Global LLM Observability Platform Market Size, Share, Industry Analysis Report By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Performance Monitoring, Prompt & Response Tracking, Cost Management & Optimization, Security & Compliance Monitoring, Others), By End-User (AI/ML Teams, DevOps/MLOps Teams, Application Developers, Others), By Vertical (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, Retail & E-commerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 168188

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Role of Generative AI

- US Market Size

- By Deployment Mode

- By Organization Size

- By Application

- By End-User

- By Vertical

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Future Outlook

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

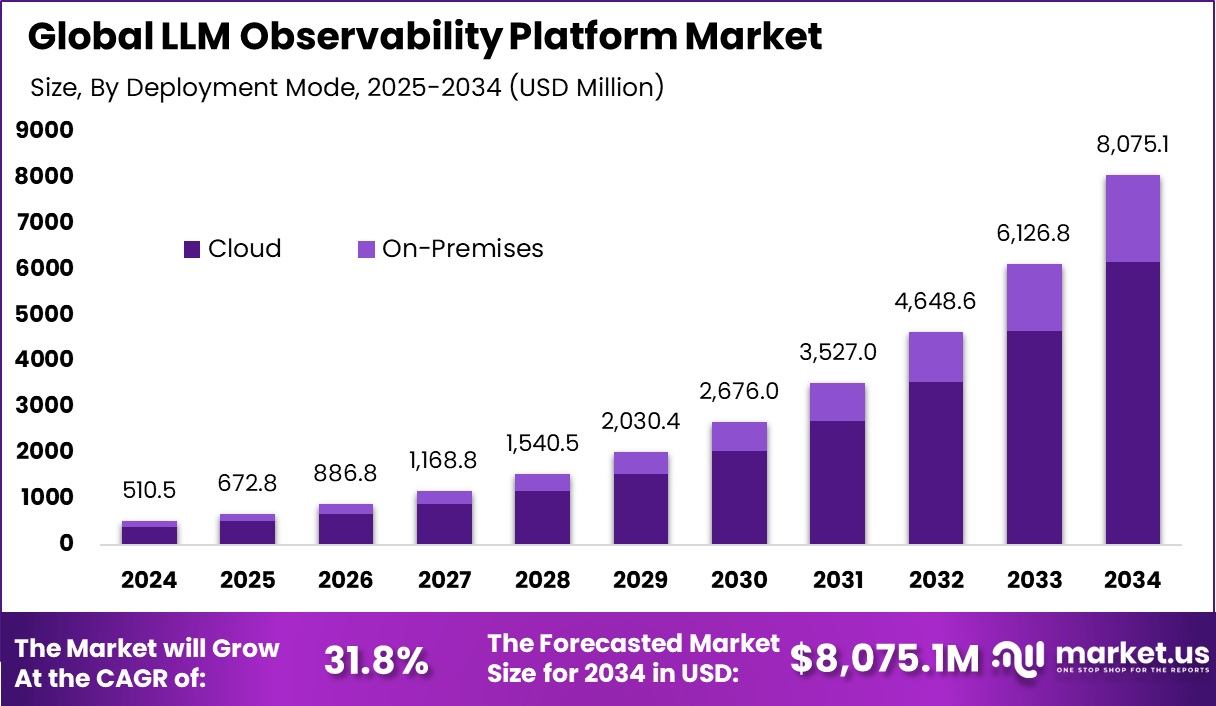

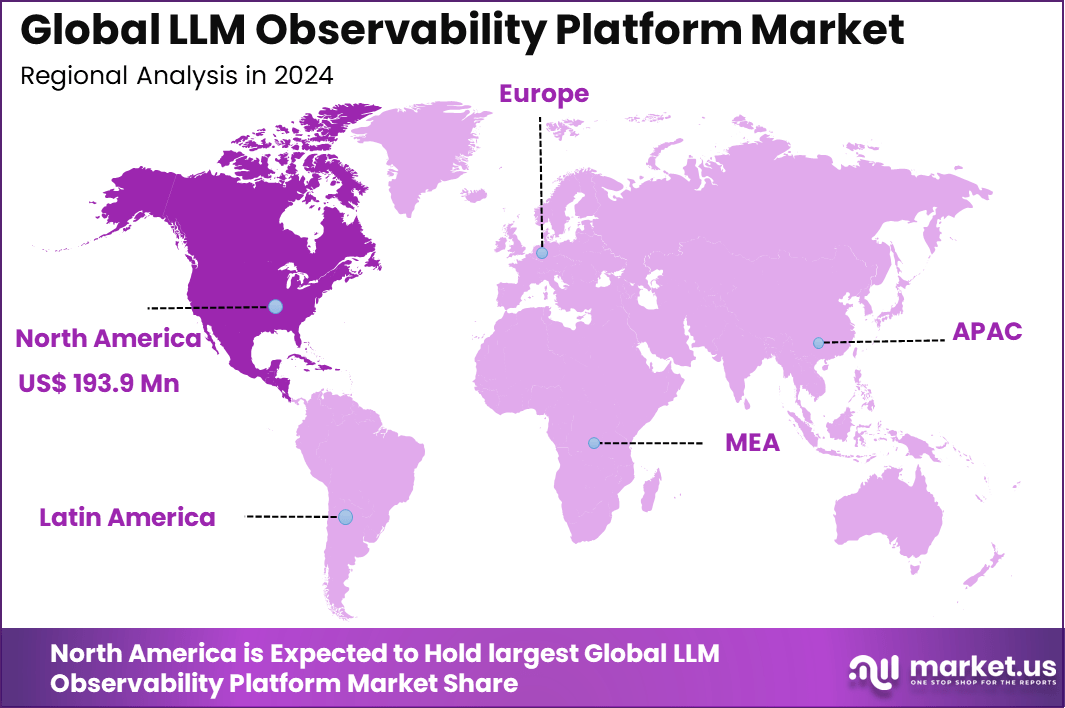

The Global LLM Observability Platform Market generated USD 510.5 Million in 2024 and is predicted to register growth from USD 672.8 Million in 2025 to about USD 8,075.1 Million by 2034, recording a CAGR of 31.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.0% share, holding USD 193.9 Million revenue.

The LLM observability platform market has expanded as organisations deploy large language models across operations and require continuous monitoring to ensure quality, safety and performance. Growth reflects the increasing complexity of AI systems, the need for reliable oversight and the shift toward production level AI workloads. These platforms track model behaviour, detect risks and provide insights into how LLMs perform in real time environments.

The market is being driven by the rapid use of LLMs in customer service, content creation, and decision support. Increasing model complexity is creating strong demand for observability tools that offer explainability, bias detection, and root-cause analysis. Regulations such as the EU AI Act and the need for ethical, reliable AI further accelerate adoption of these platforms.

According to Market.us insight, The Global Large Language Model (LLM) Market is expected to reach USD 82.1 billion by 2033, rising from USD 4.5 billion in 2023 with a strong 33.7% CAGR projected from 2024 to 2033. This growth reflects the rapid integration of advanced LLMs across enterprise workflows, automation systems, and data-driven applications.

Demand analysis shows heightened interest from industries including banking, healthcare, telecom, retail, and manufacturing. These sectors use LLMs for sensitive tasks such as fraud detection, patient diagnostics, and supply chain optimization, which require real-time monitoring to avoid operational failures. Cloud-based deployment leads the market due to the scalability, flexibility, and ease of integration it offers, supporting distributed AI implementation and rapid adaptation to changing business needs.

Top Market Takeaways

- Cloud-based deployment holds 76.3%, showing clear preference for scalable LLM observability solutions.

