Global Laminating Machines Market Size, Share, Growth Analysis By Type (Wet Laminating Machines, Dry Bond Laminating Machines, Thermal Laminating Machines), By Application (Commercial, Personal, Industrial), By Material (Paper, Foil, Plastic), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152829

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

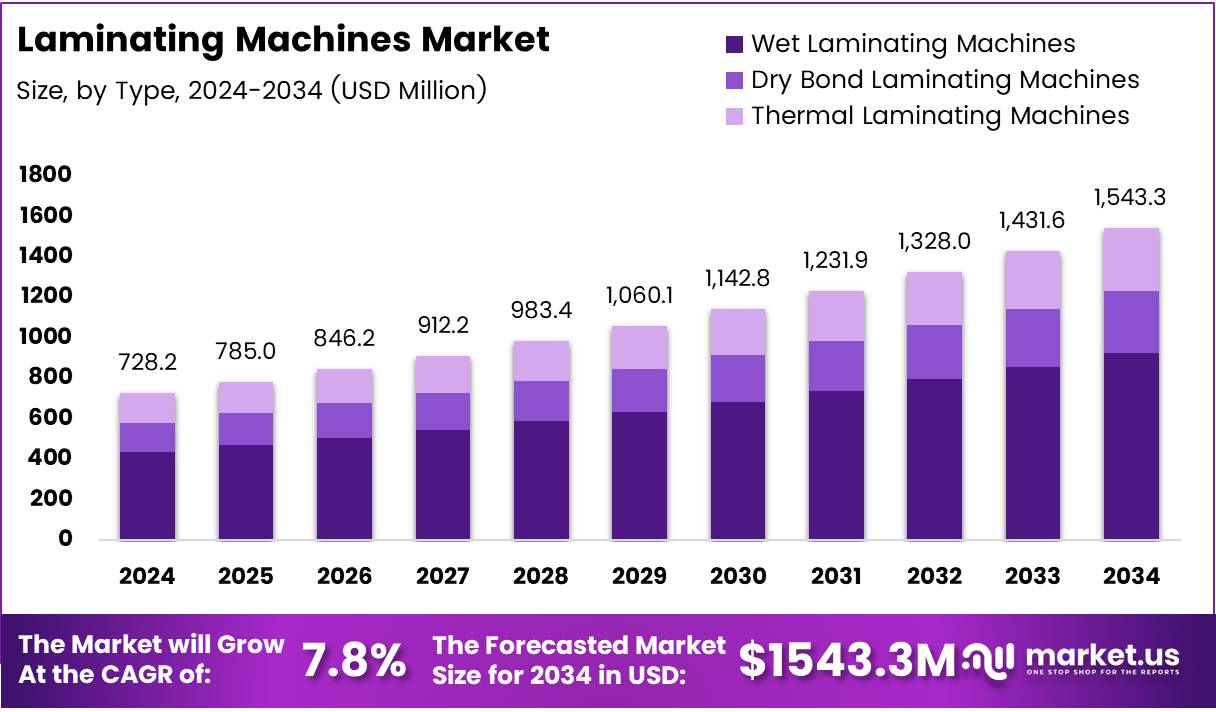

The Global Laminating Machines Market size is expected to be worth around USD 1543.3 Million by 2034, from USD 728.2 Million in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The laminating machines market plays a crucial role in various industries, especially in packaging, printing, and manufacturing sectors. These machines provide essential solutions for protecting products, improving durability, and enhancing the visual appeal of items. The market is driven by the increasing need for high-quality finishes and protective layers in consumer goods and packaging.

Over the past few years, the laminating machine industry has witnessed significant advancements in technology. The integration of automation and advanced control systems has improved the efficiency and precision of laminating processes. These innovations are anticipated to fuel market growth by offering more cost-effective solutions and faster production cycles, ultimately benefiting industries requiring mass production.

