Global Lift Trucks Market Size, Share, Growth Analysis By Product (ICE, Electric Units, Aftermarket, Service, Rental & Other), By Distribution Channel (Independent Dealers, Major Accounts), By End Use (Retail and Durable Goods, Logistics, Food and Beverage, Industrials), By Revenue Class (Class 1 Electric, Class 2 Electric, Class 3 Electric, Class 4 ICE, Class 5 ICE) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153374

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

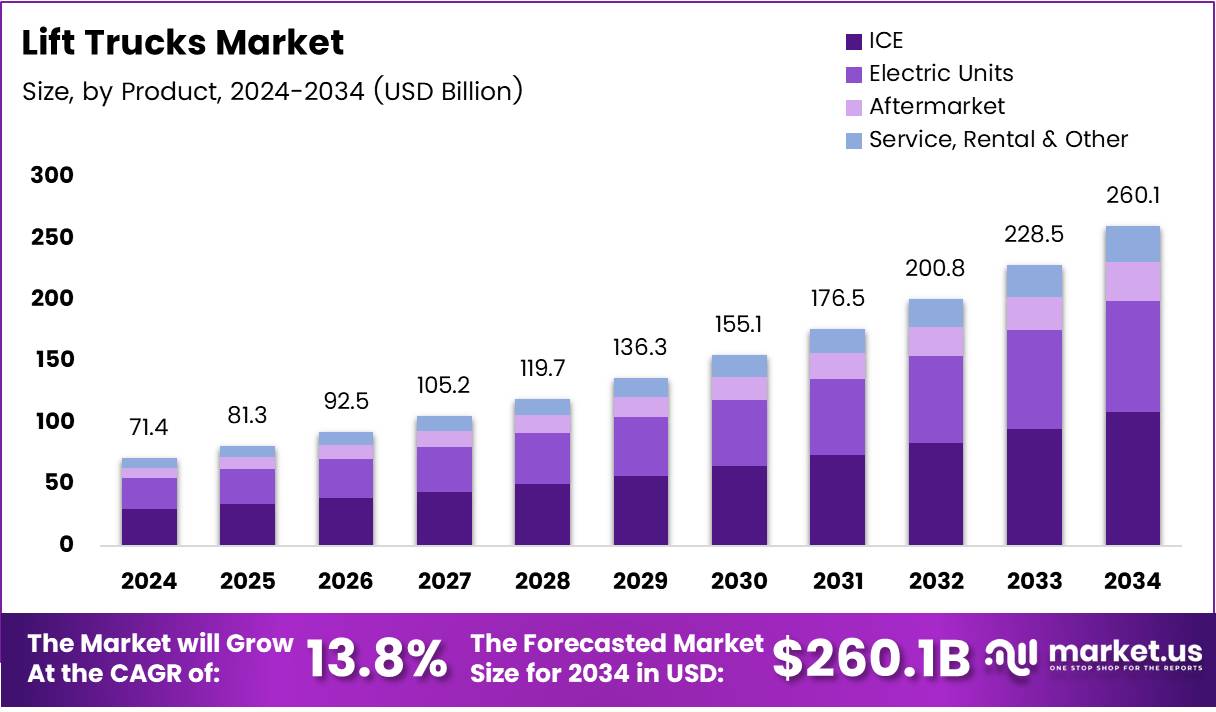

The Global Lift Trucks Market size is expected to be worth around USD 260.1 Billion by 2034, from USD 71.4 Billion in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034.

The lift trucks market is a vital segment within material handling equipment, driven by industries that rely on efficient logistics and warehouse operations. The market is characterized by a wide range of truck types, each designed for specific tasks such as transporting heavy loads, maneuvering in tight spaces, and improving productivity. As a result, the demand for lift trucks has been consistently rising, particularly in sectors like retail, e-commerce, and manufacturing.

