Global Legionella Testing Market By Testing Method (Culture-Based Methods, Molecular Methods, Immunoassay Methods (Urinary Antigen Test (UAT) and Direct Fluorescent Antibody (DFA)), Serological Methods and Others), By Application (Environmental and Clinical), By End-User (Clinical Laboratories, Environmental/Industrial Testing Labs, Hospitals & Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172400

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

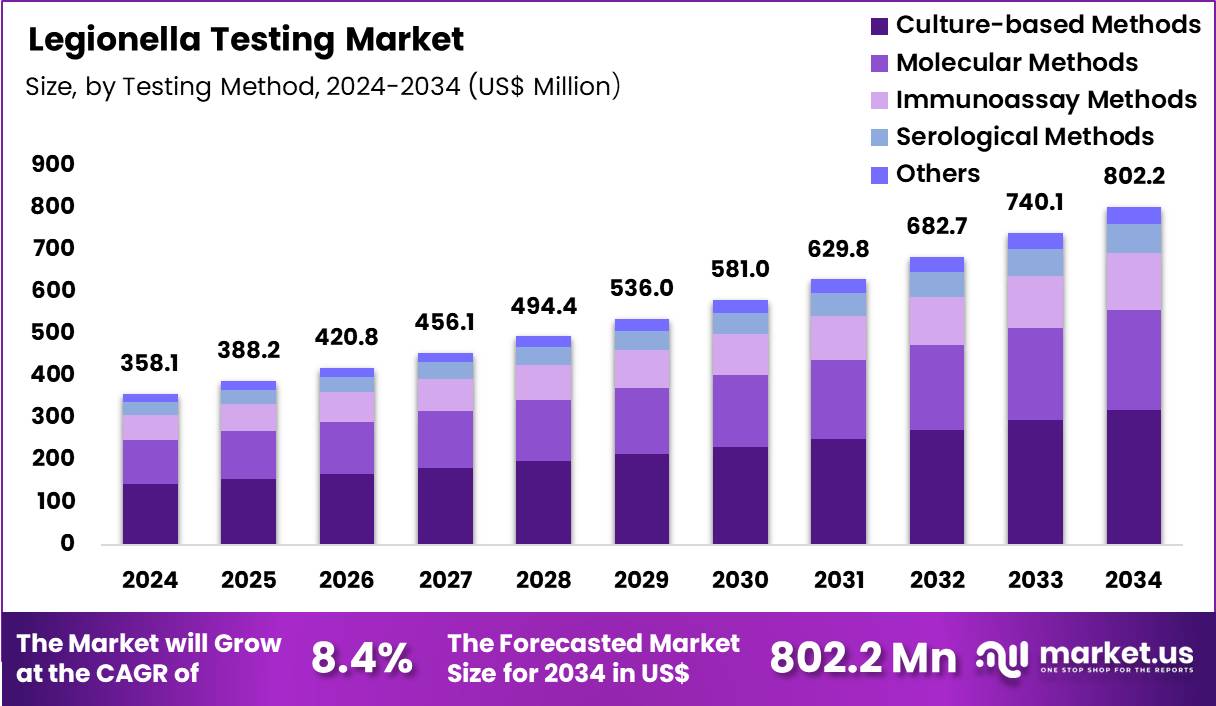

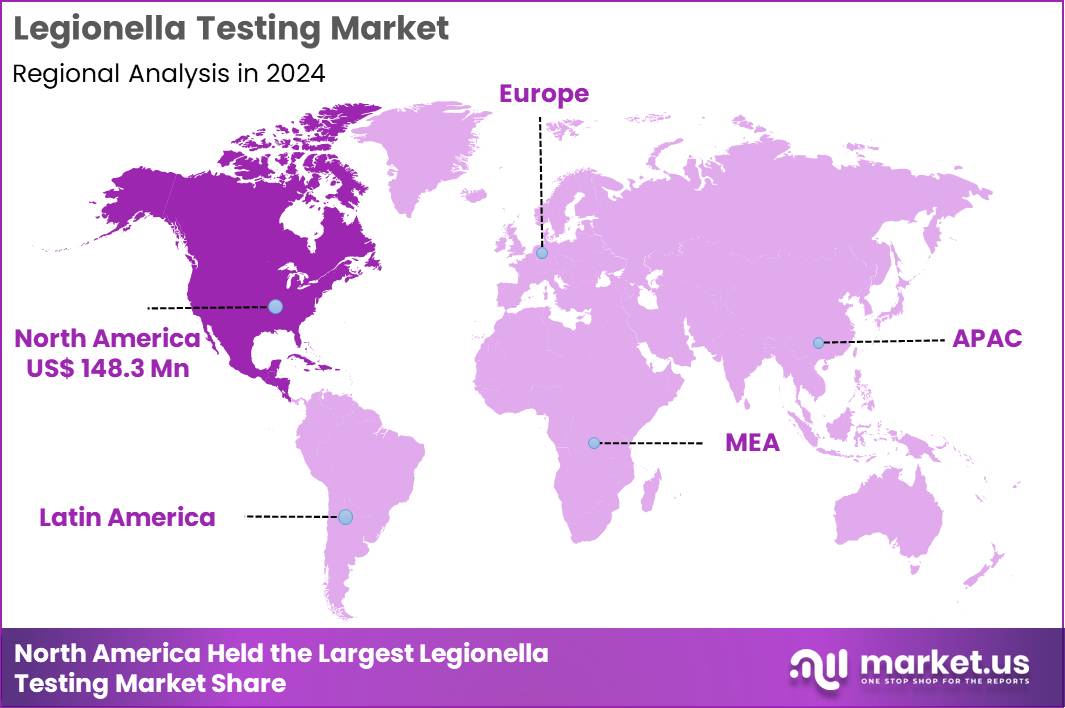

The Global Legionella Testing Market size is expected to be worth around US$ 802.2 Million by 2034 from US$ 358.1 Million in 2024, growing at a CAGR of 8.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.4% share with a revenue of US$ 148.3 Billion.

Rising incidence of Legionnaires’ disease prompts healthcare facilities and building managers to implement comprehensive Legionella testing protocols that safeguard vulnerable populations from waterborne pathogens. Laboratories frequently conduct microbial culture tests on potable water samples from hospital distribution systems to isolate and quantify viable bacteria, guiding disinfection strategies. These tests support urinary antigen assays for rapid clinical diagnosis of Legionella pneumophila serogroup 1 in patients presenting with severe pneumonia symptoms.

Facilities managers apply PCR-based methods to detect Legionella DNA in cooling tower water, enabling swift identification during routine maintenance. Environmental health specialists utilize direct fluorescent antibody staining for confirmatory analysis in hot water heaters and decorative fountains prone to biofilm formation.

