Global Kiosk Software Market By Component (Software, Services), By Deployment (On-Premises, Cloud-based), By Application (Retail & QSR (Quick Service Restaurant), Healthcare, BFSI, Hospitality, Transportation, Government, Others), By End-User (Small and Medium Enterprises, Large Enterprises), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 172082

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Component Analysis

- Deployment Analysis

- Application Analysis

- End-User Analysis

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

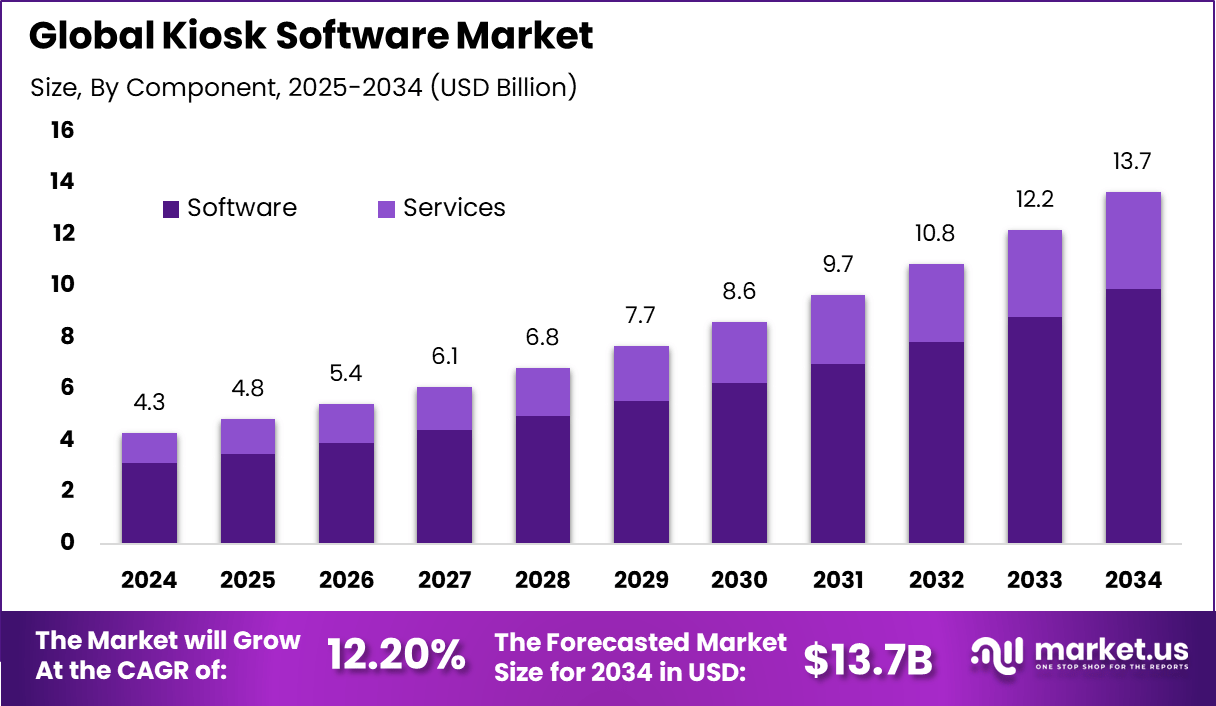

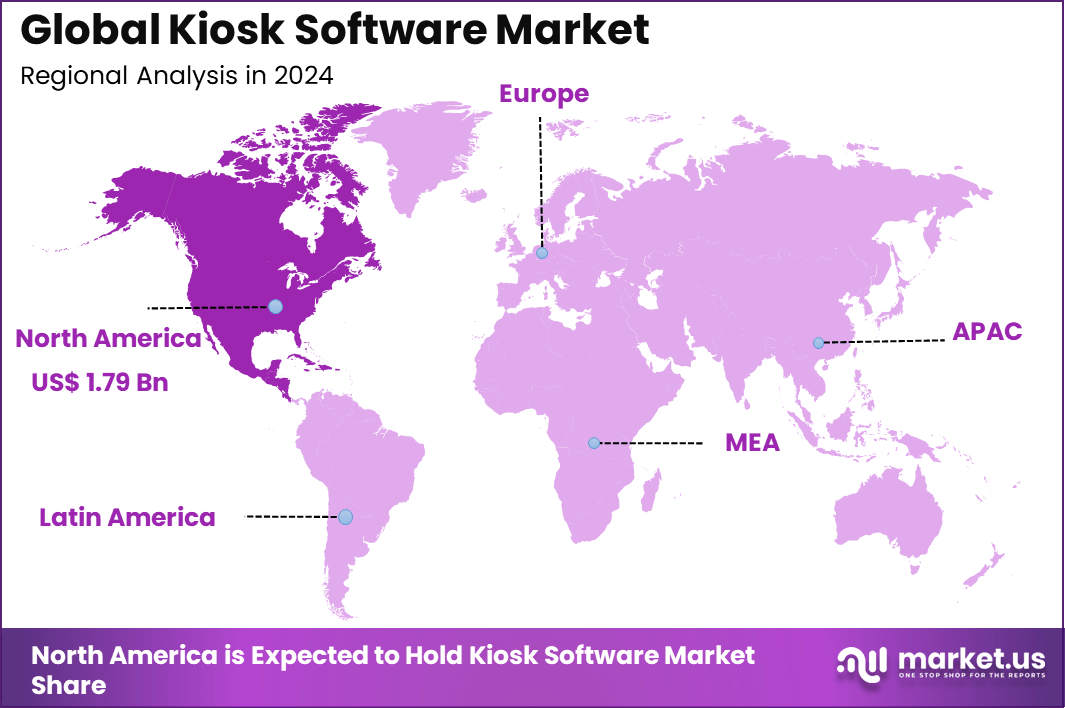

The Global Kiosk Software Market generated USD 4.3 billion in 2024 and is predicted to register growth from USD 4.8 billion in 2025 to about USD 13.7 billion by 2034, recording a CAGR of 12.20% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.5% share, holding USD 1.79 Billion revenue.

The kiosk software market refers to software solutions designed to control, manage, and secure self service kiosks used in public and commercial environments. This software allows devices to operate in a restricted mode, ensuring users can access only approved applications or services. Kiosk software is widely used across retail, healthcare, banking, transportation, and government locations. It supports smooth user interaction while maintaining system security and operational control.

Kiosk software enables businesses to deliver services without constant staff involvement. It helps organizations improve service speed, reduce waiting time, and maintain consistent user experiences across multiple locations. The market includes solutions for device lockdown, remote monitoring, content management, and analytics. Growing demand for automation and contactless services continues to support adoption of kiosk software across industries.

Top Market Takeaways

- By component, software took 72.4% of the kiosk software market, as it runs self-service screens in stores and restaurants.