Growth in the lift trucks market is fueled by technological advancements that improve efficiency and safety. Manufacturers have focused on developing electric and hybrid models, offering improved environmental performance while reducing operational costs. Moreover, innovations like telematics integration for real-time tracking are expected to boost market growth. These enhancements provide a competitive edge to companies that prioritize operational optimization.

Government investments and regulatory frameworks play a crucial role in shaping the lift trucks market. Governments worldwide are focusing on infrastructure development and manufacturing innovations. This is expected to increase demand for material handling solutions, such as lift trucks, particularly in emerging markets. For example, regulatory standards on workplace safety, such as OSHA regulations, are encouraging businesses to upgrade their fleet to meet safety requirements.

Opportunities within the market include increased adoption of automation and robotics in warehouses and distribution centers. The integration of autonomous lift trucks is likely to enhance operational efficiency and minimize human error. These technological improvements are anticipated to lower long-term operational costs while increasing productivity across industries, thereby driving market expansion.

The latest market statistics reflect a slight shift in purchasing preferences. According to industrialforklifts, in 2024, 56% of respondents indicated they would likely buy or lease a lift truck within the next 24 months, a decrease from 61% in the previous year. Additionally, 51% of lift trucks were purchased, while 29% were leased, reflecting a clear preference for ownership over leasing.

Furthermore, the most commonly replaced parts were wheels & tires (59%) and batteries & battery accessories (50%), highlighting the focus on maintaining essential components to prolong the life of lift trucks. According to toyotaliftne, the capacity of forklifts ranges from 3,000 lbs. to around 70,000 lbs., with weight, size, and position impacting their overall performance.

Key Takeaways

- The Global Lift Trucks Market is projected to reach USD 260.1 billion by 2034, from USD 71.4 billion in 2024, growing at a CAGR of 13.8% from 2025 to 2034.

- In 2024, ICE units led the By Product Analysis segment with 46.1% market share, favored for heavy-duty material handling.

- In 2024, Independent Dealers dominated the By Distribution Channel Analysis segment with 81.2% market share, due to their personalized service and flexibility.

