Global Leather Chemicals Market By Product Type (Biocides, Surfactants, and Others), Process Type( Tanning and Dyeing, Beamhouse, and Others), By Application (Footwear, Upholstery, and Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 28736

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

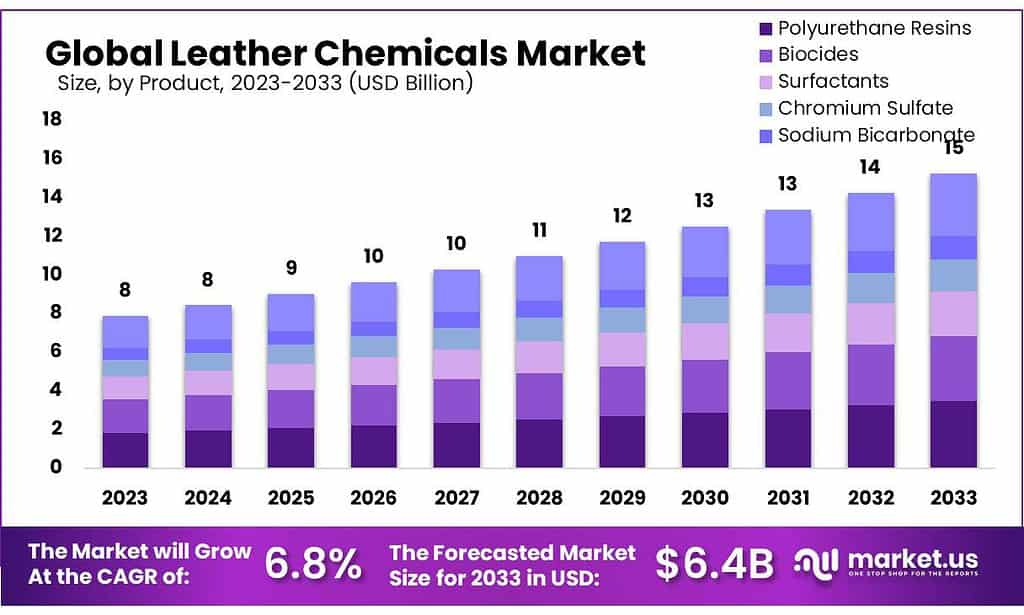

The global leather chemicals market size is expected to be worth around USD 15.2 billion by 2033, from USD 7.9 billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2023 to 2033.

The product industry will be driven by the increasing demand for premium products and the increase in disposable income. The increased demand for premium leather products is expected to drive the product’s demand.

In the past, leather demand was driven by the fast-growing upholstery industry, which is used in automobiles, furniture, and airplanes. Upholstery is durable, easy to maintain, and luxurious. It’s already available in premium brand small vehicles.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth: The leather chemicals market is projected to reach around USD 15.2 billion by 2033, exhibiting a robust CAGR of 6.8% from USD 7.9 billion in 2023. This growth is driven by the escalating demand for premium leather products and increasing disposable income.

- Product Type Insights: Polyurethane resins dominated the market in 2023, representing 22.9% of total revenue. Their versatility and eco-friendly nature are expected to further boost demand. Surfactants are also projected to grow at 7.0%, playing a significant role as surface-active agents in leather-making processes.

- Chromium Sulfate Segment: In 2021, this segment was valued at US$ 818.0 million. Its use as a tanning agent and in dye production contributes to market growth, despite challenges related to chromium oxidation.

- Process Analysis: Tanning & dyeing processes accounted for over 48.0% of revenue in 2023. The beamhouse segment is expected to grow at a CAGR of 6.6%, driven by operations involved in preparing hides and skins for preservation.

