Global Language Learning Podcast Market Size, Share and Analysis Report By Content Format (Audio-only Lessons, Bilingual Dialogues & Stories, Cultural & Immersive Content, Others), By Language (English as a Second Language (ESL), Spanish, French, Chinese (Mandarin), Others), By Proficiency Level (Beginner, Intermediate, Advanced), By Business Model (Freemium, Advertising-supported, Others), By Distribution Platform (Spotify, Apple Podcasts, Google Podcasts, Dedicated Language Learning Apps, Creator-owned Websites & Apps), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173081

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Usage Insights

- Listener Behavior Insights

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Content Format Analysis

- Language Analysis

- Proficiency Level Analysis

- Business Model Analysis

- Distribution Platform Analysis

- Investor Type Impact Matrix

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

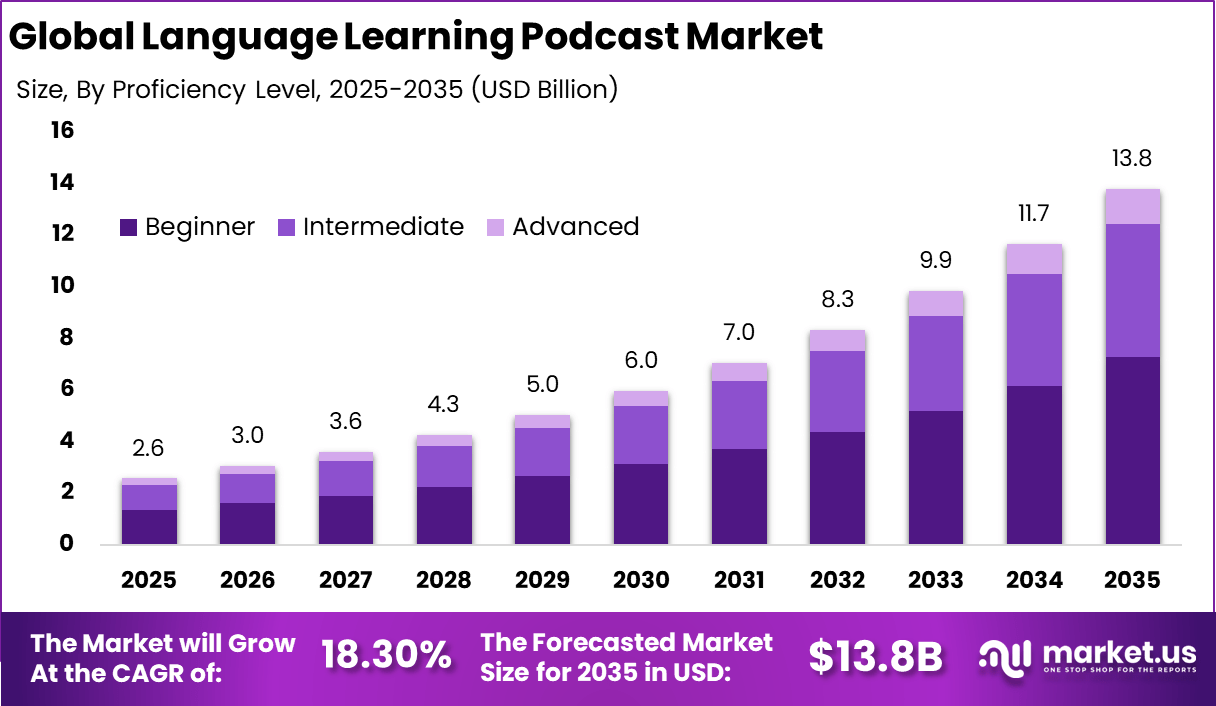

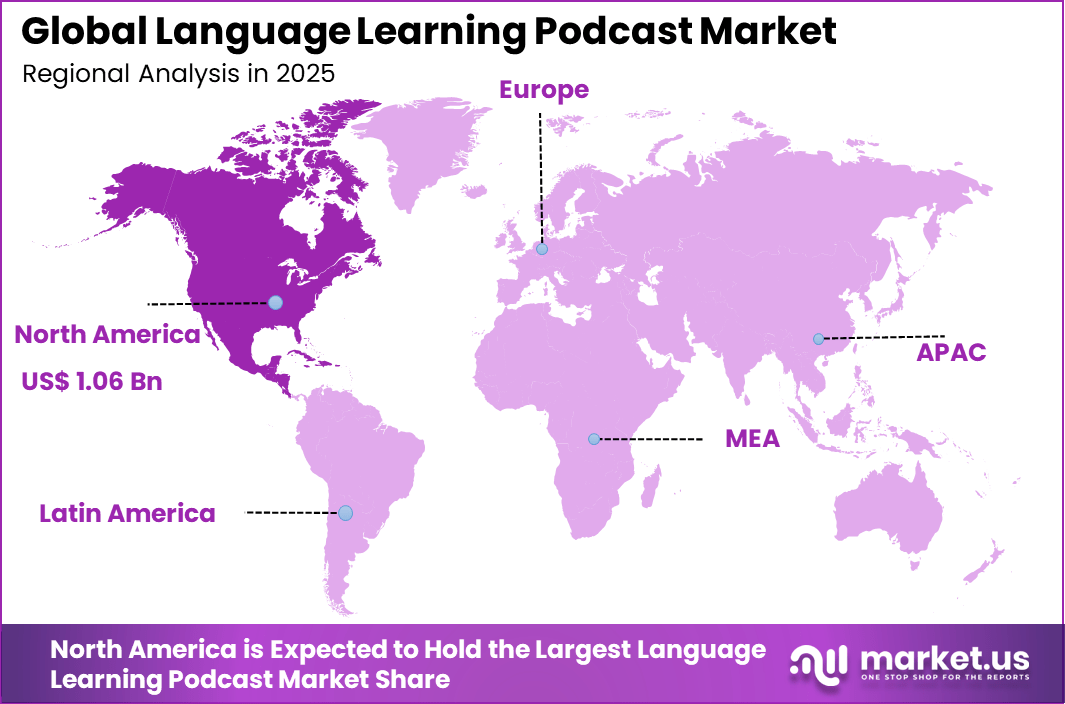

The Global Language Learning Podcast Market generated USD 2.6 billion in 2025 and is predicted to register growth from USD 3 billion in 2026 to about USD 13.8 billion by 2035, recording a CAGR of 18.30% throughout the forecast span. North America held a dominan market position, capturing more than a 41.3% share, holding USD 1.06 Billion revenue.

