Knee Replacement Market By Procedure (Total Knee Arthroplasty, Partial Knee Arthroplasty, Revision Knee Arthroplasty), By Implant Type (Fixed Bearing, Mobile Bearing, Others), By End-user (Hospitals, Orthopaedic Clinics, Ambulatory Surgical Centers, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 125200

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Procedure Type Analysis

- Implant Type Analysis

- Component Analysis

- Material Analysis

- Surgery Type Analysis

- End User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

Report Overview

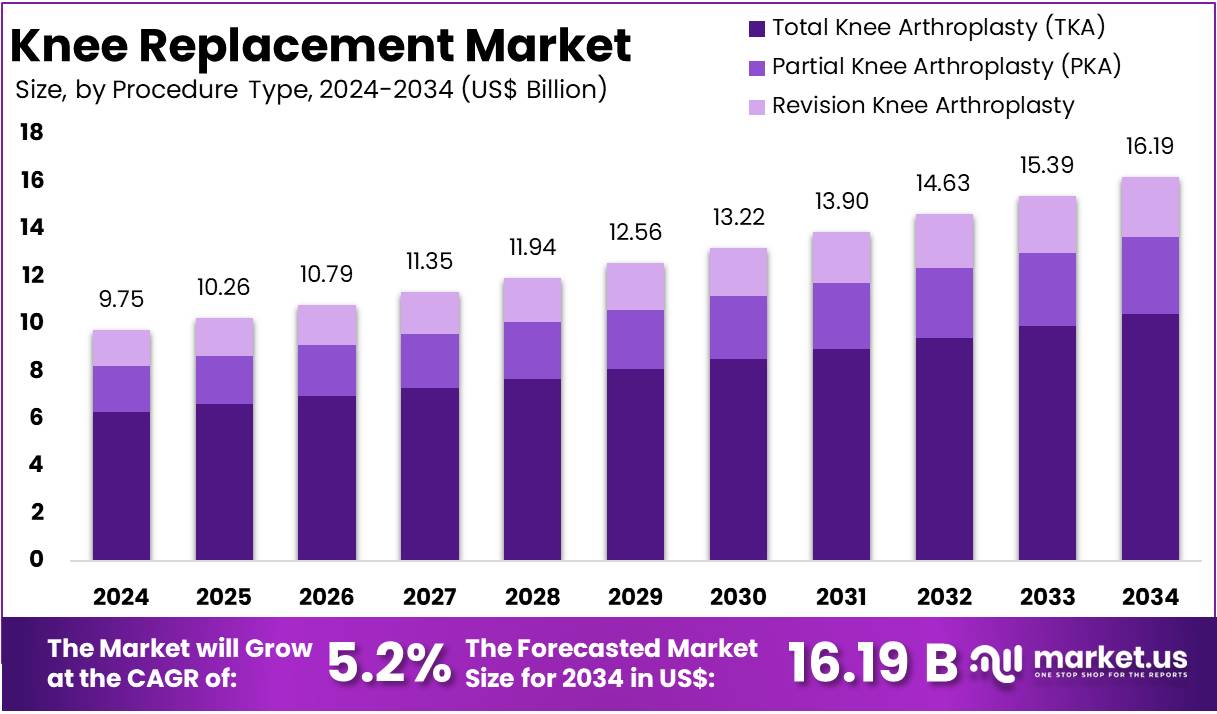

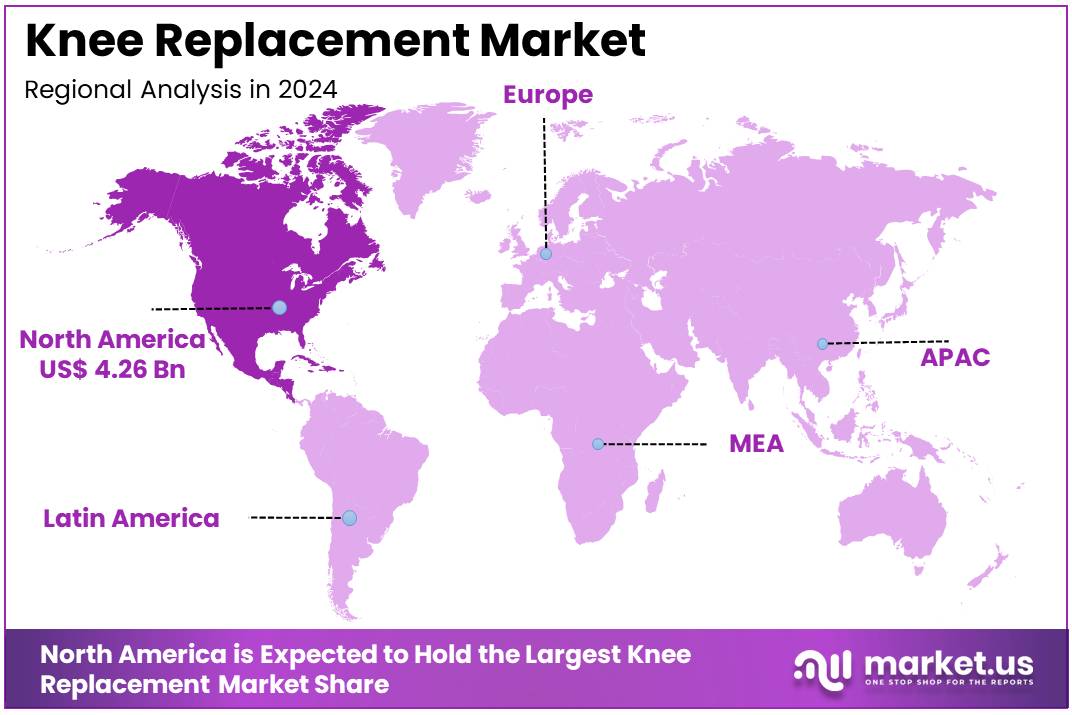

The Knee Replacement Market size is expected to be worth around US$ 16.19 billion by 2034 from US$ 9.75 billion in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.7% share and holds US$ 4.26 Billion market value for the year.

Knee replacement, or knee arthroplasty, is a surgical procedure designed to replace the weight-bearing surfaces of the knee joint to alleviate pain and disability. It is most commonly recommended when conservative treatments do not relieve joint pain.

The procedure may also be necessary for conditions such as rheumatoid arthritis. In cases of severe deformity due to advanced rheumatoid arthritis, trauma, or long-term osteoarthritis, the surgery can be more complex and carry higher risks. Osteoporosis, however, does not typically lead to knee pain, deformity, or inflammation, and is not a reason for knee replacement surgery.

