Global Legal Marijuana Market Product Type (Flower, Oil and Tinctures) By Application-Medical(Chronic Pain, Cancer, Depression and Anxiety, Arthritis, Diabetes, Glaucoma) (Recreational) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 20785

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

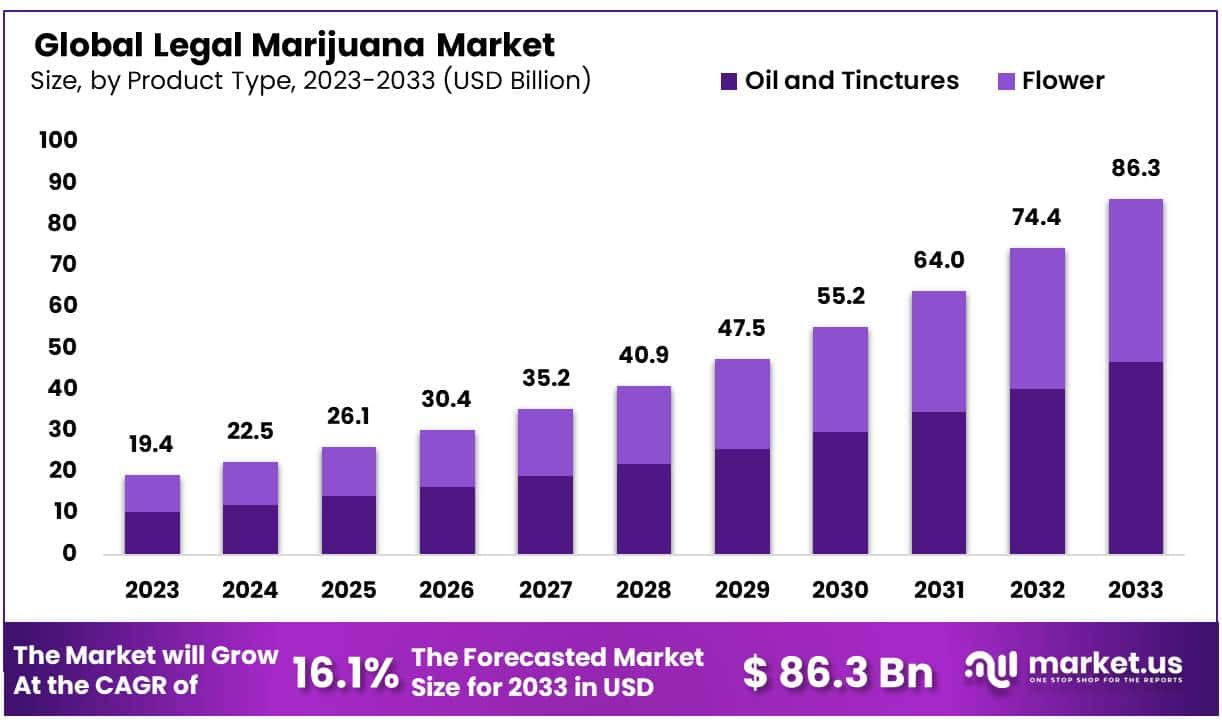

The Legal Marijuana Market size is expected to be worth around USD 86.3 Billion by 2033 from USD 19.4 Billion in 2023, growing at a CAGR of 16.1% during the forecast period from 2024 to 2033.

The growth of the market has been driven by growing demand. Many countries have legalized medical cannabis in recent years to treat various ailments. Many studies have demonstrated that medical marijuana can be used to treat various symptoms, including chronic pain, nausea due to chemotherapy, Parkinson’s disease, and Alzheimer’s.

Principal factors driving the expansion of legal marijuana markets include medicinal cannabis’s growing acceptance in traditional medical settings and rising public support of it as an alternative medicine. As evidence of marijuana-derived formulations’ therapeutic advantages accumulates, the US Food and Drug Administration has approved medications made up of cannabis components. As cancer rates continue to soar, interest has intensified on exploring THC-based drugs as potential cancer therapies.

Additionally, numerous medications containing THC and CBD for relieving muscular spasms and neuropathic pain have either received approval from regulatory authorities or are in clinical trials. As disease prevalence rises and medical marijuana becomes an accepted alternative treatment solution, market share for legal cannabis grows consistently over time.