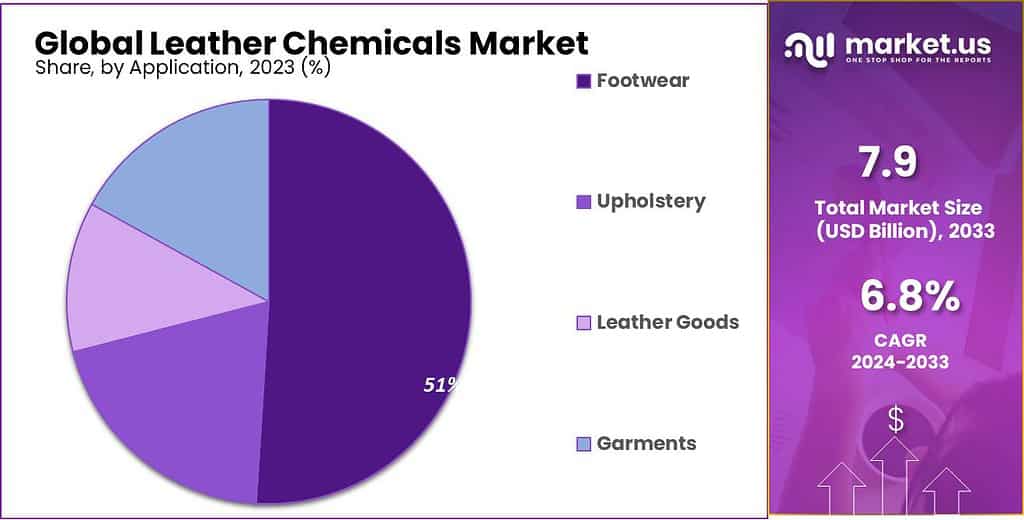

- Application Insights: Footwear dominates the market with over 51% revenue share in 2023, attributed to increased leather demand. Upholstery follows with a projected CAGR of 6.5%, especially driven by its use in the automotive and furniture industries.

- Market Drivers: Rising consumer demand for leather goods, technological advancements improving chemical refinement, and a growing preference for eco-friendly alternatives are major growth drivers.

- Market Restraints: Unpredictable raw material prices, environmental concerns regarding chemical impact, and fluctuations in fashion trends significantly influence market stability.

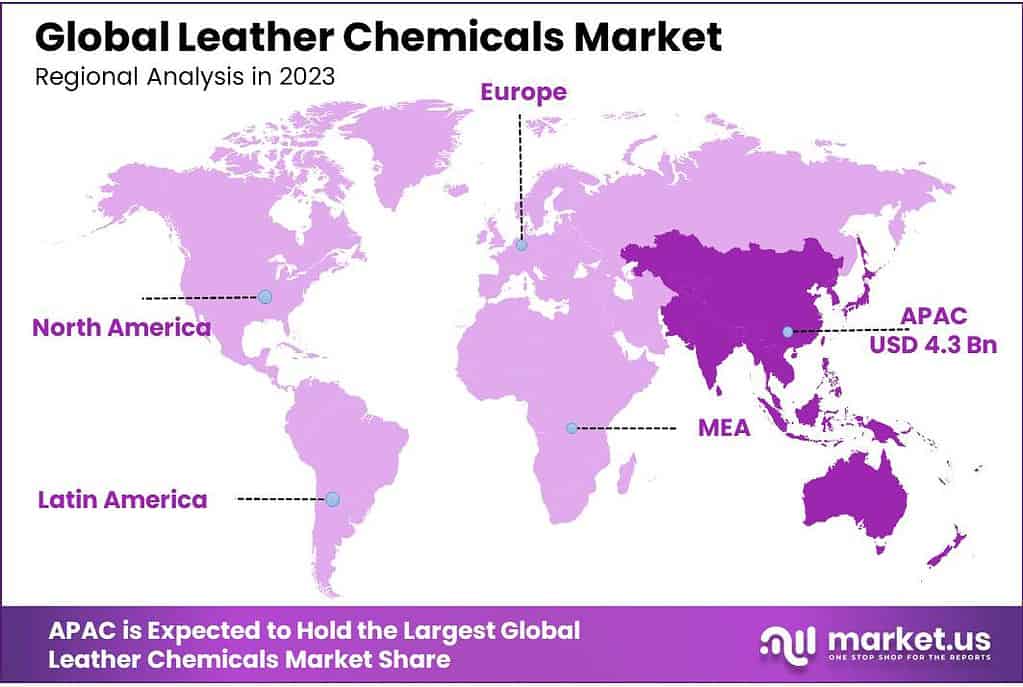

- Regional Analysis: Asia Pacific holds the dominant market share, driven by abundant raw materials and high concentrations of manufacturers. Europe, particularly Italy’s luxury market, and the growing Brazilian leather industry are also key regions fostering market growth.

- Key Players and Recent Developments: Major players like Stahl International B.V, Lanxess AG, and Bayer AG focus on research and development, aiming for market expansion. Recent developments in sustainable solutions and certifications also impact market dynamics.

