Global Lipid Market By Source (Animal, Plant), By Application (Food & Beverages, Pharmaceuticals, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 37916

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

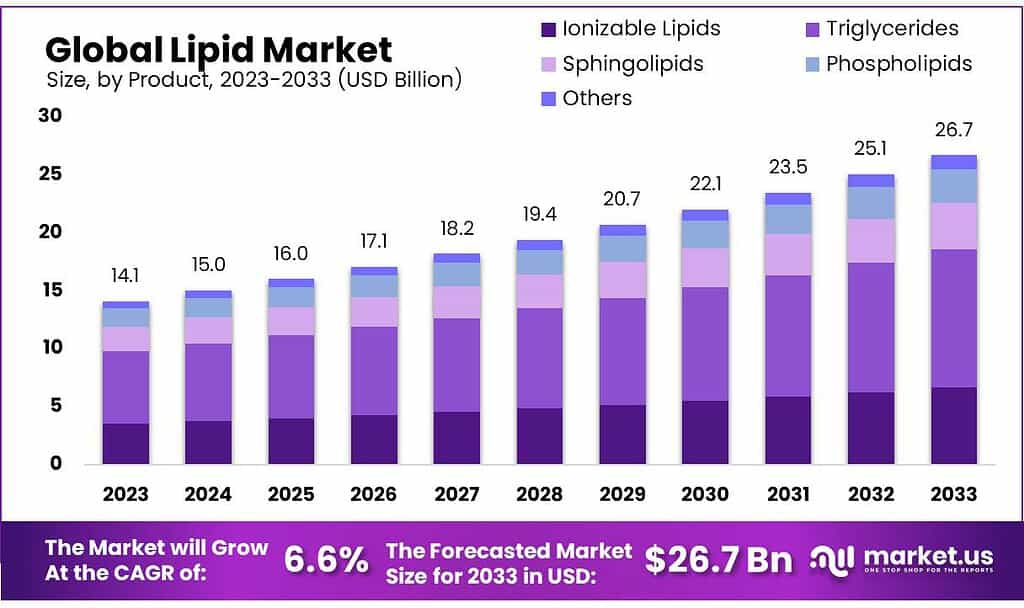

The global Lipid market size is expected to be worth around USD 26.7 billion by 2033, from USD 14.1 billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2023 to 2033.

The industry is predicted to grow due to rising demand for lipids, as well as changing lifestyles and changing food habits. The product is also important in chronic diseases like arthritis, cystic Fibrosis, asthma, and cancer. This will drive the market and see significant growth over the forecast period.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The lipid market is expected to grow significantly, reaching around USD 26.7 billion by 2033 from USD 14.1 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 6.6%.

- Driving Factors for Market Growth: Health and Lifestyle Changes: Increasing demand for lipids due to changing lifestyles and food habits, especially in chronic disease management like arthritis, cystic fibrosis, asthma, and cancer. Diverse Applications: Lipids are not only crucial in pharmaceuticals but also in food, beverages, cosmetics, and supplements, attributing to market growth.

- Top Product Segments: Triglycerides dominate the market, followed by ionizable lipids, sphingolipids, phospholipids, and others.

- Applications: Food & beverages lead the market, followed by pharmaceuticals and nutrition & supplements.

- Drivers: Increased prevalence of chronic diseases globally and the rising demand for lipid-based therapeutics.

- Restraints: High costs associated with lipid synthesis and raw materials, coupled with manufacturing challenges.

- Opportunities: Rising healthcare spending driving market growth and advancements in research and product development by key industry players.

- Challenges Faced by the Industry: Regulatory Hurdles: Obtaining approvals for lipid-based drugs and compliance with stringent regulations pose significant challenges.