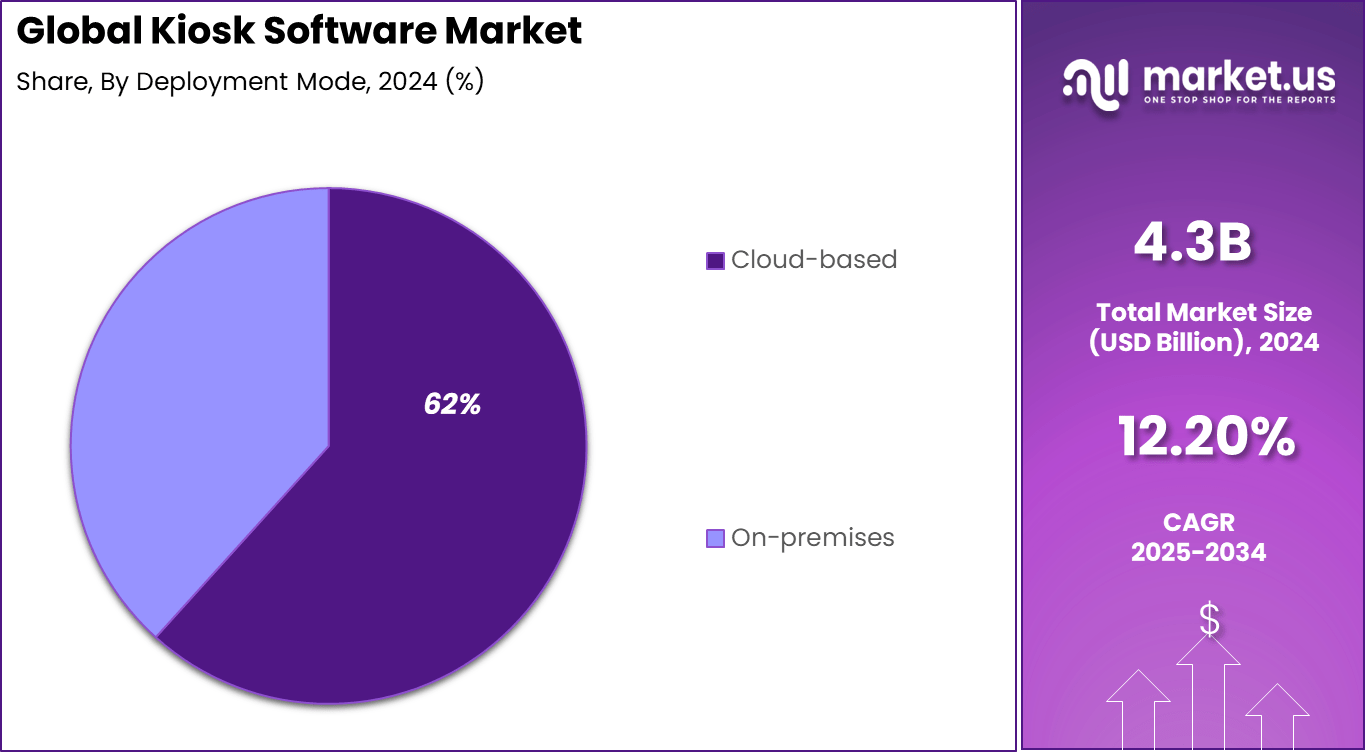

- By deployment, cloud-based solutions held 61.7% share, making kiosks easy to update from anywhere.

- By application, retail and quick service restaurants led with 26.3%, used for fast orders and payments.

- By end-user, large enterprises captured 74.8%, setting up kiosks in many locations.