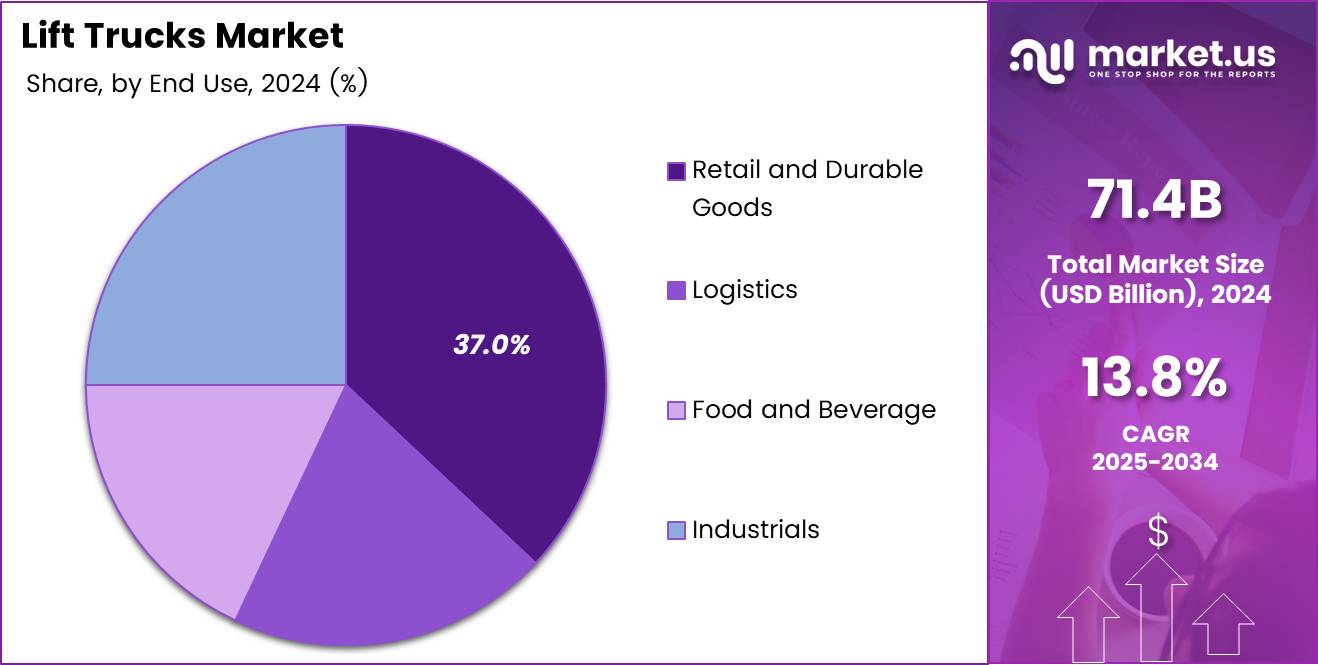

- The Retail and Durable Goods sector held the largest share of 37.1% in the By End Use Analysis segment in 2024, driven by demand for efficient material handling in retail environments.

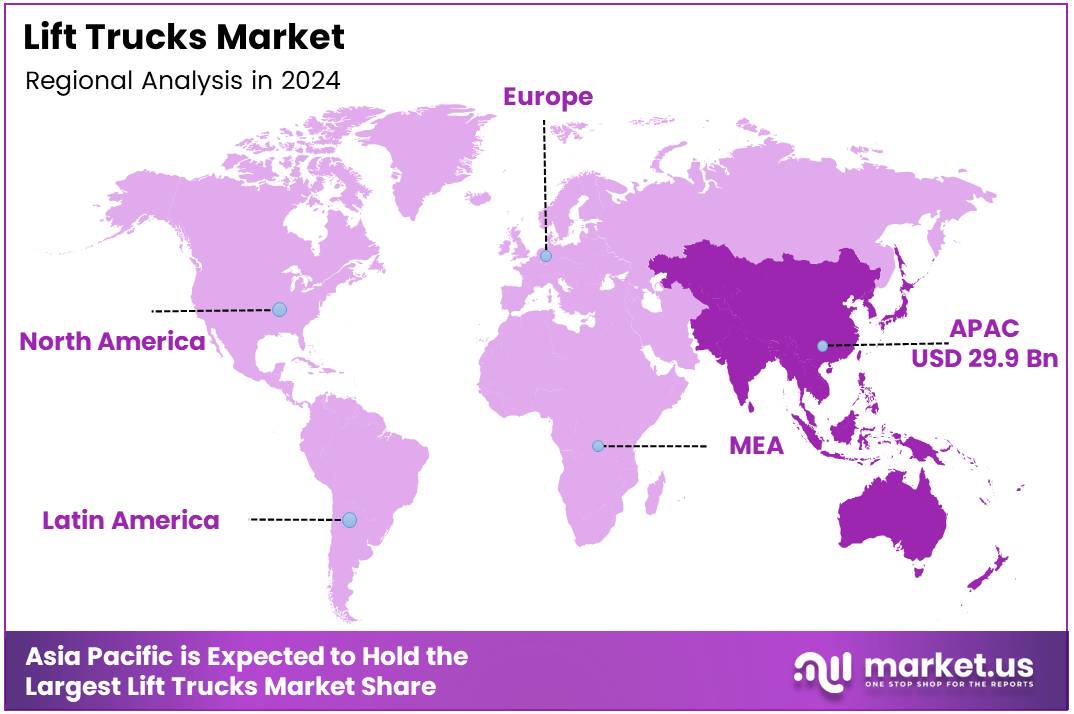

- Asia Pacific led the global lift truck market in 2024 with 41.9% market share, valued at USD 29.9 billion, fueled by e-commerce growth and industrialization.

Product Analysis

In 2024, ICE held a dominant market position in By Product Analysis segment of Lift Trucks Market, with a 46.1% share.

