Global Legal AI Software Market Size, Share, Trends Analysis Report By Deployment Mode (Cloud-Based, On-Premise), By Application (Document Review, Legal Research, Contract Analysis and Management, Prediction of Legal Outcomes, Other Applications), By End-User (Law Firms, Corporate Legal Departments, Other End-Users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 131253

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

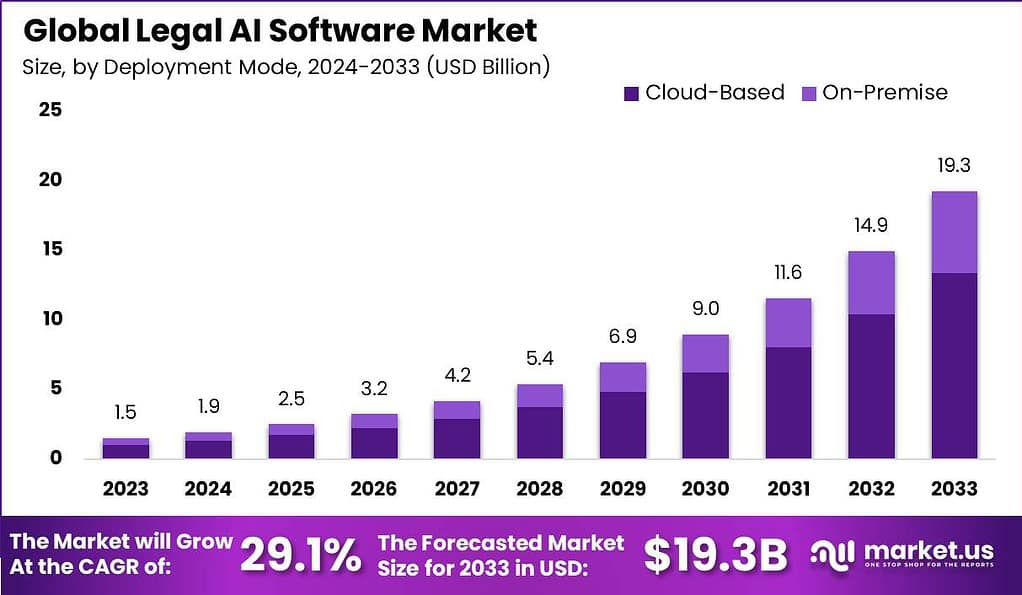

The Global Legal AI Software Market size is expected to be worth around USD 19.3 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 29.1% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 37.2% share, holding USD 0.5 Billion revenue.

Legal AI software represents a transformative category of technology designed specifically for the legal industry. This software leverages artificial intelligence to automate tasks, enhance accuracy, and improve efficiency in legal processes. It includes features like document analysis, contract review, litigation prediction, and legal research. Law firms and legal departments adopt this technology to reduce the time spent on routine tasks, allowing lawyers to focus more on complex legal strategy and client interactions.

The market for Legal AI software is on a rapid growth trajectory as more law firms and corporate legal departments seek to capitalize on the benefits of AI technology. This growth is fueled by the increasing complexity of legal cases and the volume of data that needs to be managed. The market is expanding not only in size but also in scope, as developers continue to innovate and broaden the capabilities of AI applications in legal settings, making advanced legal tools more accessible across the globe.

Several factors are driving the growth of the Legal AI software market. The primary catalyst is the growing need for efficiency and speed in legal operations, as firms face pressure to process information faster and more accurately. Additionally, the surge in data volume within the legal sector necessitates robust software that can handle and analyze extensive datasets effectively. As AI technology matures, its adoption in legal practices is becoming more widespread, supported by an increasing familiarity with its capabilities within the industry.

Recent trends in the Legal AI software market include the integration of natural language processing (NLP) to enhance the understanding and generation of legal documents. There’s also a noticeable shift towards cloud-based platforms, which offer scalability and remote accessibility. Another emerging trend is the development of AI tools tailored for specific legal applications, such as compliance monitoring and fraud detection, which provide more targeted solutions for users.