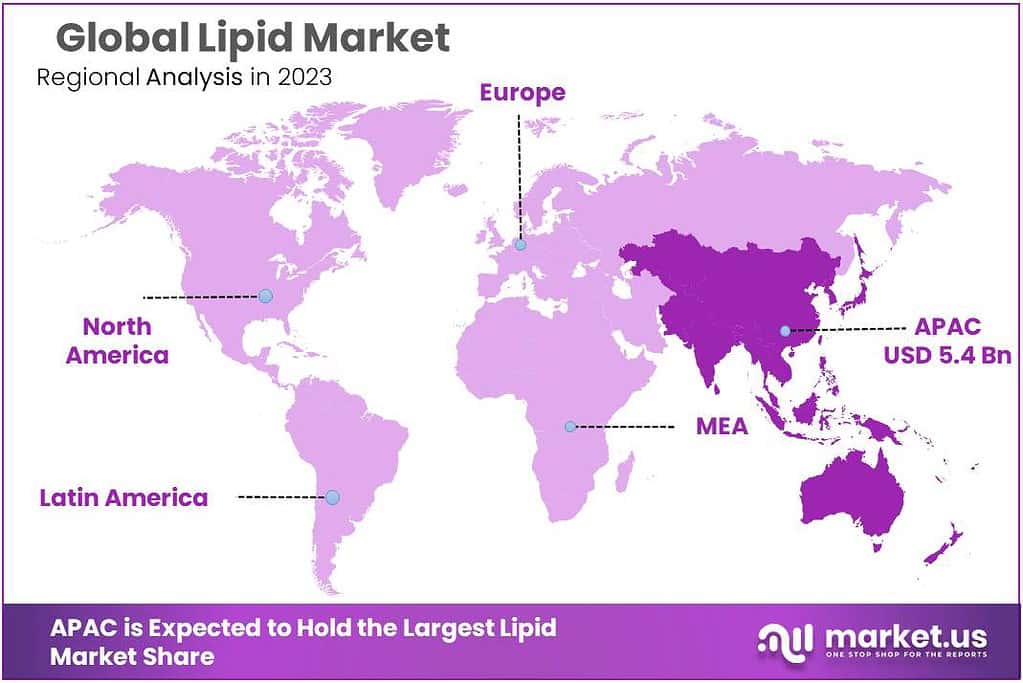

- Regional Analysis: Asia Pacific Dominance: The region holds the largest share in the lipid market (40% in 2023), driven by India and China’s growing populations, changing lifestyles, and favorable government policies.

- Key Players and Recent Developments: Major Players: Merck Millipore Ltd, Avanti Polar Lipids, ABITEC Corporation, among others, have been involved in strategic partnerships and acquisitions to advance lipid-based products.

By products

In 2023, Triglycerides were the top player in the lipid market, holding a strong position with over 44.6% market share. These fats are widely used in various industries due to their versatility.

Ionizable lipids, another key segment, showed promising growth with increased demand for their unique properties in drug delivery systems.

Sphingolipids, though a smaller segment, gained attention for their role in cell signaling and their potential applications in skincare and pharmaceuticals.

Phospholipids, with their vital role in cell membranes, maintained a steady presence in the market, finding uses in food, cosmetics, and pharmaceutical formulations.

Other lipid categories showcased potential niche applications, contributing steadily to the overall market growth with innovative uses yet to be fully explored.

Overall, the lipid market in 2023 displayed a diverse landscape, with triglycerides leading the way while other segments presented promising opportunities for innovation and growth.

By phase

In 2023, the “Others” category emerged as a dominant force in the lipid market, securing over 70.1% of the market share. This broad category encompasses a range of lipid-related products not specifically categorized in clinical or pre-clinical segments.

The Clinical segment exhibited significant growth due to the rising demand for lipid-based therapeutics in treating various diseases and conditions. Its applications in drug development and healthcare marked a notable presence within the market.

Pre-clinical products, while holding a smaller market share, showed promise in the research and development phases, playing a crucial role in testing and early-stage trials for potential lipid-based treatments and therapies.

The dominance of the “Others” category underscores the diverse applications and uses of lipids that extend beyond clinical and pre-clinical realms. This segment encompasses innovative and niche lipid products, contributing substantially to the market’s overall growth and potential for further exploration in multiple industries

Application Analysis

In 2023, Food & Beverages led the lipid market, commanding over 35.1% of the share. Lipids play a crucial role in food and beverage production, contributing to taste, texture, and shelf life extension.

