator adoption.

Europe Market Trends

The low jitter crystal oscillator market in Europe is growing steadily, supported by strong demand across automotive, industrial automation, and telecommunications sectors. Countries like Germany, France, and the UK are key contributors, driven by their focus on precision manufacturing and high-quality electronic systems. The demand for these oscillators reflects the need for reliable timing components in complex industrial and automotive applications.

Technology upgrades and the expansion of 5G infrastructure in Europe also stimulate the market. The region benefits from investments in advanced communication networks and industrial IoT applications that require precise frequency control. These factors collectively support a stable market growth trajectory, highlighting Europe’s role as a significant consumer and innovator in oscillator technologies.

Latin America Market Trends

The Latin American market for low jitter crystal oscillators is smaller but gradually expanding, supported by increased investments in telecommunications and data infrastructure. Countries such as Brazil and Mexico are seeing rising demand due to telecom upgrades and growing adoption of digital services.

Industrial automation and automotive sectors in the region are beginning to integrate advanced timing solutions, which could accelerate market growth. Though challenges like slower technology adoption rates remain, rising infrastructure development and regional market opening present promising opportunities for future growth.

Type Analysis

In 2024, the VCXO segment held a dominant market position, capturing a 33.7% share of the Global Low Jitter Crystal Oscillator Market. This dominance is due to its wide use in applications that demand precise frequency control, such as telecommunications, data centers, and high-speed networking equipment.

VCXOs offer fine-tuning capabilities that ensure stable performance in systems where even minor timing deviations can affect signal quality. Their adaptability and reliability have made them the preferred choice for industries moving toward advanced connectivity solutions. The rising demand for 5G and cloud-based infrastructure further strengthened the adoption of VCXOs worldwide.

For Instance, in January 2024, Siemens reported that Interchip Corporation used its Analog FastSPICE and Symphony platforms to verify a new Voltage-Controlled Crystal Oscillator (VCXO) and a Simple Packaged Crystal Oscillator (SPXO). The verification cycle was completed three times faster than previous methods, helping meet aggressive time-to-market goals.

Application Analysis

In 2024, the Telecommunications segment held a dominant market position, capturing a 28.7% share of the Global Low Jitter Crystal Oscillator Market. This dominance is due to the critical role oscillators play in maintaining signal integrity and synchronization across 5G networks, fiber-optic systems, and high-speed data transmission.

As telecom providers expand infrastructure to support higher bandwidth and lower latency, demand for oscillators with minimal phase noise and jitter has grown rapidly. Their reliability and precision make them indispensable in modern communication networks.

For instance, In August/September 2025, Siward launched a 312.5 MHz differential output crystal oscillator series (OSC8A, OSC95, OSCA5) for data centers and telecom, offering ~40 fs jitter (max 50 fs) and ±25 ppm stability up to +105°C.

Frequency Range Analysis

In 2024, the Up to 50 MHz segment held a dominant market position, capturing a 37.5% share of the Global Low Jitter Crystal Oscillator Market. This dominance is due to the segment’s extensive use in telecom equipment, networking hardware, and industrial automation systems, where stable and low-frequency signals are essential.

Oscillators in this range offer excellent phase noise performance, making them suitable for applications requiring high precision and reliability. Their cost-effectiveness and compatibility with diverse electronic devices further strengthened their market leadership.

For Instance, in February 2025, Abracon launched a 50 MHz low-jitter CMOS crystal oscillator designed for applications needing precise timing. The device likely offers jitter performance that meets demanding telecom or data communications tolerances, while benefiting from CMOS integration for lower power consumption and consistent output.

End-User Analysis

In 2024, the IT and Telecommunications segment held a dominant market position, capturing a 30.5% share of the Global Low Jitter Crystal Oscillator Market. This dominance is due to the sector’s heavy reliance on precise timing solutions to support high-speed data transfer, 5G network rollouts, and cloud-based services.

Low-jitter oscillators ensure signal integrity, minimize latency, and enable seamless connectivity across servers, switches, and telecom infrastructure. With the rapid adoption of advanced communication technologies, this segment continues to drive strong and sustained demand.

For Instance, in December 2020, Epson began volume production of its SG2520 series tiny, high-frequency, low phase-jitter SPXOs aimed specifically at IT & telecom applications. The SG2520 line supports frequencies up to 500 MHz with phase jitter as low as ~70 fs (12 kHz–20 MHz) at 156.25 MHz, in a compact 2.5×2.0×0.74 mm package.

