Global Linear Alpha Olefin Market Size, Share, And Industry Analysis Report By Product Type (Hexene, Butene, Octene, Decene, Dodecene, Tetradecene, Hexadecene, Octadecene), By Application (LLDPE, HDPE, Poly Alpha Olefins, Detergents, Lubricants), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177814

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

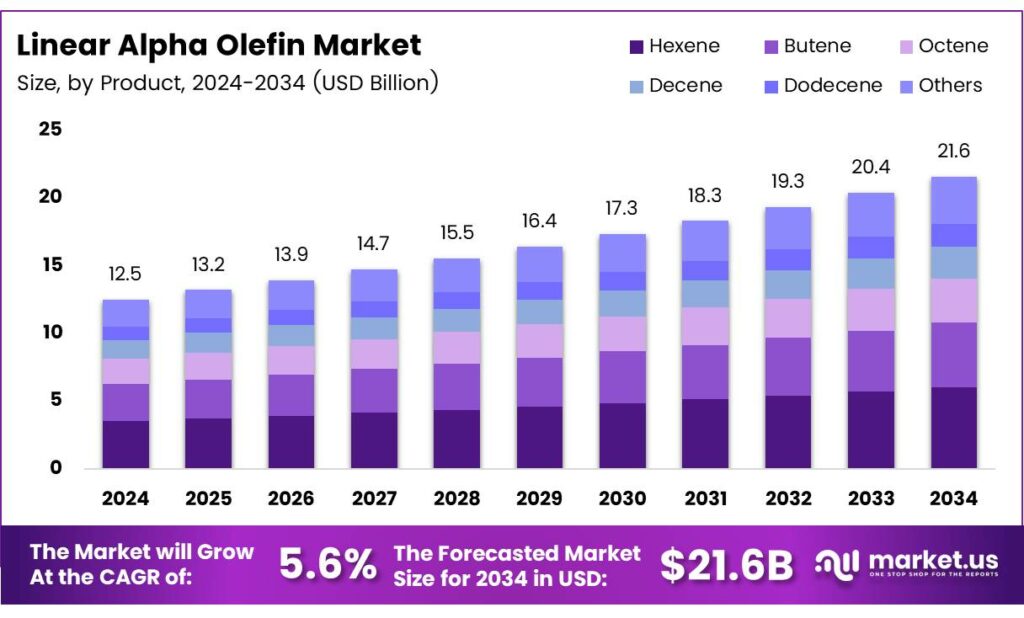

The Global Linear Alpha Olefin Market size is expected to be worth around USD 21.6 billion by 2034 from USD 12.5 billion in 2024, growing at a CAGR of 5.6% during the forecast period 2025 to 2034.

Linear alpha olefins represent essential petrochemical intermediates derived primarily from ethylene oligomerization processes. These compounds serve as critical building blocks for producing polyethylene comonomers, synthetic lubricants, and surfactant precursors. Moreover, their molecular structure enables precise tailoring of end-product properties across diverse industrial applications.

Manufacturers utilize linear alpha olefins to enhance polyethylene film strength and flexibility. Industries increasingly adopt these materials for packaging, construction, and automotive components. Consequently, demand continues expanding across multiple value chains requiring superior performance characteristics.

- Global petrochemical companies continue to invest in advanced catalyst systems and integrated production units to improve efficiency and manage fluctuating feedstock costs. Shell’s Geismar facility increased its alpha olefins capacity to 1.3 million tonnes per year after major infrastructure upgrades.

- The Geismar Tiger AO4 project alone added 425,000 tons per year through a $717 million investment, strengthening North America’s supply base for polyethylene and detergent producers. The expansion also supported the local economy by creating 1,500 construction jobs and 20 permanent roles.

Emerging markets exhibit robust consumption growth driven by urbanization and infrastructure development initiatives. Asia Pacific countries lead global demand expansion, particularly in packaging films and industrial lubricants. Additionally, shale gas availability in North America enhances regional cost competitiveness for ethylene-based alpha olefin production facilities.

