Global Licensed Toy Market Market Size, Share, Growth Analysis By Product Type (Action Figures, Dolls & Plush Toys, Arts & Crafts, Games & Puzzles, Outdoor & Sports Toys, Construction Sets, Educational Toys, Others), By Age Group (Below 1 Yrs., Age 1-3, Age 3-5, Age 5-12, Age 12+), By End-Use (Individual, Commercial), By Distribution Channel (Hypermarket/Supermarket, Online, Departmental Stores, Specialized Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169841

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

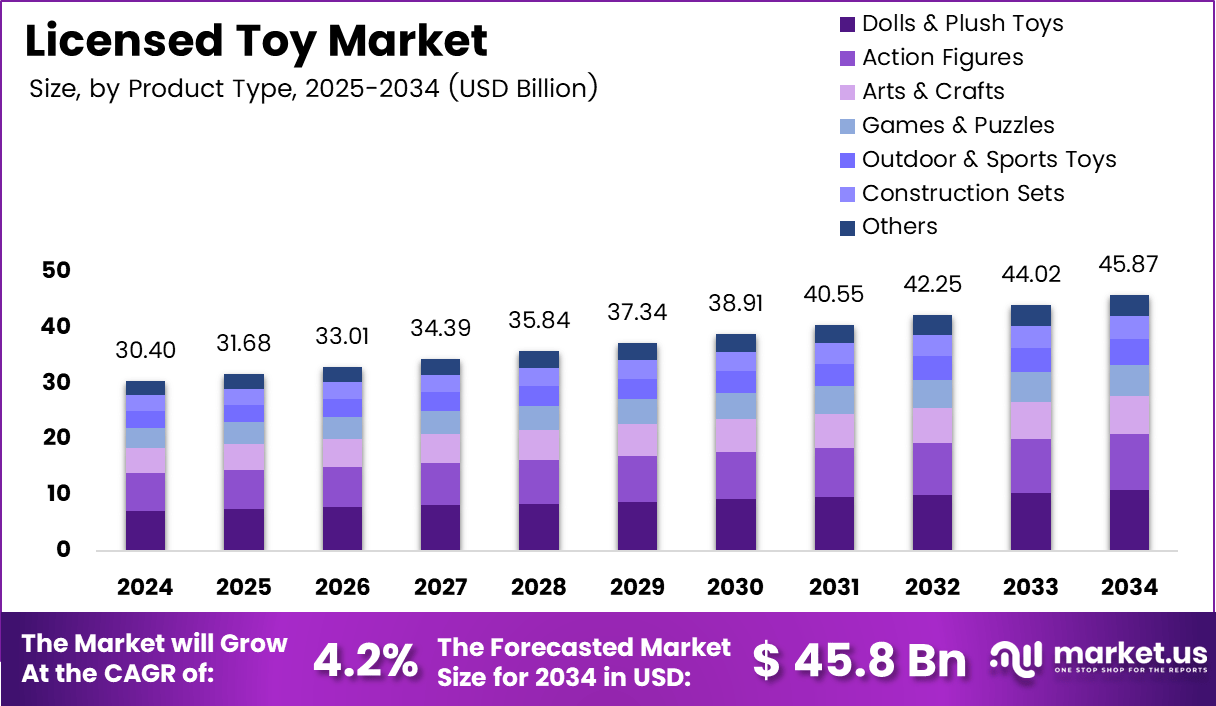

The Global Licensed Toy Market size is expected to be worth around USD 45.8 billion by 2034, from USD 30.4 billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

The Licensed Toy Market represents a fast-evolving segment where character-driven products gain momentum through strong entertainment ecosystems and rising global fandom communities. The market benefits from expanding franchise universes, deeper storytelling formats, and increasing multi-platform content consumption that fuels recurring demand. Growth accelerates as consumers prioritize emotional engagement, collectability, and familiarity in their toy purchases.

Moreover, expanding digital entertainment pipelines strengthens opportunities across retail ecosystems, prompting manufacturers to align releases with film launches and streaming premieres. This synchronization increases product relevance and encourages repeat purchases across age groups. Companies also observe rising adult collector participation, creating new revenue avenues in premium licensed merchandise within global markets.

