Global Laboratory Protective Clothing Market Size, Share, Growth Analysis By Product Type (Lab Coats and Jackets, Coveralls and Protective Suits, Disposable Gowns and Aprons, Chemical-resistant Garments, Flame-resistant and ESD Garments, Accessories), By Application (Chemical Handling Laboratories, Biosafety and BSL Labs, Cleanroom and Semiconductor, Healthcare Labs and Phlebotomy, Education and General Research), By End User (Pharma and Biotech Manufacturing, Hospitals and Diagnostic Labs, Academic Institutions, Industrial and Chemical Plants, Semiconductor and Electronics), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177528

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

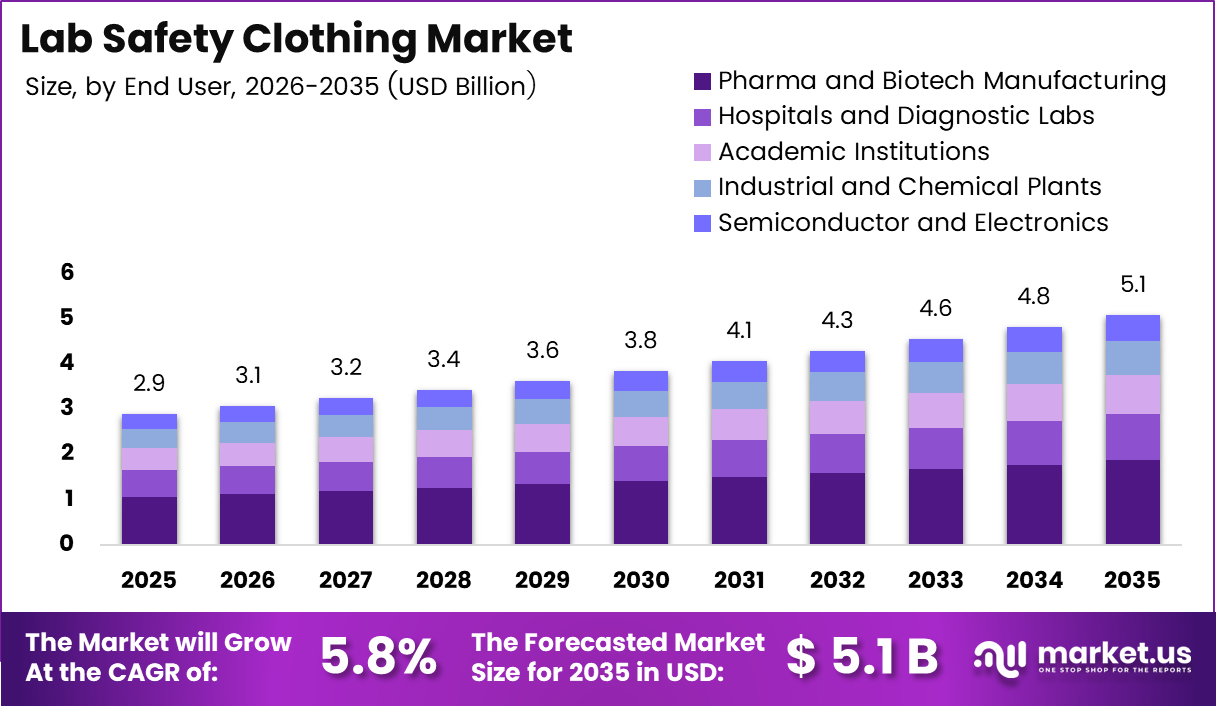

Global Laboratory Protective Clothing Market size is expected to be worth around USD 5.1 Billion by 2035 from USD 2.9 Billion in 2025, growing at a CAGR of 5.8% during the forecast period 2026 to 2035.

Laboratory protective clothing encompasses specialized garments designed to shield personnel from chemical, biological, thermal, and physical hazards in research and industrial environments. These products include lab coats, coveralls, chemical-resistant suits, flame-resistant apparel, and disposable protective wear. Moreover, they serve critical functions across pharmaceutical labs, cleanrooms, healthcare facilities, and academic research institutions.

The market experiences robust expansion driven by stringent occupational safety regulations and growing awareness of workplace hazard mitigation. Employers increasingly mandate certified protective apparel to reduce liability exposure and ensure compliance with safety standards. Consequently, demand accelerates across pharmaceutical manufacturing, biotechnology research, and semiconductor production facilities where contamination control remains paramount.

