Global Liquid Fertilizers Market By Product(Organic, Synthetic), By Type(Nitrogen, Phosphorous, Potash, Micronutrients), By Application(Fertigation, Foliar, Soil, Others), By Crop Type(Grains & Cereals, Fruits & Vegetables, Oilseeds & Pulses, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121517

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

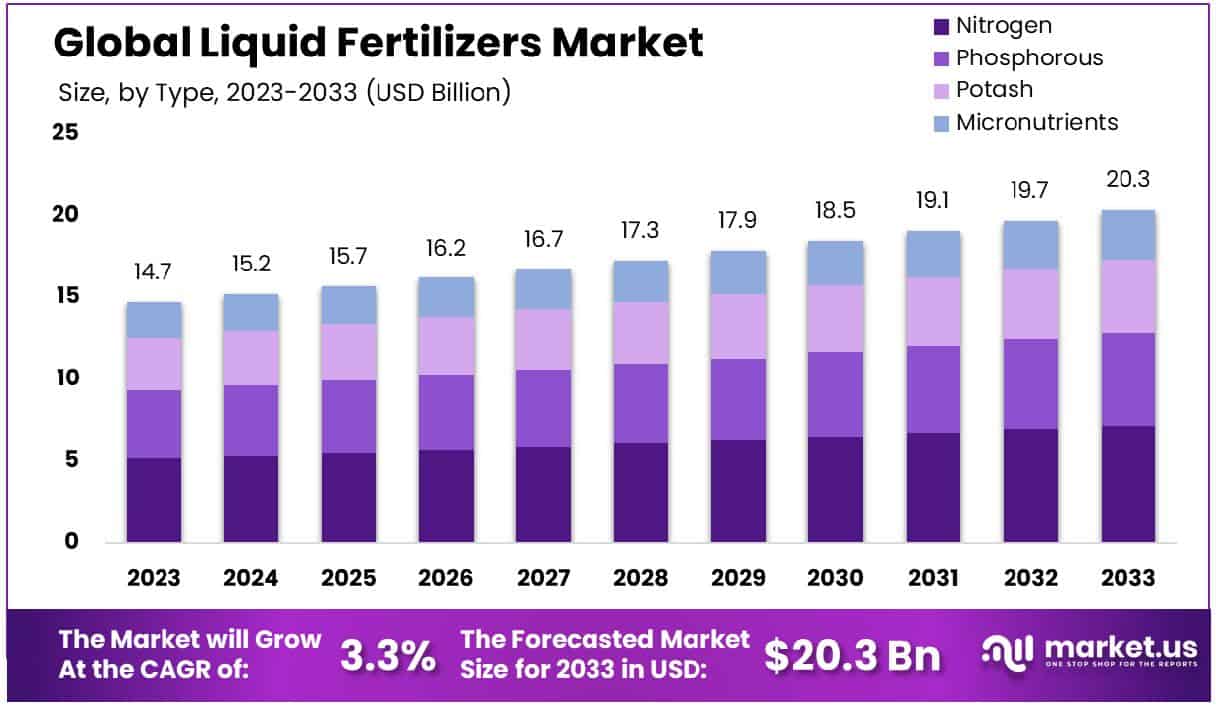

The Global Liquid Fertilizers Market size is expected to be worth around USD 20.3 Billion by 2033, From USD 14.7 Billion by 2023, growing at a CAGR of 3.3% during the forecast period from 2024 to 2033.

The Liquid Fertilizers Market encompasses the production, distribution, and application of nutrient-rich liquid solutions used to enhance soil fertility and boost crop yields. This market includes various types of fertilizers such as nitrogen, phosphorus, potassium, and micronutrients in liquid form, designed for precision agriculture.

Liquid fertilizers offer advantages like uniform nutrient distribution, easy application, and rapid absorption by plants, catering to the needs of modern agricultural practices. Key players in this market focus on innovation, sustainability, and efficiency to address the growing demand for food production and sustainable farming methods globally.