The knee replacement market is witnessing significant growth, driven by the rising prevalence of knee osteoarthritis, particularly among the aging population. Total knee replacement (TKR) procedures offer an effective solution for patients suffering from severe knee pain and disability. Technological advancements, such as robotic-assisted surgeries and 3D-printed, patient-specific implants, are enhancing surgical outcomes and reducing recovery times.

For example, Stryker’s MAKO robotic system and Zimmer Biomet’s ROSA allow for precision in implant placement, improving patient satisfaction. Additionally, the development of minimally invasive techniques is reducing post-operative pain and recovery time, further increasing the appeal of knee replacement procedures. However, the high cost of surgery and implants remains a barrier to wider adoption, especially in emerging markets.

Total knee replacement is considered one of the most successful medical procedures. The American Academy of Orthopaedic Surgeons reports that over 700,000 total knee replacement surgeries are performed annually in the United States. By 2030, it is estimated that the number of knee replacements performed each year will exceed 1.2 million in the U.S. alone.

Key Takeaways

- In 2024, the market for Knee Replacement generated a revenue of US$ 9.75 billion, with a CAGR of 5.2%, and is expected to reach US$ 16.19 billion by the year 2034.

- The Procedure Type segment is divided into Total Knee Arthroplasty (TKA), Partial Knee Arthroplasty (PKA), and Revision Knee Arthroplasty with Total Knee Arthroplasty (TKA) taking the lead in 2024 with a market share of 64.5%.