Product Type Analysis

In 2023, the polyurethane resins segment of leather chemicals dominated and represented 22.9% of the total revenue. This is due to the increase in leather processing using polyurethane. PU resins can be used in various formulations and processing, as well as to make PU-based synthetic goods due to their outstanding tensile strength and elasticity. They are also used to create organic solvent-free finish formulations.

Hybrid acrylic polyurethane polymers have greatly facilitated the development of solvent-free finish formulations. As PU-based leather is more eco-friendly than vinyl-based, there will be increased demand for PU resins. It is, however, more costly because of the long manufacturing process.

Surfactants are expected to grow at 7.0% during the forecast period. Its increased use as a leather-making surface-active agent is responsible for increasing demand. They can be used not only as main reaction agents or emulsifiers but also as anti-electrostatic and water-repellent agents. These agents can also be used to reduce oil dispersion in water. This will drive growth in the leather chemicals market.

In terms of revenue, the Chromium Sulfate Segment was worth US$ 818.0 million in 2021. It is used as a tanning agent in the leather industry. This is expected to increase the demand. It can also be used to make chrome-based dyes used in the dying process.

A large percentage of leather is tanned using chrome salts, which can be used in 80% to 90%. These tanning chemicals are used to stabilize leather by crosslinking collagen fibers. Trivalent chromium compounds are used in tanning and retention. In certain situations, the oxidation from trivalent chromium into hexavalent chromium will continue to be a challenge for leather producers.

Process Analysis

In 2023, the tanning and dyeing segment was responsible for more than 48.0% of revenue. The various operations involved in tanning and dyeing include picking, degreasing., tanning, swimming., and dyeing. Fatliquoring, drying, and retaining will all contribute to a 6.7% CAGR over the forecast period. Other processes like neutralization or bleaching are dependent on the condition of the tanned hides. They are then implemented as appropriate.

The beam house segment will see the second-largest CAGR at 6.6% in the forecast period. Its application, which includes the preparation of hides and skins for preservation, is expected to drive growth. It involves operations like wetting and soaking, liming, unhairing, deliming, and bating. The hides and skins used for such operations vary depending on the animal. These products include enzymes and degreasers and lime, sulfuric, and formic acids.

The finishing process is the final stage after drying. This includes coatings and mechanical finishing operations. You can finish leather in various ways, including buffing, spray-coating, dye treatment, pigment, resins, or lacquering with urethane.

The base, intermediate, and topcoats are the finishing coats. Surfactants and polyurethane resins are the main components and additives in this process. The demand for leather chemicals is expected to rise due to the increasing demand for premium products and a growing preference of manufacturers for aesthetic parameters.

Application Analysis

In 2023, the footwear segment was responsible for a greater than 51% revenue share. This is due to an increase in leather demand used in the manufacture of footwear. The essential components of footwear are leather, rubber, plastic, and textile. It can be used for leather finishing, tanning, and dying. These chemicals can also be used to strengthen the crust or filling.

Over the forecast period, the upholstery segment will register the second-highest CAGR at 6.5%. Extensive coating applications are expected to drive this growth. The increase in soft leather use in the automotive and furniture industries is one of the main factors driving the growth of upholstery. Leather upholstery can be used in the automotive or furniture industries.

Automotive and furniture upholstery comprises aniline, semi-aniline, and protected leather. This is because leather chemicals are required to tan, beam house, waterproof, retain, fatliquoring, and waterproof such leathers.

Leather items include wallets, belts, and other accessories. Compared to other end-use segments of the market, such products require a very small amount of leather. Accordingly, leather goods’ demand is expected to grow at a moderate pace. In the manufacture of goods, dyeing and tanning chemicals are extensively used. The forecast period will see a rise in consumer interest in product aesthetics and a rising demand for leather goods.

Note: Actual Numbers Might Vary In Final Report

Кеу Маrkеt Ѕеgmеntѕ

Product Type

- Biocides

- Surfactants

- Chromium Sulfate

- Polyurethane Resins

- Sodium Bicarbonate

- Other Product Types

Process Type

- Tanning & Dyeing

- Beamhouse

- Finishing Chemicals

Application

- Footwear

- Upholstery

- Leather Goods

- Garments

Drivers

More and more people are seeking leather goods like stylish bags, shoes, and vehicle interiors. This growing demand acts as a driving force for the leather chemicals market. Additionally, advancements in technology are aiding the refinement of these chemicals, making production quicker and better, thus giving the market an added boost.