The benefits of Legal AI software are substantial. It enhances the accuracy of document analysis and helps in identifying risks and compliance issues more efficiently. This software also significantly reduces the time required for data processing and document review, freeing up legal professionals to focus on more strategic tasks. Moreover, by automating routine processes, legal AI software minimizes human errors and improves the overall quality of legal services provided to clients.

AI technologies are transforming the legal industry, particularly in compliance and regulatory processes. Organizations are expected to increase their adoption of AI solutions by 50%, reflecting the growing reliance on these tools to meet complex legal requirements. AI’s ability to automate tasks and improve accuracy is driving its popularity among legal practitioners.

Across the globe, over 300 law firms in more than 55 countries are using AI platforms such as Luminance for legal tasks like M&A due diligence and contract negotiation. This widespread use demonstrates the legal sector’s acceptance of AI, particularly in automating time-consuming tasks and ensuring compliance with regulations.

According to data from experfy, AI-enabled legal solutions provide up to 40% faster contract review by efficiently searching, filtering, and extracting key information. This acceleration in legal processes allows firms to conduct due diligence more quickly and accurately, improving both productivity and client satisfaction.

Research from Worldmetrics reveals that 94% of legal professionals believe technology can improve their productivity, with 84% of corporate legal departments using legal technology for efficiency. Moreover, 40% of legal departments have adopted AI technologies, while 61% of law firms have increased their technology budgets, highlighting the industry’s shift towards digital transformation and its focus on enhancing operational efficiency

Key Takeaways

- Legal AI software market size is expected to reach USD 19.3 billion by 2033, projected at a CAGR of 29.1% during forecast period.

- In 2023, the Cloud-Based segment held a dominant position in the legal AI software market, capturing more than 69.5% of the market share.

- In 2023, the Document Review segment held a dominant market position in the legal AI software market, capturing more than a 32.1% share.

- In 2023, the Law Firms segment held a dominant market position in the legal AI software market, capturing more than a 47% share.

Top 5 Legal AI software

- Cecilia AI by Disco: Cecilia AI, developed by Disco, is designed to streamline various aspects of legal work, particularly in litigation and discovery processes. It employs AI to automate document review, helping legal professionals quickly sort through large volumes of data and identify relevant information. The platform aims to increase accuracy and speed, reducing the time lawyers spend on manual review.

- Harvey AI: Harvey AI focuses on providing AI-driven legal research and insights. It assists lawyers by offering quick answers to complex legal questions and suggesting relevant case laws and statutes. Harvey AI leverages natural language processing to understand and interpret legal language, making it a powerful tool for enhancing the efficiency of legal research.

- Lexis AI by LexisNexis: Lexis AI is an advanced feature integrated within the LexisNexis suite of tools. It enhances the capabilities of legal research by providing more accurate search results, predictive insights, and personalized content recommendations. Lexis AI uses machine learning algorithms to adapt to user behavior, improving its recommendations over time to better meet the specific needs of its users.

- Practical Law AI by Thomson Reuters: This platform is tailored to improve the practice of law by providing AI-enhanced legal guidance and resources. Practical Law AI offers meticulously maintained resources such as checklists, toolkits, and practice notes that are continuously updated to reflect the latest legal trends and changes. It’s designed to help lawyers reduce the time spent on administrative tasks and focus more on client service.

- Blue J L&E: Specializing in labor and employment law, Blue J L&E uses predictive analytics to help legal professionals forecast outcomes in labor disputes and employment cases. The platform analyzes case law and legal precedents to provide insights on how courts might rule on particular issues, aiding lawyers in preparing more effective case strategies.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant position in the legal AI software market, capturing more than 69.5% of the market share. This substantial share can be attributed primarily to the flexibility, scalability, and cost-effectiveness that cloud-based solutions offer.

As legal firms increasingly prioritize accessibility and efficiency, cloud-based legal AI software provides the capability to access vast databases of legal documents and case law from any location at any time, which is crucial for dynamic legal practices. Moreover, the cloud model reduces the need for substantial initial capital investment in IT infrastructure, which is particularly appealing to small to mid-sized legal firms that may have limited financial resources but require advanced tools to enhance their legal research and operations.

The leading position of the Cloud-Based segment is further reinforced by the continuous enhancements in cloud security measures, which address the legal sector’s stringent data protection requirements. As data breaches become a critical concern, cloud providers are investing heavily in advanced security protocols, thus increasing the trust and reliability in cloud-based legal AI applications.

