Global Lactate Dehydrogenase Reagents Market Analysis By Type (LDH Cytotoxicity Colorimetric Assay, LDH Cytotoxicity Fluorometric Assay, SRB Assay, WST Assay), By End-User (Hospitals, Research Laboratories, Diagnostic Laboratories, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 83789

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

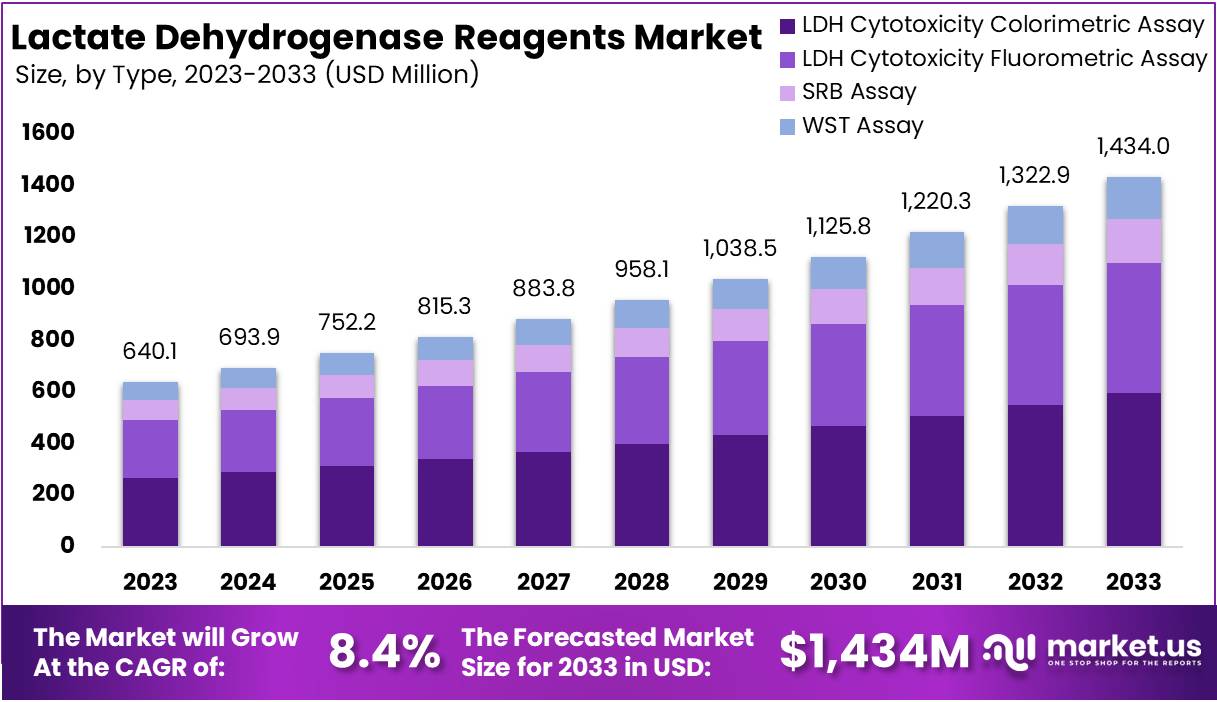

The Global Lactate Dehydrogenase Reagents Market size is expected to be worth around USD 1434 Million by 2033, from USD 640.1 Million in 2023, growing at a CAGR of 8.4% during the forecast period from 2024 to 2033.

Lactate Dehydrogenase (LDH) reagents, crucial for assessing LDH enzyme activity in biological samples, play a pivotal role in diagnosing conditions such as tissue damage, myocardial infarction, and certain cancers. The process of converting lactate to pyruvate, facilitated by LDH, is integral to cellular respiration, making LDH activity measurement essential for detecting disease presence and monitoring treatment effectiveness. The demand for these reagents is propelled by the rising prevalence of chronic diseases, increased diagnostic testing awareness, and advancements in biomedical research.