Emerging Trends

Emerging trends in the low jitter crystal oscillator market include the increasing miniaturization of oscillator packages to fit into compact electronic devices such as wearables and IoT sensors. There is a growing integration of advanced packaging technologies like chip-scale packaging and system-in-package to improve oscillator reliability and reduce space.

The demand for oscillators that can operate effectively in harsh environments with extreme temperatures and vibration is rising, especially for automotive and aerospace applications. Energy efficiency is another trend, as low power consumption oscillators are becoming essential for battery-operated devices.

Furthermore, the market is seeing more widespread adoption of advanced CMOS technologies to achieve ultra-low jitter performance, contributing to better signal quality in high-speed data communications. These trends reflect the increasing need for precision timing in diverse applications.

Growth Factors

The growth of the low jitter crystal oscillator market is primarily driven by the expansion of advanced telecommunications networks, especially 5G rollout, which demands highly precise timing components with ultra-stable frequencies.

The automotive industry’s shift toward autonomous driving and advanced driver-assistance systems significantly boosts demand for low jitter oscillators that ensure reliable communication and sensor synchronization in vehicles. Consumer electronics growth, with proliferation of smartphones, smart wearables, and IoT devices, also fuels the market by requiring components that minimize signal distortion in compact form factors.

Additionally, the rise of cloud computing and data centers intensifies the need for precise timing to maintain synchronization across servers and network equipment. Regional investment, notably in Asia Pacific, further accelerates market growth due to the dense semiconductor manufacturing ecosystem and rapid technology adoption.

Key Market Segments

By Type

- SPXO

- TCXO

- VCXO

- OCXO

- Others

By Application

- Telecommunications

- Consumer Electronics

- Automotive

- Industrial

- Medical

- Others

By Frequency Range

- Up to 50 MHz

- 50-100 MHz

- Above 100 MHz

By End-User

- Aerospace and Defense

- IT and Telecommunications

- Consumer Electronics

- Automotive

- Industrial

- Medical

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Drivers

Expansion of 5G Networks and Telecom Infrastructure

The global rollout of 5G networks is creating a strong demand for low-jitter crystal oscillators. These components are critical in maintaining signal integrity by reducing phase noise, which is essential for base stations, fronthaul, and backhaul systems.

The need for precise synchronization across advanced telecom systems, including massive MIMO and small cells, is pushing adoption. As telecom operators accelerate infrastructure upgrades, low-jitter oscillators are becoming indispensable for delivering stable, high-speed data connectivity.

For instance, in October 2023, Siward highlighted that as 5G networks and telecom infrastructure expand, crystal oscillators are increasingly vital for maintaining low jitter and reduced phase noise. These devices serve as critical timing references in base stations, switches, and backhaul systems where precise synchronization is essential.

Restraint

High Cost of Advanced Oscillators

A significant restraint restricting rapid market adoption is the high cost of manufacturing advanced low jitter crystal oscillators. These specialized components require precision engineering, high-quality materials, and rigorous testing to achieve ultra-low phase noise and jitter characteristics.

Additionally, smaller companies or those targeting emerging markets may face challenges justifying the higher prices compared to alternative timing solutions like voltage-controlled oscillators. This cost factor can slow down adoption rates in applications that do not strictly require the highest performance levels, thereby limiting the market’s near-term expansion in certain segments.

Opportunities

Evolution Towards 5G/6G

The progression to 5G and upcoming 6G networks presents wide-ranging opportunities for low-jitter oscillators. Technologies such as TDD, CoMP, and carrier aggregation demand strict timing precision. Advanced timing profiles under ITU-T G.827x frameworks are increasing the value of oscillators in fronthaul switches, radio units, and networks.

In many deployments, operators allocate budgets within sub-microsecond to nanosecond ranges, making ultra-low-jitter timing solutions critical. This evolution positions low-jitter crystal oscillators as key enablers of next-generation wireless communication systems.

For instance, in October 2024, Renesas introduced its RC38312 FemtoClock 3 ultra-low phase noise synchronizer and jitter attenuator to support 5G deployment. The solution is targeted for use in 5G radio units, distribution units, switches, and routers. It achieves jitter performance below 18 femtoseconds RMS across the 12 kHz to 20 MHz range, ensuring exceptional signal integrity.

