Global LiDAR Perimeter Detection Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Deployment (Fixed, Mobile), By Range (Short Range, Medium Range, Long Range), By End-User (Government and Defense, Utilities, Transportation, Commercial, Other End-Users), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 168068

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics

- Role of Generative AI

- Investment and Business Benefits

- North America Market Size

- Component Analysis

- Deployment Analysis

- Range Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

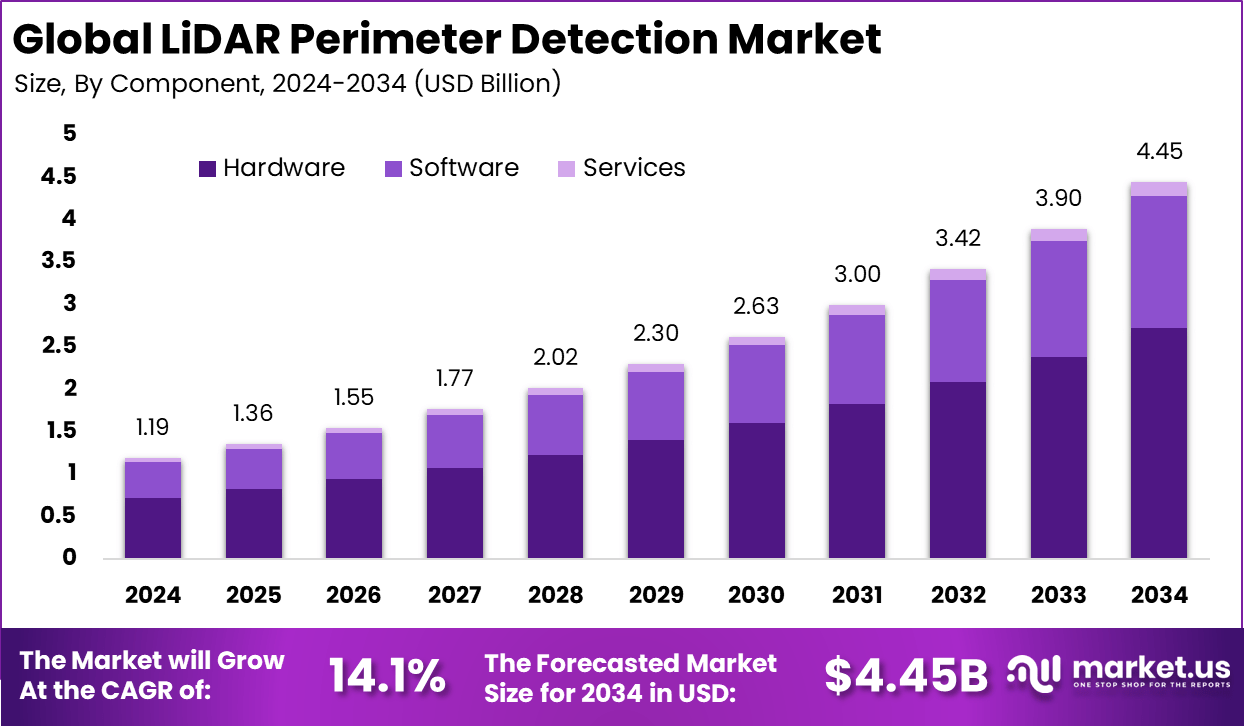

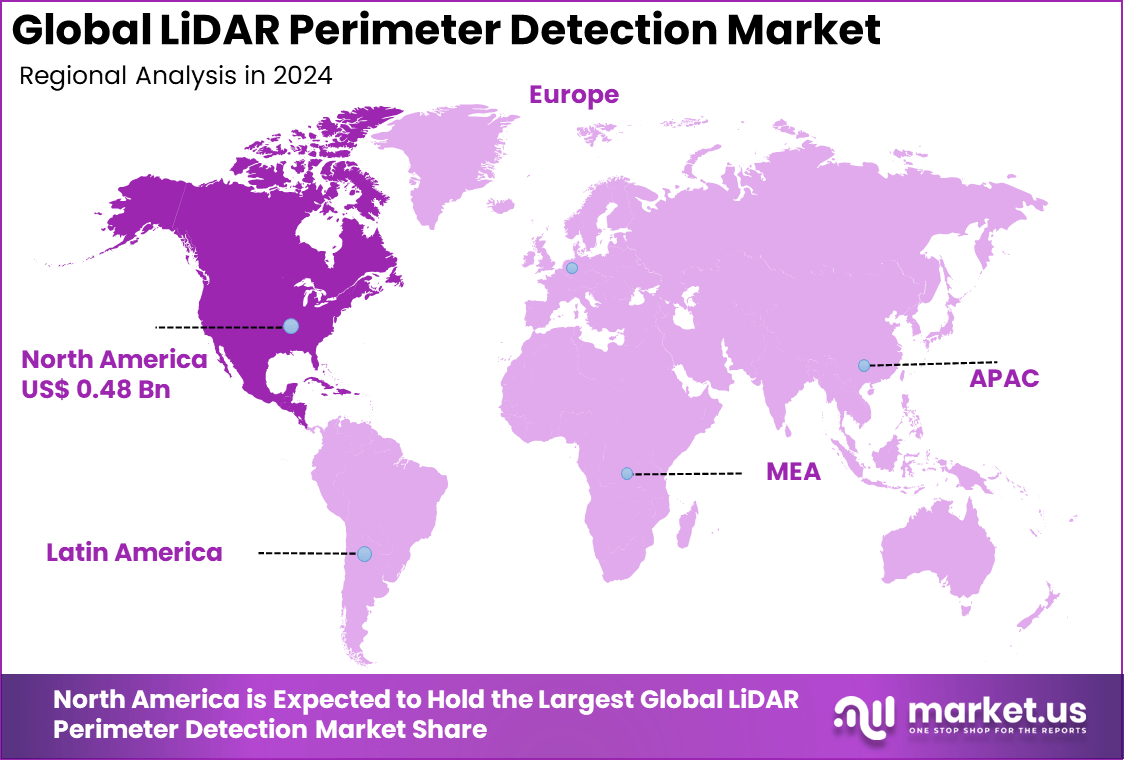

The Global LiDAR Perimeter Detection Market size is expected to be worth around USD 4.45 billion by 2034, from USD 1.19 billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.5% share, holding USD 0.48 billion in revenue.

LiDAR perimeter detection works by using laser light to map a secured boundary in 3D and detect any movement approaching the area. It delivers accurate, real-time monitoring in all lighting and weather conditions and can distinguish genuine intrusions from harmless environmental activity by analyzing object size, movement speed, and direction. This capability reduces false alarms and strengthens situational awareness for security teams.

For instance, in October 2025, Panasonic Corporation advanced its 3D LiDAR technology, offering wide-angle views for autonomous mobile robots and security applications, optimized for strong sunlight and outdoor use, expanding perimeter surveillance capabilities. Adoption is supported by the rising need for precise security solutions as threats to critical infrastructure become more advanced.

Nearly 70% of security incidents are linked to perimeter breaches, which makes early detection essential. LiDAR provides centimeter-level accuracy over long distances and functions reliably across different environments. These advantages make it suitable for airports, industrial facilities, and sensitive government locations that require high-performance surveillance.

Growth in this market is also encouraged by increasing investments in national security and smart city projects. Critical sites such as power plants, transportation hubs, and large public infrastructures rely on dependable real-time monitoring to prevent intrusion and ensure operational safety. LiDAR’s ability to produce high-resolution 3D mapping strengthens overall security performance, supporting wider adoption across global infrastructure networks.

Demand analysis shows a rising preference for LiDAR-enabled perimeter security as organizations seek to reduce false alarms, which reportedly cost businesses billions annually in operational disruption. About 80% of false alarms from traditional systems come from environmental noise, which LiDAR effectively filters out using its 3D spatial data capabilities. This enhanced reliability supports security teams in focusing on real threats rather than false positives, improving operational efficiency.

Key Takeaway

- The Hardware segment led the market in 2024 with 61.2%, driven by demand for precise sensing units.

- The Fixed segment captured 76.4%, showing preference for stationary perimeter monitoring systems.