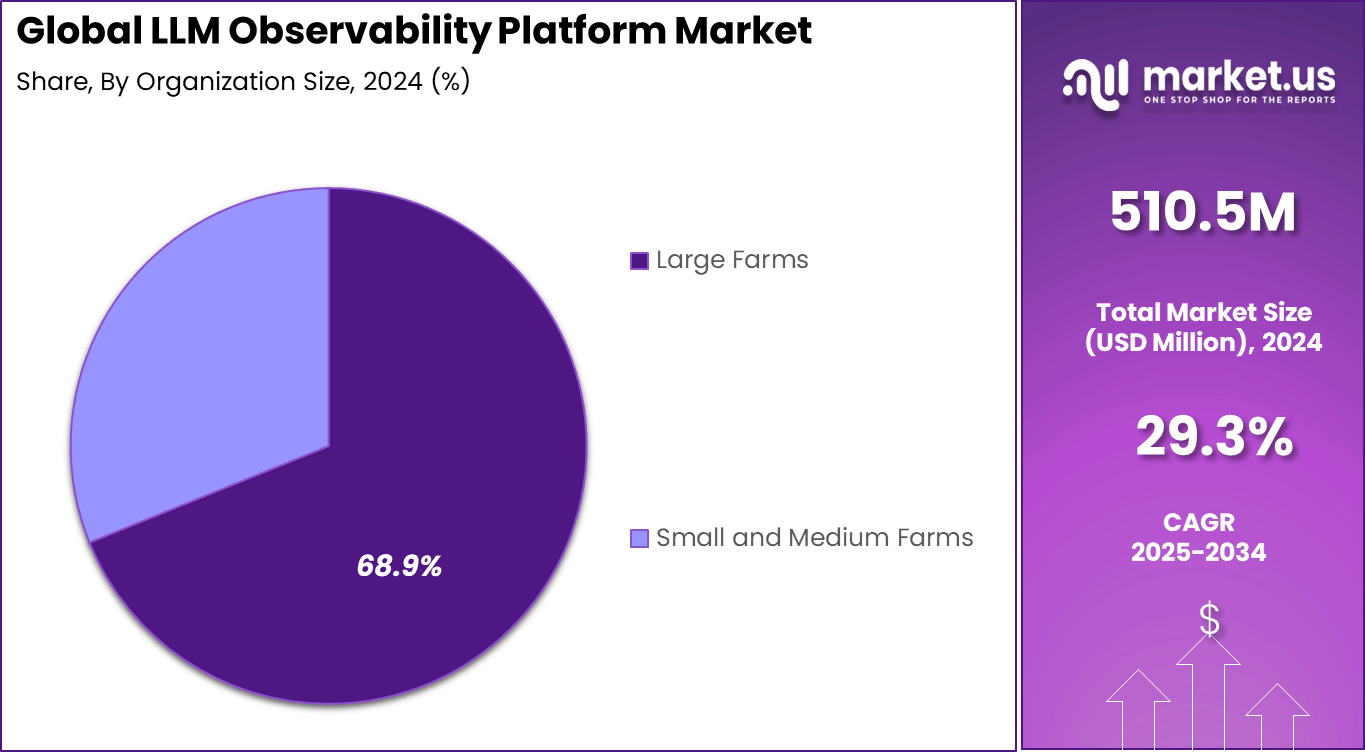

- Large enterprises account for 68.9%, reflecting higher investment in monitoring complex AI pipelines.

Performance monitoring leads applications with 32.7%, indicating strong focus on model reliability and stability. - AI and ML teams represent 45.1% of end-user adoption, driven by the need for continuous insight into model behavior.

- IT and telecommunications contribute 31.8%, supported by heavy reliance on high-volume AI workloads.

- North America captures 38%, reflecting mature AI infrastructure and advanced enterprise use.

