Global Lead Chemicals Market By Type(Lead Nitrate, Lead Acetate, Lead Stabilizers, Lead Chloride), By Application(Mining, PVC Stabilizers, Pigment and Dyes, Others), By End-use(Automotive, Construction, Electronics, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: March 2024

- Report ID: 13293

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

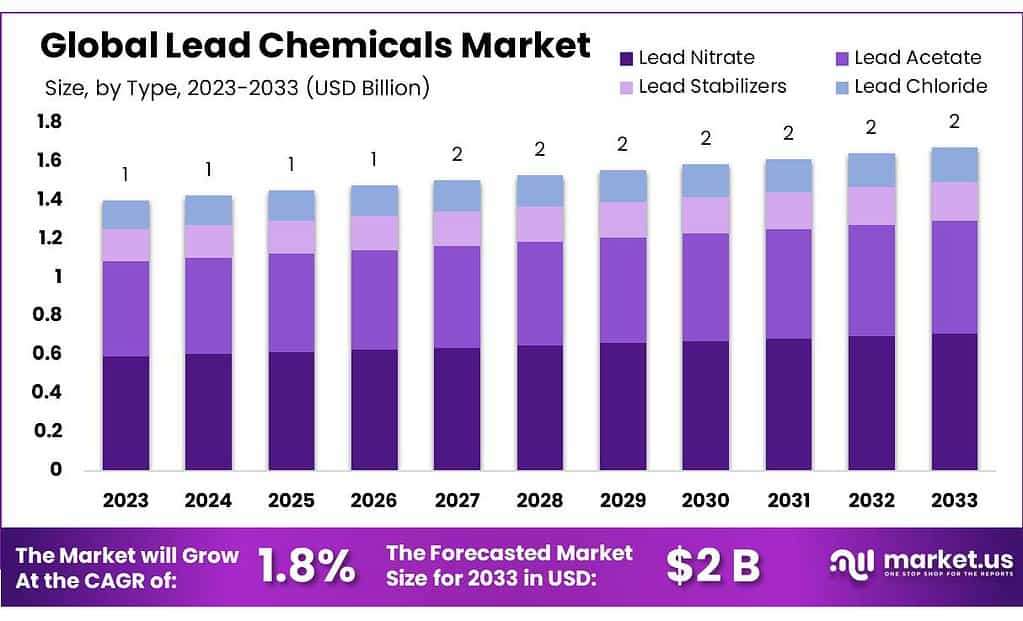

The global Lead Chemicals Market size is expected to be worth around USD 2 billion by 2033, from USD 1 billion in 2023, growing at a CAGR of 1.8% during the forecast period from 2023 to 2033.

The Lead Chemicals Market refers to the segment of the chemical industry that deals specifically with chemicals containing lead or derived from lead. Lead chemicals encompass a wide range of compounds and substances where lead is a primary component or an essential element. These chemicals are used in various industrial applications across different sectors.

The market for lead chemicals is influenced by factors such as industrial demand, regulatory policies, technological advancements, and environmental concerns. While lead chemicals have been widely used historically, there has been a shift towards reducing their usage due to concerns about their toxicity and environmental impact.

As a result, there is increasing emphasis on finding alternatives to lead chemicals in various applications. Nonetheless, lead chemicals continue to be used in certain industries where their unique properties make them difficult to replace or where suitable alternatives have not yet been developed.

Overall, the Lead Chemicals Market encompasses the production, distribution, and application of chemicals containing lead, serving diverse industrial needs while navigating regulatory and environmental challenges.

Key Takeaways

- Market Growth Projection: Lead Chemicals Market to reach USD 2 billion by 2033, with a 1.8% CAGR from 2023.

- Top Applications: Lead Nitrate dominates with a 42.4% market share, used in fireworks and matches.