Data published by the National Center for Biotechnology Information in October 2023 highlighted reports from the European Centre for Disease Prevention and Control showing an upward trend in both Legionella outbreaks and confirmed cases across multiple European countries. This rise in incidence underscores the growing need for reliable, scalable Legionella testing methods, reinforcing long-term demand for molecular, rapid, and automated diagnostic technologies within the market.

Facility operators explore opportunities to deploy quantitative PCR assays that provide faster results than traditional culture techniques, enhancing proactive monitoring in large-scale water systems like industrial evaporative condensers. Developers integrate multiplex PCR panels to simultaneously screen for multiple Legionella species in spa and whirlpool samples, improving outbreak source tracing efficiency. These approaches expand applications in point-of-care urinary antigen testing for emergency departments managing community-acquired pneumonia cases.

Opportunities emerge in viability PCR methods that distinguish live from non-viable cells in remedial water samples post-disinfection. Companies advance automated sampling kits for remote hot tub facilities, ensuring compliance with health guidelines through simplified collection and transport. Firms pursue hybrid testing strategies combining culture confirmation with rapid molecular screens for comprehensive risk assessment in complex plumbing networks.

Market innovators introduce viability-enhanced PCR protocols that selectively amplify DNA from intact cells, offering superior accuracy in post-treatment verification for hospital water systems. Laboratories adopt next-generation sequencing integrations to characterize strain-specific markers during epidemiological investigations of cooling tower-associated clusters. Industry participants refine rapid antigen detection kits with improved sensitivity for non-pneumophila species in clinical respiratory specimens.