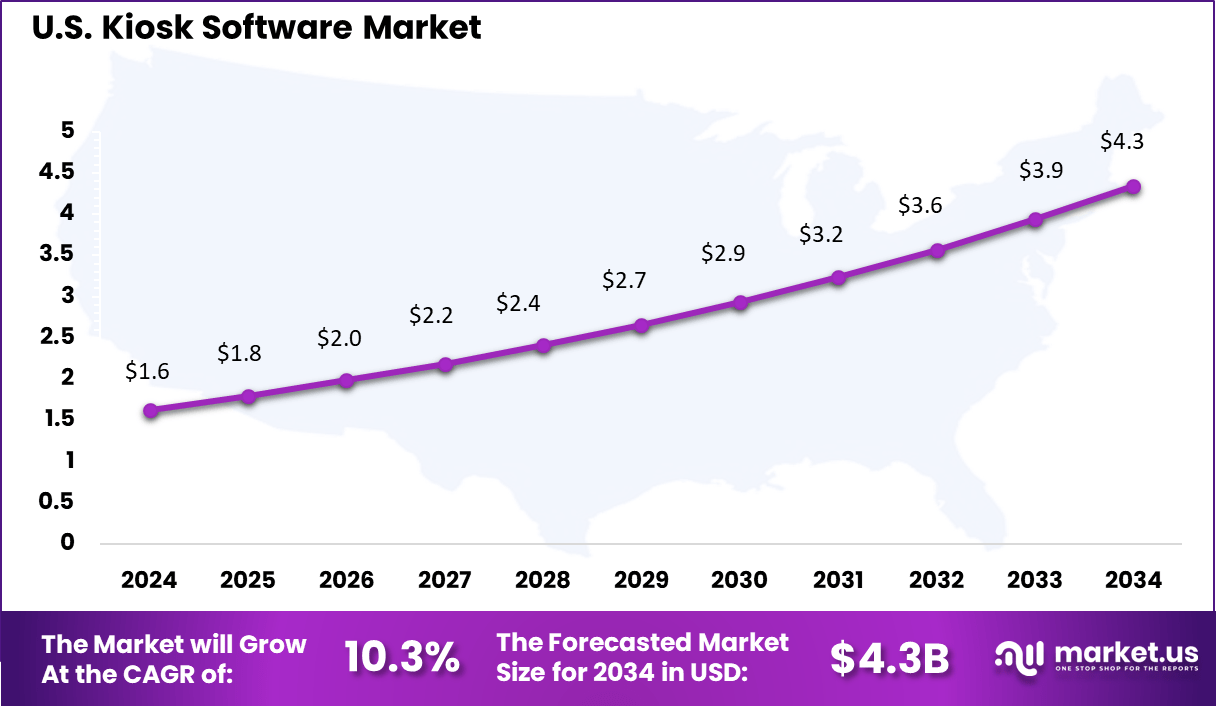

- North America had 41.5% of the global market, with the U.S. at USD 1.63 billion in 2025 and growing at a CAGR of 10.3%.

Component Analysis

Software accounts for 72.4%, showing that digital platforms are the core of kiosk operations. Kiosk software manages user interfaces, transactions, content display, and device control. Reliable software ensures smooth interaction and system stability. It also supports updates and customization across kiosk networks.

The dominance of software is driven by the need for centralized management and automation. Organizations use software to control multiple kiosks from a single dashboard. Integration with payment and backend systems improves functionality. These capabilities support widespread adoption.

Deployment Analysis

Cloud-based deployment holds 61.7%, reflecting strong preference for remote management and scalability. Cloud platforms allow real-time monitoring and updates across kiosk locations. This reduces on-site maintenance requirements. Centralized control improves operational efficiency.

Adoption of cloud-based deployment is driven by flexibility and cost efficiency. Organizations benefit from faster deployment and automatic software updates. Cloud systems also support data analytics and reporting. These advantages continue to support growth.

Application Analysis

Retail and quick service restaurants account for 26.3%, making them a key application area. Kiosks are used for self-ordering, payments, and customer information. These systems help reduce wait times and improve order accuracy. Customer convenience remains a priority.

Growth in this application is driven by demand for contactless and self-service options. Retailers and restaurants use kiosks to manage high customer volumes. Software supports menu updates and promotions. This improves service efficiency.

End-User Analysis

Large enterprises represent 74.8%, highlighting their strong adoption of kiosk software. These organizations operate extensive kiosk networks across multiple locations. Centralized software helps maintain consistency and control. Large-scale deployment requires stable and secure platforms.

Adoption among large enterprises is driven by operational scale and efficiency goals. Kiosk software supports standardized customer experiences. It also enables performance monitoring across locations. These factors sustain high demand.

Key Reasons for Adoption

- The need to reduce waiting time and improve service flow in high-traffic locations is driving adoption across retail, healthcare, and transport settings.

- Businesses are adopting kiosk software to lower operational pressure on staff while maintaining consistent service quality.

- The growing focus on self-service and contactless interactions is supporting wider use of digital kiosks.

- Organizations are seeking better control over customer journeys, content display, and transaction processes through centralized software platforms.

- The demand for real-time data visibility and system integration with existing enterprise tools is encouraging adoption.

Benefits

- Kiosk software helps improve customer experience by offering faster, more direct access to services and information.

- It supports cost efficiency by reducing dependency on manual staff intervention for routine tasks.

- Businesses benefit from improved accuracy in transactions, orders, and data capture.

- The software allows centralized management of multiple kiosks, ensuring uniform updates and branding.

- It enhances data collection, helping organizations understand user behavior and service demand patterns.

Usage

- In retail environments, kiosk software is used for self-ordering, product lookup, and payment processing.

- In healthcare settings, it supports patient check-in, appointment management, and information access.

