Global Loan Compliance Monitoring Market By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-User (Banks, Credit Unions, Non-Banking Financial Institutions, Mortgage Lenders, Others), By Application (Regulatory Compliance, Risk Management, Audit Management, Reporting and Analytics, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 169430

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Component

- By Deployment Mode

- By Organization Size

- By End-User

- By Application

- Key Reasons for Adoption

- Key Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

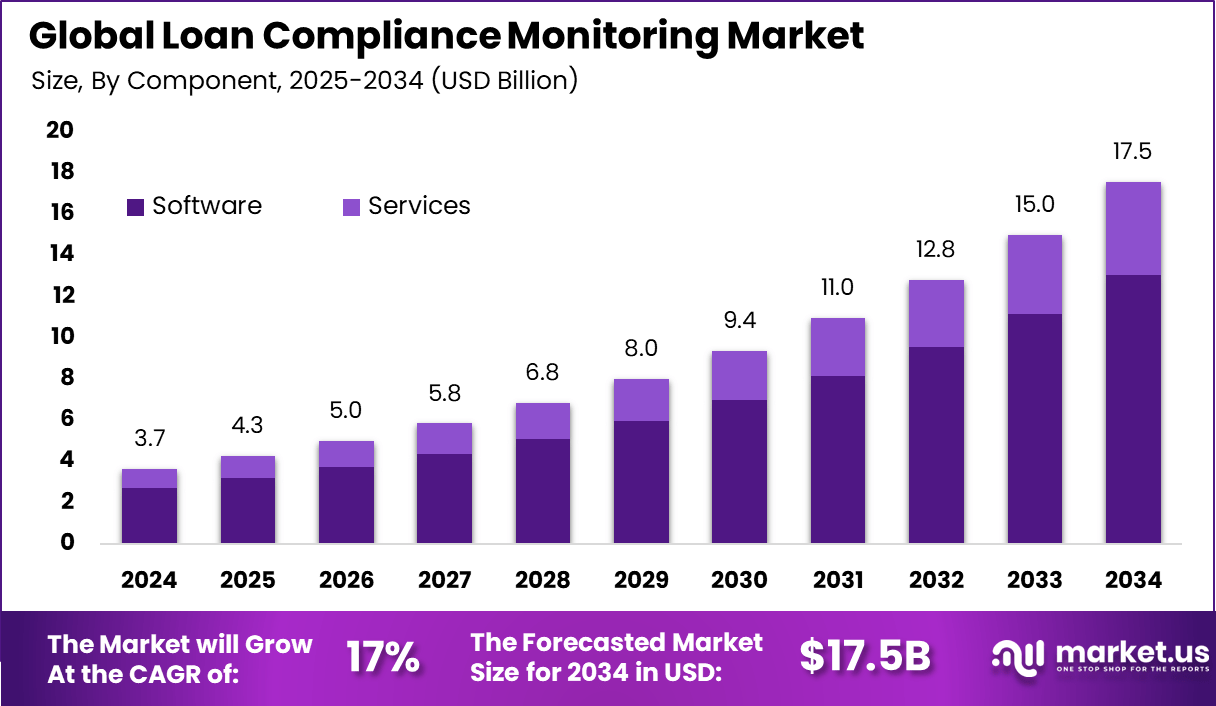

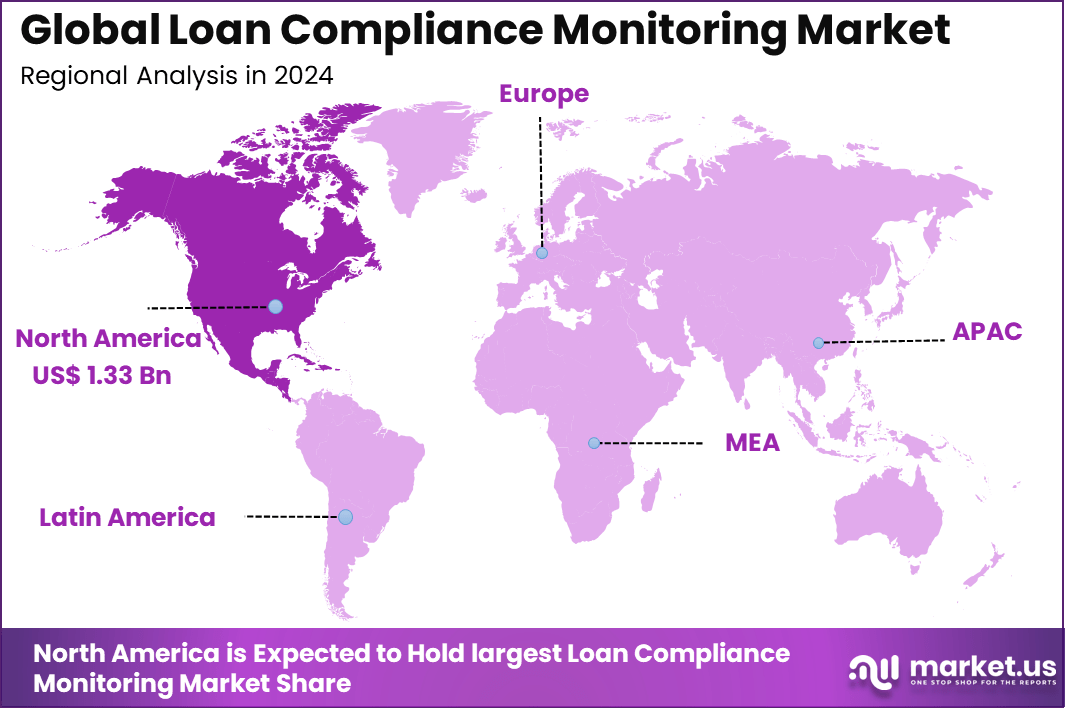

The Global Loan Compliance Monitoring Market generated 3.7 billion in 2024 and is predicted to register growth from USD 4.3 billion in 2025 to about USD 17.5 billion by 2034, recording a CAGR of 17% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.5% share, holding USD 1.33 Billion revenue.

Loan compliance monitoring covers software and services that help banks, credit unions, and other lenders track rules across the loan process from start to finish. These tools automate checks for regulations, spot risks early, and handle reporting to avoid fines or shutdowns. Banks lead the pack as main users, with cloud setups gaining ground for easy scaling in a world of digital loans and open banking.

Tighter rules worldwide on money laundering and borrower protection push lenders to upgrade systems fast, while digital lending booms add layers of oversight needs. Tech like AI and machine learning steps in for real-time alerts and smarter risk spotting, cutting manual work. Post-pandemic loan surges from government aid programs keep the pressure on for solid tracking tools.

Demand stays strong from big banks handling complex portfolios and smaller outfits jumping into fintech lending, favoring cloud options for quick rollout. North America holds steady ground with strict oversight, but Asia-Pacific picks up speed on digital growth and new regs. Lenders chase uptime and penalty dodges amid rising cyber threats and cross-border deals.

Top Market Takeaways

- By component, software holds a dominant 74.4% share of the loan compliance monitoring market, driven by growing demand for advanced analytics, automation, and real-time tracking capabilities.