- Long Range systems above 200 meters held 50.7%, reflecting the need for extended detection coverage.

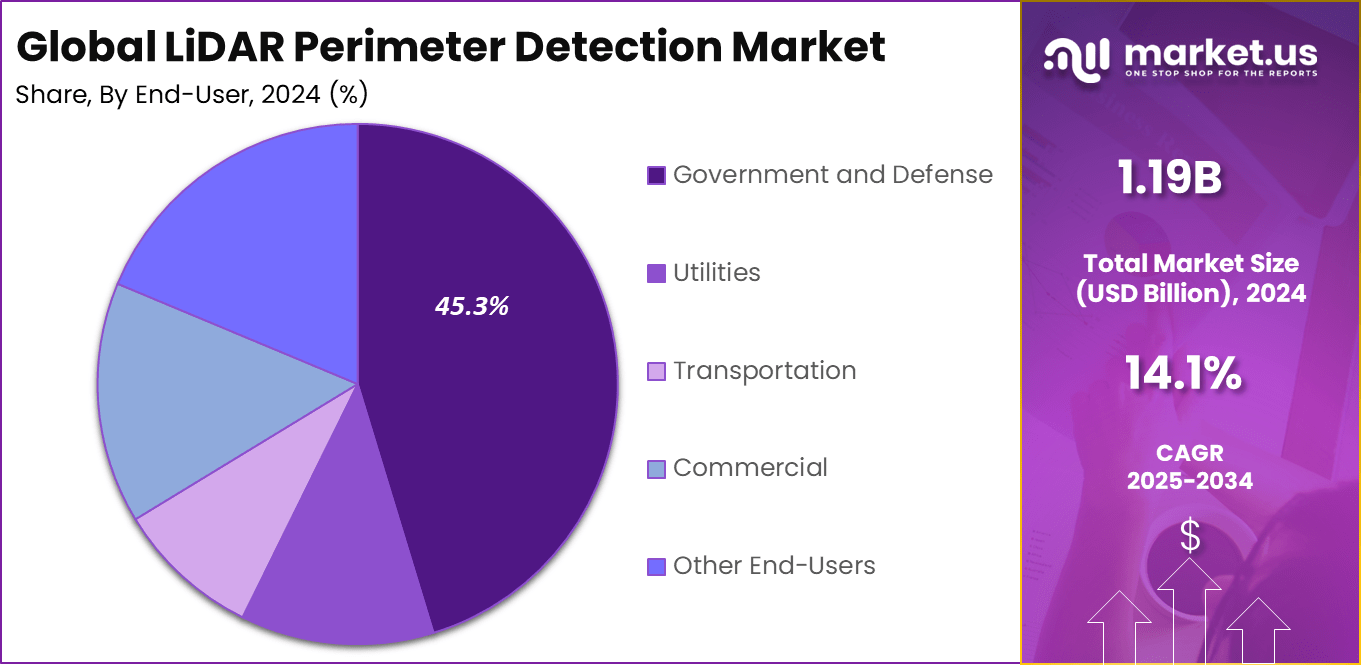

- The Government and Defense segment reached 45.3%, supported by higher investment in perimeter security.