The Liquid Fertilizers Market is anticipated to experience significant growth due to the increasing demand for efficient and effective fertilization methods in modern agriculture. Liquid fertilizers offer distinct advantages, including ease of application, improved nutrient absorption, and the ability to be used in various irrigation systems, which are driving their adoption across diverse agricultural landscapes. The shift towards sustainable agricultural practices and the rising need for higher crop yields to meet global food demands are further catalyzing market expansion.

In the fiscal year 2023-24, the budget for fertilizer subsidies is set at Rs 1,75,103 crore, marking a 22% reduction from the revised estimates of 2022-23 but representing a 66% increase compared to the budget estimates for 2022-23. This substantial budget allocation underscores the government’s commitment to supporting the agricultural sector, albeit with a recalibrated focus. The approval of a subsidy of Rs 51,875 crore for the Nutrient-Based Subsidy (NBS) Rabi-2022, which includes provisions for urea and other fertilizers, further reinforces the strategic emphasis on ensuring the availability of essential agricultural inputs at subsidized rates.

The Direct Benefit Transfer (DBT) scheme, designed to provide fertilizers at subsidized rates directly to farmers, has been a critical policy measure. As of 2023, 2.63 lakh Point of Sale (PoS) devices have been deployed across all states, and 16,067 training sessions have been conducted for retailers. These initiatives are pivotal in ensuring transparency, efficiency, and timely distribution of subsidies, thereby enhancing farmer access to essential inputs.

Key Takeaways

- Market Growth: The Global Liquid Fertilizers Market size is expected to be worth around USD 20.3 Billion by 2033, From USD 14.7 Billion by 2023, growing at a CAGR of 3.3% during the forecast period from 2024 to 2033.

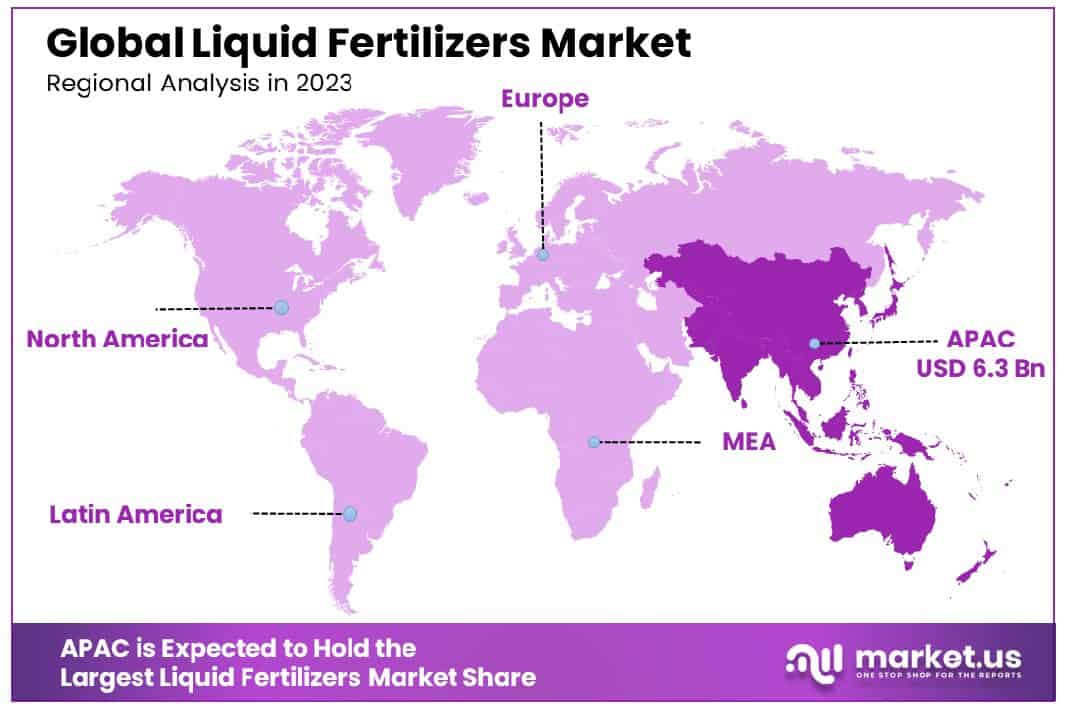

- Regional Dominance: The Asia Pacific Liquid Fertilizers Market holds 43.2%, valued at USD 6.3 billion.