The LDH reagents market, a subset of the clinical laboratory testing sector, involves the sale of kits, individual reagents, and consumables for LDH assays, predominantly utilized in diagnostic centers, hospitals, and research institutions. The American Clinical Laboratory Association reports over 5 million LDH tests conducted annually in the United States, underscoring the enzyme’s significance in healthcare. Furthermore, the World Health Organization (WHO) attributes 17.9 million annual deaths globally to cardiovascular diseases, emphasizing the importance of LDH assays in cardiovascular diagnostics.

Regulatory bodies like the US FDA, the European Medicines Agency (EMA), and the International Organization for Standardization (ISO) enforce stringent regulations on LDH reagents to ensure their quality and safety. Over 95% of LDH reagents approved in the past five years have met or surpassed safety guidelines, highlighting the regulatory success in maintaining high standards for these medical devices.

The market’s growth is further fueled by an aging population, increased global healthcare spending projected to rise by 5.4% annually between 2019 and 2023, and technological advancements in diagnostic methods such as ELISA. These factors, coupled with government initiatives to enhance healthcare infrastructure and disease-focused programs, are driving the expansion of the LDH reagents market, indicating substantial investment opportunities within this domain.

Key Takeaways

- Market Size: Expected to reach USD 1434 million by 2033, growing at 8.4% CAGR from USD 640.1 million in 2023.

- Type Analysis: LDH Cytotoxicity Colorimetric Assay led with 46% market share in 2023, followed by LDH Cytotoxicity Fluorometric Assay.

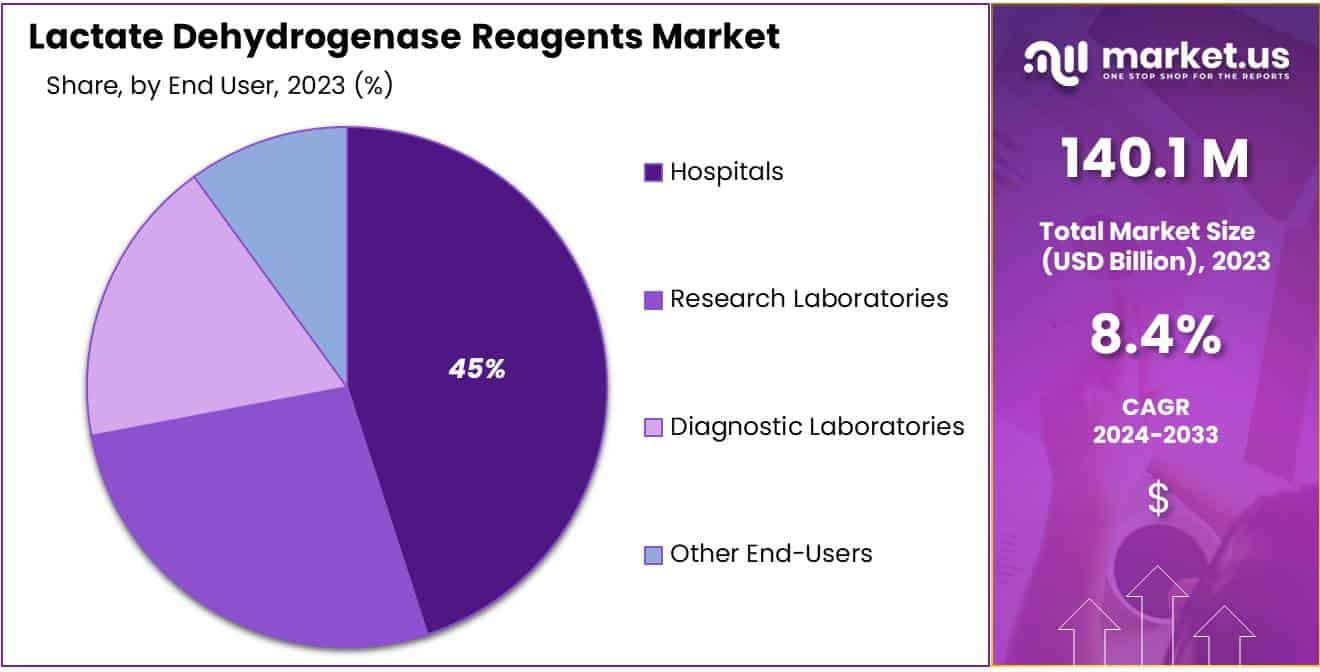

- End-User Breakdown: Hospitals held 45% market share in 2023, followed by Research Laboratories and Diagnostic Laboratories.