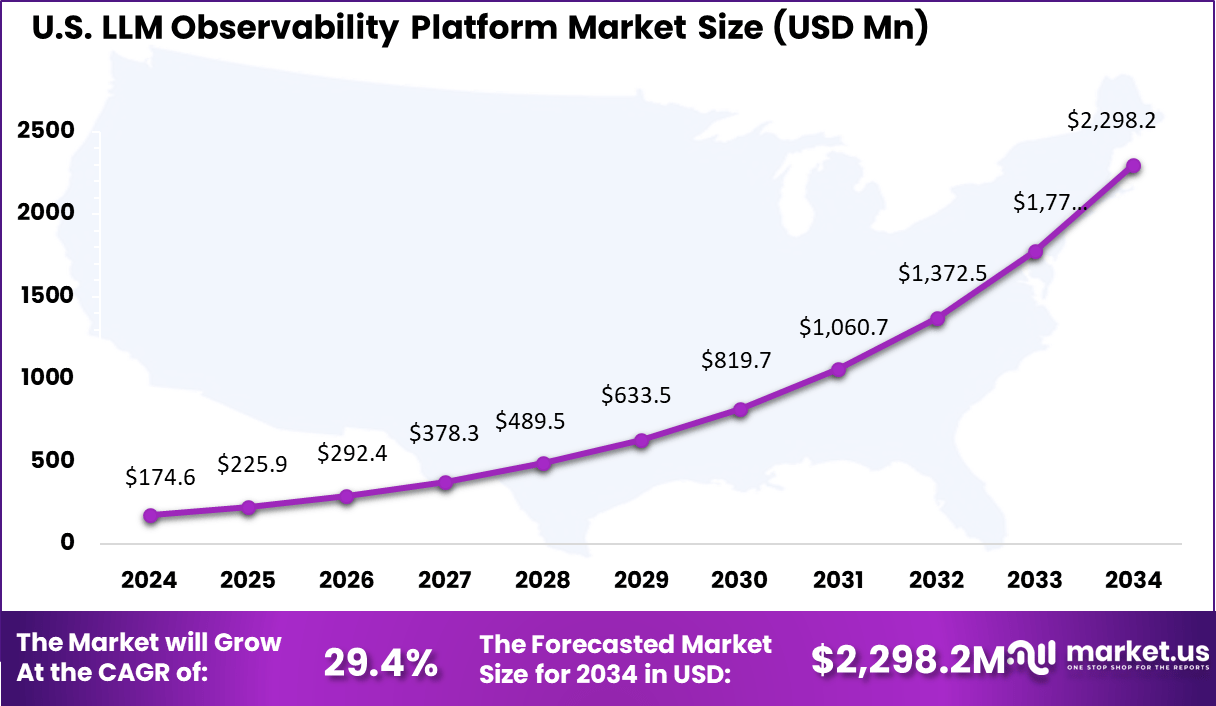

The market in United States shows strong traction, supported by rising adoption across data-intensive sectors. - Growth progresses at 29.4% CAGR, showing increasing need for transparent and accountable LLM operations.

Role of Generative AI

Generative AI plays a crucial role in LLM observability platforms by enabling advanced capabilities such as automated error detection, bias identification, and real-time monitoring of large language model outputs. Approximately 94% of decision-makers in observability recognize the tremendous potential of AI, including generative AI, to transform operational workflows.

These platforms leverage generative AI to interpret complex performance metrics and deliver actionable insights with improved accuracy and speed. Generative AI also enhances natural language interfaces within observability tools, allowing users to query and analyze telemetry data more intuitively.

Studies show that this technology improves program generation quality, with syntax validation success rates over 99%, significantly reducing operational risks associated with LLM deployments. This integration accelerates anomaly detection and optimizes model performance, making observability a vital part of managing generative AI at scale

US Market Size

The United States plays the primary role within the region, contributing approximately USD 174.6 million in market value. This robust market is growing at a notable 29.4% CAGR, fueled by heavy enterprise adoption in key sectors such as BFSI, healthcare, IT, and telecommunications.

In 2024, North America commands about 38% of the LLM Observability Platform market share, highlighting its leadership position in this evolving industry. Its dominance is strongly supported by a mature AI ecosystem, rapid cloud adoption, and a concentration of leading technology innovators.

By Deployment Mode

Cloud-based deployment dominates the LLM Observability Platform market, holding about 76.3% of the total share. This preference reflects the ease of scalability, flexibility, and integration offered by cloud platforms. Cloud deployment enables organizations to monitor complex, distributed LLM environments in real time, allowing for rapid updates and enhanced collaboration across globally dispersed teams.

