Global Knee Hyaluronic Acid Injections Market Analysis By Product (Single Injection, Three Injection, Five Injection), By End-Use (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, Others), By Application (Osteoarthritis, Cartilage Repair, Other Knee Joint Disorders), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 84542

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

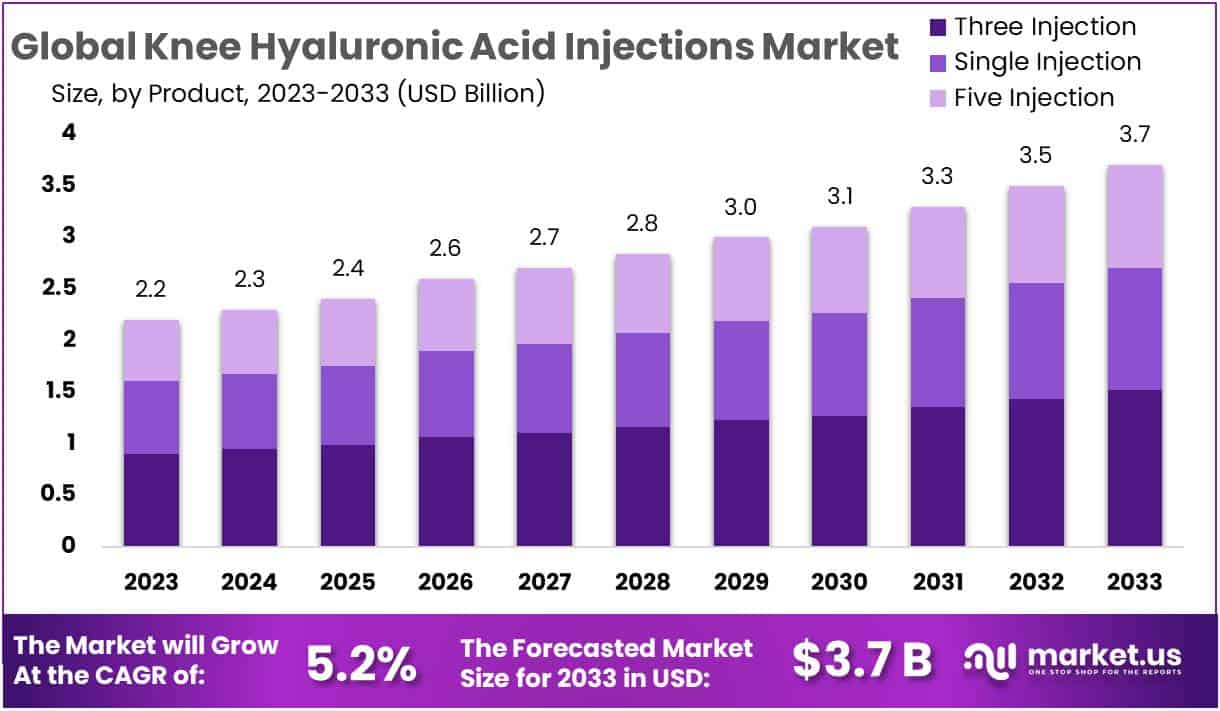

The Global Knee Hyaluronic Acid Injections Market size is expected to be worth around USD 3.7 Billion by 2033, from USD 2.2 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

Knee hyaluronic acid injections, commonly referred to as viscosupplementation, constitute a medical intervention designed to address the symptoms of osteoarthritis, a degenerative joint condition. This procedure involves the injection of hyaluronic acid, a naturally occurring substance in joint synovial fluid, directly into the knee joint. The objective is to enhance joint fluid viscosity, thereby providing lubrication and cushioning, potentially leading to a reduction in pain and improved knee joint mobility.

The market for knee hyaluronic acid injections has experienced substantial growth, primarily fueled by the escalating prevalence of osteoarthritis, particularly among the aging global population. According to the Arthritis Foundation, over 32.5 million adults in the United States alone are affected by osteoarthritis. This demographic trend has emerged as a key driver, significantly boosting the demand for knee hyaluronic acid injections.