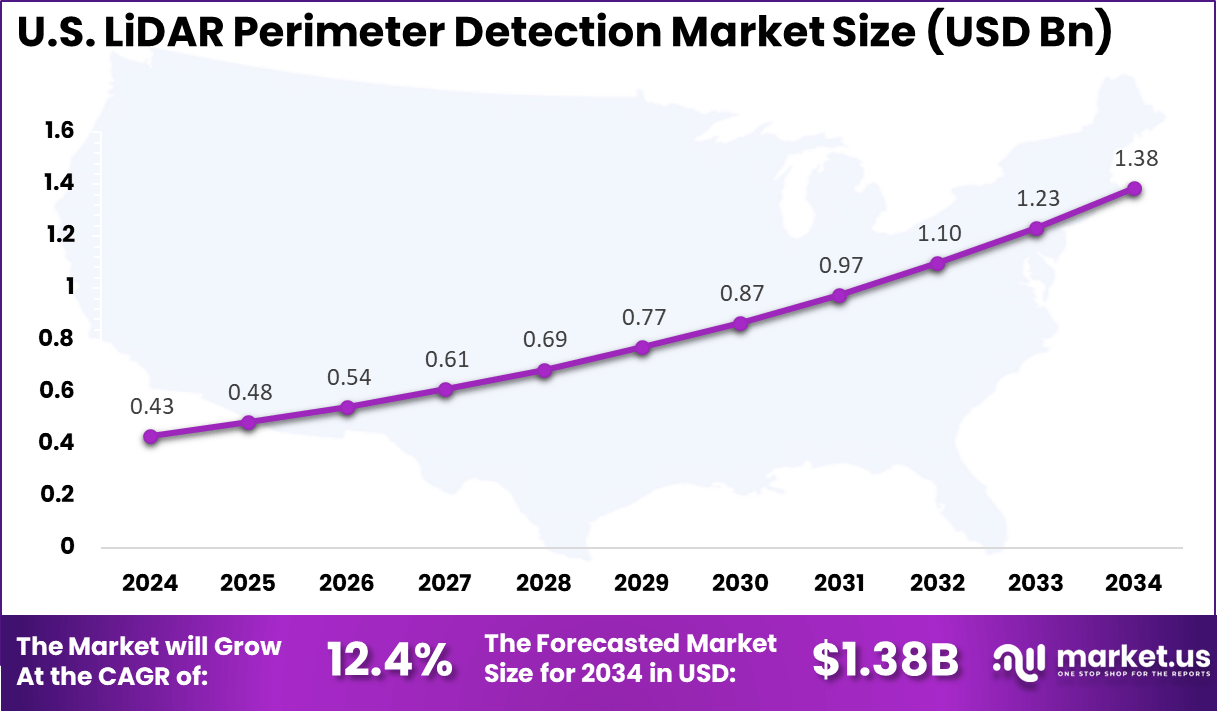

- The market in United States showed strong traction due to rising security upgrades.

- North America held more than 40.5%, indicating early adoption of advanced LiDAR perimeter solutions.

Key Statistics

Performance Statistics

- False alarm reduction: 3D LiDAR reduces false alarms by over 95% compared with traditional cameras or motion sensors. A data center case reduced false alerts from hundreds of thousands to fewer than ten per day.

- Detection accuracy: Image-fusion LiDAR systems on railways achieved 99.95% alarm accuracy for pedestrian intrusion detection, compared with 88.19% for a camera-only setup.

- Object classification: LiDAR distinguishes between people, vehicles, animals, and environmental factors using size, movement direction, and speed, which helps minimize nuisance alarms.

- Environmental resilience: LiDAR maintains stable performance in darkness, rain, and snow, while camera accuracy can drop by over 30% in adverse conditions.

Range and Coverage

- Long-range detection: Sensors such as the Ouster OS2 can detect objects up to 200 meters away at 10% reflectivity.

- Large-area monitoring: A single LiDAR unit can cover up to 15,000 square meters, supporting wide-area perimeter security.

- Target detection performance: One study showed a 92.41% correct detection rate for dynamic targets and a 1.43% error rate for static objects, indicating strong consistency and low false detection.

Role of Generative AI

Generative AI is transforming LiDAR perimeter detection by significantly improving how data is processed and threats are identified. It helps analyze complex point cloud data generated by LiDAR sensors, enabling faster and more accurate detection of intrusions. This reduces false alarms by about 30%, which means security teams can focus on real threats rather than distractions.

The AI algorithms also enhance real-time decision-making by predicting potential risks, thus enabling quicker response actions. With AI integration, LiDAR systems are becoming smarter, learning to distinguish between different types of objects such as humans, animals, and vehicles. This ability improves overall system reliability and effectiveness.

Investment and Business Benefits

Investment opportunities in LiDAR technologies are strong due to increased spending on border surveillance, critical infrastructure protection, and smart city security projects. With the global rise in cyber-physical security threats, funding is flowing into solutions that combine LiDAR with AI to form more robust, proactive perimeter defense systems.

Long-term investments focus on sensor enhancements, integration platforms, and expanding applications in commercial and residential security. Business benefits of LiDAR perimeter detection include a significant reduction in labor costs by cutting false alarms, improved security outcomes through accurate and continuous monitoring, and lower capital expenditures since fewer sensors cover wider areas.