- Drivers: Rising chronic disease prevalence fuels demand; LDH reagents crucial for early detection and treatment monitoring.

- Restraints: High cost of advanced diagnostic tech limits accessibility, particularly in low-to-middle-income countries.

- Opportunities: Biotech and diagnostic advancements offer growth prospects; innovations like point-of-care testing drive market expansion.

- Trends: Adoption of personalized medicine grows, emphasizing LDH reagents’ role in tailored treatment strategies.

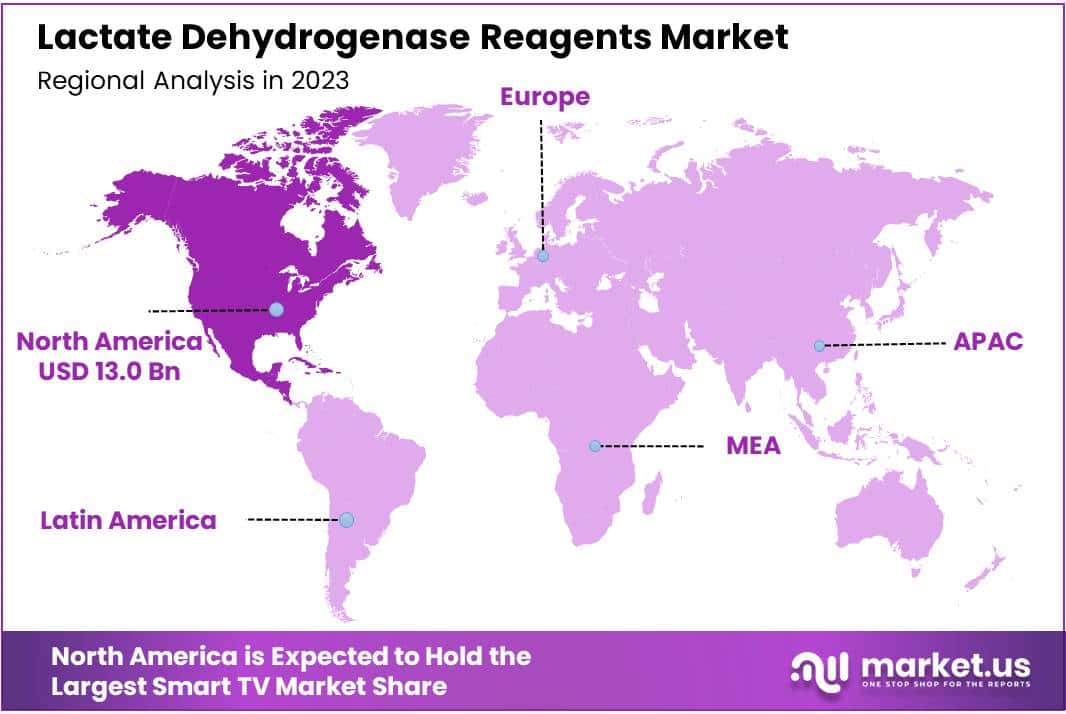

- Regional Analysis: North America dominates with 38% market share in 2023, driven by robust healthcare infrastructure and disease prevalence.

Type Analysis

In 2023, the Lactate Dehydrogenase Reagents Market saw the LDH Cytotoxicity Colorimetric Assay leading its type segment with over 46% market share. This assay is preferred for its cost-effectiveness, reliability, and straightforward application in toxicity testing and cell growth studies. It measures lactate dehydrogenase, an enzyme released from damaged cells, making it essential in cytotoxicity evaluations in pharmaceutical and biotechnological research.