The FDA and other similar associations now accept marijuana derivatives for a prescription for diseases it has proved useful. Another reason marijuana has been legalized in many countries is its quick turnaround. North America, which includes Canada and the U.S., has legalized recreational marijuana. More than half of the U.S. states have legalized cannabis.

Key Takeaways

- Market Size: Legal Marijuana Market size is expected to be worth around USD 86.3 Billion by 2033 from USD 19.4 Billion in 2023.

- Market Growth: The market growing at a CAGR of 16.1% during the forecast period from 2024 to 2033.

- Product Analysis: The largest revenue share was held by the oil and other tinctures segment, which accounted for over 54%.

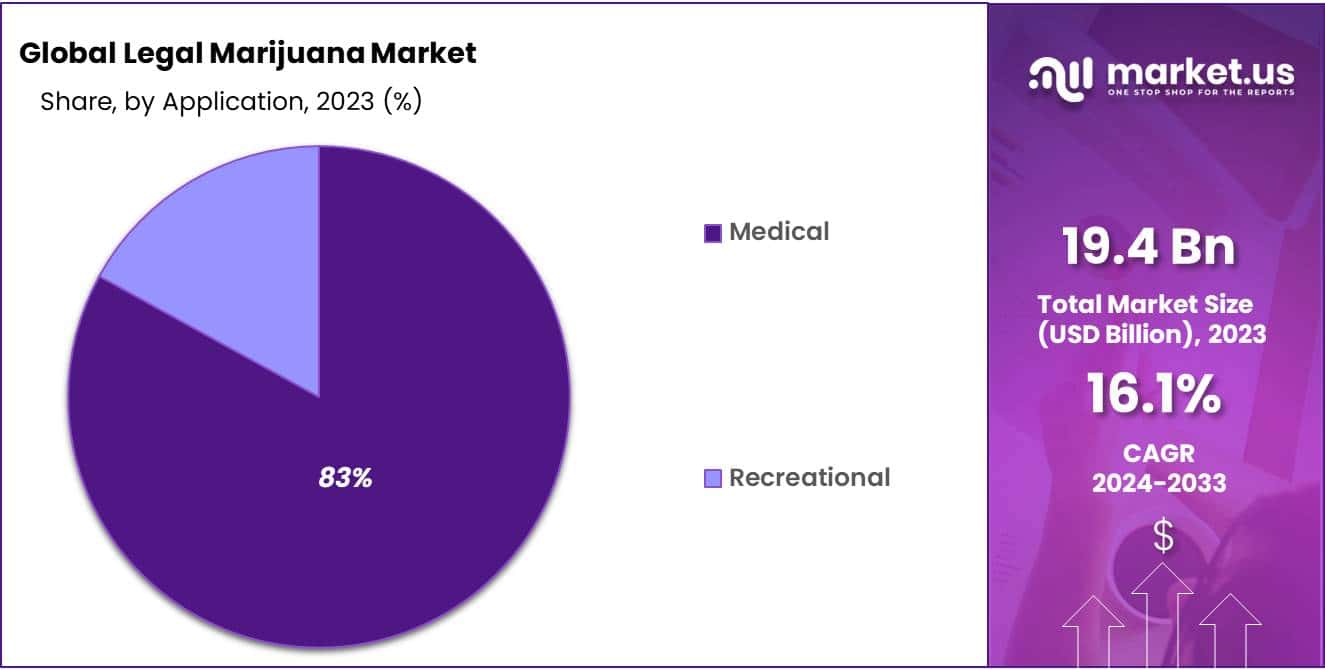

- Application Analysis: The largest revenue share was held by the medical segment, which accounted for more than 83% in 2023.

- Regional Analysis: North America accounted for the majority of North America’s revenue share, with 75% as of 2023.

- Pandemic Impact: The pandemic disrupted logistics and imports of cannabis derivatives, causing shortages in government-authorized dispensaries.

- Government Support: Governments are encouraging cannabis cultivation to reduce imports and increase tax revenue.

- Startup Growth: Startups are focusing on alternative uses of cannabis, fostering liberal cultivation and medical use policies.