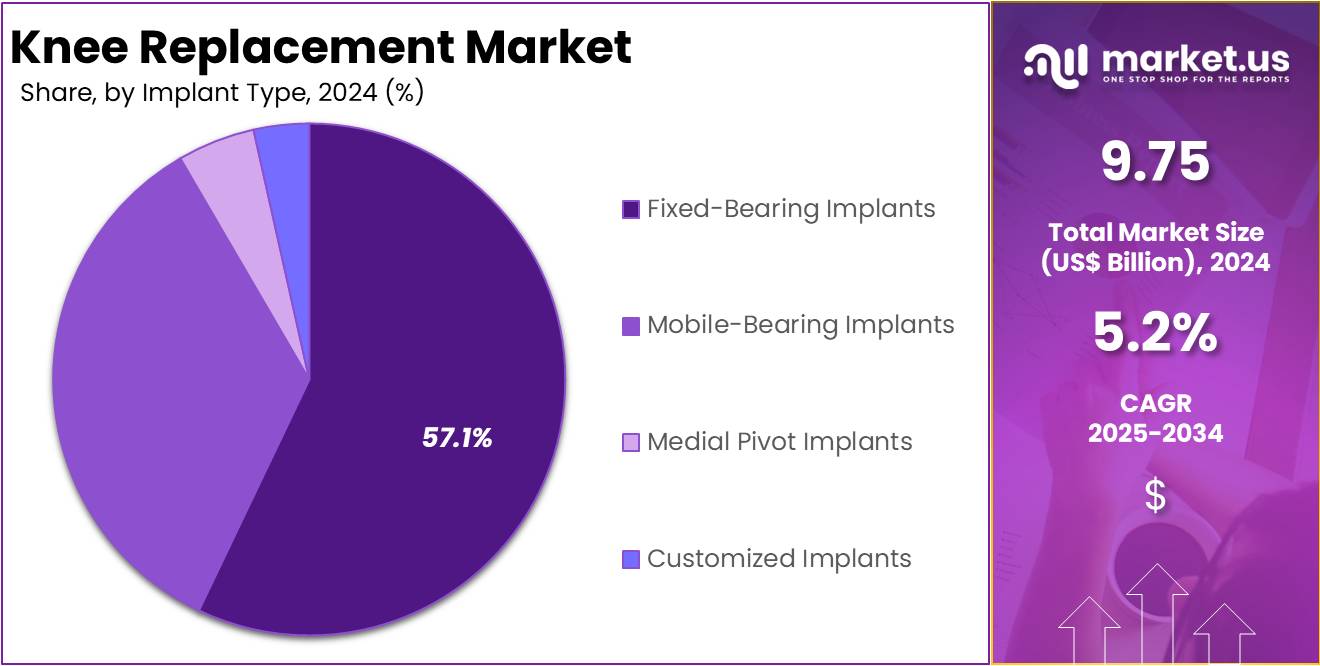

- By Implant Type, the market is bifurcated into Fixed-Bearing Implants, Mobile-Bearing Implants, Medial Pivot Implants, and Customized Implants, with Fixed-Bearing Implants leading the market with 57.1% of market share in 2024.

- Considering the Component segment, the market is bifurcated Femoral, Tibial, and Patellar, with Tibial taking the lead in 2024 with 55.5% market share.

- By Material segment, the market is bifurcated into Metal-on-Plastic, Ceramic-on-Ceramic, Metal-on-Metal, and Ceramic-on-Plastic with Metal-on-Plastic dominating the market with 49.1% market share.

- By Surgery Type, the market is classified into Traditional Surgery, and Technology-Assisted, with Traditional Surgery taking the lead in 2024 with 83.2% market share.

- Moreover, by End-User, the market is divided into Hospitals, Ambulatory Surgical Centers (ASCs), and Orthopedic Clinics, with Hospitals taking the lead in 2024 with 64.8% share of the global market.

- North America led the market by securing a market share of 43.7% in 2024.

Procedure Type Analysis

Total Knee Arthroplasty (TKA) is the dominant procedure type in the global Knee Replacement Market which accounted for over 64.5% market share in 2024, accounting for the largest share in 2024. TKA involves the complete replacement of the knee joint with prosthetic components, making it the preferred treatment for patients with severe osteoarthritis, rheumatoid arthritis, or traumatic knee injuries. The widespread prevalence of end-stage knee degeneration is the primary factor driving demand for TKA over Partial Knee Arthroplasty (PKA) or Revision Knee Arthroplasty.

