Global Legal Transcription Market Size, Share, Industry Analysis Report By Component (Software/Platform, Services), By Service Model (Human-Based Transcription, AI & Automated Transcription, Hybrid Models), By Type (Court Transcripts, Depositions, Real-time/Live Captioning, Translation & Multilingual Transcription, Others), By End-User (Law Firms & Attorneys, Courts & Judiciary, Corporate Legal Departments, Government Agencies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157108

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. Legal Transcription Market

- Component: Software/Platform (64.3%)

- Service Model: Human-Based Transcription (45.1%)

- Type: Court Transcripts (32.6%)

- End-User: Law Firms & Attorneys (40%)

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

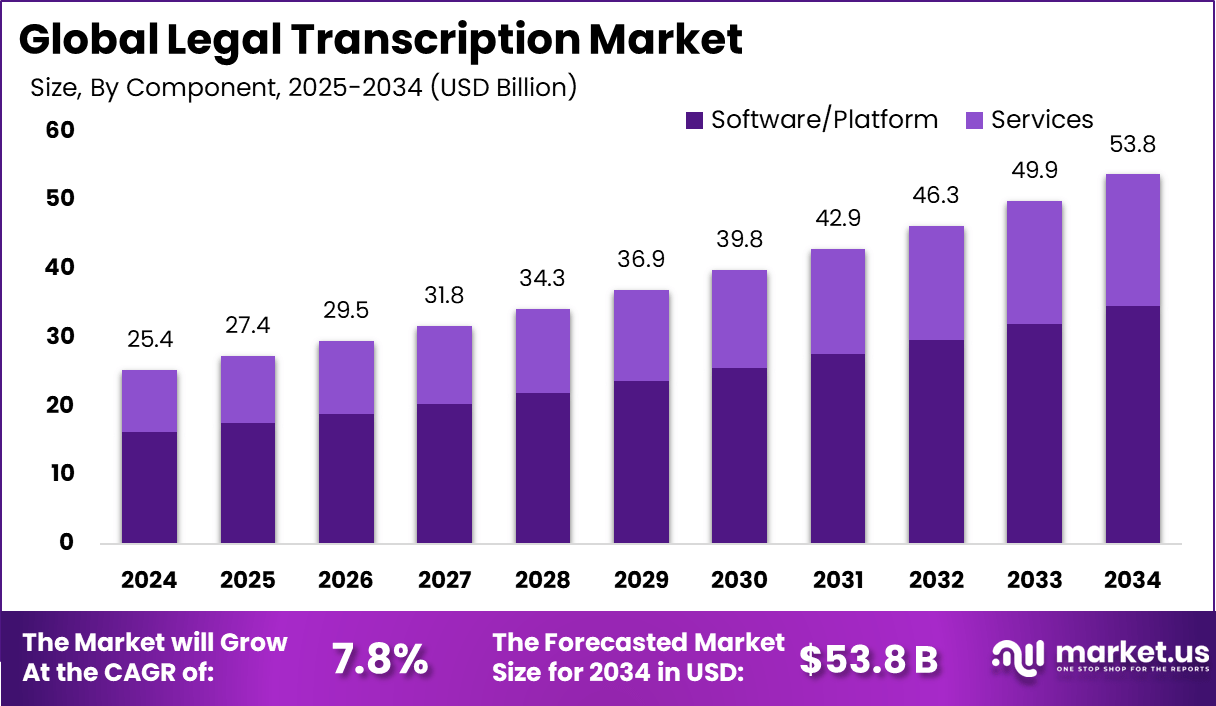

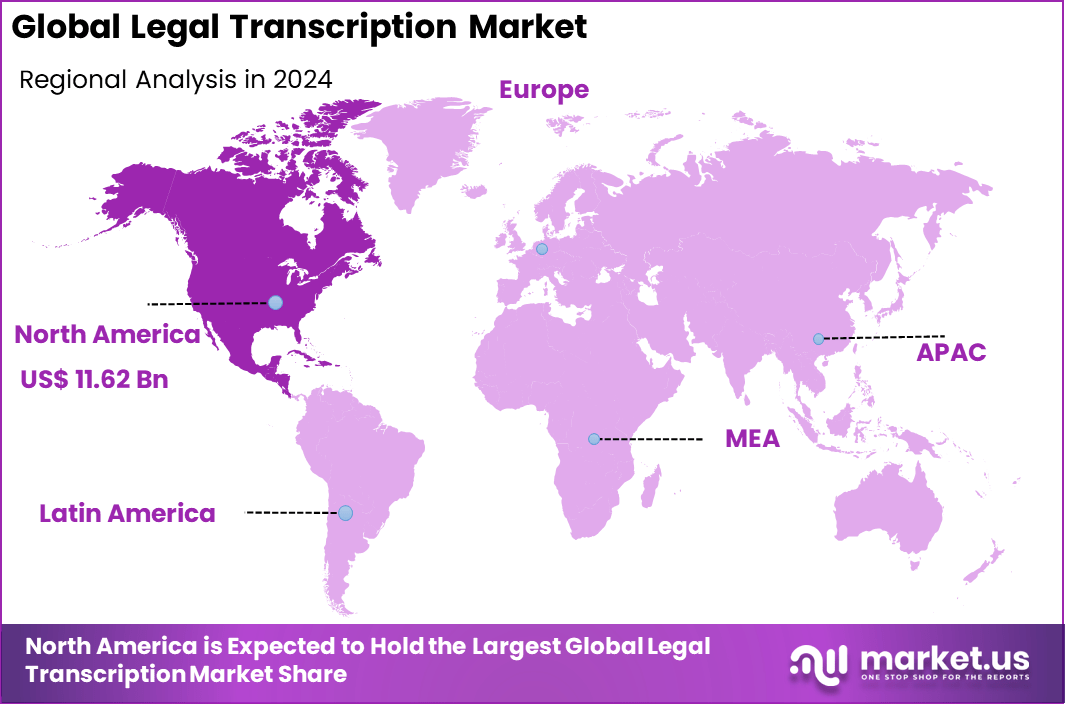

The Global Legal Transcription Market size is expected to be worth around USD 53.8 billion by 2034, from USD 25.38 billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.8% share, holding USD 11.62 billion in revenue.

The legal transcription market involves converting legal proceedings such as court hearings, depositions, and client meetings into accurate written records essential for case preparation, compliance, and archival purposes. The market is driven by increasing litigation volumes, stringent documentation requirements, and rapid digitization of legal workflows.

Law firms, courts, and corporate legal departments are adopting AI-powered and hybrid transcription models to reduce turnaround times while maintaining accuracy. Rising demand for real-time captioning, multilingual transcription for cross-border cases, and integration with case management and e-discovery platforms further fuels growth, with North America leading due to its advanced legal infrastructure.