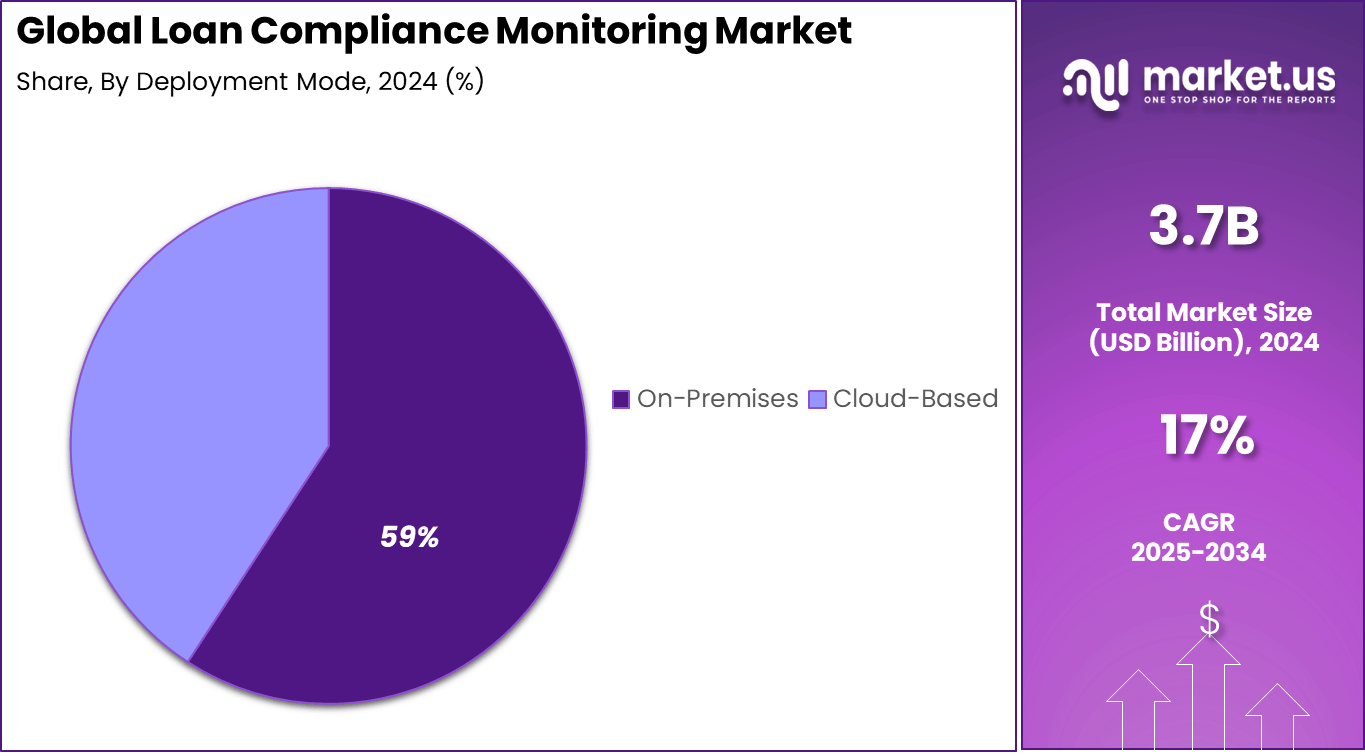

- By deployment mode, on-premises solutions account for 59.2%, favored by large financial institutions seeking greater control and security over sensitive compliance data and systems.

- By organization size, large enterprises represent 71.2% of the market, as these organizations face complex regulatory environments and require robust compliance monitoring tools to manage risk effectively.

- By end-user, banks lead with 38.5% share, reflecting their critical role in lending activities and the urgent need to adhere to stringent regulatory standards.

- By application, regulatory compliance drives 36.3% of use cases, focusing on meeting legal requirements, avoiding penalties, and ensuring transparent reporting in lending operations.