It also supports multi-cloud and hybrid strategies, which many companies adopt as they expand their AI infrastructure. The shift to cloud reflects broader enterprise digital transformation trends where cloud-native solutions reduce the cost and complexity of maintaining on-premises infrastructure.

Cloud-based platforms often come with built-in advanced analytics, automated incident detection, and seamless integration with other AI tools. This deployment mode is particularly attractive to organizations looking to rapidly deploy, scale, and improve observability capabilities without heavy upfront capital expenditure or long integration timelines.

By Organization Size

Large enterprises account for approximately 68.9% of the market, driven by their complex and large-scale AI initiatives. These companies deploy multiple LLM models across various divisions and require sophisticated observability platforms to monitor performance, ensure compliance, and manage operational risks effectively.

Their investments focus on platforms offering comprehensive analytics, governance features, and integration with existing IT ecosystems, which support their AI governance frameworks. Large enterprises often lead AI adoption and are focused on optimizing the performance and reliability of AI-driven processes that impact core business functions.

Their demand for advanced observability tools is further motivated by regulatory requirements and the critical need to maintain transparency and fairness in AI operations. Meanwhile, smaller organizations are gradually entering this space, attracted by the availability of cloud-based, scalable solutions tailored to their needs but the bulk of current market revenue remains with larger firms.

By Application

In 2024, Performance monitoring is the leading application segment, making up 32.7% of the market. Observability platforms focusing on performance monitoring help organizations track LLM response times, accuracy, and throughput in real time, enabling quick issue identification and resolution.

Ensuring optimal performance is critical as LLMs are embedded in customer-facing applications, operational processes, and decision-support systems where downtime or degraded outputs can have significant business impacts.

Beyond performance, observability also supports reliability, compliance, and bias detection, but performance monitoring remains foundational. Accurate metrics and alerting systems help maintain SLA agreements and optimize resource allocation for AI workloads. Enterprises increasingly rely on these capabilities to sustain customer trust and operational efficiency in their AI-powered services.

By End-User

In 2024, AI/ML teams represent the largest end-user group with around 45.1% of market share. These teams are directly responsible for building, deploying, and maintaining LLM models, making observability critical for their workflow. Observability platforms provide these teams with detailed insights into model behavior, input/output traceability, and automated alerts, supporting model debugging and continuous improvement.

AI/ML teams also use observability tools for collaboration across data scientists, engineers, and operations staff to ensure models meet performance and compliance goals. As model complexity grows, their need for end-to-end visibility increases. Observability becomes a core capability not just for monitoring but also for transparent reporting and informed decision-making about AI deployments.

By Vertical

In 2024, the IT & Telecommunications sector leads with 31.8% of the market, reflecting the broad deployment of LLMs for network optimization, customer service automation, and knowledge management. Organizations in this industry value observability platforms that provide real-time insights into AI model performance and enable rapid troubleshooting to maintain service uptime.

These sectors also push innovation in observability by demanding platforms that support multi-cloud environments and handle high data throughput. As telecom networks evolve and IT infrastructures become more AI-powered, observability ensures operational resilience and supports compliance with emerging regulations on AI use and data security.

Emerging Trends

A major trend in 2025 is the widespread adoption of open standards such as OpenTelemetry for collecting and managing observability data. This shift facilitates better interoperability and richer context for troubleshooting, with around 65% of enterprises transitioning from proprietary systems.

Platforms increasingly focus on LLM-specific features like prompt-response monitoring, latency tracking, and bias detection to address the unique complexities of generative AI systems. Another emerging trend is consolidation in the observability market as specialized vendors are acquired to offer comprehensive solutions combining metrics, traces, and logs with AI-driven insights.

Approximately 72% of observability professionals prioritize automated correlation across data types to boost root cause analysis and predictive capabilities. This evolution underscores the move towards unified platforms that support transparent and ethical AI usage across industries.

Growth Factors

The exponential rise in enterprise adoption of LLMs is the primary driver of growth for observability platforms. Over 65% of the market revenue comes from large enterprises deploying LLMs in sectors like BFSI, healthcare, and telecommunications.