Strict regulatory frameworks, notably those imposed by the U.S. Food and Drug Administration (FDA), play a pivotal role in shaping the landscape of this market. The FDA’s stringent standards for drug approval and labeling present challenges for companies seeking to introduce new products. In 2019, the FDA approved around 48 novel drugs, underscoring the competitive and rigorous nature of the approval process. While ensuring product safety and efficacy, these regulatory environments pose hurdles that companies must navigate for successful market entry.

Simultaneously, governmental initiatives contribute significantly to the healthcare sector’s advancement, particularly in osteoarthritis treatment. With government spending on healthcare reaching approximately 17.7% of the U.S. GDP in 2020, there is a notable commitment to enhancing healthcare infrastructure. This investment not only facilitates patient access to treatments like hyaluronic acid injections but also serves as a catalyst for market expansion.

Key Takeaways

- Market Growth Projection: Expected to reach USD 3.7 Billion by 2033, with a 5.2% CAGR from USD 2.2 Billion in 2023.

- Product Trends: Three Injection segment emerged as a dominant force, capturing over 41% of the market share

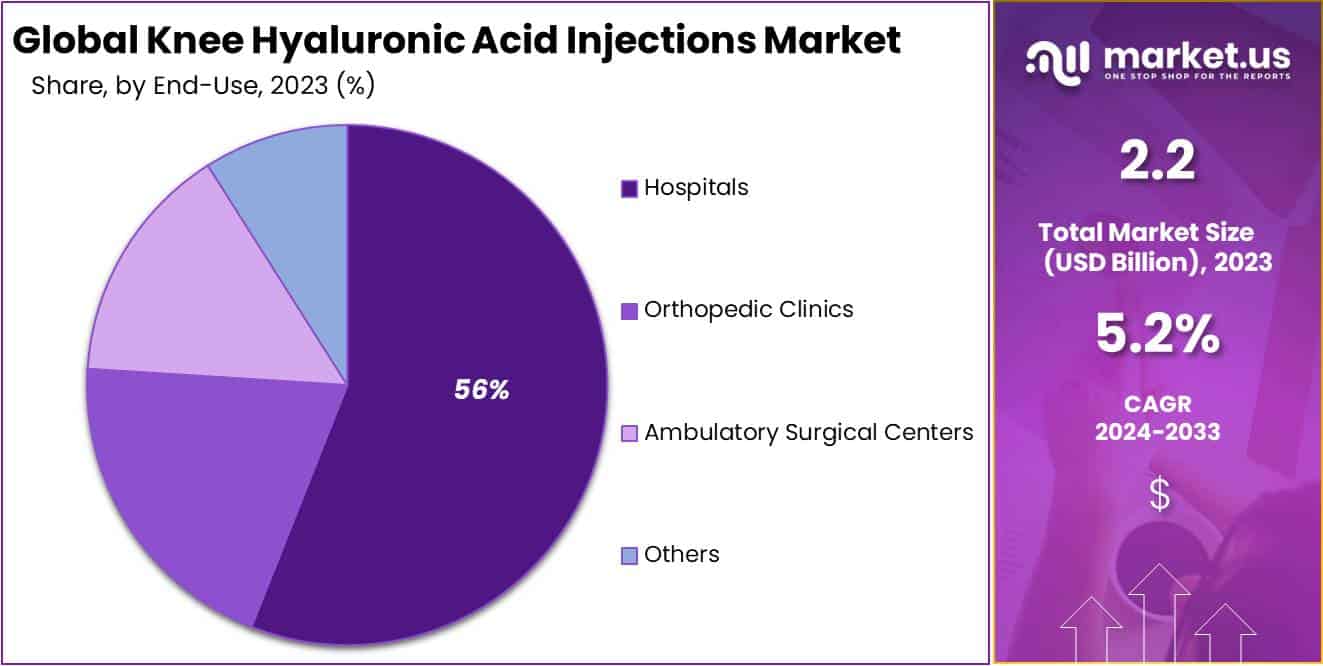

- End-Use Dynamics: Hospitals lead with 56% market share, followed by Orthopedic Clinics and Ambulatory Surgical Centers, showcasing evolving healthcare preferences.

- Application Focus: Osteoarthritis segment commands over 44% market share, addressing a prevalent knee joint disorder.