The annual incidence of symptomatic knee osteoarthritis is estimated at 240 cases per 100,000 patients. In the United States, approximately 400,000 primary total knee arthroplasties (TKA) are performed each year. Primary osteoarthritis remains the most common diagnosis associated with these procedures.

However, other underlying conditions also contribute to the demand for TKA. These include inflammatory arthritis, fractures leading to posttraumatic osteoarthritis or deformities, congenital or developmental dysplasia, and malignancies. The high prevalence of osteoarthritis and related conditions continues to drive surgical volumes, highlighting the growing clinical and economic burden of knee joint diseases.

TKA offers superior pain relief, improved joint stability, and enhanced mobility compared to partial replacements, which are suitable only for localized cartilage damage. Additionally, technological advancements such as patient-specific implants and robotic-assisted TKA surgeries have increased procedural accuracy and post-operative outcomes, boosting adoption rates. For instance, Zimmer Biomet’s ROSA and Stryker’s MAKO robotic systems allow surgeons to align prosthetic components precisely, reducing complications and recovery time.

Implant Type Analysis

Fixed-bearing implants hold the dominant market share in the Knee Replacement Market accounting for 57.1% market share, primarily due to their stability, durability, and well-established clinical track record. These implants feature a fixed bearing surface that is not designed to move, offering long-term functionality and reliability.

Fixed-bearing implants are often the preferred choice in traditional knee replacement procedures, particularly for older patients or those with lower activity levels, as they provide consistent support and are less prone to wear and tear.

In December 2024, Zimmer Biomet Holdings, Inc., a global leader in medical technology, has announced that the U.S. Food and Drug Administration (FDA) has granted 510(k) clearance for its Persona SoluTion Porous Plasma Spray (PPS) Femur. This total knee implant component provides an alternative for patients with sensitivities to bone cement and/or metal. The Persona SoluTion PPS Femur is designed with a porous coating for cementless fixation and incorporates a proprietary surface treatment aimed at improving wear performance.

The popularity of fixed-bearing implants is driven by their proven performance in improving knee stability and functionality. As these implants are cost-effective and simpler to design compared to mobile-bearing implants, they are widely adopted across healthcare systems, especially in cost-sensitive regions. Furthermore, the long history of fixed-bearing implants and their low complication rates make them a trusted option for surgeons and patients alike.

Component Analysis

In the Knee Replacement Market, the Tibial component dominated the market share with over 55.5% among the three main components: femoral, tibial, and patellar. The tibial component plays a crucial role in ensuring proper alignment, stability, and function of the knee joint after replacement surgery. It serves as the foundation of the knee implant, bearing much of the load and stress during walking, running, and other activities.

Tibial components are typically made of metal or polymer and feature a flat or curved surface that interacts with the femoral component. The tibial plateau provides an interface for the femur to glide smoothly, allowing the knee to flex and extend properly. As the tibial component is essential for the load-bearing capacity of the entire knee system, it is a focal point of innovation, with companies developing implants that enhance durability and reduce wear.

Material Analysis

The Metal-on-Plastic material combination dominated the Knee Replacement Market with 49.1% due to its cost-effectiveness, durability, and long track record of clinical success. This combination typically involves a metal femoral component, often made from cobalt-chromium or titanium alloys, paired with a plastic tibial insert made from ultra-high molecular weight polyethylene (UHMWPE).

Metal-on-Plastic implants have been widely used for decades and remain the preferred choice due to their balanced performance. The metal femoral component provides strength and resistance to wear, while the plastic tibial insert offers a smooth surface that facilitates proper joint movement. This combination is highly effective in minimizing friction, which helps reduce wear and tear over time, increasing the longevity of the implant.

Additionally, Metal-on-Plastic implants are more affordable compared to alternatives like ceramic-based or metal-on-metal implants, making them more accessible to patients worldwide. They are also well-suited for patients with varying activity levels, from more sedentary individuals to those with moderate activity, making them the most widely used material type in total knee arthroplasties.