Furthermore, government support for creative industries encourages IP development and licensing frameworks that improve collaboration between storytellers and toy makers. Updated consumer-protection regulations also promote safer materials, eco-friendly packaging, and sustainable production practices. These improvements elevate product trust while improving brand equity across physical and digital retail channels in the Licensed Toy Market.

Additionally, evolving manufacturing capabilities accelerate customization and shorten product cycles, helping brands react quickly to viral trends and character-driven demand spikes. Parents increasingly seek toys that reinforce learning, empathy, and imaginative play, strengthening long-term adoption. Retailers also integrate data-driven inventory planning, ensuring improved availability during franchise peaks and seasonal spikes.

Sustainability emerges as a crucial opportunity as environmentally conscious families demand responsible licensed products. According to Resoftables, production of eco-friendly plush toys has repurposed 3 million plastic bottles and containers in under 12 months, demonstrating strong circular-economy potential. This shift encourages broader adoption of recycled inputs across character-based toy lines globally.

Social media amplification further accelerates growth, driven by fan communities and viral character trends. According to brand social channels, The Child plush became the requested Squishmallow style, generating 3.3+ million TikTok views under the. Premium collectability also expands, shown through limited editions featuring over 2,000 crystals on individually numbered game boards.

Overall, the Licensed Toy Market Market strengthens through innovation, sustainability, digital engagement, and global storytelling investments. These trends reshape consumer expectations while creating new opportunities for long-term brand-driven growth.

Key Takeaways

- The Global Licensed Toy Market reached USD 30.4 billion in 2024 and is projected to hit USD 45.8 billion by 2034.

- The market is expected to grow at a steady CAGR of 4.2% from 2025 to 2034.

- Dolls & Plush Toys dominated the product segment with a leading share of 23.7% in 2024.

- The Age 5-12 group accounted for the greatest age-based demand, holding a strong share of 36.8% in 2024.

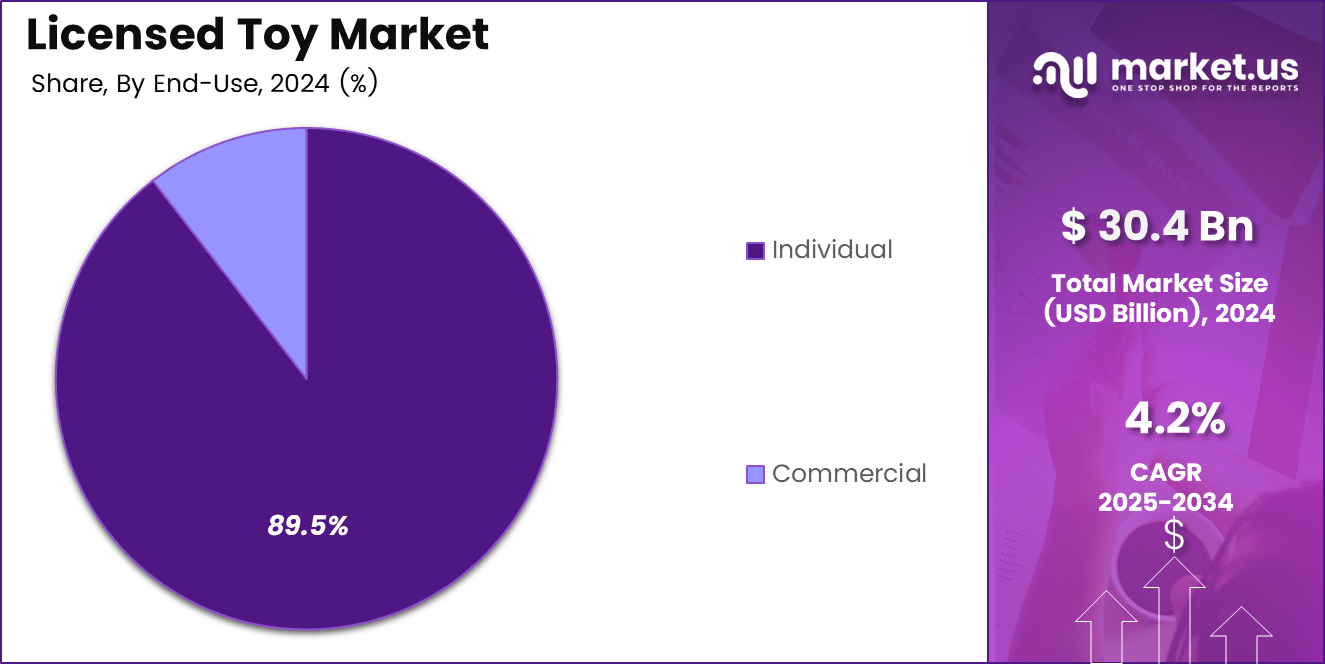

- Individual end-use led the market with a substantial contribution of 89.5% in 2024.