The language learning podcast market refers to audio based educational content designed to help learners improve language skills through listening. These podcasts focus on vocabulary building, pronunciation, grammar, cultural context, and conversational practice. Content is delivered through streaming platforms and podcast applications, allowing users to learn at their own pace. The market serves casual learners, students, professionals, and lifelong learners seeking flexible education formats.

One major driving factor of the language learning podcast market is the rising demand for flexible and self paced learning. Learners seek formats that do not require screens or fixed schedules. Podcasts allow continuous exposure to language content without disrupting daily activities. This convenience strongly supports adoption across age groups.

Demand for language learning podcasts is influenced by increased interest in informal education and micro learning. Users prefer short, focused episodes that address specific language topics. This format aligns with modern attention patterns and busy lifestyles. As a result, demand favors structured yet concise audio content.

Mobile technology has played a key role in expanding access to language learning podcasts. Smartphones and wireless headphones enable easy listening anywhere and anytime. Podcast platforms provide download and offline listening features that support uninterrupted learning. These capabilities have accelerated adoption among mobile first users.

Artificial intelligence is also influencing adoption through personalized recommendations and adaptive content delivery. Listening history and preferences are used to suggest relevant episodes. Some platforms integrate speech recognition and interactive features alongside podcasts. These technologies enhance engagement and learning effectiveness.