Government regulations and investment in the manufacturing sector are also contributing factors to the growth of the laminating machine market. For example, various countries are increasing their focus on improving manufacturing technologies and automation, which is directly affecting the demand for laminating machines. Additionally, sustainability initiatives in packaging are creating opportunities for the development of more eco-friendly laminating solutions.

In India, the laminating machine imports stood at 7.7K shipments, imported by 1,359 Indian importers from 1,397 suppliers as of June 5, 2025, according to Volza. This reflects a growing demand for laminating machines in the region, with a diverse range of suppliers contributing to the market’s expansion. The continuous inflow of laminating machinery indicates a robust supply chain, which can support various industries that rely on these machines for production.

India’s laminating machine exports are primarily concentrated in a few key markets. According to Volza, the US, Italy, and the UAE account for 96% of the total exports. This concentration in specific markets suggests a high level of demand for laminating machines in these countries, which further demonstrates the export potential of India’s laminating machine sector.

The laminating machines market continues to show promising growth, fueled by technological advancements, regulatory support, and expanding global trade. As demand rises in key regions, the market is expected to grow in both domestic and international markets. These trends highlight a dynamic environment for manufacturers and suppliers of laminating machines globally.

Key Takeaways

- The Global Laminating Machines Market is projected to reach USD 1543.3 Million by 2034, growing at a CAGR of 7.8% from 2025 to 2034.

- Wet Laminating Machines dominated the By Type Analysis segment with 72.1% market share in 2024.

- The Commercial segment led the By Application Analysis with 46.9% market share in 2024.

- Paper held the largest share of 42.6% in the By Material Analysis segment in 2024.

- North America accounted for 41.3% of the global laminating machines market, valued at USD 300.7 million in 2024.

Type Analysis

In 2024, Wet Laminating Machines held a dominant market position in By Type Analysis segment of Laminating Machines Market, with a 72.1% share

In 2024, Wet Laminating Machines commanded the largest share in the Laminating Machines market under the By Type Analysis segment, securing a robust 72.1% market share. This dominance can be attributed to their efficiency and reliability in providing high-quality lamination for various applications. Wet Laminating Machines are widely used for their ability to bond materials securely and effectively, making them the preferred choice for numerous industries.

Dry Bond Laminating Machines, while accounting for a significant share, followed behind in the market. These machines are often utilized for processes where immediate adhesion is required without the need for moisture-based bonding.

Thermal Laminating Machines, though essential, occupy a smaller share in the segment. These machines rely on heat to bond layers, offering a quick solution for specific applications. While not as dominant as Wet Laminating Machines, thermal laminating technology plays a key role in industries requiring speed and precision.