North America Market Size

In 2024, North America held a dominant market position in the Global LiDAR Perimeter Detection Market, capturing more than a 40.5% share, holding USD 0.48 billion in revenue. This strong position results from heavy investments in securing critical infrastructure, borders, and government facilities, which require advanced sensing solutions.

The region benefits from widespread adoption of cutting-edge LiDAR technologies driven by strong governmental support, stringent security regulations, and a large presence of technology providers. Additionally, North America’s leadership is bolstered by innovation hubs and a mature ecosystem of system integrators who accelerate the deployment of fixed and long-range LiDAR systems.

The growing demand for autonomous vehicles, smart infrastructure, and defense-related applications also fuels market growth. These factors collectively support sustained expansion and technological advancement in the LiDAR perimeter detection sector across North America.

For instance, in October 2025, Teledyne Technologies Incorporated advanced its LiDAR solutions with Teledyne OPTECH, offering comprehensive LiDAR systems focusing on fast data processing tailored for land and water applications, enhancing perimeter security and actionable intelligence capabilities.

The market for LiDAR Perimeter Detection within the U.S. is growing tremendously and is currently valued at USD 0.43 billion, the market has a projected CAGR of 12.4%. This growth is fueled by increasing security concerns and substantial investments in advanced sensing technologies for critical infrastructure protection.

The rising need to secure borders, government installations, and commercial facilities has driven demand for LiDAR systems capable of precise and reliable perimeter monitoring. Additionally, the growth is supported by advancements in autonomous vehicles, smart infrastructure, and defense applications that rely on high-resolution 3D sensing.

Government initiatives and private sector adoption for environmental monitoring and urban planning also contribute to this upward trend. The combined impact of technological innovation and heightened security requirements is accelerating LiDAR perimeter detection implementation across multiple sectors in the U.S. market.

For instance, in August 2025, Aeva Inc. launched the Atlas Orion 4D LiDAR sensor designed for smart infrastructure and security, featuring ultra-long-range detection up to 500 meters for vehicles and 200 meters for pedestrians, with privacy-by-design architecture suitable for perimeter detection in critical facilities.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 61.2% share of the Global LiDAR Perimeter Detection Market. Hardware includes vital parts such as LiDAR sensors, scanners, transmitters, and receivers that capture and process spatial data to create detailed 3D maps. These components are essential for precise and reliable perimeter monitoring, with their quality directly influencing detection accuracy and system performance.

Recent developments in miniaturization and solid-state LiDAR have made hardware more accessible, enabling widespread deployment in various security environments. Beyond its fundamental role, hardware advancements are driving the market forward. The integration of LiDAR hardware with Internet of Things (IoT) devices allows real-time monitoring and enhances situational awareness.

This connectivity supports proactive security measures and remote management, which are crucial for critical infrastructure and high-security installations. Vendors are increasingly bundling hardware with software analytics and support services, offering complete, scalable security solutions that meet evolving operational needs.

For Instance, in September 2025, SICK AG partnered with Ibeo to co-develop an industrial 3D solid-state LiDAR sensor. This collaboration leverages automotive sensor technology for industrial applications, aiming to offer cost-efficient and robust solutions. The partnership reflects a trend where companies focus on hardware innovations that enhance precision and affordability for perimeter detection markets.

Deployment Analysis

In 2024, the Fixed segment held a dominant market position, capturing a 76.4% share of the Global LiDAR Perimeter Detection Market. These systems are permanently installed at strategic points around perimeters, offering continuous and reliable surveillance. Fixed LiDAR setups are preferred because they provide steady, long-term security coverage and can effectively monitor large, complex areas such as government facilities, critical infrastructure, and commercial sites.

The market trend favors networked fixed systems that can be centrally managed, which improves operational efficiency and response coordination. Fixed LiDAR deployments also support integration with other security technologies like video cameras and access controls, creating a multi-layered defense framework. This seamless integration strengthens threat detection capabilities and ensures rapid, informed reactions to potential breaches.