Product Type Analysis

The largest revenue share was held by the oil and other tinctures segment, which accounted for over 54%. The majority of countries that have legalized marijuana are doing so to benefit from its medicinal properties. In many countries, marijuana oil and tinctures are being extensively studied for many purposes. With the recent legalization of cannabis and its derivatives, it is likely to be the fastest-growing sector over the forecast period. Cannabis oil can be used to treat nausea and vomiting due to cancer.

Additionally, cannabinoids in oil aid in anxiety and stress reduction. Oils and tinctures are expected to be in demand over the next few years due to an increase in oil-based patients. Due to the respiratory issues caused by smoking, cannabis derivatives cannot be recommended for children. Instead, they are being prescribed oils or tinctures.

Application Analysis

The largest revenue share was held by the medical segment, which accounted for more than 83% in 2023. It is expected to continue growing at a steady pace between 2024-2033. This growth can be attributed to the legalization and decriminalization recently of medical marijuana. Because of the availability of medical marijuana and the affordability of the product, patients in these regions prefer to use it for their medical purposes.

In 2023, chronic pain accounted for the highest revenue share at over 28%. For their analgesic potency, recreational cannabis derivatives have been extensively researched. It has produced better results than traditional medications with fewer side effects. It has been shown to be effective in reducing arthritic pain and has negligible side effects. Market growth factors are expected to be steady due to increasing awareness about medical cannabis and its derivatives.

The segment of the adult-use cannabis market is expected to grow the fastest in the forecast projection period. In countries like Canada and the U.S. where both adult-use and medicinal cannabis are legal, consumers still prefer to use adult-use marijuana because they don’t have the reimbursements for medical marijuana. Another factor that will help the segment grow is changing consumer behavior toward recreational marijuana.

Key Market Segments

Product Type

- Flower

- Oil and Tinctures

Application

Medical

- Chronic Pain

- Cancer

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

Recreational

Driver

Increased Legalization Efforts

One of the key forces propelling legal marijuana markets globally is increasing legalization efforts. Governments and regulatory bodies increasingly recognize its economic benefits – such as tax revenue generation and job creation – which leads to expanded markets.

Consumer Perception Shift

There has been a marked shift in consumer perception regarding marijuana, with more people viewing it as both medically necessary and recreationally legal products. This change has contributed to an explosion of the legal cannabis market as consumers look for safer ways to obtain cannabis products legally.

American cultivators for cannabis are increasing in number. The cultivation of marijuana also brings in more revenue for the government. It also lowers the import cost. It can be used for a variety of purposes, from medical to industrial. The exponential growth in marijuana sales since legalization has opened up new revenue streams. Legal marijuana will continue to grow as more FDA-level authorizations are being issued. Many clinical trials will help to prove the legality of marijuana derivatives.

Trend

Trends Product Diversification

One trend within the legal marijuana market that stands out is product-diversified offerings beyond flower and edibles, such as vaping devices, concentrates and topicals that meet different consumer preferences and needs. This not only expands product options but also increases market reach.

Rising Demand for CBD Products

As more awareness emerges of the health advantages associated with cannabidiol (CBD), we see rising interest for products incorporating it in multiple industries, including healthcare, cosmetics and wellness. This trend presents many opportunities for businesses in legal marijuana to capitalize on this surge of enthusiasm for cannabidiol by diversifying their product lines accordingly.

Restraints

Regulatory Challenges

Despite legalization efforts, the legal marijuana market still faces regulatory obstacles and inconsistencies at both a national and international levels. Cultivation, distribution, advertising, sales regulations can differ widely by jurisdiction; thus making compliance challenging for businesses looking to navigate complicated legal frameworks in compliance with their local regulations.

Major factors that cause revenue decline are disruptions in supply chains, conditions of oversupply or shortage in various geographical locations, and a drop in prices. Post-pandemic, the shift in patients’ attitudes toward marijuana for adult consumption and the legalization of marijuana to be used for medical purposes and/or for personal use is expected to continue.