- Segmentation Insights:

- By Product: Organic products constitute 61.5% of the market share currently.

- By Type: Nitrogen fertilizers dominate 35.2% of the total market distribution.

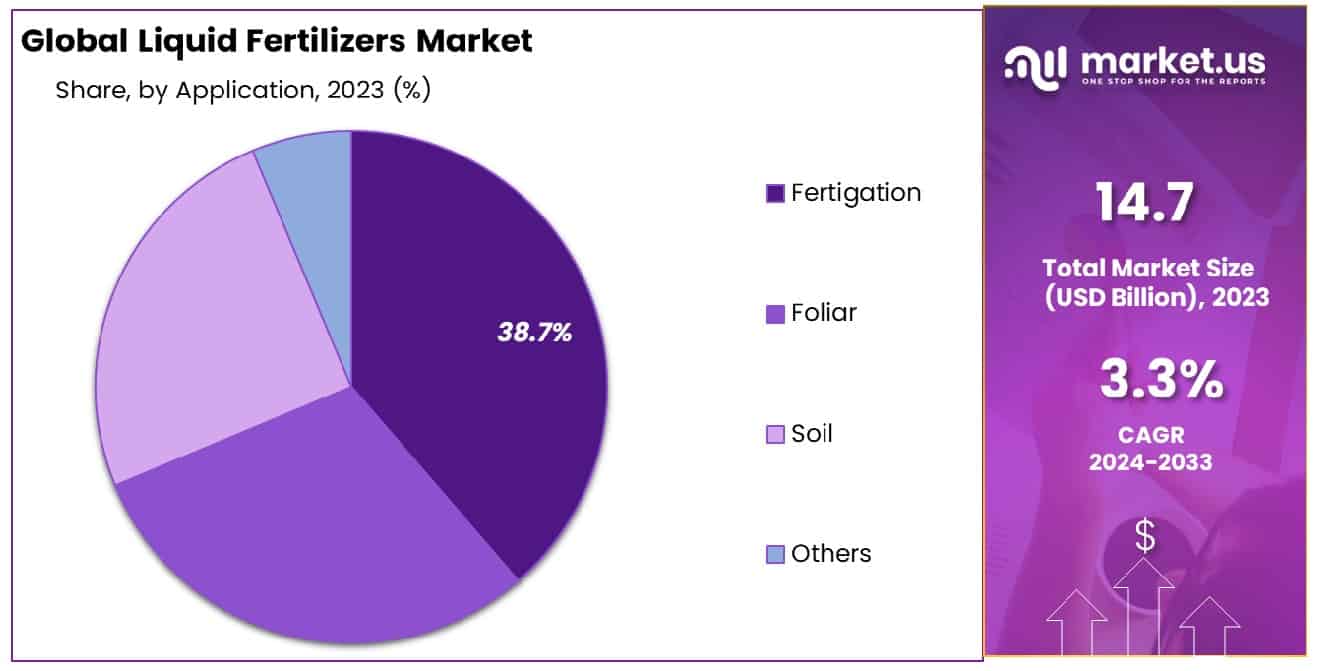

- By Application: Fertigation methods account for 38.7% of application-specific market usage.

- By Crop Type: Grains and cereals comprise 47.6% of the crop type market.

- Growth Opportunities: The global liquid fertilizers market in 2023 is driven by the expansion of organic farming practices and the development of innovative formulations, enhancing sustainability, efficiency, and crop performance.

Driving Factors

Rising Global Population Drives Food Demand

The burgeoning global population is a primary driver for the growth of the liquid fertilizers market. As the world’s population is projected to reach 9.7 billion by 2050, there is an escalating demand for food to sustain this growth. This necessitates increased agricultural productivity, which can be effectively supported by the use of liquid fertilizers.