Government agencies worldwide enforce stricter laboratory safety protocols, compelling organizations to invest in high-quality protective clothing solutions. Regulatory frameworks such as OSHA standards in North America and EU directives mandate specific protection levels for different hazard categories. Therefore, manufacturers focus on developing garments that meet evolving certification requirements while maintaining user comfort and mobility.

Innovation in fabric technology drives market evolution as manufacturers integrate antimicrobial treatments, fluid-repellent finishes, and breathable barrier materials. Smart textile integration enables real-time contamination monitoring and exposure tracking capabilities. Additionally, sustainability trends promote adoption of reusable and recyclable protective clothing alternatives, reducing environmental impact while maintaining safety performance.

Emerging economies witness rapid laboratory infrastructure expansion, particularly in Asia Pacific where pharmaceutical and biotechnology sectors experience significant growth. Academic institutions and private research facilities multiply across developing regions, creating substantial demand for affordable yet compliant protective apparel. However, cost considerations and comfort limitations present ongoing challenges for widespread adoption among laboratory personnel.

According to the Department of Chemistry at the University of Washington, 100% cotton lab coats offer superior protection against flames and heat compared to synthetic alternatives. According to Oregon State University, barrier lab coats typically feature front and sleeve construction from 100% polyester with back panels using 65/32 polyester-cotton blends treated with specialized protective finishes.

The competitive landscape intensifies as major players pursue strategic acquisitions to expand product portfolios and geographic reach. Material science advancements enable development of lightweight, ergonomic designs that enhance compliance without compromising protection standards. Furthermore, customization trends gain momentum as organizations seek task-specific and gender-specific protective clothing solutions tailored to unique laboratory environments.

Key Takeaways

- Global Laboratory Protective Clothing Market projected to reach USD 5.1 Billion by 2035 from USD 2.9 Billion in 2025