Technological adoption is increasing rapidly in this market, with cloud-based platforms, artificial intelligence (AI), and machine learning (ML) playing pivotal roles. AI-powered transcription tools enhance accuracy by better understanding legal terminology, multiple speakers, accents, and background noises. Cloud technology brings flexibility and accessibility, allowing legal teams to access secured transcripts anytime and anywhere, improving collaboration and workflow efficiency.

AI transcription tools like those highlighted by LLCBuddy can achieve transcription accuracy rates of up to 99% under optimal conditions. Verbit utilizes a hybrid approach combining advanced AI-driven speech recognition with human editing, enabling it to deliver transcription accuracy close to 99%. However, some imperfections related to punctuation, speaker identification, and grammar typically require minor manual adjustments, particularly in complex audio with accents or overlapping speech.

Key Takeaways

- The global legal transcription market size in 2024 is USD 25.38 billion, projected to grow at a CAGR of 7.8% from 2025 to 2034.

- Software/Platform solutions dominate by component, holding 64.3% market share in 2024, driven by demand for efficient, automated transcription tools.

- Human-Based Transcription leads the service model segment with 45.1% share, reflecting continued reliance on accuracy and expertise in complex legal proceedings.

- Court Transcripts represent the largest type segment with 32.6% market share, highlighting their critical role in judicial processes.