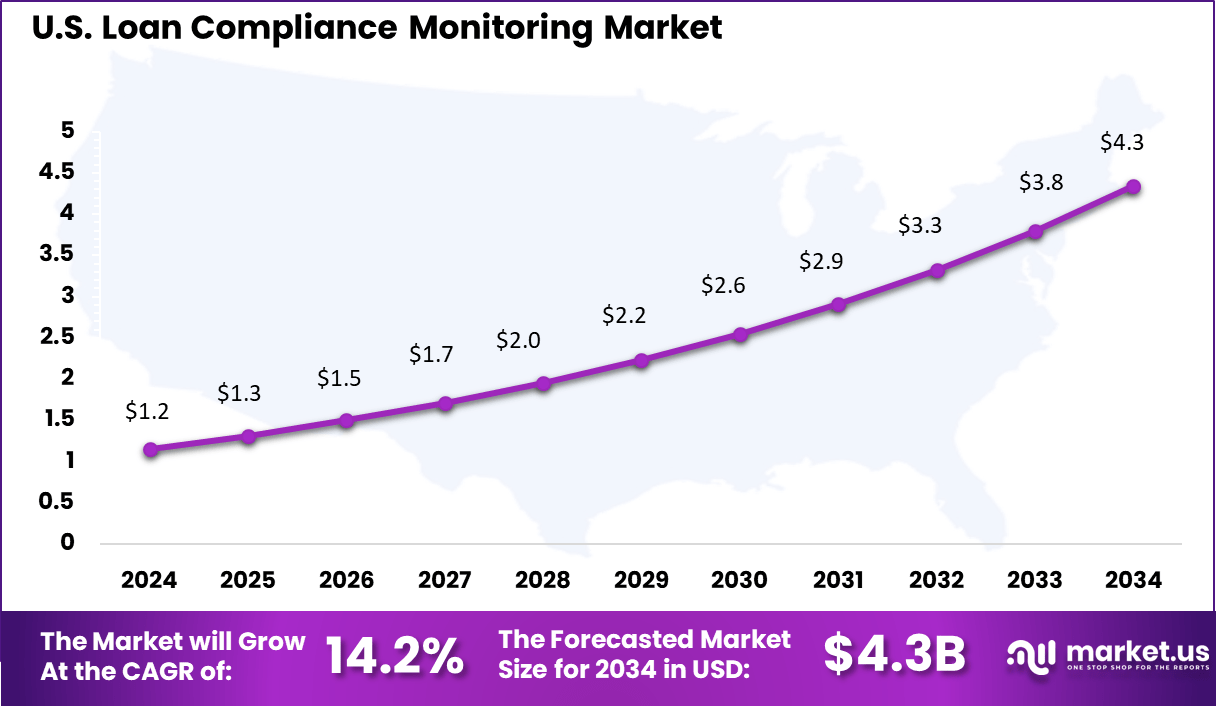

- By region, North America holds 36.5% of the market, with the U.S. valued at approximately USD 1.15 billion. The market in this region grows at a CAGR of 14.2%, supported by regulatory tightening and technology adoption in banking sectors.

By Component

The software segment holds a dominant 74.4% share within the loan compliance monitoring market. This leadership is supported by the rising need for automated tracking of regulatory rules, audit trails, and reporting workflows. Financial institutions are relying more on rule based engines, AI driven checks, and centralized compliance dashboards to reduce manual effort and regulatory exposure.

Software based platforms are preferred due to easier updates aligned with regulatory changes and stronger data integration across loan origination, servicing, and risk systems. The shift toward digital compliance automation continues to strengthen this segment across large financial institutions.

By Deployment Mode

The on premises deployment segment accounts for 59.2% of the market share. This dominance is mainly driven by strict data control policies followed by regulated financial institutions. Banks and lending organizations continue to prioritize internal data hosting to protect sensitive borrower information.

On premises systems also provide greater customization and tighter internal integration with legacy banking systems. For institutions with complex compliance structures, internal control over infrastructure remains a key operational requirement.

By Organization Size

Large enterprises represent 71.2% of total adoption in loan compliance monitoring. These institutions manage high loan volumes across multiple regions and product categories, which increases compliance complexity and regulatory exposure.

Large organizations also possess higher budgets for advanced compliance platforms, continuous audits, and integrated risk management tools. Their strong focus on governance and reporting accuracy continues to support high system adoption rates.

By End-User

Banks contribute 38.5% of total end user adoption. This share reflects the growing regulatory pressure around lending practices, customer data protection, and financial transparency standards enforced on traditional banking institutions.