Challenges

Technical Complexity and Regulatory Compliance

The design and manufacturing complexity of low jitter crystal oscillators pose an ongoing challenge for market participants. Achieving ultra-low phase noise and stable frequency over varying environmental conditions requires advanced materials, temperature compensation techniques, and precise assembly processes.

This technical difficulty raises the barrier to entry for new manufacturers and increases development timelines and costs for existing players. In addition, strict regulatory requirements related to electromagnetic compatibility (EMC) and radio frequency interference (RFI) add layers of testing and compliance pressures.

For instance, in February 2023, Salitronic published detailed design guidelines underscoring the complexity involved in engineering low-jitter crystal oscillators. The article emphasized that reliable performance depends on managing parasitic capacitances, ensuring proper load capacitance, and achieving adequate negative resistance in the amplifier circuit.

Key Players Analysis

In the low jitter crystal oscillator market, Seiko Epson, Murata Manufacturing, Kyocera, and NDK America are leading suppliers with strong global presence. Their products are widely adopted in telecommunications, networking equipment, and consumer electronics.

Specialized firms such as Rakon, SiTime, TXC Corporation, Vectron International, and Microchip Technology play a critical role in supporting applications that demand ultra-low phase noise and superior frequency accuracy. Their oscillators are used extensively in aerospace, defense, automotive, and industrial automation.

Other contributors including Abracon, IQD Frequency Products, CTS Corporation, Bliley Technologies, Connor-Winfield, Pletronics, Taitien Electronics, AVX Corporation, Fox Electronics, MtronPTI, and Raltron Electronics add diversity to the competitive landscape. Their products cater to regional demand and specialized industries, offering cost-effective and customizable solutions.

Top Key Players in the Market

- Seiko Epson Corporation

- TXC Corporation

- NDK America Inc.

- Rakon Limited

- SiTime Corporation

- Vectron International

- Abracon LLC

- IQD Frequency Products Ltd

- Murata Manufacturing Co., Ltd.

- Kyocera Corporation

- Microchip Technology Inc.

- CTS Corporation

- Bliley Technologies, Inc.

- Connor-Winfield Corporation

- Pletronics, Inc.

- Taitien Electronics Co., Ltd.

- AVX Corporation

- Fox Electronics

- MtronPTI

- Raltron Electronics Corporation

- Others

Recent Developments

- In February 2025, Abracon unveiled the ClearClock AK2B/AK3B series, high-frequency differential output oscillators, with ~54 femtoseconds RMS jitter at 156.25 MHz, targeting high-speed data communications and telecom and optical module applications.

- In October 2024, Epson also launched its SG-8200 / SG-8201 programmable oscillators (P-SPXO line), offering lower jitter and phase noise, tighter stability over temperature (-40°C to +125°C), in a compact package (2.0 × 1.6 mm).

Report Scope

Report Features Description Market Value (2024) USD 2.2 Bn Forecast Revenue (2034) USD 4.62 Bn CAGR(2025-2034) 87.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (SPXO, TCXO, VCXO, OCXO, Others), By Application (Telecommunications, Consumer Electronics, Automotive, Industrial, Medical, Others), By Frequency Range (Up to 50 MHz, 50-100 MHz, Above 100 MHz), By End-User (Aerospace and Defense, IT and Telecommunications, Consumer Electronics, Automotive, Industrial, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Seiko Epson Corporation, TXC Corporation, NDK America Inc., Rakon Limited, SiTime Corporation, Vectron International, Abracon LLC, IQD Frequency Products Ltd, Murata Manufacturing Co., Ltd., Kyocera Corporation, Microchip Technology Inc., CTS Corporation, Bliley Technologies, Inc., Connor-Winfield Corporation, Pletronics, Inc., Taitien Electronics Co., Ltd., AVX Corporation, Fox Electronics, MtronPTI, Raltron Electronics Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low Jitter Crystal Oscillator MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Low Jitter Crystal Oscillator MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Seiko Epson Corporation

- TXC Corporation

- NDK America Inc.

- Rakon Limited

- SiTime Corporation

- Vectron International

- Abracon LLC

- IQD Frequency Products Ltd

- Murata Manufacturing Co., Ltd.

- Kyocera Corporation

- Microchip Technology Inc.

- CTS Corporation

- Bliley Technologies, Inc.

- Connor-Winfield Corporation

- Pletronics, Inc.

- Taitien Electronics Co., Ltd.

- AVX Corporation

- Fox Electronics

- MtronPTI

- Raltron Electronics Corporation

- Others