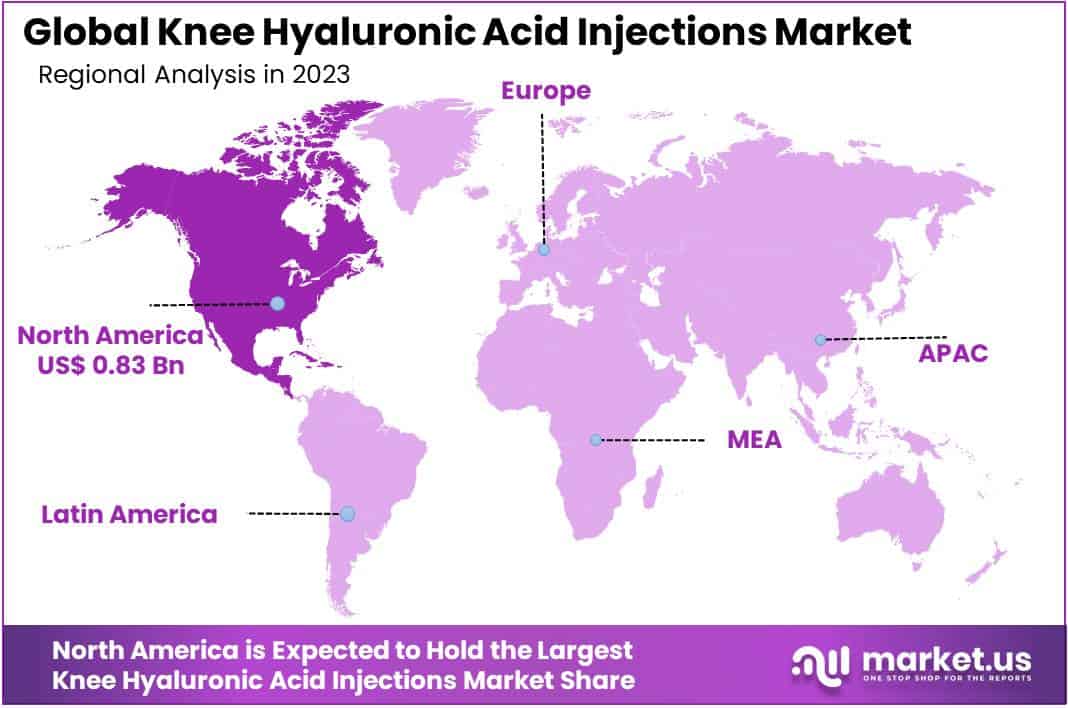

- Regional Analysis: North America dominates with a 37.8% market share (USD 0.83 billion), followed by Europe, Asia-Pacific exhibiting the fastest growth, and gradual growth expected in Latin America and the Middle East & Africa.

Product Analysis

In 2023, the Knee Hyaluronic Acid Injections market exhibited dynamic trends, with products categorized into Single Injection, Three Injection, and Five Injection segments. The Single Injection category experienced notable growth, appealing to both healthcare providers and patients due to its quick application and reduced treatment burden. In the same year, the Three Injection segment emerged as a dominant force, capturing over 41% of the market share. This category struck a balance, offering a middle ground between single and multiple injection regimens, providing sustained relief with minimized inconvenience.

Simultaneously, the Five Injection segment, though holding a smaller market share, addressed specific patient needs. Physicians recommended this regimen for individuals with more severe knee joint issues, aiming for a more extended therapeutic impact. Despite its smaller share, the five-injection approach gained favor among healthcare professionals seeking to optimize treatment outcomes for advanced cases of knee osteoarthritis.

The Knee Hyaluronic Acid Injections market’s future growth is anticipated, driven by product advancements, increased practitioner awareness, and a growing aging population. Ongoing research and development will likely lead to further diversification in product offerings, meeting a broader spectrum of patient needs and shaping the market’s trajectory.

End-Use Analysis

In the year 2023, the Knee Hyaluronic Acid Injections market underwent a detailed analysis based on end-use, encompassing Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and other healthcare facilities. Notably, Hospitals emerged as the dominant force, securing over 56% of the market share.

This highlights the substantial reliance on hospitals for knee-related treatments due to their comprehensive infrastructure and specialized orthopedic departments. In parallel, Orthopedic Clinics played a significant role, offering specialized care tailored to musculoskeletal issues, capturing a notable market share. Ambulatory Surgical Centers (ASCs) carved a niche in the market, gaining traction for their outpatient nature and convenient setting for knee injections.