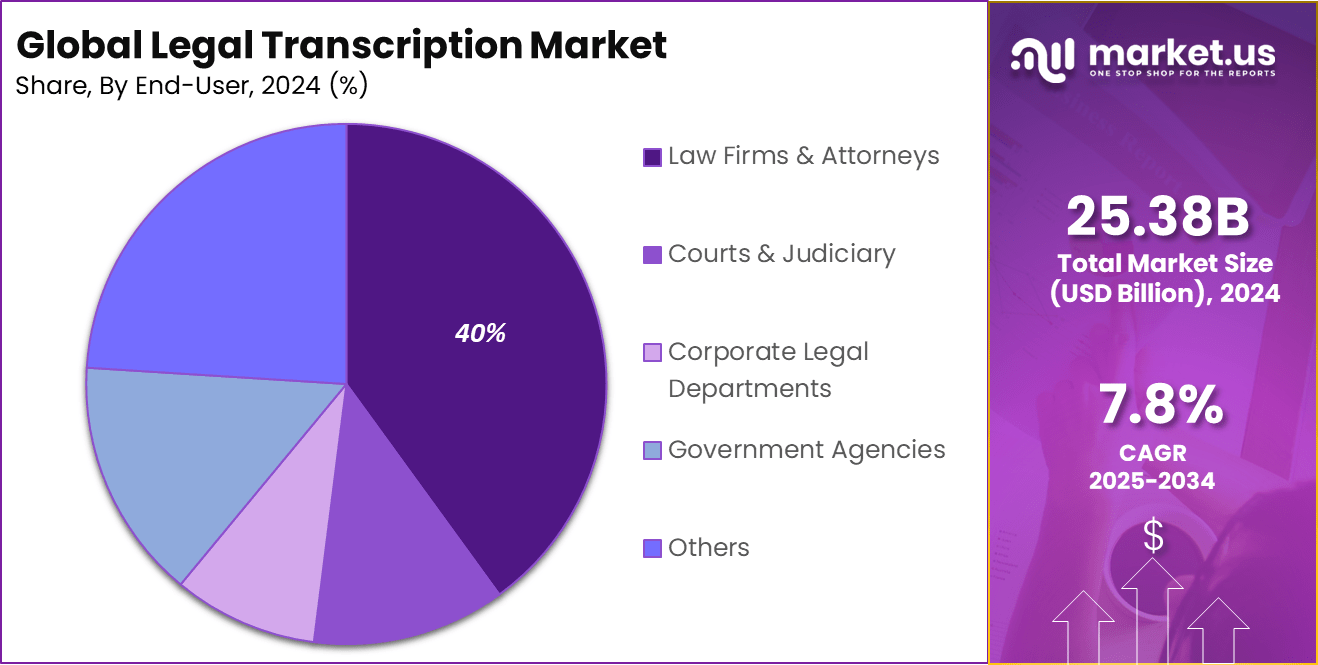

- Law Firms & Attorneys are the top end-users, accounting for a 40% share, as they heavily depend on precise documentation for case preparation.

- North America leads regionally with 45.8% market share, fueled by advanced legal infrastructure and strong compliance requirements.