Furthermore, the integration capabilities of cloud-based legal AI software allow for seamless updates and the addition of new functionalities, which helps law firms stay at the forefront of technological advancements without the need for manual software upgrades.

Additionally, the market’s inclination toward cloud-based solutions is driven by the growing trend of remote working arrangements. The COVID-19 pandemic accelerated this shift, demonstrating the value of cloud platforms in supporting dispersed teams. Legal professionals can collaborate effectively, sharing insights and resources via cloud-based platforms, which enhances productivity and decision-making processes.

Application Analysis

In 2023, the Document Review segment held a dominant market position in the legal AI software market, capturing more than a 32.1% share. This leadership is largely due to the critical role that document review plays in legal processes and the significant efficiency gains that AI can deliver in these tasks.

AI-powered document review systems streamline the analysis of large volumes of legal documents by quickly identifying relevant materials, categorizing content, and highlighting potential issues. This capability not only reduces the time lawyers spend on routine data analysis but also enhances accuracy and reduces the risk of human error, which is paramount in legal proceedings.

The dominance of the Document Review segment is also bolstered by the increasing volume of data handled by legal firms and departments. With the rise of digital communication and documentation, the sheer quantity of data that needs to be reviewed in legal cases has grown exponentially. AI software assists in managing this data deluge by automating the review process, thus allowing legal professionals to focus on more strategic tasks that require human judgment.

Furthermore, as regulatory requirements become more stringent and complex across various industries, the demand for efficient document review solutions that ensure compliance is likely to increase, supporting continued growth in this segment. Moreover, the integration of machine learning algorithms has enhanced the capabilities of document review systems, enabling them to learn from previous interactions and improve their performance over time.

This adaptive learning feature is particularly valuable in legal settings, where precedent and context play critical roles in shaping legal outcomes. As AI technology continues to advance, the potential for further automation and sophistication in document review processes is vast, promising even greater efficiencies and accuracy. This ongoing development is expected to sustain the growth and leading status of the Document Review segment in the legal AI software market.

End-User Analysis

In 2023, the Law Firms segment held a dominant market position in the legal AI software market, capturing more than a 47% share. This segment’s leadership stems primarily from the extensive adoption of AI technologies by law firms seeking to enhance their operational efficiencies and competitive edge.

AI tools in law firms are extensively utilized for a range of applications including document review, legal research, and contract analysis, which are critical tasks that consume considerable time and resources. By integrating AI software, law firms can drastically reduce the time required for these activities, increase accuracy, and allow lawyers to concentrate on higher-value aspects of legal practice such as client consultation and courtroom representation.

The dominance of the Law Firms segment is also reinforced by the increasing pressure on legal professionals to deliver results faster and more cost-effectively. In the face of growing legal service demands, AI tools help law firms handle larger caseloads without a corresponding increase in staffing costs. Moreover, as clients become more aware of the possibilities offered by technology, there is a rising expectation for tech-driven solutions that promise both efficiency and effectiveness.

Law firms adopting AI are therefore seen as more innovative and capable, attracting clients who are looking for cutting-edge legal services. Furthermore, the growth of this segment is supported by the ongoing advancements in AI technology tailored specifically for the legal industry. Developers of legal AI software continuously refine their products to better match the unique needs of law firms, such as compliance with specific legal standards and integration with existing digital infrastructure.

This has resulted in highly specialized solutions that further encourage adoption. Given these trends, the Law Firms segment is likely to maintain its leading position in the market, as more law firms recognize the indispensable benefits of AI in enhancing service delivery and operational productivity.

Key Market Segments

Deployment Mode

- Cloud-Based

- On-Premise

Application

- Document Review

- Legal Research

- Contract Analysis and Management

- Prediction of Legal Outcomes

- Other Applications

End-User

- Law Firms

- Corporate Legal Departments

- Other End-Users

Driver

Increasing Efficiency and Cost Reduction

The primary driver for the adoption of legal AI software is the significant increase in efficiency and cost reduction it offers law firms and corporate legal departments. Legal AI systems automate routine tasks such as document review, contract management, and legal research, which traditionally require substantial human effort and time.