- Hypermarket/Supermarket channels captured the highest distribution share at 31.3% in 2024.

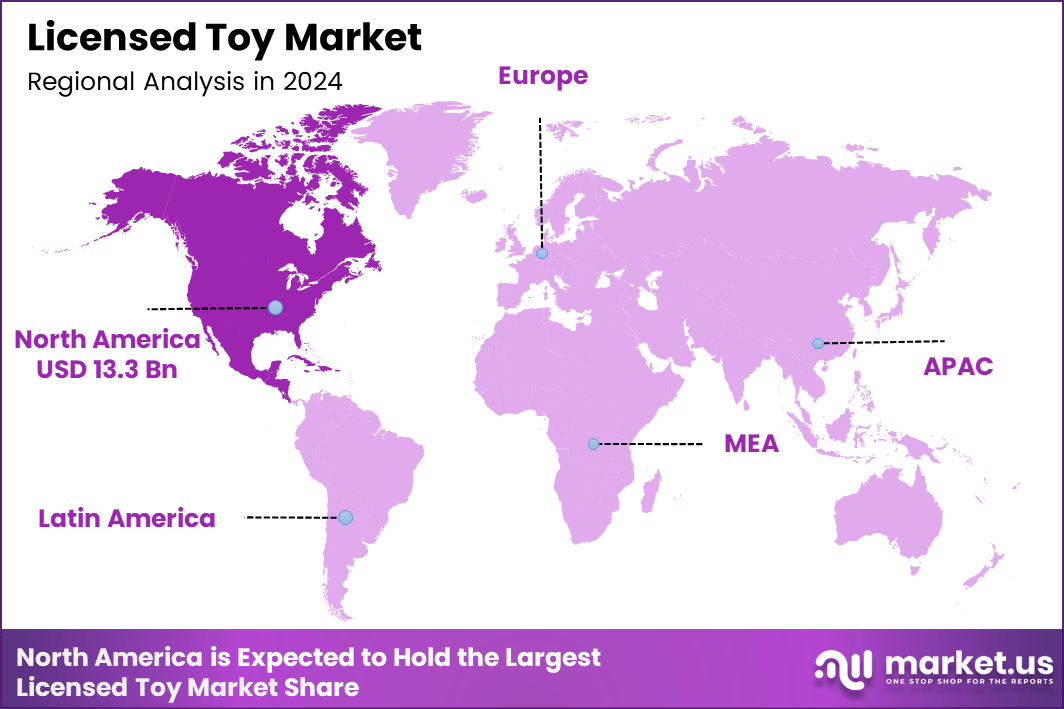

- North America dominated the global landscape with a significant market share of 43.9% valued at USD 13.3 billion in 2024.

- Asia Pacific emerged as the fastest-growing region due to rising youth population and expanding entertainment IP consumption.

By Product Type Analysis

Dolls & Plush Toys dominate with 23.7% due to rising character-driven designs and emotional appeal.

In 2024, Action Figures held a strong presence in the By Product Type Analysis segment of the Licensed Toy Market, driven by expanding movie universes and gaming franchises. These toys attract children and collectors through storytelling value, detailed accessories, and frequent refresh cycles that maintain engagement across global markets.

Dolls & Plush Toys held a dominant market position in the FBy Product Type Analysis segment of the Licensed Toy Market, with a 23.7% share. These products gained traction as parents favored soft, safe, and themed plush toys tied to popular characters. Eco-friendly plush innovations also strengthened adoption among young children and caregivers.

Arts & Crafts gained steady adoption in the By Product Type Analysis segment of the Licensed Toy Market as parents encouraged creative skills. Licensed coloring kits, craft sets, and DIY-themed products supported sensory learning while aligning with entertainment franchises, boosting interest among children seeking personalized and hands-on play activities.