Developers enhance loop-mediated isothermal amplification techniques for field-deployable testing in recreational water features. Companies prioritize automated workflow platforms that streamline sample processing from collection to reporting in high-volume environmental surveillance programs. Ongoing advancements emphasize multiplex real-time PCR assays that deliver quantifiable results within hours, transforming routine compliance testing in diverse water management scenarios.

Key Takeaways

- In 2024, the market generated a revenue of US$ 358.1 Million, with a CAGR of 8.4%, and is expected to reach US$ 802.2 Million by the year 2034.

- The testing method segment is divided into culture-based methods, molecular methods, immunoassay methods, serological methods and others, with culture-based methods taking the lead in 2024 with a market share of 40.0%.

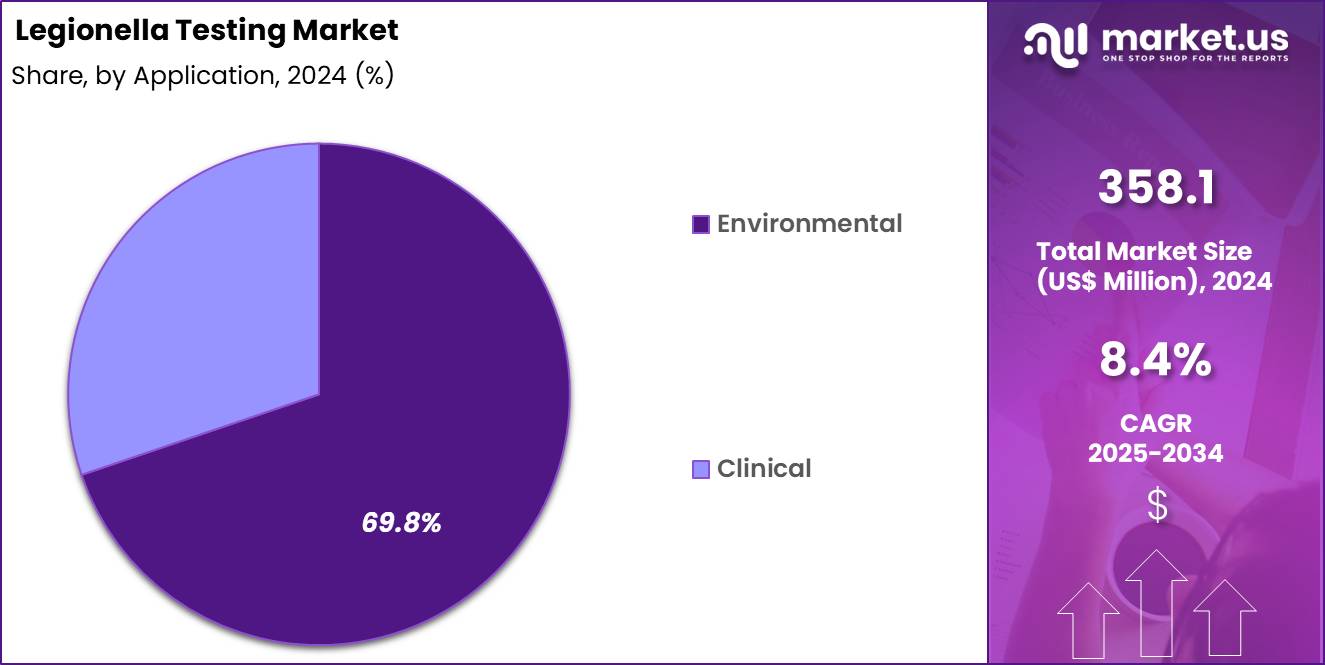

- Considering application, the market is divided into environmental and clinical. Among these, environmental held a significant share of 69.8%.

- Furthermore, concerning the end-user segment, the market is segregated into clinical laboratories, environmental/industrial testing labs, hospitals & clinics and others. The environmental/industrial testing labs sector stands out as the dominant player, holding the largest revenue share of 65.5% in the market.

- North America led the market by securing a market share of 41.4% in 2024.

Testing Method Analysis

Culture-based methods, accounting for 40.0%, are expected to dominate because regulatory agencies continue to recognize them as the reference standard for Legionella detection. Environmental monitoring programs rely on culture confirmation to assess bacterial viability and concentration levels. These methods support outbreak investigations by enabling strain identification and comparison.