By leveraging AI, legal professionals can complete these tasks more quickly and with fewer errors, freeing up time to focus on more complex legal issues. Additionally, AI helps reduce overhead costs associated with manual labor and allows firms to handle larger volumes of work without proportionally increasing their staff. This efficiency not only improves profitability but also enhances client satisfaction by speeding up legal processes and providing more accurate legal advice.

Restraint

Data Security and Privacy Concerns

A significant restraint in the adoption of legal AI software is the concern surrounding data security and privacy. Legal data often includes sensitive client information, and the potential for breaches can make law firms and corporate legal departments hesitant to adopt cloud-based AI solutions. The complexity of ensuring compliance with global data protection regulations such as GDPR in Europe or HIPAA in the United States adds another layer of challenge.

Additionally, the reliance on third-party AI service providers can complicate the control over data security. These concerns necessitate substantial investments in secure infrastructure and may slow down AI adoption rates as firms weigh the risks associated with digital transformation against the benefits.

Opportunity

Expansion into Emerging Markets

Emerging markets present a significant opportunity for the expansion of legal AI software. As legal systems in countries such as India, Brazil, and parts of Africa continue to evolve, there is increasing demand for efficient legal services that can support economic growth and regulatory compliance. These markets are relatively untapped by advanced legal technologies, offering a ripe environment for the introduction of AI solutions.

Legal firms and corporations in these regions are beginning to recognize the benefits of AI in handling growing caseloads and complex legal requirements. By entering these markets, AI software providers can establish a foothold, expand their global presence, and drive innovation tailored to diverse legal systems.

Challenge

Integration with Existing Systems

A major challenge facing the adoption of legal AI software is integrating new AI systems with existing IT infrastructure. Many law firms and corporate legal departments operate on legacy systems that are not readily compatible with the latest AI technologies. The cost and complexity of updating these systems can be substantial.

Furthermore, the need for staff training and the potential disruption to ongoing operations can deter firms from undertaking such upgrades. Overcoming these integration challenges requires careful planning, significant investment, and a strategic approach to digital transformation, which can be daunting for organizations that lack the necessary resources or expertise.

Growth Factors

- Demand for Automation: The increasing requirement for automation in legal processes due to the growing number of litigations is significantly driving market growth.

- Enhanced Efficiency: Legal AI enhances operational efficiency by automating time-consuming tasks such as document review and legal research, thus allowing legal professionals to focus on more strategic activities.

- Cost Reduction: AI technologies help reduce costs associated with manual legal processes and personnel expenses by streamlining operations.

- Accuracy and Speed: AI systems offer high accuracy and speed in processing legal data, which is crucial for law firms handling vast amounts of information.

- Regulatory Compliance: With the growing complexity of legal and regulatory environments, AI helps firms stay compliant more efficiently, reducing the risk of penalties or legal issues.

Emerging Trends

- Use of Natural Language Processing (NLP): AI software increasingly employs Natural Language Processing to interpret and organize large volumes of unstructured legal data, making information retrieval faster and more accurate.

- Predictive Analytics: More firms are utilizing AI for predictive analytics, using historical data to forecast legal outcomes and enhance decision-making processes.

- Legal Chatbots: The introduction of AI-powered chatbots for client interaction and support is on the rise, improving client service and operational efficiency.

- Integration with Existing Technologies: AI tools are being designed to integrate seamlessly with existing legal firm technologies, such as case management systems and e-billing tools.

- Expansion into New Markets: There’s a notable trend of deploying legal AI solutions into emerging markets where legal systems are evolving and demand for efficient legal services is increasing.

Regional Analysis

In 2023, North America held a dominant market position in the legal AI software market, capturing more than a 37.2% share. This prominence can be attributed to several pivotal factors. Primarily, the region boasts a robust technological infrastructure, which facilitates the adoption and integration of advanced AI solutions within legal practices.

The demand for Legal AI Software in North America was valued at USD 0.5 billion in 2023 and is anticipated to grow significantly in the forecast period. Moreover, North America is home to a significant number of leading legal AI software developers, which drives innovation and accessibility in this market segment. The legal systems in the U.S. and Canada are characterized by high volumes of data generation, necessitating efficient data management solutions that AI technologies are well-equipped to provide.