Stigma and Social Resistance

Although attitudes about marijuana consumption may have evolved over the years, certain demographics and regions remain highly stigmatized when it comes to using legal products like medical or recreational cannabis. Social resistance fuelled by misconceptions or cultural prejudice can serve to block widespread acceptance or adoption thereby restricting market growth to some degree.

Opportunities

Exploration into New Markets

With more regions legalizing marijuana use, companies have the chance to tap into emerging cannabis industries through strategic partnerships, investments and market entry strategies that capitalize on growing consumer demand for legal pot products in previously unexplored regions.

Research and Development

Research and development offers significant potential for innovation and differentiation within the legal marijuana market. Businesses investing in R&D may develop proprietary strains, improve cultivation techniques or uncover novel applications of cannabis compounds which give their business a competitive advantage while opening new revenue streams.

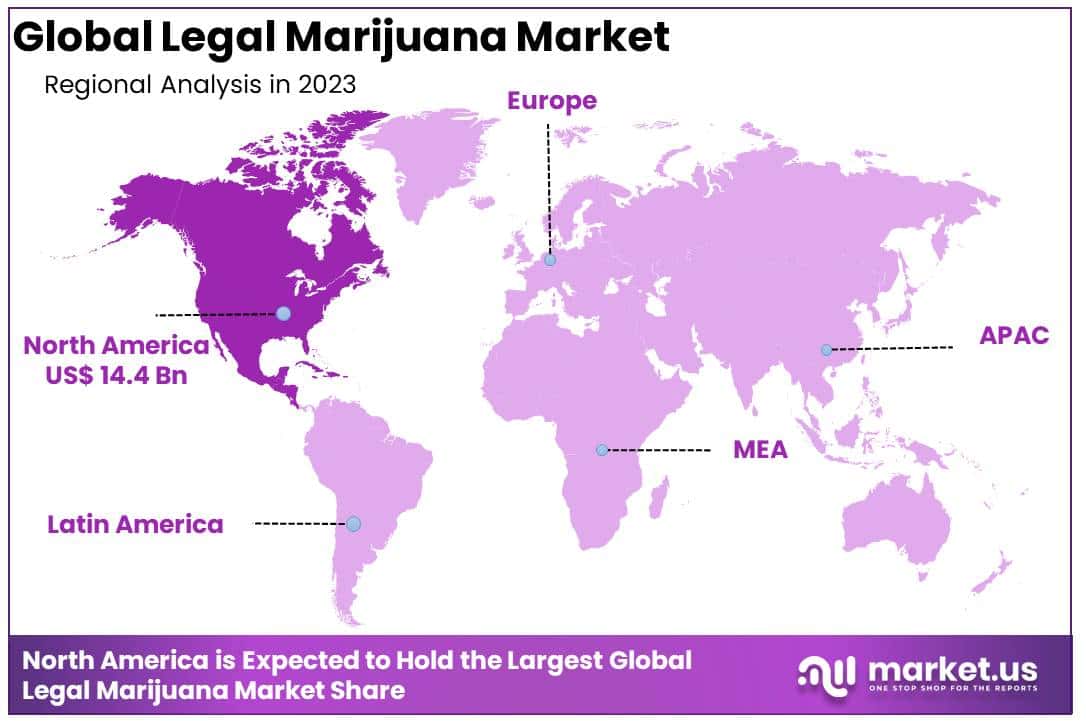

Regional Analysis

North America accounted for the majority of North America’s revenue share, with 75% as of 2023. The region’s market is being driven by the rapid growth in the rate at which the government decriminalizes the cannabis market for medical, adult use, or recreational purposes. The majority of the major players in the cannabis testing industry further enhance this position. More than two-thirds (or more) of the United States is now legal to possess cannabis. This has further strengthened North America’s position in the world.

Other European countries, particularly the U.K., as well as South American regions such as Mexico, Colombia, Ecuador, and Colombia have legalized marijuana use. However, it is only allowed in very limited quantities and for very specific uses. In response to the growing demand from these regions, this market will continue to grow. Many countries are more open to marijuana legalization in the Asia Pacific region.