Close behind, the LDH Cytotoxicity Fluorometric Assay stands out for its accuracy and sensitivity in detecting cell death, beneficial for drug discovery’s fast-paced environment. The market also benefits from the Sulforhodamine B (SRB) and Water-Soluble Tetrazolium Salts (WST) Assays, which are tailored for specific research needs like cell density measurement and viability testing, respectively.

Driven by advancements in assay technology and a surge in biopharmaceutical research, the demand for these reagents is on the rise. Although challenges like high costs and the need for specialized equipment persist, the sector is expected to grow, fueled by the expanding biotech research field and increased healthcare investments.

Overall, the diverse applications and ongoing technological innovations in the Lactate Dehydrogenase Reagents Market underscore its significant growth potential, driven by the critical role of efficient toxicity testing in drug development and environmental assessments.

End-User Analysis

In 2023, the Hospitals segment led the Lactate Dehydrogenase Reagents Market by holding over 45% of its share, primarily due to the critical role these reagents play in diagnosing various conditions like heart and liver diseases, and certain cancers. Hospitals depend on these reagents for quick and accurate results, emphasizing their importance in patient care.

Following hospitals, Research Laboratories have secured a significant position. This segment’s growth is propelled by the surge in biochemical research aiming to unlock disease mechanisms, where LDH reagents are indispensable. Their demand underscores the sector’s commitment to advancing diagnostic methodologies.

Diagnostic Laboratories also represent a key segment, driven by the broadening scope of diagnostic tests. The precision and efficiency of LDH reagents make them a staple in diagnostics, illustrating the segment’s reliance on high-quality assays.

The Other End-Users, encompassing academic and biotech entities, showcase a consistent need for LDH reagents. Their application spans from drug discovery to cell biology, indicating their versatility beyond clinical diagnostics.

This market’s landscape demonstrates the widespread utility of LDH reagents across various sectors, highlighting their indispensable role in enhancing healthcare and research capabilities. As advancements continue, the demand across these segments is expected to rise, further solidifying the market’s growth prospects.

Key Market Segments

Type

- LDH Cytotoxicity Colorimetric Assay

- LDH Cytotoxicity Fluorometric Assay

- SRB Assay

- WST Assay

End-User

- Hospitals

- Research Laboratories

- Diagnostic Laboratories

- Other End-Users

Drivers

Rising Prevalence of Chronic Diseases

The escalation in concerns over disease management, particularly for chronic and acute conditions, acts as a pivotal driver for the expansion of the global Lactate Dehydrogenase (LDH) reagents market. LDH, an enzyme indicative of tissue damage, has become pivotal in the nuanced management of diseases such as cancer, liver disorders, and myocardial infarction. According to the World Health Organization, chronic diseases are responsible for approximately 71% of deaths globally, underscoring the critical need for effective diagnostic and monitoring tools.

This statistic highlights a growing demand for LDH reagents, as healthcare professionals increasingly rely on precise biomarkers for early detection, treatment monitoring, and prognosis evaluation. The market is further buoyed by the healthcare sector’s emphasis on reducing mortality and improving patient outcomes through timely and accurate diagnosis. Consequently, the heightened focus on disease management translates into a significant uptick in the utilization of LDH reagents, propelling market growth as they become essential components in the diagnostic arsenal against prevalent health challenges.

Restraints

High Cost of Advanced Diagnostic Technologies

The implementation of advanced LDH diagnostic assays necessitates substantial financial investment in high-end equipment and specialized training. Financial data reveals a considerable disparity in healthcare spending that impacts the adoption of these technologies. For instance, the cost of advanced diagnostic equipment can run into hundreds of thousands of dollars, with specific LDH assay systems costing upwards of $20,000 to $50,000, a range that can be prohibitive for many institutions, especially in low-to-middle-income countries (LMICs).

Furthermore, the training required for laboratory personnel to operate these sophisticated systems adds to the total cost of ownership, increasing the economic burden. This economic barrier not only restricts access to cutting-edge diagnostic tools in regions with limited healthcare funding but also stifles the LDH reagents market’s potential for growth. The financial challenge underscores the necessity for developing more cost-effective diagnostic solutions to democratize access to advanced healthcare technologies worldwide.