Water safety guidelines across healthcare, hospitality, and industrial facilities emphasize culture testing for compliance. Laboratories value the method’s specificity and regulatory acceptance. Demand increases as aging water infrastructure raises contamination risks. Skilled laboratory expertise supports consistent usage. These factors keep culture-based methods anticipated to retain a leading position.

Application Analysis

Environmental applications, holding 69.8%, are projected to lead because Legionella prevention focuses strongly on water system surveillance rather than post-infection diagnosis. Building water systems, cooling towers, and industrial plumbing require routine monitoring to prevent outbreaks. Governments and occupational safety authorities mandate periodic environmental testing in public and commercial facilities.

Proactive risk management strategies drive regular sampling and analysis. Facility managers prioritize prevention to avoid costly shutdowns and liability. Climate change and warmer water temperatures increase bacterial growth risks. Expanded construction activity raises monitoring needs. These dynamics keep environmental testing likely to remain the dominant application.

End-User Analysis

Environmental and industrial testing laboratories, representing 65.5%, are expected to dominate end-user demand due to their specialized capabilities and large-scale testing contracts. These labs handle routine surveillance programs for municipalities, hospitals, and industrial operators. Advanced infrastructure supports high sample throughput and standardized reporting.

Accreditation requirements favor specialized labs over in-house testing. Long-term service agreements ensure consistent testing volumes. Expertise in regulatory compliance strengthens client trust. Investments in method validation improve efficiency. These drivers keep environmental and industrial testing labs anticipated to lead market adoption.

Key Market Segments

By Testing Method

- Culture-based Methods

- Molecular Methods

- Immunoassay Methods

- Urinary Antigen Test (UAT)

- Direct Fluorescent Antibody (DFA)

- Serological Methods

- Others

By Application

- Environmental

- Clinical

By End-User

- Clinical Laboratories

- Environmental/Industrial Testing Labs

- Hospitals & Clinics

- Others

Drivers

Increasing reported outbreaks of legionellosis is driving the market

The legionella testing market is driven by the increasing reported outbreaks of legionellosis, prompting heightened demand for diagnostic and environmental sampling to identify and mitigate contamination sources. Health authorities emphasize proactive testing in water systems to prevent disease transmission among vulnerable populations. Facilities such as manufacturing plants and cruise ships have faced clusters, necessitating comprehensive testing protocols to ensure compliance with safety standards.

Clinicians rely on accurate testing to confirm cases through urinary antigen or culture methods, supporting timely public health responses. Epidemiological investigations link outbreaks to aerosol-generating devices, amplifying the need for routine monitoring. Governmental surveillance systems track incidence to guide resource allocation for testing infrastructure.

Collaborative efforts between local health departments and facilities enhance outbreak detection through expanded sampling. Rising awareness of environmental risks sustains investment in advanced testing technologies. In a 2022 cluster at a South Carolina manufacturing facility, 34 cases were reported, including 15 hospitalizations and 2 deaths. This example illustrates the clinical burden that fuels market growth through increased testing requirements.

Restraints

High monitoring and reporting complexities and costs are restraining the market

The legionella testing market is restrained by high monitoring and reporting complexities and costs, which burden public water systems and regulatory entities in implementing comprehensive programs. Inclusion of legionella in national monitoring rules was avoided due to significant operational challenges in sampling and data management. Stakeholders highlighted the need for specialized protocols that differ from standard contaminant testing, adding layers of technical difficulty.

Financial implications include substantial expenditures for laboratory analysis and system modifications. Smaller utilities struggle with resource allocation for validation and quality assurance processes. Regulatory timelines for data utility limit the feasibility of broad-scale testing initiatives. Coordination across federal and state levels introduces administrative hurdles in compliance.

Economic evaluations underscore the disproportionate impact on program budgets without immediate benefits. Estimated additional costs for legionella monitoring in UCMR 5, if included, would total $10.5 million for large public water systems over five years. These factors collectively impede market expansion by deterring widespread adoption of routine testing.