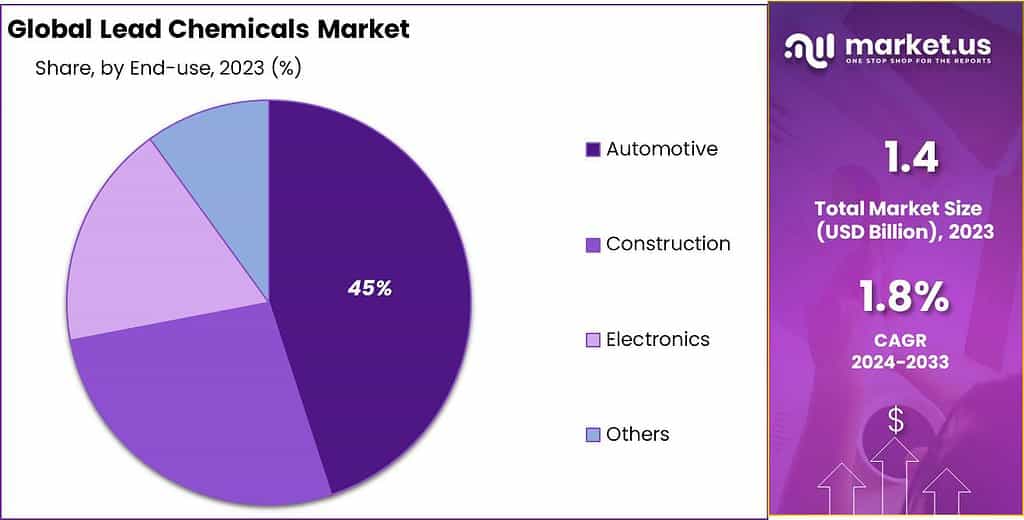

- Key End Uses: The automotive sector leads with 47.8% market share, driven by lead-acid batteries.

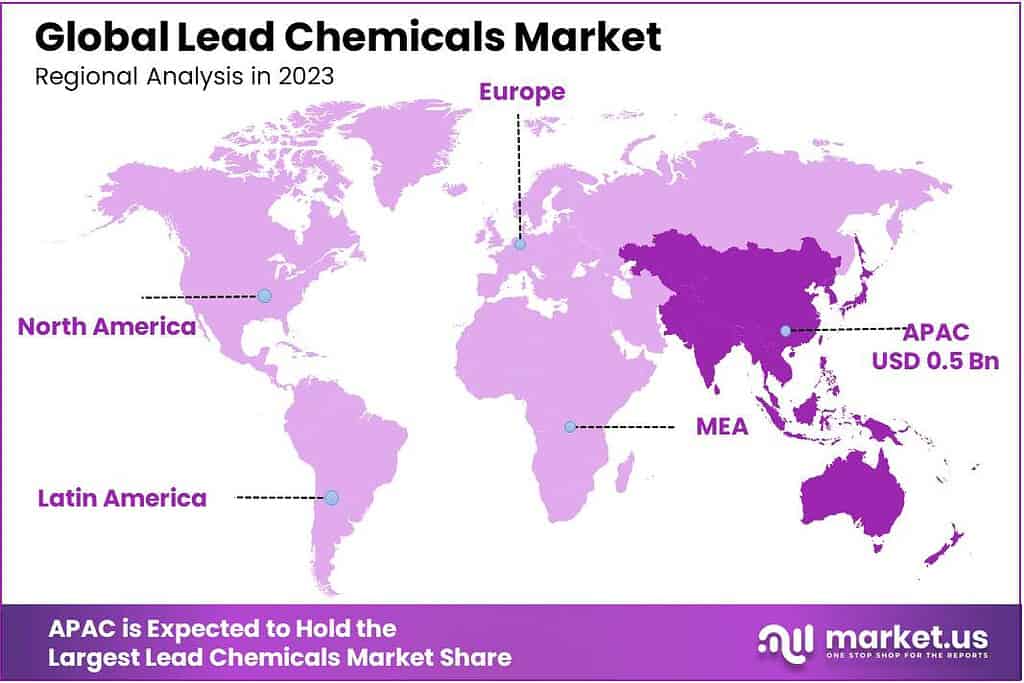

- Regional Dominance: Asia Pacific holds a 42.8% market share, led by increased industrial demand.

- Recycling lead-acid batteries is a significant source of lead supply, contributing to over 60% of global lead production.

- In 2024, the World Bank announced a $200 million fund to support the remediation of lead-contaminated sites in developing countries.

- Lead-acid batteries account for around 85% of the global lead consumption in the battery industry.

By Type

In 2023, Lead Nitrate emerged as the leading segment in the Lead Chemicals Market, commanding a significant market share of over 42.4%. Lead Nitrate is widely utilized in various applications such as fireworks, matches, and in the manufacturing of other lead compounds. Its dominance can be attributed to its extensive use in the explosives industry and its role as a precursor in the production of other lead-based chemicals. Moreover, its high solubility and stability make it a preferred choice in several industrial processes.