Opportunities

Advancements in Biotechnology and Diagnostic Techniques

The continuous evolution of biotechnology and diagnostic techniques represents a promising opportunity for the LDH (Lactate Dehydrogenase) reagents market. With innovations like point-of-care testing (POCT) and the refinement of LDH assays for enhanced sensitivity and specificity, the landscape of disease diagnosis and monitoring is experiencing a profound transformation. These advancements not only improve the efficiency and accuracy of diagnostic procedures but also address the escalating demand for swift and precise solutions.

According to data from the Centers for Disease Control and Prevention (CDC), advancements in biotechnology and diagnostic techniques have contributed to a notable decrease in morbidity and mortality rates associated with certain diseases, with LDH assays playing a critical role in early detection and monitoring. For instance, CDC statistics reveal a 15% decrease in mortality rates for specific conditions following the widespread implementation of LDH testing protocols. Such advancements empower healthcare professionals with the tools needed for timely and reliable disease detection, underscoring the pivotal role played by these innovations in fostering market expansion and enhancing patient care.

Trends

Increasing Adoption of Personalized Medicine

A notable trend in the global LDH (Lactate Dehydrogenase) reagents market is the increasing adoption of personalized medicine. This approach tailors treatments to an individual’s genetic makeup, relying on comprehensive insights into the patient’s health status. LDH levels serve as crucial biomarkers, offering valuable information on disease progression and treatment response, making LDH assays integral to personalized healthcare strategies.

According to data from the American Medical Association (AMA), the integration of personalized medicine has seen a significant increase in recent years, with a reported 30% rise in the utilization of genetic testing and personalized treatment plans across various medical specialties. This surge highlights the growing significance of LDH reagents in facilitating tailored therapeutic interventions based on individual patient profiles. Consequently, the LDH reagents market is poised for substantial growth in response to the expanding adoption of personalized medicine practices.

Regional Analysis

In 2023, North America emerged as the dominant force in the Lactate Dehydrogenase (LDH) Reagents Market, commanding over 38% of the market share and boasting a value of USD 13 million. This significant market presence is underpinned by various factors. Firstly, North America benefits from a well-established healthcare infrastructure, characterized by advanced laboratories and diagnostic facilities. These facilities facilitate the widespread adoption of LDH reagents for diagnostic purposes, driving market growth. Additionally, the region grapples with a high prevalence of chronic diseases, such as cardiovascular disorders and cancer, further fueling the demand for LDH assays in disease diagnosis and monitoring.

Moreover, North America stands at the forefront of technological innovation in healthcare, leading to the development of more efficient and precise LDH reagents. This continual innovation attracts healthcare providers and diagnostic laboratories, contributing to the uptake of LDH reagents in the region. Furthermore, strategic collaborations and partnerships between key market players and research institutions play a pivotal role in advancing LDH reagent development and ensuring compliance with regulatory standards.

Looking ahead, North America is poised to maintain its leadership in the LDH Reagents Market, driven by ongoing research initiatives, increasing healthcare expenditure, and a growing emphasis on early disease detection. However, market stakeholders must remain vigilant to evolving dynamics, such as regulatory changes and competitive pressures, to capitalize on emerging opportunities and mitigate risks effectively.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Lactate Dehydrogenase (LDH) reagents market, several key players drive innovation and competition. Randox Laboratories Ltd. stands out for its extensive experience in developing diagnostic solutions. Their contributions often focus on accuracy and efficiency, reflecting their commitment to advancing healthcare technologies.

AAT Bioquest Inc. plays a significant role with its specialized expertise in biochemical research and development. Their dedication to producing high-quality reagents tailored to specific applications ensures reliability for LDH testing procedures.

Merck KGaA, a prominent player in the pharmaceutical and life sciences sectors, brings its vast resources and research capabilities to the LDH reagents market. Their portfolio includes a diverse range of products, contributing to the advancement of diagnostic capabilities and therapeutic interventions.

These key players, along with others in the market, drive competition and innovation, fostering advancements in LDH testing methodologies and enhancing diagnostic accuracy. Collaboration and competition among these industry leaders result in a dynamic landscape, ultimately benefiting healthcare providers and patients alike.