- Market expected to grow at a CAGR of 5.8% during the forecast period 2026-2035

- Lab Coats and Jackets segment dominates with 32.7% market share in 2025

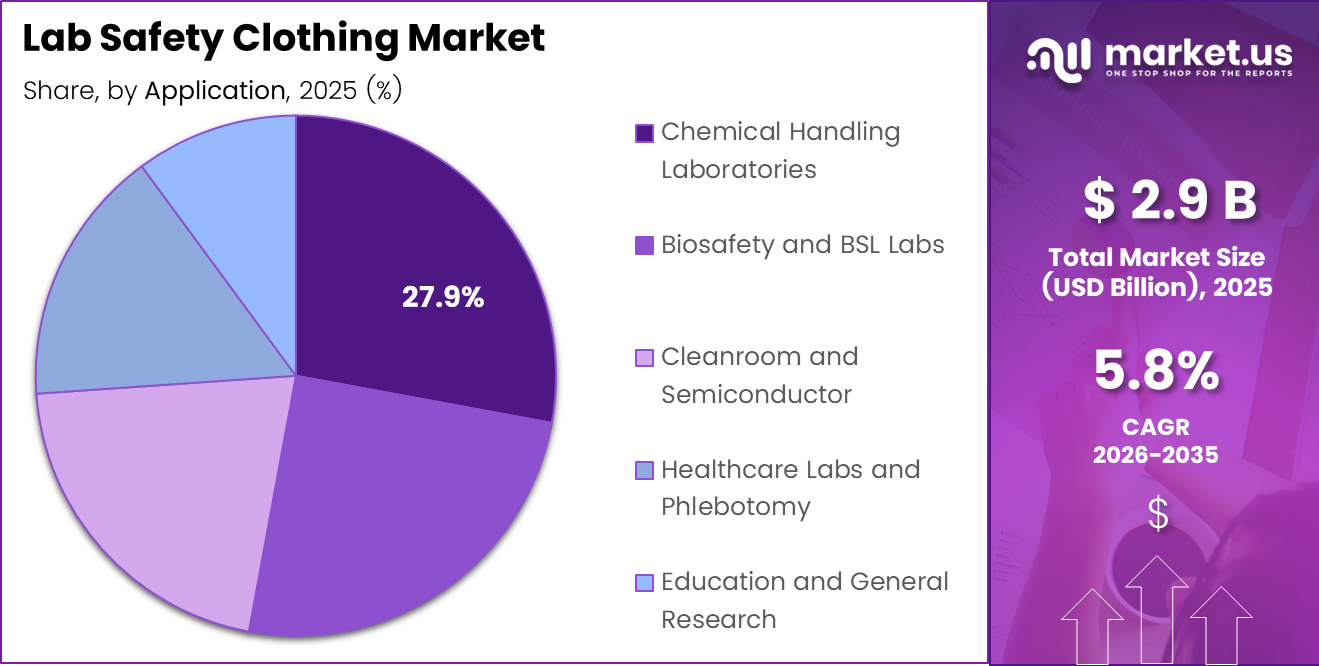

- Chemical Handling Laboratories application holds 27.9% market share

- Pharma and Biotech Manufacturing leads end-user segment with 36.8% share

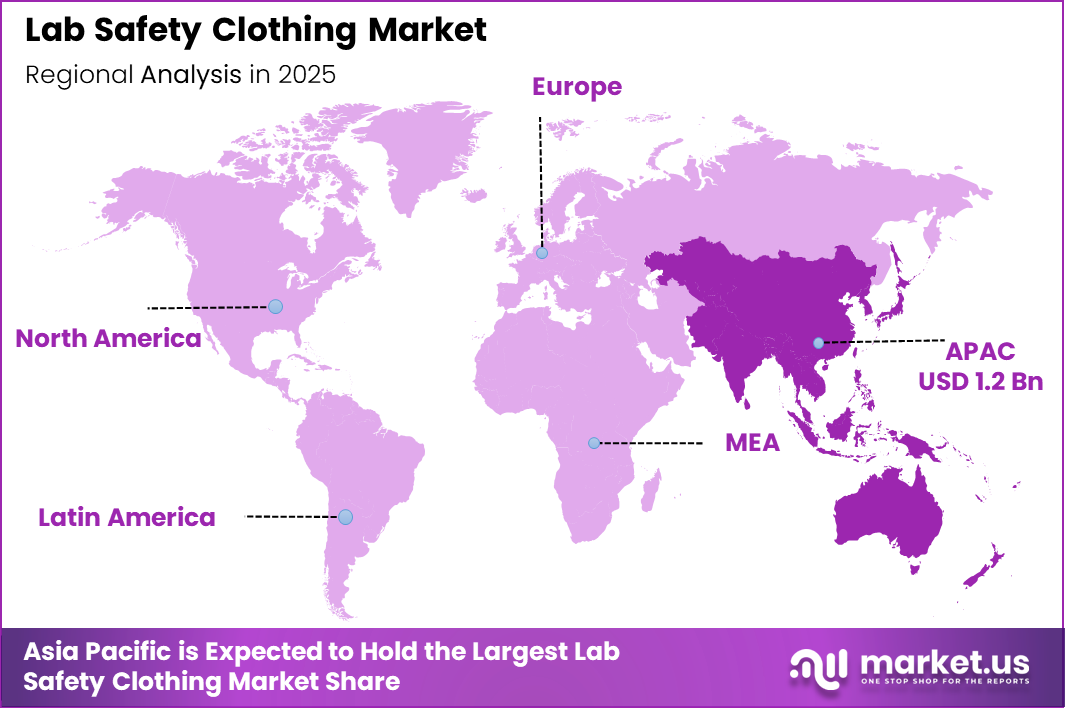

- Asia Pacific dominates regional market with 42.80% share, valued at USD 1.2 Billion

- North America and Europe represent significant markets driven by stringent safety regulations

- Rising adoption of antimicrobial and flame-resistant fabric technologies reshapes product development

Product Type Analysis

Lab Coats and Jackets dominate with 32.7% due to widespread adoption across diverse laboratory environments and regulatory compliance requirements.

In 2025, Lab Coats and Jackets held a dominant market position in the Product Type segment of Laboratory Protective Clothing Market, with a 32.7% share. These garments represent the most fundamental protective apparel required across virtually all laboratory settings. Their versatility, ease of use, and compliance with basic safety protocols drive consistent demand among academic, pharmaceutical, and research institutions globally.

Coveralls and Protective Suits gain traction in high-containment laboratories requiring comprehensive body protection against hazardous materials. These full-body garments provide superior barrier performance for cleanroom operations, chemical handling, and biosafety applications. Moreover, increasing biosafety level requirements in pharmaceutical manufacturing and clinical research facilities accelerate adoption rates among specialized end-users.