Following closely behind, Lead Acetate secured a notable market position, contributing to the overall growth of the Lead Chemicals Market. Lead Acetate finds widespread application in industries such as cosmetics, dyes, and pigments, owing to its role as a catalyst and mordant in various chemical reactions. Its versatility and compatibility with different manufacturing processes have propelled its demand in recent years.

Additionally, Lead Stabilizers emerged as a significant segment in the Lead Chemicals Market, driven by their essential role in the stabilization of PVC (polyvinyl chloride) materials. Lead Stabilizers act as additives in PVC formulations, enhancing the thermal and UV stability of the final products. The increasing demand for PVC materials in the construction, automotive, and packaging industries has fueled the growth of the Lead Stabilizers segment.

Furthermore, Lead Chloride maintained a steady market presence, supported by its applications in laboratory research, electroplating, and metallurgy. Lead Chloride’s ability to form stable complexes and its conductivity properties make it indispensable in various chemical processes and industrial applications.

By Application

In 2023, the Mining application segment emerged as the dominant force in the Lead Chemicals Market, commanding a substantial market share of over 47.3%. Lead chemicals play a crucial role in the mining industry, particularly in ore processing and extraction activities.

Lead compounds are utilized in flotation processes to separate valuable minerals from ore, contributing to increased efficiency and recovery rates in mining operations. The segment’s dominance is driven by the growing demand for lead chemicals in mining applications, fueled by the expansion of mining activities worldwide.

Following closely behind, the PVC Stabilizers application segment secured a significant market position in the Lead Chemicals Market. Lead-based stabilizers are essential additives in the manufacturing of polyvinyl chloride (PVC) materials, providing thermal and UV stability to the final products. The segment’s growth is propelled by the increasing usage of PVC materials in the construction, automotive, and packaging industries, driving the demand for lead stabilizers.

Moreover, the Pigment & Dyes application segment maintained a notable presence in the Lead Chemicals Market. Lead compounds are widely employed as pigments and dyes in various industries such as paints, coatings, and textiles. Lead-based pigments offer superior color intensity, durability, and weather resistance, making them preferred choices in the production of high-quality coatings and decorative materials.

Additionally, the Others application segment encompasses a diverse range of industrial uses for lead chemicals beyond mining, PVC stabilizers, and pigments & dyes. This segment includes applications such as batteries, ammunition, electronics, and healthcare. While individually smaller in market share compared to the dominant segments, the Others segment collectively contributes to the overall growth and diversification of the Lead Chemicals Market.

By End-use

In 2023, the Lead Automotive segment emerged as the dominant force in the Lead Chemicals Market, commanding a substantial market share of over 47.8%. Lead chemicals are extensively used in automotive batteries, serving as essential components for starting, lighting, and ignition systems in vehicles. The segment’s dominance is driven by the widespread adoption of lead-acid batteries in conventional internal combustion engine vehicles, as well as in hybrid and electric vehicles for auxiliary power.

Following closely behind, the Construction segment secured a significant market position in the Lead Chemicals Market. Lead-based products, such as lead sheets, lead bricks, and lead compounds, are widely used in the construction industry for applications such as radiation shielding, waterproofing, and soundproofing. The segment’s growth is fueled by the increasing demand for lead-based construction materials in residential, commercial, and infrastructure projects worldwide.

Moreover, the Electronics segment maintained a notable presence in the Lead Chemicals Market. Lead compounds are essential components in electronic devices and circuitry, particularly in soldering applications. Lead-based solders offer superior conductivity, reliability, and durability, making them indispensable in the manufacturing of electronic products such as computers, smartphones, and consumer electronics.

Additionally, the Others end-use segment encompasses a diverse range of industrial applications for lead chemicals beyond automotive, construction, and electronics. This segment includes uses in industries such as healthcare, aviation, energy storage, and manufacturing. While individually smaller in market share compared to the dominant segments, the Others segment collectively contributes to the overall growth and diversification of the Lead Chemicals Market.