Surgery Type Analysis

Traditional Surgery continues to dominate the Knee Replacement Market with 83.2% market share in 2024, largely due to its long-established methods, familiarity among surgeons, and wide acceptance in healthcare systems globally.

In traditional knee replacement surgery, the surgeon manually performs the procedure, using conventional tools to prepare the bone surfaces and place the knee implant. This method has been the standard approach for decades and is associated with high success rates and well-understood recovery patterns.

While technology-assisted surgeries, such as robotic-assisted and computer-assisted surgeries, are gaining popularity, traditional surgery remains the preferred option in many regions, especially in cost-sensitive healthcare systems where the additional expense of technology can be a barrier.

For example, in March 2024, PolarisAR, a developer of cutting-edge mixed-reality surgical guidance technology, has announced the successful completion of the first total knee arthroplasty (TKA) using its STELLAR Knee mixed-reality surgical guidance system.

The procedure took place at New York-Presbyterian/Columbia University Irving Medical Center in New York. Traditional surgery offers a lower upfront cost for both patients and healthcare providers, as it doesn’t require expensive robotic systems or specialized software.

End User Analysis

Hospitals dominate the Knee Replacement Market with 64.8% market share as the primary end-user due to their comprehensive infrastructure, specialized surgical teams, and post-operative care facilities. Most knee replacement surgeries are performed in hospitals because they offer the necessary resources and expertise to manage complex procedures and handle any complications that may arise during or after surgery.

Hospitals are well-equipped with operating rooms, intensive care units (ICUs), and physical therapy services, which are critical for ensuring positive surgical outcomes and proper recovery for knee replacement patients.

Hospitals also have the advantage of experienced orthopedic surgeons and multi-disciplinary teams that can manage the entire treatment process—from pre-operative assessment to post-operative care and rehabilitation. This makes them the go-to choice for both patients and surgeons when it comes to major surgeries like total knee arthroplasties (TKA).

Key Market Segments

By Procedure Type

- Total Knee Arthroplasty (TKA)

- Partial Knee Arthroplasty (PKA)

- Revision Knee Arthroplasty

By Implant Type

- Fixed-Bearing Implants

- Mobile-Bearing Implants

- Medial Pivot Implants

- Customized Implants

By Component

- Femoral

- Tibial

- Patellar

By Material

- Metal-on-Plastic

- Ceramic-on-Ceramic

- Metal-on-Metal

- Ceramic-on-Plastic

By Surgery Type

- Traditional Surgery

- Technology-Assisted

By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics

Drivers

Aging Population and Rising Prevalence of Osteoarthritis

The global aging population is a significant driver for the TKR market. As the world’s population grows older, the incidence of age-related conditions such as osteoarthritis (OA) increases, leading to a higher demand for knee replacement surgeries. OA, a degenerative joint disease, is the leading cause of knee pain and disability in older adults, often requiring TKR for mobility restoration. According to the World Health Organization (WHO), the number of elderly people is expected to double by 2050, intensifying the burden of OA globally.

According to the World Health Organization (WHO), approximately 73% of individuals with osteoarthritis are over the age of 55, and 60% are female. The knee joint is the most commonly affected, with a prevalence of 365 million cases, followed by the hip and hand. Of those affected, 344 million individuals experience moderate to severe severity levels, making them candidates for rehabilitation. As populations age and obesity and injury rates rise, the global prevalence of osteoarthritis is expected to keep increasing.

This demographic shift directly translates into a greater need for TKR procedures, particularly in developed regions such as North America and Europe. Furthermore, advancements in TKR procedures, including minimally invasive surgeries and improved implant designs, have made the treatment more accessible and successful. As the global healthcare systems improve, more patients are opting for knee replacements, significantly fueling market growth.

Restraints

High Cost of Surgery and Implants

The high cost associated with total knee replacement surgeries and implants is a major restraint in the market. While TKR is often the most effective solution for patients suffering from severe knee osteoarthritis, the procedure remains expensive, particularly in developed regions.