Disposable Gowns and Aprons experience growing demand driven by convenience, cost-effectiveness, and contamination control protocols in healthcare and diagnostic laboratories. Single-use garments eliminate cross-contamination risks and reduce laundering expenses. Additionally, pandemic-driven hygiene awareness sustains elevated consumption levels across hospital laboratories and phlebotomy centers where frequent garment changes remain mandatory for infection prevention.

Chemical-resistant Garments serve critical protective functions in industrial and chemical handling laboratories where exposure to corrosive substances poses significant safety risks. Advanced polymer coatings and multi-layer construction technologies enhance barrier properties against aggressive chemicals. Furthermore, regulatory mandates for specific chemical resistance ratings drive specification purchases among petrochemical, agrochemical, and specialty chemical research facilities.

Flame-resistant and ESD Garments cater to specialized applications in semiconductor manufacturing, electronics testing, and pyrophoric material handling environments. These garments incorporate aramid fibers and static-dissipative fabrics that prevent ignition hazards and electrostatic discharge damage. Consequently, semiconductor industry expansion in Asia Pacific fuels segment growth as cleanroom facilities require both flame protection and contamination control capabilities.

Accessories including gloves, shoe covers, and head protection complement primary protective garments to ensure comprehensive personal safety systems. These ancillary products integrate seamlessly with lab coats and coveralls to provide multi-barrier protection. Therefore, bundled accessory sales correlate directly with primary garment adoption, creating sustained revenue streams for manufacturers offering complete protective clothing solutions.

Application Analysis

Chemical Handling Laboratories dominate with 27.9% due to stringent safety requirements and high exposure risks associated with hazardous substance management.

In 2025, Chemical Handling Laboratories held a dominant market position in the Application segment of Laboratory Protective Clothing Market, with a 27.9% share. These facilities demand robust protective apparel to safeguard personnel against corrosive, toxic, and reactive chemical exposure. Regulatory compliance frameworks mandate certified chemical-resistant garments, driving consistent procurement cycles. Moreover, industrial chemistry research expansion sustains strong demand growth across this critical application segment.

Biosafety and BSL Labs require specialized protective clothing for handling infectious agents and biohazardous materials across different biosafety levels. Containment protocols necessitate barrier garments that prevent pathogen transmission while maintaining wearer comfort during extended procedures. Additionally, expanding vaccine development and infectious disease research facilities increase demand for high-performance biosafety apparel with validated microbiological barrier properties.

Cleanroom and Semiconductor environments impose the most stringent contamination control requirements, necessitating lint-free, static-dissipative protective clothing systems. Particle generation minimization remains critical for semiconductor wafer fabrication and pharmaceutical aseptic processing operations. Consequently, this application demands premium-priced garments manufactured from specialized synthetic fibers with electrostatic discharge protection and validated cleanliness certifications.

Healthcare Labs and Phlebotomy centers prioritize fluid-resistant and antimicrobial protective apparel to prevent bloodborne pathogen transmission and cross-contamination. Diagnostic laboratories processing clinical specimens require frequent garment changes to maintain sterile conditions. Therefore, disposable gown consumption remains elevated in this segment, supported by hospital infection control protocols and clinical laboratory safety standards.

Education and General Research facilities represent a cost-sensitive segment balancing safety compliance with budget constraints across diverse experimental activities. Academic institutions purchase versatile lab coats suitable for chemistry, biology, and physics teaching laboratories. Furthermore, growing STEM education emphasis in developing economies expands the installed base of educational laboratories requiring basic protective clothing solutions.

End User Analysis

Pharma and Biotech Manufacturing dominates with 36.8% due to comprehensive safety protocols and stringent regulatory oversight governing pharmaceutical production environments.

In 2025, Pharma and Biotech Manufacturing held a dominant market position in the End User segment of Laboratory Protective Clothing Market, with a 36.8% share. These facilities maintain rigorous contamination control standards throughout drug development and production processes. Personnel safety regulations mandate certified protective garments across cleanrooms, quality control laboratories, and active pharmaceutical ingredient manufacturing zones, driving substantial and recurring protective clothing consumption.

Hospitals and Diagnostic Labs constitute a major end-user segment requiring diverse protective apparel for clinical testing, pathology, and specimen processing operations. Healthcare facilities prioritize fluid-resistant and antimicrobial garments to protect laboratory staff from infectious material exposure. Moreover, increasing diagnostic testing volumes and hospital laboratory expansions in emerging markets sustain steady demand growth for both reusable and disposable protective clothing solutions.