Key Market Segments

By Type

- Lead Nitrate

- Lead Acetate

- Lead Stabilizers

- Lead Chloride

By Application

- Mining

- PVC Stabilizers

- Pigment & Dyes

- Others

By End-use

- Automotive

- Construction

- Electronics

- Others

Driving Factors

Growing Demand for Lead-Acid Batteries: Powering the Lead Chemicals Market

The Lead Chemicals Market is significantly driven by the growing demand for lead-acid batteries across various industries worldwide. Lead-acid batteries are a type of rechargeable battery widely used for automotive, industrial, and stationary power applications. These batteries rely on lead-based chemistry for their construction, making lead one of the essential components in their manufacturing process.

Automotive Sector Growth: One of the primary drivers behind the increasing demand for lead-acid batteries is the rapid growth of the automotive sector globally. Lead-acid batteries serve as the primary power source for starting, lighting, and ignition systems in conventional internal combustion engine vehicles, as well as in hybrid and electric vehicles for auxiliary power. With the automotive industry witnessing robust growth, particularly in emerging economies, the demand for lead-acid batteries continues to soar.

Industrial Applications: Lead-acid batteries also find extensive use in various industrial applications beyond the automotive sector. They are employed in industries such as telecommunications, power utilities, material handling equipment, and backup power systems.

These batteries provide reliable and cost-effective energy storage solutions for uninterrupted power supply, emergency backup, and off-grid applications. The increasing industrialization and urbanization globally further drive the demand for lead-acid batteries, thereby fueling the growth of the Lead Chemicals Market.

Rising Demand for Renewable Energy Storage

Moreover, the transition towards renewable energy sources, such as solar and wind power, has led to a surge in the demand for energy storage solutions, including lead-acid batteries. Lead-acid batteries are preferred for their affordability, reliability, and established technology compared to other battery chemistries.

They are widely used for grid-scale energy storage, residential and commercial solar energy systems, and off-grid power applications in remote areas. As the renewable energy sector continues to expand, the demand for lead-acid batteries for energy storage purposes is expected to escalate, driving the growth of the Lead Chemicals Market.

Restraining Factors

Environmental Concerns and Regulatory Restrictions: A Key Challenge for the Lead Chemicals Market

The Lead Chemicals Market faces significant challenges due to environmental concerns and stringent regulatory restrictions imposed on the usage of lead-based products. Lead is a highly toxic metal that poses serious health risks to humans and the environment, leading to widespread apprehensions and regulatory actions aimed at mitigating its adverse effects.

Health Risks and Public Awareness:

One of the major restraining factors for the Lead Chemicals Market is the growing awareness of the health hazards associated with lead exposure. Lead exposure can lead to various health problems, particularly in children and pregnant women, including developmental delays, neurological damage, and impaired cognitive functions.

Furthermore, lead contamination in the environment can occur through air, water, soil, and food sources, posing significant risks to public health. As a result, there is heightened public concern and advocacy for reducing lead exposure, leading to stricter regulations and consumer preferences for lead-free alternatives.

Stringent Regulatory Measures:

Governments and regulatory bodies worldwide have implemented stringent regulations and guidelines to limit the usage of lead-based products and mitigate environmental contamination. These regulations encompass restrictions on lead content in consumer goods, occupational exposure limits, waste management practices, and emission standards for industrial processes.

For instance, regulations such as the Restriction of Hazardous Substances (RoHS) Directive in the European Union and the Lead and Copper Rule in the United States impose restrictions on the use of lead in various products, including electronics, toys, paints, and drinking water infrastructure. Compliance with these regulations necessitates investments in research, development, and adoption of lead-free alternatives, posing challenges for businesses operating in the Lead Chemicals Market.

Transition to Lead-Free Alternatives:

Moreover, the shift towards lead-free alternatives in various industries presents a significant challenge for the Lead Chemicals Market. Manufacturers and consumers are increasingly opting for alternatives to lead-based products to mitigate health and environmental risks. This transition involves developing and adopting alternative materials, processes, and technologies that are safer and more sustainable.

While lead-free alternatives may offer benefits in terms of environmental and health protection, they often require investment in research and development, retooling of manufacturing processes, and retraining of personnel, which can pose economic challenges for businesses in the Lead Chemicals Market.

Growth Opportunity

Transition to Sustainable Energy Storage Solutions: A Major Growth Opportunity for the Lead Chemicals Market

The Lead Chemicals Market is poised for significant growth opportunities driven by the transition to sustainable energy storage solutions, particularly in the renewable energy sector. As the world moves towards reducing greenhouse gas emissions and combating climate change, there is a growing emphasis on renewable energy sources such as solar and wind power.