Games & Puzzles, Outdoor & Sports Toys, Construction Sets, Educational Toys, and Others continued expanding due to growing family game time, outdoor activities, engineering-focused play, and STEM learning. These categories benefited from cross-media licensing, seasonal demand, and increasing consumer preference for multi-skill developmental toys inspired by well-known characters.

By Age Group Analysis

Age 5-12 dominates with 36.8% due to higher engagement with licensed entertainment content and diversified play themes.

In 2024, below 1 Yrs. toys held measurable demand in the By Age Group Analysis segment of the Licensed Toy Market, as parents selected soft, sensory-friendly licensed plush and rattles. Safety certifications, non-toxic materials, and recognizable characters contributed to purchasing decisions supporting early developmental stimulation.

Age 1-3 toys expanded steadily in the By Age Group Analysis segment of the Licensed Toy Market through interactive learning toys and simple character-themed products. Franchises targeting toddlers boosted awareness, while durable materials, rounded designs, and developmental play features encouraged repeat purchases among young families.

Age 3-5 toys gained traction in the By Age Group Analysis segment of the Licensed Toy Market as preschoolers connected strongly with TV shows and animated films. Imaginative role-play toys, puzzles, and beginner construction sets shaped decision-making, supporting stronger growth within households seeking story-driven play experiences.

Age 5-12 held a dominant market position in the By Age Group Analysis segment of the Licensed Toy Market, with a 36.8% share. This group adopted action figures, games, building sets, and STEM toys tied to popular characters. Age 12+ toys also retained interest through advanced collectibles, model kits, and franchise-driven merchandise.

By End-Use Analysis

Individual dominates with 89.5% due to rising household spending on licensed character toys.

In 2024, Individual held a dominant market position in the By End-Use Analysis segment of the Licensed Toy Market, with an 89.5% share. Parents, collectors, and gifting trends shaped demand as licensed toys aligned with movies, streaming series, and seasonal events. Wider product availability also increased household consumption across regions.

Commercial users contributed to the buy-end-use analysis segment of the Licensed Toy Market through entertainment venues, daycare centers, promotional gifting, and themed events. Retailers stocked licensed toys for experiential zones, while educational centers adopted character-based learning aids to engage children during structured activities.

By Distribution Channel Analysis

Hypermarket/Supermarket dominates with 31.3% due to easy access and a wide licensed toy assortment.

In 2024, Hypermarket/Supermarket held a dominant market position in the By Distribution Channel Analysis segment of the Licensed Toy Market, with a 31.3% share. These stores enabled convenient shopping, seasonal promotions, and high visibility for licensed merchandise across diverse age groups, boosting impulse and planned purchases.

Online channels grew significantly in the By Distribution Channel Analysis segment of the Licensed Toy Market through broad catalog access, doorstep delivery, exclusive product drops, and influencer-driven promotions. Digital marketplaces strengthened franchise visibility and supported fast adoption among tech-savvy parents and collectors.

Departmental Stores maintained relevance in the By Distribution Channel Analysis segment of the Licensed Toy Market due to curated offerings and branded sections. Their structured layouts, gift-oriented assortments, and premium licensed toys attracted families seeking trustworthy shopping environments for character merchandise.

Specialized Stores and Others continued contributing to the By Distribution Channel Analysis segment of the Licensed Toy Market by offering niche collectibles, franchise-specific merchandise, and expert guidance. Hobby shops, pop-culture stores, and event-based retailers enhanced brand loyalty through limited-edition licensed toy selections.

Key Market Segments

By Product Type

- Action Figures

- Dolls & Plush Toys

- Arts & Crafts

- Games & Puzzles

- Outdoor & Sports Toys

- Construction Sets

- Educational Toys

- Others

By Age Group

- Below 1 Yrs.

- Age 1-3

- Age 3-5

- Age 5-12

- Age 12+

By End-Use

- Individual

- Commercial

By Distribution Channel

- Hypermarket/Supermarket

- Online

- Departmental Stores

- Specialized Stores

- Others

Drivers

Expansion of Global Entertainment Franchises Drives Market Growth

The expansion of global entertainment franchises is increasing the demand for character-based licensed toys as children and adults follow popular IPs more actively. New movie releases, animated shows, and gaming titles keep refreshing interest, encouraging repeat purchases across age groups. This consistent content pipeline keeps the market energized.

Streaming platforms are also boosting visibility for animated and live-action characters, enabling instant global exposure. As families access diverse content from multiple regions, demand for toys linked to trending series grows quickly. This wider reach allows brands to introduce toys that resonate with international audiences.