The cost includes the surgery itself, post-operative care, rehabilitation, and the cost of the implants. Premium implant systems with advanced materials and designs, such as customized or robotic-assisted knee implants, further elevate the price.

For instance, a single knee replacement surgery can cost between $30,000 to $70,000 depending on the region, type of implant, and medical facility. This significant expense often leads to reduced accessibility, especially in emerging economies or for patients without adequate insurance coverage.

Additionally, the recovery time and follow-up treatments further burden patients, limiting the procedure’s affordability and ultimately affecting market growth. Overcoming this restraint will require cost-reduction strategies, such as improved surgical techniques, more affordable implant materials, and government initiatives to subsidize healthcare costs.

Opportunities

Technological Advancements in Knee Implants and Surgical Techniques

Technological advancements present a major growth opportunity for the Total Knee Replacement market. Innovations such as robotic-assisted surgeries, 3D-printed implants, and patient-specific prosthetics have transformed the TKR landscape.

Robotic systems, such as Stryker’s MAKO and Zimmer Biomet’s ROSA, enable more precise and personalized knee replacement surgeries, resulting in better outcomes, shorter recovery times, and fewer complications. The use of 3D printing technology allows for the development of customized implants tailored to the individual’s anatomy, which can significantly improve the performance and longevity of the implant.

Additionally, advancements in minimally invasive surgical techniques reduce the trauma of surgery, leading to faster recovery and lower healthcare costs. These innovations not only enhance the quality of care but also make knee replacement procedures more accessible, particularly for younger, more active patients. As healthcare providers and manufacturers continue to invest in these technologies, the Total Knee Replacement market is expected to expand significantly, offering new growth avenues for companies and improving patient satisfaction.

For instance in August 2024, Exactech, a global leader in medical technology, has announced the introduction of new balancing technology for patients requiring total knee replacement surgery. Utilizing ExactechGPS® computer-assisted technology, the Newton™ knee procedure offers surgeons visual guidance to achieve personalized, balanced results during surgery.

Impact of Macroeconomic / Geopolitical Factors

Economic downturns can strain healthcare budgets, potentially delaying elective procedures like knee replacements. However, studies indicate that in the U.S., the demand for total knee arthroplasties remained robust during the 2000s economic downturns, with procedures increasing by over 6% annually . This resilience suggests that, despite economic challenges, the aging population’s need for joint replacements often outweighs financial constraints.

Socioeconomic status influences access to knee replacement surgeries. Patients with lower incomes may face barriers such as inadequate insurance coverage or limited access to specialized care, impacting their ability to undergo surgery and achieve optimal outcomes.

Geopolitical tensions and export restrictions can disrupt the global supply chain for medical devices, including knee implants. Such disruptions may lead to shortages, increased costs, and delays in procedures, particularly affecting countries reliant on imported medical technologies.

Differences in healthcare policies across regions impact the accessibility and affordability of knee replacement surgeries. For instance, countries with comprehensive public healthcare systems may offer more equitable access to joint replacement procedures compared to those with limited healthcare coverage.

Latest Trends

Minimally Invasive and Robotic-Assisted Surgeries

A key trend in the Total Knee Replacement market is the increasing adoption of minimally invasive and robotic-assisted surgeries. These techniques are gaining popularity due to their numerous advantages, such as smaller incisions, reduced blood loss, faster recovery times, and less postoperative pain. Robotic-assisted surgeries allow for more precise alignment and positioning of the implant, which can improve the long-term functionality and longevity of the knee.

Companies like Stryker, Zimmer Biomet, and Medtronic have developed robotic systems that offer enhanced surgical precision and enable orthopedic surgeons to tailor procedures to each patient’s unique anatomy. This trend is particularly appealing to younger, active patients who are seeking faster recovery times and more natural post-surgery knee function.

In February 2023, CK Birla Hospital in Delhi has launched fully active robotic technology for minimally invasive knee replacement surgery. This advanced surgical robot system enables 3D pre-planning, precise assessment of deformities, and accurate surgical outcomes, ensuring exceptional patient results. The introduction of this technology aims to address the growing orthopedic burden in India, leveraging medical technology to enhance patient care through improved diagnosis and precise surgical outcomes.