For instance, in July 2025, Hexagon AB demonstrated advancements in 3D LiDAR solutions during its global event. Their software enables optimal placement of fixed LiDAR sensors by modeling beam distributions and blind spot coverage, improving fixed perimeter deployments while reducing false alarms. This approach represents an evolution in fixed system deployments, maximizing the efficiency and reliability of permanent installations.

Range Analysis

In 2024, the long-range (>200 meters) segment held a dominant market position, capturing a 50.7% share of the Global LiDAR Perimeter Detection Market. They are crucial for securing large-scale perimeters such as borders, military bases, and expansive industrial sites where early threat detection is essential.

Long-range detection allows security personnel to identify and evaluate potential intrusions well before they reach critical areas, increasing reaction time to prevent damage or unauthorized access. Technological advancements have enhanced the accuracy and reliability of long-range LiDAR systems, even in challenging conditions like adverse weather or complex terrain.

This makes them indispensable for government and defense applications, which often require expansive and detailed perimeter coverage. The demand for such systems is rising due to growing security concerns and the need to protect strategic assets over wide geographical areas.

For Instance, in April 2024, KOITO Manufacturing Co. Ltd. launched a medium- and long-range LiDAR lineup for automotive and industrial applications. Their long-range models enable 360-degree monitoring with reliable high-resolution detection, fitting long-range perimeter needs. This expansion into long-range sensors addresses the critical demand for early detection over broad perimeters.

End-User Analysis

In 2024, The Government and Defense segment held a dominant market position, capturing a 45.3% share of the Global LiDAR Perimeter Detection Market. These sectors require highly secure and reliable detection systems to protect sensitive facilities, borders, and critical infrastructure. The stringent security standards and evolving threats faced by these users drive continuous investment in advanced LiDAR technologies capable of detailed 3D mapping and fast threat response.

This demand fosters ongoing innovation to meet the unique challenges of government and defense environments, including operation under harsh conditions and seamless integration with broader security networks. LiDAR’s ability to deliver precise, real-time perimeter monitoring increases its adoption in these sectors where security failures could have severe consequences.

For Instance, in August 2025, Waymo LLC outlined the continued use of LiDAR sensors as part of safety-critical technology for autonomous driving, signaling importance in government-related safety frameworks. Although centered on mobility, their robust LiDAR research benefits government and defense sectors where reliable perception in diverse conditions is paramount.

Emerging trends

Emerging trends in LiDAR perimeter detection focus on the adoption of solid-state LiDAR sensors, which offer more durability and less maintenance than traditional rotating sensors. These sensors provide precise, high-resolution 3D images with fewer moving parts, making them well-suited for harsh environments. This technology advancement is broadening the use of LiDAR in perimeter security, especially in large, complex sites such as solar farms and airports.

Another trend is the increasing integration of LiDAR with Internet of Things (IoT) platforms and edge computing. This combination enables distributed processing of security data close to the source, reducing the time it takes to detect and respond to threats. It also allows for better scalability and more comprehensive coverage in perimeter security systems, supporting the growing demand for smart security infrastructure.

Growth Factors

Growth factors for the LiDAR perimeter detection market include rising security needs for protecting sensitive sites against intrusions and vandalism. Increasingly complex threats require systems capable of delivering high accuracy even in challenging weather or lighting conditions. LiDAR’s ability to deliver detailed 3D spatial data and function in all conditions is a key driver pushing adoption across various industries.

Technological improvements that reduce costs and improve sensor capabilities are also helping with growth. Enhanced software, better AI integration, and hardware miniaturization are making these systems more accessible and practical for more users. This combination of demand and better technology is strengthening the market’s expansion.

Key Market Segments

By Component

- Hardware

- Laser Scanners

- Global Positioning System (GPS) Units

- Inertial Measurement Units (IMUs)

- Cameras And Sensors

- Software

- Light Detection And Ranging (LiDAR) Data Processing Software

- Mapping And Visualization Software

- Object Detection And Tracking Software

- Integration And Analytics Platforms

- Services

- Installation And Calibration Services

- Maintenance And Support Services

- Training And Consulting Services

- System Integration Services

By Deployment

- Fixed

- Mobile

By Range

- Short Range

- Medium Range

- Long Range

By End-User

- Government and Defense

- Utilities

- Transportation

- Commercial

- Other End-Users

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Need for Critical Infrastructure Security

The market is strengthened by the growing need to protect critical infrastructure such as power plants, airports, and water treatment facilities. Rising security threats have increased the use of LiDAR systems because they offer precise, real time perimeter monitoring that supports safety and operational continuity. Government initiatives for infrastructure modernization and national security further encourage investments in LiDAR based security technologies.