Strategic collaborations between petrochemical producers and end-use manufacturers accelerate product innovation cycles. Companies develop specialty grades targeting high-value applications in oilfield chemicals and advanced polymer formulations. Consequently, market participants capture premium pricing opportunities while diversifying revenue streams beyond commodity-grade products.

Key Takeaways

- The Global Linear Alpha Olefin Market is projected to grow from USD 12.5 billion in 2024 to USD 21.6 billion by 2034 at a CAGR of 5.6%.

- Hexene segment dominates the By Product Type category with 26.7% market share in 2025.

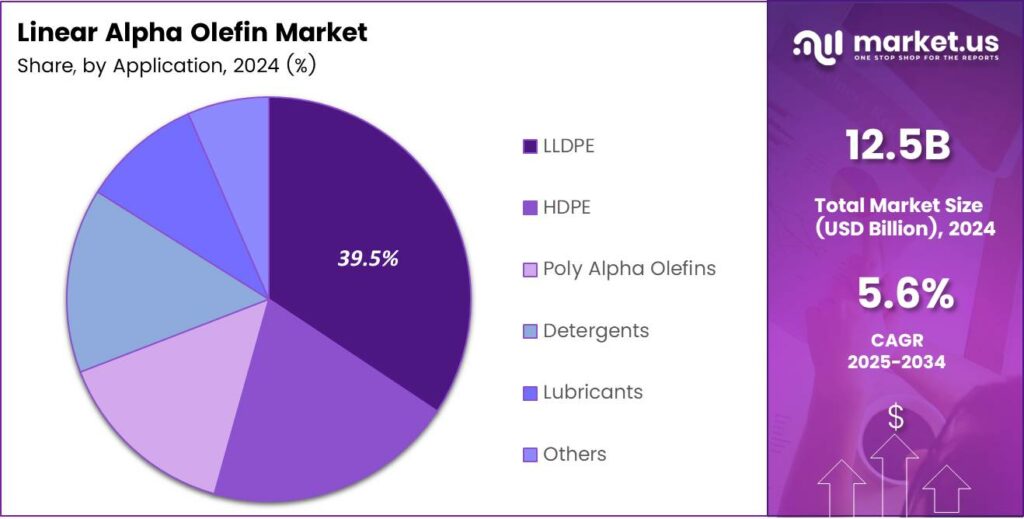

- LLDPE application leads the By Application segment, holding 39.5% share in 2025.