Moreover, robotic surgeries reduce the risk of human error, leading to better clinical outcomes. As these technologies continue to evolve and become more affordable, they are expected to become standard practice in knee replacement surgeries, further driving the growth of the Total Knee Replacement market.

Regional Analysis

North America is leading the Knee Replacement Market

North America is the leading market in the knee replacement sector, driven by a high number of patients requiring knee replacement surgery. The region’s access to advanced surgical and robotic-assisted procedures, along with high treatment costs, contributes to its dominance. Additionally, the presence of key market players further fuels the growth of this market across various regions.

In June 2024, Johnson & Johnson MedTech announced that its orthopaedics company, DePuy Synthes, secured FDA 510(k) clearance for the clinical use of the VELYS Robotic-Assisted Solution in Unicompartmental Knee Arthroplasty (UKA). This expanded indication builds on the system’s earlier clearance for Total Knee Arthroplasty (TKA). The VELYS platform is already available in over 20 markets, with more than 55,000 procedures performed.

The robotic solution provides surgeons with critical data to preserve soft tissue, predict joint stability, and support the restoration of knee function. This development is expected to strengthen Johnson & Johnson’s position in the robotic-assisted orthopaedics market and enhance adoption in minimally invasive knee procedures.

Europe has also emerged as a significant market for knee replacement surgeries, owing to the large patient population in need of such procedures. Meanwhile, the Asia-Pacific region shows promising growth potential, as an increasing number of people in the region experience knee-related issues, further driving demand for knee replacement surgeries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Knee Replacement market includes Zimmer Biomet Holdings, Inc., Stryker Corporation, DePuy Synthes (Johnson & Johnson), Smith & Nephew plc, Medtronic PLC, MicroPort Scientific Corporation, Exactech, Inc., Corin Group plc, Aesculap Implants Systems LLC (B. Braun), Medacta International SA, ConforMIS, Inc., Waldemar Link GmbH & Co. KG, United Orthopedic Corporation, LimaCorporate S.p.A., Arthrex, Inc., THINK Surgical, Inc., and Other key players.

Key Opinion Leaders

Report Features Description Dr. Linda Thompson, Orthopedic Surgeon, Clinical Researcher, Zimmer Biomet Holdings, Inc. “Zimmer Biomet continues to be a dominant player in the knee replacement market, particularly with their industry-leading Persona knee system. From a clinical standpoint, their focus on personalized care—such as customized implants and the integration of cutting-edge surgical technologies—has been a game changer. The Persona knee offers a patient-specific approach, improving outcomes by providing more natural motion post-surgery. Additionally, their investment in robotic-assisted surgery platforms like ROSA has made knee replacements more precise, reducing complications and enhancing long-term durability. With an aging population and an increased demand for knee replacements globally, Zimmer Biomet’s focus on innovation and patient-centric solutions positions them strongly for continued market leadership. I anticipate that their next phase of growth will stem from the expansion of these technologies into emerging markets, where demand for knee replacement procedures is accelerating.” Dr. Robert Chen, Orthopedic Surgeon, Leading Expert in Robotic-Assisted Surgery, Stryker Corporation “Stryker’s MAKO robotic-assisted surgery platform has revolutionized the knee replacement space by combining advanced imaging systems with precision robotic technology. What stands out to me is how MAKO allows for greater customization of the knee replacement procedure, making it more accurate than traditional methods. In my experience, it leads to improved recovery times and more consistent outcomes for patients. Stryker’s continued investment in AI and robotics is a huge advantage in this increasingly competitive market. Furthermore, their prosthetics, like the Triathlon Knee System, continue to demonstrate excellent wear resistance and functionality, particularly in active patients. As robotics continue to reshape the knee replacement landscape, Stryker is likely to remain a major player in pushing the boundaries of what’s possible in orthopedic surgery.” Dr. Emily Sanchez, Orthopedic Surgeon, Clinical Educator, DePuy Synthes (Johnson & Johnson) “DePuy Synthes is a staple in the orthopedic space, with its ATTUNE knee system being one of the most widely used implants. The flexibility and reliability of the ATTUNE system, paired with Johnson & Johnson’s ability to integrate it seamlessly into their comprehensive surgical offerings, truly sets them apart. One of the most significant advancements they’ve made is their focus on the soft tissue-preserving surgical techniques, which helps to improve post-surgery mobility and reduce recovery time for patients. The strong research backing from Johnson & Johnson’s broader healthcare portfolio also supports continued innovation, and I expect their new materials and advancements in design to keep DePuy Synthes competitive in the knee replacement sector. The development of enhanced patient-specific solutions and the integration of data-driven insights into surgery will further cement their leadership position in the market.” Recent Developments