Cross-merchandising strategies between film studios, gaming brands, and toy companies further strengthen growth. Coordinated marketing campaigns around major releases create unified consumer experiences, making toys an essential part of franchise engagement. This synergy improves brand recall and expands retail opportunities.

Collector communities are expanding and supporting premium demand for limited-edition merchandise. Adults increasingly purchase exclusive figures, special-edition plush toys, and nostalgic collectibles. Their willingness to pay higher prices encourages manufacturers to design high-value items that boost revenue and market visibility.

Restraints

High Royalty Costs Restrict Market Expansion

High royalty and licensing fees are raising production expenses for toy manufacturers. These added costs limit pricing flexibility, making it difficult for companies to offer budget-friendly products. Smaller firms struggle the most, often avoiding popular IPs due to financial pressure.

Short product life cycles present another restraint as entertainment trends change quickly. When shows lose popularity, associated toys decline in demand just as fast. Manufacturers must constantly update their inventory, increasing operational risks and reducing long-term planning stability.

Limited licensing rights across regions also restrict global distribution opportunities. Some IPs are available only in specific countries, preventing brands from scaling successful toy lines internationally. This inconsistency in access affects production volume and delays expansion strategies.

These restraints combined create challenges for companies aiming to balance creativity, profitability, and competitive pricing in the licensed toy market.

Growth Factors

Rising Adoption of AI-Integrated Licensed Toys Creates Growth Opportunities

The growing adoption of AI-integrated licensed toys is opening new opportunities for immersive storytelling and interactive play. Children engage longer with toys that talk, respond, or adapt to behavior, increasing the value proposition for modern parents. These technologies elevate traditional character toys into smart, connected play experiences.

Partnerships with digital influencers and virtual characters are also expanding. As children spend more time on social platforms and gaming environments, influencer-driven toy lines gain strong traction. These collaborations offer unique branding prospects and allow manufacturers to reach audiences beyond traditional TV-based IPs.

Virtual characters from metaverse platforms, animated channels, and online creators also attract global fan communities. Licensing such characters enables toy companies to diversify product lines and experiment with digital-physical hybrid play formats.

These opportunities highlight a shift toward tech-enhanced and socially driven licensed toys, supporting future market expansion.

Emerging Trends

Nostalgia and Movie-Timed Releases Shape Market Trends

Nostalgia-driven purchases are reshaping demand as adults revisit retro and classic character toys from their childhood. These buyers seek emotional value, boosting sales of reissued action figures, plush toys, and limited-edition replicas. Their enthusiasm also encourages brands to revive older IPs.

Toy launches aligned with major movie releases significantly influence consumer engagement. Coordinated campaigns create excitement before film debuts, increasing early purchases. Children often look for collectibles immediately after watching their favorite characters on screen, amplifying short-term retail spikes.

Blind boxes and mystery-pack licensed toys are becoming dominant trends among young consumers. These products encourage repeat buying due to their surprise-based format. The social excitement around unboxing videos further elevates demand.

Together, these factors signal a shift toward emotional engagement, event-linked sales peaks, and playful mystery-based purchasing patterns in the licensed toy market.

Regional Analysis

North America Dominates the Licensed Toy Market with a Market Share of 43.9%, Valued at USD 13.3 Billion

North America holds a commanding position in the licensed toy market, supported by strong consumer spending, rapid franchise expansion, and high engagement with entertainment IPs. The region’s dominance, reflected in its 43.9% share and USD 13.3 billion value, stems from sustained demand for character-driven toys and consistent product innovation. Robust marketing collaborations across streaming platforms further reinforce market penetration.

Europe Licensed Toy Market Trends

Europe shows stable growth driven by expanding children’s entertainment content, rising collectible culture, and increased adoption of premium licensed products. The region benefits from strong cross-border toy distribution networks and high acceptance of global movie franchises. Growing emphasis on sustainable toy designs also contributes to consumer interest.

Asia Pacific Licensed Toy Market Trends

Asia Pacific emerges as one of the fastest-growing regions due to a large young population and rising disposable incomes. Streaming platforms and localized content adaptations accelerate the popularity of licensed characters. Expanding retail infrastructure and urbanization further enhance product reach across emerging economies.