One of the main factors behind the growth of the food and beverage industries is the increasing importance of lipids in our bodies with their functional benefits. Preparing commercial edibles for sale involves the use of lipids to enhance the taste, texture, and density.

The industry share for nutrition & supplement applications is above 22% in 2023. It is expected to grow at a 9.8% CAGR between 2023 and 2032. The segment will be driven by rising awareness of health and fitness and increased consumption of nutrition and supplements.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Product

- Ionizable Lipids

- Triglycerides

- Sphingolipids

- Phospholipids

- Others

By Phase

- Clinical

- Pre-clinical

- Others

By Application

- Food & Beverages

- Pharmaceuticals

- Nutrition & Supplements

- Other Applications

Drivers

Increase in Prevalence of Chronic Diseases:

Chronic diseases have become a worldwide epidemic. According to the World Health Organization, they were responsible for approximately 60% of deaths worldwide in 2023 – partly driven by aging populations in Western nations where more older people suffer from ailments like heart and neurological problems and disorders that require medication containing lipids – driving up demand and demand for medicines that will fuel growth of the global lipid market over the coming years.

Lipids are increasingly present across industries such as food, beverages, and cosmetics; not just medicine. Dietary supplements containing lipids provide energy as well as fat-soluble vitamins; thanks to COVID-19’s impact on health, there has been an explosion of demand for dietary supplements with various forms and flavors now making them attractive to people of all ages; therefore driving up market demand for lipids even further.

Lipids and polymers play an essential role in medicine making. Acting like building blocks for numerous medications, they keep things stable while aiding their dissolution faster. People are now using various kinds of lipids and polymers found both naturally or created artificially to create medications; this trend will undoubtedly drive market expansion for these materials in future.

Restraints

Lipid Synthesis and Raw Materials Costs:

Drug development using lipids can be quite expensive. First off, developing them takes both time and money; you have to determine how to make them, obtain all of the right materials, and test them thoroughly to ensure safety before releasing the final version onto the market. Any changes require further tests – with additional investments for new technologies like that involved with it all adding up quickly making drugs made with lipids extremely costly in terms of price for consumers – this being an issue within their respective market sectors.

Manufacturing challenges associated with lipid nanoparticle production:

Lipid nanoparticles are essential in medicine production, acting like carriers that carry essential ingredients directly to our cells. Recently vaccines have relied heavily on them. But their production can present numerous obstacles. To make these important particles efficiently and without incident. Pharmaceutical industry members are constantly working to address them as production challenges; much like solving a puzzle.Opportunity

As people across countries spend more money on healthcare, governments and healthcare groups have contributed more money towards meeting people’s needs. This increase in healthcare spending has proved hugely helpful for medical facilities; helping them treat more diseases that are now widespread.

Big companies in the market are doing some smart things to deal with the rising number and seriousness of diseases worldwide. They’re putting a lot more effort and money into doing better research. They’re launching new products, teaming up with others, buying or merging with different companies, and doing more. For example, Evonik, a company, put a bunch of money into making specialty lipids faster at their places in Germany. These lipids were a big part of the Pfizer/BioNTech vaccine. They even delivered the first batches way ahead of schedule, which was a big deal. All these moves by companies are expected to create more chances for growth and progress in the market.

Challenges

Regulatory hurdles and compliance issues: Securing approval for new lipid-based drugs or products is no simple matter. Companies must abide by numerous rules and regulations which, at times, can be quite restrictive, slowing down the entire approval process. Fulfilling all requirements to comply with regulations can present companies operating in this market with numerous challenges to face.

Competition and Innovation Pressure:

It can be tough for companies in the lipid market to stand out amongst all of the competition and innovate new uses for lipids; many businesses compete to come up with something groundbreaking that stands out. Staying ahead requires constantly coming up with creative ways to use lipids; staying ahead requires constantly coming up with innovative uses for them – it can feel like a race between companies trying to come up with something groundbreaking! Keeping pace requires constantly thinking up ways of using them that differentiate yourself, something many cannot manage successfully when trying to differentiate themselves against rival companies trying to be first!Technological Advancements and Complexity:

Technology keeps progressing rapidly, which affects the lipid market as well. New tech means new ways of creating drugs or using lipids effectively; companies must keep up by staying abreast with developments. Understanding complex technologies and finding out how best to apply them effectively may present unique challenges; similar to learning a foreign language before learning how to write poems with it!Regional Analysis

The Asia Pacific dominated the global lipids market with the largest volume share of 40% in 2023. The region is positively influenced by India and China. The market is being driven by a growing population, changing lifestyles, favorable government policies & investments made by large enterprises.