Academic Institutions operate extensive teaching and research laboratory networks across chemistry, biology, physics, and engineering disciplines requiring compliant protective apparel. Budget-conscious procurement emphasizes durable, multipurpose lab coats suitable for varied experimental activities. Additionally, enrollment growth in science and technology programs globally expands the student and faculty population requiring basic laboratory safety garments.

Industrial and Chemical Plants demand heavy-duty, chemical-resistant protective clothing for research and development laboratories, quality assurance testing, and process monitoring applications. These facilities handle aggressive chemicals and hazardous materials requiring certified barrier protection. Furthermore, manufacturing safety audits and liability considerations drive investment in premium protective apparel that exceeds minimum regulatory requirements.

Semiconductor and Electronics manufacturing facilities require specialized cleanroom garments combining particle control, electrostatic discharge protection, and flame resistance. Advanced fabrication processes involve chemical exposure risks alongside stringent contamination prevention protocols. Consequently, this end-user segment drives demand for technically sophisticated protective clothing systems validated for both safety performance and cleanroom compatibility.

Key Market Segments

By Product Type

- Lab Coats and Jackets

- Coveralls and Protective Suits

- Disposable Gowns and Aprons

- Chemical-resistant Garments

- Flame-resistant and ESD Garments

- Accessories

By Application

- Chemical Handling Laboratories

- Biosafety and BSL Labs

- Cleanroom and Semiconductor

- Healthcare Labs and Phlebotomy

- Education and General Research

By End User

- Pharma and Biotech Manufacturing

- Hospitals and Diagnostic Labs

- Academic Institutions

- Industrial and Chemical Plants

- Semiconductor and Electronics

Drivers

Escalating Enforcement of Occupational Health and Safety Regulations Drives Market Expansion

Regulatory agencies worldwide implement increasingly stringent laboratory safety standards requiring certified protective apparel across research and industrial facilities. Organizations face substantial penalties for non-compliance, compelling mandatory personal protective equipment adoption. Moreover, regular safety audits verify proper protective clothing usage, ensuring sustained procurement cycles. Consequently, regulatory pressure creates a stable demand foundation supporting consistent market growth across developed and emerging economies.

Workplace safety incidents involving chemical burns, pathogen exposure, and thermal injuries drive employer liability concerns and insurance requirements. Organizations mitigate legal exposure through comprehensive protective clothing programs exceeding minimum regulatory standards. Additionally, corporate safety culture evolution prioritizes employee well-being, translating into higher-quality protective apparel investments. Therefore, liability risk management becomes a powerful driver for premium protective clothing adoption.

Expansion of pharmaceutical manufacturing, biotechnology research, and clinical laboratory infrastructure creates substantial protective clothing demand. New facility construction incorporates advanced safety systems requiring compliant protective apparel from operational commencement. Furthermore, capacity expansions at existing laboratories increase personnel counts requiring proportional protective clothing inventory growth. This infrastructure development trend particularly accelerates across Asia Pacific emerging markets.

Restraints

High Cost of Certified Flame-Resistant and Chemical-Barrier Laboratory Garments Limits Adoption

Advanced protective clothing incorporating specialized fabrics such as Nomex aramid, Kevlar, and chemical-resistant polymers commands premium pricing. Budget-constrained laboratories, particularly in academic and small research settings, struggle to afford certified high-performance garments. Moreover, organizations requiring frequent garment replacement due to contamination or damage face escalating operational expenses. Consequently, cost barriers drive substitution toward lower-specification alternatives that may compromise safety performance.

Protective laboratory garments often sacrifice comfort and breathability to achieve required barrier properties and flame resistance. Extended wear periods cause heat stress, restricted mobility, and reduced productivity among laboratory personnel. Additionally, uncomfortable garments reduce user compliance with mandatory protective apparel protocols. Therefore, comfort limitations create resistance to consistent protective clothing usage, undermining safety objectives despite regulatory requirements.

Limited availability of gender-specific and ergonomically designed protective clothing contributes to user dissatisfaction and compliance challenges. Standard sizing often fails to accommodate diverse body types, particularly affecting female laboratory personnel. Furthermore, ill-fitting garments compromise both protection effectiveness and wearer comfort during complex laboratory procedures. This design limitation represents an ongoing restraint requiring industry innovation.