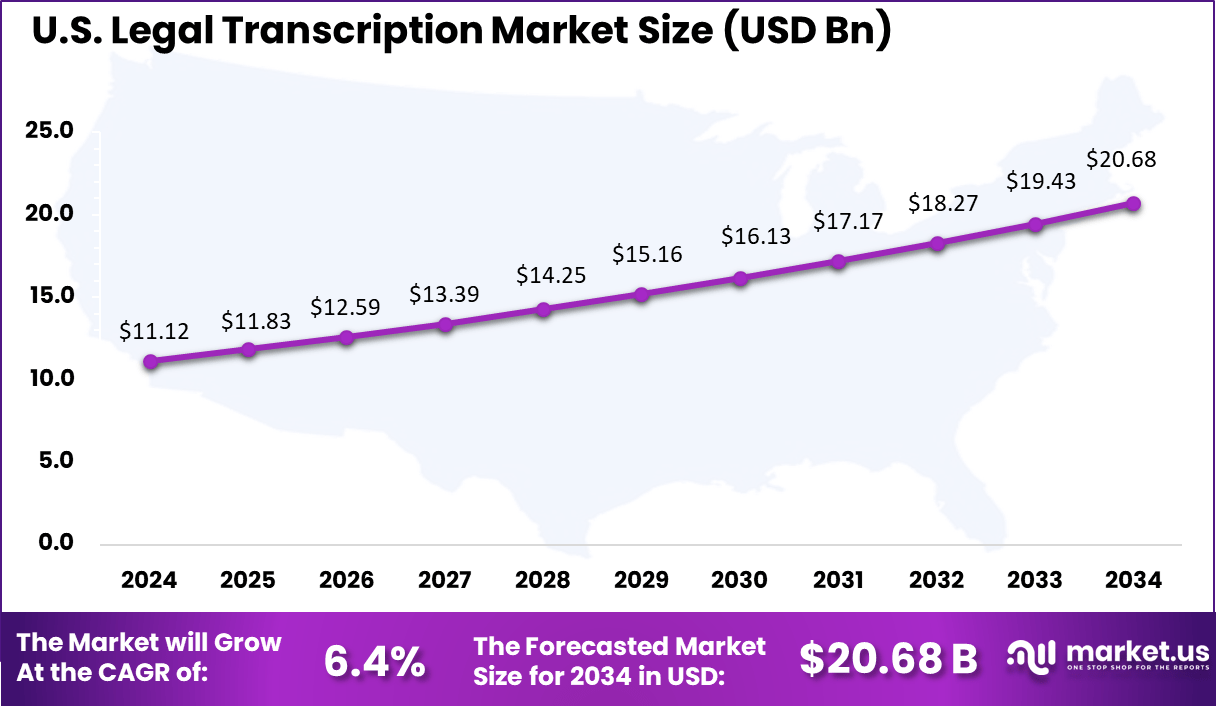

- The US alone accounts for USD 11.12 billion in 2024, growing at a CAGR of 6.4%, underscoring its dominant position within the global market.

Analysts’ Viewpoint

Investment opportunities in the legal transcription market are found in expanding AI capabilities, improving cloud infrastructure, and developing niche transcription services for specialized legal areas such as intellectual property or healthcare law. As more law firms outsource transcription to cut costs and boost efficiency, providers that offer robust, secure, and precise transcription services are positioned to capitalize on this trend.

Business benefits of legal transcription are substantial. Accurate transcripts prevent misunderstandings, help in legal research and case building, and support compliance with regulatory mandates. Transcription services also enhance productivity by freeing legal staff from manual documentation tasks and enable cost savings by reducing the need for in-house transcription specialists.

The regulatory environment strongly impacts this market. Legal transcription providers must comply with strict data protection laws such as GDPR and HIPAA, which mandate secure handling, storage, and confidentiality of sensitive client data. Regulatory compliance drives providers to implement encryption, conduct regular audits, and maintain confidentiality agreements.

U.S. Legal Transcription Market

The U.S. Legal Transcription Market was valued at USD 11.12 Billion in 2024 and is anticipated to reach approximately USD 20.68 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.4% during the forecast period from 2025 to 2034.

According to the American Bar Association, law firms are investing more in technology to meet growing compliance and documentation workloads, reducing review times by up to 30% through transcription integrated with case management and e-discovery platforms. These factors collectively ensure steady market expansion in the U.S. legal sector.

In 2024, North America held a dominant market position, capturing more than 45.8% share and generating USD 11.62 billion in revenue in the legal transcription market. The leadership of this region is closely linked to the high volume of legal proceedings across the United States and Canada, which demand accurate and timely transcription services.

Courts, law firms, and government agencies in North America have been early adopters of digital transcription solutions powered by artificial intelligence, ensuring greater efficiency in managing vast volumes of case-related documentation. The region’s dominance is also supported by strict regulatory frameworks that emphasize accuracy and compliance in legal records. T

The requirement for precise documentation in litigation, arbitration, and corporate law processes has led to the widespread use of professional transcription services. Moreover, strong investments in advanced voice recognition systems and natural language processing technologies have accelerated adoption rates, making transcription faster, more cost-efficient, and reliable.

For instance, Verbit and VIQ Solutions provide real-time transcription for virtual courtrooms, which became critical during the pandemic and continue to streamline remote hearings. In Europe, GDPR-compliant transcription solutions are gaining traction, while APAC is seeing growth as legal systems digitize in markets like India and Singapore. Latin America and MEA remain emerging markets, with rising demand for multilingual and affordable transcription services as cross-border litigation increases.

Component: Software/Platform (64.3%)

Software and platform solutions dominate the legal transcription market, accounting for 64.3% of the segment in 2024. The rising adoption of AI and machine learning technologies enhances transcription accuracy and turnaround time, making software solutions more efficient and cost-effective. These platforms enable legal professionals to automate large volumes of audio and video documentation, reducing reliance on manual transcription and increasing workflow efficiency.