Liquid fertilizers offer a more efficient nutrient delivery system, ensuring that crops receive the necessary nutrients to enhance growth and yield. This direct correlation between population growth and food demand underscores the critical role of liquid fertilizers in modern agriculture, making them indispensable in meeting the food requirements of an expanding global populace.

Precision Farming Techniques Enhance Fertilizer Use

Advancements in precision farming techniques significantly contribute to the growth of the liquid fertilizers market. Precision farming, which involves the use of GPS technology, smart sensors, and data analytics, enables farmers to apply fertilizers more accurately and efficiently. This technological progress ensures that crops receive the precise amount of nutrients needed, reducing waste and optimizing productivity.

Liquid fertilizers, with their ease of application and compatibility with precision farming equipment, are particularly well-suited for this approach. By facilitating targeted nutrient delivery, precision farming techniques not only enhance crop yields but also promote the adoption of liquid fertilizers as a preferred choice among farmers aiming for sustainable and efficient agricultural practices.

High Efficiency and Quick Absorption Rates Boost Adoption

The high efficiency and quick absorption rates of liquid fertilizers are pivotal factors driving their market growth. Unlike traditional granular fertilizers, liquid fertilizers can be absorbed by plants more rapidly, ensuring immediate availability of nutrients. This quick uptake results in faster plant growth and improved crop yields. Additionally, the uniform application of liquid fertilizers minimizes the risk of nutrient runoff and environmental contamination.

These benefits make liquid fertilizers an attractive option for farmers seeking to maximize their agricultural output while adhering to environmental sustainability practices. The superior performance characteristics of liquid fertilizers, therefore, play a crucial role in their increasing adoption and market expansion.

Restraining Factors

High Cost of Liquid Fertilizers Limits Market Penetration

The elevated cost of liquid fertilizers compared to their granular counterparts is a significant restraining factor for market growth. Liquid fertilizers often require specialized equipment for application, which adds to the overall expense for farmers. According to industry estimates, the cost of liquid fertilizers can be up to 30-40% higher than granular fertilizers.

This price disparity makes liquid fertilizers less attractive, particularly for small-scale farmers or those operating on tight budgets. Consequently, the higher cost can deter widespread adoption, limiting market penetration, especially in regions where cost efficiency is a crucial consideration for agricultural operations. Despite their benefits, the economic burden associated with liquid fertilizers remains a substantial barrier to their broader acceptance and use.

Limited Awareness and Adoption in Developing Regions Hinder Growth

In developing regions, the awareness and adoption of liquid fertilizers are significantly constrained, further restraining market growth. Many farmers in these areas lack access to the necessary information and resources to understand the benefits and proper usage of liquid fertilizers. Additionally, infrastructural challenges, such as inadequate distribution networks and limited access to advanced farming technologies, exacerbate this issue.

This lack of awareness and adoption means that a large potential market for liquid fertilizers remains untapped. Educational initiatives and government support could play a vital role in addressing this challenge, but until these are widely implemented, the limited penetration of liquid fertilizers in developing regions will continue to impede market expansion. The combined impact of high costs and limited awareness creates a substantial hurdle for the liquid fertilizers market, highlighting the need for strategies aimed at reducing costs and increasing education to foster growth.

By Product Analysis

Organic fertilizers dominate the market, accounting for 61.5% of total usage and demand globally.

In 2023, Organic held a dominant market position in the By Product segment of the Liquid Fertilizers Market, capturing more than a 61.5% share. The significant market share of organic liquid fertilizers can be attributed to the growing consumer demand for organic food products and the increasing awareness of sustainable agricultural practices. Organic liquid fertilizers are derived from natural sources, such as plant and animal waste, which makes them environmentally friendly and promotes soil health and biodiversity.

The market growth for organic liquid fertilizers is further driven by stringent regulations and policies favoring organic farming practices. Governments and agricultural bodies worldwide are increasingly advocating for the reduction of chemical inputs in farming to minimize environmental impact and promote sustainable agriculture. This regulatory support has bolstered the adoption of organic liquid fertilizers among farmers, contributing to their market dominance.