Top Market Takeaways

- By content format, bilingual dialogues and stories took 47.3% of the language learning podcast market, helping beginners grasp new words through their native language.

- By language, English as a second language held 58.4% share, popular for global jobs, travel, and education among non-native speakers.

- By proficiency level, beginner content captured 52.7%, offering simple lessons and repetition for new learners.

- By business model, freemium led with 61.8%, giving free basic episodes to attract users and charge for premium features.

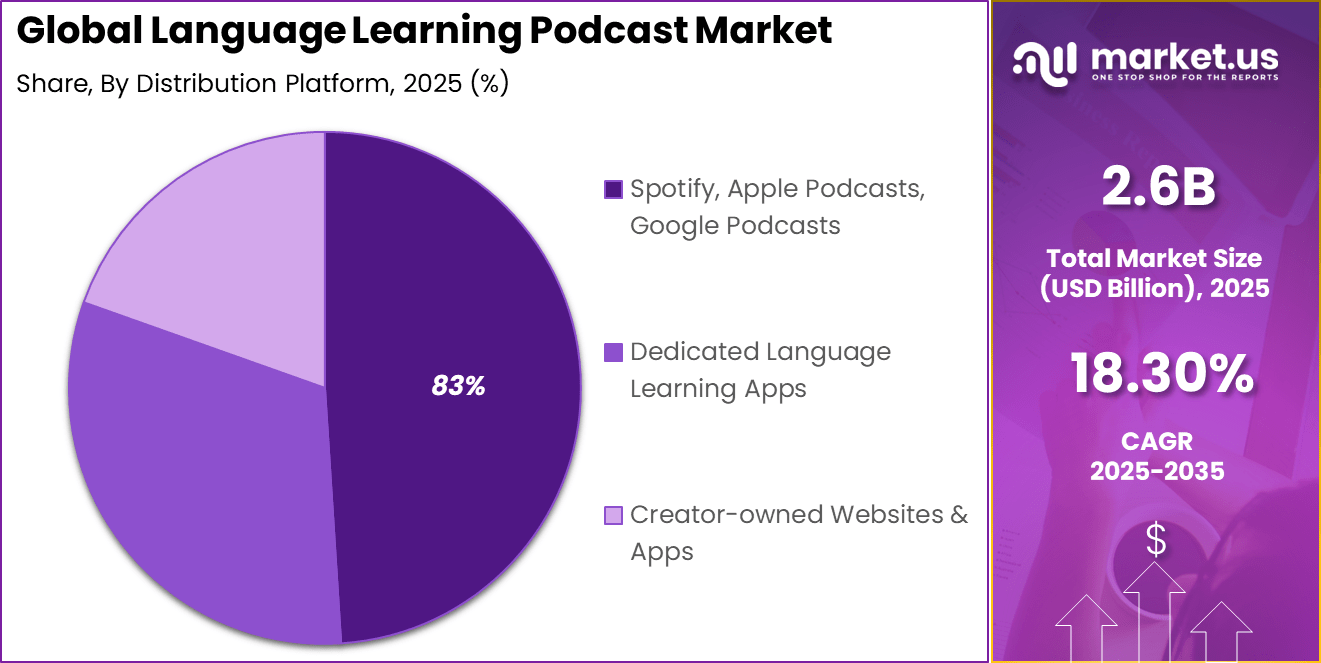

- By distribution platform, Spotify, Apple Podcasts, and Google Podcasts accounted for 82.6%, as they reach millions with easy subscriptions.