The growing complexity of multi-model and hybrid AI ecosystems demands advanced monitoring tools capable of providing end-to-end visibility into model behavior and performance. Increased regulatory pressure is another significant growth factor.

Governments worldwide are introducing frameworks to ensure transparency, compliance, and ethical AI use. This drives organizations to adopt observability tools for governance and risk mitigation. The combination of technological advancements and regulatory impetus is fueling sustained expansion in the market for LLM observability solutions.

Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Performance Monitoring

- Prompt & Response Tracking

- Cost Management & Optimization

- Security & Compliance Monitoring

- Others

By End-User

- AI/ML Teams

- DevOps/MLOps Teams

- Application Developers

- Others

By Vertical

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Retail & E-commerce

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Increasing Deployment of LLMs in Enterprises

The rapid increase in the deployment of large language models (LLMs) across various enterprise sectors is a key driver for the LLM observability platform market. Organizations are leveraging LLMs for critical applications such as customer service automation, fraud detection, and personalized experiences, which creates a need for real-time monitoring to ensure performance accuracy and reduce risks like bias and errors.

Moreover, as LLM architectures grow more complex, including multi-model and hybrid AI ecosystems, enterprises require advanced observability tools to handle distributed environments. These platforms help businesses gain full visibility into data lineage, model outputs, and system health, fostering trust and effective AI governance.

Restraint Analysis

Data Privacy and Integration Complexity

A significant restraint impacting the LLM observability platform market is the challenge posed by data privacy concerns and the complexity of integrating new observability solutions with existing legacy systems. Strict data sovereignty laws and privacy regulations in various regions restrict how and where data can be processed, making cloud-based observability deployments difficult for organizations with sensitive information, particularly in sectors like finance and healthcare.

In addition, the technical complexity involved in integrating observability platforms into diverse IT infrastructures with heterogeneous AI models represents a barrier. Organizations often need to invest significant resources in customization and ongoing maintenance to ensure smooth interoperability, slowing down adoption especially among smaller companies or those with limited AI expertise. This slows market growth and requires vendors to develop highly flexible and user-friendly integration capabilities.

Opportunity Analysis

Expansion into Emerging Deployment Environments

The expansion of LLM observability into emerging deployment environments such as edge computing, IoT, and decentralized AI presents a strong growth opportunity. As more LLM-powered applications move closer to the edge for real-time decision-making and faster response times, there is growing demand for lightweight observability platforms that can operate efficiently in resource-constrained environments.

Furthermore, integrating observability with AI governance, risk management, and lifecycle management frameworks presents a chance for vendors to offer more comprehensive solutions. There is increasing interest in observability platforms that also support explainable AI, ethical AI practices, and automated compliance reporting, which can differentiate offerings and attract customers seeking robust, unified AI monitoring and management tools.

Challenge Analysis

Talent Shortages and High Implementation Costs

A major challenge for the LLM observability platform market is the shortage of skilled professionals who can effectively operate and maintain sophisticated monitoring solutions. The specialized knowledge required in AI, data science, and IT infrastructure to deploy observability effectively is limited, which slows down the adoption rate especially in smaller enterprises with limited HR capacity.

Training and retaining talent are costly and time-consuming, which poses a significant operational hurdle for organizations aiming to implement these platforms at scale. Additionally, the high cost of advanced observability platforms and the expenses involved in integration and customization create financial barriers, particularly for SMEs and companies in emerging markets.

These cost factors, combined with the complexity of aligning with rapidly evolving AI regulations, discourage some organizations from investing aggressively in observability solutions despite the clear benefits. Vendors must continue to innovate on pricing models and provide scalable solutions to address this dual challenge.

Future Outlook

Looking forward, the future outlook for the LLM observability market is robust. Advances in AI governance integration, AI lifecycle management, and security are expected to drive further platform innovation and adoption. As regulatory scrutiny intensifies globally, platforms offering comprehensive monitoring, compliance support, and automated reporting will hold higher value.