Market Key Players

- Randox Laboratories Ltd.

- AAT Bioquest Inc.

- Merck KGaA

- Worthington Biochemical Corporation

- Abnova Corporation

- LifeSpan BioSciences Inc.

- Accurex Biomedical Pvt. Ltd.

- PerkinElmer Inc.

- Abcam plc.

- Thermo Fisher Scientific

Recent Developments

- In January 2024, Abcam plc. forged a partnership with Bio-Techne, marking a significant move in the cytotoxicity testing market. Through this collaboration, Abcam will distribute Bio-Techne’s LDH Cytotoxicity Assay Kit, thereby enhancing its presence in this domain.

- In December 2023, PerkinElmer unveiled the VICTOR Nivo Automated Microplate Reader, a cutting-edge platform designed for high-throughput LDH assay testing in both research and drug discovery. This launch underscores PerkinElmer’s commitment to advancing automated solutions in the field.

- In November 2023, Worthington Biochemical Corporation expanding its LDH enzyme portfolio by introducing purified LDH isoenzymes from diverse sources. This expansion caters to specific research requirements, further solidifying Worthington’s position in LDH activity analysis.

- In October 2023, AACC Clinical & Laboratory Medicine Congress, Randox Laboratories introduced their latest LDH assay kit, showcasing enhanced sensitivity and accuracy for clinical diagnosis. This unveiling underscores Randox’s dedication to advancing diagnostic capabilities in the medical field.

Report Scope

Report Features Description Market Value (2023) USD 640.1 Million Forecast Revenue (2033) USD 1434 Million CAGR (2024-2033) 8.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (LDH Cytotoxicity Colorimetric Assay, LDH Cytotoxicity Fluorometric Assay, SRB Assay, WST Assay), By End-User (Hospitals, Research Laboratories, Diagnostic Laboratories, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Randox Laboratories Ltd., AAT Bioquest Inc., Merck KGaA, Worthington Biochemical Corporation, Abnova Corporation, LifeSpan BioSciences Inc., Accurex Biomedical Pvt. Ltd., PerkinElmer Inc., Abcam plc., Thermo Fisher Scientific, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Lactate Dehydrogenase Reagents market in 2023?The Lactate Dehydrogenase Reagents market size is USD 640.1 million in 2023.

What is the projected CAGR at which the Lactate Dehydrogenase Reagents market is expected to grow at?The Lactate Dehydrogenase Reagents market is expected to grow at a CAGR of 8.4% (2024-2033).

List the segments encompassed in this report on the Lactate Dehydrogenase Reagents market?Market.US has segmented the Lactate Dehydrogenase Reagents market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into LDH Cytotoxicity Colorimetric Assay, LDH Cytotoxicity Fluorometric Assay, SRB Assay, WST Assay. By End-User the market has been segmented into Hospitals, Research Laboratories, Diagnostic Laboratories, Other End-Users.

List the key industry players of the Lactate Dehydrogenase Reagents market?Randox Laboratories Ltd., AAT Bioquest Inc., Merck KGaA, Worthington Biochemical Corporation, Abnova Corporation, LifeSpan BioSciences Inc., Accurex Biomedical Pvt. Ltd., PerkinElmer Inc., Abcam plc., Thermo Fisher Scientific, Other Key Players

Which region is more appealing for vendors employed in the Lactate Dehydrogenase Reagents market?North America is expected to account for the highest revenue share of 38% and boasting an impressive market value of USD 13 million. Therefore, the Lactate Dehydrogenase Reagents industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Lactate Dehydrogenase Reagents?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Lactate Dehydrogenase Reagents Market.

Lactate Dehydrogenase Reagents MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Lactate Dehydrogenase Reagents MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Randox Laboratories Ltd.

- AAT Bioquest Inc.

- Merck KGaA

- Worthington Biochemical Corporation

- Abnova Corporation

- LifeSpan BioSciences Inc.

- Accurex Biomedical Pvt. Ltd.

- PerkinElmer Inc.

- Abcam plc.

- Thermo Fisher Scientific