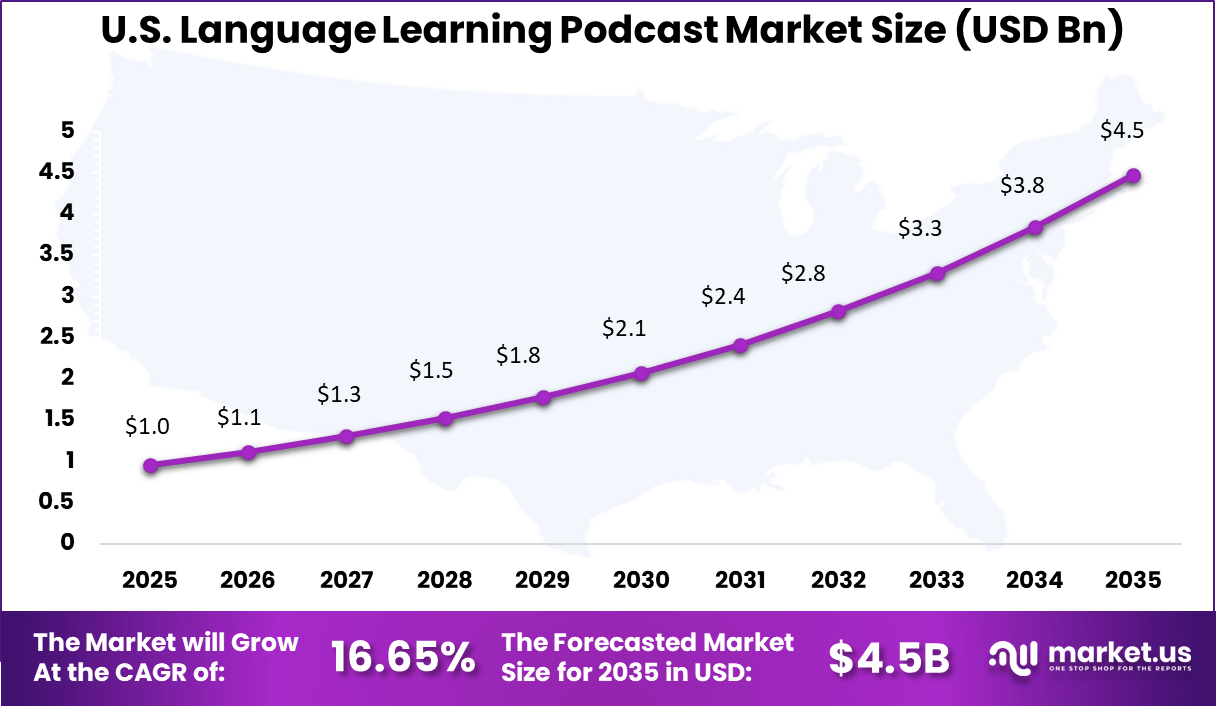

- North America had 41.3% of the global market, with the U.S. at USD 0.96 billion in 2025 and growing at a CAGR of 16.65%.

Usage Insights

- In 2026, the global landscape included approximately 16,821 language learning podcasts. This indicates a broad content base, though market saturation has increased competition for listener attention.

- Only 26.3% of available shows, equal to about 4,422 podcasts, were classified as active. This highlights a clear gap between content creation and sustained publishing consistency.

- Content depth remained moderate, as the average language learning podcast featured around 46.7 episodes. This suggests that many creators focus on short to mid-length learning series rather than long-running programs.

- Learner preferences showed strong alignment toward interactive and narrative-driven formats. 82.27% of students favored interview-based episodes, reflecting demand for real-world language exposure.

- Storytelling formats followed closely, preferred by 81.36% of learners, as they support contextual understanding and memory retention.

- Conversational podcasts were also highly valued, with 80.45% preference, emphasizing the importance of natural dialogue in language acquisition.

Listener Behavior Insights

- Listener retention remained strong, as nearly 70% of followers listened to most of the episodes they downloaded. However, full completion rates were slightly lower, with 68% finishing episodes from start to end, indicating selective listening within longer formats.

- Usage frequency showed consistent engagement among committed learners. Around 42.1% of regular users listened to language learning podcasts on a daily basis, while 15.8% engaged on a weekly schedule, reflecting varied learning routines.