Growth Factors

Technological Advancements in Protective Fabric Solutions Accelerate Market Expansion

Increasing demand for task-specific and customized laboratory protective clothing creates opportunities for specialized product development. Organizations seek garments optimized for unique hazard profiles and operational requirements rather than generic solutions. Moreover, customization enables improved fit, comfort, and functionality tailored to specific laboratory processes. Consequently, manufacturers offering bespoke protective clothing solutions capture premium market segments willing to invest in optimized safety performance.

Rapid expansion of academic research institutions and private laboratories across emerging Asian, Latin American, and Middle Eastern economies drives substantial market growth. Government investments in scientific research infrastructure and pharmaceutical manufacturing capabilities accelerate laboratory construction. Additionally, multinational corporations establish research and development facilities in cost-advantaged regions. Therefore, emerging market laboratory proliferation represents a significant growth opportunity for protective clothing suppliers.

Environmental sustainability concerns drive adoption of reusable protective clothing systems designed for multiple laundering cycles. Durable garments reduce waste generation and operational costs compared to single-use alternatives. Furthermore, recyclable fabric technologies and closed-loop manufacturing processes appeal to environmentally conscious organizations. This sustainability trend creates differentiation opportunities for manufacturers developing eco-friendly protective apparel solutions.

Emerging Trends

Digital Integration and Smart Textile Technologies Transform Laboratory Safety Apparel

Manufacturers develop lightweight, ergonomic protective clothing designs addressing historical comfort and mobility limitations. Gender-specific sizing and anatomically contoured patterns improve fit across diverse user populations. Moreover, breathable barrier fabrics incorporate moisture management technologies reducing heat stress during extended wear. Consequently, enhanced comfort drives improved user compliance with protective clothing protocols, strengthening overall laboratory safety outcomes.

Antimicrobial fabric treatments and fluid-repellent finishes gain widespread adoption across laboratory protective clothing products. These technologies provide additional barriers against pathogen transmission and chemical splash hazards. Additionally, durable antimicrobial properties maintain effectiveness through multiple laundering cycles in reusable garments. Therefore, advanced fabric functionalization represents a key product differentiation strategy as organizations prioritize comprehensive hazard protection.

Environmental consciousness drives preference for protective clothing manufactured from recycled materials and biodegradable fibers. Organizations pursue sustainability certifications and circular economy principles in procurement decisions. Furthermore, manufacturers implement take-back programs enabling garment recycling at end-of-life. This eco-friendly trend aligns with corporate environmental social governance initiatives, creating competitive advantages for sustainable protective clothing brands.

Regional Analysis

Asia Pacific Dominates the Laboratory Protective Clothing Market with a Market Share of 42.80%, Valued at USD 1.2 Billion

Asia Pacific leads global market growth driven by rapid pharmaceutical manufacturing expansion, semiconductor industry development, and academic research infrastructure investment across China, India, and Southeast Asia. In 2025, the region captured 42.80% market share, valued at USD 1.2 Billion. Government initiatives promoting biotechnology research and chemical manufacturing create substantial protective clothing demand. Moreover, cost-competitive production capabilities attract multinational laboratory operations, accelerating regional market expansion through increased facility construction and personnel hiring.

North America Laboratory Protective Clothing Market Trends

North America maintains significant market presence supported by stringent OSHA regulations, extensive pharmaceutical research activities, and advanced semiconductor manufacturing infrastructure. The region emphasizes premium protective clothing solutions meeting rigorous safety certifications and performance standards. Additionally, established laboratory safety culture drives consistent replacement cycles and adoption of innovative protective apparel technologies across research institutions and industrial facilities.

Europe Laboratory Protective Clothing Market Trends

Europe demonstrates strong demand driven by comprehensive EU safety directives, robust pharmaceutical manufacturing base, and extensive academic research networks. The region prioritizes sustainable protective clothing solutions aligning with circular economy principles and environmental regulations. Furthermore, Germany, France, and the United Kingdom lead regional consumption through concentrated chemical industry presence and advanced biotechnology research capabilities.

Latin America Laboratory Protective Clothing Market Trends

Latin America experiences steady growth as pharmaceutical manufacturing expands and laboratory infrastructure improves across Brazil and Mexico. Increasing regulatory enforcement and foreign investment in research facilities drive protective clothing adoption. However, price sensitivity influences procurement decisions toward cost-effective solutions balancing safety compliance with budget constraints.