Clinical studies proving its effectiveness as an analgesic will help countries with large geriatric populations to accelerate the legalization process. They can also spur the growth of this industry. Many start-ups have been formed to produce and research derivatives of marijuana in other regions. This will help to increase the market for cannabis.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Players Analysis

Marijuana products have many medical benefits that can be used to treat various chronic conditions. These products are rapidly gaining popularity. The global market is highly competitive because many companies are focused on increasing product offerings, entering new countries, and gaining more customers.

Market growth is rapid as many European and Asian countries have legalized medical marijuana. Market leaders are expected to capitalize by expanding their regional presence and consolidating market share. Cross-border trade is also being affected by various regulatory, quality, and pricing norms.

Key Market Players

- Canopy Growth Corporation

- Aurora Cannabis

- Aphria, Inc.

- Tilray

- ABcann Medicinals, Inc.

- Maricann Group, Inc.

- The Cronos Group

- Organigram Holding, Inc.

- Lexaria Corp.

- GW Pharmaceuticals

Recent Developments

- Canopy Growth Corporation: Acquired US-based Acreage Holdings for $3.4 billion in a bid to enter the American cannabis market upon federal legalization.

- Aurora Cannabis: Purchased TerraFarma, Thrive Cannabis, and BeLeaf Medical to expand its reach in the Canadian market.

- Aphria Inc.: Completed a merger with Tilray to create the world’s largest cannabis company by revenue.

- Maricann Group Inc.: Acquired by High Park Farms in 2021, focusing on the Canadian recreational cannabis market.

- The Cronos Group: Expanding operations in Europe, Latin America, and Australia.

Report Scope

Report Features Description Market Value (2023) USD 19.4 Billion Forecast Revenue (2033) USD 86.3 Billion CAGR (2024-2033) 16.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type-(Flower, Oil and Tinctures) By Application-Medical(Chronic Pain, Cancer, Depression and Anxiety, Arthritis, Diabetes, Glaucoma) (Recreational) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Canopy Growth Corporation, Aurora Cannabis, Aphria, Inc., Tilray, ABcann Medicinals, Inc., Maricann Group, Inc., The Cronos Group, Organigram Holding, Inc., Lexaria Corp., GW Pharmaceuticals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the legal marijuana market?The legal marijuana market refers to the regulated industry involved in the cultivation, distribution, sale, and consumption of marijuana products for medical and/or recreational purposes, in compliance with applicable laws and regulations.

How big is the Legal Marijuana Market?The global Legal Marijuana Market size was estimated at USD 19.4 Billion in 2023 and is expected to reach USD 86.3 Billion in 2033.

What is the Legal Marijuana Market growth?The global Legal Marijuana Market is expected to grow at a compound annual growth rate of 16.1%. From 2024 To 2033

Who are the key companies/players in the Legal Marijuana Market?Some of the key players in the Legal Marijuana Markets are Canopy Growth Corporation, Aurora Cannabis, Aphria, Inc., Tilray, ABcann Medicinals, Inc., Maricann Group, Inc., The Cronos Group, Organigram Holding, Inc., Lexaria Corp., GW Pharmaceuticals.

What factors are driving the growth of the legal marijuana market?Key drivers include the increasing legalization of marijuana, changing societal attitudes towards cannabis, expanding medical applications, and the potential for economic growth and tax revenue generation.

What are the main challenges facing the legal marijuana market?Challenges include navigating complex and evolving regulatory frameworks, overcoming social stigma and resistance, ensuring product quality and safety, accessing banking and financial services, and competing with illicit markets.

What types of products are available in the legal marijuana market?Products range from dried flower and pre-rolled joints to edibles, concentrates, topicals, tinctures, and vaporizer cartridges. Additionally, there are various accessories and ancillary products catering to different consumption preferences.

How is medical marijuana different from recreational marijuana?Medical marijuana is used primarily for therapeutic purposes under the guidance of a healthcare professional, while recreational marijuana is consumed for non-medical purposes, such as relaxation or social enjoyment, by individuals of legal age in jurisdictions where it is permitted.

-

-

- Canopy Growth Corporation

- Aurora Cannabis

- Aphria, Inc.

- Tilray

- ABcann Medicinals, Inc.

- Maricann Group, Inc.

- The Cronos Group

- Organigram Holding, Inc.

- Lexaria Corp.

- GW Pharmaceuticals