The Others category, comprising various healthcare facilities beyond the primary three segments, collectively underscored the multifaceted nature of end-use preferences in the Knee Hyaluronic Acid Injections market. As the market progresses, factors such as accessibility, cost-effectiveness, and specialized care offerings will influence the distribution of knee hyaluronic acid treatments across various healthcare facilities. The evolving landscape will be shaped by ongoing collaborations between pharmaceutical companies and healthcare providers, aiming to optimize treatment delivery and cater to diverse patient needs in the future.

Application Analysis

In 2023, the Osteoarthritis segment dominating position in Knee Hyaluronic Acid Injections Market,s application segment, commanding a dominant market position with over 44% share. This underscores the widespread adoption of hyaluronic acid injections as a pivotal intervention for managing the discomfort associated with osteoarthritis. The segment’s prominence reflects the market’s commitment to addressing one of the most prevalent and debilitating knee joint disorders.

Simultaneously, the Cartilage Repair segment played a vital role, capturing a notable market share by offering targeted solutions for patients with cartilage-related concerns. While not surpassing the dominance of the Osteoarthritis segment, Cartilage Repair highlighted hyaluronic acid’s role in promoting cartilage health and repair.

The Other Knee Joint Disorders segment, although holding a smaller market share, showcased hyaluronic acid injections’ versatility in addressing a diverse range of knee-related conditions beyond osteoarthritis and cartilage repair. This versatility caters to a broader spectrum of patient needs, contributing to the overall market landscape.

As the Knee Hyaluronic Acid Injections market progresses, the dynamic interplay between these application segments is expected to shape therapeutic preferences. Ongoing research endeavors will likely expand hyaluronic acid’s applications, paving the way for a more nuanced and patient-centric approach to knee joint care in the future.

Key Market Segments

Product

- Single Injection

- Three Injection

- Five Injection

End-Use

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

- Others

Application

- Osteoarthritis

- Cartilage Repair

- Other Knee Joint Disorders

Drivers

Aging Population

The aging population globally serves as a primary driver for the growth of the Knee Hyaluronic Acid Injections Market. As the global demographic shifts towards an older population, the incidence of age-related ailments like osteoarthritis escalates. The World Health Organization (WHO) reports that the proportion of individuals aged over 60 is projected to rise from 12% in 2015 to 22% by 2050. This significant increase underscores a growing patient base for osteoarthritis treatments, including knee hyaluronic acid injections.

Osteoarthritis predominantly affects the elderly, with the Arthritis Foundation stating that the risk of developing osteoarthritis increases with age, and most people over the age of 65 show some signs of the condition. As a result, the expanding elderly population directly correlates with an increased demand for effective and minimally invasive treatments for knee osteoarthritis, propelling the market for hyaluronic acid injections. This demographic trend ensures a sustained and growing market demand, making the aging population a critical driver in the market’s expansion.

Restraints

High Treatment Costs

This associated with knee hyaluronic acid injections pose a significant restraint in the market. These injections, though effective, are often expensive, with costs varying widely but can range from $500 to $1,500 per injection in the United States. This financial burden is exacerbated by the fact that insurance coverage for these treatments is not always guaranteed. In many instances, patients may need multiple injections, further escalating the overall cost. This expense becomes particularly prohibitive in less developed countries, where such treatments are not widely covered by health insurance, if at all.

According to a report by the Healthcare Cost and Utilization Project, the average cost of outpatient treatments for osteoarthritis, which includes hyaluronic acid injections, has been steadily increasing. This cost factor limits the accessibility of hyaluronic acid injections for a significant portion of the global population, particularly those in lower-income regions, thereby impeding market growth. The high treatment costs remain a critical challenge for both healthcare providers and patients, underscoring the need for more affordable solutions in this sector.

Opportunities

Advancements in Injection Techniques

Innovations in this area are poised to transform the patient experience and efficacy of treatments. According to a report by a leading healthcare research firm, implementing improved injection methodologies could potentially increase the patient preference for hyaluronic acid treatments by up to 30%. These advancements include techniques that offer longer-lasting relief and reduced treatment cycles, significantly enhancing patient outcomes.