Restraints

The prices of raw materials used in making these chemicals can be quite unpredictable, causing instability. There’s also considerable concern about the environmental impact of these chemicals and their production processes. Moreover, changes in fashion trends greatly influence the demand for leather, affecting the market’s stability.

Opportunities

Looking ahead, the rising demand for trendy leather products signals ample room for market expansion. The discovery of more intelligent methods to produce these chemicals might make them more affordable and efficient. Furthermore, the utilization of eco-friendly chemical alternatives presents new growth prospects.

Challenges

The global economic landscape can significantly impact the stability of the leather chemicals market. Additionally, competition from synthetic materials poses a challenge to traditional leather. Moreover, the quest for creating eco-friendly chemicals without compromising quality remains a significant hurdle in this industry’s growth journey.

Regional Analysis

The Asia Pacific was the dominant market for leather chemicals, accounting for a revenue share of over 50.0% in 2021. This is due to the abundance of raw materials and the high concentration of product makers.

Low-cost labor is one of the main factors driving market growth in the Asia Pacific. The product is not well-received in Japan’s product sector due to its large imports of luxury goods and footwear. Japan has a well-established vehicle industry and consumes a lot of the product. The country’s product market will be driven by rising demand from the automotive industry.

The European leather chemicals market will experience the second-largest CAGR at 6.9% during the forecast period. It is expected to drive the footwear, automotive, and consumer appliances industries. Europe’s tanning industry is heavily dependent on exports and raw materials. Due to the increasing demand for leather chemicals in footwear, interiors, and apparel manufacturing, the market for leather chemicals will likely grow in the coming years.

Italy’s luxury market will drive market expansion. This is why the market for leather chemicals in Italy is very focused and robust. Vegetable tanning has become more popular in the region. It is expected to replicate some of the benefits of chromium which will increase the use of synthetic leather chemicals.

The growing Brazilian leather industry is expected to drive the Central and South American markets for leather chemicals. Brazil’s product industry is known for its extensive production of shoes & goods, including travel accessories, as well as strong connections with the U.S. market. These characteristics have created lucrative growth opportunities for the leather chemicals market in the region.

Note: Actual Numbers Might Vary In Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Companies

The leather chemicals market is very competitive, with major international brands focusing on long-term relationships and building trust with end-users. The future is expected to see increased competition in the garments, footwear, and upholstery sectors.

Elementis plc and Bayer AG are examples of companies that integrate across the value chain. They also produce caprolactam. These companies are key manufacturers, and they focus on research and development to find new uses for the product.

Кеу Маrkеt Рlауеrѕ

- Stahl International B.V

- Lanxess AG

- Bayer AG

- Elementis plc

- Texapel

- Chemtan Company Inc.

- Lawrence Industries Limited

- Other Key Players

Recent Developments

January 2023: LANXESS and TotalEnergies entered into a cooperation on the supply of bio-circular styrene. By partnering with TotalEnergies, the company can offer its customers sustainable solutions and raw materials with a low carbon footprint.

October 2022: Chem-MAP is pleased to share that Texapel was granted ZDHC Level 3 certification for their leather chemicals, the highest certification offered by the ZDHC Road Map to Zero program.

Report Scope

Report Features Description Market Value (2023) USD 7.9 Billion Forecast Revenue (2033) USD 15.2 Billion CAGR (2023-2032) 6.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Biocides, Surfactants, and Others), Process Type( Tanning & Dyeing, Beamhouse, and Others), By Application (Footwear, Upholstery, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Stahl International B.V, Lanxess AG, Bayer AG, Elementis plc, Texapel, Chemtan Company Inc., Lawrence Industries Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are leather chemicals?Leather chemicals are substances used in the production of leather goods, like bags, shoes, and car interiors. They help in various stages of leather making, such as tanning and finishing.

What restrains the leather chemicals market?Fluctuating prices of raw materials used in making these chemicals, environmental concerns related to their production, and changes in fashion trends impacting leather demand can restrain the market.

What challenges does the leather chemicals market face?Global economic shifts, competition from synthetic materials, and the pursuit of eco-friendly chemicals without compromising quality pose significant challenges to the industry.

-

-

- Stahl International B.V

- Lanxess AG

- Bayer AG

- Elementis plc

- Texapel

- Chemtan Company Inc.

- Lawrence Industries Limited

- Other Key Players