Opportunities

Issuance of final EPA guidance on efficacy testing is creating growth opportunities

The legionella testing market benefits from the issuance of final EPA guidance on efficacy testing, which standardizes methods for evaluating antimicrobial products against planktonic legionella in cooling towers. This development enables manufacturers to generate robust data for product registrations and label claims. Registrants can pursue public health assertions for reducing legionella associated with Legionnaires’ disease through validated protocols.

The guidance accommodates liquid and solid formulations, broadening applicability across water treatment sectors. Collaborative testing under defined conditions simulates real-world scenarios, facilitating innovation in disinfectants. Regulatory acceptance of alternative methods on a case-by-case basis encourages research into novel approaches.

Integration with existing standards like ASHRAE enhances program implementation in buildings. Economic incentives arise from addressing underdiagnosis and high healthcare costs linked to infections. The guidance, released on August 28, 2024, references a 2021 CDC study estimating true Legionnaires’ disease cases as 1.8 to 2.7 times higher than reported. These opportunities support expanded market entry for efficacious products and related testing services.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends invigorate the Legionella testing market as escalating healthcare budgets and heightened regulatory demands for water safety compel facilities worldwide to embrace advanced PCR assays and microbial culture methods for early pathogen detection. Leading suppliers aggressively expand portfolios with portable, rapid-result kits, tapping into surging awareness of Legionnaires’ disease risks in hotels, hospitals, and cooling systems to fuel consistent demand growth.

At the same time, stubborn inflation drives up costs for reagents, consumables, and lab infrastructure, prompting smaller operators to postpone upgrades and reduce routine screenings in cost-constrained environments. Geopolitical strains, including U.S.-China trade conflicts and regional water resource disputes, repeatedly sever supply chains for essential testing components like antibodies and media, creating production bottlenecks and sourcing uncertainties for globally reliant manufacturers.

Current U.S. tariffs apply a universal baseline duty on imported diagnostic devices alongside steeper rates on Chinese-origin products, amplifying procurement expenses for American distributors and eroding competitive pricing in domestic healthcare channels. These tariffs also provoke counter-measures from trading partners that constrain U.S. exports of innovative testing solutions and slow multinational R&D alliances.

Still, the evolving pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Recognition of emerging sources for legionella exposure is a recent trend

In 2024, the legionella testing market has observed a notable trend in the recognition of emerging sources for legionella exposure, such as private balcony hot tubs on cruise ships, leading to updated recommendations for inclusive water management. Investigations reveal inadequate maintenance practices enabling bacterial amplification in non-traditional systems. Public health reports advocate for adapting protocols from public hot tubs to private devices, including continuous disinfection and frequent testing.

Operators are urged to inventory all hot tub-style equipment for risk assessment and monitoring. Enhanced sampling strategies target both potable and non-potable water to detect colonization early. Collaborative responses between vessel owners and authorities emphasize routine legionella cultures. This shift addresses gaps in previous oversight, promoting broader environmental surveillance.

Professional guidelines now incorporate these sources into outbreak prevention frameworks. During November 2022 to July 2024, two cruise ship outbreaks involved 12 cases with 10 hospitalizations. Overall, this trend drives integration of comprehensive testing into diverse operational settings for improved safety.

Regional Analysis

North America is leading the Legionella Testing Market

In 2024, North America held a 41.4% share of the global Legionella testing market, spurred by rigorous public health regulations and a series of high-profile outbreaks that underscored the need for proactive water quality monitoring in commercial and residential structures. Healthcare facilities and hospitality providers ramped up adoption of culture-based and PCR assays to comply with updated guidelines from the Environmental Protection Agency, minimizing risks in cooling towers and plumbing systems prone to bacterial colonization.

Technological enhancements in portable detection kits enabled on-site analysis, empowering facility managers to implement swift remediation measures amid aging infrastructure vulnerabilities. Increased federal funding for environmental surveillance programs encouraged widespread screening in long-term care homes, where vulnerable populations face elevated exposure threats.

Industrial sectors, including manufacturing plants, invested in automated sampling tools to integrate testing into routine maintenance, reducing downtime associated with contamination events. Public awareness campaigns amplified demand for certified laboratories offering validated Legionella serotyping services, fostering a culture of prevention.