Middle East and Africa Laboratory Protective Clothing Market Trends

Middle East and Africa witness emerging demand driven by petrochemical industry expansion, healthcare laboratory development, and academic institution growth. Government investments in research infrastructure and pharmaceutical manufacturing capabilities create new market opportunities. Additionally, GCC countries prioritize laboratory safety standards aligned with international best practices, supporting premium protective clothing adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

DuPont de Nemours, Inc. leads the laboratory protective clothing market through its Tyvek and Tychem product lines offering superior chemical and biological barrier protection. The company leverages advanced material science capabilities to develop innovative protective fabrics meeting evolving safety regulations. Moreover, DuPont maintains extensive distribution networks across pharmaceutical, chemical, and semiconductor industries globally. Their established brand reputation and technical expertise position them as a preferred supplier for high-performance protective apparel applications requiring validated contamination control.

Ansell Limited strengthens its market position through strategic acquisitions and comprehensive protective clothing portfolios serving diverse laboratory environments. The company combines chemical-resistant garments with integrated hand protection solutions for complete safety systems. Additionally, Ansell invests in ergonomic design innovations improving wearer comfort and compliance. Their global manufacturing footprint enables responsive customer service and localized product customization across regional markets.

3M Company differentiates through integration of proprietary fabric technologies and respiratory protection expertise into comprehensive laboratory safety solutions. The company offers disposable and reusable protective clothing incorporating advanced barrier materials and breathable comfort features. Furthermore, 3M leverages extensive research and development capabilities to introduce next-generation protective apparel addressing emerging hazards. Their multi-industry presence provides cross-sector innovation insights strengthening product development strategies.

Kimberly-Clark Corporation focuses on disposable protective apparel solutions emphasizing convenience, cost-effectiveness, and reliable contamination control for healthcare and research laboratories. The company’s fabric technologies balance barrier performance with breathability and comfort during extended wear periods. Moreover, Kimberly-Clark maintains efficient manufacturing operations supporting competitive pricing strategies. Their established distribution relationships with healthcare and laboratory supply channels facilitate market penetration across institutional end-users.Key Players

- DuPont de Nemours, Inc.

- Ansell Limited

- 3M Company

- Kimberly-Clark Corporation

- Honeywell International Inc.

- Lakeland Industries, Inc.

- Alpha Pro Tech, Ltd.

- International Enviroguard, Inc.

- Kappler, Inc.

- VF Corporation

Recent Developments

- July 2024 – Ansell Limited completed the acquisition of Kimberly-Clark’s Personal Protective Equipment Business, significantly expanding its protective clothing portfolio and market reach across laboratory and industrial safety segments. This strategic transaction valued at approximately USD 640 Million enhances Ansell’s capability to serve pharmaceutical, healthcare, and research laboratory customers with comprehensive protective apparel solutions while achieving operational synergies through combined manufacturing and distribution networks.

- December 2025 – NSA strengthened its safety solutions for frontline workers through the acquisition of NASCO Industries, marking its third strategic acquisition in 2025 and eighteenth overall transaction. This expansion reinforces NSA’s position as a comprehensive personal protective equipment industry leader, broadening its laboratory protective clothing offerings and enhancing manufacturing capabilities to serve growing demand across pharmaceutical, chemical, and research facility end-users seeking integrated safety solutions.

Report Scope

Report Features Description Market Value (2025) USD 2.9 Billion Forecast Revenue (2035) USD 5.1 Billion CAGR (2026-2035) 5.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Lab Coats and Jackets, Coveralls and Protective Suits, Disposable Gowns and Aprons, Chemical-resistant Garments, Flame-resistant and ESD Garments, Accessories), By Application (Chemical Handling Laboratories, Biosafety and BSL Labs, Cleanroom and Semiconductor, Healthcare Labs and Phlebotomy, Education and General Research), By End User (Pharma and Biotech Manufacturing, Hospitals and Diagnostic Labs, Academic Institutions, Industrial and Chemical Plants, Semiconductor and Electronics) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape DuPont de Nemours, Inc., Ansell Limited, 3M Company, Kimberly-Clark Corporation, Honeywell International Inc., Lakeland Industries, Inc., Alpha Pro Tech, Ltd., International Enviroguard, Inc., Kappler, Inc., VF Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DuPont de Nemours, Inc.

- Ansell Limited

- 3M Company

- Kimberly-Clark Corporation

- Honeywell International Inc.

- Lakeland Industries, Inc.

- Alpha Pro Tech, Ltd.

- International Enviroguard, Inc.

- Kappler, Inc.

- VF Corporation