Moreover, advancements in organic fertilizer formulations have enhanced their efficacy, making them comparable to synthetic fertilizers in terms of nutrient delivery and crop yield. Innovations in production processes have also led to cost-effective organic fertilizers, making them more accessible to small and medium-scale farmers.

On the other hand, synthetic liquid fertilizers, accounting for 38.5% of the market share, continue to play a vital role in modern agriculture due to their rapid nutrient release and high concentration of essential nutrients. However, concerns regarding the long-term environmental impact and soil degradation associated with synthetic fertilizers have driven a gradual shift towards organic alternatives.

Overall, the liquid fertilizers market is witnessing a paradigm shift towards organic products, driven by sustainability trends, regulatory support, and advancements in organic fertilizer technology. This shift is expected to continue as stakeholders across the agricultural value chain increasingly prioritize eco-friendly and sustainable farming solutions.

By Type Analysis

Nitrogen-based fertilizers are the most popular, making up 35.2% of the market share.

In 2023, Nitrogen held a dominant market position in the By Type segment of the Liquid Fertilizers Market, capturing more than a 35.2% share. This substantial share can be attributed to nitrogen’s crucial role in promoting plant growth and enhancing crop yields. Nitrogen is a vital nutrient responsible for the development of plant tissues and the synthesis of proteins, making it indispensable for high agricultural productivity.

The high adoption rate of nitrogen-based liquid fertilizers is driven by their quick absorption and immediate impact on crop health. Farmers prefer nitrogen fertilizers for their efficiency in boosting crop growth, particularly in high-demand crops such as cereals and grains. Additionally, the development of advanced formulations and application techniques has improved the effectiveness of nitrogen fertilizers, further supporting their dominant market position.

Phosphorous-based liquid fertilizers, accounting for 25.8% of the market share, play a critical role in root development and energy transfer within plants. Phosphorous is essential for early plant growth and development, leading to its significant usage in various agricultural practices. The market for phosphorous fertilizers is bolstered by the increasing demand for high-quality crops and the need for efficient nutrient management.

Potash, with a 22.0% market share, is crucial for water regulation and disease resistance in plants. Its importance in improving crop quality and yield has led to steady demand in the liquid fertilizers market. Potash fertilizers are particularly favored in regions with potassium-deficient soils, contributing to their substantial market share.

Micronutrients, though holding a smaller share of 17.0%, are essential for overall plant health and development. These fertilizers address specific nutrient deficiencies and enhance the effectiveness of macronutrients, thereby playing a vital role in comprehensive nutrient management strategies.

Overall, the liquid fertilizers market is characterized by a strong preference for nitrogen-based products, supported by their critical role in agricultural productivity and crop quality. The ongoing advancements in fertilizer technology and application methods are expected to further solidify nitrogen’s leading position in the market.

By Application Analysis

Fertigation methods are widely utilized, representing 38.7% of fertilizer application practices.

In 2023, Fertigation held a dominant market position in the “By Application” segment of the Liquid Fertilizers Market, capturing more than a 38.7% share. The values at the start include Fertigation, Foliar, Soil, and Others.

The integration of fertilizers through irrigation systems has become increasingly popular due to its efficiency and effectiveness in nutrient delivery. This method not only optimizes the use of fertilizers but also ensures that nutrients are readily available to plants, resulting in better growth and yield. The rising adoption of precision agriculture and smart farming techniques has further driven the growth of fertigation. The ability to control the exact amount of nutrients and water provided to crops makes fertigation a highly efficient and environmentally friendly option, contributing to its leading market share of 38.7% in 2023.

Foliar feeding, which involves spraying liquid fertilizers directly onto plant leaves, held a significant portion of the market. This method is particularly effective for correcting nutrient deficiencies quickly and improving the overall health of plants. It is often used in conjunction with other fertilization methods to enhance crop quality and yield. Despite its benefits, foliar application captured a smaller market share compared to fertigation, indicating a preference for more integrated and controlled fertilization methods.