However, one of the challenges of renewable energy is intermittency – the energy generated is not always available when needed. This is where energy storage technologies play a crucial role, and lead-acid batteries present a compelling solution.

Expanding Renewable Energy Sector:

One of the major growth opportunities for the Lead Chemicals Market lies in the expanding renewable energy sector. Lead-acid batteries have been widely used for energy storage due to their reliability, cost-effectiveness, and well-established technology.

These batteries can store excess energy generated from renewable sources during periods of high generation and release it when demand is high or when renewable sources are not available. With the increasing deployment of solar and wind power installations globally, there is a growing demand for energy storage solutions, creating significant opportunities for lead-acid battery manufacturers and the Lead Chemicals Market.

Grid-Scale Energy Storage:

Grid-scale energy storage is another area of opportunity for the Lead Chemicals Market. Lead-acid batteries are well-suited for grid-scale applications due to their scalability, fast response times, and ability to provide backup power during grid outages.

These batteries can help stabilize the grid, manage peak demand, and integrate renewable energy sources into the existing power infrastructure. Governments and utilities worldwide are investing in grid-scale energy storage projects to enhance grid reliability, resilience, and flexibility, presenting lucrative opportunities for lead-acid battery manufacturers and suppliers of lead chemicals.

Off-Grid and Remote Applications:

Furthermore, off-grid and remote applications represent a growing market segment for lead-acid batteries and lead chemicals. In areas without access to reliable grid infrastructure, lead-acid batteries serve as essential energy storage solutions for powering telecommunications equipment, remote communities, and off-grid installations such as rural electrification projects, mining sites, and military operations.

As the demand for off-grid power solutions continues to rise, particularly in emerging economies and remote regions, there is a significant growth opportunity for lead-acid battery manufacturers to cater to these markets.

Latest Trends

Shift Towards Lead Recycling and Circular Economy Initiatives

In recent years, a major trend shaping the Lead Chemicals Market is the increasing emphasis on lead recycling and circular economy initiatives. With growing environmental awareness and concerns about resource depletion, there has been a concerted effort to promote sustainable practices in the lead industry. As a result, lead recycling has emerged as a significant trend, driven by economic, environmental, and regulatory factors.

Economic Incentives for Lead Recycling:

One of the primary drivers behind the trend towards lead recycling is the economic incentives associated with the reuse of lead materials. Lead recycling offers cost savings compared to primary lead production from virgin ores.

Recycled lead is often cheaper to produce due to lower energy and raw material requirements, making it economically attractive for manufacturers. Additionally, the volatility of lead prices in global markets and the fluctuating demand for lead-acid batteries further incentivize companies to invest in lead recycling as a sustainable and cost-effective solution.

Environmental Benefits:

Furthermore, lead recycling offers significant environmental benefits by reducing the need for primary lead production and minimizing the environmental impact of lead mining and extraction.

Recycling lead helps conserve natural resources, reduce greenhouse gas emissions, and mitigate pollution associated with lead mining and smelting operations. By recycling lead materials, companies can contribute to environmental conservation efforts and demonstrate their commitment to sustainability, thereby enhancing their corporate reputation and brand value.

Regulatory Drivers:

Regulatory initiatives aimed at promoting waste management and recycling practices also play a crucial role in driving the trend toward lead recycling. Governments and regulatory bodies worldwide have implemented stringent regulations and directives to encourage recycling and minimize the environmental impact of lead-containing products.

For instance, regulations such as the End-of-Life Vehicles (ELV) Directive and the Waste Electrical and Electronic Equipment (WEEE) Directive in the European Union mandate the collection, recycling, and proper disposal of lead-acid batteries and other lead-containing products. Compliance with these regulations requires businesses to establish efficient recycling processes and invest in recycling infrastructure, driving the adoption of lead recycling practices.

Technological Advancements:

Moreover, technological advancements in lead recycling processes have facilitated the growth of the lead recycling market. Innovations in smelting technologies, separation techniques, and battery dismantling methods have improved the efficiency, cost-effectiveness, and environmental performance of lead recycling operations.

Advanced recycling technologies such as hydrometallurgical processes, electrolytic refining, and thermal treatments enable the recovery of high-purity lead from diverse lead-containing materials, further promoting the adoption of lead recycling as a sustainable solution.