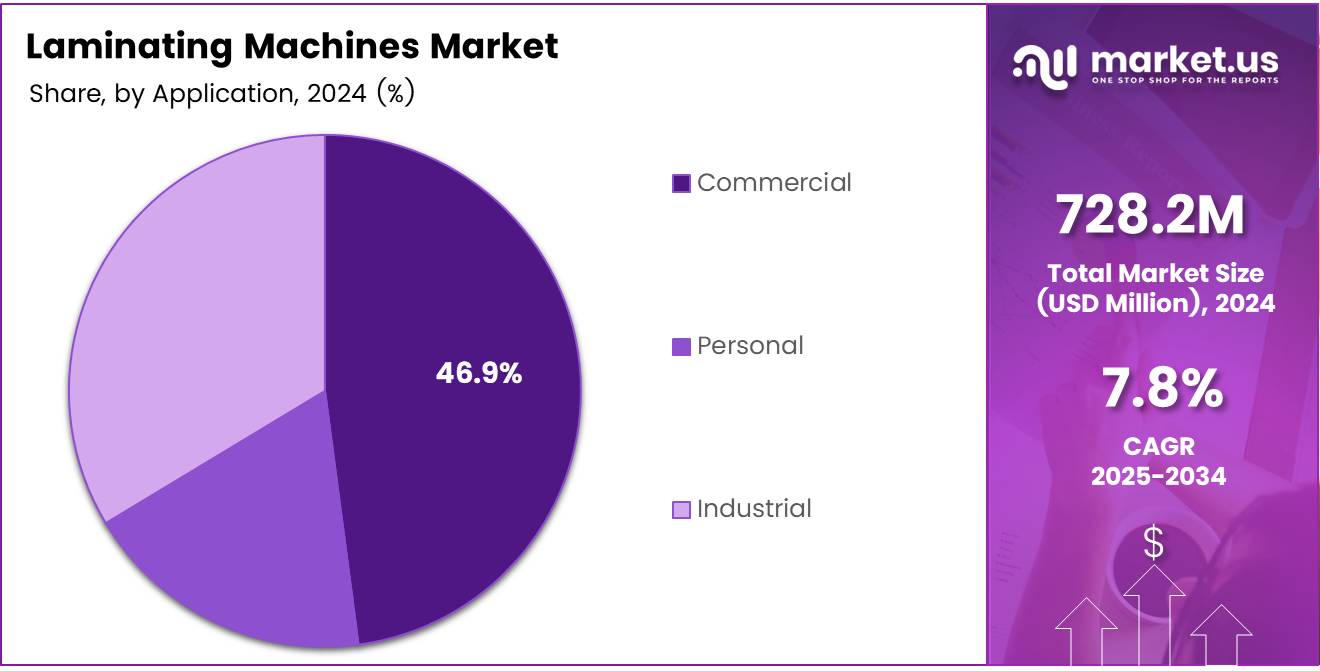

Application Analysis

In 2024, Commercial held a dominant market position in By Application Analysis segment of Laminating Machines Market, with a 46.9% share

In 2024, the Commercial segment emerged as the leader in the Laminating Machines market under the By Application Analysis segment, with a notable 46.9% share. This dominance is driven by the high demand for laminating solutions in various commercial sectors, including retail, packaging, and printing industries. Commercial laminating machines offer flexibility, scalability, and speed, meeting the needs of businesses with large volumes of lamination tasks.

The Personal segment, while essential, holds a smaller portion of the market. Personal laminating machines cater to individual or small-scale uses, such as at-home or office applications. Their ease of use and compact size make them ideal for low-volume tasks.

The Industrial segment, though holding a market share in the Laminating Machines market, continues to experience steady growth. Industrial applications require specialized machines capable of handling heavy-duty lamination tasks for production lines and large-scale operations, contributing to its growth in the overall market.

Material Analysis

In 2024, Paper held a dominant market position in By Material Analysis segment of Laminating Machines Market, with a 42.6% share

In 2024, Paper led the By Material Analysis segment of the Laminating Machines market, holding a significant 42.6% share. Paper laminating machines are widely used for their versatility and essential role in producing laminated paper products. The demand for paper-based lamination continues to drive the segment, particularly in industries such as packaging, retail, and document preservation.

Foil-based laminating machines, though popular, occupy a smaller portion of the market. They are primarily used in food packaging and other sectors where protective properties, such as barrier resistance, are essential.

Plastic laminating machines make up the remaining portion of the segment, with a growing demand in industries that require durable, flexible, and lightweight lamination solutions. Although not as dominant as paper laminating machines, plastic laminates continue to gain traction in various applications due to their enhanced durability and aesthetic appeal.

Key Market Segments

By Type

- Wet Laminating Machines

- Dry Bond Laminating Machines

- Thermal Laminating Machines

By Application

- Commercial

- Personal

- Industrial

By Material

- Paper

- Foil

- Plastic

Drivers

Increasing Demand for Durable Packaging Solutions Drives Market Growth

The laminating machines market is experiencing growth due to the increasing demand for durable packaging solutions. Industries such as food, electronics, and pharmaceuticals require packaging that provides added protection and extends shelf life. As a result, laminating machines are becoming essential for ensuring the robustness of packaging materials.

Furthermore, advancements in laminating technology are enhancing machine efficiency. New innovations in the design and operation of these machines have made them more energy-efficient, precise, and faster. This is improving production output while minimizing costs for manufacturers, making the machines more attractive to companies seeking efficiency improvements.