In 2024, ICE (Internal Combustion Engine) units led the By Product Analysis segment of the lift truck market, capturing a significant share of 46.1%. This dominance can be attributed to the widespread use of ICE-powered trucks in industries requiring heavy-duty material handling. ICE units are particularly favored for their power and efficiency, especially in rugged environments where electric units may fall short.

Electric units followed as the second most preferred product type, providing a cleaner alternative with improved energy efficiency. However, the higher initial cost and limited range of electric lift trucks hinder their growth in comparison to ICE units.

The aftermarket segment plays a crucial role in sustaining the market, providing customers with essential spare parts and service solutions. The aftermarket segment’s growth is anticipated to remain robust due to the extensive base of ICE-powered lift trucks in operation.

Service, rental, and other solutions also showed significant demand, reflecting the growing preference for flexible and cost-effective material handling options. These segments are expected to continue expanding as businesses seek more adaptable solutions for their logistics needs.

Distribution Channel Analysis

In 2024, Independent Dealers held a dominant market position in By Distribution Channel Analysis segment of Lift Trucks Market, with a 81.2% share.

In 2024, Independent Dealers held the largest share of the By Distribution Channel Analysis segment of the lift truck market, accounting for 81.2%. Independent dealers have a well-established distribution network and are preferred for their personalized service and flexibility in product offerings. Their strong market presence has helped them build trust among customers looking for customized solutions and support.

Major accounts, while contributing to the segment, held a smaller market share. These accounts typically engage in bulk purchases and long-term contracts, providing a more standardized approach to lift truck distribution. Despite the growth in major accounts, the dominance of independent dealers is expected to persist due to their ability to offer diverse products and services that cater to different customer needs.

The growing preference for independent dealers is also driven by their ability to provide localized support and better after-sales services. Their extensive reach across various regions has played a key role in maintaining their market dominance.

End Use Analysis

In 2024, Retail and Durable Goods held a dominant market position in By End Use Analysis segment of Lift Trucks Market, with a 37.1% share.

In 2024, the Retail and Durable Goods sector captured the largest share in the By End Use Analysis segment of the lift truck market, representing 37.1%. This segment benefits from the ongoing demand for efficient material handling in retail environments, where fast-paced logistics and inventory management are crucial. Lift trucks are essential in warehouses, distribution centers, and retail operations to manage heavy loads and improve throughput.

Logistics followed closely, driven by the increasing need for transportation and supply chain solutions. The growing reliance on e-commerce platforms further boosts the demand for efficient logistics operations, which rely heavily on lift trucks.

The Food and Beverage sector showed significant growth as well, with demand for lift trucks to support the movement of goods in food processing plants and distribution centers. However, it lagged behind logistics and retail in overall market share.

The Industrials sector remained a steady consumer of lift trucks, supporting manufacturing and construction activities. While contributing to the overall market, its share was lower than other key sectors.

Key Market Segments

By Product

- ICE

- Electric Units

- Aftermarket

- Service, Rental & Other

By Distribution Channel

- Independent Dealers

- Major Accounts

By End Use

- Retail and Durable Goods

- Logistics

- Food and Beverage

- Industrials

By Revenue Class

- Class 1 Electric

- Class 2 Electric

- Class 3 Electric

- Class 4 ICE

- Class 5 ICE

Drivers

Growing Demand for Automated Material Handling Systems Drives Lift Trucks Market Growth

The demand for automated material handling systems in warehouses and factories is growing rapidly. As companies seek to improve efficiency and reduce labor costs, automated lift trucks are becoming more essential. These systems help in handling materials with precision, reducing errors and increasing overall productivity.

The rapid expansion of e-commerce is also a key driver of lift truck market growth. With online shopping booming, there is an increasing need for efficient logistics and inventory management. Lift trucks are crucial for handling large volumes of products in warehouses, helping businesses meet consumer demand more effectively.

Increased investments in infrastructure and the manufacturing sectors also contribute to market growth. As industries grow and expand, there is a rising demand for lift trucks to support production and supply chain processes.