Moreover, cloud-based transcription platforms offer attorneys and law firms seamless accessibility and scalability, catering to the growing volume of legal proceedings. These software solutions are often integrated with case management and legal research tools, allowing faster and more reliable retrieval of critical legal documents, which contributes to the strong market preference for platform-based transcription services.

Service Model: Human-Based Transcription (45.1%)

Despite the growth in software automation, human-based transcription services hold a critical share of 45.1% in the market. This segment remains preferred for its higher accuracy in understanding legal jargon, context, and nuances that automated systems may misinterpret. Human transcribers play an essential role in accurately converting spoken word to text, especially during complex legal proceedings such as depositions and court trials.

Legal professionals favor human transcription for confidentiality, adherence to regulatory standards, and the assurance of error-free transcripts required in sensitive legal environments. Additionally, the human element is often necessary to ensure clarity and reliability where AI and automated systems can fall short, balancing technology adoption with expert oversight.

Type: Court Transcripts (32.6%)

Court transcripts constitute the largest type segment with 32.6% market share as of 2024. The high volume of court proceedings, hearings, and trials necessitates accurate and detailed transcription to support case records and legal appeals. These transcripts form an indispensable part of the judicial process, providing verifiable and clear evidence of courtroom exchanges.

The increasing digitization of court systems complements legal transcription demand by enabling easier audio-video recording and subsequent transcription requirements. As more courts adopt technology, legal transcription services for court transcripts continue to be crucial for maintaining comprehensive and accessible case documentation.

End-User: Law Firms & Attorneys (40%)

Law firms and attorneys remain the largest end-user segment of the legal transcription market, accounting for 40% in 2024. These users require transcription services to streamline trial preparation, case analysis, and client interaction documentation. Access to accurate transcripts allows them to build stronger cases, meet legal deadlines, and manage growing case documentation efficiently.

Furthermore, law firms leverage transcription services to reduce administrative burdens and focus more on legal strategy and client advocacy. The demand is further heightened by the increasing number of legal cases worldwide and the trend towards outsourcing transcription to specialized providers to enhance quality and operational cost savings.

Key Market Segments

By Component

- Software/Platform

- Services

By Service Model

- Human-Based Transcription

- AI & Automated Transcription

- Hybrid Models

By Type

- Court Transcripts

- Depositions

- Real-time/Live Captioning

- Translation & Multilingual Transcription

- Others

By End-User

- Law Firms & Attorneys

- Courts & Judiciary

- Corporate Legal Departments

- Government Agencies

- Others

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Driver Analysis

Rising Volume of Legal Proceedings

The growing number of court cases, depositions, and legal hearings is a primary driver for the legal transcription market. As legal activities increase worldwide, there is a heightened need to produce accurate and timely written records of spoken words in these proceedings. Legal professionals require reliable transcripts to ensure clarity, compliance, and proper documentation of evidence.

This surge in legal documentation demand pushes law firms, courts, and legal departments to seek transcription services to handle the growing workload efficiently. Additionally, advancements in technology, such as AI-based speech recognition tools, have made transcription faster and more cost-effective, encouraging legal service providers to adopt these solutions more widely.

These technologies support the expanding volume of legal transcription by enabling quicker turnaround times and reducing the burden on human transcribers. Together, the increase in legal proceedings and technology adoption act as a dual catalyst for market growth in this sector.

Restraint Analysis

Data Security and Privacy Concerns

Legal transcription involves handling highly sensitive and confidential information. One of the biggest challenges restricting market growth is ensuring data privacy and security. Legal documents must comply with strict regulatory requirements such as GDPR, HIPAA, and other jurisdictional laws to protect client confidentiality and avoid legal penalties.

Failing to maintain rigorous security protocols can lead to breaches or data leaks, which severely damage trust and reputation. Service providers face significant costs and operational challenges in implementing encryption, secure data storage, and controlled access systems.

The requirement for constant compliance adds considerable complexity and expense, especially for smaller transcription firms. These hurdles can limit the willingness of some organizations to fully outsource transcription services or adopt new technologies, slowing market expansion.

Opportunity Analysis

Integration of AI and Cloud-Based Solutions

A major opportunity in the legal transcription market lies in the growing use of AI and cloud computing. AI-powered transcription tools improve accuracy and speed by automatically converting speech to text while learning legal terminologies and nuances.