Collaborative efforts between state health departments and private labs streamlined data reporting, facilitating epidemiological tracking. The Centers for Disease Control and Prevention documented 99 cases of legionellosis in South Carolina during 2022, representing a statewide increase compared to prior years and highlighting the urgency for expanded testing protocols.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry leaders project steady advancement in Legionella detection practices across Asia Pacific throughout the forecast period, with governments enforcing stricter water safety standards to safeguard burgeoning urban centers. Authorities in key nations deploy mobile PCR units for real-time assessments in high-risk venues like hotels and hospitals, curbing potential epidemics from contaminated aerosols.

Local manufacturers innovate affordable urinary antigen tests, enabling small businesses to conduct regular checks on hot water systems amid humid climates that favor bacterial proliferation. Health ministries initiate nationwide training for environmental inspectors, equipping them with immunoassay kits to monitor recreational facilities and spas frequented by tourists.

Collaborative research hubs develop strain-specific probes, tailoring solutions to regional serogroup prevalences that threaten immunocompromised groups. Economic zones prioritize integration of IoT sensors in building management, automating alerts for anomalous water parameters to preempt outbreaks. Community outreach programs educate residents on home filtration maintenance, boosting uptake of consumer-grade testing strips. Hong Kong’s Department of Health recorded 135 Legionnaires’ disease cases in 2024, underscoring the imperative for intensified surveillance measures.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Legionella Testing market drive growth by expanding rapid molecular and culture-based solutions that shorten detection timelines and support proactive water safety management. Companies in the Legionella Testing market strengthen demand through partnerships with hospitals, hospitality chains, and facility managers that must comply with stringent water-quality regulations. Product strategies within the Legionella Testing market emphasize ease of sampling, high sensitivity, and compatibility with on-site and laboratory workflows to broaden adoption.

Commercial teams in the Legionella Testing market invest in training, certification support, and service models that help customers implement routine monitoring programs at scale. Geographic expansion remains central as suppliers target regions with aging infrastructure and stricter public-health oversight of water systems.

bioMérieux stands out in the Legionella Testing market with a strong infectious-disease diagnostics portfolio, global manufacturing and distribution capabilities, and proven expertise in microbiology solutions that support reliable environmental and clinical surveillance.

Top Key Players

- Abbott

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Hologic, Inc

- BD

- Eiken Chemical Co., Ltd.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Pro Lab Diagnostics Inc.

- Takara Bio Inc.

- IDEXX Laboratories

- Promega Corporation

- Merck KGaA

Recent Developments

- In September 2024, LuminUltra Technologies Ltd., a Canada-based diagnostics developer, strengthened its Legionella testing portfolio by acquiring specific assets from Genomadix Inc. The transaction brought in a compact qPCR-based testing platform capable of producing Legionella results in less than one hour while maintaining high analytical sensitivity. This move supports wider adoption of rapid, on-site Legionella detection solutions, particularly in facilities that require fast decision-making without relying on centralized laboratories.

- In May 2024, Dubai Central Laboratory, operating under Dubai Municipality, implemented a new artificial intelligence–enabled solution designed to detect Legionella bacteria associated with severe respiratory infections. As one of the first deployments of this technology in the region, the adoption reflects increasing demand for advanced diagnostic tools that combine accuracy with shorter turnaround times, supporting faster public health responses and routine environmental monitoring.

Report Scope

Report Features Description Market Value (2024) US$ 358.1 Million Forecast Revenue (2034) US$ 802.2 Million CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Testing Method (Culture-based Methods, Molecular Methods, Immunoassay Methods, Serological Methods, Others) By Application (Environmental, Clinical) By End-User (Clinical Laboratories, Environmental/Industrial Testing Labs, Hospitals & Clinics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott, BIOMÉRIEUX, Bio-Rad Laboratories, Inc., Hologic, Inc, BD, Eiken Chemical Co., Ltd., Danaher Corporation, Thermo Fisher Scientific Inc., QIAGEN, F. Hoffmann-La Roche Ltd., Pro Lab Diagnostics Inc., Takara Bio Inc., IDEXX Laboratories, Promega Corporation, Merck KGaA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Hologic, Inc

- BD

- Eiken Chemical Co., Ltd.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Pro Lab Diagnostics Inc.

- Takara Bio Inc.

- IDEXX Laboratories

- Promega Corporation

- Merck KGaA