Growth is also supported by the transportation sector, where airports, seaports, and railways depend on reliable detection systems to prevent unauthorized access. Expanding smart city projects and higher surveillance needs across commercial and industrial sites add to this demand, making perimeter security a major driver for LiDAR adoption.

In October 2025, Panasonic Corporation introduced a 3D LiDAR sensor that provides wide angle distance detection for autonomous mobile robots. The system improves security and operational safety by allowing robots to monitor surroundings accurately in bright light or darkness. Its simplified control design reduces development time and costs, supporting broader use of LiDAR in security applications.

Restraint

Data Privacy and Regulatory Concerns

One major restraint facing the LiDAR perimeter detection market is growing concern over data privacy and regulatory compliance. The use of LiDAR for surveillance raises questions about the collection, storage, and sharing of sensitive data, especially in regions with strict privacy laws. These concerns may slow down adoption, as organizations balance the benefits of enhanced security against legal and ethical implications.

Additionally, industries with tight budgets or limited awareness may hesitate to invest in LiDAR solutions. Regulatory complexities can also create barriers for vendors and end-users, increasing the time and cost required to deploy advanced systems. As a result, these factors collectively limit the pace of market expansion despite the technology’s potential benefits.

For instance, In November 2025, Valeo S.A. presented its SCALA™ 3 LiDAR and advanced driving assistance technologies. The company continues to face integration challenges and strict automotive safety rules. These requirements increase development time and investment needs, slowing overall market progress. Valeo’s efforts show how firms must balance innovation with regulatory compliance.

Opportunities

Integration with AI and Smart City Initiatives

The integration of LiDAR perimeter detection with artificial intelligence (AI) and machine learning presents a substantial opportunity for market growth. Combining these technologies enhances real-time threat detection, predictive analysis, and automated responses, making security systems smarter and more efficient. This technological synergy is attracting investments and fostering innovation in the sector.

Furthermore, the rise of smart city projects worldwide creates new use cases for LiDAR perimeter detection. As urban areas grow more connected and complex, demand is increasing for scalable and cost-effective solutions that safeguard public spaces, transportation hubs, and utility infrastructure. Vendors introducing modular and AI-enabled LiDAR platforms are well-positioned to capitalize on these expanding market segments.

For instance, In August 2025, Aeva Technologies Inc. launched the Atlas Orion 4D LiDAR sensor with long-range detection and dynamic object tracking that avoids collecting personal data. The sensor strengthens smart infrastructure and security through AI integration, supporting growth in advanced perimeter detection. Its Power over Ethernet setup and alignment with traffic standards also expand use cases in traffic control and urban security.

Challenges

Talent Shortages and High Input Costs

The market is constrained by a notable shortage of skilled professionals in areas such as AI, data analytics, and cybersecurity. This limitation affects the ability of companies to develop, integrate, and manage advanced LiDAR perimeter systems. When expertise is limited, organizations struggle to use LiDAR technology to its full potential, leading to slower deployment timelines and reduced operational efficiency.

Cost pressure is another significant challenge, as LiDAR sensors and processing hardware remain expensive for many users. Rising input costs reduce profit margins and slow product development, making it difficult for vendors to offer competitively priced solutions. This issue is especially challenging for small and medium sized enterprises and regions with limited budgets, where high equipment costs restrict wider adoption and delay market expansion.

In October 2025, Teledyne Technologies introduced compact survey grade LiDAR units for drone and aerial platforms. While the technology is advanced, high component costs and the requirement for trained specialists to manage multi sensor integration and real time data processing create adoption hurdles. The limited availability of such expertise slows customer uptake and affects the overall pace of innovation in the LiDAR perimeter detection market.