Emerging technologies like edge AI and federated learning present new avenues for platform expansion, making observability indispensable in managing decentralized AI models. Opportunities in the market include developing observability tools that integrate seamlessly with broader AI governance frameworks, advancing explainability features, and enhancing support for diverse deployment environments like cloud, on-premises, and edge devices.

The rise of SaaS and open-source solutions enables broader adoption across enterprises and SMEs, democratizing access to LLM observability and fostering responsible AI practices. These trends underscore strong potential for continuing growth and innovation in the sector.

Competitive Analysis

Arize AI, Weights & Biases, Datadog, and Dynatrace lead the LLM observability platform market with advanced monitoring tools designed to track model performance, drift, latency, and data quality. Their platforms support real-time diagnostics for large language models, enabling teams to detect anomalies quickly and maintain stable outputs. These companies focus on scalable pipelines, error analysis, and automated alerts.

New Relic, Splunk, IBM, Microsoft, Google, NVIDIA, Honeycomb, and Lightstep strengthen the competitive landscape with deep telemetry, distributed tracing, and AI performance analytics. Their solutions help organizations understand model behavior across complex architectures, improving reliability and troubleshooting efficiency. These providers integrate LLM logs, metrics, and tracing data into unified dashboards.

Tecton, Monte Carlo Data, Superwise, and other emerging participants expand the market with specialized tools for model governance, feature monitoring, and data lineage tracking. Their platforms focus on preventing performance degradation and ensuring compliance with internal and external standards. These companies support continuous evaluation and safe scaling of LLM applications. Rising expectations for trustworthy, auditable AI systems continue to drive adoption of dedicated LLM observability platforms.

Top Key Players in the Market

- Arize AI, Inc.

- Weights & Biases, Inc.

- Datadog, Inc.

- Dynatrace LLC

- New Relic, Inc.

- Splunk Inc.

- IBM Corporation

- Microsoft Corporation

- Google LLC

- NVIDIA Corporation

- Honeycomb.io, Inc.

- Lightstep, Inc.

- Tecton, Inc.

- Monte Carlo Data, Inc.

- Superwise, Inc.

- Others

Recent Developments

- October 2025 – Arize AI, Inc. announced a partnership with Infogain to accelerate enterprise AI outcomes using their Ignis observability platform. Earlier in March, Arize AI acquired Velvet, an AI gateway platform that helps developers monitor and analyze AI features quickly, enhancing Arize’s evaluation and observability capabilities for LLM applications.

- June 2025 – Datadog, Inc. launched new LLM observability features focused on monitoring agentic AI and experimenting with large language models. This release provides tools to track AI errors such as hallucinations and optimize AI model performance and cost, helping businesses deploy generative AI confidently

Report Scope

Report Features Description Market Value (2024) USD 510.5 Mn Forecast Revenue (2034) USD 8,075.1 Mn CAGR(2025-2034) 31.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Performance Monitoring, Prompt & Response Tracking, Cost Management & Optimization, Security & Compliance Monitoring, Others), By End-User (AI/ML Teams, DevOps/MLOps Teams, Application Developers, Others), By Vertical (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, Retail & E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Arize AI, Inc., Weights & Biases, Inc., Datadog, Inc., Dynatrace LLC, New Relic, Inc., Splunk Inc., IBM Corporation, Microsoft Corporation, Google LLC, NVIDIA Corporation, Honeycomb.io, Inc., Lightstep, Inc., Tecton, Inc., Monte Carlo Data, Inc., Superwise, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  LLM Observability Platform MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

LLM Observability Platform MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arize AI, Inc.

- Weights & Biases, Inc.

- Datadog, Inc.

- Dynatrace LLC

- New Relic, Inc.

- Splunk Inc.

- IBM Corporation

- Microsoft Corporation

- Google LLC

- NVIDIA Corporation

- Honeycomb.io, Inc.

- Lightstep, Inc.

- Tecton, Inc.

- Monte Carlo Data, Inc.

- Superwise, Inc.

- Others