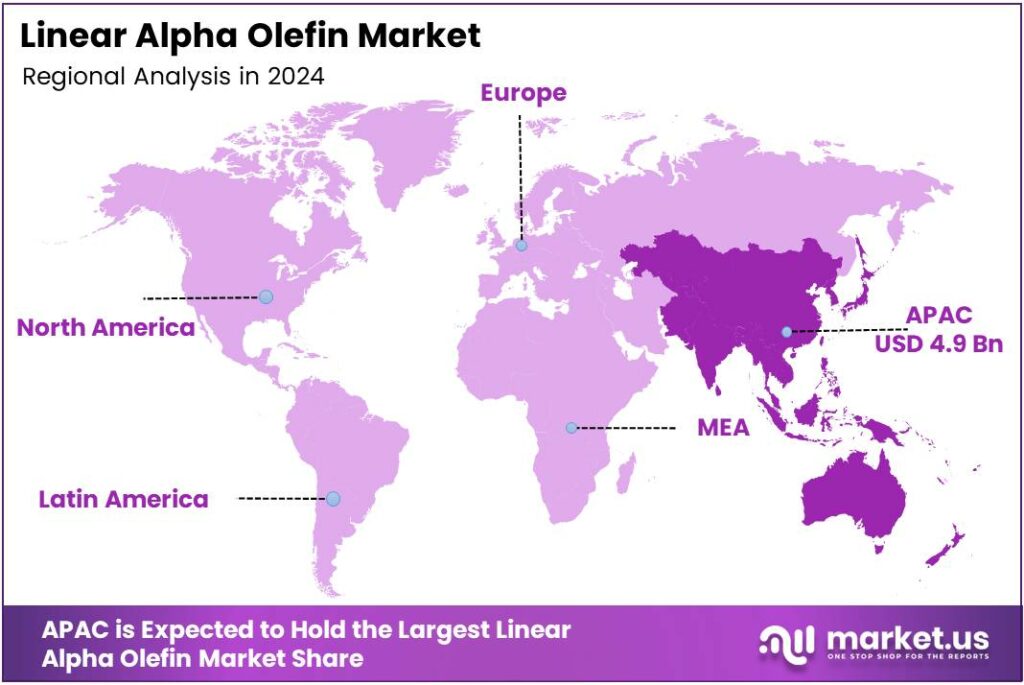

- The Asia-Pacific region commands 39.4% market share, valued at USD 4.9 billion.

By Product Type Analysis

Hexene dominates with 26.7% due to its critical role as LLDPE comonomer

In 2025, Hexene held a dominant market position in the By Product Type segment of the Linear Alpha Olefin Market, with a 26.7% share. Manufacturers prioritize hexene production because it enhances polyethylene film properties, including puncture resistance and flexibility. Consequently, packaging and agricultural film producers maintain a consistent demand for this essential comonomer grade.

Butene serves specialized applications in high-density polyethylene and synthetic rubber formulations. Producers utilize butene for creating impact-resistant plastic components and elastomeric materials. Additionally, this lower-carbon alpha olefin enables cost-effective polymer modification for specific industrial requirements.

Octene provides superior performance characteristics in premium linear low-density polyethylene grades. Film manufacturers adopt octene-based resins for demanding applications requiring exceptional clarity and mechanical strength. Therefore, specialty packaging and medical film markets drive sustained octene consumption growth.

By Application Analysis

LLDPE dominates with 39.5% due to extensive packaging and film applications

In 2025, LLDPE held a dominant market position in the By Application segment of the Linear Alpha Olefin Market, with a 39.5% share. Linear low-density polyethylene manufacturing consumes significant alpha olefin volumes as essential comonomers. Moreover, flexible packaging, stretch films, and agricultural mulch applications sustain robust LLDPE resin demand globally.

HDPE production utilizes alpha olefins to improve polymer density and stiffness characteristics. Pipe manufacturers and container producers prefer HDPE grades incorporating alpha olefin comonomers. Additionally, infrastructure projects and potable water systems drive sustained high-density polyethylene consumption patterns.

Poly Alpha Olefins represent high-performance synthetic lubricants serving automotive and industrial machinery sectors. These fluids offer superior thermal stability and viscosity performance compared to conventional mineral oils. Consequently, automotive manufacturers increasingly specify polyalphaolefin-based lubricants for modern engine designs.

Key Market Segments

By Product Type

- Hexene

- Butene

- Octene

- Decene

- Dodecene

- Tetradecene

- Hexadecene

- Octadecene

- Others

By Application

- LLDPE

- HDPE

- Poly Alpha Olefins

- Detergents

- Lubricants

- Others

Drivers

Rising Demand for High-Performance Polyethylene Drives Market Growth

Packaging industries require advanced polyethylene films offering superior mechanical properties and barrier performance. Alpha olefins enable manufacturers to produce flexible packaging materials with enhanced puncture resistance. Consequently, food preservation and consumer goods sectors drive sustained comonomer demand growth across global markets.

- Infrastructure development projects worldwide consume substantial quantities of polyethylene pipes and geomembranes. Construction companies specify alpha olefin-modified resins for critical applications requiring long-term durability. According to Chevron Phillips Chemical, the Cedar Bayou facility expanded normal alpha olefins capacity by 100,000 metric tons per year, supporting downstream polyethylene producers.