- Transportation hubs use kiosk software for ticketing, wayfinding, and travel updates.

- Hospitality and food service outlets rely on kiosks for ordering, menu display, and customer engagement.

- Public sector and enterprise offices use kiosk systems for visitor management and service enrollment.

Emerging Trends

Key Trend Description AI Personal Help AI chats and provides suggestions based on user face or voice. Touchless Check In QR codes, mobile apps, and face scan allow check in without physical touch. Cloud Remote Control Kiosks are managed centrally through a web dashboard from any location. Biometric Security Face or fingerprint identification enables secure logins and payments. Voice Smart Orders Users speak to kiosks to order food or tickets without using screens. Growth Factors

Key Factors Description Self Service Demand Automated check in and sales reduce staffing costs. Contactless Hygiene Post virus conditions increase preference for no touch interactions. Retail Digital Push Retailers deploy kiosks to speed up checkout lines. Cloud Easy Scale New kiosks can be added quickly without purchasing extra hardware. Smart City Growth Airports and shopping malls require better visitor flow management. Key Market Segments

By Component

- Software

- Services

By Deployment

- On-Premises

- Cloud-based

By Application

- Retail & QSR (Quick Service Restaurant)

- Healthcare

- BFSI

- Hospitality

- Transportation

- Government

- Others

By End-User

- Small and Medium Enterprises

- Large Enterprises

Regional Analysis

North America represents a significant regional market for kiosk software, accounting for 41.5% of the overall market share. Growth in the region is supported by widespread adoption of self service technologies across retail, healthcare, transportation, and public service environments.

Organizations are increasingly deploying kiosk software to improve operational efficiency, reduce staffing pressure, and enhance customer engagement. Strong digital infrastructure, high technology awareness, and early adoption of automation solutions continue to support stable demand across the region.

The U.S. kiosk software market reached USD 1.63 Bn and is projected to expand at a CAGR of 10.3%. Market growth is driven by rising installation of kiosks in quick service restaurants, airports, hospitals, and large commercial facilities.

Enterprises are focusing on cloud based kiosk management, secure payment integration, and remote monitoring to support large scale deployments. Continued investment in contactless solutions and customer experience optimization is expected to sustain long term growth in the U.S. market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Demand for Enhanced User Experience and Operational Insights

A key driver of this market is the demand for enhanced user experience. Customers and visitors seek fast, intuitive interactions when accessing information or completing transactions. Kiosk software that supports clear navigation, responsive touch controls, and personalized interfaces improves satisfaction and encourages repeated use. Organizations that invest in refined interfaces can differentiate service quality.

Another driver is the need for operational insights from usage data. Kiosks generate valuable information such as service demand patterns, peak usage times, and common user actions. Software platforms that collect, analyze, and visualize these data points help organizations evaluate service effectiveness and make informed decisions on placement, content, and performance optimization.

Restraint Analysis

Security Concerns and Integration Complexity

A significant restraint in the kiosk software market is ensuring secure operation. Kiosk systems often process sensitive information, including payments, personal data, and access credentials. Software platforms must enforce strong access control, secure payment integration, and protection against malware or unauthorized use. Ensuring robust security while preserving usability requires careful configuration and ongoing maintenance.

Another restraint arises from integration with existing backend systems. Kiosks often connect to databases, payment gateways, scheduling systems, and CRM platforms. Ensuring seamless interoperability without data loss or synchronization issues can be technically demanding. Integration complexity may require specialized development resources and increase deployment timelines.

Opportunity Analysis

Expansion of Contactless and Touchless Interaction Features

There is strong opportunity in supporting contactless and touchless interaction capabilities. Demand for hygienic self-service options has increased with emphasis on health safety. Kiosk software that supports mobile interaction, QR code scanning, voice commands, or gesture navigation helps reduce physical contact and improves accessibility. Expanding these capabilities can attract customers in high-traffic environments.

Another opportunity lies in sector-specific customization. Retail, healthcare, hospitality, and transportation each have unique service workflows and content requirements. Software providers that offer tailored templates, domain-specific integrations, and compliance support can appeal to targeted segments. Customization reduces setup effort for end users and enhances value proposition.