Traditional soil application of liquid fertilizers remains a crucial segment, especially in regions with conventional farming practices. This method involves applying fertilizers directly to the soil, where they are absorbed by plant roots. While effective, soil application can sometimes lead to nutrient runoff and inefficient utilization. However, advancements in soil health management and targeted nutrient delivery systems are expected to sustain its market presence.

Other methods of liquid fertilizer application, including hydroponics and aeroponics, are gaining traction, particularly in urban and indoor farming. These innovative techniques offer high efficiency and sustainability, although they currently represent a smaller portion of the market.

By Crop Type Analysis

Grains and cereals lead the demand, with 47.6% of fertilizers used for these crops.

In 2023, Grains & Cereals held a dominant market position in the “By Crop Type” segment of the Liquid Fertilizers Market, capturing more than a 47.6% share. The values at the start include Grains & Cereals, Fruits & Vegetables, Oilseeds & Pulses, and Others.

The cultivation of grains and cereals has significantly driven the demand for liquid fertilizers due to their high nutrient requirements and extensive planting areas. Major crops such as wheat, rice, corn, and barley have been primary beneficiaries of liquid fertilizers, which provide a rapid and efficient nutrient supply. This segment’s dominance, with a market share of over 47.6%, can be attributed to the global emphasis on food security and the need to enhance crop yields to feed a growing population. The use of liquid fertilizers in grains and cereals ensures better nutrient uptake, resulting in higher productivity and quality of the produce.

The fruits and vegetables segment also commands a substantial portion of the liquid fertilizers market. These crops require precise nutrient management to achieve optimal growth and quality, making liquid fertilizers an ideal choice. The increasing consumer demand for fresh and high-quality produce has led farmers to adopt liquid fertilization techniques to meet market standards. Despite its importance, this segment holds a smaller share compared to grains and cereals but continues to grow steadily due to the rising trend of health-conscious eating and organic farming practices.

Oilseeds and pulses, including crops like soybeans, sunflowers, and lentils, are essential for both human consumption and industrial use. The application of liquid fertilizers in these crops enhances their growth by providing essential nutrients in a readily available form. This segment has shown promising growth, driven by the demand for biofuels and plant-based proteins. Although not as large as the grains and cereals segment, oilseeds and pulses represent a vital and expanding market within the liquid fertilizers sector.

Other crop types, including specialty crops like herbs, spices, and ornamental plants, also utilize liquid fertilizers for their cultivation. These niche markets, while smaller in scale, benefit from the precise nutrient delivery and enhanced growth provided by liquid fertilizers. The increasing popularity of urban and vertical farming has further spurred the use of liquid fertilizers in these unconventional crop segments.

Key Market Segments

By Product

- Organic

- Synthetic

By Type

- Nitrogen

- Phosphorous

- Potash

- Micronutrients

By Application

- Fertigation

- Foliar

- Soil

- Others

By Crop Type

- Grains & Cereals

- Fruits & Vegetables

- Oilseeds & Pulses

- Others

Growth Opportunities

Expansion of Organic Farming Practices

The global liquid fertilizers market in 2023 presents significant growth opportunities due to the expanding adoption of organic farming practices. As consumers increasingly prioritize sustainability and health, the demand for organic produce continues to rise. This shift has prompted farmers to seek environmentally friendly and efficient nutrient solutions, such as liquid fertilizers, which are compatible with organic farming standards.

The organic farming sector’s growth is further fueled by supportive government policies and incentives aimed at promoting sustainable agriculture. Consequently, the liquid fertilizers market is poised to benefit from the increased use of organic farming methods, driving demand for innovative, organic-certified liquid fertilizers that enhance crop yield and quality.

Development of Innovative Liquid Fertilizer Formulations

The development of innovative liquid fertilizer formulations represents another critical growth opportunity for the global liquid fertilizers market in 2023. Technological advancements and ongoing research have led to the creation of more efficient and targeted liquid fertilizers, capable of meeting the specific nutrient needs of various crops. These advancements include the formulation of slow-release fertilizers, micronutrient-enriched solutions, and bio-based products that improve nutrient uptake and reduce environmental impact.