The increasing volume of retail, corporate, and digital loans has made continuous compliance monitoring a core operational function for banks. Automated compliance tools now support routine audits, exception handling, and regulatory reporting across loan lifecycles.

By Application

Regulatory compliance applications account for 36.3% of total market adoption. This segment focuses on monitoring adherence to lending laws, fair credit practices, customer protection rules, and reporting standards across jurisdictions.

The rising frequency of regulatory updates has increased dependency on automated compliance engines. These systems help institutions maintain audit readiness, reduce penalties, and ensure transparency across all lending operations.

Key Reasons for Adoption

- Lenders face tougher rules from bodies like the CFPB on fair lending and disclosures, with fines hitting millions for violations. Compliance tools automate checks to stay ahead of updates and avoid penalties that hurt profits.

- Digital lending through apps and online platforms has exploded, creating more loans to track across borders. Banks need software to handle the volume and ensure every step meets local regs without slowing growth.

- Rising cyber threats and data privacy laws like GDPR push firms to monitor borrower info closely. These systems flag risks early, protecting against breaches that lead to lawsuits or lost trust.

- Manual reviews waste time on paperwork and audits, tying up staff from core lending work. Automation cuts errors and speeds processes, letting smaller credit unions compete with big banks.

- Post-pandemic stimulus and credit programs boosted loan books, raising default risks. Real-time monitoring spots issues like covenant breaches fast, helping manage portfolios better.

Key Benefits

- Cuts compliance costs by automating reports and audits, saving hours of manual work each month. Firms redirect staff to customer service or new loans instead of chasing paperwork.

- Builds a full audit trail of loan docs and decisions, making regulator exams smooth. No scrambling for records means fewer findings and lower legal fees during reviews.

- Spots risks like biased approvals or missed disclosures in real time via alerts. This prevents small slips from turning into big fines or reputational hits.

- Improves loan quality by validating borrower data against bureaus upfront. Lenders approve better fits, reducing defaults and boosting portfolio health over time.

- Scales with business growth, handling more loans without adding headcount. Cloud options let teams work remote while keeping everything compliant and secure.

Usage

- During origination, software scans apps for fair lending flags like income bias and auto-generates TILA disclosures. Lender approves a mortgage in hours, not days.

- Portfolio dashboard tracks covenant compliance on business loans, alerting if debt ratios slip. Team renegotiates terms before default, saving the account.

- Real-time alerts ping on AML red flags in a personal loan app, like mismatched IDs. Compliance officer reviews and rejects risky cases instantly.

- Audit prep pulls all servicing docs for a loan batch with one click, including payment history. Regulators get clean files, passing the exam without issues.

- Post-funding, system monitors payments and flags ECOA violations in collections. Adjusts dunning letters to stay fair, avoiding discrimination claims.

Emerging Trends

Key Trends Description AI and ML Integration Platforms use AI for real-time anomaly detection, predictive compliance, and automated risk assessment in loan processes. Cloud-Based Deployment Surge Flexible cloud solutions enable scalability, remote access, and rapid updates for evolving regulations. Blockchain for Data Security Secure, tamper-proof ledgers ensure transparent audit trails and regulatory reporting. Real-Time Monitoring Tools Continuous oversight with automated remediation and dynamic dashboards flags issues instantly. No-Code Customization Platforms Low-code tools allow non-technical users to build compliant workflows for niche lending needs. Growth Factors

Key Factors Description Stringent Regulatory Mandates Global rules on AML, KYC, and data privacy drive demand for automated compliance systems. Digital Lending Expansion Rise in fintech platforms, P2P lending, and online loans increases compliance complexity. High Non-Compliance Penalties Fines and reputational risks push financial institutions to invest in monitoring technologies. Operational Efficiency Needs Automation reduces manual work, strengthens risk control, and improves business competitiveness. Asia Pacific Digitalization Rapid banking growth and evolving regulations in India and China support fast regional adoption. Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By End-User

- Banks

- Credit Unions

- Non-Banking Financial Institutions

- Mortgage Lenders

- Others

By Application

- Regulatory Compliance

- Risk Management

- Audit Management

- Reporting and Analytics

- Others

Regional Analysis

North America claims 36.5% of the loan compliance monitoring market. The U.S. leads with USD 1.15 billion in value. Growth runs at a 14.2% CAGR. Banks and lenders face strict rules from Dodd-Frank and CFPB that demand real-time checks on fair lending and anti-money laundering. Fintech tools rise fast to handle data volumes from digital loans, cutting manual reviews by half in big firms.