Additionally, the increasing demand for automation of routine tasks and data-driven decision-making in legal practices further fuels the adoption of AI in this region. The presence of a tech-savvy legal workforce and a culture that is generally receptive to technological innovations also contribute to the substantial market share held by North America.

Europe’s legal AI software market is also experiencing significant growth, driven by the increasing digitization of legal processes and stringent data protection regulations such as GDPR which demand sophisticated data handling and compliance solutions. European law firms and corporate legal departments are increasingly leveraging AI to enhance efficiency and reduce operational costs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Legal AI software market has witnessed significant growth in recent years, primarily driven by advancements in artificial intelligence (AI) technology and the increasing demand for automation and efficiency in the legal industry. Key players in this market have played a crucial role in shaping the landscape and driving innovation to meet the evolving needs of legal professionals.

One of the prominent players in the Legal AI software market is ROSS Intelligence. Known for its flagship AI-powered legal research platform, ROSS has revolutionized the way legal professionals conduct legal research. The platform utilizes natural language processing and machine learning algorithms to analyze vast amounts of legal data, providing lawyers with relevant and accurate information quickly and efficiently.

Another key player in the market is Casetext. Casetext offers an AI-driven legal research platform called “CARA,” which stands for Case Analysis Research Assistant. CARA leverages machine learning and semantic search technology to analyze legal documents and provide attorneys with relevant case law and legal precedents, helping them make more informed decisions and streamline their research process.

These companies, along with other key players in the market, contribute to a competitive and rapidly evolving legal AI landscape, where continuous innovation is key to gaining and sustaining market leadership. This competitive environment not only pushes the boundaries of what AI can achieve in the legal field but also significantly enhances the efficiency, accuracy, and cost-effectiveness of legal services.

Top Key Players in the Market

- IBM Corporation

- ROSS Intelligence

- Thomson Reuters Corporation

- LexisNexis

- Luminance

- Kira Systems

- Veritone Inc.

- Everlaw

- Blue J Legal

- LegalSifter, Inc.

- Neota Logic

- Casetext Inc.

- Other Key Players

Recent Developments

- In May 2023, LexisNexis Group Inc introduced a highly anticipated API for state court Legal Analytics. This new offering allows customers to access Lex Machina’s state court analytics and data seamlessly through the API. It facilitates the integration of Lex Machina’s advanced Legal Analytics directly into customers’ existing workflows. Furthermore, with Lex Machina’s new API, users can amalgamate their internal data with Lex Machina’s comprehensive analytics for both state and federal courts, enhancing their legal operational efficiency.

- In April 2023, Luminance Technologies Ltd announced a partnership with the alternative service legal provider, Nexa, to incorporate Luminance’s advanced AI technology into the NexaConnex legal service platform. By integrating Luminance’s next-generation AI, NexaConnex aims to streamline its clients’ daily operations and free up more time for high-value client activities. This partnership is poised to drive significant efficiencies and improve the service delivery model in legal practices.

- In January 2023, the San Francisco-based law firm modCounsel partnered with Luminance, a global leader in legal process automation, to provide the full suite of Luminance’s AI-powered products to the firm’s diverse clientele of high-growth companies. This collaboration aims to enhance legal services by leveraging advanced AI technology, thereby streamlining processes and improving efficiency for modCounsel’s clients.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Bn Forecast Revenue (2033) USD 19.3 Bn CAGR (2024-2033) 29.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Cloud-Based, On-Premise), By Application (Document Review, Legal Research, Contract Analysis and Management, Prediction of Legal Outcomes, Other Applications), By End-User (Law Firms, Corporate Legal Departments, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, ROSS Intelligence, Thomson Reuters Corporation, LexisNexis, Luminance, Kira Systems, Veritone Inc., Everlaw, Blue J Legal, LegalSifter, Inc., Neota Logic, Casetext Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM Corporation

- ROSS Intelligence

- Thomson Reuters Corporation

- LexisNexis

- Luminance

- Kira Systems

- Veritone Inc.

- Everlaw

- Blue J Legal

- LegalSifter, Inc.

- Neota Logic

- Casetext Inc.

- Other Key Players