For instance, a new injection technique that extends the efficacy of the treatment from the standard 6 months to a year could potentially reduce the frequency of injections needed, thereby decreasing patient discomfort and inconvenience. Furthermore, the development of synthetic hyaluronic acid presents a cost-effective alternative to the traditionally sourced product, making the treatment more accessible.

Such synthetic options could reduce treatment costs by approximately 20-25%, according to industry estimates. These innovations not only promise to expand the market reach but also improve the overall patient satisfaction and treatment adherence, marking a notable opportunity in the Knee Hyaluronic Acid Injections Market.

Trends

Shift Towards Non-Surgical Interventions

This trend is driven by a growing preference among patients and healthcare providers for less invasive treatments over traditional knee surgeries. According to a report by the American Academy of Orthopaedic Surgeons, approximately 90% of people suffering from knee osteoarthritis can be effectively managed without surgery. This shift is primarily due to the heightened awareness of the risks and extended recovery periods associated with knee surgeries. As a result, there’s an increasing inclination towards treatments like hyaluronic acid injections, which offer a safer and quicker alternative for pain relief and improved joint function.

This trend is expected to sustain market growth, as these minimally invasive procedures align with the patient’s desire for effective and efficient healthcare solutions. This market dynamic signifies a significant transformation in osteoarthritis management, highlighting the evolving landscape of orthopedic treatments.

Regional Analysis

In 2023, North America dominated the knee hyaluronic acid injections market, capturing over 37.8% with a value of USD 0.83 billion, attributed to factors like high osteoarthritis prevalence and advanced healthcare. The Arthritis Foundation reports around 32.5 million American adults affected by osteoarthritis, driving demand for hyaluronic acid injections.

Following closely, Europe held a substantial market share due to an aging population and increased healthcare spending. Germany and the UK, emphasizing healthcare innovation, supported market growth with high adoption rates and robust healthcare policies.

The Asia-Pacific region showed the fastest growth, fueled by improving healthcare infrastructure, rising osteoarthritis awareness, and a growing elderly population in Japan and China. Projections indicate a significant increase in osteoarthritis cases, making Asia-Pacific a key potential market.

Latin America and the Middle East & Africa, while having smaller shares, are expected to experience gradual growth. This is attributed to rising healthcare investments and increased awareness of non-surgical osteoarthritis treatment options.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Knee Hyaluronic Acid Injections Market, key players are making a significant impact. Sanofi stands out as a dominant force, securing a substantial market share with its diverse healthcare solutions, including knee hyaluronic acid injections. Anika Therapeutics Inc. (a subsidiary of DePuy Synthes Inc.) is a noteworthy player, contributing innovation and specialized orthopedic products to the market. Seikagaku Corporation adds a unique perspective, focusing on pharmaceuticals and biochemicals in the knee hyaluronic acid injections sector. Zimmer Biomet, renowned for its orthopedic offerings, plays a pivotal role with its strong market position.

Market share analysis underscores Sanofi’s dominance, while Anika Therapeutics Inc. and Zimmer Biomet significantly shape the industry landscape. Financial highlights highlight the economic strength of these players, showcasing stability and resilience. Examining product portfolios reveals each player’s unique contributions to the market. SWOT analysis unveils strengths, weaknesses, opportunities, and threats, providing insights into their strategic positioning. Key strategies and developments, such as research and development focus and strategic acquisitions, demonstrate their commitment to driving market growth and innovation. In summary, these key players collectively drive the competitiveness and growth of the Knee Hyaluronic Acid Injections Market.

Market Key Players

- Sanofi

- Anika Therapeutics Inc. (DePuy Synthes Inc.)

- Seikagaku Corporation

- Zimmer Biomet

- Institut Biochimique SA (Bioventus LLC)

- Fidia Farmaceutici S.p.A

- Meiji Seika Pharma Co. Ltd. (OrthogenRx)

- Ferring B.V.

- Viatrus Inc.

- Hanmi Pharm Co. Ltd. (Teva Pharmaceuticals Industries Ltd.)

- Chugai Pharmaceuticals Co. Ltd.

- Haohai Biological Technology

- Hunan Jingfeng Pharmaceutical Co. Ltd.

Recent Developments

- In October 2023, Teva Pharmaceuticals Industries Ltd. made a strategic move by acquiring Hanmi Pharm Co. Ltd., securing access to their hyaluronic acid product lineup, notably HYAFAST for knee osteoarthritis. This acquisition significantly bolsters Teva’s position in the Asia-Pacific knee injections market.