- Active learning strategies were widely adopted, as 69% of listeners recorded unfamiliar words using digital tools such as apps or notes. This behavior highlights the role of podcasts as a complementary learning resource rather than a standalone method.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth in self paced learning Preference for flexible, on demand language learning ~5.1% Global Short Term Smartphone and podcast penetration Easy access to educational audio content ~4.3% Global Short Term Rising global migration Increased need for language proficiency ~3.7% North America, Europe Mid Term Expansion of lifelong learning culture Learning beyond formal education ~2.9% Global Long Term Cost effectiveness of podcasts Lower cost compared with traditional courses ~2.3% Emerging Markets Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Content monetization limits Free content reduces paid subscription conversion ~3.6% Global Short Term Listener retention challenges High drop off rates across episodes ~2.9% Global Short Term Content quality inconsistency Lack of standardized learning outcomes ~2.2% Global Mid Term Platform dependency Revenue sensitivity to podcast platform policies ~1.7% Global Long Term Language market saturation High competition in popular languages ~1.3% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Limited certification value Podcasts not formally accredited ~3.1% Global Long Term Assessment limitations Lack of structured testing ~2.5% Global Mid Term Discoverability issues Difficulty standing out in crowded platforms ~2.1% Global Short Term Monetization dependency Reliance on ads and subscriptions ~1.6% Global Mid Term Language diversity gaps Limited content for niche languages ~1.2% Emerging Markets Long Term Content Format Analysis

Bilingual dialogues and stories account for 47.3%, showing their strong appeal in language learning podcasts. This format allows learners to hear both native and target languages in context. Dialogues help improve listening comprehension and pronunciation. Story-based learning keeps users engaged for longer durations. Practical usage makes this format effective.

The popularity of bilingual content is driven by ease of understanding. Learners can compare language structures naturally. Stories improve memory retention and contextual learning. This format suits self-paced learning environments. It continues to attract a wide learner base.

Language Analysis

English as a Second Language represents 58.4%, making it the most dominant language segment. English is widely used for education, work, and communication. Learners rely on podcasts to improve fluency and comprehension. Audio learning supports flexible schedules. ESL content remains highly demanded.

Growth in ESL podcasts is driven by global English usage. Learners seek accessible and affordable learning tools. Podcasts provide consistent exposure to spoken English. They also support accent familiarity. This sustains strong adoption.

Proficiency Level Analysis

Beginner-level content accounts for 52.7%, reflecting strong demand from new learners. Beginners require simple explanations and slow-paced content. Podcasts help build basic vocabulary and listening skills. Introductory lessons reduce learning barriers. Accessibility supports early engagement.

The dominance of beginner content is driven by first-time learners. Many users prefer starting with audio learning. Beginner podcasts encourage confidence building. Simple lesson structures support consistency. This keeps beginner content widely used.

Business Model Analysis

Freemium models account for 61.8%, highlighting preference for flexible access. Users can start learning without upfront payment. Free content builds trust and engagement. Premium features provide advanced lessons. This model supports wide user acquisition.

The freemium approach is driven by trial-based adoption. Learners prefer evaluating content quality before upgrading. Platforms benefit from larger audiences. Conversion grows with consistent value delivery. This model remains dominant.

Distribution Platform Analysis

Major podcast platforms account for 83%, making them the primary distribution channels. These platforms offer easy access and discovery. Users prefer familiar applications for learning. Subscription and offline access improve convenience. Platform reliability supports frequent usage.

Growth in platform-based distribution is driven by mobile listening habits. Learners access podcasts during travel and leisure time. Platform algorithms support content discovery. Global reach increases audience size. This strengthens platform dominance.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Individual learners Very High ~63.8% Skill development and flexibility Subscription driven EdTech companies High ~18% Platform engagement and upselling Content investment Educational institutions Moderate ~9% Supplemental learning resources Pilot adoption Media companies Moderate ~6% Audience expansion Ad supported models Employers Low to Moderate ~3% Workforce language training Selective sponsorship Key Reasons for Adoption

- Demand for flexible language learning options is rising among students and working professionals