This reduces turnaround time and cost, allowing firms to handle more cases efficiently. The evolution of these intelligent systems provides a pathway for companies to differentiate their offerings and capture additional market share.

Cloud-based transcription services further enhance flexibility by enabling remote access, collaborative workflows, and scalable usage that adapts to fluctuating demand. These solutions also improve cost efficiency and make advanced transcription available to smaller legal practices and emerging markets.

Challenge Analysis

Shortage of Skilled and Security-Cleared Transcriptionists

Despite technological progress, a critical challenge remains in the shortage of qualified human transcriptionists who understand legal language and meet security clearance requirements. Legal transcription often demands specialized knowledge to ensure accuracy and consistency, especially in complex cases with industry-specific terminology.

Additionally, transcriptionists must pass strict background checks and comply with security regulations to handle confidential legal materials. The limited pool of skilled and cleared professionals can cause delays in turnaround times and reduce service quality.

This shortage is more pronounced in sectors like law enforcement and government, where regulatory standards are very high. As demand for transcription grows, recruiting and retaining competent personnel becomes a major operational challenge, impacting overall market scalability and service reliability.

Key Player Analysis

In the legal transcription market, established providers such as TransPerfect, Rev, Scribie, and Lexitas hold a strong presence. Their expertise in handling complex legal documentation and ensuring compliance with industry standards has contributed to their prominence. These companies focus on maintaining high levels of accuracy, speed, and confidentiality, which are critical for legal professionals.

Another group of companies, including Verbit, Crimson Interactive, SpeakWrite, and GoTranscript, emphasize innovation and scalability. These players integrate artificial intelligence with human review processes to improve efficiency while ensuring legal accuracy. Their services are designed to handle large volumes of transcription work, making them suitable for law firms, courts, and corporate legal departments.

Emerging and specialized providers such as LexTranscribe, Ditto, Flatworld Solutions, TranscribeMe!, GMR Transcription, Vee Technologies, Kissamago Transcriptions, and VIQ Solutions also contribute to market growth. These firms often cater to niche client requirements, ranging from real-time transcription to customized solutions for regional markets. Their focus on affordability and targeted legal expertise enables them to attract smaller law practices and independent professionals.

Top Key Players

- TransPerfect

- Rev

- Scribie

- Lexitas

- Verbit

- Crimson Interactive

- SpeakWrite

- GoTranscript

- LexTranscribe

- Ditto

- Flatworld Solutions

- TranscribeMe!

- GMR Transcription

- Vee Technologies

- Kissamago Transcriptions Pvt Ltd

- VIQ Solutions Inc.

- Other Key Players

Recent Developments

- Verbit launched a new “Legal Real-Time” transcription service in early 2025, leveraging its AI-powered Captivate platform. This offering targets live legal proceedings like depositions, hearings, and trials with high accuracy and cost efficiency, catering to the shortage of human court reporters

- Lexitas introduced Deposition Insights+ in July 2025, an AI-powered transcript and video analysis platform designed to accelerate litigation preparations, reducing the labor-intensive review of depositions. This new tool includes AI-assisted search, identification of contradictions and key admissions, exhibit summaries, and behavioral video analysis..

Report Scope

Report Features Description Market Value (2024) USD 25.38 Bn Forecast Revenue (2034) USD 53.8 Bn CAGR(2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platform and Services), By Service Model (Human-Based Transcription, AI & Automated Transcription, and Hybrid Models), By Type (Court Transcripts, Depositions, Real-time/Live Captioning, Translation & Multilingual Transcription, and Others), By End-User (Law Firms & Attorneys, Courts & Judiciary, Corporate Legal Departments, Government Agencies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TransPerfect, Rev, Scribie, Lexitas, Verbit, Crimson Interactive, SpeakWrite, GoTranscript, LexTranscribe, Ditto, Flatworld Solutions, TranscribeMe!, GMR Transcription, Vee Technologies, Kissamago Transcriptions Pvt Ltd, VIQ Solutions Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Legal Transcription MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Legal Transcription MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- TransPerfect

- Rev

- Scribie

- Lexitas

- Verbit

- Crimson Interactive

- SpeakWrite

- GoTranscript

- LexTranscribe

- Ditto

- Flatworld Solutions

- TranscribeMe!

- GMR Transcription

- Vee Technologies

- Kissamago Transcriptions Pvt Ltd

- VIQ Solutions Inc.

- Other Key Players