Automotive manufacturers increasingly adopt lightweight plastic components to improve fuel efficiency and reduce emissions. Alpha olefin-based polymers deliver necessary strength-to-weight ratios for interior and exterior applications. Additionally, electric vehicle production accelerates demand for specialized polymer formulations incorporating advanced comonomer technologies.

Restraints

Feedstock Price Volatility Constrains Production Economics

Ethylene prices fluctuate significantly based on crude oil costs and natural gas availability patterns. Producers face margin compression during periods of elevated feedstock expenses combined with competitive product pricing. Therefore, integrated petrochemical complexes maintain strategic advantages through vertical supply chain optimization.

Environmental compliance costs continue increasing as governments implement stricter emission standards and waste management requirements. Manufacturers invest substantially in pollution control equipment and process modifications to meet regulatory mandates. Moreover, carbon pricing mechanisms in developed markets add operational expense burdens, affecting overall profitability.

Market participants navigate complex permitting processes for new production facilities and capacity expansions. Regulatory approval timelines extend project development schedules and increase capital expenditure uncertainty. Additionally, public opposition to petrochemical investments creates additional challenges for industry growth initiatives.

Growth Factors

Shale Gas Expansion Creates Cost-Competitive Production Opportunities

North American shale gas development provides abundant low-cost ethylene feedstock for alpha olefin manufacturers. Producers leverage regional natural gas liquids availability to establish a competitive advantage in global markets. Consequently, United States facilities expand capacity aggressively while maintaining favorable production economics.

- Specialty chemical applications demand high-purity alpha olefin grades for oilfield chemicals and enhanced recovery solutions. Energy sector operators adopt advanced drilling fluid formulations and production chemicals incorporating specialty olefins. According to Dow, Packaging & Specialty Plastics generated $21,776 million in net sales in FY2024, demonstrating the substantial value chains consuming alpha-olefin-based polyethylene products.

Biodegradable detergent formulations increasingly utilize linear alkylbenzene derived from alpha olefin feedstocks. Consumer preference for environmentally friendly cleaning products drives surfactant demand growth. Additionally, regulatory pressures to reduce phosphate usage enhance linear alkylbenzene adoption in household and industrial applications.

Emerging Trends

Sustainable Manufacturing Processes Reshape Industry Standards

Petrochemical producers develop bio-based alpha olefin production routes utilizing renewable feedstock sources. Companies invest in research programs exploring enzymatic processes and biomass conversion technologies. Therefore, market participants position themselves for future regulatory requirements and consumer preferences favoring sustainable materials.

- Catalyst technology advancements improve ethylene oligomerization selectivity and energy efficiency significantly. Manufacturers adopt next-generation catalyst systems, reducing by-product formation and operational costs. The Geismar facility achieved 1.3 million tonnes per year total capacity through strategic technology implementations and infrastructure optimization.

Integrated petrochemical complexes pursue aggressive capacity expansion strategies in high-growth regional markets. Companies establish world-scale production facilities leveraging economies of scale and feedstock integration benefits. Additionally, strategic partnerships between producers and end-users accelerate product development cycles for specialized applications.

Regional Analysis

Asia Pacific Dominates the Linear Alpha Olefin Market with a Market Share of 39.4%, Valued at USD 4.9 Billion

Asia Pacific commands global market leadership driven by robust polyethylene demand and expanding petrochemical infrastructure. China, India, and Southeast Asian nations invest heavily in integrated production facilities supporting domestic manufacturing sectors. The region holds 39.4% market share, valued at USD 4.9 billion, reflecting sustained consumption growth across the packaging, construction, and automotive industries.

North America benefits from abundant shale gas resources, enabling cost-competitive ethylene production and downstream integration. United States Gulf Coast facilities undergo substantial capacity expansion,s leveraging feedstock advantages. Moreover, Chevron Phillips Chemical’s Cedar Bayou expansion created up to 600 construction jobs, demonstrating regional economic impacts beyond production capacity additions.