- Podcasts allow learning without screens, fitting into daily routines

- Growing smartphone and audio platform usage supports easy access to content

- Learners prefer natural conversation formats over traditional textbooks

- Content creators can reach global audiences at low distribution cost

Benefits

- Language exposure improves through listening to real-life conversations

- Learning becomes consistent due to easy and repeated access

- Pronunciation and listening skills develop naturally over time

- Stress-free learning is supported through informal audio formats

- Cultural understanding improves alongside language skills

Usage

- Students use language podcasts to support classroom learning

- Professionals listen during commuting or daily activities

- Self-learners rely on podcasts for vocabulary and fluency practice

- Teachers recommend podcasts as supplementary learning tools

- Language platforms use podcasts to expand digital learning offerings

Emerging Trends

Key Trend Description Smart Device Integration Voice commands and seamless access on smart speakers enable hands-free learning during daily routines. AI Content Personalization AI adapts lessons to user progress, preferences, and proficiency for tailored learning experiences. Short-Form Episodes Bite-sized content with gamification improves engagement and retention for busy listeners. Immersive Storytelling Narrative-driven formats teach through stories, improving memory and contextual understanding. Transcription Support Read-along transcripts strengthen grammar, spelling, and vocabulary through multi-modal learning. Growth Factors

Key Factors Impact Mobile Technology Rise Smartphones and apps provide anytime, anywhere access to portable language learning content. On-the-Go Learning Demand Fits multitasking lifestyles such as commuting or exercising for auditory learners. Globalization Needs Multilingual skills drive demand for business travel and cross-cultural communication. Diverse Teaching Formats Varied formats from conversations to storytelling attract beginners and advanced users. Platform Expansions Streaming services and education apps curate and recommend language podcasts widely. Key Market Segments

By Content Format

- Audio-only Lessons

- Bilingual Dialogues & Stories

- Cultural & Immersive Content

- Grammar & Vocabulary Focused

- Others

By Language

- English as a Second Language (ESL)

- Spanish, French, Chinese (Mandarin)

- Japanese, Korean, German

- Niche & Less Commonly Taught Languages

- Others

By Proficiency Level

- Beginner

- Intermediate

- Advanced

By Business Model

- Freemium

- Advertising-supported

- Premium Subscription

- Crowdfunded / Donation-based

By Distribution Platform

- Spotify, Apple Podcasts, Google Podcasts

- Dedicated Language Learning Apps

- Creator-owned Websites & Apps

Regional Analysis

North America accounted for 41.3% share, supported by strong adoption of digital learning formats and high podcast consumption across the region. Language learning podcasts have gained popularity among students, professionals, and lifelong learners seeking flexible and on demand education.

Demand has been driven by growing interest in self paced learning and the convenience of audio based content that can be accessed during commuting or daily activities. The region’s strong smartphone and streaming penetration has further supported market growth.

Regional Driver Comparison

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America High podcast adoption and paid learning 41.3% USD 1.06 Bn Advanced Europe Multilingual workforce demand 26.8% USD 0.69 Bn Advanced Asia Pacific Mobile first learning expansion 23.1% USD 0.60 Bn Developing Latin America Growing digital education usage 5.4% USD 0.14 Bn Developing Middle East and Africa Language learning for employment 3.4% USD 0.09 Bn Early The U.S. market reached USD 0.96 Bn and is projected to grow at a 16.65% CAGR, reflecting rising demand for accessible and affordable language learning resources. Adoption has been particularly strong among working professionals and students who prefer flexible learning schedules. Language learning podcasts have helped U.S. users improve listening skills, pronunciation, and vocabulary without the need for structured classroom settings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunity

A strong opportunity exists in connecting podcasts with language learning apps and practice tools. Combining audio lessons with quizzes, pronunciation practice, and progress tracking can strengthen learning outcomes. This integrated approach can turn podcasts into a more complete learning experience.

Another opportunity lies in expanding content that includes cultural context and everyday usage. Podcasts that explain idioms, customs, and real life communication styles can make learning more engaging. Cultural insight also helps learners use language more naturally.