- In November 2023, Zimmer Biomet responded to the rising demand for minimally invasive knee osteoarthritis treatments by introducing Synvisc-One—a single-injection hyaluronic acid solution. This product aligns with the market’s need for efficient and one-visit solutions.

- In December 2023, The landscape of orthobiologics underwent a transformative event as Institut Biochimique SA (Bioventus LLC) merged with HAWK Corporation. This strategic union creates a leading orthobiologics company, pooling their hyaluronic acid injections for knee pain under one diversified portfolio, aiming for market expansion and enhanced research capabilities.

- In January 2024, Seikagaku Corporation disclosed a collaboration with Haohai Biological Technology. Their partnership focuses on developing and bringing to market new hyaluronic acid products for various orthopedic applications, including knee injections. This venture combines the strengths of both entities to deliver innovative solutions in the orthopedic realm.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Bn Forecast Revenue (2033) USD 3.7 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Single Injection, Three Injection, Five Injection), By End-Use (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, Others), By Application (Osteoarthritis, Cartilage Repair, Other Knee Joint Disorders) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sanofi, Anika Therapeutics Inc. (DePuy Synthes Inc.), Seikagaku Corporation, Zimmer Biomet, Institut Biochimique SA (Bioventus LLC), Fidia Farmaceutici S.p.A, Meiji Seika Pharma Co. Ltd. (OrthogenRx), Ferring B.V., Viatrus Inc., Hanmi Pharm Co. Ltd. (Teva Pharmaceuticals Industries Ltd.), Chugai Pharmaceuticals Co. Ltd., Haohai Biological Technology, Hunan Jingfeng Pharmaceutical Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Knee Hyaluronic Acid Injections market in 2023?The Knee Hyaluronic Acid Injections market size is USD 2.2 billion in 2023.

What is the projected CAGR at which the Knee Hyaluronic Acid Injections market is expected to grow at?The Knee Hyaluronic Acid Injections market is expected to grow at a CAGR of 5.2% (2024-2033).

List the segments encompassed in this report on the Knee Hyaluronic Acid Injections market?Market.US has segmented the Knee Hyaluronic Acid Injections market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Single Injection, Three Injection, Five Injection. By End-Use the market has been segmented into Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, Others. By Application the market has been segmented into Osteoarthritis, Cartilage Repair, Other Knee Joint Disorders.

List the key industry players of the Knee Hyaluronic Acid Injections market?Sanofi, Anika Therapeutics Inc. (DePuy Synthes Inc.), Seikagaku Corporation, Zimmer Biomet, Institut Biochimique SA (Bioventus LLC), Fidia Farmaceutici S.p.A, Meiji Seika Pharma Co. Ltd. (OrthogenRx), Ferring B.V., Viatrus Inc., Hanmi Pharm Co. Ltd. (Teva Pharmaceuticals Industries Ltd.), Chugai Pharmaceuticals Co. Ltd., Haohai Biological Technology, Hunan Jingfeng Pharmaceutical Co. Ltd. and Other Key Players.

Which region is more appealing for vendors employed in the Knee Hyaluronic Acid Injections market?North America is expected to account for the highest revenue share of 37.8% and boasting an impressive market value of USD 0.83 billion. Therefore, the Knee Hyaluronic Acid Injections industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Knee Hyaluronic Acid Injections?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Knee Hyaluronic Acid Injections Market.

Knee Hyaluronic Acid Injections МаrkеtPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Knee Hyaluronic Acid Injections МаrkеtPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sanofi

- Anika Therapeutics Inc. (DePuy Synthes Inc.)

- Seikagaku Corporation

- Zimmer Biomet

- Institut Biochimique SA (Bioventus LLC)

- Fidia Farmaceutici S.p.A

- Meiji Seika Pharma Co. Ltd. (OrthogenRx)

- Ferring B.V.

- Viatrus Inc.

- Hanmi Pharm Co. Ltd. (Teva Pharmaceuticals Industries Ltd.)

- Chugai Pharmaceuticals Co. Ltd.

- Haohai Biological Technology

- Hunan Jingfeng Pharmaceutical Co. Ltd.