Additionally, the integration of smart farming technologies, such as precision agriculture, enables farmers to optimize the application of liquid fertilizers, enhancing efficiency and crop performance. As the agricultural industry continues to evolve, the demand for advanced liquid fertilizer formulations is expected to rise, driving market growth and offering substantial opportunities for manufacturers and stakeholders.

Latest Trends

Integration of Liquid Fertilizers with Micro-Irrigation Systems

In 2023, one of the prominent trends in the global liquid fertilizers market is the integration of liquid fertilizers with micro-irrigation systems. This combination offers a more efficient and targeted approach to nutrient delivery, optimizing water and fertilizer use. Micro-irrigation systems, such as drip and sprinkler irrigation, allow precise application of liquid fertilizers directly to the plant root zone, reducing wastage and ensuring that nutrients are available where they are most needed.

This method not only enhances crop yields but also contributes to water conservation and sustainable agricultural practices. The growing awareness of water scarcity and the need for efficient resource management are driving the adoption of integrated liquid fertilizer and micro-irrigation systems, providing farmers with a practical solution to improve productivity while minimizing environmental impact.

Increasing Adoption of Sustainable and Eco-Friendly Fertilizer Solutions

Another significant trend in the global liquid fertilizers market in 2023 is the increasing adoption of sustainable and eco-friendly fertilizer solutions. As environmental concerns and regulatory pressures intensify, there is a growing demand for fertilizers that are not only effective but also minimize ecological footprints. Liquid fertilizers formulated from natural and renewable sources are gaining traction, as they offer a more sustainable alternative to conventional synthetic fertilizers.

These eco-friendly products are designed to reduce soil and water contamination, improve soil health, and promote long-term agricultural sustainability. Additionally, advancements in biotechnology and the development of bio-based fertilizers are supporting this trend, providing innovative solutions that align with the principles of sustainable agriculture. The increasing focus on sustainability is expected to drive the market for eco-friendly liquid fertilizers, shaping the future of agricultural practices worldwide.

Regional Analysis

The Asia Pacific liquid fertilizers market holds a 43.2% share, valued at USD 6.3 billion.

The liquid fertilizers market exhibits significant regional variations, with diverse growth trajectories and market dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In North America, the market benefits from advanced agricultural practices and significant investment in precision farming, contributing to robust demand.

The region’s market size was valued at approximately USD 4.1 billion in 2023, with the United States leading due to its extensive arable land and technological advancements. Europe follows closely, driven by stringent environmental regulations and the adoption of sustainable agricultural practices. The market in Europe was valued at around USD 3.5 billion, with countries like Germany and France at the forefront.

Asia Pacific dominates the global liquid fertilizers market, accounting for 43.2% of the market share, equivalent to USD 6.3 billion in 2023. This dominance is attributed to the extensive agricultural activities in countries such as China and India, which are the largest consumers of liquid fertilizers due to their vast population and agricultural land. The region’s rapid urbanization and growing food demand further propel market growth.

The Middle East & Africa region, though smaller in market size, exhibits a growing trend driven by the increasing focus on enhancing agricultural productivity in arid regions. The market here was valued at approximately USD 1.2 billion. Latin America, with its expanding agricultural sector in countries like Brazil and Argentina, accounted for a market size of USD 2.4 billion, supported by the rising adoption of modern farming techniques.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

The global Liquid Fertilizers Market in 2023 has witnessed substantial contributions from several key players, each playing a critical role in shaping the market dynamics. Yara International ASA, a dominant force in the market, continues to leverage its extensive distribution network and advanced nutrient solutions to maintain its leadership position. Nutrien Ltd., another major player, has capitalized on its comprehensive product portfolio and robust supply chain to expand its market share, particularly in North America and Europe.

Israel Chemicals Ltd. and Haifa Group have been instrumental in promoting specialty fertilizers, focusing on high-value crops and precision agriculture. Their innovative products and strong research and development capabilities have enabled them to cater to niche markets effectively. Agrium Inc. and K+S Aktiengesellschaft, with their strategic mergers and acquisitions, have fortified their market presence, enhancing their production capacities and geographical reach.