Challenge Analysis

Device Fragmentation and User Accessibility

A key challenge in this market is managing device fragmentation. Kiosks vary in screen size, hardware capability, sensors, and peripherals. Ensuring consistent software performance across varied configurations requires rigorous testing and adaptable design. Inconsistent experiences can undermine user trust and hinder adoption.

Another challenge involves supporting accessibility needs. Kiosk systems must accommodate users with diverse abilities, language preferences, and input requirements. Ensuring software meets accessibility standards and provides clear guidance for users with disabilities increases development complexity. Organizations must balance inclusive design with performance and simplicity.

Competitive Analysis

Provisio, KioWare, ProMobi, and Antamedia lead the kiosk software market by offering secure platforms for self service terminals across retail, hospitality, healthcare, and public spaces. Their solutions support device lockdown, content control, remote monitoring, and user session management. These companies focus on stability, security, and multi device compatibility. Growing adoption of self service models continues to reinforce their market position.

Meridian, Toast, Advanced Kiosks, Livewire, Cammax, and Coinage strengthen the market with industry specific kiosk solutions for payments, food ordering, wayfinding, and digital signage. Their platforms emphasize user friendly interfaces, fast deployment, and integration with backend systems. Rising demand for contactless services supports wider adoption.

Xpedient, Acante, MAPTMedia, NetKiosk, Porteus Kiosk, and other players expand the landscape with lightweight and open source kiosk software. Their offerings target small businesses and public access deployments. These companies focus on affordability, flexibility, and ease of configuration. Increasing digitalization of customer touchpoints continues to drive steady growth in the kiosk software market.

Top Key Players in the Market

- Provisio

- KioWare

- ProMobi

- Antamedia

- Meridian

- Toast

- Advanced Kiosks

- Livewire

- Cammax

- Coinage

- Xpedient

- Acante

- Global Software Applications

- MAPTMedia

NetKiosk - KioskSimple Kiosk Software

- Porteus Kiosk

- Others

Future Outlook

The future outlook for the kiosk software market is expected to show steady growth driven by rising demand for self-service technology across industries. Adoption of advanced features such as cloud-based solutions, artificial intelligence, and analytics is anticipated to increase, enabling businesses to improve operational efficiency and customer experience. Expansion in retail, healthcare, transportation, and hospitality sectors will support broader implementation of kiosk solutions.

Continued focus on contactless interactions and automation is likely to sustain market momentum, creating new opportunities for software developers and service providers. Overall, the kiosk software market is projected to evolve with greater integration of digital technologies and higher usage in both consumer and enterprise environments.

Recent Developments

- October 2025 – KioWare: Acquired by DynaTouch (Harris subsidiary), integrating kiosk lockdown software with visitor management tools like TIPS. This bolsters remote monitoring and AI-driven security for Windows/Android kiosks across retail and government deployments.

- In 2025 – Antamedia: Updated Kiosk Software with lifetime licenses, secure USB popups, and multilanguage virtual keyboards for touchscreens. Adds credit card billing without profit-sharing, ideal for public access PCs in libraries and hotels.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Bn Forecast Revenue (2034) USD 13.7 Bn CAGR(2025-2034) 12.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment (On-Premises, Cloud-based), By Application (Retail & QSR (Quick Service Restaurant), Healthcare, BFSI, Hospitality, Transportation, Government, Others), By End-User (Small and Medium Enterprises, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Provisio, KioWare, ProMobi, Antamedia, Meridian, Toast, Advanced Kiosks, Livewire, Cammax, Coinage, Xpedient, Acante, Global Software Applications, MAPTMedia, NetKiosk, KioskSimple Kiosk Software, Porteus Kiosk, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Provisio

- KioWare

- ProMobi

- Antamedia

- Meridian

- Toast

- Advanced Kiosks

- Livewire

- Cammax

- Coinage

- Xpedient

- Acante

- Global Software Applications

- MAPTMedia

- NetKiosk

- KioskSimple Kiosk Software

- Porteus Kiosk

- Others