The market is also seeing a surge in demand for eco-friendly and recyclable laminating materials. As environmental concerns rise, industries are shifting toward sustainable packaging solutions. Laminating machines that use recyclable materials are gaining popularity, driven by consumer preferences for products with minimal environmental impact.

Additionally, the rise of e-commerce is driving growth in the packaging market, particularly in the demand for laminated materials. With increased online shopping, packaging solutions that are protective and durable are in high demand. This trend is expected to continue, as the need for secure and visually appealing packaging increases.

Restraints

Stringent Environmental Regulations Affecting Production and Material Use

The laminating machines market faces significant challenges due to stringent environmental regulations. Manufacturers are required to comply with laws regarding the use of eco-friendly materials, which can impact production costs. This puts pressure on producers to invest in technology and processes that meet these regulatory standards.

Fluctuations in raw material prices are another restraint impacting the laminating machines market. The prices of key materials such as plastics, adhesives, and laminates can be volatile, affecting the cost structure for machine manufacturers. This volatility can lead to uncertainty in pricing and hinder the profitability of companies in the industry.

Additionally, manufacturers must adapt to ever-changing environmental policies, which may require costly modifications to their production processes. These regulatory challenges may delay product development and reduce the flexibility of manufacturers to respond to market demand quickly.

Despite these challenges, manufacturers are finding ways to innovate by developing alternative materials and processes that align with sustainability goals, allowing them to maintain market relevance.

Growth Factors

Expanding Demand in Packaging Solutions Drives Market Growth

The laminating machines market is benefiting from expanding applications in the food and beverage industry. With the growing need for packaging that preserves the freshness of products, laminated packaging materials are gaining popularity. This trend is expected to increase as consumer demand for longer shelf life continues to rise.

Another exciting opportunity comes from the integration of AI and automation into the laminating process. The adoption of these technologies is streamlining operations, improving precision, and reducing the labor required for machine operation. As industries look for ways to optimize their production processes, AI-powered laminating machines offer greater efficiency.

The packaging needs for electronic goods are also contributing to the growth of the laminating machines market. Electronics manufacturers require high-quality laminated packaging to protect delicate components. As the demand for electronic devices continues to grow, so does the need for efficient and reliable packaging solutions, driving market demand.

In addition, there is a rising demand for customizable laminating solutions, particularly in emerging markets. Businesses are increasingly looking for tailored solutions that meet specific product requirements. This trend opens up new avenues for companies offering flexible and innovative laminating technologies.

Emerging Trends

Increasing Focus on Sustainability and High-Quality Packaging Drives Market Trends

Sustainability is becoming a key factor in the laminating machines market. Increasing focus on reducing the environmental impact of packaging has led manufacturers to seek more eco-friendly laminating solutions. Companies are developing laminating machines that use fewer resources and create less waste, which aligns with growing environmental concerns.

Another significant trend is the adoption of smart packaging solutions. Laminating machines are being integrated into packaging systems that offer enhanced features, such as tracking and authentication. This shift toward smart packaging is driven by the increasing demand for technology-driven, consumer-friendly packaging.

There is also a growing demand for high-quality finishing and aesthetic packaging designs. Consumers are increasingly attracted to products with visually appealing and well-packaged designs. Laminated packaging allows manufacturers to achieve high-quality finishes that enhance the overall product appeal.

Finally, small to medium enterprises are seeking compact, user-friendly laminating machines that require less space and are easier to operate. As these businesses enter the market, there is a greater demand for affordable, efficient, and easy-to-use laminating solutions, further driving innovation in the sector.