Regional Analysis

The Asia Pacific region has emerged as a dominant force in the global Lead Chemicals Market, securing a remarkable market share of 42.8%. This growth is primarily attributed to the escalating demand for lead chemicals, notably in industries such as automotive, construction, and electronics.

The expansion of industrial activities and heightened environmental awareness are driving the surge in demand for lead chemicals across the Asia Pacific region. Countries like China, India, Japan, South Korea, Australia, and New Zealand are witnessing significant increases in both production and utilization of lead chemicals, thereby substantially contributing to market expansion.

In North America, the Lead Chemicals Market is witnessing noteworthy growth, propelled by economic advancements and the rising demand for lead-based products across various sectors. The preference for lead chemicals, particularly in applications like automotive batteries and construction materials, is fueling market expansion, particularly in the United States and Canada.

Europe presents promising prospects for substantial growth in the Lead Chemicals Market, driven by escalating demand across diverse sectors including manufacturing, infrastructure development, and electronics. The region’s focus on technological innovation and sustainability initiatives is further stimulating the adoption of lead chemicals, positioning Europe as a significant market player in the global lead chemicals industry.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the Lead Chemicals Market, several key players contribute significantly to the industry’s dynamics through their extensive product portfolios, technological expertise, and global market presence. Doe Run Resources Corporation stands out as a major player, known for its comprehensive lead mining and smelting operations.

Gravita India Limited is another notable player, specializing in lead recycling and secondary lead production, offering a wide range of lead products to diverse industries. Brunswick Corporation is recognized for its lead-acid batteries and marine products, catering to automotive, marine, and industrial sectors. Exide Technologies is a prominent manufacturer of lead-acid batteries and energy storage solutions, serving various applications across automotive, industrial, and renewable energy sectors.

Market Key Players

- 5N Plus

- Aerocell

- AVA Chemicals

- Baerlocher

- Chloral Chemicals (India)

- Cuprichem

- Dominion Colour

- Dynakrom

- Flaurea Chemicals

- Hammond Group

- Hanhua Chemical

- Hebei Yanxi Chemical

- Kwang Cheng

- L.S. Chemicals & Pharmaceuticals

- Orica

- Waldies

Recent Developments

- 2024 Aerocell: Invested in research and development to enhance the efficiency of lead-acid battery manufacturing processes, reducing environmental footprint.

- 2024 Cuprichem: Partnered with automotive OEMs to develop lead-based additives for fuel systems, improving engine performance and emissions control.

- 2024 Flaurea Chemicals: Expanded its product portfolio to include lead-based catalysts for industrial chemical processes, catering to diverse customer needs.

- 2023 5N Plus: Expanded its lead chemicals production capacity to meet growing market demand.

- 2023 Baerlocher: Introduced innovative lead stabilizers for PVC applications, enhancing product performance and sustainability.

Report Scope

- 5N Plus

- Aerocell

- AVA Chemicals

- Baerlocher

- Chloral Chemicals (India)

- Cuprichem

- Dominion Colour

- Dynakrom

- Flaurea Chemicals

- Hammond Group

- Hanhua Chemical

- Hebei Yanxi Chemical

- Kwang Cheng

- L.S. Chemicals & Pharmaceuticals

- Orica

- Waldies

Frequently Asked Questions (FAQ)

Name the major industry players in the Lead Chemicals Market?5N Plus, Aerocell, AVA Chemicals, Baerlocher, Chloral Chemicals (India), Cuprichem, Dominion Colour, Dynakrom, Flaurea Chemicals, Hammond Group, Hanhua Chemical, Hebei Yanxi Chemical, Kwang Cheng, L.S. Chemicals & Pharmaceuticals, Orica, Waldies

What is the size of Lead Chemicals Market?Lead Chemicals Market size is expected to be worth around USD 2 billion by 2033, from USD 1 billion in 2023

What CAGR is projected for the Lead Chemicals Market?The Lead Chemicals Market is expected to grow at 1.8% CAGR (2024-2033).

-

-

- 5N Plus

- Aerocell

- AVA Chemicals

- Baerlocher

- Chloral Chemicals (India)

- Cuprichem

- Dominion Colour

- Dynakrom

- Flaurea Chemicals

- Hammond Group

- Hanhua Chemical

- Hebei Yanxi Chemical

- Kwang Cheng

- L.S. Chemicals & Pharmaceuticals

- Orica

- Waldies