Sociedad Química y Minera de Chile and The Mosaic Company have focused on optimizing their production processes and expanding their product offerings to meet the growing demand for liquid fertilizers. Terra Industries Inc. and CF Industries Holdings, Inc. have utilized their extensive manufacturing facilities and logistics networks to ensure a steady supply of high-quality fertilizers globally.

BASF SE and Bayer CropScience have significantly contributed to market growth through their innovative agrochemical solutions and extensive research initiatives. Syngenta AG has emphasized sustainable farming practices, aligning its product development with environmental goals. Zuari Agro Chemicals Ltd. and EuroChem Group AG have focused on emerging markets, leveraging their competitive pricing strategies and localized distribution channels to capture market share.

Market Key Players

- Yara International ASA

- Nutrien Ltd.

- Israel Chemicals Ltd.

- Haifa Group

- Agrium Inc.

- K+S Aktiengesellschaft

- Sociedad Química y Minera de Chile

- The Mosaic Company

- Terra Industries Inc.

- CF Industries Holdings, Inc.

- BASF SE

- Bayer CropScience

- Syngenta AG

- Zuari Agro Chemicals Ltd.

- EuroChem Group AG

Recent Development

- In May 2024, IFFCO received government approval for its new products, nano liquid zinc and nano liquid copper, which will help address zinc and copper deficiencies in crops, enhancing productivity and crop quality.

- In November 2023, Pittsburgh International Airport and Ecotone Renewables partnered to convert food waste into sustainable fertilizer using ZEUS, enhancing airport sustainability and supporting local artists through vibrant murals.

Report Scope

Report Features Description Market Value (2023) USD 14.7 Billion Forecast Revenue (2033) USD 20.3 Billion CAGR (2024-2033) 3.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Organic, Synthetic), By Type(Nitrogen, Phosphorous, Potash, Micronutrients), By Application(Fertigation, Foliar, Soil, Others), By Crop Type(Grains & Cereals, Fruits & Vegetables, Oilseeds & Pulses, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Yara International ASA, Nutrien Ltd., Israel Chemicals Ltd., Haifa Group, Agrium Inc., K+S Aktiengesellschaft, Sociedad Química y Minera de Chile, The Mosaic Company, Terra Industries Inc., CF Industries Holdings, Inc., BASF SE, Bayer CropScience, Syngenta AG, Zuari Agro Chemicals Ltd., EuroChem Group AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Liquid Fertilizers Market Size in 2023?The Global Liquid Fertilizers Market Size is USD 14.7 Billion in 2023.

What is the projected CAGR at which the Global Liquid Fertilizers Market is expected to grow at?The Global Liquid Fertilizers Market is expected to grow at a CAGR of 3.3% (2024-2033).

List the segments encompassed in this report on the Global Liquid Fertilizers Market?Market.US has segmented the Global Liquid Fertilizers Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product(Organic, Synthetic), By Type(Nitrogen, Phosphorous, Potash, Micronutrients), By Application(Fertigation, Foliar, Soil, Others), By Crop Type(Grains & Cereals, Fruits & Vegetables, Oilseeds & Pulses, Others)

List the key industry players of the Global Liquid Fertilizers Market?Yara International ASA, Nutrien Ltd., Israel Chemicals Ltd., Haifa Group, Agrium Inc., K+S Aktiengesellschaft, Sociedad Química y Minera de Chile, The Mosaic Company, Terra Industries Inc., CF Industries Holdings, Inc., BASF SE, Bayer CropScience, Syngenta AG, Zuari Agro Chemicals Ltd., EuroChem Group AG

Name the key areas of business for Global Liquid Fertilizers Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Liquid Fertilizers Market.

-

-

- Yara International ASA

- Nutrien Ltd.

- Israel Chemicals Ltd.

- Haifa Group

- Agrium Inc.

- K+S Aktiengesellschaft

- Sociedad Química y Minera de Chile

- The Mosaic Company

- Terra Industries Inc.

- CF Industries Holdings, Inc.

- BASF SE

- Bayer CropScience

- Syngenta AG

- Zuari Agro Chemicals Ltd.

- EuroChem Group AG