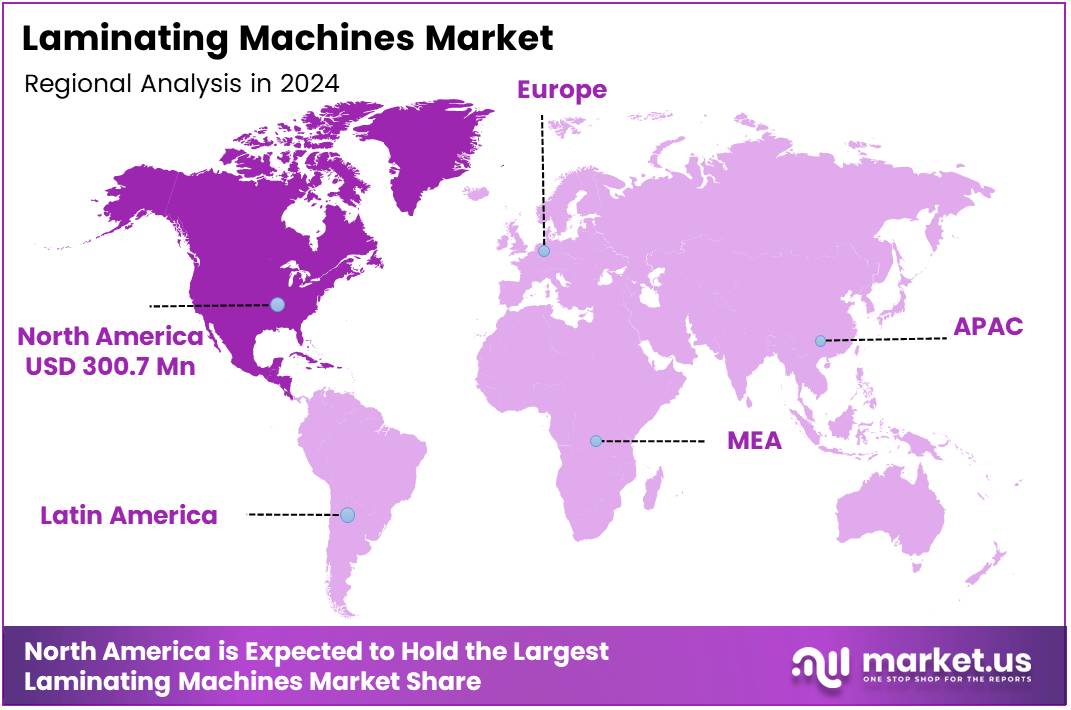

Regional Analysis

North America Dominates the Laminating Machines Market with a Market Share of 41.3%, Valued at USD 300.7 Million

North America holds the largest share in the laminating machines market, commanding 41.3% of the global market, valued at USD 300.7 million. This dominance is attributed to the robust demand for laminating machines driven by industries such as packaging and manufacturing.

Furthermore, the region benefits from advanced technological developments and high adoption rates of eco-friendly laminating materials. The U.S. remains the leading country in this region, contributing significantly to market growth due to the strong presence of industrial and commercial sectors.

Europe Laminating Machines Market Trends

Europe is another prominent market for laminating machines, capturing a significant share of the global market. The increasing demand for high-quality packaging solutions, combined with a strong emphasis on sustainability and eco-friendly materials, drives the growth in this region. Several European countries, including Germany and France, are expected to see a rise in laminating machine adoption due to the expansion of manufacturing facilities and growing e-commerce packaging needs.

Asia Pacific Laminating Machines Market Trends

The Asia Pacific region is expected to exhibit substantial growth in the laminating machines market, driven by rapid industrialization and expanding packaging needs. The market is anticipated to grow due to the rising demand for durable and cost-effective packaging solutions in countries such as China, India, and Japan. The region’s increasing focus on technological advancements and sustainable materials also plays a significant role in fostering market expansion.

Middle East and Africa Laminating Machines Market Trends

The Middle East and Africa market for laminating machines is experiencing steady growth, particularly in the packaging and industrial sectors. This region is expected to benefit from the increasing demand for high-quality, durable packaging solutions and the expansion of manufacturing activities. As the region focuses on modernizing its infrastructure and industries, the laminating machines market is expected to grow in alignment with these trends.