Regulators push audits after high-profile fines hit top banks, which boosts spending on automated platforms. Mortgage volumes climb with home buys, tying to higher needs for Truth in Lending Act tracking. Vendors bundle AI scans for bias in approvals, drawing mid-size lenders into the mix. Steady demand flows from credit unions adapting to open banking shifts.

The U.S. holds USD 1.15 billion in the loan compliance monitoring market. This anchors North America’s 36.5% share and 14.2% CAGR. Lenders track millions of loans yearly against federal rules on disclosures and servicing. High default risks from economic swings force daily flags on payment plans and collections.

State laws add layers like California data privacy, which layers onto national standards for originations. Big players like JPMorgan roll out cloud tools for end-to-end oversight, pulling smaller shops via SaaS deals. Growth ties to fintech mergers that scale compliance loads. Brokers push tailored setups amid rising cyber checks on borrower files.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A major driver in the loan compliance monitoring market is the steady rise in regulatory requirements across the lending sector. Financial institutions must follow detailed rules related to borrower protection, documentation standards, repayment tracking, and reporting. These rules change often, and manual review becomes difficult as loan volumes grow.

Compliance monitoring tools help institutions check that each loan follows required steps, reducing the risk of penalties or process errors. This growing need for accuracy and consistency supports market expansion. Another driver is the increase in digital lending.

Banks, credit unions, and fintech lenders now process large numbers of applications through online platforms. This creates more data to track and more points where mistakes may occur. Compliance monitoring systems help automate checks, maintain audit records, and provide oversight throughout the life of a loan. As digital lending continues to grow, the demand for automated compliance support increases.

Restraint Analysis

A key restraint is the cost of adopting advanced compliance systems. Smaller lenders may struggle to invest in new software, training, and system updates, especially when profit margins are narrow. This financial barrier slows adoption among institutions with limited budgets.

Another restraint relates to integration difficulties. Many lenders use older systems for loan origination, servicing, and customer data. Connecting new compliance monitoring tools to these systems can be complex and time consuming. Some institutions may postpone adoption because of concerns about disruptions during migration.

Opportunity Analysis

There is strong opportunity in the expansion of digital and non-bank lending. New lenders often operate with small teams and handle large volumes of loans across different borrower segments. Automated compliance tools provide these organizations with a practical way to monitor risk and follow regulations without large compliance departments. This creates a growing market for flexible, easy to deploy solutions.

Another opportunity lies in the use of data analysis to improve oversight. Compliance systems that highlight unusual activity, missing documents, or repayment issues help lenders react sooner. Institutions that adopt such tools can improve portfolio quality and reduce exposure to compliance gaps, making the technology attractive to a wider range of users.

Challenge Analysis

A major challenge is keeping systems updated as rules change. Regulations differ across regions and may be revised frequently. Lenders must ensure their monitoring tools reflect current requirements. If updates are delayed, the institution risks non-compliance. Maintaining this alignment requires ongoing effort.

Another challenge involves data quality. Effective monitoring depends on complete and accurate information drawn from several internal systems. If data is inconsistent or outdated, compliance checks may be unreliable. Ensuring steady data quality remains a common difficulty for many lenders, especially those managing older or fragmented systems.

Competitive Analysis

Wolters Kluwer Financial Services, Fiserv, SAS Institute, Oracle, and FIS Global lead the loan compliance monitoring market with enterprise-grade platforms for regulatory reporting, audit automation, and real-time risk checks. Their solutions support banks and lenders in meeting evolving lending regulations with higher accuracy and speed. These companies focus on rule automation, data consistency, and system interoperability.