Finally, the adoption of electric lift trucks is on the rise due to their environmental sustainability benefits. Businesses are increasingly focusing on reducing their carbon footprint, which makes electric models an attractive option.

Restraints

High Initial Investment and Maintenance Costs Restrain Lift Trucks Market Growth

One of the key challenges faced by the lift truck market is the high initial investment and maintenance costs associated with advanced models. This can be a barrier for small and medium-sized enterprises looking to upgrade their equipment.

The market is also impacted by the shortage of skilled labor in material handling and forklift operations. Proper training and experience are essential to operate lift trucks efficiently and safely, but the lack of qualified operators can limit market growth.

Stringent regulations related to safety and emissions compliance pose another challenge. These regulations can increase the costs and complexity of manufacturing lift trucks, making it harder for companies to stay competitive.

Additionally, supply chain disruptions can affect the availability of parts and materials needed to manufacture lift trucks. This can cause delays in production and negatively impact market growth.

Growth Factors

Development of Smart Lift Trucks with AI and IoT Capabilities Creates Market Growth Opportunities

The development of smart lift trucks with artificial intelligence (AI) and Internet of Things (IoT) capabilities presents significant growth opportunities. These advanced trucks can provide real-time data for improved decision-making, maintenance alerts, and performance tracking, making them an attractive investment for businesses seeking enhanced productivity.

Emerging markets are also creating opportunities for lift truck rental and leasing services. As industries in these regions grow, the demand for flexible equipment solutions increases, opening up new revenue streams for manufacturers and service providers.

The integration of autonomous and robotic systems with lift trucks is another promising opportunity. Autonomous systems can improve efficiency by reducing the need for human intervention and optimizing material handling processes.

Finally, the growing demand for battery-powered and fuel-efficient lift trucks aligns with the shift toward sustainability. These trucks reduce operational costs and carbon emissions, making them increasingly popular across various industries.

Emerging Trends

Increasing Focus on Ergonomic Designs and Sustainable Technologies Trends in Lift Trucks Market

There is a growing focus on ergonomic designs to enhance operator comfort and safety. Lift truck manufacturers are incorporating features such as adjustable seats, improved visibility, and better controls to reduce operator fatigue and minimize the risk of injury.

The integration of telematics is another important trend. This technology allows for real-time fleet management, helping businesses monitor the performance of their lift trucks, optimize usage, and track maintenance schedules.

As urbanization increases, there is a surge in demand for smaller and more compact lift trucks. These trucks are ideal for navigating tight spaces in urban warehouses and distribution centers, allowing businesses to maximize their storage and operational efficiency.

Green initiatives are also gaining traction in the market. Many companies are promoting the use of sustainable lift truck technologies, such as electric models, which align with global sustainability goals and appeal to environmentally conscious consumers.

Regional Analysis

Asia Pacific Dominates the Lift Trucks Market with a Market Share of 41.9%, Valued at USD 29.9 Billion

In 2024, Asia Pacific led the global lift trucks market with a dominant share of 41.9%, valued at USD 29.9 billion. The rapid expansion of e-commerce, particularly in countries like China and India, has spurred the demand for efficient material handling solutions. The ongoing industrialization and infrastructure development in emerging economies are expected to further drive growth in the region.

North America Lift Trucks Market Trends

North America holds a significant position in the lift trucks market due to the high demand for advanced material handling technologies in industries such as automotive and warehousing. The U.S. is particularly strong, benefiting from a well-established logistics infrastructure. The market is anticipated to continue growing as companies seek automation solutions to enhance operational efficiency.

Europe Lift Trucks Market Trends

Europe is experiencing steady growth in the lift trucks market, with a strong demand for electric and automated lift trucks. Environmental sustainability regulations are pushing businesses toward greener, more efficient solutions. Countries like Germany and the UK are key players in the market, with a focus on reducing carbon emissions and adopting clean technologies.

Middle East and Africa Lift Trucks Market Trends

The Middle East and Africa region is projected to see moderate growth in the lift trucks market, driven by ongoing construction projects and the need for improved logistics in the region. Increasing investments in infrastructure and warehousing are expected to boost market demand. However, economic fluctuations and geopolitical issues may present challenges.