Latin America Laminating Machines Market Trends

The Latin American market for laminating machines is in a developing phase but is expected to witness steady growth in the coming years. Key drivers include the rise in industrial applications, the growing demand for packaging solutions in retail and e-commerce, and the increasing focus on sustainability. Brazil and Mexico are the primary markets in the region, where the adoption of laminating technologies is anticipated to increase with growing manufacturing needs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Laminating Machines Company Insights

In 2024, Black Bros. Co. is anticipated to maintain a prominent position in the global laminating machines market. The company’s strong reputation for producing durable and high-performance laminating systems positions it well to cater to the increasing demand for efficient and cost-effective packaging solutions.

Graphco, known for its expertise in the printing and finishing sectors, has developed a range of laminating machines that integrate advanced technologies to meet the diverse needs of industries such as packaging, automotive, and consumer goods. Their innovative solutions are expected to continue driving their market share in the coming years.

Robert Bürkle GmbH has become a key player due to its highly automated and reliable laminating machines. With a focus on delivering high-quality finishes, the company’s systems are used extensively in industries such as electronics and furniture manufacturing. Their emphasis on precision and durability makes them a preferred choice in the market.

VEIT GmbH, with its strong technical capabilities and experience in the laminating machine market, is poised to benefit from the rising demand for eco-friendly and energy-efficient products. The company’s solutions are known for their sustainability and are increasingly favored by manufacturers looking to reduce their environmental footprint while maintaining operational efficiency.

These companies, with their focus on innovation, quality, and efficiency, are expected to lead the market in the coming years, addressing the evolving needs of various industries globally.

Top Key Players in the Market

- Black Bros. Co.

- Graphco

- Robert Bürkle GmbH

- VEIT GmbH

- Karl Menzel Maschinenfabrik GmbH

- KOMFI spol. s r. o.

- WORLDLY INDUSTRIAL CO., LTD.

- ALEMO

- L.R. Schmitt Nachfolger Sondermaschinenbaugesellschaft m.b.H.

- HMT Manufacturing, Inc.

- Monotech Systems Ltd.

- Comexi Group Industries

- GMP

- D&K Group

- Chongqing Sinstar Packaging Machinery Co., Ltd.

Recent Developments

- In April 2025, IPCO AB, a wholly owned subsidiary of FAM AB, acquired New Era Converting Machinery Inc., a prominent manufacturer of web converting equipment, further expanding its product offerings and market reach.

- In April 2025, Coral Products announced the acquisition of Arrow Film Converters Limited, enhancing its capabilities in film production and positioning itself for greater competitiveness in the packaging industry.

- In May 2024, Timberlab acquired American Laminators, accelerating its growth in the mass timber construction sector and expanding its manufacturing and operational capacity to meet rising demand for sustainable building materials.

Report Scope

Report Features Description Market Value (2024) USD 728.2 Million Forecast Revenue (2034) USD 1543.3 Million CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Wet Laminating Machines, Dry Bond Laminating Machines, Thermal Laminating Machines), By Application (Commercial, Personal, Industrial), By Material (Paper, Foil, Plastic) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Black Bros. Co., Graphco, Robert Bürkle GmbH, VEIT GmbH, Karl Menzel Maschinenfabrik GmbH, KOMFI spol. s r. o., WORLDLY INDUSTRIAL CO., LTD., ALEMO, L.R. Schmitt Nachfolger Sondermaschinenbaugesellschaft m.b.H., HMT Manufacturing, Inc., Monotech Systems Ltd., Comexi Group Industries, GMP, D&K Group, Chongqing Sinstar Packaging Machinery Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Black Bros. Co.

- Graphco

- Robert Bürkle GmbH

- VEIT GmbH

- Karl Menzel Maschinenfabrik GmbH

- KOMFI spol. s r. o.

- WORLDLY INDUSTRIAL CO., LTD.

- ALEMO

- L.R. Schmitt Nachfolger Sondermaschinenbaugesellschaft m.b.H.

- HMT Manufacturing, Inc.

- Monotech Systems Ltd.

- Comexi Group Industries

- GMP

- D&K Group

- Chongqing Sinstar Packaging Machinery Co., Ltd.