Europe emphasizes sustainable manufacturing practices and circular economy initiatives within petrochemical operations. Producers invest in emissions reduction technologies and renewable feedstock research programs. Additionally, stringent environmental regulations drive innovation in process efficiency and waste minimization across regional facilities.

Middle East countries leverage abundant natural gas reserves for petrochemical complex development and export-oriented production. Qatar and Saudi Arabia establish world-scale facilities serving Asian and European markets. Furthermore, strategic geographic positioning enables efficient product distribution to high-growth consumption regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ExxonMobil Chemical Company maintains global leadership through vertically integrated operations spanning ethylene production to alpha olefin manufacturing. The company operates world-scale facilities leveraging proprietary catalyst technologies and process innovations. Moreover, ExxonMobil serves diverse end-markets including polyethylene, synthetic lubricants, and surfactant applications, while maintaining strong customer relationships across value chains.

Chevron Phillips Chemical Company LLC demonstrates strategic commitment through substantial capacity investments and technological advancement initiatives. The company expanded Cedar Bayou operations, adding 100,000 metric tons per year of normal alpha-olefins capacity. Additionally, Chevron Phillips operates a 250,000 metric ton on-purpose 1-hexene unit co-located at Cedar Bayou, strengthening comonomer supply capabilities.

SABIC leverages its Middle Eastern feedstock advantages to establish a competitive position in global alpha olefin markets. The company operates integrated petrochemical complexes producing ethylene derivatives and downstream specialty products. Furthermore, SABIC pursues strategic partnerships and technology licensing agreements, expanding its geographical footprint and market presence.

Shell Chemicals operates leading-edge production facilities, including the Geismar complex featuring advanced alpha olefin manufacturing capabilities. Shell invested $717 million in the Tiger AO4 expansion project, utilizing an 800-acre site footprint to achieve substantial capacity additions. Therefore, Shell maintains strong market positioning through operational excellence and continuous infrastructure investments.

Top Key Players in the Market

- ExxonMobil Chemical Company

- Chevron Phillips Chemical Company LLC

- SABIC

- INEOS Group

- Shell Chemicals

- Sasol Ltd.

- Evonik Industries AG

- Dow Chemical Company

- Qatar Chemical Company Ltd.

- Reliance Industries Ltd.

- Indian Oil Corporation Ltd.

Recent Developments

- In 2025, ExxonMobil successfully started up a new Linear Alpha Olefins (LAO) production facility, marking its entry into the linear alpha olefins market and enhancing its Specialty and Chemical Products businesses. This development is part of broader investments at the Baytown chemical complex, which aim to grow volumes and improve product mix.

- In 2025, SABIC highlighted its Linear Alpha Olefin catalyst for ethylene oligomerization innovative solutions portfolio, emphasizing process reliability improvements and long shelf-life for LAO production. This catalyst is designed to produce full-range LAO products with adjustable distribution to meet market demands, lower polymer formation, and enhanced overall process reliability.

Report Scope

Report Features Description Market Value (2024) USD 12.5 billion Forecast Revenue (2034) USD 21.6 billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hexene, Butene, Octene, Decene, Dodecene, Tetradecene, Hexadecene, Octadecene, Others), By Application (LLDPE, HDPE, Poly Alpha Olefins, Detergents, Lubricants, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ExxonMobil Chemical Company, Chevron Phillips Chemical Company LLC, SABIC, INEOS Group, Shell Chemicals, Sasol Ltd., Evonik Industries AG, Dow Chemical Company, Qatar Chemical Company Ltd., Reliance Industries Ltd., Indian Oil Corporation Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Linear Alpha Olefin MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Linear Alpha Olefin MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ExxonMobil Chemical Company

- Chevron Phillips Chemical Company LLC

- SABIC

- INEOS Group

- Shell Chemicals

- Sasol Ltd.

- Evonik Industries AG

- Dow Chemical Company

- Qatar Chemical Company Ltd.

- Reliance Industries Ltd.

- Indian Oil Corporation Ltd.