- November 2024: The American Joint Replacement Registry (AJRR) announced a major milestone, surpassing 4 million hip and knee arthroplasty procedures recorded in its database. This achievement was featured in the 11th edition of the AJRR Annual Report, issued by the American Academy of Orthopaedic Surgeons (AAOS) Registry Program. The report analyzed more than 3.7 million procedures submitted by 1,447 institutions across all 50 states and the District of Columbia between 2012 and 2023. It also highlighted an 18% year-on-year growth in procedures.

- November 2022: Zimmer Biomet Holdings, Inc., a global leader in medical technology, received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the Persona OsseoTi Keel Tibia, a cementless knee replacement component. The Persona OsseoTi, part of the Persona Knee System, incorporates Zimmer Biomet’s OsseoTi Porous Metal Technology, which applies anatomical data and 3D printing to replicate the structure of human cancellous bone. Its keeled design and porous architecture provide stable initial and biological fixation.

- May 2021: Eventum Orthopaedics, a UK-based medtech startup, introduced a sensor-equipped device designed to improve patient outcomes following knee replacement surgery. The company secured £1.4 million in funding through an investment round led by NPIF – Mercia Equity Finance, managed by Mercia and part of the Northern Powerhouse Investment Fund. Additional investments were made by Mercia’s EIS funds and private investors, including several leading orthopaedic surgeons.

Top Key Players in the Knee Replacement Market

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Smith & Nephew plc

- Medtronic PLC

- MicroPort Scientific Corporation

- Exactech, Inc.

- Corin Group plc

- Aesculap Implants Systems LLC (B. Braun)

- Medacta International SA

- ConforMIS, Inc.

- Waldemar Link GmbH & Co. KG

- United Orthopedic Corporation

- LimaCorporate S.p.A.

- Arthrex, Inc.

- THINK Surgical, Inc.

- Other key players

Report Features Description Market Value (2024) US$ 9.75 billion Forecast Revenue (2034) US$ 16.19 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Procedure Type (Total Knee Arthroplasty (TKA), Partial Knee Arthroplasty (PKA) and Revision Knee Arthroplasty), By Implant Type (Fixed-Bearing Implants, Mobile-Bearing Implants, Medial Pivot Implants and Customized Implants), By Component (Femoral, Tibial and Patellar), By Material (Metal-on-Plastic, Ceramic-on-Ceramic, Metal-on-Metal and Ceramic-on-Plastic), By Surgery Type (Traditional Surgery and Technology-Assisted), By End-User (Hospitals, Ambulatory Surgical Centers (ASCs), and Orthopedic Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Biomet Holdings, Inc., Stryker Corporation, DePuy Synthes (Johnson & Johnson), Smith & Nephew plc, Medtronic PLC, MicroPort Scientific Corporation, Exactech, Inc., Corin Group plc, Aesculap Implants Systems LLC (B. Braun), Medacta International SA, ConforMIS, Inc., Waldemar Link GmbH & Co. KG, United Orthopedic Corporation, LimaCorporate S.p.A., Arthrex, Inc., THINK Surgical, Inc., and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Smith & Nephew plc

- Medtronic PLC

- MicroPort Scientific Corporation

- Exactech, Inc.

- Corin Group plc

- Aesculap Implants Systems LLC (B. Braun)

- Medacta International SA

- ConforMIS, Inc.

- Waldemar Link GmbH & Co. KG

- United Orthopedic Corporation

- LimaCorporate S.p.A.

- Arthrex, Inc.

- THINK Surgical, Inc.

- Other key players