Latin America Lift Trucks Market Trends

The Latin American lift trucks market is experiencing gradual growth, primarily due to the rising demand for automation in industries like food processing and manufacturing. Brazil and Mexico are leading the market in this region. While economic conditions have been fluctuating, the continued development of industrial sectors is expected to drive demand for material handling solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Lift Trucks Company Insights

In 2024, Hyster-Yale Material Handling Inc. is expected to maintain a strong position in the global lift trucks market with its diverse product portfolio and continuous innovation in material handling solutions. The company is focused on providing a wide range of electric and internal combustion lift trucks, enhancing operational efficiency for various industries.

Toyota Industries Corporation continues to be a market leader, driven by its commitment to advanced technology and sustainability in the forklift sector. Known for their high-quality products and exceptional after-sales service, Toyota’s electric lift trucks are gaining significant traction in warehouses and manufacturing facilities globally.

Jungheinrich Group is anticipated to see substantial growth in 2024 due to its emphasis on automation and warehouse management systems. The company’s innovative approach to integrating robotics with lift truck operations is expected to enhance productivity and reduce operational costs, positioning it as a preferred choice for customers seeking advanced material handling solutions.

KION Group AG remains a prominent player, leveraging its strong market presence with brands like Linde and Still. Known for its technologically advanced lift trucks and commitment to sustainability, KION is well-positioned to expand its reach in both the conventional and electric lift truck segments in the coming years.

Top Key Players in the Market

- Hyster-Yale Material Handling Inc.

- Toyota Industries Corporation

- Jungheinrich Group

- KION Group AG

- Mitsubishi Nichiyu Forklift Corporation.

- Crown Equipment

- Clark Material Handling

- Doosan Industrial

- Manitou

- Yale

- Linde Material Handling

Recent Developments

- In Jan 2025, Cyngn gains $33 million for its self-driving forklifts to advance the development of autonomous forklift solutions, enabling greater efficiency in material handling processes. This investment is expected to significantly enhance their product’s capabilities and market reach.

- In Sep 2024, Seegrid announces the closing of $50M Series D investment, surpassing expectations and positioning the company for significant growth in the autonomous lift truck market. The funds will help Seegrid accelerate the adoption of its autonomous solutions in logistics and warehousing.

- In Feb 2024, Big Lift LLC acquires ePicker LLC to expand its portfolio and enhance its technological capabilities in material handling. This strategic acquisition is expected to strengthen Big Lift’s market position by incorporating ePicker’s innovative products and technologies.

- In Feb 2024, Angus Lift Trucks is sold to Aprolis UK, marking a significant move in the lift truck industry. This acquisition is aimed at expanding Aprolis UK’s market presence and improving its product offering in the material handling sector.

Report Scope

Report Features Description Market Value (2024) USD 71.4 Billion Forecast Revenue (2034) USD 260.1 Billion CAGR (2025-2034) 13.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (ICE, Electric Units, Aftermarket, Service, Rental & Other), By Distribution Channel (Independent Dealers, Major Accounts), By End Use (Retail and Durable Goods, Logistics, Food and Beverage, Industrials), By Revenue Class (Class 1 Electric, Class 2 Electric, Class 3 Electric, Class 4 ICE, Class 5 ICE) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Hyster-Yale Material Handling Inc., Toyota Industries Corporation, Jungheinrich Group, KION Group AG, Mitsubishi Nichiyu Forklift Corporation., Crown Equipment, Clark Material Handling, Doosan Industrial, Manitou, Yale, Linde Material Handling Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hyster-Yale Material Handling Inc.

- Toyota Industries Corporation

- Jungheinrich Group

- KION Group AG

- Mitsubishi Nichiyu Forklift Corporation.

- Crown Equipment

- Clark Material Handling

- Doosan Industrial

- Manitou

- Yale

- Linde Material Handling