Challenge

One challenge for the language learning podcast market is keeping learners motivated over time. Language learning requires repeated exposure and practice. Podcast creators must maintain interest through varied content and clear progress indicators.

Another challenge is creating sustainable revenue models while keeping content accessible. Producing high quality educational audio requires resources and expertise. Balancing monetisation with affordable access remains a key consideration.

Competitive Analysis

Duolingo, Inc., Babbel, GmbH, and Coffee Break Languages are key contributors to the language learning podcast market. Their content focuses on structured lessons and conversational practice. Strong emphasis is placed on accessibility and learner engagement. These providers target beginners and casual learners. Podcast formats support flexible learning schedules. Integration with apps and websites strengthens user retention. Their wide language coverage supports global reach. Brand trust plays an important role in audience growth.

Innovative Language Learning, LLC operates platforms such as ChinesePod, SpanishPod101, FrenchPod101, and JapanesePod101. These podcasts focus on practical language use and cultural context. Lessons are segmented by skill level. Subscription-based models support monetization. Audio content is supported by transcripts and exercises. These platforms appeal to self-directed learners. Consistent content updates support long-term engagement. Community features further improve learner interaction.

LingQ, Ltd., Language Transfer, The Fluent Show, and Talk To Me In Korean focus on immersion and real-world usage. Public broadcasters such as Deutsche Welle Learn German and RFI Savoirs add educational credibility. These providers emphasize natural speech and listening skills. Other players serve niche languages and learner communities.

Top Key Players in the Market

- Duolingo, Inc.

- Coffee Break Languages

- Innovative Language Learning, LLC

- Babbel, GmbH

- News in Slow

- ChinesePod

- SpanishPod101

- FrenchPod101

- JapanesePod101

- LingQ, Ltd.

- Language Transfer

- The Fluent Show

- Talk To Me In Korean

- Deutsche Welle (DW) Learn German

- RFI (Radio France Internationale) Savoirs

- Others

Future Outlook

Growth in the Language Learning Podcast market is expected to continue as learners prefer flexible and audio based study formats. Podcasts allow users to practice listening skills during daily activities such as commuting or exercise, which supports consistent learning habits.

Rising smartphone usage and improved access to streaming platforms are supporting wider adoption across age groups. Over time, better content personalization, level based series, and integration with language apps are likely to improve learning outcomes and user retention.

Recent Developments

- November, 2025: LingQ launched support for Urdu, expanding its platform to 50 languages total and strengthening its immersive content approach.

Report Scope

Report Features Description Market Value (2025) USD 2.6 Bn Forecast Revenue (2035) USD 13.8 Bn CAGR(2025-2035) 18.30% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Content Format (Audio-only Lessons,Bilingual Dialogues & Stories,Cultural & Immersive Content,Others), By Language (English as a Second Language (ESL),Spanish, French, Chinese (Mandarin),Others), By Proficiency Level (Beginner,Intermediate,Advanced), By Business Model (Freemium,Advertising-supported,others), By Distribution Platform (Spotify, Apple Podcasts, Google Podcasts,Dedicated Language Learning Apps,Creator-owned Websites & Apps) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Duolingo, Inc., Coffee Break Languages, Innovative Language Learning, LLC, Babbel, GmbH, News in Slow, ChinesePod, SpanishPod101, FrenchPod101, JapanesePod101, LingQ, Ltd., Language Transfer, The Fluent Show, Talk To Me In Korean, Deutsche Welle (DW) Learn German, RFI (Radio France Internationale) Savoirs, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Language Learning Podcast MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Language Learning Podcast MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Duolingo, Inc.

- Coffee Break Languages

- Innovative Language Learning, LLC

- Babbel, GmbH

- News in Slow

- ChinesePod

- SpanishPod101

- FrenchPod101

- JapanesePod101

- LingQ, Ltd.

- Language Transfer

- The Fluent Show

- Talk To Me In Korean

- Deutsche Welle (DW) Learn German

- RFI (Radio France Internationale) Savoirs

- Others