This can be recognized by the increased demand for nutraceutical products and the expansion of the regional pharmaceutical industry. Due to growing demand in the nutraceutical industry, India will likely hold the largest share of the Asia Pacific lipids market.

North America’s market held 24.8% of the global market in 2023, & it is estimated to grow 8.3% between 2023-2032. The U.S. has a positive impact on the market. The market is being supported by a growing awareness of health & fitness in the region. This area has a large market for nutritional supplements and fortified foods.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

There are many well-established players, as well as small and medium players in the lipid market. Croda purchased Avanti Polar Lipids, one of the largest companies in drug delivery systems. Moderna Inc. extended the contract with CordenPharma in May 2020. CordenPharma is a supplier of pharmaceutical ingredients.

Moderna was able to secure large quantities of lipids for the production of the COVID-19 vaccine, as per the agreement. This initiative will increase the number of customers who can implement the product. To expand their reach across the globe, the manufacturers are following both organic and inorganic strategies. The following are some of the major players in the global market for lipids:

Market Key Players

- Merck Millipore Ltd

- Avanti Polar Lipids

- ABITEC Corporation

- Chemi S.p.A

- Tokyo Chemical Industry Co. Ltd

- Stepan Company

- Archer Daniels Midland Company

- Matreya LLC

- Cargill Incorporated

- Omega Protein Corporation

- DSM

- Polaris

Recent Developments

In November 2022, BioNTech SE announced its Singapore affiliate BioNTech Pharmaceuticals Asia Pacific Pte. Ltd. had agreed with Novartis Singapore Pharmaceutical Manufacturing Pte. Ltd. to acquire one of its GMP-certified manufacturing facilities.

In April 2023, DSM announced a partnership with Nutreco to develop sustainable aquafeed solutions using algae-based omega-3 fatty acids.

In March 2023, Cargill announced the launch of its new line of plant-based meat alternatives, made from pea protein.

Report Scope

Report Features Description Market Value (2023) USD 14.1 Billion Forecast Revenue (2033) USD 26.6 Billion CAGR (2023-2032) 6.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Ionizable Lipids, Triglycerides, Sphingolipids, Phospholipids, Others), By Phase (Clinical, Pre-clinical, Others), By Application (Food And Beverages, Pharmaceuticals, Nutrition And Supplements, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Merck Millipore Ltd, Avanti Polar Lipids, ABITEC Corporation, Chemi S.p.A, Tokyo Chemical Industry Co. Ltd, Stepan Company, Archer Daniels Midland Company, Matreya LLC, Cargill Incorporated, Omega Protein Corporation, DSM, Polaris Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are lipids?Lipids are organic compounds that include fats, oils, waxes, and certain vitamins (like A, D, E, and K). They serve as essential structural components of cell membranes and play a crucial role in energy storage and signaling.

What challenges does the lipid market face?Challenges include fluctuating prices of raw materials (such as oilseeds for oil production), sustainability concerns regarding sourcing, regulatory compliance, and the need for innovation to develop healthier lipid alternatives.

What are the emerging trends in the lipid market?Emerging trends include the development of functional lipids with specific health benefits, increased use of omega-3 fatty acids in food and supplements, and technological advancements in lipid extraction and modification processes.

-

-

- Merck Millipore Ltd

- Avanti Polar Lipids

- ABITEC Corporation

- Chemi S.p.A

- Tokyo Chemical Industry Co. Ltd

- Stepan Company

- Archer Daniels Midland Company

- Matreya LLC

- Cargill Incorporated

- Omega Protein Corporation

- DSM

- Polaris