Middle East and Africa Licensed Toy Market Trends

The Middle East and Africa market experiences steady growth driven by increasing exposure to global entertainment brands and rising interest in themed merchandise. Expanding mall culture, improved retail channels, and family entertainment centers stimulate category adoption. Premium licensed toys gain traction among urban households.

Latin America Licensed Toy Market Trends

Latin America shows improving momentum supported by expanding media consumption and strong affinity for animated and gaming characters. Economic recovery in key countries enhances toy purchasing capacity. Seasonal demand peaks, especially during festivals, contribute to steady market expansion despite pricing sensitivity.

United States Licensed Toy Market Trends

The US acts as the core growth engine within North America, driven by high franchise activity, strong collector communities, and rapid merchandise tie-ins across films, series, and games. Consistent product launches and strategic licensing collaborations maintain strong consumer engagement, supporting long-term market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Licensed Toy Market Company Insights

In 2024, the global Licensed Toy Market Market continued to evolve as manufacturers strengthened character-based offerings and technology-enabled play experiences. VTech Communications, Inc. expanded its licensed electronic learning toys by integrating interactive storylines tied to popular children’s IPs, reinforcing its leadership in early childhood engagement. The company’s focus on durable, curriculum-linked content helped sustain repeat consumer interest across retail channels.

Motorola, Inc. enhanced its licensed kids’ gadget portfolio by collaborating with well-known entertainment franchises to design safe, communication-focused devices for younger audiences. This strategic alignment with trusted IPs allowed Motorola to capture families seeking reliability alongside branded entertainment value, especially in markets with rising digital adoption.

Dorel Industries Inc. strengthened its presence through licensed ride-on toys, protective gear, and juvenile products that leverage globally recognized characters. Its emphasis on safety-certified materials and ergonomic design positioned the company as a preferred partner for premium licensors targeting high-quality brand extensions across toys and mobility-based play.

Panasonic Corp. supported the market with licensed battery technologies and power solutions embedded in electronic toys, improving device efficiency and user experience. Panasonic’s partnerships with toy manufacturers helped enhance product longevity and strengthen the value proposition for licensed electronic merchandise worldwide.

Collectively, these companies contributed to a competitive ecosystem driven by innovation, franchise collaborations, and consumer demand for immersive, character-driven play. Their investments in design, safety, and technology reinforced market resilience, supporting continuous growth across global licensed toy categories in 2024.

Top Key Players in the Market

- Bandai Namco Holdings Inc.

- Mattel

- Funko Inc.

- Hasbro Inc.

- JAKKS Pacific Inc.

- LEGO Group

- Mattel Inc.

- Melissa & Doug LLC

- Spin Master Corp.

- Tomy Company Ltd.

Recent Developments

- In Jan 2024, Spin Master, a global children’s entertainment company, completed its previously announced acquisition of Melissa & Doug, a U.S. based early childhood play brand, for $950 million. This acquisition significantly strengthens Spin Master’s position in the educational and wooden toy segment, expanding its portfolio in early learning and developmental play.

- In Aug 2024, Hunter Price International acquired online toy retailer BargainMax.co.uk, accelerating its growth and expansion strategy following a strong trading performance in 2023. The acquisition reinforces Hunter Price’s customer first retail approach and expands its reach across toys, accessories, lifestyle, stationery, and arts & crafts categories.

Report Scope

Report Features Description Market Value (2024) USD 30.4 Billion Forecast Revenue (2034) USD 45.8 billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Action Figures, Dolls & Plush Toys, Arts & Crafts, Games & Puzzles, Outdoor & Sports Toys, Construction Sets, Educational Toys, Others), By Age Group (Below 1 Yrs., Age 1-3, Age 3-5, Age 5-12, Age 12+), By End-Use (Individual, Commercial), By Distribution Channel (Hypermarket/Supermarket, Online, Departmental Stores, Specialized Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bandai Namco Holdings Inc., Mattel, Funko Inc., Hasbro Inc., JAKKS Pacific Inc., LEGO Group, Mattel Inc., Melissa & Doug LLC, Spin Master Corp., Tomy Company Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bandai Namco Holdings Inc.

- Mattel

- Funko Inc.

- Hasbro Inc.

- JAKKS Pacific Inc.

- LEGO Group

- Mattel Inc.

- Melissa & Doug LLC

- Spin Master Corp.

- Tomy Company Ltd.