Key Players Analysis

Panasonic, Valeo, Koito, Hexagon, and Teledyne Technologies lead the LiDAR perimeter detection market with advanced sensing systems designed for high-accuracy object recognition and real-time boundary monitoring. Their solutions support smart infrastructure, industrial facilities, and transportation security. These companies focus on long-range detection, enhanced reliability, and seamless integration with surveillance systems.

SICK AG, Waymo, Leuze electronic, OPTEX, Ouster, LeddarTech, Senstar, and Innoviz expand the market with LiDAR platforms optimized for precise intrusion detection and environmental mapping. Their systems deliver robust performance in outdoor conditions, supporting automated alerts and intelligent threat recognition. These providers help enterprises improve situational awareness while reducing false alarms.

Benewake, Aeva, SiLC Technologies, Lumotive, RIEGL, LightWare LiDAR, Hesai, and other participants enhance the landscape with compact solid-state LiDARs, low-power sensors, and cost-efficient perimeter solutions. Their technologies support drones, autonomous robots, and smart surveillance units. These companies prioritize high resolution, fast response rates, and easy deployment.

Top Key Players in the Market

- Panasonic Corporation

- Valeo S.A.

- Koito Manufacturing Co., Ltd.

- Hexagon AB

- Teledyne Technologies Incorporated

- SICK AG

- Waymo LLC

- Leuze electronic GmbH + Co. KG

- OPTEX Co. Ltd.

- Ouster Inc.

- LeddarTech Inc.

- Senstar Technologies Ltd.

- Innoviz Technologies Ltd.

- Benewake (Beijing) Co., Ltd.

- Aeva Inc.

- SiLC Technologies Inc.

- Lumotive Inc.

- RIEGL Laser Measurement Systems GmbH

- LightWare LiDAR LLC

- Hesai Technology Co. Ltd.

- Others

Recent Developments

- In November 2025, Valeo S.A. showcased its next-generation vehicle technology, including the SCALA™ 3 LiDAR for level 3 and beyond functions at IAA MOBILITY 2025. They also introduced AI-based perception software that improves object classification in point clouds, enhancing perimeter detection capabilities in automotive and mobility applications.

- In August 2025, Aeva Technologies Inc. launched the Atlas Orion 4D LiDAR sensor designed for smart infrastructure, traffic management, and security. The sensor integrates Power-over-Ethernet for easy installation and uses FMCW 4D LiDAR technology to enable long-range detection and precise tracking of moving objects.

Report Scope

Report Features Description Market Value (2024) USD 1.19 Bn Forecast Revenue (2034) USD 4.45 Bn CAGR(2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Deployment (Fixed, Mobile), By Range (Short Range, Medium Range, Long Range), By End-User (Government and Defense, Utilities, Transportation, Commercial, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Panasonic Corporation, Valeo S.A., Koito Manufacturing Co. Ltd., Hexagon AB, Teledyne Technologies Incorporated, SICK AG, Waymo LLC, Leuze electronic GmbH + Co. KG, OPTEX Co. Ltd., Ouster Inc., LeddarTech Inc., Senstar Technologies Ltd., Innoviz Technologies Ltd., Benewake (Beijing) Co. Ltd., Aeva Inc., SiLC Technologies Inc., Lumotive Inc., RIEGL Laser Measurement Systems GmbH, LightWare LiDAR LLC, Hesai Technology Co. Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  LiDAR Perimeter Detection MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

LiDAR Perimeter Detection MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Panasonic Corporation

- Valeo S.A.

- Koito Manufacturing Co., Ltd.

- Hexagon AB

- Teledyne Technologies Incorporated

- SICK AG

- Waymo LLC

- Leuze electronic GmbH + Co. KG

- OPTEX Co. Ltd.

- Ouster Inc.

- LeddarTech Inc.

- Senstar Technologies Ltd.

- Innoviz Technologies Ltd.

- Benewake (Beijing) Co., Ltd.

- Aeva Inc.

- SiLC Technologies Inc.

- Lumotive Inc.

- RIEGL Laser Measurement Systems GmbH

- LightWare LiDAR LLC

- Hesai Technology Co. Ltd.

- Others