Temenos, nCino, Smarsh, S&P Global Market Intelligence, and ICE Mortgage Technology strengthen the market with embedded compliance controls across core banking, loan origination, and communications monitoring. Their platforms help lenders detect violations early and maintain clean audit trails. These providers emphasize cloud deployment, workflow automation, and real-time alerts.

Black Knight, Moody’s Analytics, Abrigo, Jack Henry, MetricStream, Riskonnect, Ascent RegTech, Actico, and LogicManager expand the landscape with specialized risk engines, policy management, and automated regulatory change tracking. Their tools support continuous compliance across the full loan lifecycle. These companies focus on accuracy, scalability, and faster remediation.

Top Key Players in the Market

- Wolters Kluwer Financial Services

- Fiserv, Inc.

- SAS Institute Inc.

- Oracle Corporation

- FIS Global

- Temenos AG

- nCino, Inc.

- Smarsh Inc.

- S&P Global Market Intelligence

- Ellie Mae (now part of ICE Mortgage Technology)

- Black Knight, Inc.

- Moody’s Analytics

- Compliance Systems, Inc.

- Abrigo

- Jack Henry & Associates, Inc.

- MetricStream

- Riskonnect, Inc.

- Ascent RegTech

- Actico GmbH

- LogicManager, Inc.

- Others

Future Outlook

The loan compliance monitoring market stands ready for continued transformation. Financial institutions will grapple with intensifying regulatory demands amid the rise of digital lending and open banking frameworks.

Solution providers will advance AI-driven tools for real-time risk detection, automated reporting, and predictive analytics, easing the burden of complex compliance across banks and fintechs. Cloud platforms and integrated regtech will gain favor, supporting smaller lenders and emerging markets in navigating multi-jurisdictional rules while fostering transparency and operational resilience.

Opportunities lie in

- AI-powered predictive tools for proactive risk assessment in digital lending ecosystems.

- Cloud-based solutions tailored for SMEs and non-banking institutions entering new markets.

- Integration with blockchain and open banking APIs to streamline cross-border compliance.

Recent Developments

- October, 2025, Wolters Kluwer launched Compliance Intelligence AI solution for regulatory management. September 2025, company introduced Community Development Wiz for CRA loan tracking compliance.

- September, 2025, Fiserv launched Content Next AI platform accelerating loan processing compliance reviews.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Bn Forecast Revenue (2034) USD 17.5 Bn CAGR(2025-2034) 17% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-User (Banks, Credit Unions, Non-Banking Financial Institutions, Mortgage Lenders, Others), By Application (Regulatory Compliance, Risk Management, Audit Management, Reporting and Analytics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wolters Kluwer Financial Services, Fiserv, Inc., SAS Institute Inc., Oracle Corporation, FIS Global, Temenos AG, nCino, Inc., Smarsh Inc., S&P Global Market Intelligence, Ellie Mae (now part of ICE Mortgage Technology), Black Knight, Inc., Moody’s Analytics, Compliance Systems, Inc., Abrigo, Jack Henry & Associates, Inc., MetricStream, Riskonnect, Inc., Ascent RegTech, Actico GmbH, LogicManager, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Loan Compliance Monitoring MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Loan Compliance Monitoring MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wolters Kluwer Financial Services

- Fiserv, Inc.

- SAS Institute Inc.

- Oracle Corporation

- FIS Global

- Temenos AG

- nCino, Inc.

- Smarsh Inc.

- S&P Global Market Intelligence

- Ellie Mae (now part of ICE Mortgage Technology)

- Black Knight, Inc.

- Moody's Analytics

- Compliance Systems, Inc.

- Abrigo

- Jack Henry & Associates, Inc.

- MetricStream

- Riskonnect, Inc.

- Ascent RegTech

- Actico GmbH

- LogicManager, Inc.

- Others